Archer-Daniels-Midland Company (ticker: ADM)

2024-01-19

Archer-Daniels-Midland Company (NYSE: ADM) is a global leader in human and animal nutrition and the world's premier agricultural origination and processing company. Founded in 1902 and headquartered in Chicago, Illinois, ADM transforms natural products into a complete portfolio that includes oils and meal, corn sweeteners, flour, biodiesel, ethanol, and other value-added food and feed ingredients. With a strong commitment to sustainability, ADM leverages its wide geographic reach and scale to serve customers across various industries, from food and beverage to animal feed, industrial, and energy markets, helping to meet the demands of a growing global population. The company's innovation-driven approach and strategic investments, along with its operational excellence, ensure it remains a vital link in the global food chain. Through its extensive global supply chain network, ADM continues to focus on providing nutritional products while maintaining an environmentally and socially responsible footprint. As of the knowledge cutoff date, ADM has a strong presence in more than 200 countries, underpinned by an expansive asset base, including over 450 crop procurement locations, more than 330 food and feed ingredient manufacturing facilities, 62 innovation centers, and the world's premier crop transportation network.

Archer-Daniels-Midland Company (NYSE: ADM) is a global leader in human and animal nutrition and the world's premier agricultural origination and processing company. Founded in 1902 and headquartered in Chicago, Illinois, ADM transforms natural products into a complete portfolio that includes oils and meal, corn sweeteners, flour, biodiesel, ethanol, and other value-added food and feed ingredients. With a strong commitment to sustainability, ADM leverages its wide geographic reach and scale to serve customers across various industries, from food and beverage to animal feed, industrial, and energy markets, helping to meet the demands of a growing global population. The company's innovation-driven approach and strategic investments, along with its operational excellence, ensure it remains a vital link in the global food chain. Through its extensive global supply chain network, ADM continues to focus on providing nutritional products while maintaining an environmentally and socially responsible footprint. As of the knowledge cutoff date, ADM has a strong presence in more than 200 countries, underpinned by an expansive asset base, including over 450 crop procurement locations, more than 330 food and feed ingredient manufacturing facilities, 62 innovation centers, and the world's premier crop transportation network.

| Full Time Employees | 40,360 | Phone | 312 634 8100 | Website | https://www.adm.com |

| Industry | Farm Products | Sector | Consumer Defensive | Dividend Rate | $1.80 |

| Dividend Yield | 2.61% | Payout Ratio | 24.34% | Five Year Avg Dividend Yield | 2.61 |

| Beta | 0.783 | Trailing PE | 9.5605 | Forward PE | 10.657364 |

| Market Cap | $36,664,606,720 | Book Value per Share | 47.155 | Price to Book | 1.4577457 |

| Net Income to Common | $3,936,999,936 | Trailing EPS | 7.19 | Forward EPS | 6.45 |

| Total Cash | $1,498,000,000 | Total Debt | $9,500,000,256 | Total Revenue | $96,896,000,000 |

| Free Cash Flow | $2,261,625,088 | Operating Cash Flow | $2,020,999,936 | Earnings Growth | -16.9% |

| Revenue Growth | -12.1% | Current Ratio | 1.686 | Return on Assets | 4.543% |

| Return on Equity | 15.824% | Shares Outstanding | 533,380,992 | Shares Short | 5,377,297 |

Based on a comprehensive review of technical analysis (TA), fundamentals, and balance sheet data for ADM (Archer Daniels Midland Company), we can draw several informed conclusions about the stock's potential performance in the coming months.

Based on a comprehensive review of technical analysis (TA), fundamentals, and balance sheet data for ADM (Archer Daniels Midland Company), we can draw several informed conclusions about the stock's potential performance in the coming months.

