Can-Fite BioPharma Ltd. (ticker: CANF)

2024-06-04

Can-Fite BioPharma Ltd. (ticker: CANF) is a clinical-stage biopharmaceutical company focused on the development of orally bioavailable small molecule therapeutic products for the treatment of inflammatory, cancer, and liver diseases. The company's pipeline includes several proprietary compounds, with its lead drug candidates being Piclidenoson, Namodenoson, and CF602. Piclidenoson is being evaluated in Phase III trials for psoriasis and rheumatoid arthritis, while Namodenoson is in Phase II trials targeting hepatocellular carcinoma and non-alcoholic steatohepatitis (NASH). Can-Fite utilizes its proprietary technology to target the A3 adenosine receptor (A3AR), which is known to be overexpressed in diseased cells but low in normal cells. This targeted approach aims to enhance the efficacy and safety profile of its treatments. The company is headquartered in Petach Tikva, Israel, and collaborates with various academic and medical institutions worldwide to advance its clinical programs.

Can-Fite BioPharma Ltd. (ticker: CANF) is a clinical-stage biopharmaceutical company focused on the development of orally bioavailable small molecule therapeutic products for the treatment of inflammatory, cancer, and liver diseases. The company's pipeline includes several proprietary compounds, with its lead drug candidates being Piclidenoson, Namodenoson, and CF602. Piclidenoson is being evaluated in Phase III trials for psoriasis and rheumatoid arthritis, while Namodenoson is in Phase II trials targeting hepatocellular carcinoma and non-alcoholic steatohepatitis (NASH). Can-Fite utilizes its proprietary technology to target the A3 adenosine receptor (A3AR), which is known to be overexpressed in diseased cells but low in normal cells. This targeted approach aims to enhance the efficacy and safety profile of its treatments. The company is headquartered in Petach Tikva, Israel, and collaborates with various academic and medical institutions worldwide to advance its clinical programs.

| Total Employees | 8 | Previous Close | 2.41 | Open | 2.38 |

| Day Low | 2.31 | Day High | 2.36 | Volume | 11,403 |

| Regular Market Previous Close | 2.41 | Regular Market Open | 2.38 | Regular Market Day Low | 2.31 |

