Bank of New York Mellon Corporation (ticker: BK)

2023-12-29

The Bank of New York Mellon Corporation (ticker: BK), commonly known as BNY Mellon, is one of the world's largest financial services corporations, offering a broad spectrum of investment servicing and investment management services. With its origins stretching back to the founding of the Bank of New York in 1784 by American statesman Alexander Hamilton, today's corporation was formed from the merger of The Bank of New York and the Mellon Financial Corporation in 2007. As a global financial institution, BNY Mellon operates in numerous countries and serves a diverse clientele, including corporations, institutions, and high-net-worth individuals. The company's vast array of services includes asset servicing, issuer services, treasury services, and wealth management. BNY Mellon is renowned for its custody and asset servicing businesses, managing trillions of dollars in assets and acting as a trusted intermediary for investors and financial market participants. The firm is headquartered in New York City and is regulated by the Federal Reserve and other global financial regulatory authorities. BNY Mellon's performance and strategic decisions are critical for investors and stakeholders, considering its notable position in the global financial infrastructure.

The Bank of New York Mellon Corporation (ticker: BK), commonly known as BNY Mellon, is one of the world's largest financial services corporations, offering a broad spectrum of investment servicing and investment management services. With its origins stretching back to the founding of the Bank of New York in 1784 by American statesman Alexander Hamilton, today's corporation was formed from the merger of The Bank of New York and the Mellon Financial Corporation in 2007. As a global financial institution, BNY Mellon operates in numerous countries and serves a diverse clientele, including corporations, institutions, and high-net-worth individuals. The company's vast array of services includes asset servicing, issuer services, treasury services, and wealth management. BNY Mellon is renowned for its custody and asset servicing businesses, managing trillions of dollars in assets and acting as a trusted intermediary for investors and financial market participants. The firm is headquartered in New York City and is regulated by the Federal Reserve and other global financial regulatory authorities. BNY Mellon's performance and strategic decisions are critical for investors and stakeholders, considering its notable position in the global financial infrastructure.

| Industry | Asset Management | Sector | Financial Services | Full Time Employees | 53,600 |

| Previous Close | 52.07 | Open | 52.01 | Day Low | 52.01 |

| Day High | 52.315 | Dividend Rate | 1.68 | Dividend Yield | 3.23% |

| Payout Ratio | 35.83% | Five Year Avg Dividend Yield | 2.89 | Beta | 1.096 |

| Trailing PE | 12.23 | Forward PE | 10.36 | Volume | 1,783,266 |

| Average Volume | 4,655,544 | Average Volume 10 Days | 4,135,570 | Bid | 50.91 |

| Ask | 52.3 | Bid Size | 1,100 | Ask Size | 800 |

| Market Cap | 40,160,993,280 | 52 Week Low | 39.65 | 52 Week High | 52.315 |

| Price to Sales Trailing 12 Months | 2.3549 | 50 Day Average | 46.7636 | 200 Day Average | 44.41265 |

| Trailing Annual Dividend Rate | 1.53 | Trailing Annual Dividend Yield | 2.94% | Shares Outstanding | 769,073,024 |

| Held Percent Insiders | 0.128% | Held Percent Institutions | 85.32% | Short Ratio | 1.79 |

| Book Value | 46.976 | Price To Book | 1.112 | Last Fiscal Year End | December 31, 2022 |

| Net Income To Common | 3,400,999,936 | Trailing Eps | 4.27 | Forward Eps | 5.04 |

| Last Split Factor | 9434:10000 | Last Split Date | June 1, 2007 | Current Price | 52.22 |

| Total Cash | 160,353,992,704 | Total Cash Per Share | 208.503 | Total Debt | 65,381,998,592 |

| Total Revenue | 17,054,000,128 | Revenue Per Share | 21.445 | Return On Assets | 0.871% |

| Return On Equity | 8.955% | Earnings Growth | 212.8% | Revenue Growth | 1.4% |

| Operating Margins | 29.673% |

Technical Analysis often serves as a gauge for identifying the trend, momentum, and potential reversal points in stock price action. Based on the latest data provided, we observe the following key technical indicators:

- The stock price has been on an upward trajectory for the last few months, with the most recent closing price being higher than the opening price. This indicates a bullish trend in the short term.

- The On Balance Volume (OBV) metric has increased steadily, suggesting that volume is supporting the upward price trend, which can be a positive signal for continued bullishness.

- The Moving Average Convergence Divergence (MACD) histogram readings indicate that as of the last trading day, the momentum has slightly weakened, with a move into negative territory (-0.001393). This suggests a potential slowing of the trend or an impending consolidation or reversal.

Considering the fundamentals, we analyze various aspects:

- Operating Margins stand at 0.29673, implying a reasonable level of operational efficiency.

- The Trailing PEG ratio at 0.5707 suggests that the stock may be undervalued on a growth-adjusted basis, assuming earnings growth predictions are accurate.

- The balance sheet shows a substantial level of Total Assets, overshadowing Total Liabilities, indicative of a strong financial position. However, the high level of Treasury Stock and Preferred Stock may reflect significant funding through equity dilution, which could potentially limit future stock price appreciation.

