Air Canada (ticker: ACDVF)

2024-03-12

Air Canada, operating under the ticker symbol ACDVF, is Canada's largest airline in terms of both fleet size and passengers carried. The company was founded in 1937, originally as Trans-Canada Air Lines, and has since grown to serve over 200 destinations worldwide. With its global headquarters in Montreal, Quebec, Air Canada plays a pivotal role in Canadian air transport, offering passenger and cargo services. The airline operates in a highly competitive international market, facing challenges from both traditional and low-cost carriers. Despite these challenges, Air Canada has managed to maintain its market position through strategic partnerships, a focus on customer service, and investments in its fleet, including modern, fuel-efficient aircraft. Its participation in the Star Alliance network also enhances its connectivity and reach. Financially, the airline has experienced fluctuating fortunes, significantly impacted by global events such as economic downturns and the COVID-19 pandemic, but it has continually adapted its operations to navigate through such turbulent times.

Air Canada, operating under the ticker symbol ACDVF, is Canada's largest airline in terms of both fleet size and passengers carried. The company was founded in 1937, originally as Trans-Canada Air Lines, and has since grown to serve over 200 destinations worldwide. With its global headquarters in Montreal, Quebec, Air Canada plays a pivotal role in Canadian air transport, offering passenger and cargo services. The airline operates in a highly competitive international market, facing challenges from both traditional and low-cost carriers. Despite these challenges, Air Canada has managed to maintain its market position through strategic partnerships, a focus on customer service, and investments in its fleet, including modern, fuel-efficient aircraft. Its participation in the Star Alliance network also enhances its connectivity and reach. Financially, the airline has experienced fluctuating fortunes, significantly impacted by global events such as economic downturns and the COVID-19 pandemic, but it has continually adapted its operations to navigate through such turbulent times.

| Full Time Employees | 35,700 | CEO Total Pay | $2,891,928 | CFO Total Pay | $918,990 |

| COO Total Pay | $1,049,992 | Chief Legal Officer Total Pay | $783,045 | Chief Human Resources Total Pay | $856,456 |

| Market Cap USD | $4,742,544,384 | Market Volume | 52,212 | 60 Day Average Volume | 180,096 |

| Enterprise Value | $10,021,286,912 | Profit Margin | 10.425% | Shares Outstanding | 358,468,992 |

| Insiders Percent | 0.165% | Institutions Percent | 14.417% | Book Value | 2.221 |

| Price to Book | 5.957 | Net Income to Common | $2,276,000,000 | Trailing EPS | 4.4 |

| Forward EPS | 3.12 | Total Cash | $8,551,000,064 | Total Debt | $13,861,999,616 |

| Total Revenue | $21,833,000,960 | Debt to Equity | 1741.457 | Revenue Per Share | 60.986 |

| Return on Assets | 4.824% | Free Cash Flow | $2,044,749,952 | Operating Cash Flow | $4,320,000,000 |

| Revenue Growth | 10.6% | Gross Margin | 33.541% | EBITDA Margin | 15.376% |

| Operating Margin | 2.01% | Current Price | $13.23 | Target High Price | $23.89 |

| Target Low Price | $13.35 | Target Mean Price | $21.2 | Target Median Price | $22.62 |

| Number of Analyst Opinions | 8 | Total Cash Per Share | 23.854 | EBITDA | $3,356,999,936 |

