Bank of America Corporation (ticker: BAC)

2023-12-29

Bank of America Corporation, operating under the ticker BAC, is one of the largest financial institutions in the world, providing a full range of banking, investing, asset management, and other financial and risk management products and services. With a vast network that spans across the United States and caters to individuals, small and middle-market businesses, as well as large corporations, the bank boasts a comprehensive suite of services. BAC is a component of the S&P 500 Index and is notable for its extensive retail banking coverage. In addition to traditional banking services, the company operates through various segments including Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets. Known for its wide-reaching influence, Bank of America serves clients through operations in numerous countries and is committed to providing digital banking services to meet the evolving needs of its customers, highlighting a strong emphasis on innovation and technology in the banking sector.

Bank of America Corporation, operating under the ticker BAC, is one of the largest financial institutions in the world, providing a full range of banking, investing, asset management, and other financial and risk management products and services. With a vast network that spans across the United States and caters to individuals, small and middle-market businesses, as well as large corporations, the bank boasts a comprehensive suite of services. BAC is a component of the S&P 500 Index and is notable for its extensive retail banking coverage. In addition to traditional banking services, the company operates through various segments including Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets. Known for its wide-reaching influence, Bank of America serves clients through operations in numerous countries and is committed to providing digital banking services to meet the evolving needs of its customers, highlighting a strong emphasis on innovation and technology in the banking sector.

| Full Time Employees | 213,000 | Previous Close | 33.84 | Open | 33.82 |

| Day Low | 33.77 | Day High | 33.97 | Dividend Rate | 0.96 |

| Dividend Yield | 0.0284 | Payout Ratio | 0.2521 | Five Year Avg Dividend Yield | 2.36 |

| Beta | 1.407 | Trailing PE | 9.49 | Forward PE | 11.48 |

| Volume | 21,731,860 | Average Volume | 48,036,311 | Average Volume 10 Days | 50,010,200 |

| Bid | 33.88 | Ask | 33.90 | Market Cap | 268,117,180,416 |

| Fifty Two Week Low | 24.96 | Fifty Two Week High | 37.00 | Price to Sales Trailing 12 Months | 2.7706 |

| Fifty Day Average | 29.501 | Two Hundred Day Average | 28.9706 | Trailing Annual Dividend Rate | 0.9 |

| Trailing Annual Dividend Yield | 0.0266 | Enterprise Value | 125,771,243,520 | Profit Margins | 0.3152 |

| Shares Outstanding | 7,913,730,048 | Shares Short | 69,581,156 | Shares Percent Shares Out | 0.0088 |

| Held Percent Insiders | 0.00106 | Held Percent Institutions | 0.71024 | Short Ratio | 1.63 |

| Book Value | 32.646 | Price to Book | 1.0378 | Earnings Quarterly Growth | 0.102 |

| Net Income to Common | 28,931,999,744 | Trailing EPS | 3.57 | Forward EPS | 2.95 |

| PEG Ratio | 2.8 | Enterprise to Revenue | 1.3 | S&P 52 Week Change | 0.2454 |

| Total Cash | 860,959,014,912 | Total Debt | 690,215,976,960 | Total Revenue | 96,771,997,696 |

Bank of America Corporation (BAC) has displayed an intriguing performance profile over the recent months, positioning itself in a landscape conducive to multifaceted analysis. The synthesis of technical analysis, alongside an inspection of the underlying fundamentals and balance sheets, offers a comprehensive view of potential price trajectories in the medium-term horizon.

Technical Analysis:

- Over the last quarter, BAC shares ascended from a low near $28.40 to highs brushing $34, a bullish momentum confirmed by the On-Balance Volume (OBV) which showcases significant buying pressure, transitioning from negative to positive territory.

- The Moving Average Convergence Divergence (MACD) histogram supports this bullish sentiment with values edging into positive territory toward the closing days of the period, endorsing a potential continuation of the uptrend.

- The absence of overbought conditions, as not indicated by any extrema in oscillators such as the Relative Strength Index (RSI), provides room for further potential gains without the immediate threat of a corrective pullback due to technical exhaustion.

Fundamentally, BAC presents a robust financial framework:

- Net income has held steady over recent years, underpinning a consistently profitable operation, integral for sustained confidence among investors.

- The operating margin, remaining substantial at 33.824%, delineates efficiency in the bank's core business operations which is a positive signal for operational acumen.

- Debt levels, albeit high, are counterbalanced by a formidable equity and tangible book value base, signalling a sound debt management structure.

- The increase in preferred stock equity reflects a confidence in capital management strategies, potentially enticing for income-focused equity holders.

Balance Sheet Observations:

- A substantial common stock equity position of $244.8 billion bolsters investor confidence by demonstrating underlying asset strength.