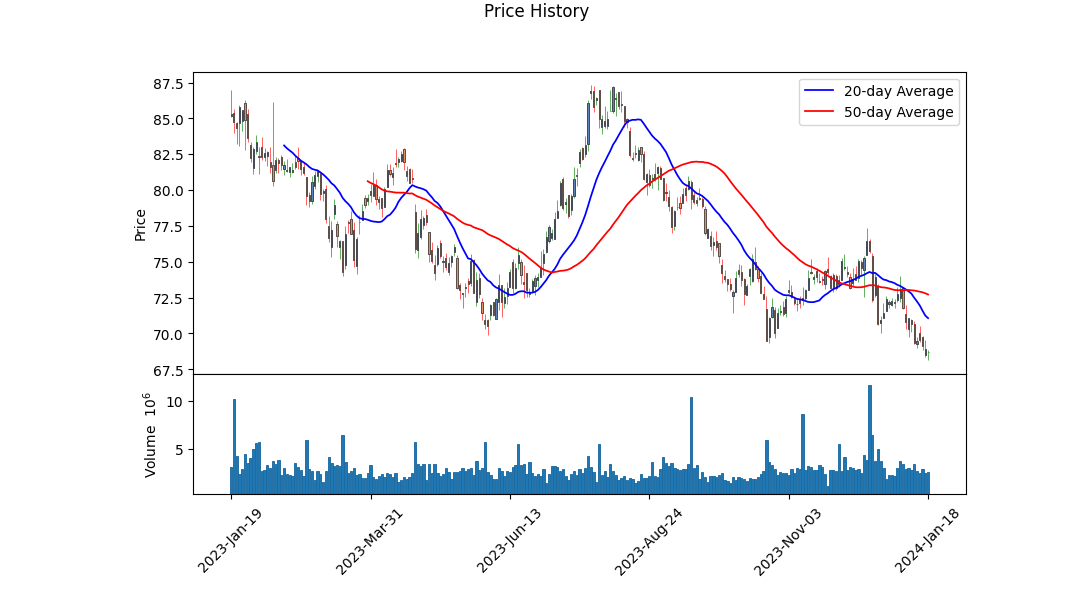

Technical Analysis: - The On-Balance Volume (OBV) has shown a decrease from 0.26377 million to -1.1223 million in recent times, indicating that selling pressure has been dominant, with volume confirming the downtrend. - The Moving Average Convergence Divergence (MACD) histogram has entered negative territory as of the last available data, which suggests that the stock is currently experiencing bearish momentum.

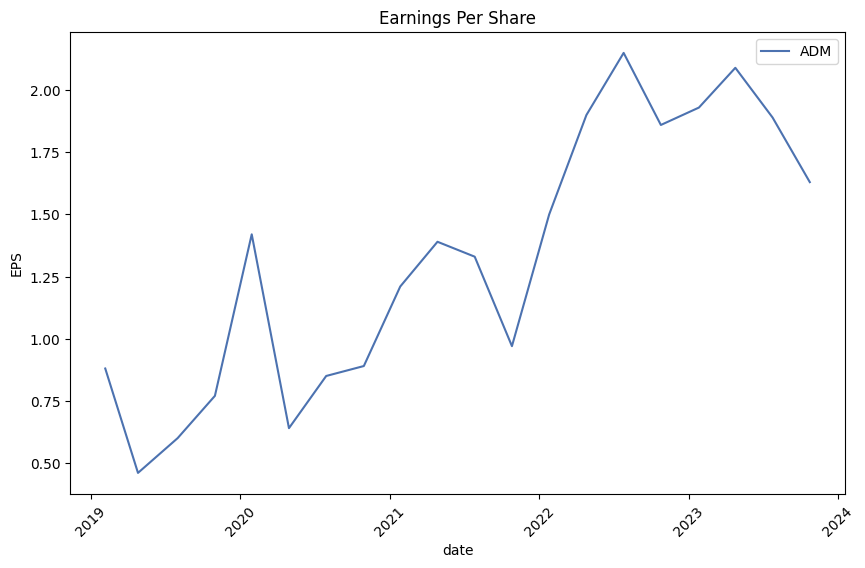

Fundamentals: - Fundamental analysis reveals that ADM's gross margins and operating margins are relatively modest at 0.07776 and 0.04605, respectively. While not exceedingly high, these margins indicate operational efficiency. - The EBITDA and net income figures illustrate a solid financial performance, with 2022 showing a marked improvement over the previous year. - Analyst expectations on earnings per share (EPS) for the upcoming year project a decrease in comparison to the prior year, which could potentially temper investor enthusiasm.

Balance Sheets: - The balance sheet data indicates a net debt reduction from $9.263 billion in 2020 to $8.143 billion in 2022, signaling an improved debt position. - The tangible book value has seen an appreciable increase, enhancing the company's intrinsic value.

