BioNTech SE (ticker: BNTX)

2024-01-18

BioNTech SE, trading under the NASDAQ ticker BNTX, is a biotechnological company with a global presence, renowned for its pioneering work in the field of messenger RNA (mRNA) technology. Founded in 2008 and headquartered in Mainz, Germany, BioNTech is devoted to the development and manufacturing of active immunotherapies for a patient-specific approach to the treatment of diseases. The company gained international prominence for its collaboration with Pfizer in developing one of the first widely administered COVID-19 vaccines, utilizing its proprietary mRNA technology. BioNTech's innovative platform also extends to other therapeutic areas, including oncology, where it develops personalized cancer treatments, and infectious diseases, aiming to provide rapid response solutions for future global health challenges. Its scientific advancements have not only contributed significantly to public health during the pandemic but have also propelled the company into the forefront of the biotech industry, with a commitment to harnessing cutting-edge technologies to create a new generation of transformative medicines.

BioNTech SE, trading under the NASDAQ ticker BNTX, is a biotechnological company with a global presence, renowned for its pioneering work in the field of messenger RNA (mRNA) technology. Founded in 2008 and headquartered in Mainz, Germany, BioNTech is devoted to the development and manufacturing of active immunotherapies for a patient-specific approach to the treatment of diseases. The company gained international prominence for its collaboration with Pfizer in developing one of the first widely administered COVID-19 vaccines, utilizing its proprietary mRNA technology. BioNTech's innovative platform also extends to other therapeutic areas, including oncology, where it develops personalized cancer treatments, and infectious diseases, aiming to provide rapid response solutions for future global health challenges. Its scientific advancements have not only contributed significantly to public health during the pandemic but have also propelled the company into the forefront of the biotech industry, with a commitment to harnessing cutting-edge technologies to create a new generation of transformative medicines.

| City | Mainz | Country | Germany | Website | https://www.biontech.de |

|---|---|---|---|---|---|

| Industry | Biotechnology | Sector | Healthcare | Full Time Employees | 5,700 |

| Previous Close | 97.6 | Day Low | 96.33 | Day High | 97.99 |

| Beta | 0.271 | Trailing PE | 7.96 | Forward PE | 43.93 |

| Volume | 513,090 | Average Volume | 725,243 | Average Volume 10 Days | 794,530 |

| Market Cap | 23,184,441,344 | Fifty Two Week Low | 88.0 | Fifty Two Week High | 147.66 |

| Price to Sales (TTM) | 3.50 | Enterprise Value | 7,637,192,704 | Profit Margins | 41.57% |

| Float Shares | 84,075,218 | Shares Outstanding | 237,716,000 | Shares Short | 2,747,066 |

| Shares Short Prior Month | 3,012,854 | Shares Percent Shares Out | 1.16% | Held Percent Insiders | 66.01% |

| Held Percent Institutions | 16.95% | Short Ratio | 3.48 | Short Percent of Float | 3.31% |