| Quick Ratio | 0.966 | Current Ratio | 1.025 | EBITDA | $3,356,999,936 |

| Sharpe Ratio | -0.14708665758186032 | Sortino Ratio | -2.5667353767364314 |

| Treynor Ratio | -0.03352569407101533 | Calmar Ratio | -0.13130188704015364 |

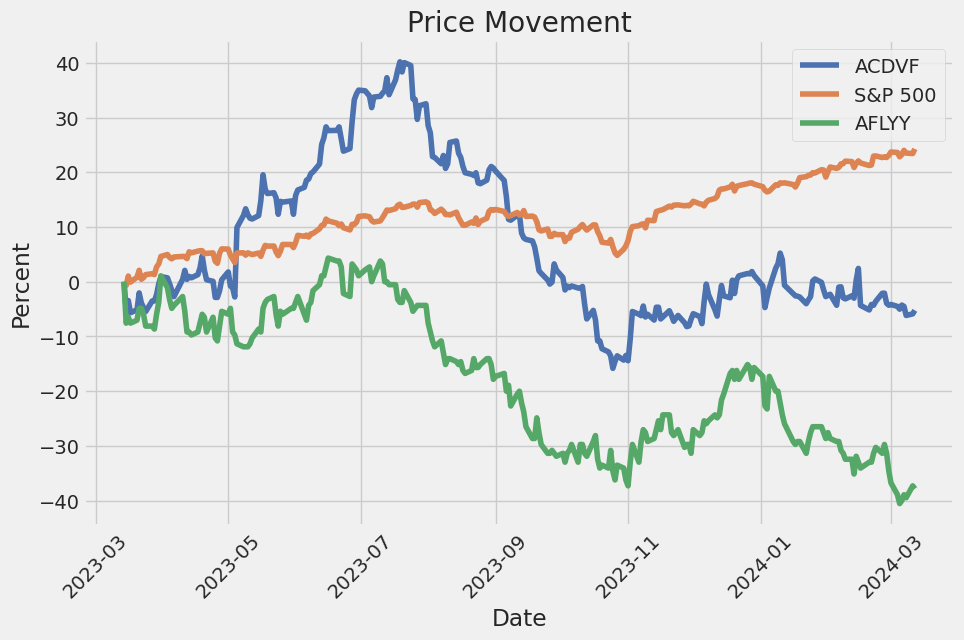

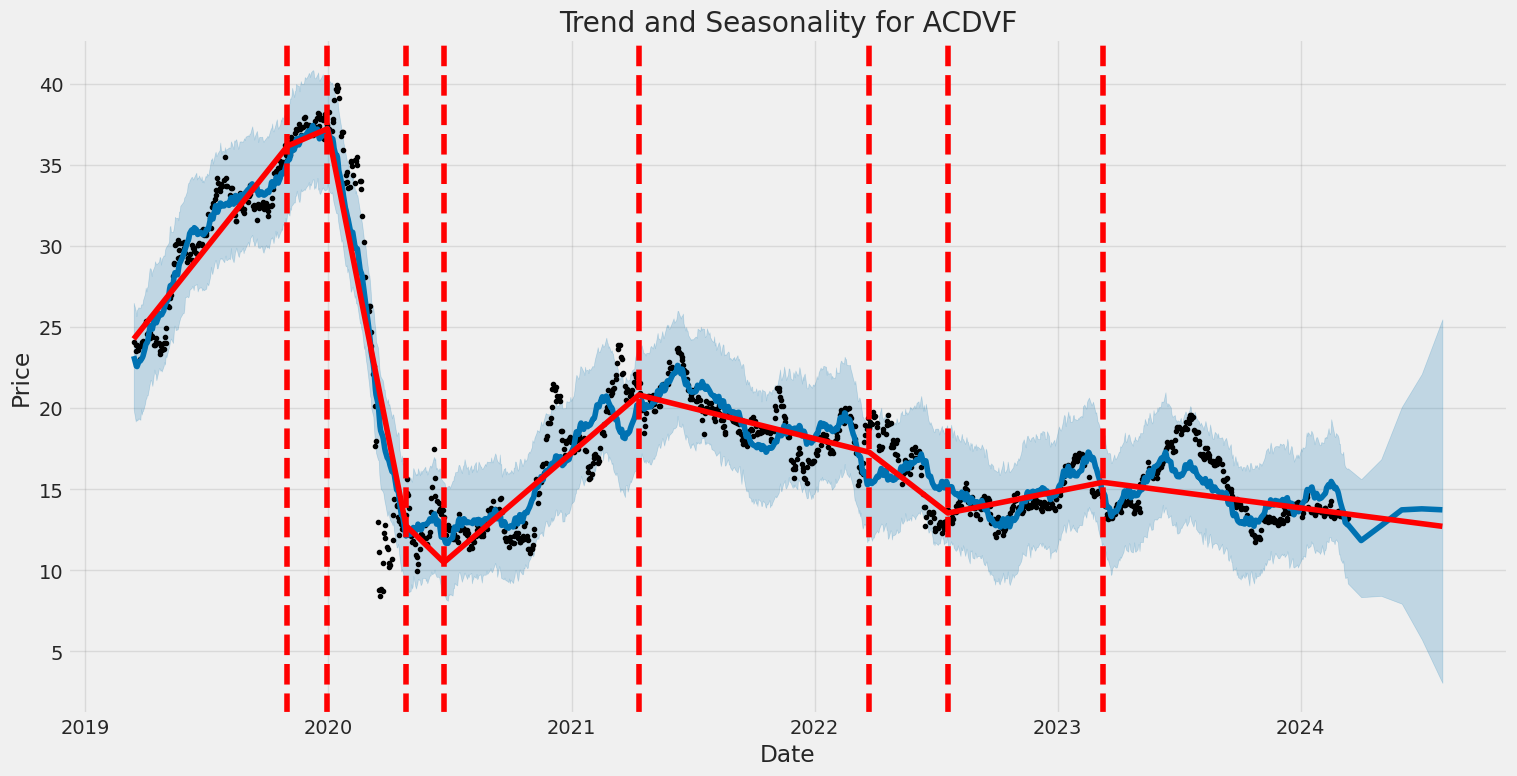

The analysis of ACDVF's current financial, technical, and fundamental metrics presents a mixed outlook with several noteworthy aspects to consider for predicting the stock's future performance. Considering the provided data, particularly technical indicators, financial health, and market sentiment, we can establish a reasoned forecast on the stock's trajectory in the upcoming months.

