Analog Devices, Inc. (ticker: ADI)

2024-01-27

Analog Devices, Inc. (ADI) is a multinational semiconductor company specializing in data conversion, signal processing, and power management technology. Founded in 1965, the company has established a reputation for innovation by creating high-performance analog, mixed-signal, and digital signal processing (DSP) integrated circuits (ICs). ADI serves a diverse array of applications and industries including healthcare, instrumentation, automation, communications, and transportation. Its extensive product portfolio includes amplifiers, ADCs, DACs, MEMS, and power management ICs. Headquartered in Wilmington, Massachusetts, Analog Devices operates on a global scale, with design and manufacturing facilities across the world. The company's stocks are traded under the NASDAQ ticker symbol ADI, and it is recognized as a key player in the semiconductor industry, contributing substantially to advances in electronics and technology. Through a combination of strategic acquisitions and focused R&D efforts, ADI maintains a significant presence in the competitive semiconductor market, continually adapting to the evolving demands of electronics consumers and professionals.

Analog Devices, Inc. (ADI) is a multinational semiconductor company specializing in data conversion, signal processing, and power management technology. Founded in 1965, the company has established a reputation for innovation by creating high-performance analog, mixed-signal, and digital signal processing (DSP) integrated circuits (ICs). ADI serves a diverse array of applications and industries including healthcare, instrumentation, automation, communications, and transportation. Its extensive product portfolio includes amplifiers, ADCs, DACs, MEMS, and power management ICs. Headquartered in Wilmington, Massachusetts, Analog Devices operates on a global scale, with design and manufacturing facilities across the world. The company's stocks are traded under the NASDAQ ticker symbol ADI, and it is recognized as a key player in the semiconductor industry, contributing substantially to advances in electronics and technology. Through a combination of strategic acquisitions and focused R&D efforts, ADI maintains a significant presence in the competitive semiconductor market, continually adapting to the evolving demands of electronics consumers and professionals.

| Full Time Employees | 26,000 | CEO & Chair of the Board Pay | $5,545,963 | CEO Unexercised Stock Options | $27,091,980 |

| Previous Close | $197.30 | Day Low | $193.4707 | Day High | $196.44 |

| Dividend Rate | $3.44 | Dividend Yield | 1.74% | Payout Ratio | 50.99% |

| Five Year Avg Dividend Yield | 1.82% | Beta | 1.217 | Trailing PE | 29.61 |

| Forward PE | 22.21 | Volume | 2,286,825 | Average Volume | 3,192,595 |

| Market Cap | $96,164,069,376 | Fifty Two Week Low | $154.99 | Fifty Two Week High | $202.77 |

| Price to Sales | 7.81 | Enterprise Value | $104,409,907,200 | Profit Margins | 26.94% |

| Book Value | $71.666 | Price to Book | 2.71 | Net Income to Common | $3,314,578,944 |

| Trailing EPS | 6.55 | Forward EPS | 8.73 | Total Cash | $958,060,992 |

| Total Debt | $7,455,540,224 | Total Revenue | $12,305,539,072 | Free Cash Flow | $3,313,682,432 |

| Sharpe Ratio | -15.314 | Sortino Ratio | -251.536 |

| Treynor Ratio | 0.134 | Calmar Ratio | 0.732 |

As a Technical Analysis expert, evaluating the potential stock price movement for ADI over the next few months entails a synthesis of technical indicators, fundamental analysis, and balance sheet assessment.