| Book Value | 83.574 | Price to Book | 1.17 | Last Fiscal Year End | 2022 |

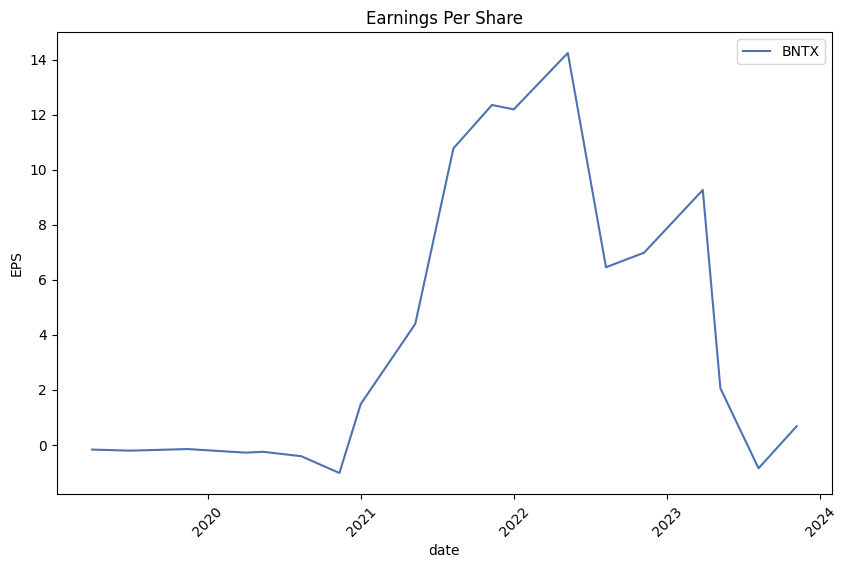

| Most Recent Quarter | 2022 | Earnings Quarterly Growth | -91.00% | Net Income to Common | 2,751,099,904 |

| Trailing EPS | 12.26 | Forward EPS | 2.22 | Total Cash | 15,749,099,520 |

| Total Cash Per Share | 66.252 | EBITDA | 4,108,400,128 | Total Debt | 201,900,000 |

| Quick Ratio | 9.986 | Current Ratio | 10.375 | Total Revenue | 6,618,299,904 |

| Debt to Equity | 1.016 | Revenue Per Share | 27.353 | Return on Assets | 11.24% |

| Return on Equity | 14.39% | Free Cash Flow | 4,738,562,560 | Operating Cash Flow | 5,349,700,096 |

| Earnings Growth | -90.40% | Revenue Growth | -74.10% | Gross Margins | 90.87% |

| EBITDA Margins | 62.08% | Operating Margins | 11.08% | Currency | USD |

Technical Analysis Perspective:

Technical Analysis Perspective:

