Angel Oak Mortgage, Inc. (ticker: AOMR)

2024-01-17

Angel Oak Mortgage, Inc. (ticker: AOMR) is a real estate finance company focused on investing in and managing a portfolio of residential mortgage loans and other mortgage-related assets. The company operates as a real estate investment trust (REIT) for federal income tax purposes and is well-known for capitalizing on opportunities within the U.S. mortgage market. Angel Oak Mortgage, Inc. primarily targets investments in non-qualified mortgages (non-QM loans), which are designed for borrowers who cannot meet the strict lending standards imposed by government agencies or the criteria for conventional loans. AOMR deploys a diversified investment strategy that involves risk assessment and mitigation techniques. The company's approach is supported by the extensive expertise of its management team and affiliated entities, which specialize in the structured credit and asset management sector. As a relatively recent player in the mortgage REIT landscape, Angel Oak Mortgage, Inc. aims to provide consistent and attractive dividends to its shareholders by leveraging its unique position in the non-QM loan space and the broader mortgage lending industry.

Angel Oak Mortgage, Inc. (ticker: AOMR) is a real estate finance company focused on investing in and managing a portfolio of residential mortgage loans and other mortgage-related assets. The company operates as a real estate investment trust (REIT) for federal income tax purposes and is well-known for capitalizing on opportunities within the U.S. mortgage market. Angel Oak Mortgage, Inc. primarily targets investments in non-qualified mortgages (non-QM loans), which are designed for borrowers who cannot meet the strict lending standards imposed by government agencies or the criteria for conventional loans. AOMR deploys a diversified investment strategy that involves risk assessment and mitigation techniques. The company's approach is supported by the extensive expertise of its management team and affiliated entities, which specialize in the structured credit and asset management sector. As a relatively recent player in the mortgage REIT landscape, Angel Oak Mortgage, Inc. aims to provide consistent and attractive dividends to its shareholders by leveraging its unique position in the non-QM loan space and the broader mortgage lending industry.

| Address 1 | 3344 Peachtree Road Northeast | Address 2 | Suite 1725 | City | Atlanta |

|---|---|---|---|---|---|

| State | GA | Zip | 30326 | Country | United States |

| Phone | 404 953 4900 | Website | https://www.angeloakreit.com | Industry | REIT - Mortgage |

| Sector | Real Estate | Previous Close | 10.45 | Open | 10.31 |

| Day Low | 10.36 | Day High | 10.50 | Dividend Rate | 1.28 |

| Dividend Yield | 0.1225 | Payout Ratio | 0.4752 | Beta | 1.393 |

| Forward PE | 9.06087 | Volume | 24,432 | Average Volume | 50,554 |

| Average Volume 10 Days | 38,100 | Bid | 4.5 | Ask | 11.1 |

| Bid Size | 1,000 | Ask Size | 1,800 | Market Cap | 260,138,432 |

| 52 Week Low | 6.00 | 52 Week High | 11.20 | Price to Sales Trailing 12 Months | 15.292366 |

| 50 Day Average | 10.2614 | 200 Day Average | 8.8309 | Trailing Annual Dividend Rate | 1.28 |

| Trailing Annual Dividend Yield | 0.12248804 | Enterprise Value | 1,758,330,112 | Profit Margins | -0.21651 |

| Float Shares | 11,776,619 | Shares Outstanding | 24,965,300 | Shares Short | 863,437 |

| Shares Short Prior Month | 875,132 | Shares Percent Shares Out | 0.0346 | Held Percent Insiders | 0.03819 |

| Held Percent Institutions | 0.79626 | Short Ratio | 15.32 | Short Percent of Float | 0.0717 |

| Book Value | 9.289 | Price to Book | 1.121757 | Net Income to Common | -3,809,000 |

| Trailing EPS | -0.15 | Forward EPS | 1.15 | Enterprise to Revenue | 103.364 |

| 52 Week Change | 0.34664953 | S&P 52 Week Change | 0.21306944 | Last Dividend Value | 0.32 |