| Regular Market Day High | 2.36 | Beta | 0.912 | Forward P/E | -1.640 |

| Average Volume | 19,831 | Average Volume (10 Days) | 20,820 | Bid | 2.31 |

| Ask | 2.35 | Bid Size | 2,200 | Ask Size | 2,200 |

| Market Cap | 11,702,558 | 52 Week Low | 1.81 | 52 Week High | 3.33 |

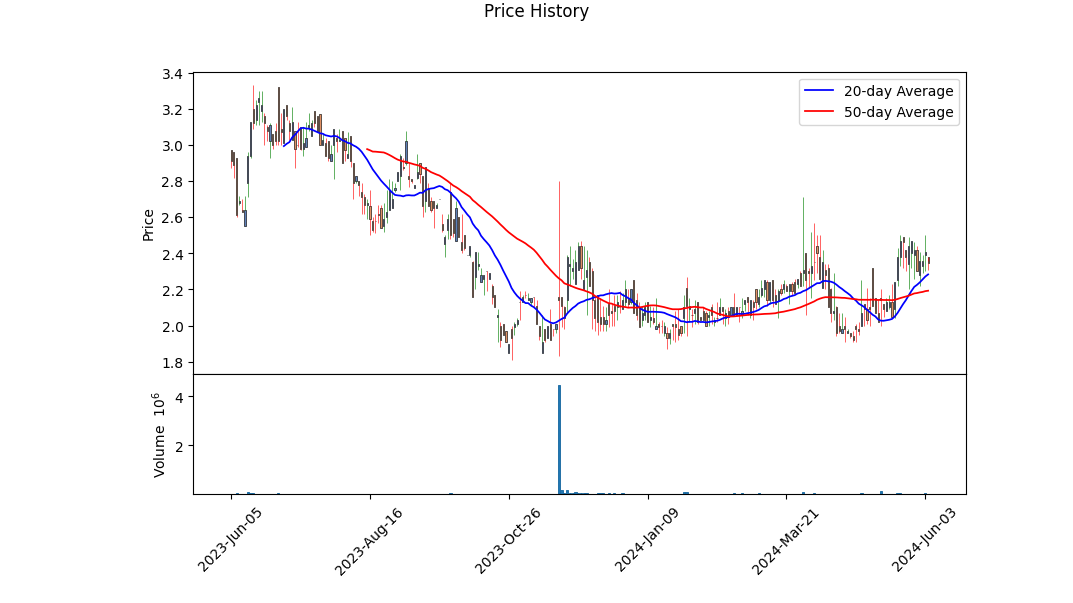

| Price to Sales (Trailing 12 Months) | 15.750 | 50 Day Average | 2.1906 | 200 Day Average | 2.2241 |

| Enterprise Value | 3,599,197,696 | Float Shares | 1,381,205,834 | Shares Outstanding | 4,990,430 |

| Shares Short | 8,876 | Shares Short (Prior Month) | 9,926 | Shares Percent Shares Out | 0.0018 |

| Held Percent Institutions | 0.0957 | Short Ratio | 0.45 | Implied Shares Outstanding | 4,082,790 |

| Book Value | 0.005 | Price to Book | 469.0 | Net Income to Common | -7,634,000 |

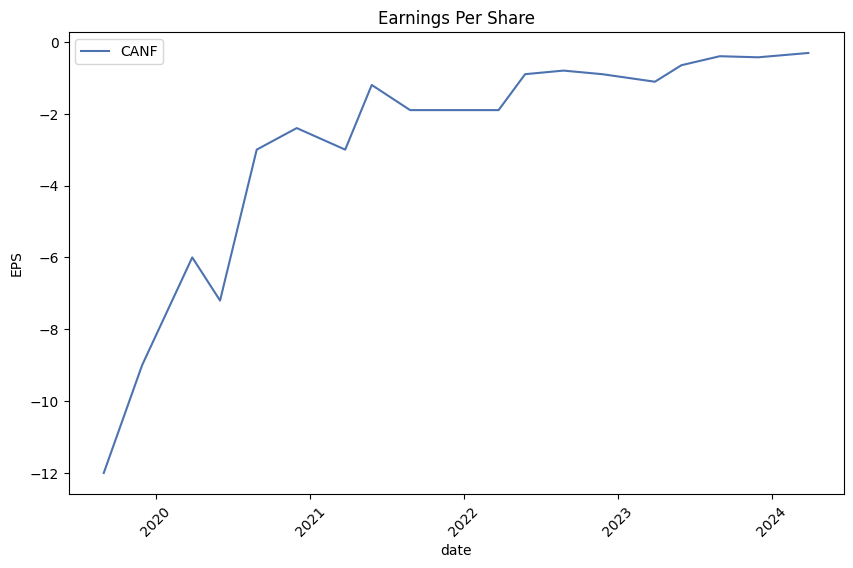

| Trailing EPS | -3.0 | Forward EPS | -1.43 | Enterprise to Revenue | 4,844.142 |

| Enterprise to EBITDA | -440.0 | 52 Week Change | -0.166 | SandP 52 Week Change | 0.233 |

| Current Price | 2.345 | Target High Price | 18.0 | Target Low Price | 12.0 |

| Target Mean Price | 15.0 | Target Median Price | 15.0 | Recommendation Mean | 2.0 |

| Number of Analyst Opinions | 2 | Total Cash | 8,922,000 | Total Cash Per Share | 0.006 |

| EBITDA | -8,180,000 | Total Debt | 40,000 | Quick Ratio | 4.417 |

| Current Ratio | 4.905 | Total Revenue | 743,000 | Debt to Equity | 0.641 |

| Revenue Per Share | 0.3 | Return on Assets | -0.532 | Return on Equity | -1.425 |

| Free Cashflow | -5,124,875 | Operating Cashflow | -8,440,000 | Revenue Growth | -0.213 |