The financial performance metrics, including Healthy Free Cash Flow, Net Income, and Revenue, further bolster the sentiment that the company is currently on stable financial footing, which could lead the market to maintain or increase the stock's valuation.

The Cash Flow statements portray a company comfortably managing its financing activities, with positive cash flows from operations and investing activities.

For the next few months, assuming no major economic disruptions or company-specific negative news, the stock price might continue to reflect the company's financial strength, possibly testing higher resistance levels stemming from the current bullish trend. If the MACD histogram turns decisively negative, this could signal a stronger bearish reversal, so investors should watch for further divergences in this indicator. Additionally, a sideways movement is plausible should the market consolidate recent gains.

Investors should look out for the OBV to continue its uptrend to support a bullish forecast. However, an unexpected drop in this metric could precede a price decline. The intersection of technical and fundamental analysis should, therefore, guide investment decisions.

The combination of strong fundamentals with relatively positive technical indications suggests a cautious but optimistic outlook for the stock price movement in the short to medium term. However, attention should be paid to technical indicators such as MACD for early signs of trend reversal and to fundamental news that might alter the current trajectory.

The Bank of New York Mellon Corporation, commonly known as BNY Mellon, felt the impact of market forces on October 17, 2023, as its stock price underwent significant fluctuations post the release of its third-quarter earnings report. The immediate response was a dip by up to 5.2%, only to be followed by a rebound leading to a 3.9% increase by midday, a pattern that grabbed the attention of investors and analysts alike. These movements were underpinned by an earnings report that, in some respects, was a mixed bag but still managed to beat analysts' expectations with a 2% increase in revenue totaling $4.37 billion and an adjusted earnings per share increment of 5% up to $1.27.

However, not all indicators were as promising. BNY Mellon reported a decline in average loans and deposits, 6% and 9% respectively, moves interpreted unfavorably by investors which likely contributed to the initial drop in share prices. On a positive note, the bank's net interest revenues boasted a 10% growth achieving $1.02 billion while fee revenue stood its ground at $3.36 billion. During the earnings call, the bank's executives presented a calming influence, shedding light on proactive measures such as strategies aimed at margin expansion and efficiency savings exceeding $500 million. The fact that average deposits showed signs of resurgence in September and October further alleviated concerns.

The management at BNY Mellon expressed confidence moving forward, fortifying their optimistic outlook by projecting net interest revenue to reach upwards of $20 billion and revising the anticipated rate of expense growth from 4% to about 3%. The consistency of the bank's performance over two decades has been a hallmark of stability, and this was no less true in the current financial milieu. Shareholders were reassured with a robust 4% dividend yield and a commitment to continuation of share buybacks.

Moreover, BNY Mellon's resilience is particularly noteworthy in the banking sector characterized by susceptibility to macroeconomic shifts, such as changing interest rates and global economic health. For income investors in search of reliable dividend yields, the company's stock may signal a haven of financial safety and a sensible alternative, especially considering the current geopolitical unrest and fluctuations in the global energy market.

The rising crude oil prices, a result of sanctions on Russian oil imposed by the Biden administration amid conflicts involving Israel, Hamas, Russia, and Ukraine, have catapulted the energy sector into a state of considerable volatility. The recommendation for investment in energy mutual funds comes at a time when such a move could deliver noteworthy returns given the right choice of funds. The energy-focused mutual funds like the Fidelity Select Energy Portfolio, Invesco SteelPath MLP Income Fund, and BNY Mellon Natural Resources have all been recognized for their resilience and performance, each carrying the coveted Zacks Mutual Fund Rank #1 (Strong Buy).

A closer examination of BNY Mellon's High Yield Strategies Fund reveals a planned dividend payment of $0.02 per share set for January 11, 2024. This closed-end management investment company has been consistent in providing dividend payments since 1998. Observing the funds historical performance reveals a 12-month trailing dividend yield of 7.76% and consistent but negative growth rates in dividend payments, although this has improved slightly over the five-year period. Despite profitability being ranked at a lower scale, the fund has shown notable revenue and earnings growth, surpassing a good portion of its global competitors.

Ownership patterns within BNY Mellon display a remarkable leaning towards institutional investors, with a whopping 85% of shares held by such entities. This level of institutional interest often reflects the confidence of seasoned investors in the companys management and financial prospects. The distribution among major shareholders indicates a desirable diversity that minimizes risks associated with concentrated control. Non-institutional stakeholders, inclusive of retail investors and insiders, hold a lesser but still significant stake, with insiders owning shares worth an approximate $51 million, echoing a vested interest in the company's sustained success.

The firm has also been successful in securing the interest of the hedge fund community as evidenced by 51 hedge funds having stakes in BNY Mellon as of the third quarter of 2023. Despite a slight decrease from the previous quarter, the majority sentiment amongst these funds remains optimistic. Following on the heels of market challenges, the steadiness in dividend distribution from BNY Mellon reinforces the company's robust operational capacity and adaptability within the financial sector.