- The total assets of over $3 trillion reflect significant scale and diversified asset holdings, which are positive for the resilience of the institution.

- The liquidity position is comforting, with cash and cash equivalents being well within manageable bounds and supporting normal operational exigencies.

Cash Flow Considerations:

- Free cash flow being negative might normally raise concerns; however, for a financial institution like Bank of America, the net cash position and operating cash flows are particularly more relevant.

- Repurchases of capital stock signify management's belief in the bank's intrinsic value, while a broad debt issuance and repayment structure illustrate BAC's active capital markets engagement and financial flexibility.

Factoring in the above elements, the next few months herald a cautiously optimistic price trajectory for BAC. The technicals suggest sustained upside momentum, tempered by the perpetually possible ebb and flow inherent in financial stock volatility. As BAC continues to navigate the fiscal waters with a fortified balance sheet and robust fundamentals, share prices may well persist in reflecting this corporate stability. A keen eye must be kept on variables such as the interest rate environment, regulatory changes, and macroeconomic shifts, as these externalities have proven to affect the banking sector profoundly.

Investors participating in BAC's narrative may anticipate probable appreciation in the market valuation of their holdings, catalyzed by these corroborated indicators of financial health and technical momentum. However, vigilance is warranted as market dynamics are susceptible to sudden shifts, not entirely predictable by either technical or fundamental metrics.

The Federal Reserve's announcement of a potential shift in its interest rate policy has unarguably instigated a wave of reevaluation across major financial institutions, with Bank of America Corporation (BAC) at the epicenter. Analysts have been swift to flag concerns that anticipate weaker profitability for BAC in the financial year 2024, catalyzed by the expected reduction in the federal funds rate.

With the decrease in interest rates on the horizon, projections about BAC's Net Interest Income (NII)a critical performance metric for bankshave prompted some degree of skepticism in the stock market. BAC, like many Wall Street banks, typically thrives in higher rate environments which facilitate net interest margin expansion, a cadence that may be interrupted as the Federal Reserve nudges rates downwards.

In response to the Fed's pivot, market response was mixed; BAC's shares experienced a commendable surge in late 2023. Tactical investors recognized this spike as an opportune moment for exit, given the upcoming pressure on BAC's NII. Despite this, the broader implications for BAC's stock valuation can't be ignored and have led some market participants to double down on scrutiny, particularly as the stock began trading slightly above its historical average price-to-book (P/B) ratio.

While BAC's valuation does not appear stretched, it pivots around historical averages, a trend suggesting cautious engagement with the stock as the Fed prepares for the projected rate adjustments. This anticipatory atmosphere has triggered some analysts to approach BAC's equity with a recommendation to sell, envisaging a contraction in profitability due to the looming interest rate dip.

Bank of America's consumer banking sector offers a potential buffer against such NII compression. The segment stands as a cornerstone, historically the largest source of net income for the company. Its strength is particularly significant, given its potential to offset some of the adverse effects that an economic downturn, assuming one is avoided, could inflict on the firm's financial health.

Notably, during a comparative analysis of banking stocks, the performance of Ally Financial stood out in recent times with a substantial 27% surge, buoyed by the indirect endorsement from Berkshire Hathaway's 9.6% stake. Ally's success can also be attributed to its digital-first model which reduces operational costs and enables competitive rate offerings. Its solid net interest margin and a consistent increase in total deposits mirror an evolution not felt evenly across the landscapeBAC, despite its gains, does not match Ally's proportionate ascent.

Against this backdrop, financial journalist A.J. Button shone a light on high-yield stocks for the fiscal year 2024, setting a foundation for strategic shifts by investors against Treasury rides. Button's insight highlighted TD Bank and Oaktree Specialty Lending as promising buys, underlining their robust fundamentals and ability to navigate the expected easing monetary policies differently than lower-quality prospects.

Warren Buffett's concentrated investment strategy, encompassing a substantial position in BAC, serves as a beacon for others in the investment community. Berkshire Hathaway's significant stake in BAC reflects confidence in the bank's prospects, notwithstanding short-term headwinds. This concentration aligns with Buffett's investing principles, favoring significant positions in a limited portfolio of outstanding companies with the potential for consistent returns.

Amidst this strategic shuffling, Bank of America's stock remained steady in the latest trading session, closing unchanged at $33.86. The assessment toward the earnings release set for January 12, 2024, is being watched closely with expectations set for a decrease in EPS compared to the same quarter in the previous year. Despite potential declines, the revised consensus estimate suggests some optimism for the year.

Furthermore, the investment reallocation observed by individual investors reflects an ongoing belief in BAC's resilience and prospects in the face of short-term volatility. Investment dynamics are ever-fluctuating, and while the immediate share price movement may seem unpromising, the broader perspective seems favorable for investors with a long-term horizon.