Cash Flows: - Free cash flow is positive and significant at $2.159 billion, suggesting that the company has good liquidity and the ability to fund operations, investments, and return capital to shareholders through dividends and stock repurchases. - Investing and financing cash flows reflect a strategic deployment of capital, with debt repayment outstripping the issuance of new debt, indicating a focus on reducing leverage.

Analyst Expectations: - The aggregate estimate suggests a decline in earnings for both the current quarter and the following year, which can impact future stock pricing negatively if the market had higher expectations. - However, the history of earnings surprises denotes that the company has consistently outperformed analysts' EPS estimates, which, if continued, could lend some support to the stock price.

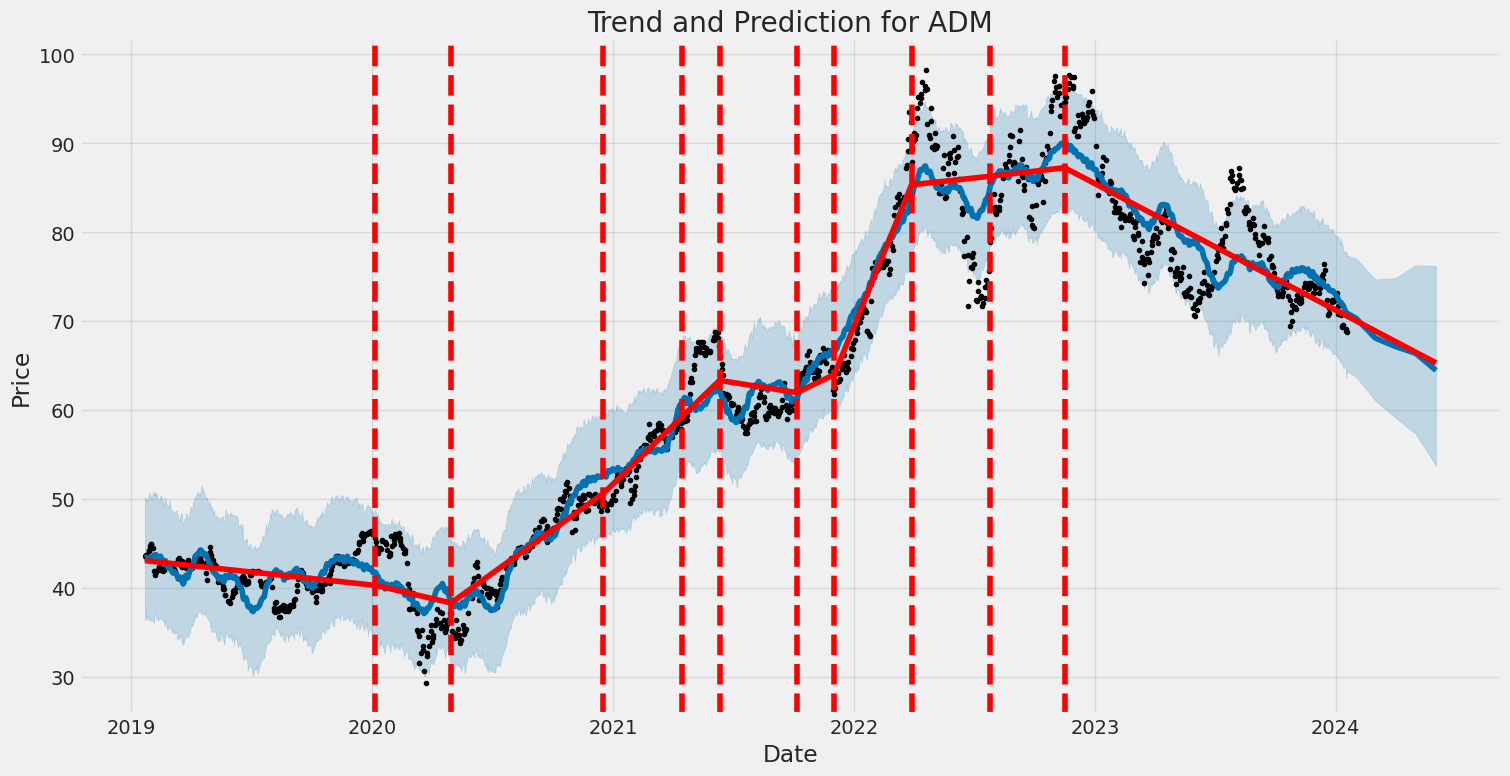

Future Outlook: When synthesizing the information derived from the technical, fundamental, and financial perspectives, we must anticipate potential headwinds for ADM's stock price in the near to medium term. The technical indicators show negative momentum, and the projected earnings dip may lead to cautious sentiment amongst investors.

