Becton, Dickinson and Company (ticker: BDX)

2024-01-11

Becton, Dickinson and Company (BDX), commonly known as BD, stands as a global medical technology company that specializes in the development, manufacture, and sale of a broad range of medical supplies, devices, laboratory equipment, and diagnostic products. Founded in 1897 and headquartered in Franklin Lakes, New Jersey, the company serves healthcare institutions, life science researchers, clinical laboratories, the pharmaceutical industry, and the general public. BD's product portfolio encompasses a wide variety of medical devices in areas such as diabetes care, medication management, infection prevention, and biosciences, to name a few. The company is committed to advancing the world of health by improving medical discovery, diagnostics, and the delivery of care. Through its various business segments and international operations, BD aims to provide solutions that help to enhance outcomes, lower health care delivery costs, increase efficiencies, improve health care safety, and expand access to health. As of the knowledge cutoff date, BD remains a significant player in the health care sector, consistently investing in innovation and strategic partnerships to stay at the forefront of medical technology advancements.

Becton, Dickinson and Company (BDX), commonly known as BD, stands as a global medical technology company that specializes in the development, manufacture, and sale of a broad range of medical supplies, devices, laboratory equipment, and diagnostic products. Founded in 1897 and headquartered in Franklin Lakes, New Jersey, the company serves healthcare institutions, life science researchers, clinical laboratories, the pharmaceutical industry, and the general public. BD's product portfolio encompasses a wide variety of medical devices in areas such as diabetes care, medication management, infection prevention, and biosciences, to name a few. The company is committed to advancing the world of health by improving medical discovery, diagnostics, and the delivery of care. Through its various business segments and international operations, BD aims to provide solutions that help to enhance outcomes, lower health care delivery costs, increase efficiencies, improve health care safety, and expand access to health. As of the knowledge cutoff date, BD remains a significant player in the health care sector, consistently investing in innovation and strategic partnerships to stay at the forefront of medical technology advancements.

| Full Time Employees | 73,000 | CEO Name | Mr. Thomas E. Polen Jr. | CEO Total Pay | $3,460,875 |

| Previous Close | $238.41 | Open | $238.22 | Day Low | $234.28 |

| Day High | $238.90 | Dividend Rate | $3.80 | Dividend Yield | 1.59% |

| Payout Ratio | 71.37% | Five Year Avg Dividend Yield | 1.32% | Beta | 0.482 |

| Trailing PE | 46.08 | Forward PE | 16.48 | Volume | 1,883,338 |

| Average Volume | 1,648,557 | Market Cap | $68,248,076,288 | Fifty Two Week Low | $228.62 |

| Fifty Two Week High | $287.32 | Price To Sales (TTM) | 3.523 | Fifty Day Average | $240.8382 |

| Two Hundred Day Average | $256.0281 | Trailing Annual Dividend Rate | $3.64 | Trailing Annual Dividend Yield | 1.5267% |

| Enterprise Value | $83,234,111,488 | Profit Margins | 7.661% | Shares Outstanding | 289,542,016 |

| Held Percent Insiders | 0.3039% | Held Percent Institutions | 90.878% | Book Value | $88.832 |

| Price To Book | 2.6456 | Gross Profits | $8,823,000,000 | Operating Cashflow | $2,988,999,936 |