The dividends paid by Bank of America to one of its largest shareholders, Berkshire Hathaway, illustrate a narrative of consistent shareholder value. The bank's policy of gradual dividend increases, even amid challenging economic conditions, resonates with Buffetts investment philosophy which leans towards businesses with sturdy and sustainable growth models.

As BAC navigates a multifaceted operational and economic terrain, its decision to expand trading operations amid industry headwinds has paid dividends, albeit without a concomitant rise in investor enthusiasm. The dilemma surrounding the banks trading success versus investor sentiment potency underscores the complexity of the financial market and investor decision-making processes.

The evolving dynamics in the REIT market and their relation to interest rate forecasts weigh on financial giants including BAC, which hold the potential to navigate such economic undercurrents competently. With experts pointing to REITs as a ripe sphere for investing, given projected interest rate decreases, there lies an environment replete with investment opportunities that could provide both yield and capital appreciation.

All these signals point to an intricate investment fabric where BAC, within the realm of prevailing economic trends, must balance the expectations set by market dynamics and industry comparatives. Despite trailing behind the broader industry growth, investor sentiment and subsequent performance in 2024 remain variables in the equation that defines Bank of America Corporation's trajectory in the financial marketplace.

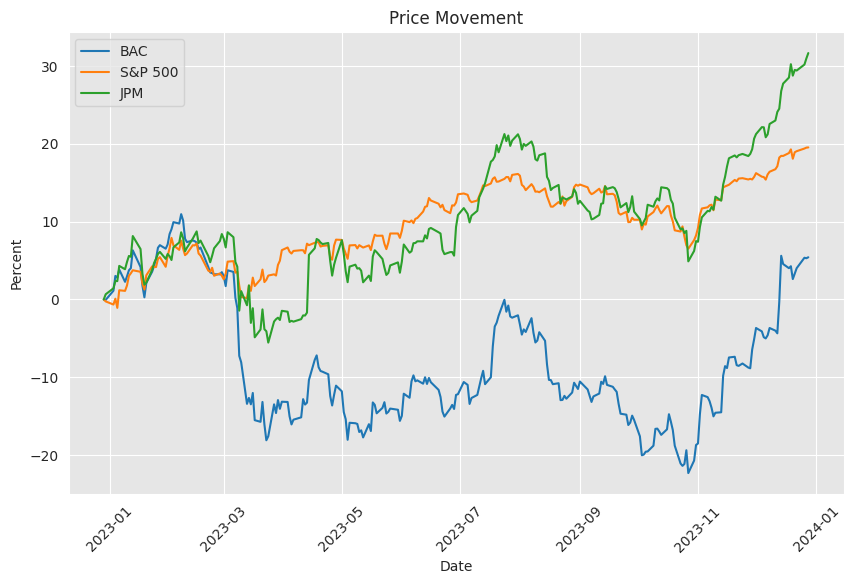

Similar Companies in Banking:

JPMorgan Chase & Co. (JPM), Wells Fargo & Company (WFC), Citigroup Inc. (C), Goldman Sachs Group Inc. (GS), Morgan Stanley (MS), U.S. Bancorp (USB), PNC Financial Services Group, Inc. (PNC), Truist Financial Corporation (TFC), TD Bank, N.A. (TD), Capital One Financial Corporation (COF)

News Links:

https://www.fool.com/investing/2023/12/22/65-warren-buffett-portfolio-invested-in-3-stocks/

https://seekingalpha.com/article/4658944-the-fed-just-made-bank-of-america-a-sell-rating-downgrade

https://seekingalpha.com/article/4660033-2-high-yielders-buying-2024-and-1-eyeing

https://www.fool.com/investing/2023/12/27/bank-stocks-are-soaring-after-the-latest-interest/

https://finance.yahoo.com/news/bank-america-bac-flat-market-224522530.html

https://www.fool.com/investing/2023/12/20/meet-the-stock-that-just-paid-warren-buffett-184-m/

https://www.fool.com/investing/2023/12/23/3-stocks-i-bought-this-week/

https://seekingalpha.com/article/4657945-5-reits-to-add-to-your-christmas-shopping-list

https://finance.yahoo.com/news/bank-america-corporation-bac-attracting-140011953.html

https://www.fool.com/investing/2023/12/24/the-sp-500-is-about-to-do-something-its-only-done/

https://finance.yahoo.com/news/3-warren-buffett-approved-dividend-210142577.html

https://finance.yahoo.com/news/bank-america-bac-lags-peers-141100055.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: KX5IQi

https://reports.tinycomputers.io/BAC/BAC-2023-12-29.html Home