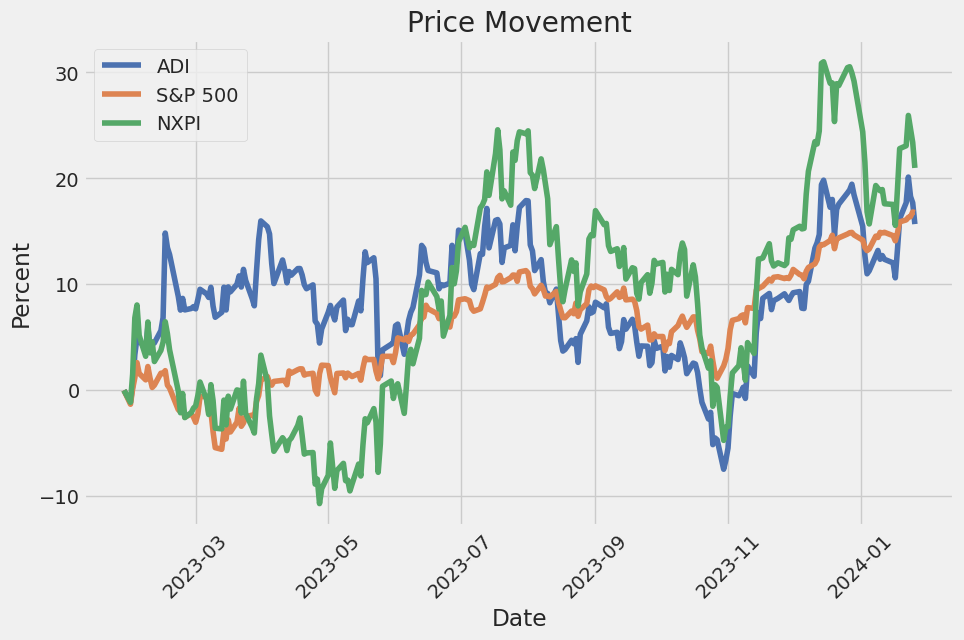

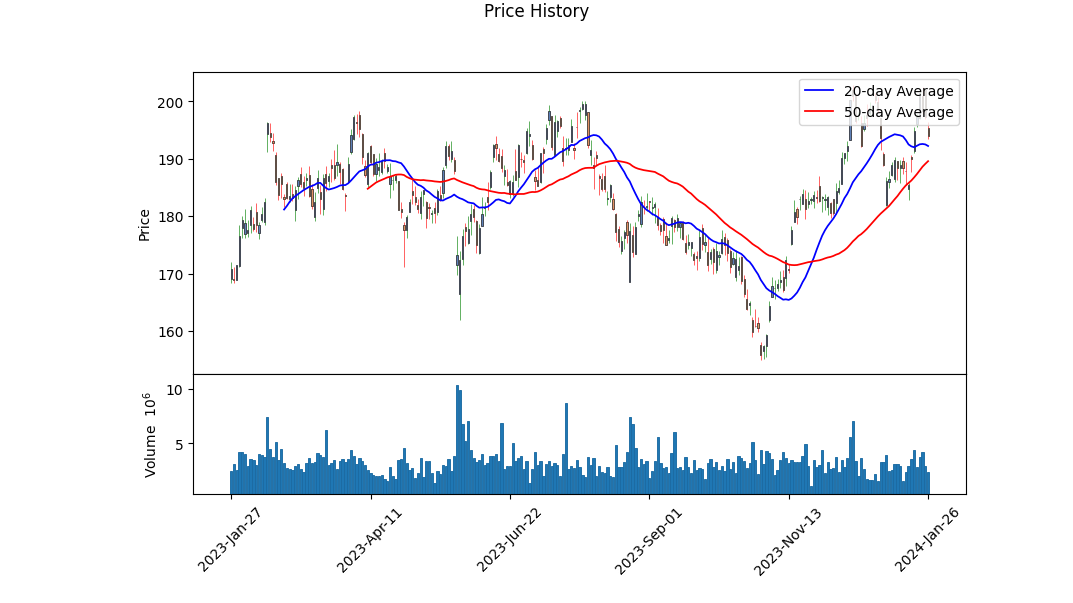

A review of the recent technical data shows a noticeable uptrend in the stock with increasing On-Balance Volume (OBV), indicative of strong volume backing the rise in price, typically a bullish sign. The recent MACD histogram values suggest increasing bullish momentum. However, it is crucial to note the absence of MACD histogram data prior to January 22, which limits the ability to assess the trend over the entirety of the provided timeframe fully.