| Earnings Growth | -60.1% | Revenue Growth | 6.8% | Gross Margins | 45.5449% |

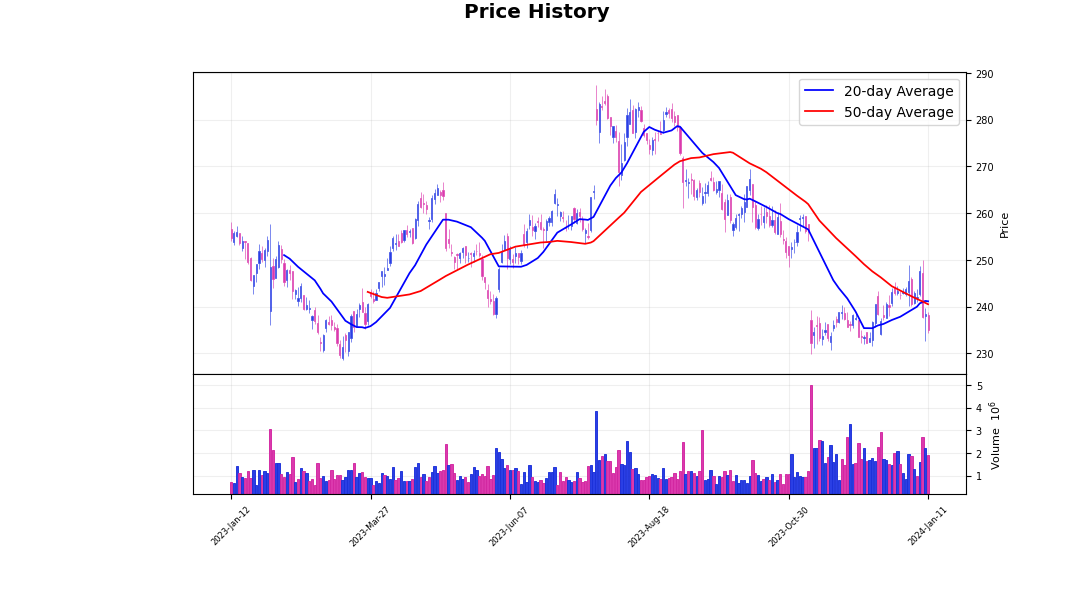

Technical Analysis Perspective:

Upon analyzing the data, a few key technical indicators suggest possible price movement for BDX in the coming months. The Parabolic SAR (PSAR) began to appear below the price, indicating an uptrend from the 19th of September onwards. However, the most recent data shows the MACD histogram trending downwards, shifting from a positive 0.502121 to a negative -0.518189, implying a potential shift in momentum or a weakening trend.

Fundamental Analysis Perspective:

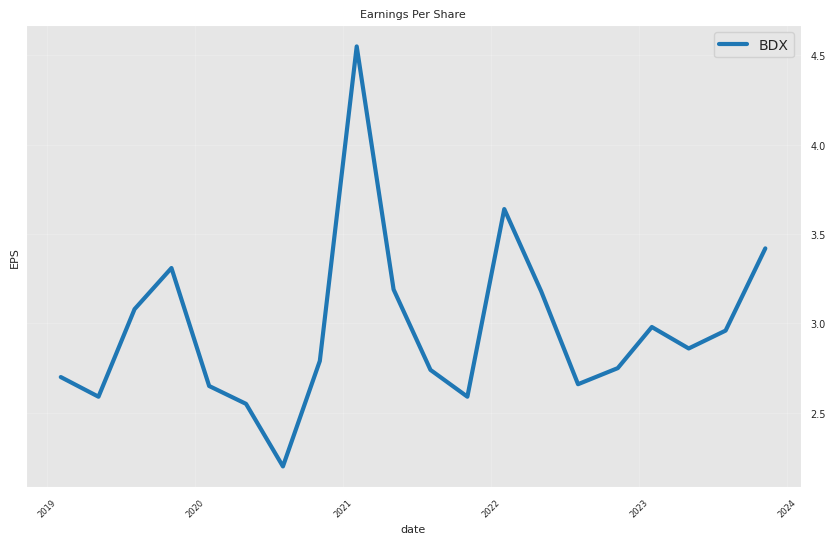

BDX's fundamental data highlights a company with solid gross and EBITDA margins at 45.545% and 26.012% respectively. Operating margins are also healthy at 20.7%, and the trailing PEG ratio is at 1.3166, suggesting that the stock may be reasonably valued based on earnings growth. Analyst expectations for the current and next quarters show an anticipated EPS increase, along with a year-on-year revenue growth prediction of 4.3% for 2024 and 5.8% for 2025.

Balance Sheet and Cash Flows Perspective:

BDX's balance sheet shows significant leverage with net debt at roughly $14.46 billion and a steady increase in treasury shares over the years, indicating a history of share buybacks. The cash flow statements reveal a strong free cash flow, but there is a noticeable decline in the past year. Repayment of debt outstrips the issuance of new debt, and the cash position has increased over the last fiscal year end.

Market Sentiment and Forward-Looking Statements:

Analysts show mixed EPS revisions in recent periods with both upgrades and downgrades, which could reflect uncertainty around BDX's future performance. The EPS trend shows a decreasing pattern over the last 90 days. However, growth estimates remain positive for the next five years, indicating optimism about the company's longer-term growth potential.

Conclusion:

Taking into account the combined view from technical indicators, fundamental data, and financial statements, BDX appears to be in a moderate growth phase with some caution due to its technical momentum indicators. While the company has robust financial and operational metrics, the recent negative momentum seen in MACD histogram data may indicate potential challenges or consolidation in the stock price in the short term.