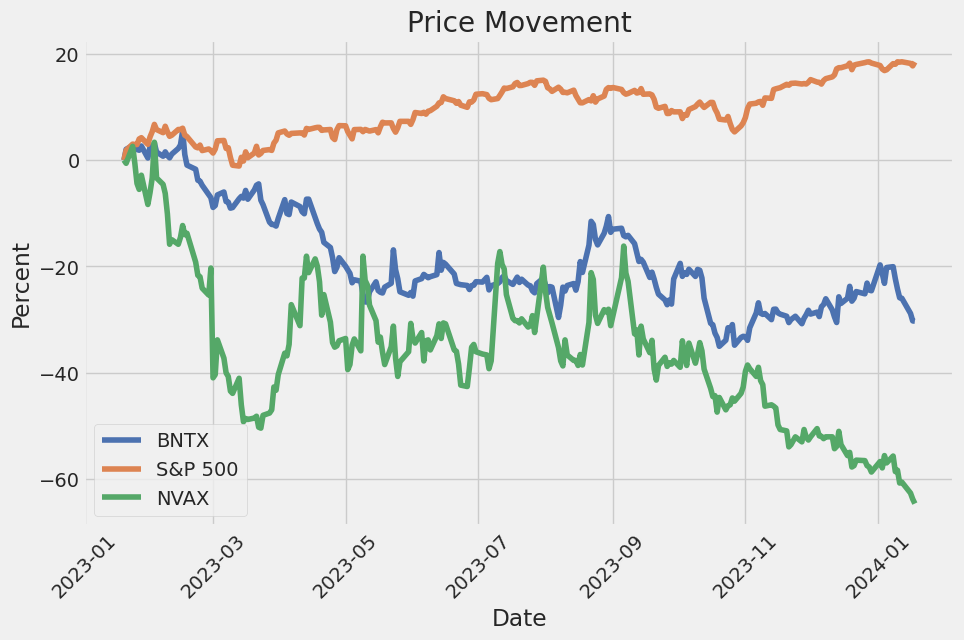

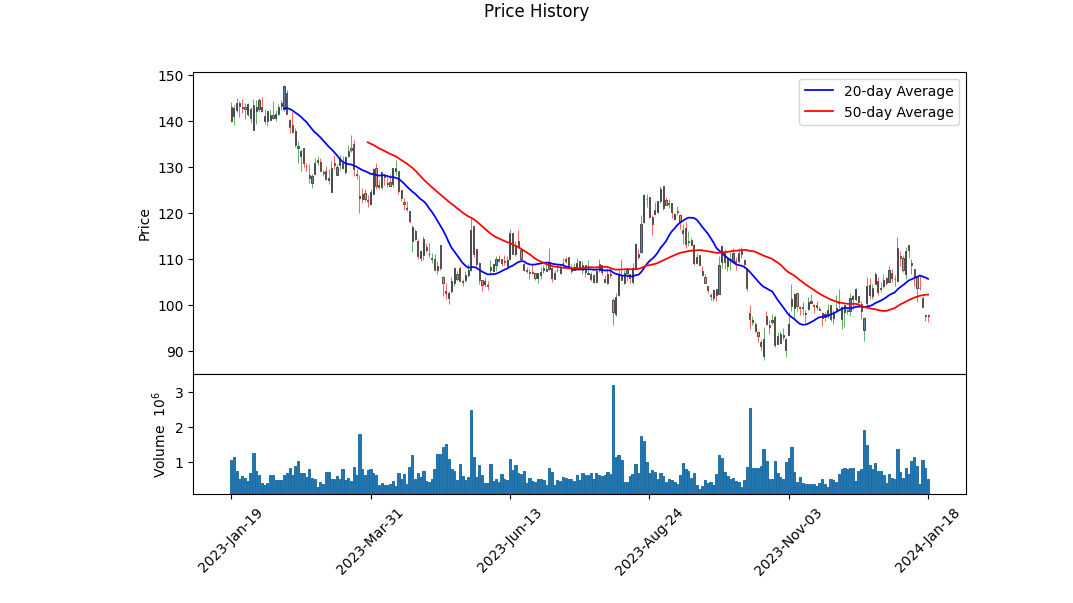

The provided technical indicators and price movement for BNTX suggests a bearish sentiment in the market over the recent period. The Parabolic SAR (PSAR) indicates a downtrend as the indicators values are above the price, reflecting potential selling pressure. Moreover, the On-Balance Volume (OBV) in millions has been declining, implying a reduced buying interest and potentially lower liquidity in the market. The Moving Average Convergence Divergence (MACD) histogram has also been negative with no sign of a bullish crossover, further cementing the bearish outlook.

Fundamental Analysis Perspective:

Upon reviewing the fundamentals, the company has strong gross and EBITDA margins, although there is a notable decline in operating margins. The earnings and revenue estimates for the upcoming quarters show a significant drop compared to previous figures, hinting at a possible downturn in the companys performance. The next quarters also present a substantial anticipated decrease in sales growth, which could weigh down on investor sentiment and stock price.

Balance Sheet and Cash Flows:

The balance sheet illustrates a robust position with high tangible book value and ample cash cash equivalents and short term investments, which are significantly higher than the previous ones. This strong liquidity position affords the company flexibility and resilience. The free cash flow is positive and has increased over the past periods, indicating good financial health and the potential for future investments or shareholder returns. Despite this, the stock repurchase and debt repayment suggest money is being channeled to optimize capital structure rather than direct business expansion.

Analyst Expectations:

Analyst estimates and revisions point towards a downward trend in earnings per share (EPS) compared to the previous year. Although there have been some upward revisions, the general consensus is that of a decrease both in the current fiscal year and the next. Such analyst sentiment often guides market expectations and can impact stock price performance accordingly.

