Archer Daniels Midland Company (ticker: ADM)

2023-12-28

Archer Daniels Midland Company (ADM) is a global leader in food processing and commodities trading, with a significant presence in the agricultural industry. The company operates through various segments, including Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition. ADM's extensive value chain encompasses sourcing, transportation, storage, processing, and distribution of agricultural products. It refines oilseeds like soybeans and canola into products for food, animal feed, industrial, and energy uses. In addition to processing corn into sweeteners, starches, and bioproducts, ADM also provides food ingredients, such as flavors and specialty proteins, to enhance the taste and nutritional value of consumer goods. By leveraging a vast network of facilities and transportation assets, ADM efficiently connects crops with markets on a global scale. The company's commitment to innovation and sustainability has positioned it as a key player in facilitating the food and agricultural sector's response to the growing demand for wholesome and responsibly-sourced products. As a publicly-traded company with ticker symbol ADM on the New York Stock Exchange, it provides investors with exposure to the essential commodities and food ingredients markets.

Archer Daniels Midland Company (ADM) is a global leader in food processing and commodities trading, with a significant presence in the agricultural industry. The company operates through various segments, including Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition. ADM's extensive value chain encompasses sourcing, transportation, storage, processing, and distribution of agricultural products. It refines oilseeds like soybeans and canola into products for food, animal feed, industrial, and energy uses. In addition to processing corn into sweeteners, starches, and bioproducts, ADM also provides food ingredients, such as flavors and specialty proteins, to enhance the taste and nutritional value of consumer goods. By leveraging a vast network of facilities and transportation assets, ADM efficiently connects crops with markets on a global scale. The company's commitment to innovation and sustainability has positioned it as a key player in facilitating the food and agricultural sector's response to the growing demand for wholesome and responsibly-sourced products. As a publicly-traded company with ticker symbol ADM on the New York Stock Exchange, it provides investors with exposure to the essential commodities and food ingredients markets.

| As of Date: 12/27/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 38.61B | 40.43B | 40.50B | 43.41B | 51.01B | 44.17B |

| Enterprise Value | 46.61B | 48.83B | 51.15B | 52.67B | 59.65B | 55.80B |

| Trailing P/E | 10.07 | 10.06 | 9.48 | 10.33 | 12.81 | 12.69 |

| Forward P/E | 10.79 | 11.26 | 11.36 | 11.81 | 14.51 | 13.30 |

| PEG Ratio (5 yr expected) | - | - | - | - | 16.49 | - |

| Price/Sales (ttm) | 0.41 | 0.42 | 0.41 | 0.44 | 0.53 | 0.48 |

| Price/Book (mrq) | 1.53 | 1.62 | 1.61 | 1.79 | 2.12 | 1.81 |

| Enterprise Value/Revenue | 0.48 | 2.25 | 2.03 | 2.19 | 2.27 | 2.26 |

| Enterprise Value/EBITDA | 7.26 | 33.75 | 32.50 | 29.21 | 44.28 | 35.16 |

| Industry | Farm Products | Sector | Consumer Defensive | Full Time Employees | 40,360 |

| Previous Close | $72.39 | Open | $72.08 | Day Low | $71.76 |

| Day High | $72.36 | Dividend Rate | $1.80 | Dividend Yield | 2.49% |

| Payout Ratio | 24.34% | Five Year Avg Dividend Yield | 2.63% | Beta | 0.817 |

| Trailing PE | 10.04 | Forward PE | 11.10 | Volume | 2,367,890 |

| Market Cap | $38,494,105,600 | Fifty Two Week Low | $69.31 | Fifty Two Week High | $95.90 |

| Price to Sales (TTM) | 0.397 | Fifty Day Average | $73.19 | Two Hundred Day Average | $76.77 |

| Trailing Annual Dividend Rate | $1.75 | Trailing Annual Dividend Yield | 2.42% | Enterprise Value | $46,966,468,608 |

| Profit Margins | 4.06% | Float Shares | 529,775,598 | Shares Outstanding | 533,380,992 |

| Shares Short | 5,997,924 | Held Percent Insiders | 0.73% | Held Percent Institutions | 80.81% |

| Short Ratio | 1.93 | Book Value | $47.16 | Price to Book | 1.53 |

| Last Fiscal Year End | 2022 | Most Recent Quarter | Q3 2022 | Earnings Quarterly Growth | -20.4% |