| Current Price | 10.42 | Target High Price | 12.00 | Target Low Price | 9.00 |

| Target Mean Price | 10.33 | Target Median Price | 10.00 | Recommendation Mean | 2.7 |

| Number of Analyst Opinions | 3 | Total Cash | 49,751,000 | Total Cash Per Share | 1.993 |

| Total Debt | 1,547,193,984 | Quick Ratio | 1.704 | Current Ratio | 1.708 |

| Total Revenue | 17,011,000 | Debt to Equity | 667.464 | Revenue Per Share | 0.689 |

| Return on Assets | -0.00132 | Return on Equity | -0.014830001 | Operating Cashflow | 652,238,016 |

| Gross Margins | 0.31133 | Operating Margins | 0.65322 | Currency | USD |

Technical Analysis and Outlook for AOMR:

Technical Analysis and Outlook for AOMR:

Key Technical Indicators:

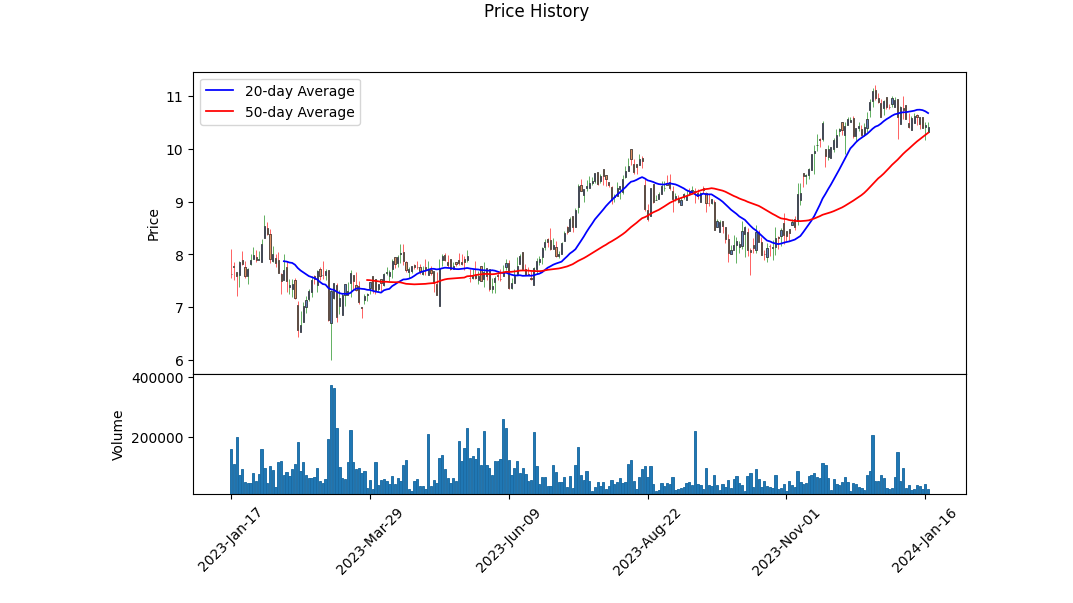

- The stock has been trending higher as evidenced by recent price action, with the Open and Close prices steadily increasing over the last four months.

- The Parabolic SAR (PSAR), a technical indicator used to determine the direction of an asset's momentum, has shown a bearish signal with the PSAR above the price on the last trading day.

- The On-Balance Volume (OBV) has remained consistent, indicating a good balance of buying and selling pressure.

- The Moving Average Convergence Divergence (MACD) histogram shows a negative value on the last trading day, suggesting that the bearish momentum might be gaining strength.

Fundamental Analysis:

- The company's operating cash flow is positive, reflecting its ability to generate revenue from its core business activities.