The ongoing negative MACD histogram suggests that bearish tendencies might persist, but a turnaround in these indicators would be necessary to confirm a change in trend. ANTICIPATE that the OBV indicator needs to show an accumulation pattern to indicate buying pressure before expecting a price uptrend.

Additionally, it is prudent to monitor the company's upcoming earnings releases, as the previous trend of positive surprises could provide upside potential if it continues. Adjustments in analyst sentiment, as observed in recent EPS revisions, also deserve attention as they often precede market reactions.

Investors should PAY ATTENTION to global commodity markets, agricultural trends, and trade policy changes due to ADM's business model being significantly influenced by these factors. A positive or negative shift in these external forces can have a considerable impact on ADM's performance, independent of company-specific fundamentals.

Overall, cautiousness is advised based on the current technical posture and projected earnings decrease, yet one should also acknowledge the company's strong cash flows and debt management, which could underpin its financial stability and potentially offset some downward pressure on the stock price.

| Statistic Name | Statistic Value |

| Alpha (Intercept) | 0.0103 |

| Beta (Slope) | 0.8251 |

| R-squared | 0.381 |

| Adj. R-squared | 0.381 |

| F-statistic | 771.9 |

| Prob (F-statistic) | 8.89e-133 |

| No. Observations | 1,256 |

| AIC | 4,386 |

| BIC | 4,396 |

The linear regression model between ADM (Archer Daniels Midland Co.) and SPY (SPDR S&P 500 ETF Trust) describes the relationship between the individual stock and the broader stock market as measured by the S&P 500 index. In this model, the coefficient or 'alpha' value is 0.0103, which can be interpreted as the expected performance differential of ADM relative to the market when the market's return is zero. An alpha of 0.0103 suggests that ADM is expected to slightly outperform the market on average. Alpha is considered a measure of an investment's performance on a risk-adjusted basis, with a positive alpha indicating outperformance and a negative alpha indicating underperformance relative to the benchmark index (SPY in this case).

Additionally, the 'beta' value of the model is 0.8251, which reflects the sensitivity of ADM's returns to the movements of the market index. A beta less than 1 implies that ADM is less volatile than the market, meaning it should theoretically experience smaller fluctuations in price compared to the market. The R-squared value of 0.381 indicates that approximately 38.1% of ADM's price movement can be explained by the movements in the SPY ETF, which represents the market portfolio in this regression. It's also important to note that the F-statistic is significant, with a highly improbable chance that these results are due to random fluctuations, which suggests that the market model is a good fit for explaining the behavior of ADM's stock price in relation to the market.

Archer-Daniels-Midland Company (ADM) showcased strong financial performance in its third quarter earnings call for 2023. CEO Juan Luciano highlighted that the company achieved an adjusted earnings per share of $1.63 and an adjusted segment operating profit of $1.5 billion, marking ADM's second-best EPS year in just nine months. ADM's strategic planning and business model adjustments have been effective in navigating global macro trends and customer needs. Despite the challenges of geopolitical tensions, inflation, and fluctuating commodity supply and demand, ADM is on track to surpass its 2023 expectations, with significant growth across its segments.

The Ag Services & Oilseeds segment benefited from the accelerated energy transition, boosting demand for vegetable oil and resulting in a robust crushing environment. ADM's flexible logistics and global trade franchise effectively managed Brazil's record crop, and the Carbohydrate Solutions segment achieved record figures due to strong margins in starches, sweeteners, ethanol demand, and its BioSolutions portfolio. The Nutrition segment continued to thrive, with growth in Flavors outpacing the market and improvements in Animal Nutrition due to productivity actions and market volume recovery, though the segment also faced challenges in plant-based proteins and certain demand softness.

