Amazon.Com Inc (ticker: AMZN)

2023-12-17

Amazon.com Inc (ticker: AMZN) is a multinational technology company focused on e-commerce, cloud computing, digital streaming, and artificial intelligence. Established by Jeff Bezos in 1994 and headquartered in Seattle, Washington, Amazon started as an online bookstore and has since expanded to become one of the world's most valuable and influential companies. It operates through three core segments: North America, International, and Amazon Web Services (AWS). The North America and International segments comprise the retail sale of consumer products and subscriptions, while AWS offers a suite of cloud services and solutions to businesses and individuals, playing a significant role in the growth of the infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) markets. With its vast product selection, Amazon Prime membership program, and advanced fulfillment network, Amazon has revolutionized the way people shop and access entertainment. Additionally, the company remains at the forefront of innovation with initiatives in areas such as autonomous delivery, cashless convenience stores, and ambitious plans for sustainability. AMZN's continued dominance in various sectors, strategic acquisitions, and ongoing diversification underscore its significant presence in the global marketplace.

Amazon.com Inc (ticker: AMZN) is a multinational technology company focused on e-commerce, cloud computing, digital streaming, and artificial intelligence. Established by Jeff Bezos in 1994 and headquartered in Seattle, Washington, Amazon started as an online bookstore and has since expanded to become one of the world's most valuable and influential companies. It operates through three core segments: North America, International, and Amazon Web Services (AWS). The North America and International segments comprise the retail sale of consumer products and subscriptions, while AWS offers a suite of cloud services and solutions to businesses and individuals, playing a significant role in the growth of the infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) markets. With its vast product selection, Amazon Prime membership program, and advanced fulfillment network, Amazon has revolutionized the way people shop and access entertainment. Additionally, the company remains at the forefront of innovation with initiatives in areas such as autonomous delivery, cashless convenience stores, and ambitious plans for sustainability. AMZN's continued dominance in various sectors, strategic acquisitions, and ongoing diversification underscore its significant presence in the global marketplace.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 1.55T | 1.31T | 1.34T | 1.06T | 856.94B | 1.15T |