| Net Income to Common | $3,936,999,936 | Trailing Eps | $7.19 | Forward Eps | $6.50 |

| Total Cash | $1,498,000,000 | Total Cash Per Share | $2.81 | Ebitda | $5,088,000,000 |

| Total Debt | $9,500,000,256 | Quick Ratio | 0.438 | Current Ratio | 1.686 |

| Total Revenue | $96,896,000,000 | Debt to Equity | 37.14 | Revenue Per Share | $177.14 |

| Return on Assets | 4.54% | Return on Equity | 15.82% | Gross Profits | $7,570,000,000 |

| Free Cash Flow | $2,261,625,088 | Operating Cash Flow | $2,020,999,936 | Earnings Growth | -16.9% |

| Revenue Growth | -12.1% | Gross Margins | 7.78% | Ebitda Margins | 5.25% |

| Operating Margins | 4.61% |

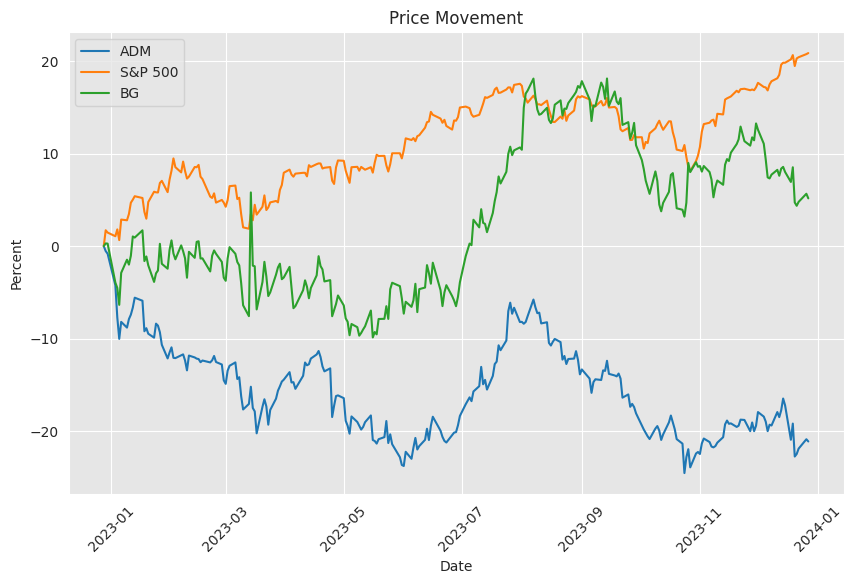

Based on the provided technical data and fundamental analysis for ADM, we can observe certain market trends and financial health indicators that may influence the stock price movement over the next few months.

Technical Indicators Analysis: - The On-Balance Volume (OBV) has shown a downward trend from 0.296910 million to -2.361949 million over the reporting period, suggesting that volume is heavier on days where the stock price is falling. This could indicate a bearish sentiment among investors. - The Movement Average Convergence Divergence (MACD) Histogram is displaying a negative value, which signifies that the short-term momentum is less than the longer-term momentum, generally interpreted as a bearish signal. - The stock price has reduced from an opening price of 81.57 on the first recorded date of this dataset to an opening price of 72.08 on the last available trading day, which also aligns with the bearish sentiment suggested by the OBV.

Fundamental Analysis: - The Market Cap has significantly decreased from 51.01B at the end of the previous year to 38.61B, indicative of a decrease in the valuation of the company by the market. - Trailing P/E has decreased from 12.81 to 10.07, showing the stock may have become more attractively priced in terms of earnings. - The Price/Book ratio has also decreased, reflecting a potential undervaluation when considering the company's assets. - Enterprise Value/Revenue has a substantial decrease from 2.27 to 0.48, and Enterprise Value/EBITDA has also declined from 44.28 to 7.26, which could imply the company is being viewed as more valuable based on its revenue and EBITDA.

Financial Performance Snapshot: - The company's Net Income has seen a significant increase from the year 2019 to 2022, indicating that the company's profitability has improved. - Normalized EBITDA has more than doubled from 2019 to 2022, which correlates with the increase in Net Income and suggests that the company's overall financial health and operational efficiency are on the rise. - Reconciled Cost of Revenue and Total Revenue have seen a parallel rise, which could point towards increased production and sales activity.