Luciano underscored ADM's integrated business model as a key competitive advantage, showcasing partnerships with major companies and investments in renewable energy projects, such as the Spiritwood JV with Marathon for renewable diesel production and the Broadwing Energy Project. ADM's commitment to sustainability is evident in its target of 4 million regenerative acres by 2025 and innovation in low-carbon intensity products. ADM is also closely collaborating with customers, focusing on sustainability solutions, flavor innovation, and nutrition, evidenced by the world's largest probiotic manufacturing facility in Valencia and over 50 ongoing clinical trials.

CFO Vikram Luthar provided a detailed analysis of segment-level performance, emphasizing solid results in Ag Services and Oilseeds despite environmental dynamics. The Crushing subsegment saw strong performance but lower margins compared to the previous year. Refined Products and Other posted strong results driven by solid volumes and margins, particularly in biodiesel and domestic food oil demand. Carbohydrate Solutions delivered an exceptional quarter, significantly higher than the previous year, and the Nutrition segment showed resilience with strong results in Flavors and Health & Wellness, but faced headwinds in the plant-based protein market and demand fulfillment challenges in pet solutions.

Looking ahead to 2024, Luciano expressed optimism for ADM's continued solid progression, citing the company's alignment with enduring macro trends like food security, health and well-being, and sustainability. ADM's focus on productivity and innovation is expected to build momentum, along with anticipated continuous leverage in Ag Services & Oilseeds and a strong year for Carbohydrate Solutions. Despite the temporary slowdown, Nutrition is anticipated to return to growth with an expansive revenue opportunity pipeline and accelerated performance across its portfolio. ADM's strategic initiatives, coupled with a firm commitment to safety and operational efficiency, position the company for sustainable long-term profit growth. Concluding the call, ADM raised its full-year earnings outlook, now expecting EPS in excess of $7 per share for 2023.

Archer-Daniels-Midland Company (ADM), a leading global food processing and commodities trading corporation, filed its Form 10-Q for the quarter ending September 30, 2023, reflecting its ongoing business operations and financial performance. The filing discloses revenues, costs, net earnings, comprehensive earnings, and other financial data, providing insights into the company's performance during the period.

The company reported gross revenues of $21.695 billion for the quarter, down from the $24.683 billion reported in the same period of the previous year. The total revenues from external customers were impacted by variances in different segments, including the Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition segments. The Ag Services and Oilseeds segment generated $16.479 billion in revenues; the Carbohydrate Solutions segment generated $3.325 billion; the Nutrition segment produced $1.784 billion, while the Other Business segment contributed $107 million.

ADM's segment operating profit for Ag Services and Oilseeds was $848 million, representing a decrease from $1.075 billion in the same quarter of the prior year. Nonetheless, the segment's nine-month performance showed a decrease in operating profit compared to the previous year. The Carbohydrate Solutions segments operating profit for the quarter was $460 million, a gain from $309 million previously. The Nutrition segment showed an operating profit of $138 million, down from $177 million, and Other Business reported $46 million, up from $18 million in the prior-year period.

Total segment operating profit stood at $1.421 billion for the quarter, a decrease from $1.559 billion for the same period last year. When corporate expenses and other specified items such as asset impairment, exit, and restructuring costs were considered, earnings before income taxes amounted to $1.031 billion, a decline from $1.230 billion in the comparable quarter the previous year.

Income tax expense for the quarter was recorded at $207 million, leading to net earnings attributable to controlling interests of $821 million, again down from $1.031 billion. The average number of shares outstanding for both basic and diluted earnings per share calculations decreased relative to the previous year. Basic and diluted earnings per share for the quarter were $1.52, which showed a decrease from the prior year.

ADM's effective tax rate increased to 20.1% for the quarter and 17.9% for the nine months, compared to 15.7% and 16.9% for the previous year's respective periods. This increase was mainly attributed to changes in the geographic mix of forecasted pretax earnings.

The company's cash and cash equivalents stood at $1.498 billion, with a total of $30.522 billion in current assets. Its consolidated balance sheets also reported a total liability of $18.105 billion in current liabilities. Notably, the company issued $500 million aggregate principal amount of 4.500% Notes due 2033, and redeemed 600 million aggregate principal amount of 1.750% Notes due 2023 and $300 million aggregate principal amount of zero coupon exchangeable bonds due 2023 during the reporting period.