Examining the fundamentals, ADI has robust profit margins, with gross margins of approximately 64% and EBITDA margins around 51%. This suggests a healthy profitability profile, which is often attractive to investors. A substantial increase in revenue over the last reported periods indicates company growth. The earnings estimates suggest analyst confidence in continued EPS growth, both for the current and the following year. Fundamental analysis, therefore, yields a positive outlook.

The balance sheet and cash flow summaries provide additional context for ADI's financial health. A noteworthy point is the negative tangible book value, indicating that intangible assets (like intellectual property) significantly influence the companys equity value. However, the company has managed its debt, as seen by the issuance and repayment activities, and keeps a steady flow of free cash, which is a sign of financial stability.

Risk-adjusted performance metrics, such as the Sharpe, Sortino, Treynor, and Calmar ratios, are significantly varied. The Sharpe and Sortino ratios are negative, violating the general interpretation of these measures, possibly due to an extremely volatile stock performance against a backdrop of a low risk-free rate. The positive Treynor and Calmar ratios, while not negative, are relatively low, implying some reward for the risk taken, but they are not strongly indicative of excellent risk-adjusted returns.

Given the potent cocktail of strong fundamentals, a technically bullish trend, and a balance sheet that is robust despite some nuances, the outlook for ADI's stock price in the coming months seems cautiously optimistic. The strong macroeconomic factors are supportive of growth, yet, investors' mileage may vary based on their risk tolerance due to the conflicting messages sent by the various risk-adjusted performance measures. The reported ratios indicate that the stock could be facing higher volatility or specific risks not fully captured by the traditional ratios, which warrants investor diligence. Robust profitability and growth prospects, as expressed in the analysts' expectations as well as the growing OBV and bullish MACD histogram, give grounds to forecast that the ADI stocks is poised for continued upward momentum. Nevertheless, market dynamics are subject to change due to external factors, and thus ongoing vigilance and analysis will be paramount.

| R-squared | 0.596 |

| Adj. R-squared | 0.595 |

| F-statistic | 1,850 |

| Prob (F-statistic) | 3.25e-249 |

| Log-Likelihood | -2,197.5 |

| AIC | 4,399 |

| BIC | 4,409 |

| Alpha (const) | 0.0052 |

| Beta (0) | 1.2803 |

The linear regression model between ADI (the dependent variable) and SPY (the independent variable representing the market) suggests a positive relationship, as indicated by the beta coefficient of 1.2803. This implies that for every one-unit change in SPY, ADI is expected to change by approximately 1.2803 units. The coefficient of determination, or R-squared, is 0.596, indicating that about 59.6% of the variation in ADI can be explained by SPY. The F-statistic is significant, with a very small probability value, indicating that the model is a good fit for the data. The alpha, or y-intercept, is 0.0052, which is the expected value of ADI when SPY is zero. However, the alpha has a P>|t| value of 0.895, suggesting it is not statistically significant at common levels of confidence.

Alpha, representing the constant or intercept term in the regression equation, provides insight into the expected performance of ADI when the market return (SPY) is zero. An alpha of 0.005158825289795472 indicates that even if SPY were to yield no return, there would be a small positive effect on ADI, equating to approximately 0.52%. However, since the statistical significance of this alpha is weak (P>|t| = 0.895), the interpretation should be approached with caution, as it may not be distinguishable from zero in a practical sense. This suggests that ADI's returns are more influenced by market movements (as represented by SPY) than by any inherent performance attributed solely to ADI. The beta, being greater than 1, suggests that ADI is more volatile relative to the market.