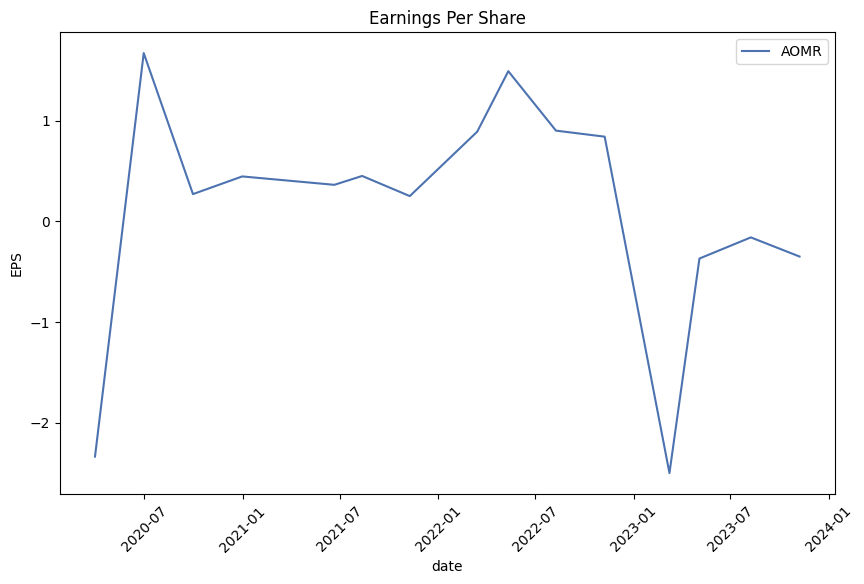

- However, the company has reported a significant net loss in the last fiscal year, which could be a cause for concern for investors.

- The gross and operating margins are healthy, demonstrating the company's ability to manage its costs successfully.

- A high net debt figure is notable on the balance sheet, which could indicate a higher risk profile for the company.

- The company has a trailing Peg Ratio not provided, making it challenging to assess its future growth prospects relative to its earnings growth.

Balance Sheet and Cash Flows:

- There has been a substantial increase in net debt over the past three years, a potential risk factor for long-term sustainability.

- Despite recent operating losses, the company possesses tangible book value and equity, suggesting some underlying asset support.

- The company's balance sheet shows a high level of Total Assets compared to Total Liabilities, which is a positive indicator of the company's financial stability.

- The Cash Flow statement indicates negative free cash flow in the past year, which could impact future operations and investment capabilities.

Analyst Expectations:

- Analysts are projecting significant earnings growth in the upcoming quarters, which could signal higher investor expectations for the company's performance.

- The next year's earnings estimate shows a substantial increase, indicating analyst confidence in the company's recovery and growth potential.