Investors should monitor for continuity in the positive Parabolic SAR trend, observe whether MACD histogram levels can rebound to indicate resumed bullish momentum, and keep an eye on the next few earnings releases, as they may significantly influence market sentiment. If BDX can maintain its growth trajectory and analyst sentiment remains strong, the stock could see upward price movement. However, the high level of debt and the mixed message from the technical momentum indicators suggest a cautious approach, with potential for short-term volatility.

Overall, while the company shows potential and strong fundamentals, mixed technical signals suggest that BDX's stock price movement in the next few months could exhibit some variability before establishing a clearer trend. Investors would be wise to watch technical indicators closely along with upcoming earnings reports for signs that corroborate or challenge the fundamental growth narrative.

| Alpha () | -0.0147 |

| Beta () | 0.5621 |

| R-squared | 0.224 |

| Adjusted R-squared | 0.223 |

| F-statistic | 361.3 |

| Prob (F-statistic) | 5.25e-71 |

| Log-Likelihood | -2,188.5 |

| No. Observations | 1,257 |

| AIC | 4,381 |

| BIC | 4,391 |

| Const | -0.0147 |

| Std Err of Beta | 0.030 |

| t-statistic () | 19.009 |

| P>|t| | 0.000 |

| [0.025 | 0.504 |

| 0.975] | 0.620 |

| Durbin-Watson | 2.007 |

| Omnibus | 412.547 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 6,325.975 |

| Skew | -1.091 |

| Kurtosis | 13.771 |

| Cond. No. | 1.32 |

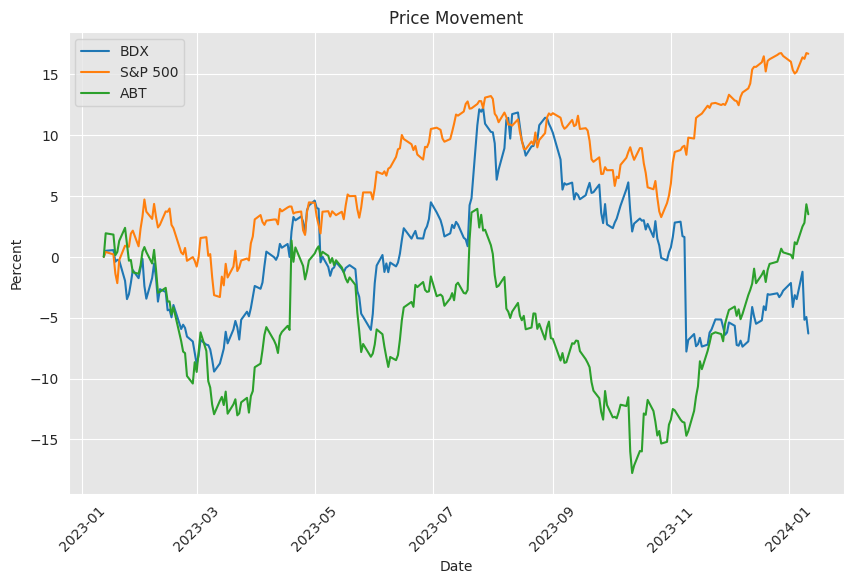

The linear regression model depicting the relationship between BDX (Becton, Dickinson and Company) and SPY (SPDR S&P 500 ETF Trust, a representation of the S&P 500 index, thus the market) shows a beta () of approximately 0.5621. This implies that BDX has less volatility compared to the market and suggests a partial movement with the SPY for the period under review. A positive beta indicates that BDX generally moves in the same direction as the market, albeit with lesser magnitude. The R-squared of the model is 0.224, which suggests that about 22.4% of the variation in BDX's returns can be explained by the movements in the SPY.

The alpha () of the model is -0.0147, indicating that the stock has underperformed the market on a risk-adjusted basis by this amount over the observed period. A negative alpha generally suggests that an investment has earned returns below those predicted by the Capital Asset Pricing Model (CAPM). In this context, holding BDX would have resulted in a slight drag on performance relative to the broader market index, according to the data provided. With a p-value less than 0.05 for beta, the relationship between BDX and SPY is statistically significant. However, the alpha is not statistically significant (p-value greater than 0.05), indicating uncertainty in the performance divergence between BDX and the market.