Summary of Analog Devices, Inc. Earnings Call for Q4 FY2023

Introduction and Preliminary Remarks During the Analog Devices' fourth-quarter fiscal 2023 earnings call, Vice President of Investor Relations and FP&A Michael Lucarelli provided preliminary remarks, mentioning the availability of the earnings release and financial schedules on the investor website and highlighting forward-looking statements and non-GAAP measures. Changes in revenue mapping to better align with customer end markets and a reminder that Q1 FY2024 will be a 14-week quarter were also noted.

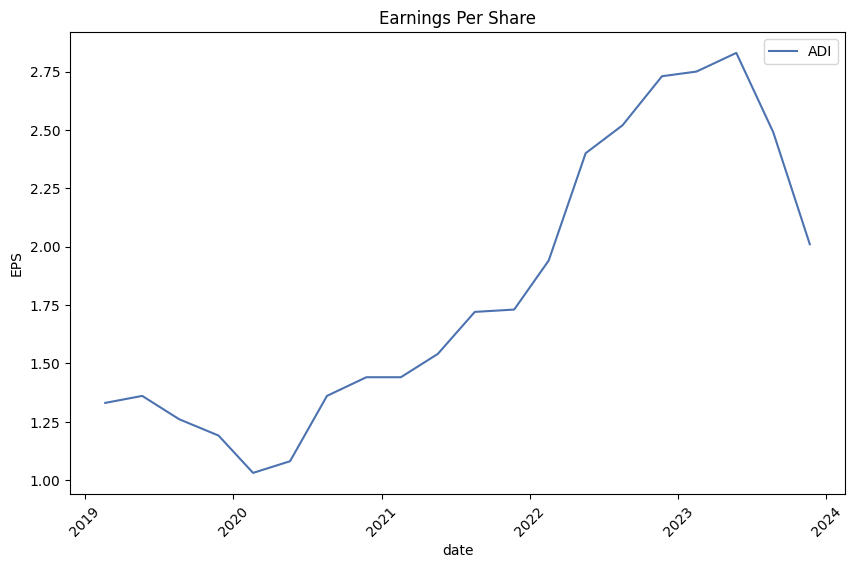

CEOs Overview CEO Vincent Roche presented an overview of the fourth quarter and full-year fiscal 2023, citing $2.7 billion in Q4 revenue led by automotive growth, with operating margins at 44.7% and EPS at $2.01. Fiscal year revenue was reported as $12.3 billion, with an EPS increase of 5% to $10.09. Despite challenging times and a broad-based inventory correction anticipated to persist through the first half of the next year, Roche emphasized the strength of ADI's diversified business model and its commitment to strategic investments for market recovery. The company's design win pipeline, synergies from the Maxim acquisition, and strength in Industrial Automation and Automotive were significant highlights.

Financial Performance and Expectations Interim CFO Jim Mollica discussed the detailed financials, indicating a 2% revenue increase to $12.3 billion for FY2023. Though Q4 revenue declined sequentially and year-over-year due to broad-based weakness, automotive remained strong. He provided a breakdown of market segments, mentioning declines in communications and consumer segments as well. Gross margin was reported at 70.2%. OpEx reduction contributed to an operating margin of 44.7% and EPS of $2.01. The balance sheet showed a strong position, with inventory and channel inventory being actively managed. The company returned 130% of free cash flow to shareholders through buybacks and dividends. Guidance for Q1 FY2024 set revenue expectations at $2.5 billion. Mollica emphasized ADI's actions to preserve financial integrity amidst weak market conditions.

Q&A Highlights

The Q&A session highlighted queries about the company's approach to a cyclical downturn, pricing stability, inventory management, CapEx reduction, and sector-specific performance, particularly in Industrial. Management remained confident in maintaining pricing power, managing inventory, and upholding gross margins despite revenue declines. They also addressed strategies to lower CapEx while ensuring future growth and resilience. Automotive was expected to fare well despite macro challenges, and bookings showed signs of stability. CEO Vincent Roche concluded the call with optimism towards the intelligent edge opportunities when the business recovery arrives and wished everyone a happy Thanksgiving.