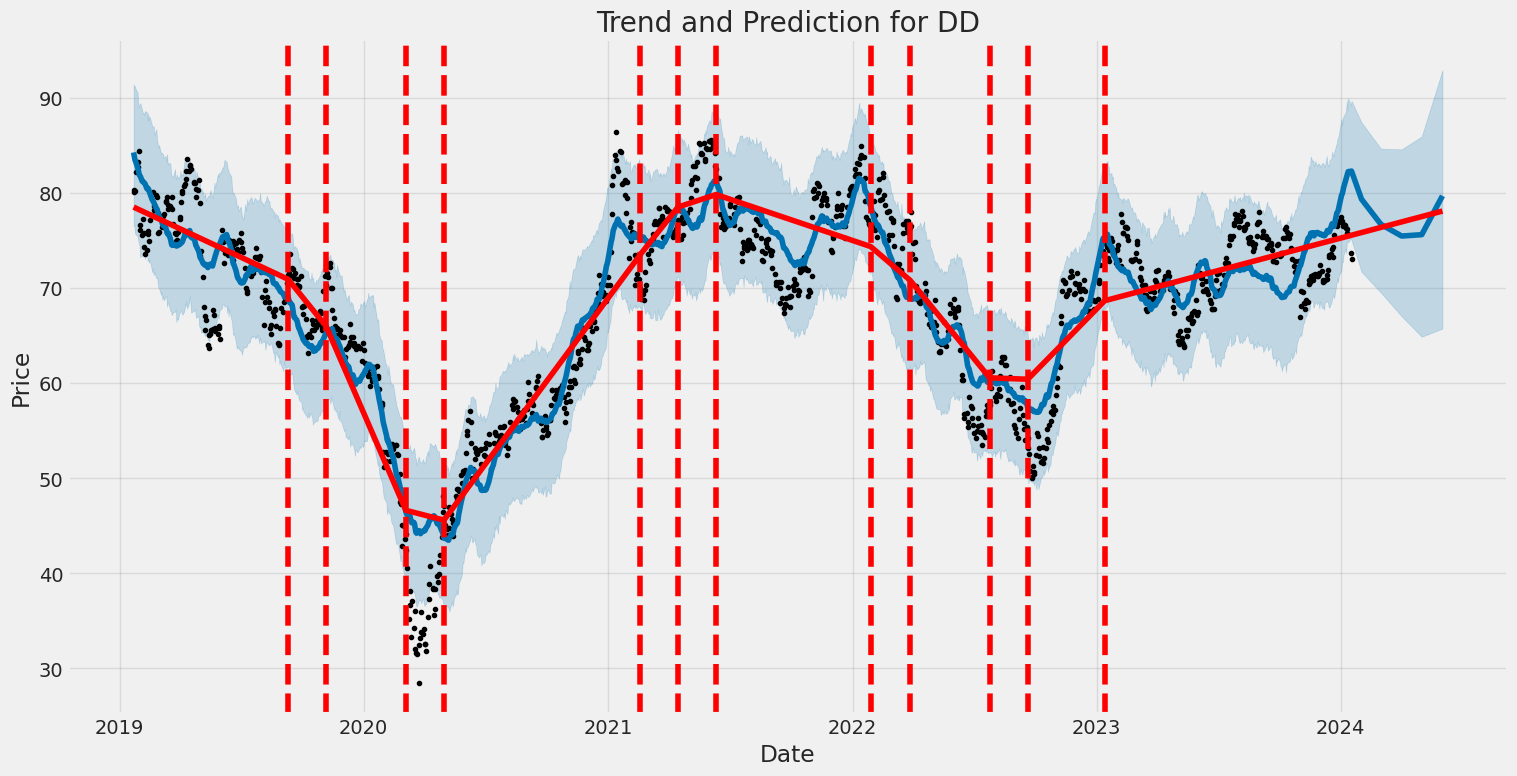

Based on the latest technical indicators, fundamentals, balance sheet, cash flows, and analyst expectations, AOMR's stock price movement seems to be approaching a potential inflection point. The bearish indicators suggested by the MACD and PSAR need to be monitored closely as they may signal the beginning of a downside move. However, if AOMR can capitalize on the positive earnings outlook and demonstrate a turnaround in their financials, there could be an opportunity for upside in the next few months, supported by the analysts' projections of earnings growth.

Investors should keep a close eye on the company's ability to manage its debt levels. The operating margins and gross margins signal that AOMR is efficient in its operations, which could translate to improved earnings if they continue on this path. The positive operating cashflow is a silver lining that suggests AOMR is retaining some liquidity from its business operations.

The key for investors will be whether the company can sustain its cost management strategy and translate analyst expectations into concrete earnings results. If AOMR manages to post positive earnings surprises in the upcoming quarters, it could provide a significant tailwind to the stock's price. Given these observations, it would be prudent for investors to watch the next few earnings releases closely, as they will likely be significant indicators of the company's future direction. The combination of fundamental strength and improving earnings could outweigh the current bearish technical signals, leading to potential positive price momentum over the next few months.

| Alpha | -0.0292 |

| Beta | 0.8857 |

| R-squared | 0.123 |

| Adj. R-squared | 0.122 |

| F-statistic | 90.73 |

| Prob (F-statistic) | 3.23e-20 |

| No. Observations | 649 |

| AIC | 3,133 |

| BIC | 3,142 |

In analyzing the relationship between the AOMR (dependent variable) and SPY (independent variable), which represents the overall market, the linear regression model outputs key statistics that inform us about the nature of their relationship up to the present day. The model's alpha value is -0.0292, which is an indicator of the average return of AOMR that is independent of the market's performance, suggesting that AOMR underperforms by approximately 2.92% when the market's return is zero. In other words, this alpha figure implies the excess return or the active return AOMR provides above the benchmark represented by SPY when market movements are not taken into account.