Becton, Dickinson and Company (BDX) Earnings Call Summary:

*BDX held its Q4 and full-year fiscal 2023 earnings call, hosted by Greg Rodetis, Senior VP, Treasurer, and Head of Investor Relations, alongside Tom Polen, Chairman, CEO and President, and Chris DelOrefice, EVP and CFO.

*The company reported strong performance in FY '23, influenced by its BD 2025 strategy, product diversification, innovation, and a culture of operational excellence. Despite facing macroeconomic headwinds, BD achieved a 7% base revenue growth, significant margin expansion, and an adjusted EPS of $12.21, reflecting an 11% currency-neutral growth. The company also made strides towards its BD 2025 financial targets, including a 7% base organic revenue CAGR and 390 basis points of operating margin expansion.

*BD detailed progress in strategic areas such as obtaining FDA clearance for the updated BD Alaris infusion system, advancing its innovation pipeline with 27 key product launches, completing tuck-in acquisitions to fuel growth, and undertaking simplification initiatives to reallocate resources and reduce complexity. The company strengthened its balance sheet and continued its tradition of returning capital to shareholders, marking its 52nd year of dividend increases.

*Looking ahead to FY '24, BD remains confident in meeting its BD 2025 strategy and financial targets despite persistent and evolving macro uncertainties. The company committed to driving organic growth above its 5.5% target and advancing a series of new product launches to maintain a strong organic portfolio in high-growth areas. BD plans further organizational simplification to support investments in growth and aims to achieve a 25% adjusted operating margin goal by FY '25.

*During the Q&A session, there were discussions about the impact of currency fluctuations on financial guidance, considerations around Alaris revenue expectations, the outlook on China's market performance due to various pressures, and the strategic decisions around inventory management for cash flow improvement. Additionally, BD expressed a strong commitment to pursuing value-adding tuck-in M&A opportunities in the future, leveraging its robust financial position.

Becton, Dickinson and Company (BDX), a global medical technology company, reported their financial results for the third quarter ending June 30, 2023, in a 10-Q filing with the SEC. Worldwide revenues for the quarter reached $4.878 billion, a 5.1% increase compared to the same period in the previous year. This uptick in revenue is attributed to a 3.5% increase in volume/other and a 4.3% increase in pricing, partially offset by a 1.5% decrease in COVID-19-only testing revenues and 1.2% adverse impact from foreign currency translations.

The revenue increase reflects strong sales across their medical segments, particularly in areas such as Medication Delivery Solutions, Medication Management Solutions, and Pharmaceutical Systems within the BD Medical segment. The BD Life Sciences segment, while exhibiting a lower revenue, still showed strong demand for Biosciences and clinical and research reagents. The BD Interventional segment also saw revenue growth, driven by Surgery, Peripheral Intervention, and Urology and Critical Care units.

Despite the overall revenue growth, the company's net income from continuing operations was $407 million, compared to $390 million in the same quarter last year. The company continued to pay dividends, with $0.91 per common share paid during the quarter, reflecting their ongoing commitment to shareholder value.

Operating expenses highlighted in the report included selling and administrative expenses at 24.4% of revenues and research and development expenses at 6.3%. Additionally, the report detailed acquisition-related integration and restructuring expenses amounting to $70 million along with other operating income and expenses.

BD also faced various legal proceedings, including product liability claims involving their hernia repair devices, litigation related to securities and shareholder derivative actions, and other investigations and litigations concerning their products and business practices.

The company's financial position was strong, with cash flows from continuing operating activities at $1.665 billion during the first nine months of fiscal year 2023. They had a sizable amount of cash and equivalents, including restricted cash amounting to $1.032 billion by the end of the quarter.

Looking at the macroeconomic environment, BD noted the ongoing challenges, such as inflation, limited supply of raw materials, labor shortages, and logistics capacity constraints. Nonetheless, they've been deploying strategies to mitigate these impacts effectively.

In terms of strategic moves, BD completed the sale of their Interventional segment's Surgical Instrumentation platform and recorded the proceeds and adjustments in their financial statements.

On the taxation front, the company reported an effective income tax rate for continuing operations of 13.6% for the third quarter, which was influenced by specified items impacting the rate.

Overall, Becton, Dickinson and Company's Q3 2023 report described a period of growth in revenues and a solid financial position, despite the backdrop of challenging global economic conditions and ongoing legal matters. The report also indicated the company's proactive steps in strategic divestiture and continuing efforts to manage operational expenses efficiently.