In this report, Analog Devices, Inc. (ADI) provides a comprehensive overview of its financial results for the quarterly period ended July 29, 2023, as detailed in its SEC Form 10-Q filing. The filing discusses key financial metrics, including revenue, gross margin, operating expenses, and net income.

For the quarter ended July 29, 2023, ADI reported revenue of $3.076 billion, which represents a slight decline of 1% from the same quarter in the previous year. Despite the revenue decrease, the company managed to maintain a profitable quarter with a net income of $877 million, marking a 17% increase compared to the equivalent period last year. This improvement in profitability was attributed to operational efficiencies and a favorable tax benefit that offset the decline in revenues. Diluted earnings per share (EPS) rose to $1.74, which is a significant 21% increase from the prior year's $1.44.

ADI's gross margin for the quarter was reported at 63.8%, showing a decrease from the previous year's 65.7%. The decline in gross margin percentage was mainly due to lower factory utilization stemming from a decrease in customer demand. However, for the nine-month period, gross margin improved by 350 basis points compared to the same duration in the previous year, largely due to a significant one-time cost of goods sold adjustment related to the acquisition of Maxim Integrated Products in the previous year.

Operating expenses, categorized as Research and Development (R&D), Selling, Marketing, General and Administrative (SMG&A), and special charges, were closely managed. R&D expenses were slightly reduced by 2% year-over-year for both the quarter and nine-month periods, aligning with the company's intent to continue investing strategically in innovation. SMG&A expenses increased by 2% for the quarter but were managed effectively to contribute positively to the overall operating income.

As for special charges, ADI reported a substantial decrease of 83% for the quarter, which further contributed to the enhancement of operating income. The reported special charges were associated with ongoing organizational initiatives and the integration activities related to Maxim.

ADI's non-operating expenses increased compared to the previous year, mainly due to higher interest expenses related to debt obligations and lower gains from investments, offset by increased interest income. The effective tax rate for the quarter was notably negative at (0.3)%, as the company benefited from the approval of a federal corporate income tax relief claim.

The company's liquidity remains strong, with $1.149 billion in cash and cash equivalents. Cash flow from operations is robust and reported to be sufficiently covering capital expenditures, R&D, dividend payments, and debt servicing. The capital expenditure for fiscal 2023 is anticipated to be between 7% to 9% of revenue, which is a significant investment primarily for expanding manufacturing capacity.

The company has an active share repurchase program, with $2.6 billion remaining available under the current authorized plan. The Board of Directors has also declared a quarterly cash dividend of $0.86 per share to be distributed in September 2023.

In summary, ADI has showcased consistent financial management despite a slight decrease in revenue. Increased profitability, effective control of operating expenses, strategic investments in R&D, and strong liquidity position the company for ongoing success. The report does not anticipate any material impacts from new accounting pronouncements or reflect any unresolved legal proceedings. Moreover, ADIs commitment to returning value to its shareholders through dividends and share repurchases underscores the company's confidence in its long-term financial health.

The recent performance and outlook for Analog Devices, Inc. (ADI), a leader in the semiconductor industry specializing in analog, mixed signal, and digital signal processing (DSP) integrated circuits, paint a complex picture. On the one hand, ADI has been impacted by negative sentiment resulting in a downward revision of its earnings estimates. Zacks Equity Research listed ADI as a Zacks Rank #5 (Strong Sell) on January 19, 2024, implying expected underperformance relative to the market in the near term. The Zacks Consensus Estimate for ADI's current-year earnings has seen a decrement of about 15.7% over the past 60 days.

This pessimistic stance aligns with concerns of potential company-specific or industry-wide challenges affecting ADI's performance. The substantial reduction in its earnings estimate is a clear indicator of these challenges. Furthermore, this downgrade prompts investors to reassess their positions and potential strategy adjustments. (Zacks.com article).