The beta value of the model, which stands at 0.8857, reflects the sensitivity of AOMR's returns to the movements in the market (SPY). This statistic shows that AOMR's returns tend to move in the same direction as the market but are less volatile since a beta of 1 would indicate a direct correlation with market movements. The R-squared value of 0.123 indicates that approximately 12.3% of the variation in AOMR's returns can be explained by the market returns captured by SPY. An Adj. R-squared of 0.122 takes into account the number of predictors in the model and represents this fit proportionally.

In Angel Oak Mortgage Inc.'s third-quarter 2023 earnings call, the company outlined strategies that have led to growth and resilience despite market challenges. Angel Oak has refocused its portfolio to mitigate risks and increase liquidity. They've achieved a balance between risk management and asset growth by acquiring loans selectively at competitive rates and cutting down on interest and operating expenses. The company reported significant improvement in net interest margin thanks to strategic securitization activities and the purchase of new loans with higher interest rates. The average coupon of the loan portfolio grew from 4.63% at the end of the first quarter to approximately 6.37% post-quarter, indicating successful execution of their growth-oriented approach.

Chief Financial Officer Brandon Filson provided a detailed financial performance review, highlighting an increase in net income to $8.3 million for the third quarter. Despite distributable earnings showing a loss of $8.6 million, primarily due to unrealized gains not being included, an adjusted figure based on the impact of the AOMT 2023-5 securitization would have resulted in distributable earnings of $4.3 million. Filson emphasized the expansion of net interest margin, a reduction in expenses, and a strong liquidity position enabled by proactive cash flow management and strategic financing decisions. The balance sheet was portrayed positively, with a healthy ratio of recourse debt to equity and a proactive approach to portfolio leverage, and he highlighted the company's solid capital position that supports further loan purchases and securitization efforts.

The call also discussed inventory and delinquency rates, showing a stable housing market supportive of Angel Oak's investment strategy. Credit performance has been strong with low delinquency rates, and the company expects muted impact from any potential slowdown due to robust underwriting criteria and a solid economy. Going forward, the company's executives expressed confidence in their capability to grow earnings while keeping a firm grip on liquidity and a low expense profile. The approach and the measures taken have set up a powerful platform likely to yield stable and resilient returns.

To summarize, Angel Oak has taken a growth-oriented but risk-conscious strategy that has translated into a stronger net interest margin and a good rate of earnings. Despite some disparity between GAAP net income and distributable earnings due to non-realized gains, they underlined a solid liquidity position and a well-managed leverage. The portfolio's credit performance remains robust, and they have a clear path ahead for further purchases and securitizations. A dividend payout was announced, reinforcing the notion that the company is on stable financial footing. The executives are poised to navigate the volatile market environment with an emphasis on a sustainable return profile.

As of September 30, 2023, Angel Oak Mortgage, Inc. (AOMR) maintained a diverse loan portfolio primarily composed of residential real estate loans, including one- to four-family, multi-family, and home equity loans, as well as construction and land loans, commercial real estate loans, consumer loans, and commercial loans. The loans receivable amount in total was approximately $1.65 billion. The company classified loans into distinct risk categories premised on borrower information, historical performance, and other relevant data to assess credit risk. The majority of the loan portfolio was considered to be in the "pass" category with a smaller portion categorized as "watch" or "substandard," reflecting varying degrees of estimated default risk.