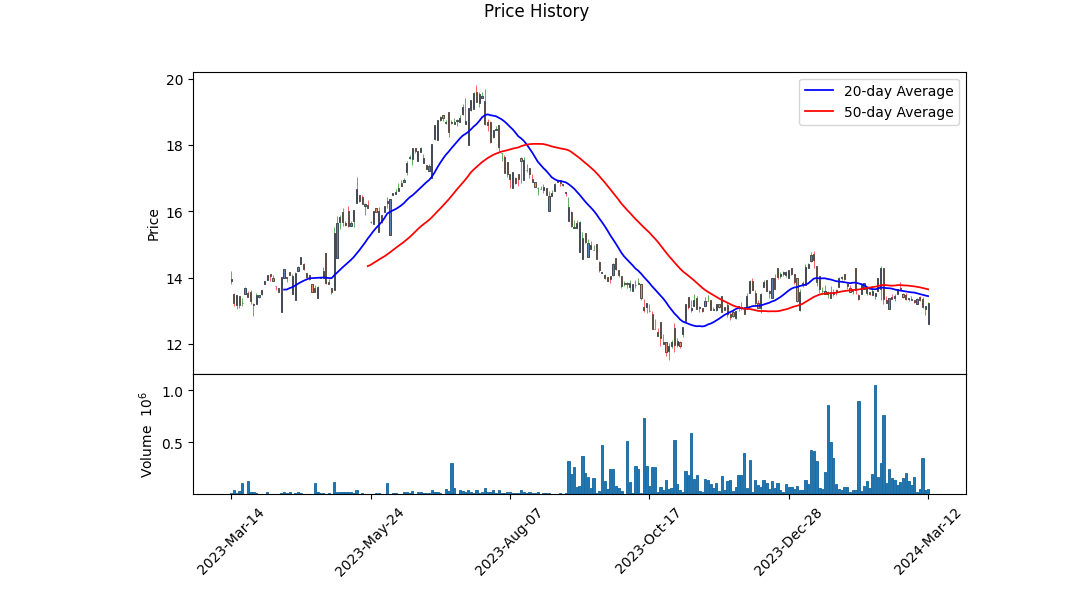

Starting with technical indicators, there was a noticeable fluctuation in the stock's price movement, culminating in a downward trend as evidenced by the negative On-Balance Volume (OBV) and declining Moving Average Convergence Divergence (MACD) histogram values in the latter dates. This trend suggests negative momentum and could hint at continued selling pressure or investor withdrawal. The absence of MACD histogram values for a significant period initially complicates the early trend analysis; however, the negative values towards the most recent dates provide clarity on the trend direction.