Taking these factors into account, the technical indicators suggest a bearish sentiment in the current market, as evidenced by declining OBV and negative MACD Histogram values. However, the fundamentals present a more nuanced picture. The strong growth in Net Income and EBITDA underscore financial fortitude, which could support a positive re-evaluation of the stock over the medium term.

Investors might be cautious in the short term given the recent negative trends in stock price and volume indicators, leading to potential pressure on the stock price. However, considering the apparent financial health and profitability improvements, long-term investors may find value at current price levels, particularly if they believe the market has overly penalized the stock in the short term. Over the next few months, the stock price movement of ADM will likely be a tug-of-war between short-term technical sentiment and the fundamental belief in the company's inherent valuation and future growth prospects.

It is crucial for investors to monitor the market for any changes in both technical and fundamental aspects. Should the financial strength of the company continue to solidify, and the macroeconomic conditions remain favorable, we may anticipate a reversal of the bearish trend observed in the technical analysis. Conversely, sustaining bearish technical signals might impede short-term recovery, despite favorable fundamentals.

Archer Daniels Midland Company (ADM) represents a cornerstone in the diversified dividend growth portfolio highlighted in the Seeking Alpha portfolio update summary for Q3 2023. As one of the 85 blue-chip companies contributing to the resilience of this portfolio amidst a 4% downturn in the S&P 500, ADM plays an integral role in providing dividend stability and growth. This can be attributed to the companys long-standing commitment to increasing shareholder value through regular dividend payments, which have grown in tandem with the portfolios income, rising by 18.03% year-over-year.

The portfolio's strategic approach, which favors a lower volatility profile and prioritizes dividend income over total returns, is evident in the allocation of ADM stocks, which constitute 1.31% of the total investments and generate 1.02% of the portfolio's income. This approach is consistent with the overall investment thesis that seeks to deliver financial freedom through a growing stream of dividends, adopting proactive management actions such as capitalizing on opportunities presented by Realty Income Corporation and steering clear of underperforming stocks like Medical Properties Trust.

Despite economic headwinds highlighted by global tensions and rate hikes, ADMs solid fundamentals provide a bedrock for the portfolio's performance. The emphasis on consistent income and potential for appreciation guides the monthly investment into undervalued or fairly valued stocks, with ADM being one of the target companies anticipated to contribute to both income and total returns. Moving into Q4 2023, the portfolio manager looks to refine the allocation within consumer staples, with ADM continuing as a pivotal fixture in this category.

Wall Street analysts have showcased a favorable stance towards ADM, with an average brokerage recommendation of 'Buy', reflecting a positive outlook which half of the 12 brokerage firms rate as 'Strong Buy'. However, caution is warranted as research indicates potential conflicts of interest among brokerage analysts, leading to an optimistic skew in these advisories. Conversely, the Zacks Rank system presents a more quantitatively grounded prediction model. In light of unchanging earnings estimates, ADM was given a Zacks Rank of 'Hold', portraying the expectations for the stock's near-term performance as stable but not overtly positive.

On the merger and acquisition front, ADM has strategically bolstered its flavor and ingredients portfolio through the recent agreements to acquire Revela Foods and FDL. Revelas focus on dairy flavorings complements ADM's North American market, and the UK-based FDL, with a strong European presence and a broad repertoire of flavor formulations, augments ADMs global capabilities in this sector. These purchases occur as ADM prepares for changes in consumer preferences, aiming at innovation through transactions and technological partnerships, such as the collaboration with Brightseed.

ASM's role in the global food processing market, valued at $2.3 trillion in 2021, is expected to maintain significant growth through the years. Hedge fund sentiment, as per Insider Monkey's database, echoes investor confidence with an increase in hedge fund backing. Coupled with a solid record of dividend payments, the quarterly dividend of $0.45 per share attests to longstanding shareholder value. Companies like ADM, with their pricing power and strategic diversification, exhibit operational resilience and potential for profitability.