Stock Price Movement Prediction for the Next Few Months:

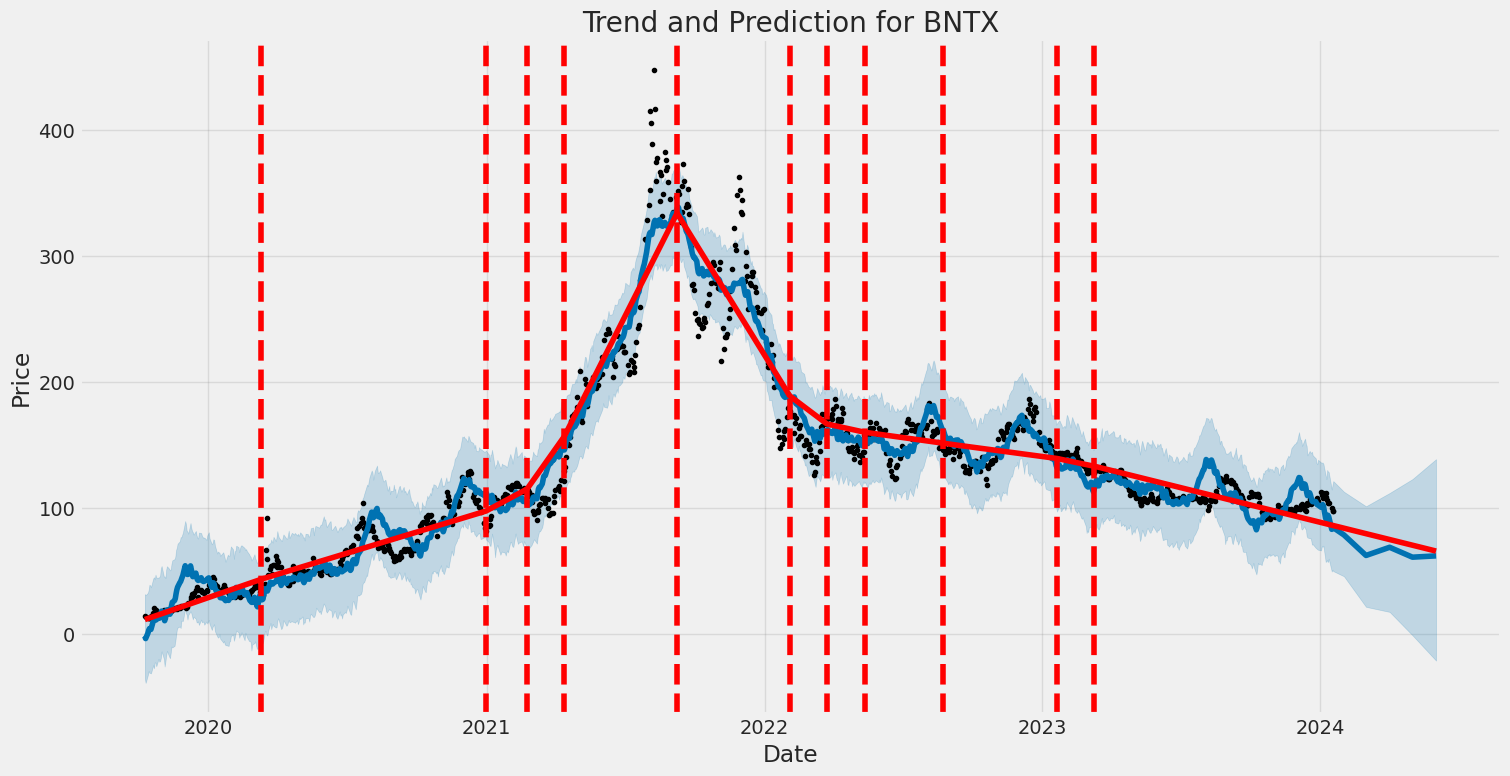

Considering the bearish technical indicators, alongside the lower analyst expectations for earnings and revenue growth, a cautious outlook is warranted. In the near term, the stock may continue to face downward pressure as indicated by the technical readings. While fundamentals such as a solid balance sheet and liquidity position offer some support, the declining earnings outlook could overshadow these strengths and drive the share price lower.