However, not all news around Analog Devices signals caution. The companys strategic foray into new technologies is evident from its recent partnership with SambaNova Systems aimed at implementing SambaNova's generative AI technology to improve various aspects of its business, including sales and customer relations. This collaboration, announced on January 11, 2024, is likely to further ADI's commitment to the industrial and automotive sectors, where there is a consistent demand for its cutting-edge solutions (Zacks.com).

Despite facing stiff competition from the likes of Synopsys and Intel Corporation, ADI has been proactively adapting its strategies to stay competitive. Some of its strategic moves include the launch of the Apollo MxFE platform, sizable investments in the expansion of its European headquarters in Ireland, and the introduction of an open radio unit reference design platform. Additionally, financial forecasts remain robust, with a projection of $61.14 billion in total revenues for the year 2024, suggesting a 12.7% year-over-year increase, and earnings expectations of $1.85 per share, a substantial 94.7% growth from the previous year. These moves showcase ADI's dedication to growth and innovation in a challenging and evolving market.

Yet, ADI's Q4 fiscal year 2023 report indicates a challenging period, with the company meeting its earnings per share expectations but experiencing a 26% decrease from the previous year's quarter. Revenue also declined by 16% from the last year, with the automotive segment showing strength, offsetting weakness in other sectors (Zacks).

Adding a layer of complexity to ADI's investment narrative is an analyst upgrade by Wolfe Research, contrary to the sentiment expressed by Zacks. On January 18, 2024, Wolfe Research upgraded Analog Devices to Outperform from Peerform with a price target of $225.00, indicating that ADI may have weathered the worst of the inventory correction, which is a favorable shift in market perception (Investing.com).

ADI's dedication to innovation and its willingness to explore new opportunities is underscored in the company's involvement in a technology partnership for Honeywell's "Advance Control for Buildings." As a strategic ally, ADI looks to enhance connectivity and signal conversion, promising heightened efficiency in building management systems. This relationship showcases ADIs potential to contribute to sustainable and smart infrastructure (PR Newswire).

Simultaneously, ADI's recent bump in its Relative Strength Rating, reported on January 22, 2024, by Investor's Business Daily, although not surpassing the market's top echelon, reflects a positive shift in price performance, suggesting some degree of market strength, even if not yet indicative of leading performance in the market (Investor's Business Daily).

Looking at broader industry trends, a report released on January 25, 2024, by Anthony Lee at Yahoo Finance summarizing Q3 performances, positions ADI within a sector that has seen mixed results. While ADI itself reported a 7.8% increase in stock price despite a revenue decrease, the average revenue for the industry conformed more to forecasts with a lagging guidance for the next quarter (Yahoo Finance - Winners And Losers Of Q3: Analog Devices (NASDAQ:ADI) Vs The Rest Of The Analog Semiconductors Stocks).

In contrast to the cautious view from Zacks, it is also necessary to consider that ADI's recent price action has not entirely reflected the negative sentiment. On January 24, 2024, ADI's stock price was reported to have encountered a slight downturn, contrasting the positive trends in the broader market indicated by the S&P 500 and the Nasdaq Composite Index. The dip in stock price calls for attention from investors, especially as the company approaches a new earnings disclosure, with expectations of a decrease in EPS and revenue for the forthoming quarter (Zacks Finance Article on Analog Devices, Inc.).

Amidst this mixed outlook, it is clear that while ADI confronts challenges, it doesn't shy away from strategic initiatives aimed at better positioning the company within a competitive and volatile market. Stakeholders and investors must weigh the analyst downgrades, upgrades, and strategic developments, evaluating each within the broader context of ADI's long-term growth prospects and role in the semiconductor industry.