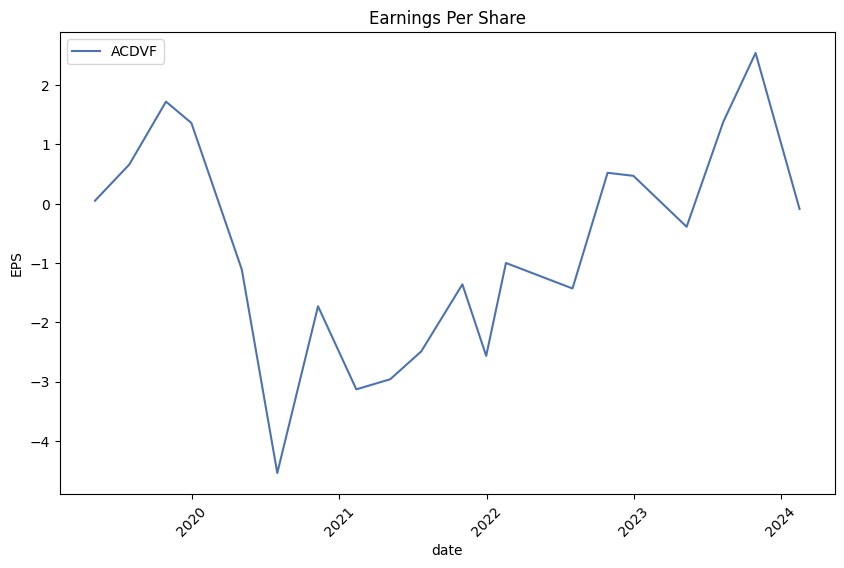

On the fundamental aspect, the financial summary indicates a company grappling with challenges yet showing resilience in certain areas. The significant net income growth to $2.276 billion from previous years losses reflects a strong recovery, bolstered by substantial revenues of $21.833 billion. This turnaround is noteworthy given the company's operating margins and EBITDA margins, suggesting improvements in operational efficiency and a solid foundation for further growth.

However, a substantial net debt figure of $8.508 billion alongside an increase in total debt from the previous years places the company in a leveraged position that may concern investors, particularly in volatile market conditions. The balance sheet reflects a growth in assets and an improvement in working capital, pointing towards better financial health and the companys ability to meet its short-term obligations.

The cash flow statements revealed a positive trajectory with a strong free cash flow of $2.756 billion, indicating the companys operational efficiency and the potential to support and grow its operations. This financial health could be a critical factor in sustaining future growth.

Market sentiment, extrapolated from analyst expectations and the historical earnings surprises, suggests a cautiously optimistic view of the companys prospects. Analysts predict an average earnings growth and a positive sales growth year-over-year, which could signal confidence in the companys trajectory. Notably, the historical earnings surprises show a trend of outperforming estimates, which may bolster investor confidence.

Risk-adjusted return ratios including Sharpe, Sortino, Treynor, and Calmar ratios, are in negative territory, reflecting the investment's diminished return prospects relative to its risk. In particular, the very low Sortino ratio underscores the risky nature of expecting positive returns amid volatility. Such ratios signal caution for risk-averse investors but could represent opportunities for those with higher risk tolerance targeting potential rebounds.

Considering the amalgamation of technical, financial, and market sentiment data, the forecast for ACDVFs stock in the coming months leans toward a conservative optimism. The companys strong revenue generation, improved net income, and solid free cash flow position it well for potential growth. However, the negative momentum indicated by technical indicators and the substantial debt load raise caution.

Potential investors should weigh the technical downtrend against the company's fundamental improvements and market expectations. The observed improvement in financial health juxtaposed with the technical indicators suggests a potential for volatility with opportunities for value-driven investment strategies. In conclusion, while a cautious approach is advisable given the mixed indicators, the underlying fundamentals provide a basis for speculative optimism in the medium to long term.

In our analysis of Air Canada (ACDVF), we've calculated two key financial metrics that are crucial for assessing the company's current performance and potential for future investment. Firstly, the return on capital (ROC) stands at -19.723611867848827%. This negative figure indicates that the company is currently not generating a positive return on the capital invested, suggesting that Air Canada is losing value on its investments. Such a scenario typically reflects challenges in operational efficiency, market competition, or external factors affecting the company's revenue and cost structures. Secondly, the earnings yield is calculated at an unusually high 47.99697656840514%. Earnings yield, which is the inverse of the price-to-earnings ratio, offers insight into the company's profitability relative to its share price. A high earnings yield can suggest that the company's stock is undervalued or that the company is generating substantial earnings compared to its market valuation. In the case of Air Canada, this high earnings yield could indicate a potential investment opportunity, assuming the company can overcome the challenges reflected in its negative ROC. Investors should consider these metrics alongside other financial analyses and market conditions to make informed decisions.

In analyzing the financial metrics of Air Canada (ACDVF) through the lens of Benjamin Graham's value investing principles, we observe a mixture of adherence to and deviation from his criteria. Here's how Air Canada's calculated metrics stack up against Graham's investment philosophy:

Price-to-Earnings (P/E) Ratio: Air Canada shows a negative P/E ratio of -4.583. According to Graham, a low P/E ratio indicates a potentially undervalued stock, however, a negative P/E ratio signifies that the company is currently unprofitable. This condition is outside the scope of Grahams preferred criteria as it suggests financial distress or challenges in profitability, which Graham would likely advise caution against.

Price-to-Book (P/B) Ratio: The P/B ratio of 0.157 suggests that the stock is trading significantly below its book value, which aligns well with Graham's principle of seeking stocks trading below their intrinsic value to ensure a margin of safety. This metric indicates that Air Canada might provide a significant margin of safety, assuming the book value is not overestimated or the company is not in severe distress.

