BioNTech SE American Depositary Share (ticker: BNTX)

2023-12-28

BioNTech SE, represented by the ticker BNTX on the stock exchange, is a German biotechnology company that has gained significant attention due to its role in developing one of the first and most widely used COVID-19 vaccines, in partnership with Pfizer. The company's American Depositary Share (ADS) provides a mechanism for U.S. investors to hold shares in the foreign entity. Each ADS represents a specific number of the company's ordinary shares, and the price of BNTX stock is reflective of BioNTech's valuation in the market. BioNTech's groundbreaking mRNA technology platform, which was pivotal in the rapid development of the COVID-19 vaccine, suggests potential for future vaccine development and other therapeutic applications. The company's financial performance and stock value have been closely watched by investors, especially in light of the global pandemic and the consequent demand for vaccines. BioNTech's investment in research and development continues to drive its pursuit of innovation in the biotechnology sector, potentially affecting the long-term outlook of BNTX. As the situation with the pandemic evolves and the company diversifies its product pipeline, BNTX remains an important stock for investors monitoring the biotech industry.

BioNTech SE, represented by the ticker BNTX on the stock exchange, is a German biotechnology company that has gained significant attention due to its role in developing one of the first and most widely used COVID-19 vaccines, in partnership with Pfizer. The company's American Depositary Share (ADS) provides a mechanism for U.S. investors to hold shares in the foreign entity. Each ADS represents a specific number of the company's ordinary shares, and the price of BNTX stock is reflective of BioNTech's valuation in the market. BioNTech's groundbreaking mRNA technology platform, which was pivotal in the rapid development of the COVID-19 vaccine, suggests potential for future vaccine development and other therapeutic applications. The company's financial performance and stock value have been closely watched by investors, especially in light of the global pandemic and the consequent demand for vaccines. BioNTech's investment in research and development continues to drive its pursuit of innovation in the biotechnology sector, potentially affecting the long-term outlook of BNTX. As the situation with the pandemic evolves and the company diversifies its product pipeline, BNTX remains an important stock for investors monitoring the biotech industry.

| As of Date: 12/28/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 25.57B | 26.05B | 25.88B | 30.02B | 36.46B | 32.73B |

| Enterprise Value | 8.40B | 9.83B | 10.82B | 14.92B | 22.43B | 23.79B |

| Trailing P/E | 8.44 | 5.69 | 3.88 | 3.02 | 3.53 | 3.04 |

| Forward P/E | 75.76 | 30.96 | 19.68 | 22.94 | 8.19 | 8.96 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 3.48 | 2.71 | 2.00 | 1.65 | 1.96 | 1.68 |

| Price/Book (mrq) | 1.14 | 1.23 | 1.19 | 1.37 | 1.87 | 1.98 |

| Enterprise Value/Revenue | 0.91 | 10.98 | 64.55 | 11.68 | 5.24 | 6.87 |

| Enterprise Value/EBITDA | 1.39 | 36.33 | -28.56 | 20.46 | 6.68 | 9.59 |

| Full Time Employees | 5,500 | Previous Close | 104.73 | Open | 104.9 |

| Day Low | 104.9 | Day High | 108.3629 | Dividend Rate | 2.11 |

| Dividend Yield | 0.0132 | Beta | 0.241 | Trailing PE | 5.6491594 |

| Forward PE | 35.150326 | Volume | 629,156 | Average Volume | 731,577 |

| Average Volume 10 Days | 934,140 | Market Cap | 25,789,769,728 | Fifty Two Week Low | 88.0 |

| Fifty Two Week High | 156.275 | Price to Sales Trailing 12 Months | 2.8080585 | Enterprise Value | 6,445,996,032 |

| Profit Margins | 0.47641 | Shares Outstanding | 239,771,008 | Shares Short | 2,591,309 |

| Held Percent Insiders | 65.112996 | Held Percent Institutions | 17.591 | Short Ratio | 4.72 |

| Book Value | 83.023 | Price to Book | 1.2955445 | Net Income to Common | 4,375,399,936 |

| Trailing Eps | 19.04 | Forward Eps | 3.06 | Current Price | 107.56 |

| Total Cash | 15,557,300,224 | Total Debt | 205,700,000 | Total Revenue | 9,184,199,680 |

| Debt to Equity | 1.033 | Return on Assets | 0.16922002 | Return on Equity | 0.2382 |

| Free Cashflow | 8,412,125,184 | Operating Cashflow | 9,317,399,552 | Revenue Growth | -94.8% |

| Gross Margins | 86.986% | EBITDA Margins | 64.674% | Operating Margins | -293.441% |

Based on the provided technical analysis data and company fundamentals for BNTX, we can extrapolate potential stock price movements for the next few months. It's critical to consider both the historical performance indicated by the technical indicators and the fundamental analysis that gives us an understanding of the company's financial health.