| Enterprise Value | 1.62T | 1.39T | 1.42T | 1.13T | 926.53B | 1.22T |

| Trailing P/E | 78.32 | 100.89 | 310.38 | - | 76.33 | 101.76 |

| Forward P/E | 39.53 | 40.49 | 82.64 | 62.11 | 41.32 | 46.95 |

| PEG Ratio (5 yr expected) | 2.47 | 2.53 | 5.16 | 3.88 | 4.67 | 4.50 |

| Price/Sales (ttm) | 2.81 | 2.43 | 2.54 | 2.05 | 1.71 | 2.38 |

| Price/Book (mrq) | 8.45 | 7.79 | 8.70 | 7.26 | 6.26 | 8.77 |

| Enterprise Value/Revenue | 2.92 | 9.69 | 10.58 | 8.87 | 6.21 | 9.57 |

| Enterprise Value/EBITDA | 21.99 | 55.18 | 71.10 | 70.32 | 74.62 | 88.36 |

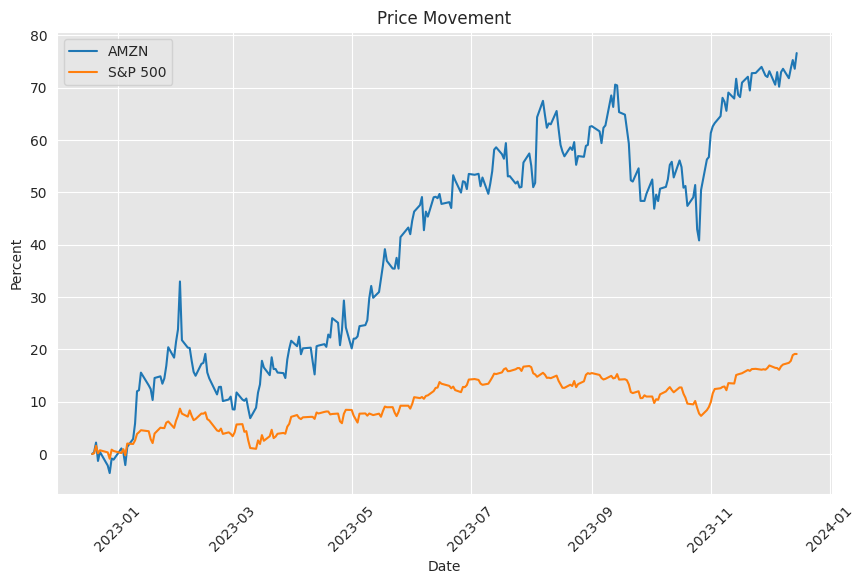

Analyzing the provided technical indicators and fundamentals, we form an understanding of Amazon's (NASDAQ: AMZN) potential stock price movements over the next few months:

Analyzing the provided technical indicators and fundamentals, we form an understanding of Amazon's (NASDAQ: AMZN) potential stock price movements over the next few months:

Technical Indicators Analysis:

- The Moving Average Convergence Divergence (MACD) presents a positive value with a negative histogram, indicating that while the stock has been in an uptrend, momentum might be slowing down or going through a consolidation phase.

- The Relative Strength Index (RSI) is in the upper range at 62, close to the overbought threshold of 70, which could mean that the stock might face some corrective pressures soon.

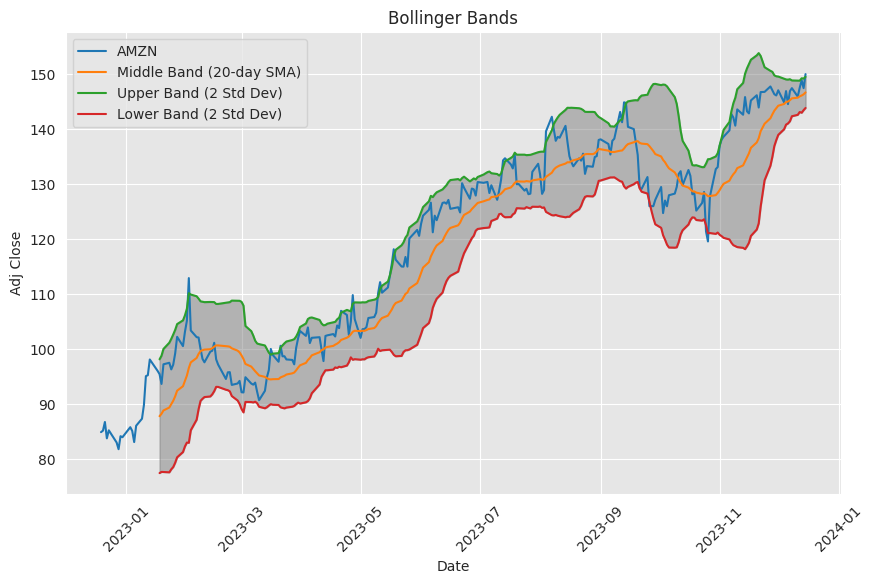

- Bollinger Bands (BBL, BBM, BBU) suggest that the stock price is hovering near the upper band, reflecting a higher price in the short term, but also a potential pullback as the price nears overbought levels.

- The stock is trading above both the Simple Moving Average (SMA_20) and the Exponential Moving Average (EMA_50), pointing to a recent bullish trend.

- On Balance Volume (OBV) implies there's buying interest, supported by substantial volume.

- Stochastic Oscillators (STOCHk and STOCHd) indicate the stock is in overbought territory, hinting at a need for caution.

- The Average Directional Index (ADX_14) shows a trend strength of under 20, which often suggests a weak or absent trend.

- Williams %R (WILLR_14) indicates the stock is currently being overbought.

- Chaikin Money Flow (CMF_20) shows good buying pressure with a value above 0.