In summary, the confluence of bearish technical signals, less optimistic analyst projections on earnings and revenue growth, and subdued operating margins suggest potential further downside in the stock price over the next few months. However, the strong balance sheet with significant cash reserves provides a safety net which might cushion stock price volatility. Investors should closely monitor the upcoming earnings releases, analyst revisions, and technical indicator changes for better clarity on the stocks trajectory.

| Dependent Variable | y |

| R-squared | 0.046 |

| Adjusted R-squared | 0.045 |

| F-statistic | 51.40 |

| Prob (F-statistic) | 1.40e-12 |

| No. Observations | 1,074 |

| AIC | 6,694 |

| BIC | 6,704 |

| Alpha | 0.2761 |

| Beta | 0.8624 |

Alpha, a measure of a stock's performance on a risk-adjusted basis, is a central aspect of the linear regression model between BNTX and SPY. For the time period ending today, BNTX has an alpha of approximately 0.2761, suggesting that the stock has a positive performance that is not explained by the market's movements. This positive alpha indicates that BNTX, on average, would be expected to perform better than the regression model would predict, based solely on the market's performance as represented by SPY. This implies BNTX could be offering returns that are in addition to what the market compensates for the assumed level of systematic risk.

However, the R-squared of the model is 0.046, which means that only 4.6% of the variability in BNTX's returns is explained by the changes in SPY. This low value of R-squared suggests that the relationship between BNTX and the overall market, as represented by SPY, is relatively weak. While BNTX exhibits some degree of positive performance independent of the market, the majority of the stock's movements are influenced by factors that are not captured by the SPY index. The statistics from the model reinforce the view that while some subtle positive performance is tied to market movements, BNTX's behavior largely deviates from the systematic market risk captured by the SPY index.

Summary of BioNTech SE (BNTX) Q3 2023 Earnings Call

Strategic Priorities and Financial Overview:

BioNTech SE focused on building its global leadership in the COVID-19 vaccine market, launching first-to-market Omicron XBB.1.5-adapted vaccines across multiple regions. A combination program for COVID-19 and influenza, run with Pfizer, showed positive top-line results. They are preparing for a pivotal Phase 3 study for this combined mRNA vaccine. In oncology, multiple trials with potential for registration were initiated, including a Phase 3 trial for BNT323 in hormone receptor positive HER2-low breast cancer with the partner Duality Bio. Collaborations and in-licensing, like with MediLink Therapeutics for an antibody drug conjugate, have strengthened BioNTech's portfolio.

COVID-19 Vaccine (COMIRNATY) and Market Adaptations:

The Omicron XBB.1.5-adapted vaccine was approved under full marketing authorization in Europe and under emergency use in the U.S. for various age groups. The vaccine has seen rapid progress from regulatory recommendations to shipments. However, anticipated hospitalizations due to COVID-19 are likely to increase this winter, and vaccine coverage improvement could mitigate risks associated with evolving variants. Long COVID remains a societal and healthcare challenge. Data suggest that mRNA vaccination can reduce the development of long COVID. Annual adaptive vaccines might be necessary due to the seasonal impact of COVID-19 and waning immunity.

Oncology Pipeline and Trials:

Notable activities in oncology included a Phase 3 trial for anti-CTLA-4 monoclonal antibody against metastatic non-small cell lung cancer and Phase 2 trials for BNT122 in pancreatic cancer and BNT311 in endometrial cancer. Preclinical programs are advancing, with particular excitement for the bi-specific antibody PM8002 for lung cancer. Clinical updates were presented for BNT323, with observed anti-tumor activity in HER2-expressing endometrial cancer, and for other early-phase trials in solid tumors.