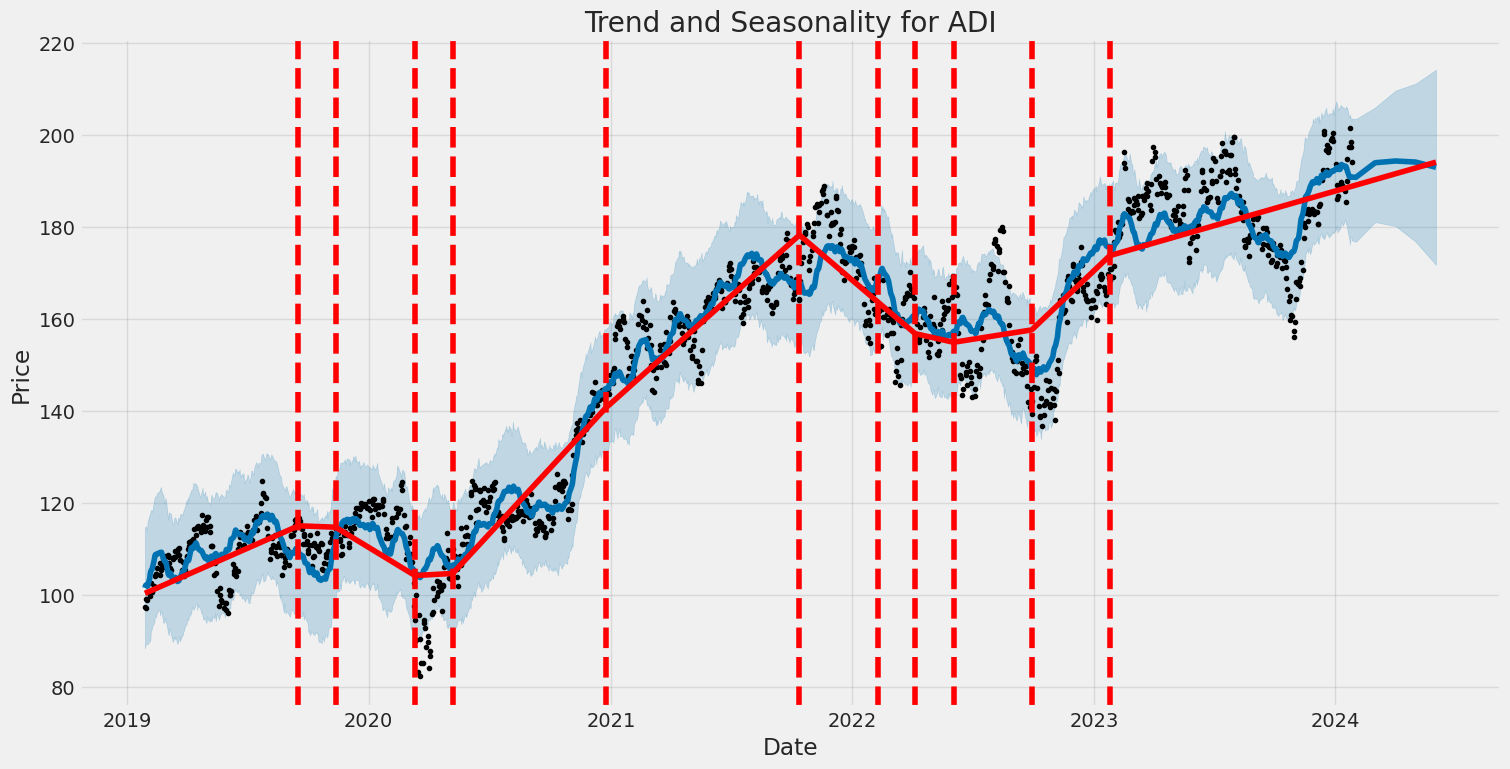

Over the period from January 2019 to January 2024, the stock of Analog Devices, Inc. (ADI) has exhibited a certain degree of volatility. The statistical analysis using an ARCH model indicates that there is a baseline level of variability in the stock's returns, as shown by the non-zero omega coefficient. Additionally, the positive alpha coefficient suggests that past volatility does have an influence on future volatility, implying that larger swings in ADI's stock price can be expected following periods of high volatility.

| Statistic | Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2686.30 |

| AIC | 5376.59 |

| BIC | 5386.87 |

| No. Observations | 1258 |

| omega | 3.5194 |

| alpha[1] | 0.1948 |

To analyze the financial risk of investing $10,000 in Analog Devices, Inc. (ADI) over one year, we'll apply volatility modeling alongside machine learning predictions. Such integrated approaches can offer a more comprehensive understanding of potential risks in equity investments.