As of the end of September 2023, AOMR reported mortgage banking operations through its subsidiary, which generated $59.9 million in mortgage banking income for the first nine months of 2023 from $1.58 billion of residential loans originated for sale. This is compared to the $83.7 million income from $2.12 billion of sales in the same period of the prior year. The company's loans serviced for others had an unpaid principal balance of approximately $220 million by the end of the reporting period.

The company's investment securities portfolio, valued at fair value, mainly comprised mortgage-backed securities and debt securities totaling roughly $194.5 million, showing a decrease resulting primarily from unrealized losses due to market conditions.

Total borrowings of AOMR stood at approximately $587.9 million, which included significant short-term Federal Home Loan Bank (FHLB) advances and other short-term borrowings from the Federal Reserve Bank. The company's borrowings strategy appeared to include a mix of fixed and variable rate advances, specifying callable and putable options reflecting the financial management's approach to liquidity and interest rate risk.

On the liabilities side, the company held total deposits of approximately $1.2 billion, of which time deposits constituted roughly $733.25 million. In terms of deposit maturity structure, most time deposits were due within one year.

Regarding asset quality, non-accrual loans were reported at $4.08 million, representing a slight portion of total loan receivables. The low non-accrual figure indicated relatively sound asset quality.

Finally, AOMR managed an allowance for credit losses to cover expected loan defaults across its loan segments. The allowance for credit losses related to loans stood at approximately $18.55 million, indicating the company's preparation for potential credit losses in its lending operations.

Overall, AOMR's financial condition as of September 30, 2023, included a significant loan portfolio backed by residential real estate, a manageable level of credit risk, and a solid approach to managing its borrowings and investments, despite the noted declines in the mortgage banking income and the unrealized losses in the investment portfolio.

Angel Oak Mortgage REIT, Inc. (NYSE: AOMR), a specialized real estate investment trust based in Atlanta, focuses on providing non-qualified (non-QM) mortgage loans. It serves a unique niche in the market by extending credit to borrowers who fall outside the purview of traditional lending guidelines, which includes asset-qualifying loans, loans to investors based on cash flow, and those directed towards self-employed individuals. This specialization allows Angel Oak to appeal to an underserved segment of the market and potentially capitalize on areas that are less competitive.

The company's operational focus is refected in its financial performance and ownership structure. According to a Yahoo Finance article from December 31, 2023, institutions hold a substantial 50% of the company's shares. This notable figure suggests a significant level of professional confidence in Angel Oak Mortgage REIT's future prospects. Institutional investors are typically considered sophisticated and their heavy involvement is often seen as a positive indicator. Their investments are usually the result of rigorous analysis, and they can play a meaningful role in the strategic direction of the companies they invest in.

Davidson Kempner Capital Management LP is Angel Oak Mortgage REITs largest shareholder, wielding a noteworthy 30% ownership of the company, underlining the confidence and commitment that this particular institution has in the firm. Following closely, the second and third largest shareholders account for 21% and 8.4% of stakes, respectively. This highlights a focal point where key decisions are influenced by these major investors, which could be vital during pivotal strategic shifts or in the shaping of governance policies.

Retail investors and the general public hold a 17% stake in Angel Oak Mortgage REIT. While not holding a majority, this segment of shareholders still represents an important demographic. Retail investors can contribute to market sentiment and trading volume, potentially influencing the stock price in meaningful ways.

In addition, insider ownership presents another layer to consider when assessing company stability and prospectus. Board members and top-level managers have invested approximately $6.6 million into the companys shares, an indication of confidence from those who intimately understand the company's workings. This investment aligns their interests with those of external shareholders and signals belief in the company's potential for growth and profitability.

However, it is imperative to consider the balance of ownership structure to ensure a diverse range of perspectives and minimize the concentration of power that may limit strategic flexibility or introduce potential governance issues.