Financial Performance:

For the first nine months of 2023, revenues were EUR 2.3 billion, mostly from sales of the recently approved Omicron-adapted vaccine. Revenue was impacted negatively by EUR 0.6 billion due to write-downs reported by Pfizer. R&D expenses rose, driven by ongoing trials and headcount expansion. The first nine months showed a profit before tax of EUR 0.5 billion and earnings per share of EUR 1.94. Strong cash and cash equivalent positions are leveraged for investments in the R&D pipeline.

Strategic Outlook and Market Dynamics:

Looking ahead, BioNTech anticipates the need for annual COVID-19 vaccines. Ongoing global vaccine rollout and transitioning to single-dose vials could drive future franchise revenue. The successful combination of flu and COVID vaccines could increase uptake and provide a potential growth opportunity. The company plans to advance key oncology programs further into late-stage development and maintain financial stability during the transition to an endemic COVID-19 market and commercial-stage oncology. Strategic investments and partnerships are expected to drive continued growth.

Q&A Highlights:

- Uncertainty remains on the evolution rate of SARS-CoV-2, with annual strain updates considered necessary for the foreseeable future.

- Financials indicate strong profitability of the COVID vaccine business, with minimized impact from shift to single dose vials.

- R&D expenses are poised to grow reflecting ongoing and additional late-stage trials but well-managed to utilize funds efficiently.

- Investment will continue in building sales and marketing for self-commercialized regions.

- Combination vaccines, oncology pipeline, and innovative platforms were discussed with anticipation of updates shortly.

- Collaboration models remain flexible and strategic for developing the pipeline and sharing R&D expenses with partners.

The company is optimistic about its future potential to create value for patients, shareholders, and society. Further details on the pipeline and corporate strategy will be discussed at the Innovation Series Day event.

BioNTech SE, widely acclaimed for its partnership with Pfizer in developing one of the first effective COVID-19 vaccines, is navigating a fluctuating marketplace where investor sentiment is both cautious and optimistic. Andrew Bary, writing for Barrons.com on December 27, 2023, highlighted BioNTech as a valuable holding, noting its strong cash position and diverse pipeline, attributes likely appealing to a value investor of Benjamin Grahams caliber. BioNTechs strategic efforts arent limited to its achievements with Comirnaty, as the company deploys its mRNA technology across a breadth of vaccines and therapies, particularly within the oncology space.

Despite a 32% stock price decline over the preceding year as of December 18, 2023, as reported by Keith Speights for The Motley Fool, analyst projections remain bullish about the company's rebound potential, spurred not by Comirnaty, but rather by the promise of its broad and diverse pipeline. This optimism persists even amid foreseeable reduced sales from the COVID-19 vaccine, given that Pfizers 2024 guidance has already dampened these prospects. BioNTech's late-stage candidates, such as the BNT161 influenza vaccine and the BNT316 cancer immunotherapy, alongside a spate of other programs in earlier trial phases, continue to fortify the company's future growth trajectory.

January 9, 2024, marked a significant forecast from BioNTech itself, as outlined by Reuters, which anticipates revenues for 2024 to reach approximately 3 billion euros. The projection rallies behind the expected expansion of its oncology portfolio and the commercial readiness in multiple countries by the close of 2025, with product launches in oncology envisaged from 2026. The company reported ending 2023 with around 17.5 billion euros in its reserves and foresees significant interest income throughout 2024.

BioNTechs strategic acquisition of MediLink Therapeutics ADC technologypart of its expansion into cancer therapeuticsdemonstrates its dexterous response to industry movements and aligns with broader shifts within the pharmaceutical sector. Stephen Ayers, writing for Seeking Alpha on December 28, 2023, contextualized BioNTech as an advantageous investment in light of its financial health and long-term strategies, despite current market skepticism and revenue downturns from the COVID vaccine.