Mario Gabelli, a prominent figure in the investment world, has brought under spotlight selected stocks including BNY Mellon. Mario's investment strategy of value investing resonates with BNY Mellon's own financial decisions such as its increase in employee minimum wage and health benefits. This approach, alongside diversification and investment in forward-looking technologies like Artificial Intelligence, offers a glimpse into a financial services landscape that balances traditional robustness with innovative growth strategies.

BNY Mellon has declared monthly distributions for several closed-end municipal bond funds managed by BNY Mellon Investment Adviser, Inc. These funds are an embodiment of BNY Mellon's extensive experience in asset management, with the distributions illustrating a stable return potential for investors interested in the municipal bond market. With assets under custody/administration reaching $45.7 trillion, BNY Mellon's massive influence in the global capital markets remains unquestioned.

The banking industry has seen its share of turbulence, typified by the collapse of Silicon Valley Bank, Signature Bank, and First Republic Bank. This upheaval, despite its negative connotation, did not dissuade the growth in major U.S. stock indices due to several positive economic indicators, such as a favorable jobs report and lower core PCE inflation figures. This optimistic trend was further bolstered by forecasts predicting a more accommodating interest rate environment in the coming year, reviving interest in the financial sector stocks.

In the wake of higher rates and anticipated regulatory changes, BNY Mellon included, banks have found themselves under the microscope of rating agencies like Moody's. The rising interest rates, proposed stringent capital requirements from the Federal Reserve, and the prospect of special assessments by the FDIC have introduced a more conservative outlook towards regional banks. For BNY Mellon, these developments call for prudential strategies to ensure capital efficiency and profitability. Nevertheless, the establishment of measures such as the Federal Reserve's Bank Term Funding Program offers a relief valve, aiming to fortify against financial instability.

Collectively, these narratives paint a picture of BNY Mellon as a company that is poised to navigate the complexities of the current financial landscape while remaining firmly rooted in the principles that have anchored its long-standing success. They underscore a multifaceted institution that is cognizant of the vicissitudes of the macroeconomic environment and is strategically geared towards delivering shareholder value and leveraging growth opportunities amidst the changing tides of the global market.

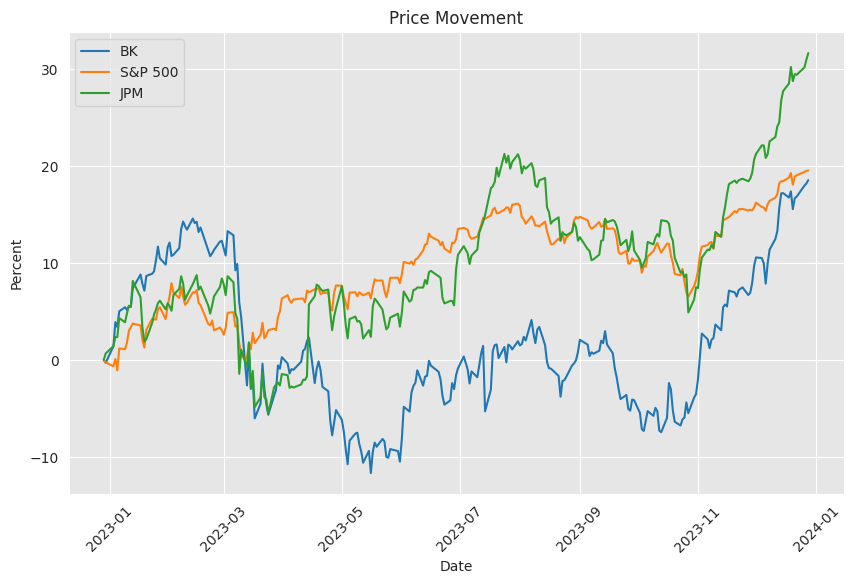

Similar Companies in Banking:

JPMorgan Chase & Co. (JPM), Bank of America Corporation (BAC), Citigroup Inc. (C), Wells Fargo & Company (WFC), Goldman Sachs Group, Inc. (GS), Morgan Stanley (MS), State Street Corporation (STT), Northern Trust Corporation (NTRS)

News Links:

https://finance.yahoo.com/news/grab-3-energy-mutual-funds-105800601.html

https://www.fool.com/investing/2023/10/17/why-bank-of-new-york-mellon-stock-dropped-and-then/

https://finance.yahoo.com/news/bny-mellon-high-yield-strategies-100759212.html

https://finance.yahoo.com/news/85-institutional-ownership-bank-york-120038470.html

https://finance.yahoo.com/news/14-best-bank-dividend-stocks-142705197.html

https://finance.yahoo.com/news/bny-mellon-municipal-bond-closed-210800608.html

https://finance.yahoo.com/news/11-most-profitable-bank-stocks-094755885.html

https://finance.yahoo.com/news/10-best-mario-gabelli-stocks-163023754.html

https://www.fool.com/investing/2023/08/17/moodys-put-big-banks-on-notice-what-need/

https://finance.yahoo.com/news/value-investor-1-stock-could-144006114.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: pNkil33