Debt-to-Equity Ratio: Air Canada's debt-to-equity ratio stands at 16.326, which is considerably high. Graham's methodology favors companies with low debt-to-equity ratios, as a lower figure indicates less financial risk. A high debt-to-equity ratio like Air Canada's would generally be viewed as unfavorable by Graham's standards, suggesting that the company carries a high level of debt relative to its equity, which could be risky for investors.

Current and Quick Ratios: Both the current ratio and quick ratio for Air Canada are 1.025, indicating that the company has just enough assets to cover its short-term liabilities. While this meets the basic criteria for financial stability in the short term, Graham might prefer a more comfortable cushion to ensure the company can withstand financial uncertainties.

Earnings Growth: The provided metrics do not include a direct measure of earnings growth over the years. Since Graham looks for companies with consistent earnings growth as a sign of financial health and stability, a comprehensive analysis would require examining Air Canada's earnings history to fully evaluate its compliance with Graham's criteria in this area.

In conclusion, Air Canada's metrics present a mixed picture from the perspective of Benjamin Graham's value investing principles. The significantly low P/B ratio could interest a Graham-style value investor seeking a margin of safety. However, the high debt-to-equity ratio, combined with negative earnings (as implied by the negative P/E ratio), suggests financial instability, which could deter a cautious investor adhering strictly to Graham's guidelines. Without evidence of consistent earnings growth, it's challenging to fully align Air Canada as an investment choice with Graham's philosophy. Potential investors might need to weigh the margin of safety against the financial risks before making an investment decision.Analyzing Financial Statements

Introduction

The ability to analyze financial statements effectively is central to any investment decision-making process. Benjamin Graham, in "The Intelligent Investor," elaborates on the importance of a comprehensive evaluation of a company's financial health before making any investment. He argues that a fundamental understanding of a company's balance sheet, income statement, and cash flow statement is essential. This section of the report delves into Graham's principles and how they can be applied to scrutinize financial statements effectively.

Balance Sheet Analysis

The balance sheet offers a snapshot of a company's financial health at a particular point in time. It details assets, liabilities, and shareholders' equity. Graham suggests that investors pay close attention to the company's working capital (current assets minus current liabilities) as a measure of its short-term financial health and operational efficiency. High working capital indicates a more financially stable company. Additionally, Graham highlights the importance of a strong equity base (the difference between total assets and liabilities) which provides a cushion against business downturns.

Income Statement Analysis

The income statement, or the profit and loss statement, provides insight into the company's operational performance over a certain period. Graham advises investors to look beyond the bottom line (net income) and evaluate the quality of earnings. This includes assessing recurring revenue streams versus one-off events, such as the sale of an asset. He also emphasizes the importance of comparing the growth in earnings per share (EPS) against competitors and the industry at large, as a measure of a company's ability to enhance shareholder value over time.

Cash Flow Statement Analysis

Graham places a significant emphasis on the cash flow statement, which delineates the inflows and outflows of cash, providing a clearer picture of a company's liquidity. He advises investors to pay special attention to cash flows from operations, which indicate the efficiency of the core business operations. A positive cash flow from operations is a healthy sign, showing that the company is generating enough revenue to cover its operating expenses. Graham warns against companies that consistently report net income but have negative cash flows from operations, as this discrepancy could indicate creative accounting practices.

Conclusion

Benjamin Graham's approach to analyzing financial statements is grounded in the principle of conservatism and thoroughness. He advocates for an in-depth look at a company's balance sheet to assess its financial stability, an evaluation of its income statement to understand its profitability and operational efficiency, and an analysis of its cash flow statement to ascertain its liquidity. By applying Graham's principles, investors can gain a comprehensive understanding of a company's financial health, allowing them to make more informed and intelligent investment decisions. This methodical approach forms the cornerstone of value investing and serves as a guide for investors aiming to build a resilient investment portfolio.Based on the principles outlined in "The Intelligent Investor" by Benjamin Graham, analyzing a company's dividend record is crucial for assessing its attractiveness as an investment. Graham placed a significant emphasis on finding companies that not only paid dividends but had a consistent history of doing so. This consistency is seen as a sign of financial health and stability, indicating that the company is not only profitable but also manages its finances in such a way that it can reward its shareholders on a regular basis. This approach aligns with Graham's value investing philosophy, which prioritizes long-term security and steady gains over speculative, high-risk investments.

When observing a company like ACDVF and its empty historical dividend record ('historical': []), there is an immediate flag for a Graham-inspired investor. Without any dividend history to review, it's challenging to gauge the company's financial health and commitment to returning value to shareholders through dividends - both key factors in Graham's analysis. This lack of dividend history could suggest that the company is either too new to have established a pattern of dividend payments, is retaining earnings for growth or operational needs, or possibly does not prioritize dividend payments as part of its financial strategy.