Overall, the 10-Q filing presents a comprehensive view of ADM's financial stance, highlighting the effects of market conditions, product pricing, and restructuring activities, while offering a detailed account of assets, liabilities, and equity.

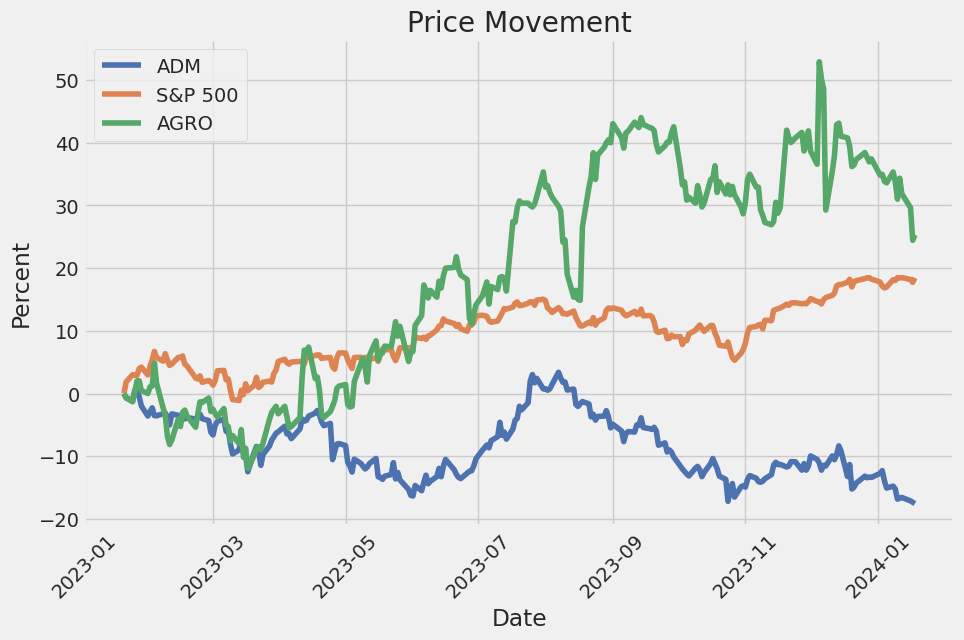

Archer Daniels Midland Company (ADM), a major global player in the agricultural industry, has been the subject of various financial analyses and performance evaluations in recent months. Despite movements in stock price that have placed it slightly behind overall market performance, as reported by a Zacks.com article dated December 21, 2023, ADM continues to demonstrate consistent and reliable financial trends. Although ADM's stock, at $70.93, showed a modest increase, it still did not keep pace with the S&P 500's daily gain. Over the previous month, ADMs shares declined by 4.91%, trailing both the Consumer Staples sector and the S&P 500.

Turning to the company's earnings report, there are anticipations that ADM's earnings per share may decrease by 14.51% to $1.65 compared to the same quarter last year, with revenue also expected to drop by 7.16% to $24.35 billion year over year. The full-year forecast sees earnings of $7.26 per share and revenue of $95.31 billion, suggesting declines as well. Nevertheless, according to Zacks, Archer Daniels Midland remains stable with a neutral Zacks Rank of #3 (Hold) and unchanged consensus EPS estimates over the last month.

ADMs Forward P/E ratio stands favorably at 9.74, considerably lower than the Agriculture - Operations industry average of 17.97, pointing to a potential undervaluation. Despite the industry placing in the bottom 40% according to the Zacks Industry Rank, ADM seems to be holding steady within these broader industry conditions.

Conversely, articles published by Seeking Alpha present ADM as being overvalued and not fitting the investment criteria for new positions based on their methodology of analyzing dividend aristocrats. As one of the S&P 500 Dividend Aristocrats, ADM's stock did not meet certain valuation metrics, growth and income outlook, and dividend quality grades as per the analysis provided on December 22, 2023.

Despite the valuation concerns, another Seeking Alpha article dated December 17, 2023, recognizes ADMs potential to provide investors with substantial net gains, forecasting a gain of $207.00 based on dividends and median target price estimates, suggesting net gains of 17.06% to 40.76%. This implies that, for investors seeking consistent income, Archer Daniels Midland represents a lucrative option, particularly through its strategy known as "dog catching".