The Seeking Alpha article dated December 23, 2023, encapsulates the sentiment that the gradual wane of COVID-19s immediacy, and the potential entry into a market shaped by annual booster shots, presents an opportunity for ongoing revenue. BioNTechs repertoire extends beyond its COVID-19 franchise, flagging a promising future wherein a diversified therapy pipeline could transform patient treatment modalitiesparticularly in oncology, with personalized mRNA immunotherapies and scaled manufacturing capabilities.

Further underscoring BioNTech's status, an article by Affan Mir on Yahoo Finance dated December 24, 2023, classifies the company's stock as one of the 15 undervalued defensive stocks for 2024. The connotation is intrinsic stability and resilience amid economic uncertainties, with a P/E ratio below 15 and a fairly low 5-year monthly beta. This aligns with hedge fund sentimentreferenced to gauge institutional interestand the broader market outlook anticipating economic recuperation and diminished inflationary pressure.

On the stage of the 42nd Annual J.P. Morgan Healthcare Conference, BioNTech projected a milestone achievement in its pipelineten or more potentially registrational trials by the year's end. Anticipating oncology product launches from 2026, BioNTech remains steadfast in its commercial pursuits. The Yahoo Finance article illuminated the fiscal resoluteness of BioNTech, touting the companys readiness to divulge detailed financial guidance for the upcoming year upon the release of its 2023 results on March 20, 2024.

January 9, 2024, however, painted a day of apprehensive trading for BioNTech, per Investing.com, which aligned with its foreshadowed revenue trough in its COVID-19 vaccine business and a broader market movement awaiting consequential economic data. Nevertheless, BioNTech anticipates revenue growth renewal by 2025, bolstered by a foray into a deeply invested oncology field.

This anticipation for a 2025 revenue boost accompanies what has been reported as lowering expectations for 2024, with BioNTech projecting around 3 billion euros, shy of analyst estimates from LSEG as mentioned by Ludwig Burger and Linda Pasquini. Transition in vaccination pricing models from government contracts to commercial sales, coupled with the prospect of versatile vaccines encompassing other respiratory diseases, showcases BioNTechs adaptive market engagement. The companys intention to march forward with at least ten late-stage cancer drug studies by the end of 2024 reverberates through its strategy, aiming to introduce oncology drugs to the market from 2026.

The narrative that unfolded at the 42nd Annual J.P. Morgan Healthcare Conference as summarized in the event transcript provided by Seeking Alpha continued to amplify BioNTech's commitment to therapeutic innovation and its impressive operational achievements. The company's aspirations, backed by a strong financial standing, stretch beyond the dominion of COVID-19 vaccines to encompass far-reaching prospects in oncology and infectious diseases.

Offsetting some of the overt optimism, Simply Wall St, on January 17, 2024, projects a more somber tone. Surpassing just a reduction in growth forecasts, analysts anticipate a precipitous drop in sales and EPS for BioNTech in 2024an alarm to a potential business headwind that may prompt a heightened level of investor prudence. This projected slow in sales growth sharply contrasts BioNTechs previous five-year growth rate and signals a period of recalibration for the company, notwithstanding the maintained price target for BioNTech stock by analysts reflecting an array of positional assessments of the company's market trajectory. Such a narrative is instrumental for gauging the company's resilience and ability to realign itself amidst shifting market landscapes.

BioNTech SE (BNTX) experienced a period of fluctuating stock prices with no consistent pattern in returns, as indicated by a R-squared value near zero. The companys stock volatility, as measured by the ARCH model, suggests that past variations had a significant influence on future volatility, with a relatively high coefficient for the omega parameter. Moreover, the alpha parameter indicates a noticeable effect of previous day's return on the current days volatility, adding to the stock's unpredictable nature.

| Statistic | Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,202.51 |

| AIC | 6,409.03 |

| BIC | 6,418.99 |

| No. Observations | 1,074 |

| omega | 16.4541 |

| alpha[1] | 0.3909 |

To analyze the financial risk inherent in a $10,000 investment in BioNTech SE (BNTX) over one year, a two-pronged approach involving volatility modeling and machine learning predictions is adopted. Volatility modeling in this context serves as a statistical tool to capture the time-varying nature of uncertainty in the stocks returns. By fitting this model to historical stock price data, it provides estimates of future volatility levels, which are crucial for risk assessment and management.