The first phase involves using volatility modeling to capture the time-varying nature of market uncertainty. In the context of ADI's stock, this model is effective in estimating the changing volatility patterns, which is crucial for risk analysis. It takes into account the clustering of high and low volatility phases and allows us to forecast future volatility based on historical price data.

Next, machine learning predictions are employed to leverage historical data to predict future stock returns. A model like the one implemented in this analysis makes use of various features in the data such as historical prices, volume, and perhaps other financial indicators to learn from the patterns in stock movements. Once trained, it can provide projections of future price movements and returns.

Combining insights from both volatility modeling and machine learning predictions offers a more dynamic assessment of risk than traditional methods. Volatility modeling gives a nuanced view of the expected range of price fluctuations, or the likely volatility, while machine learning predictions can indicate the direction of potential price movements, based on historical trends.

Bringing these analyses together provides an estimate of the potential downside risk of the investment in Analog Devices, Inc. To quantify this risk, we calculate the Value at Risk (VaR) at a 95% confidence interval. VaR is a statistical technique used to measure the level of financial risk within a firm or investment portfolio over a specific time frame. The calculated annual VaR for a $10,000 investment in ADI at a 95% confidence level is $265.24. This means that there is a 5% chance that the investment could lose more than $265.24 over the next year.

It is important to note that these models rely on historical data and statistical assumptions, and while they are sophisticated tools for risk assessment, they cannot account for all market conditions or unforeseen events. Thus, while the calculated VaR provides a metric of potential loss, investors should consider it alongside other factors when evaluating the risks of an equity investment.

Similar Companies in Semiconductors:

NXP Semiconductors N.V. (NXPI), QUALCOMM Incorporated (QCOM), Broadcom Inc. (AVGO), Microchip Technology Incorporated (MCHP), ON Semiconductor Corporation (ON), Lattice Semiconductor Corporation (LSCC), Qorvo, Inc. (QRVO), Wolfspeed, Inc. (WOLF), Texas Instruments Incorporated (TXN), Monolithic Power Systems, Inc. (MPWR), Maxim Integrated Products, Inc. (MXIM), STMicroelectronics N.V. (STM), Infineon Technologies AG (IFNNY), Skyworks Solutions, Inc. (SWKS)

https://www.zacks.com/stock/news/2201150/why-is-analog-devices-adi-up-5-2-since-last-earnings-report

https://www.zacks.com/stock/news/2203445/new-strong-sell-stocks-for-december-29th

https://seekingalpha.com/article/4661115-true-compounding-the-essential-stocks

https://seekingalpha.com/article/4661141-semiconductors-winners-losers-start-of-2024

https://www.zacks.com/stock/news/2210546/new-strong-sell-stocks-for-january-16th

https://finance.yahoo.com/news/strong-sell-stocks-january-16th-120600477.html

https://finance.yahoo.com/news/microsoft-upgraded-outperform-price-target-061800206.html

https://finance.yahoo.com/news/strong-sell-stocks-january-19th-120600325.html

https://finance.yahoo.com/m/2076d4c3-3412-31f1-89e3-92a06ea67d8b/analog-devices-stock-sees.html

https://finance.yahoo.com/news/honeywell-transforms-building-management-first-130000093.html

https://finance.yahoo.com/news/analog-devices-adi-stock-sinks-231517241.html

https://finance.yahoo.com/news/winners-losers-q3-analog-devices-084813557.html

https://www.sec.gov/Archives/edgar/data/6281/000000628123000179/adi-20230729.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: ZDMAU7

Cost: $0.71433

https://reports.tinycomputers.io/ADI/ADI-2024-01-27.html Home