Further resilience and adaptability have been demonstrated by ADM amid global market challenges. The company's strategic investments in sustainable and renewable energy have helped mitigate the impact of adverse events, such as the Ukraine war. As per a Seeking Alpha article from December 12, 2023, ADMs diversified approach has maintained steady earnings, paving the way for the company to project optimistic EPS guidance despite decreased operations in Ukraine.

Another Zacks.com analysis dated December 13, 2023, confirmed the expectations of ADM reporting lower earnings and revenue for the quarter and full year compared to the previous year. However, the consistent ranking by Zacks and the minor increment in consensus EPS estimate suggest confidence in the company's near-term performance.

Archer-Daniels-Midland's valuation metrics continue to suggest that it trades at a discount to its peers within the industry. With a Forward P/E ratio more favorable than the industry average, the company seems to be positioned as an undervalued entity within its sector. Despite ADMs shares appreciating by just 0.97% over the past month, trailing the Consumer Staples sector and the S&P 500's gains, analysts advocate for close monitoring of ADM's market position and potential.

Zacks.coms article as of December 28, 2023, underlined ADMs resilience in outperforming the broader market in the latest trading session, yet it faced a monthly decline that fell short of sector and S&P 500 gains. This performance exemplifies the importance of closely observing earnings revisions and related metrics.

In line with these observations, Zacks.com's analysis on December 25, 2023, placed ADM within an average brokerage recommendation of "Buy." Though this reflects a positive sentiment, Zacks cautions that reliance on brokerage firms' recommendations may not always provide the highest returns due to potential biases.

However, Seeking Alpha's article by Lanny from Dividend Diplomats on January 1, 2024, posits that ADM presents an attractive entry point as the stock is down nearly 20% for the year. ADM's status as a dividend aristocrat, a favorable P/E ratio, and a low dividend payout ratio underscore its investable appeal.

ADM's stable dividend payout reputation is further validated in Seeking Alphas article as of December 31, 2023. The companys illustrious streak of 48 consecutive years of dividend increases resonates with investors focused on income stability and growth. Moreover, an article from Seeking Alpha on December 27, 2023, outlines ADM as a high-quality business with an "ultrawide economic moat," highlighting attractive valuation, financial health, and significant dividend growth potential along with an estimated annual return nearing 20% through 2025.

Focusing on ADM's strategic initiatives, a January 3, 2024, article from Zacks.com clarifies the companys strategic approach of optimizing, driving, and growing. These efforts include expanding into alternative proteins and sustainable products, underscored by acquisitions that enhance the flavor portfolio and nutrition sector offerings. Grappling with a challenging market, ADM is looking to achieve annual revenue growth of 10% through such strategies.

In synch with these strategic initiatives, Seeking Alphas article dated January 2nd, 2024, sprouts optimism about an impending dividend increase in January. Detailing ADM's reputation as a near-dividend king, it reflects a robust underlying operation and commitment to shareholder returns, despite not being projected to match the previous year's level of increase.

Zacks.coms analysis, crafted by Shaun Pruitt and released on January 3, 2024, reinforces ADM as a solid investment choice. Painted as a "dividend king" with significant growth, the stock currently trades at a compelling 10 times forward earnings. This paves the way for investors, especially income investors, to benefit from its low earnings multiple and solid yield.

Lastly, an InvestorPlace article shared on Yahoo Finance on January 3, 2024, forecasts a market rebound for ADM. With projections indicating robust growth for the global food processing market, ADM is perched for an appealing comeback. The company's stock, while experiencing a decline in 2023, is posited as a moderate buy with a favorable average price target.

Concluding on a note from Zacks.com on January 3, 2024, ADM's resilience against a broader market downturn speaks for its stability. With a stock price rise on a bearish day for major indices, and a Forward P/E ratio below industry average, the Agriculture - Operations industry within the Consumer Staples sector appears promising for ADM. This highlights the need for judicious consideration of current financial trends and the potential for smart investment moves in ADM's stock.