For a follower of Benjamin Graham's principles, this absence of a dividend record could potentially make ACDVF a less attractive investment option until more information is available or until the company establishes a consistent pattern of dividend payments. However, it's also essential to consider the broader financial picture, including the company's earnings, debt levels, and overall market position, before making an investment decision. Graham's approach is comprehensive and considers several variables beyond just the dividend record.

| Statistic Name | Statistic Value |

| R-squared | 0.287 |

| Adj. R-squared | 0.287 |

| F-statistic | 505.1 |

| Prob (F-statistic) | 2.83e-94 |

| Log-Likelihood | -3047.0 |

| No. Observations | 1256 |

| AIC | 6098. |

| BIC | 6108. |

| coef (const) | -0.0772 |

| std err (const) | 0.077 |

| t (const) | -0.998 |

| P>|t| (const) | 0.319 |

| [0.025 (const) | -0.229 |

| 0.975] (const) | 0.075 |

| coef (0) | 1.3170 |

| std err (0) | 0.059 |

| t (0) | 22.475 |

| P>|t| (0) | 0.000 |

| [0.025 (0) | 1.202 |

| 0.975] (0) | 1.432 |

| Omnibus | 347.243 |

| Prob(Omnibus) | 0.000 |

| Skew | 0.648 |

| Kurtosis | 16.700 |

| Cond. No. | 1.33 |

In the linear regression model examining the relationship between ACDVF and the Standard & Poor's 500 index (SPY), which represents the overall market, the analysis yields a notably significant beta coefficient (1.3170) with a very low p-value (nearly 0.000), indicating a significant positive relationship between the movements of ACDVF and SPY. However, the alpha of the model, standing at -0.0772, suggests that ACDVF underperforms the broader market by 0.0772 units on average, assuming all other factors remain constant. This negative alpha value signals that, independent of the market movements, ACDVF's returns are slightly lower, although this finding is not statistically significant given its p-value of 0.319.

The overall R-squared value of 0.287 implies that approximately 28.7% of the variance in ACDVF's returns can be explained by the movements in the SPY index. While this demonstrates a meaningful correlation, it also suggests that over 71% of the variability in ACDVFs returns is due to factors not captured by this model, indicating other influences at play beyond market movements. The model's F-statistic (505.1) with a practically zero probability suggests the model is overall statistically significant. However, the relatively modest R-squared value coupled with the negative alpha raises discussions surrounding diversification benefits or sector-specific risks that may not be wholly mitigated by following broader market trends.

Air Canada's Fourth Quarter and Full Year 2023 Earnings Call, chaired by Valerie Durand, Head of Investor Relations and Corporate Sustainability, highlighted a year of strong financial performance and strategic achievements despite prevailing industry and economic challenges. President and CEO Michael Rousseau reported an 11% increase in Q4 operating revenue, reaching approximately $5.2 billion, and a 34% increase in adjusted EBITDA to $521 million. For the full year, the airline reported record operating revenue of $21.8 billion, up 32% from 2022, with operating income nearly $2.3 billion, marking a substantial improvement from the previous year. Adjusted EBITDA nearly doubled to approximately $4 billion, with a margin of 18.2%, among the highest in North America. Rousseau underscored the airline's commitment to cost control, operational reliability, and customer service enhancement.

Executive Vice President of Revenue and Network Planning, Mark Galardo, elaborated on revenue, network updates, and demand trends. He credited the year-over-year revenue increase to higher traffic and yields, particularly in international markets. The airline saw a 36% growth in passenger revenues, driven by strong demand and a robust load factor performance of 86.7%. Galardo highlighted strategic network expansions, including increased service to international destinations and a solid partnership with United Airlines. However, he noted a 27% decline in cargo revenues due to challenging market conditions but expressed optimism for recovery and strategic positioning for future growth.

John Di Bert, Executive Vice President and CFO, detailed the financial performance, noting an 8% increase in Q4 operating expenses aligned with revenue and capacity growth. He highlighted a 21% spike in salaries, wages, and benefits due to capacity-related growth and wage inflation but a 5% reduction in fuel expenses. Di Bert reported substantial free cash flow improvements, aggressive debt prepayment strategies, and a robust liquidity position, positioning the airline for future fleet additions and continued operational efficiency gains. Looking ahead, he projected adjusted CASM increase for 2024 but emphasized ongoing efforts to find cost-saving opportunities and expected moderate GDP growth.