- The Parabolic SAR (PSARl) suggests the current trend is still positive since were given the lower PSAR value only.

Fundamentals Analysis:

- The increase in Market Cap to 1.55T from 856.94B a year earlier shows significant market confidence and potential overvaluation concerns.

- The Trailing P/E is high at 78.32, which indicates that the stock might be overvalued compared to earnings.

- A Forward P/E of 39.53 is optimistic and a significant improvement from the Trailing P/E.

- The PEG Ratio suggests future earnings growth is embedded in the current price.

- Price/Sales and Price/Book ratios are also on the higher end indicating potential overvaluation.

- Enterprise Value metrics (EV/Revenue and EV/EBITDA) have reduced considerably from the last year, possibly signaling improved attractiveness to investors.

- The financials reveal concerns, such as negative Net Income, which if continues, could hamper stock performance.

Possible Stock Price Movement:

In the proximate few months, we might expect Amazon's stock price to exhibit volatility with potential for a near-term pullback given the overbought technical conditions. Despite this, the positive trend indicated by PSAR and high OBV suggests the overall medium-term bullish sentiment could continue. However, caution should be exercised due to the possibility of a correction or consolidation phase; the high valuation indicated by the fundamental ratios also warrants attention.

Investors should monitor upcoming earnings, market sentiment, and macroeconomic indicators closely. Any positive shifts in Amazon's fundamentals, such as an improvement in Net Income or continued growth in market share and revenue, could sustain the bullish trend and potentially propel the stock higher. Conversely, a deterioration in these areas could lead to a price correction. Given the market's forward-looking nature, anticipation of future growth prospects, especially in Amazon's cloud computing and advertising businesses, may already be priced in.

In conclusion, the outlook for Amazon's stock in the next few months is cautiously optimistic, with technical analysis suggesting continued bullish trend but with possible short-term pullbacks. Fundamental analysis indicates high valuation, and therefore, careful monitoring of the company's performance and the broader market conditions is advisable for investors. In the medium to long term, provided that fundamentals improve or continue to show resilience, bullish trends may be reinforced, leading to possible growth in stock value.

Amazon.com Inc. (AMZN) has become a benchmark of success and innovation within the e-commerce, cloud computing, and AI sectors. Heading into 2024, the company is lauded by investors and market analysts for its robust growth trajectory and myriad strategic initiatives under the leadership of CEO Andy Jassy. Much of the optimism surrounding Amazon can be traced back to its adaptability and continuous efforts to refine operations, exemplified by Amazon Web Services (AWS) and its newfound emphasis on more profitable ventures such as advertising services and third-party seller services.

One key area underscoring Amazons growth is AWS, the companys cloud services arm, which despite experiencing slower revenue growth due to efficiency optimizations by clients, still projects considerable growth momentum into 2024. The digital transformation across industries and the increased reliance on cloud-based solutions have set the stage for AWSs continued market dominance, particularly as AI and machine learning applications gain traction.

In the realm of advertising, Amazon has emerged as a formidable contender, achieving a 26% year-over-year rise in this high-margin segment. Its broad consumer base and increasing market reach have transformed it into a lucrative platform for advertisers, rivalling traditional powerhouses such as Google and Facebook.

The adaptation of Amazon's business model, shifting focus from direct sales to third-party seller services, indicates strategic evolution. This shift, which brought about a sharp 20% revenue growth in this segment, carries implications of higher margins and reduced inventory costs. It also symbolizes Amazons move to capitalize on the vast potential of its marketplace, offering third-party sellers the tools and platform to engage with a global customer base.

Financially, Amazon has continued to exhibit impressive growth metrics. The operational efficiencies have been reflected in increasing margins and substantial cash flows, an improvement from the negative cash outflows experienced in the preceding years. If these trends hold, they could unlock significant value, heightening investor interest.