Technical Analysis Observations: - The On-Balance Volume (OBV) has decreased over the time frame provided, suggesting a decrease in volume on up days versus down days. The OBV's downtrend implies that selling pressure has been dominant in the recent period. This type of bearish divergence can often precede a continued decline in stock prices if the trend persists.

- An absence of MACD histogram values leading up to the later dates suggests there may have been a lack of trend or momentum, which can be a period of consolidation. However, subsequent positive values toward the end of the year indicate a shift in momentum that may signal a potential bullish trend for the short term.

Fundamental Analysis Observations: - BNTX has shown a considerable decrease in market cap from 36.46B on 12/31/2022 to 25.57B as of the last available date, which might indicate a loss of investor confidence or a revaluation of the stock based on earnings or market conditions.

-

The trailing P/E ratio is higher than industry averages, suggesting that the stock may be overvalued relative to its earnings. Forward P/E is significantly higher, potentially indicating expected lower earnings or growth in the future.

-

The Price/Sales (ttm) ratio has increased year-over-year, which could suggest that the stock price is not keeping pace with sales growth, potentially indicating undervaluation if the company maintains its sales trajectory.

-

Enterprise Value multiples such as EV/Revenue and EV/EBITDA are much lower than the previous year's levels, suggesting that the company might currently be undervalued by the market based on these metrics.

Financials: - The company maintains strong net income figures, which may support a positive outlook for the company's profitability.

-

The improved net income, from a loss in previous years to significant profit, can act as a positive driver for future stock price if the company can sustain this growth.

-

Significant operating income and EBITDA suggest strong operational efficiency and earnings potential, which is a positive indicator for investors.

Given these points, the next few months' possible stock price movement points to the following scenarios: - If the positive MACD histogram values at the end of the year signal a shift in momentum, and if that momentum continues, we may expect a short-term bullish trend. This would be contingent upon continued positive news, earnings reports, or other market conditions favoring BNTX.

-

However, the decrease in market cap and mixed signals from both the P/E ratios and sales figures could imply market skepticism about future growth. Investors may need further assurance through upcoming quarterly reports or news about the company's pipeline and market strategy.

-

If BNTX can sustain or improve its profitability metrics, the currently lower valuation multiples may attract more investors, leading to a potential upward trend in stock prices.

-

Should the sales growth fail to translate into increased share price or if external market conditions deteriorate, there could be downward pressure on the stock in the short to medium term.

Overall, while some technical indicators suggest a potential for short-term bullish behavior in BNTX stock, the mixed fundamental signals necessitate cautious optimism. Investors should pay close attention to upcoming earnings reports, market sentiment shifts, and industry-related news which can significantly drive the stock price movements in the forthcoming months.