The volatility of Archer-Daniels-Midland Company (ADM) from January 22, 2019, to January 18, 2024, can be summarized as follows:

- ADM's volatility, as measured by the ARCH model, does not exhibit a significant trend over time, indicated by an R-squared value close to zero.

- The ARCH model parameters suggest an inherent level of volatility in ADM's returns, with a moderately high 'omega' coefficient reflecting a baseline volatility.

- The model also identifies a persistence in volatility, shown by a positive 'alpha[1]' coefficient, indicating that past volatility is somewhat predictive of future volatility.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2,410.83 |

| AIC | 4,825.67 |

| BIC | 4,835.94 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| Df Model | 0 |

| omega | 2.0145 |

| alpha[1] | 0.3649 |

The financial risk of a $10,000 investment in Archer-Daniels-Midland Company (ADM) over a one-year period can be analyzed by integrating volatility modeling with machine learning predictions. The volatility of ADM's stock is critical to understanding the investment's risk, as it measures the degree of variation of the company's share price over time.

Volatility modeling techniques, such as the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) approach, are employed to capture the time-varying nature of volatility in financial market data. By doing so, this technique provides a quantifiable measure of the variability in returns, which is especially useful for risk management purposes. The variability estimated through such a model illustrates how the price of ADM shares may fluctuate, thereby helping to quantify the risk inherent in the stock.

On the other hand, machine learning predictions can offer insights into the future performance of ADM shares by analyzing historical data and identifying patterns that might influence the direction of stock returns. A model like the RandomForestRegressor can be particularly beneficial due to its ability to handle nonlinear relationships in data and its robustness to overfitting. By training on historical returns and relevant financial indicators, the machine learning model can generate predictions for future returns of ADM stock, which, when integrated with the volatility model outputs, provide a comprehensive risk assessment.

Merging these two analytical approaches allows for a comprehensive view of both the expected future returns and the possible fluctuation range of those returns. The Value at Risk (VaR) at a 95% confidence interval calculates the potential loss that could be expected with a high degree of confidence. In the context of the ADM investment, the VaR indicates that there is a 95% chance that the investment will not lose more than $230.88 over the course of one year out of the initial $10,000 investment, based on the combined insights from volatility modeling and machine learning predictions.

This figure is critical for investors as it quantifies the potential downside risk. Such an integrated approach to risk analysis, combining historically driven volatility measures with predictive modeling, offers investors a more nuanced understanding of the risks they face when entering the market, particularly for an equities investment such as ADM. By taking into account both the likely range of stock price fluctuations and probable stock price trends, investors can make more informed decisions about their risk tolerance and investment strategy.

Similar Companies in Farm Products:

Adecoagro S.A. (AGRO), Cal-Maine Foods, Inc. (CALM), Tyson Foods, Inc. (TSN), Fresh Del Monte Produce Inc. (FDP), Bunge Limited (BG), Dole plc (DOLE), Limoneira Company (LMNR), Alico, Inc. (ALCO), BrasilAgro - Companhia Brasileira de Propriedades Agricolas (LND), Bunge Limited (BG), Ingredion Incorporated (INGR), The Andersons, Inc. (ANDE), Cargill, Incorporated (Privately Held), Glencore International (GLNCY), Louis Dreyfus Company (Privately Held), Wilmar International (WLMIY)

https://seekingalpha.com/article/4658294-4-ideal-december-dividend-fortune500-industry-leaders-of-68

https://seekingalpha.com/article/4659150-29-undervalued-dividend-aristocrats-december-2023

https://seekingalpha.com/article/4660557-januarys-54-dividend-kings-buy-8-watch-5

https://seekingalpha.com/article/4660589-dividend-stock-watch-list-lanny-january-2024-edition

https://seekingalpha.com/article/4660839-6-expected-dividend-increases-in-january-2024

https://www.zacks.com/stock/news/2205109/ongoing-strategies-put-archer-daniels-adm-on-growth-track

https://www.zacks.com/commentary/2205256/2-agriculture-stocks-to-buy-for-the-new-year

https://finance.yahoo.com/news/7-stocks-primed-spectacular-comeback-231742331.html

https://www.sec.gov/Archives/edgar/data/7084/000000708423000039/adm-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: dW4cwT

https://reports.tinycomputers.io/ADM/ADM-2024-01-19.html Home