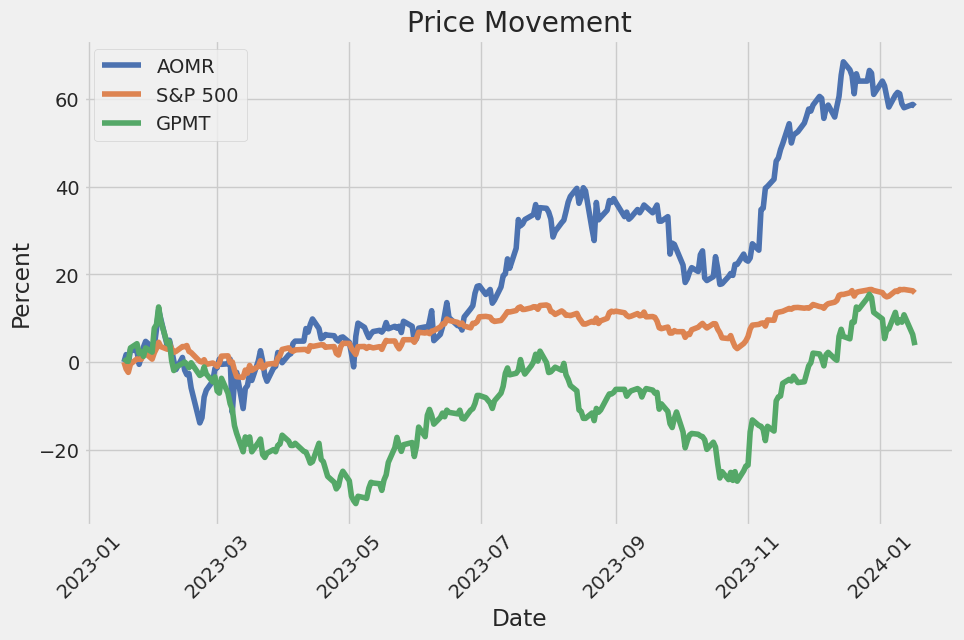

When reflecting on the performance and prospects of Angel Oak Mortgage, it is essential to consider other influential factors such as market sentiment, company announcements, and broader economic indicators. One particular note of interest is Angel Oak Mortgage's notable turnaround in the financial year 2023, chronicled in a Yahoo Finance article dated January 4, 2024, penned by Ethan Roberts. The article showcases how Angel Oak Mortgage REIT outperformed within the REIT sector with a staggering total return of 129.64% after a considerable slump in the prior year.

Primarily buoyed in January, where much of the annual gains were made, this recovery can be attributed to a number of market dynamics including macroeconomic influences such as Federal Reserve policies and a general recovery among mREITs and financial service companies. Interestingly, Angel Oak Mortgage has distinguished itself from its peers by being a top performer, particularly impressive given its micro-cap status with a market capitalization of around $273.62 million.

The performance metrics during the year, often compared with larger indices such as the S&P 500, revealed that while the S&P 500 overall had stronger annual gains, the final quarter favored the real estate sector. Importantly, the excitement was not limited to large-cap leaders but included Micro and small-cap stocks, which indicates a shift in investor focus towards potential growth in these segments.

In context, Angel Oak Mortgage's significant returns in 2023 reflect broader market trends and possibly the company's operational ability to leverage its specialized market position. It also signals to investors that, while larger entities typically dominate performance narratives, there are instances where smaller, specialized firms can seize market opportunities and yield substantial returns.

The mentioned articles from Yahoo Finance serve as a valuable resource for those seeking deeper insights into Angel Oak Mortgage REIT's institutional investment, ownership dynamics, and particular performance within the tumultuous and changing landscape of financial markets. To access these articles and delve deeper into the details, please visit the provided links: Yahoo Finance Angel Oak Article and The Best-Performing REITs Of 2023.

Angel Oak Mortgage, Inc. (AOMR) has exhibited considerable volatility from June 2021 to January 2024. The ARCH model, which is used to quantify volatility, shows that there are significant fluctuations in AOMR's returns, with a notable coefficient (omega) of 5.8385, indicating a high baseline level of volatility. Additionally, the alpha parameter is 0.3330, suggesting that past returns have a moderately strong impact on future volatility.