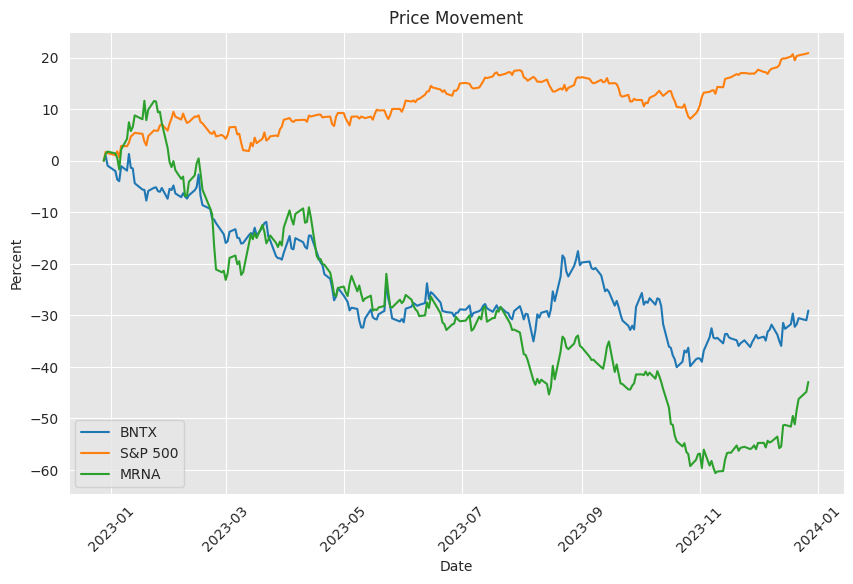

Amidst the turbulence of the stock market in 2023, investors have eyed several companies that have seen sharp declines in their stock value, including BioNTech SE, the biotechnology company lauded for its partnership with Pfizer in producing the COVID-19 vaccine, Comirnaty. The marked decrease of 32% in stock price reflects concerns over reduced vaccine sales, which contributed to lower revenues for BioNTech in the first nine months of the year, compared to the same period in the previous year. This decline in revenue has become a focal point for investors examining the company's financial health and future potential.

However, optimism prevails among Wall Street analysts who predict a rebound in BioNTech's stock value for 2024. This confidence is rooted in the company's diversified pipeline of vaccine candidates and immunotherapies. Aided by cutting-edge mRNA technology, BioNTech has several potential catalysts in the pipeline, including BNT161, an influenza vaccine, and BNT316, a cancer immunotherapy treatment, both of which could significantly bolster the company's financial outlook and market position.

Adding to the narrative, broader market indices like the S&P 500 and Nasdaq-100 have shown robust gains, fostering a bullish sentiment that could benefit BioNTech's shares. Investment platforms and news outlets contribute to shaping investor expectations, underscoring that notwithstanding analyst predictions might not always come to fruition, the overall market sentiment towards BioNTech SE remains positive, representing a beacon of hope for a strong recovery in stock value.

BioNTech SE's appeal to investors extends beyond the successful COVID-19 vaccine. The company's diverse research into mRNA therapies, cell therapies, and protein-based therapeutics has yielded 37 programs that are in early and mid-stage clinical trials. This commitment to leveraging its mRNA platform across a spectrum of therapeutic areas solidifies BioNTech's position as a front-runner in the biotechnology sector, extending its influence beyond infectious diseases.

Furthermore, the company's financial stability, boasting a cash reserve of $17.7 billion, grants it the necessary capital to sustain and amplify its research and development efforts. These financial resources position BioNTech to explore new therapeutic areas with significant growth potential. Financial analysts and industry observers have noted the company's strong fiscal posture as a key factor that could facilitate a rebound in its stock price.

Highlighting the company's alignment with value investing principles, BioNTech SE has garnered attention within the investment community for its robust cash reserves, reminiscent of the strategies employed by the likes of Benjamin Graham and his protege Warren Buffett. The global demand for vaccines has translated into substantial revenue for the company, now allowing strategic reinvestment into growth and portfolio diversification. And it's the potential embedded in its proprietary mRNA technology across various disease areas that offers the possibility for new revenue streams and a strengthened market position.

As BioNTech SE continues to weather market volatility, it confronts the stark realities of pharmaceutical industry dynamics, where valuations reflect not just current profits but anticipated future successes. The company now anticipates leveraging its mRNA platform to address other critical health concerns, thereby fostering long-term growth and maintaining investor confidence.

Further bolstering investor interest, a recent legal development involving a patent dispute with CureVac N.V. has turned in BioNTech's favor. A German court ruling nullified a crucial patent that CureVac used to stake a claim on revenues earned by BioNTech from its COVID-19 vaccine. CureVac's allegation of patent infringement centering on eight intellectual property rights is fraught with financial implications and could shift the factual landscape dramatically, depending on the outcome of the ongoing legal battle.

As BioNTech weathers the post-pandemic landscape, where vaccine demand has subsided, the company's strong financial standing offers cushioning against the storm. Despite the drop in vaccine-related income, BioNTech maintains a healthy cash reserve which allows for continued investment in its pipeline, including BNT161 and the initiation of a Phase 3 study of BNT316. However, the relatively early stage of many pipeline candidates necessitates patience from investors, as near-term performance may not reflect the long-term potential held within the company's innovative drug portfolio.