The call concluded with a Q&A session, addressing analyst inquiries on various topics, including adjusted CASM expectations, cargo trends, and international vs. domestic capacity growth strategies. The executives reiterated Air Canada's commitment to maintaining high load factors, managing cost inflation pressures, and leveraging strategic partnerships and network expansions to sustain growth and profitability. While recognizing the challenges, including competitive dynamics and regulatory environments, they expressed confidence in the airline's strategic direction and financial resilience, undersgtanding that with calculated investment in fleet and operational enhancements, Air Canada is well poised to capitalize on market opportunities and drive long-term stakeholder value.

Air Canada has been navigating a transformative period marked by its increased reliance on technological advancements, notable industry recognitions, and strategic initiatives aimed at enhancing its operational and service excellence. The airline's significant investments in AI and big data since 2019 have been pivotal in revolutionizing customer interactions and streamlining operational processes. Despite the benefits, these technological advancements propelled Air Canada into a legal predicament, as evidenced by a small claims court case reported by Forbes on February 19, 2024. The case involved a grieving passenger misled by Air Canada's AI-powered chatbot regarding the airline's bereavement fare policy, culminating in the court ruling against Air Canada and spotlighting the potential legal complexities associated with AI in customer service.

This case signifies a crucial learning curve for the airline and potentially for the broader aviation industry, emphasizing the necessity of balancing technological innovation with reliability and legal accountability. The repercussions of this case could prompt a reevaluation of the use of AI in customer-facing roles, underlining the importance of accurate information provision and the establishment of sufficient oversight mechanisms to prevent similar incidents.

Amidst this technological advancement backdrop, Air Canada Cargo was honored as the 2024 Cargo Operator of the Year at the 50th annual ATW Airline Industry Achievement Awards, as per an announcement made on February 28, 2024. This accolade, marking Air Canada Cargo as the first Canadian operator to receive the honor, underscores the division's achievements in digital transformation and operational efficiency. The recognition from such a prestigious award attests to Air Canada's successful navigation through the complexities of modern air freight, bolstered by its investments in technological enhancements and sustainability endeavors.

Furthermore, Air Canada's financial performance throughout 2023 evidently surpassed its internal profit targets, leading to senior executives being awarded larger bonuses, as reported on February 29, 2024. This achievement is particularly significant, considering the airline's previous challenges in keeping pace with its industry counterparts in stock performance. The financial success story provides a testament to Air Canada's robust operational strategies and management excellence, highlighting a promising outlook for the airline amidst a highly competitive aviation landscape.

Adding to its commendable strides in operational and service excellence, Air Canada celebrated being named one of Montreal's top employers for the eleventh consecutive year on February 29, 2024. This recognition reflects the airline's unwavering commitment to fostering a supportive and inclusive work environment, emphasizing employee well-being, training, and development programs. Such acknowledgment underlines Air Canada's role not only as a leader in the aviation sector but also as a model employer that prioritizes its workforce's health and career aspirations.

The airline's plans to resume flights to Israel in April, after a suspension due to security concerns, were disclosed on the same date, highlighting Air Canada's adaptive response to global security dynamics and its commitment to reconnecting vital international routes. This step towards resuming operations to Israel indicates Air Canada's cautious optimism towards stabilizing conditions and showcases its strategic approach to maintaining and expanding its global network, crucial for its position as Canada's largest airline and a prominent player in the international aviation space.

As Air Canada prepares to present at the 2024 J.P. Morgan Industrials Conference on March 12, 2024, it stands on the cusp of sharing its strategic insights and future outlook with the investment community. This opportunity will allow Air Canada to highlight its advancements, strategic direction, and commitment to sustainability in front of a global audience, further solidifying its standing in the aviation industry.

The airline's recent overhaul of the in-flight dining experience, introduced on March 7, 2024, embodies its dedication to customer satisfaction and service excellence. By partnering with renowned chefs and emphasizing Canadian ingredients, Air Canada has elevated the culinary experience for its passengers across all cabins, showcasing its innovative approach to enhancing the travel experience.

In a significant step towards gender diversity in aviation, Air Canada, in collaboration with CAE, announced the winners of the 2024 Captain Judy Cameron Scholarships on International Women's Day, March 8, 2024. These scholarships, promoting the participation of women in the commercial aviation sector, exemplify Air Canada's and CAE's shared commitment to fostering an inclusive and diversified industry workforce.

Air Canada's promising financial outlook is further accentuated by optimistic ratings from Wall Street analysts, as reported on March 11, 2024. With an average brokerage recommendation suggesting strong confidence in the airline's stock performance, Air Canada presents itself as an attractive investment option. The positive trends in earnings estimate revisions, coupled with its strategic initiatives and industry recognitions, position Air Canada as a leading airline poised for continued success and innovation.