Becton, Dickinson and Company (BDX), a predominant figure in the healthcare industry, has long been commended for its comprehensive range of medical supplies, devices, laboratory equipment, and diagnostic products. The corporation caters to a broad spectrum of customers including healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical companies, and the general public across the globe. The firm's broad influence and pivotal role have been particularly underscored by its segmentation into three primary divisions: BD Medical, BD Life Sciences, and BD Interventional. Each segment contributes uniquely to the company's standing as a cornerstone within the medical supplies and equipment sector, synonymous with quality and innovation in healthcare.

In recent times, however, the company's stellar reputation within healthcare circles has been somewhat overshadowed by its classification as the Bear of the Day by Zacks Investment Research. This suggests a less than favorable outlook for the company, characterized by a softening in stock prices and a general downward trajectory in its market performance. This indication of underperformance, especially reflected in the declining pattern of the company's earnings estimates, has naturally caused some degree of concern amongst its investors.

The recent trend of BD's earnings has certainly seen better days, as is evident from the adjustments made by Wall Street analysts. Following a particular earnings report, the consensus scaling from eleven different analysts denoted a cutback on the company's current year's earnings estimates, and six analysts recalibrated their projections for the subsequent year. The collective outcome led to a distinctive dip in the Zacks Consensus Estimates for the foreseeable future. Nevertheless, despite these downward revisions, the companys perspective isn't entirely bleak. There's a silver lining, with earnings per share (EPS) growth still projected at 5.16% for the current year and an even more optimistic 10.58% for the next, hinting at the potential for recovery and growth. Revenue growth estimates complement this outlook, proposing a 4.25% increase for the current year and an ascent to 5.8% in the forthcoming year.

Notably, within the Medical Dental Supplies industry, BD isn't alone in facing these trials. Companies like Align Technology and Labcorp also hold a Zacks Rank #3 (Hold), which suggests that BDX is not uniquely struggling. Instead, its part of an industry-wide shift that's affecting similar enterprises to varying degrees. As investors scrutinize their portfolio strategies, they'll concurrently weigh industry trend implications and individual company data such as that of BD.

A particular instance of internal corporate activity that piqued market interest was the transaction involving Michael Garrison, the Executive Vice President & President of the Medical segment. On December 11, 2023, Garrison sold 1,239 shares, following a pattern over the last year where he offloaded a cumulative total of 2,539 shares. This insider selling, while sometimes a routine part of personal financial management for executives, prompts market analysts to delve deeper. On the day of the sale, BD's stock was assessed at $232.46 per share, ascribing to the firm a market cap around $69.83 billion. With a price-earnings ratio standing at 48.48, this valuation lies above the median for the industry and for BD historically, possibly justifying Garrison's decision from a valuation standpoint.

Furthermore, the proprietary GuruFocus Value pegs BD's intrinsic value at $262.65, reflecting a fair market valuation, especially when considering the companys broad global presence and consistent innovations in medical technology.

BD's recognition as one of the top four healthcare stocks potentially poised for growth isn't unfounded. This assertion, based on a multitude of market indicators and foundational performance metrics, is in stark contrast to their recent highlights in the investment research narratives. The company reported mixed financial results in the most recent quarter, with certain key metrics deviating from analysts' predictions. However, CEO Tom Polen remained confident in the strength and execution of the BD2025 strategy, which seems to support their technologies' roles in improving healthcare efficiency and patient outcomes.

From a market analysis perspective, BD's current stock position might arguably appear oversold, given the proximity of its Relative Strength Index to the 30 thresholds. Amidst this market fluctuation, the companys shares recently climbed from a 52-week low, indicating a gradual positive shift. Long-term growth prospects are a vital component in many investors considerations, and the strategic realignments and portfolio enhancements that BD continually undertakes will undoubtedly play a part in shaping the company's future fortitude within the global market.

The commitment to fostering health equity is another pillar of BD's philosophy, as underscored by the company signing the World Economic Forum's Zero Health Gaps Pledge. Through this pledge, BD expresses its dedication to advancing ten commitments that integrate health equity into its corporate and social investments. By focusing on improving access to healthcare and enhancing outcomes for underserved communities, BD aims to uplift health systems globally. The company's history of contributing to critical global health milestones, such as aiding in the COVID-19 pandemic and improving diagnostics for HIV and tuberculosis, demonstrates its commitment to cohesive and equitable health solutions.