BioNTech's strategic ventures have also expanded globally, with a notable decision to establish mRNA vaccine production capabilities in Africa. The Kigali, Rwanda facility represents a proactive stance on vaccine equity and accessibility, illustrating BioNTech's commitment to addressing local and global health needs. This move not only aims to enhance vaccine access on the African continent but also aspires to shift the pharmaceutical manufacturing paradigm within the region, highlighting BioNTech's broader vision for regional medical autonomy and security.

In the broad scheme of the pharmaceutical industry, companies like Pfizer and Roche, in comparison to BioNTech, offer different investment prospects. Both Pfizer and Roche have experienced setbacks, with Pfizer's COVID-19 related sales dropping and Roche seeing a dip due to reduced demand for COVID-19 diagnostics. Investors remain attentive to each company's pipelines, strategies, and dividend prospects, with Roche presenting a less risky profile for investors due to the lack of an imminent patent cliff and a flourishing pipeline.

Within oncological pharmaceuticals, BioNTech has continued to garner significant interest. The recent Breakthrough Therapy designation by the FDA for BNT323/DB-1303 showcases the company's prowess in developing novel, targeted therapies for diseases like advanced endometrial cancer. This designation facilitates an expedited review process, signaling the therapeutic candidate's potential to provide substantial improvements over existing treatments.

Lastly, BioNTech SE's Q3 2023 earnings call unveiled the company's strategic orientations and financial resilience. With revenues totaling 2.3 billion euros and a maintained cash reserve despite writedowns, BioNTech reaffirmed its commitment to its strategic priorities, including augmented global COVID-19 vaccine leadership, progression in oncology, and new infectious disease initiatives. This forward-looking approach and the company's reported preparedness to support annual vaccine adaptations underscore a strong vision for continued growth and addressing medical needs in the future.

As BioNTech and CureVac continue their legal confrontation, the recent rulings have cast shadows on the future revenue streams and their respective positions in the market. These outcomes bear significant implications for investor confidence and the biotechnology sector's competitive landscape, potentially affecting future patent filings and litigation strategies.

In conclusion, despite the sullen performance in the stock market, analysts predict potentials for growth for companies like BioNTech SE. The stock market's dynamic nature, along with BioNTech's strategic efforts towards diversification, robust pipeline, and the legal milestones, paint a picture of a company pregnant with opportunity a potential bastion against the economic uncertainties of the future.

Similar Companies in Biotechnology:

Moderna, Inc. (MRNA), Pfizer Inc. (PFE), Novavax, Inc. (NVAX), CureVac N.V. (CVAC), Johnson & Johnson (JNJ), AstraZeneca PLC (AZN), Sanofi (SNY), GlaxoSmithKline plc (GSK), Dynavax Technologies Corporation (DVAX), Inovio Pharmaceuticals, Inc. (INO)

News Links:

https://www.fool.com/investing/2023/12/18/stocks-down-wall-street-expects-skyrocket-2024/

https://finance.yahoo.com/news/why-covid-19-vaccine-player-173110426.html

https://www.fool.com/investing/2023/10/28/3-no-brainer-stocks-to-buy-for-under-100-right-now/

https://www.fool.com/investing/2023/10/21/which-is-the-better-long-term-hold-for-investors-p/

https://www.fool.com/investing/2023/10/25/is-biontech-stock-a-buy-now/

https://finance.yahoo.com/news/biontech-dualitybio-receive-fda-breakthrough-130000003.html

https://finance.yahoo.com/news/biontech-aims-start-mrna-vaccine-150609381.html

https://finance.yahoo.com/news/german-court-quashes-curevac-patent-133554782.html

https://finance.yahoo.com/news/biontech-achieves-milestone-mrna-based-181500028.html

https://finance.yahoo.com/news/15-undervalued-defensive-stocks-2024-223442627.html

https://finance.yahoo.com/news/1-german-court-quashes-curevac-141254831.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: lGiIGC

https://reports.tinycomputers.io/BNTX/BNTX-2023-12-28.html Home