The comparison among high-quality dividend growth stocks reveals ADM as a formidable contender, alongside Pfizer Inc. and others trading near 52-week lows. The focus on dividend yields and fair valuations indicates a potential for purchasing undervalued stocks, with Pfizer being noticed for its strong financial indicators but also erring on the side of caution due to high payout ratios. ADM, by analogy, benefits from its diversified business model and active dividend growth policy, making it an attractive proposition for investors, similar to undervalued peers, enhancing portfolios focused on income and capital appreciation.

Seeking Alpha identifies ADM as a relatively safe and cheap dividend stock, suitable for investors focusing on sustainable income growth. The selection criteria heavily factor in ADMs attributes such as market cap, dividend yield, dividend growth history, and trading volume. Despite concerns about the macroeconomic implications of Federal Reserve policies, stocks like ADM, delivering consistent dividends, symbolize defensive plays against market volatility, blending income reliability with capital preservation.

ADM's acquisition of FDL, subsequent to the Revela Foods deal, manifests its ambition to lead the nutrition space. With a broadened product line and increased market penetration, particularly in the foodservice sector, ADM intensifies its focus on higher-margin businesses, aligning with consumer trends toward health-centric products. Brokerage firms like BMO Capital Markets acknowledge the strategic worth of ADM's investments in the nutrition segment, predicting return enhancements despite marginal squeezes on primary business margins.

The diversified agriculture of the United States is essential to its economy, with ADM at the forefront of initiatives to promote sustainable farming. Such endeavors enhance soil health and contribute to emission reductions, with ambitious coverage targets. This focus on sustainability complements the nation's agricultural productivity, characterized by rich and diverse regional contributions and showcasing the sector's substantiality and the challenge of maintaining economic viability across differently scaled farms.

Recently, ADM stock displayed modest gains, closing at $70.93, reflecting a slight disconnect with the broader market trends. As the company heads into its earnings report, projections suggest a potential decline in EPS and revenues on a year-over-year basis. Yet, no changes in consensus EPS estimates imply stability in expectations. With a forward P/E ratio well below the industry average, ADMs valuation suggests a potential for price appreciation, despite belonging to an industry segment considered to be in the bottom half of the Zacks Industry Rank.

The commitment to building a robust nutrition business is underscored by ADM's intent to acquire FDL. Completion of this transaction is expected to fortify ADMs global flavor capabilities and enhance its innovation footprint. This coincides with a resilient stock price trend over the past six months and draws a contrast to the decline observed throughout the industry, emphasizing ADM's stability and growth ambitions in an industry marked by dynamic change.

Finally, the global prominence of ADM is cemented by its extensive operations across various sectors, underscored by a streamlining towards sustainability and healthier living. Dividend consistency, robust financials, and an ultrawide economic moat position the company as a strong contender in investors' portfolios, especially amid market volatility. The steady expansion of its growth vectors, including the flavor ingredient segment and renewable energy, signals ADMs proactive approach to establishing a fruitful and lasting presence in global trade, nutrition, and agriculture markets.

Similar Companies in Agribusiness:

Bunge Limited (BG), Ingredion Incorporated (INGR), Mosaic Company (MOS), CF Industries Holdings, Inc. (CF), Corteva, Inc. (CTVA), Nutrien Ltd. (NTR), Darling Ingredients Inc. (DAR), Bayer AG (BAYRY), Wilmar International Limited (WLMIY), Tyson Foods, Inc. (TSN)

News Links:

https://finance.yahoo.com/news/14-most-profitable-food-stocks-173538560.html

https://finance.yahoo.com/m/e2c8ba23-95e7-3589-9e40-630b8053bb2d/adm-ends-2023-with-2.html

https://seekingalpha.com/article/4640929-my-dividend-growth-portfolio-q3-2023-summary

https://finance.yahoo.com/news/wall-street-analysts-think-adm-143006651.html

https://seekingalpha.com/article/4639167-5-relatively-safe-cheap-dividend-stocks-october-2023

https://finance.yahoo.com/news/adm-buy-uk-based-firm-135109040.html

https://finance.yahoo.com/news/13-most-productive-agricultural-regions-215148307.html

https://finance.yahoo.com/news/archer-daniels-midland-adm-ascends-224519416.html

https://finance.yahoo.com/news/archer-daniels-adm-acquire-fdl-164000222.html

https://finance.yahoo.com/news/cash-passive-income-3-dividend-000139793.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: Ethwxkq

https://reports.tinycomputers.io/ADM/ADM-2023-12-28.html Home