Here's the requested HTML table summarizing the key statistics:

| Statistic | Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.002 |

| Log-Likelihood | -1,579.56 |

| AIC | 3,163.13 |

| BIC | 3,172.08 |

| No. Observations | 649 |

| Df Residuals | 649 |

| omega | 5.8385 |

| alpha[1] | 0.3330 |

To analyze the financial risk of investing $10,000 in Angel Oak Mortgage, Inc. (AOMR), we employ a combined approach integrating volatility modeling and machine learning predictions over a one-year period. The volatility modeling technique is a critical part of this analysis as it allows us to characterize and forecast the variability in AOMR's stock price over time. This model captures the time-varying nature of volatility, an essential feature given financial markets often exhibit periods of clusters in volatility.

To complement the volatility modeling, machine learning predictions are used to estimate future stock returns based on historical data. The application of a machine learning model, particularly one that uses an ensemble of decision trees like the analysis described, allows for non-linear learning from a range of input features such as historical prices, volume, and potentially other market indicators.

By combining these two approaches, we gain a comprehensive understanding of the inherent risk in the investment. The volatility model provides the conditional variance (volatility forecast), which is fundamental in assessing the distribution of potential future returns. The machine learning component focuses on the direction and magnitude of the returns, essentially offering a predictive insight into what the future holds for AOMR's stock price.

When bringing these pieces together, we calculate the annual Value at Risk (VaR) at a 95% confidence interval. VaR is a widely-used risk measure in finance, indicating the maximum loss expected over a given time frame with a certain confidence level. For AOMR, the VaR suggests that with 95% confidence, an investor should not expect to lose more than $383.33 on their $10,000 investment over a year. This number quantifies the investment's downside risk, giving a clear metric for potential losses.

While the calculated VaR offers insight into the risk of loss, it is a probabilistic measure and does not guarantee that losses will be confined to this amount; there is still a 5% chance of experiencing a loss exceeding the VaR estimate. Therefore, the calculated VaR should be understood within the context of its assumptions and inherent limitations, serving as a tool to gauge risk exposure but not as an absolute predictor of future losses.

Similar Companies in REITMortgage:

Granite Point Mortgage Trust Inc. (GPMT), MFA Financial, Inc. (MFA), Two Harbors Investment Corp. (TWO), PennyMac Mortgage Investment Trust (PMT), Redwood Trust, Inc. (RWT), AG Mortgage Investment Trust, Inc. (MITT), Invesco Mortgage Capital Inc. (IVR), Apollo Commercial Real Estate Finance, Inc. (ARI), New York Mortgage Trust, Inc. (NYMT), KKR Real Estate Finance Trust Inc. (KREF), Ellington Residential Mortgage REIT (EARN), Ares Commercial Real Estate Corporation (ACRE), Claros Mortgage Trust, Inc. (CMTG), Cherry Hill Mortgage Investment Corporation (CHMI), Ready Capital Corporation (RC), Ellington Financial Inc. (EFC), New Residential Investment Corp (NRZ), AG Mortgage Investment Trust, Inc. (MITT), PennyMac Mortgage Investment Trust (PMT), Annaly Capital Management, Inc. (NLY), Two Harbors Investment Corp (TWO), Ellington Financial Inc. (EFC), Redwood Trust, Inc. (RWT), ARMOUR Residential REIT, Inc. (ARR), Starwood Property Trust, Inc. (STWD), Dynex Capital, Inc. (DX)

https://finance.yahoo.com/news/50-ownership-shares-angel-oak-122805476.html

https://finance.yahoo.com/news/best-performing-reits-2023-123715715.html

https://www.sec.gov/Archives/edgar/data/0001569994/000143774923029997/wsbf20230930_10q.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: xmosCE

https://reports.tinycomputers.io/AOMR/AOMR-2024-01-17.html Home