The methodology for understanding BioNTech SE's stock volatility begins with the estimation of the model parameters from past data. This process involves using historical stock prices to calibrate the model so that it reflects the characteristics of the stocks return distribution, capturing periods of high and low volatility. The output of this volatility modeling then informs about the potential scale of price movements investors might expect in the future.

On the other hand, machine learning predictions come into play through the application of a predictive algorithm such as the one mentioned. This algorithm learns from historical data patterns and attempts to forecast future stock returns. By considering various factors and their complex interactions, the machine learning model can generate predictions about the stock's performance based on learned historical data.

Together, these two techniques culminate in the evaluation of potential financial risk through the calculation of Value at Risk (VaR). VaR measures the maximum loss expected (with a certain confidence level) over a set time period and is a widely used risk management tool. The strength of using both volatility modeling and machine learning together lies in their capacity to offer a comprehensive view of the risk landscape. While volatility modeling informs about the variability and the extent of risk associated with the stock, machine learning incorporates a wide range of input variables to fine-tune return predictions.

In this specific case, the assessment shows that for the $10,000 investment in BioNTech SE, there is a 95% confidence that the investor would not lose more than $384.47 over the course of a year. This figure provides a quantified risk estimate, allowing an investor to make informed decisions regarding their exposure to BioNTech SE's stock. In turn, this helps in determining whether the returns compensation is commensurate with the level of risk taken. It is essential to acknowledge that both methods are built on historical data and assumptions which might not always capture future market dynamics or black swan events.

The comprehensive analysis using volatility modeling and machine learning indicates an understanding of BioNTech SE's potential risk dynamics. It captures the non-linearities and complexities in stock price movements, enabling investors to gauge the financial risk embedded within a one-year investment horizon.

Similar Companies in Biotechnology:

Novavax, Inc. (NVAX), CohBar, Inc. (CWBR), Ginkgo Bioworks Holdings, Inc. (DNA), CRISPR Therapeutics AG (CRSP), Ocean Biomedical, Inc. (OCEA), Enveric Biosciences, Inc. (ENVB), Hepion Pharmaceuticals, Inc. (HEPA), Elevation Oncology, Inc. (ELEV), AVROBIO, Inc. (AVRO), PTC Therapeutics, Inc. (PTCT), Krystal Biotech, Inc. (KRYS), Sarepta Therapeutics, Inc. (SRPT), Iovance Biotherapeutics, Inc. (IOVA), Madrigal Pharmaceuticals, Inc. (MDGL), Moderna, Inc. (MRNA), Pfizer Inc. (PFE), Novavax, Inc. (NVAX), CureVac N.V. (CVAC), Sanofi (SNY), AstraZeneca PLC (AZN), Johnson & Johnson (JNJ), GlaxoSmithKline plc (GSK)

https://www.fool.com/investing/2023/12/18/stocks-down-wall-street-expects-skyrocket-2024/

https://finance.yahoo.com/news/15-undervalued-defensive-stocks-2024-223442627.html

https://finance.yahoo.com/news/biontech-expects-2024-revenues-3-114500035.html

https://finance.yahoo.com/news/biontech-outlines-2024-strategic-priorities-114500463.html

https://finance.yahoo.com/news/biontech-expects-2024-revenues-3-115242034.html

https://finance.yahoo.com/news/match-group-juniper-tilray-rise-075520605.html

https://finance.yahoo.com/news/1-biontech-predicts-return-revenue-121259842.html

https://finance.yahoo.com/news/time-worry-analysts-downgrading-biontech-102755892.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: Jya0Eq

https://reports.tinycomputers.io/BNTX/BNTX-2024-01-18.html Home