Moreover, outside of its core business, Amazon is making strategic moves within the luxury fashion market. The company's recent foray, marked by Tapestry Inc.s decision to sell Coach bags on Amazon, demonstrates an innovative approach to attracting a younger consumer demographic who favor online shopping. This adaptation to changing shopper behaviors and online platform integration might serve as a blueprint for Amazon's potential ventures into new retail segments.

Turning to investor sentiment, it is buoyed by the company's performance and diversified business model. The third-party seller services growth, the advertising segment's impressive revenues, and AWS's market position make Amazons stock an attractive single-stock investment choice for 2024. This is punctuated by margin improvements and the companys operational streamlining, enhancing profitability.

Notably, Warren Buffett's Berkshire Hathaway saw Amazon as an avenue for significant growth, with Buffett lamenting the delay in adding it to his portfolio. Despite accounting for a small percentage of Berkshire's holdings, Amazon stands out as a high-growth option in the conglomerate's diversified stock portfolio. This investment reflects the strength of Amazons business model and its potential for continued advancements across its primary sectors.

Amazons response to market dynamicsfor instance, the strategic decision by luxury fashion holding company Tapestry Inc. to sell high-end Coach bags through the platformreaffirms the company's versatility. This move, part of a wider acquisition strategy, allows Amazon to tap into a new consumer base while enriching its product offerings.

Analyses suggest that Amazon's financial health and diverse revenue streams, balanced alongside strategic expansions, chart a compelling narrative of stability and growth. Its resilience despite global economic fluctuations, buttressed by a consistent emphasis on innovation and optimization, underscores Amazons staunch position. The anticipation of rate cuts in 2024 further reinforces investor confidence, as aggressive growth stocks like Amazon stand to benefit from a lower interest rate environment.

Amazon's pervasive reach and formidable market presence have been further catalyzed by its investments in emerging technologies, particularly AI. With initiatives such as Amazon Bedrock targeted towards AWS clients, the company is seizing the opportunities presented by the generative AI frenzy, following in the wake of ChatGPT's popularity.

As Amazon continues to consolidate its market position and take strides in cloud computing and AI innovation, the expectancy for its stock performance remains bright. Investors, therefore, enter 2024 with a watchful eye on Amazon as the e-commerce juggernaut persists in its journey of expansive growth and market-leading innovation. With all of these factors at play, the company is slated to remain a mainstay of investment portfolios, especially for those who weigh a company's present achievements alongside its potential to create future value.

Similar Companies in Retail - Defensive:

Walmart Inc (WMT), eBay Inc (EBAY), Alibaba Group Holding Limited (BABA), Target Corporation (TGT), Costco Wholesale Corporation (COST), Shopify Inc (SHOP), Best Buy Co., Inc. (BBY), JD.com, Inc. (JD), The Home Depot, Inc. (HD), Apple Inc (AAPL)

News Links:

https://www.fool.com/investing/2023/12/14/why-rivian-stock-surged-thursday/

https://www.fool.com/investing/2023/12/16/here-are-my-top-10-stocks-for-2024/

https://www.fool.com/investing/2023/12/15/unstoppable-artificial-intelligence-ai-stocks-buy/

https://www.fool.com/investing/2023/12/16/buy-this-monster-stock-before-it-pops/

https://www.fool.com/investing/2023/12/14/why-is-tapestry-selling-coach-bags-on-amazon/

https://www.fool.com/investing/2023/12/16/2--top-performers-youll-regret-not-buying/

https://www.fool.com/investing/2023/12/15/1-warren-buffett-stock-that-could-soar-in-2024/

https://www.fool.com/investing/2023/12/15/if-i-could-only-buy-1-stock-in-2024-this-would-be/

https://www.fool.com/investing/2023/12/16/2-stocks-to-buy-before-they-take-off/

https://www.fool.com/investing/2023/12/16/my-top-10-stocks-to-buy-in-2023-beat-the-market-by/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: k4KuT1

https://reports.tinycomputers.io/AMZN/AMZN-2023-12-17.html Home