In its environmental, social, and governance report, BD delineated plans to extend its global reach of products and expertise, form purposeful partnerships, and invest in strengthening health systems. The company acts locally and internationally, exemplified by its efforts in the early detection of cervical cancer and in assisting understaffed health systems through volunteer programs.

Reporting financial highlights, BD announced a revenue of $5.09 billion in the fourth quarter, surpassing the Zacks Consensus Estimate and indicating a year-over-year increase. The revenue growth was largely propelled by the BD Medical and BD Life Sciences segments, which exceeded analysts' projections and exhibited positive market dynamics. Despite no EPS surprise and a less than stellar performance in the BD Interventional segment, the company's resilience shines through, as shown in its ability to maintain market stability amidst evolving industry challenges.

Moreover, it's important to consider BD's positioning in comparison to other market trends. While pegged as the current Bear of the Day due to recent stock market performance and earnings estimate revisions, BD contrasts with companies like GameStop, which has been labeled a Bull of the Day by Zacks. These distinctions reflect the vast differences in market sectors and how companies within them are navigating through specific challenges.

BD's ongoing efforts to enhance global health include emphasizing education and awareness around crucial issues, such as disparities in cervical cancer screenings. A recent survey conducted by the company spotlights the need for increased access and understanding, which BD is poised to address through its technological solutions and advocacy.

Strategic partnerships embolden BD's market stance further. A prime example is the recent collaboration with Navigate BioPharma Services, Inc., emphasizing the development of flow cytometry-based diagnostics a testament to BD's enduring innovation in medical technology. This partnership holds the promise to reinforce both firms' capabilities in delivering personalized healthcare solutions to the market.

Lastly, the financial trajectory and outlook remain positive for BD even amidst market apprehensions. The company's adjusted EPS met consensus estimates, while revenue projections exhibited a leap forward. Anticipating organic revenue growth in the next fiscal year, the company is setting forth a confident and hopeful outlook in its ability to sustain progress and thrive in the competitive healthcare landscape.

From January 2019 to January 2024, Becton, Dickinson and Company (BDX) exhibited fluctuating returns as represented by the ARCH model's volatility analysis. The model predicts no persistent trend in returns as implied by an R-squared of 0.000, meaning past returns don't seem to help in predicting future variance. The significant coefficients for omega and alpha[1] indicate that volatility does respond to past shocks, with estimates suggesting that each past shock contributes positively to future volatility.

Here is an HTML table summarizing the key statistics from the ARCH model:

```html

| Measure | Value | Std Err | t | P>|t| | 95% Confidence Interval |

|---|---|---|---|---|---|

| Omega | 2.1201 | 0.231 | 9.194 | 3.790e-20 | [1.668, 2.572] |

| Alpha[1] | 0.1270 | 0.05689 | 2.233 | 0.02554 | [0.01554, 0.239] |

```

The omega value of 2.1201 with a low p-value suggests that there is a baseline volatility inherent in the stock independent of its past returns. The alpha[1] value of 0.1270 also with a low p-value indicates that recent events significantly affect volatility, where each event contributes an additional 12.7% to the forecast variance. The confidence intervals provided give an idea of the precision of these estimates.

Similar Companies in Healthcare:

Abbott Laboratories (ABT), Thermo Fisher Scientific Inc. (TMO), Danaher Corporation (DHR), Stryker Corporation (SYK), Boston Scientific Corporation (BSX), 3M Company (MMM), Medtronic plc (MDT), Baxter International Inc. (BAX), PerkinElmer Inc. (PKI), Bio-Rad Laboratories, Inc. (BIO)

https://finance.yahoo.com/news/gamestop-becton-dickinson-company-highlighted-135700569.html

https://finance.yahoo.com/news/insider-sell-alert-evp-president-080606190.html

https://finance.yahoo.com/news/bear-day-becton-dickenson-co-120000019.html

https://www.zacks.com/commentary/2196414/bear-of-the-day-becton-dickenson-and-co-bdx

https://finance.yahoo.com/news/bd-signs-world-economic-forums-115500784.html

https://finance.yahoo.com/news/survey-harris-poll-highlights-gaps-114500717.html

https://www.zacks.com/stock/news/2181912/bd-bdx-q4-earnings-in-line-with-estimates-margins-contract

https://www.sec.gov/Archives/edgar/data/0000010795/000001079523000075/bdx-20230630.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: G1UCc5

https://reports.tinycomputers.io/BDX/BDX-2024-01-11.html Home