In summary, Air Canada's recent endeavors and strategic decisions underscore its resilience, adaptability, and commitment to excellence in the rapidly evolving aviation industry. From confronting the challenges associated with technological innovation to earning prestigious accolades and advancing towards financial prosperity, Air Canada continues to navigate its path towards operational excellence, environmental sustainability, and enhanced service quality, all while fostering an inclusive and supportive work environment and contributing positively to the global aviation landscape.

Air Canada's (ACDVF) volatility from March 15, 2019, to March 12, 2024, can be summarized in a few key points. Firstly, the ARCH model analysis indicates no significant predictability in returns based on past data, as shown by an R-squared value of 0.000. Secondly, the high "omega" coefficient suggests a substantial level of base volatility in the asset's returns. Lastly, the "alpha" term indicates that past variance significantly impacts future volatility, revealing a tendency for volatility clustering in the stock's returns.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Log-Likelihood | -3170.64 |

| AIC | 6345.28 |

| BIC | 6355.55 |

| No. Observations | 1256 |

| omega | 6.5498 |

| alpha[1] | 0.4567 |

Utilizing volatility modeling, specifically the Generalized Autoregressive Conditional Heteroskedasticity approach, allows for an in-depth examination of the fluctuation in Air Canada's stock (ACDVF) prices. This method is particularly adept at capturing the persistence and patterns of volatility, a crucial factor in assessing financial risk over the course of a year. By analyzing past price movements and volatility, this model can forecast the range within which future price volatility is likely to occur. Given the inherent uncertainties in stock markets, such a nuanced understanding of volatility is invaluable for risk assessment.

On the other side, machine learning predictions, employing a technique that learns from historical data to predict future outcomes, offers a complementary perspective on Air Canadas stock. In this analysis, the machine learning method chosen is the ensemble learning method known for its ability to reduce overfitting by combining multiple predictions, thus enhancing the robustness and accuracy of forecasts regarding stock returns. By inputting historical stock prices and other relevant financial indicators into this model, it attempts to forecast future stock performance by identifying patterns and relationships within the data that are not immediately apparent.

Integrating the insights gained from volatility modeling with the predictive power of machine learning models, such as the ensemble method, creates a comprehensive view of Air Canada's (ACDVF) stock's financial risk. This synergy allows for the prediction of both the stock's future price volatility and its potential return, which are critical components in calculating the Value at Risk (VaR).

The calculated Annual Value at Risk (VaR) for a $10,000 investment in Air Canada, with a 95% confidence interval, stands at $331.14. This figure essentially indicates that there is a 95% likelihood that the investor's portfolio will not lose more than $331.14 over the next year due to price volatility in Air Canada's stock, under normal market conditions. This VaR calculation, rooted in the combined findings from the utilized volatility and machine learning models, provides a quantifiable measure of market risk associated with this specific equity investment.

By employing both the volatility and machine learning methods in this analytical framework, the assessment transcends basic statistical analysis. Instead, it captures the dynamic and complex nature of financial markets, allowing for a more informed and nuanced understanding of the potential risks involved in investing $10,000 in Air Canada (ACDVF) over a one-year period.

Similar Companies in Airlines:

Air France-KLM SA (AFLYY), Cineplex Inc. (CPXGF), Deutsche Lufthansa AG (DLAKY), International Consolidated Airlines Group S.A. (ICAGY), Singapore Airlines Limited (SINGY), Delta Air Lines, Inc. (DAL), United Airlines Holdings, Inc. (UAL), American Airlines Group Inc. (AAL), Southwest Airlines Co. (LUV), Alaska Air Group, Inc. (ALK), JetBlue Airways Corporation (JBLU)

https://finance.yahoo.com/news/air-canada-cargo-named-2024-130000842.html

https://finance.yahoo.com/news/press-digest-canada-feb-29-111829619.html

https://finance.yahoo.com/news/air-canada-named-one-montreals-155900195.html

https://finance.yahoo.com/news/air-canada-resume-flights-israel-220617211.html

https://finance.yahoo.com/news/advisory-air-canada-present-j-130000350.html

https://finance.yahoo.com/news/pack-appetite-air-canada-serves-130000140.html

https://finance.yahoo.com/news/air-canada-cae-announce-2024-130000269.html

https://finance.yahoo.com/news/air-canada-acdvf-buy-wall-133010954.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: t4yvJ4

Cost: $0.52379

https://reports.tinycomputers.io/ACDVF/ACDVF-2024-03-12.html Home