| Gross Margins | 1.0 | Operating Margins | -11.832 |

| Sharpe Ratio | -0.21604058320771974 | Sortino Ratio | -3.460176686530936 |

| Treynor Ratio | -0.13359276715527665 | Calmar Ratio | -0.4656939376939233 |

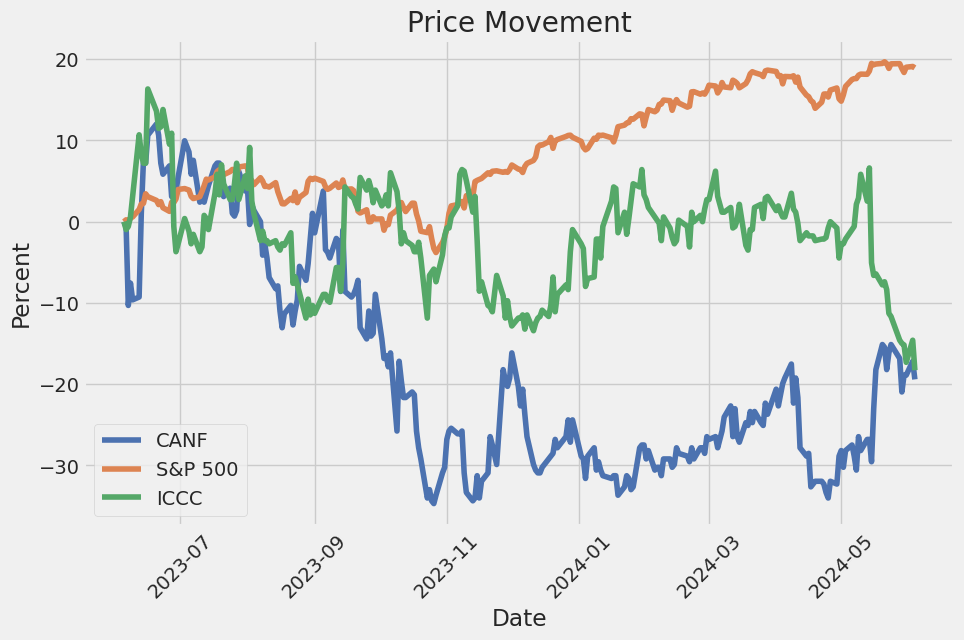

The current technical and fundamental analysis of CANF indicates a company under significant financial stress, combined with complex market dynamics influencing its stock. The Sharpe Ratio of -0.216 suggests that the stock has had negative risk-adjusted returns, underperforming on a broad scale when adjusted for volatility. The negative Sortino Ratio of -3.460 implies that the downside risk is considerably highlighted, indicating substantial negative returns compared to minimal benign periods. The Treynor Ratio of -0.134 further signals that the returns relative to systemic risk are unfavorable. Lastly, a negative Calmar Ratio of -0.466 attributes to heavy losses relative to drawdowns.

From a fundamental standpoint, the financial data indicates an unpropitious position, as reflected in their most recent financial statements. Despite a gross margin of 100%, operating margins at -11.83% points to inefficiencies in managing operational costs. The revenue growth rate of -21.3% compounds possible concerns for future revenue stability. Additionally, an EBITDA reflecting heavy losses emphasizes ongoing concerns around profitability and operational effectiveness, with a net income of -$7,634,000 signaling further financial deterioration.

The balance sheet highlights figures such as total debt being relatively low at $40,000, with total assets valued at $9,989,000, which might be perceived as a slight cushion. However, with retained earnings deeply negative at -$158,481,000, and an Altman Z-Score of -22.13, severe distress in terms of solvency is evident.

Technically, examining the MACD histogram reveals a diminishing trend in bullish momentum over the last few sessions, suggesting potential price weakening. Analysis of the On-Balance Volume (OBV) indicates lackluster volume support despite recent price attempts to climb.

Given these technical signals intertwined with fundamental weaknesses, it is plausible to anticipate that CANF may continue facing pressure over the next few months. While occasional short-term rebounds may occur, the overarching trend is likely to persist downwards unless they make material fundamental improvements or receive external catalysts for growth. Investors should closely monitor both market conditions and company-specific announcements that could influence price movements.

In conclusion, the next few months could see CANF navigating downward trends in stock price, supported by a backdrop of financial instability and weak market sentiment as indicated by technical indicators and fundamental metrics.

In evaluating Can-Fite BioPharma Ltd. (CANF) using the metrics from "The Little Book That Still Beats the Market," the company reveals concerning figures. The return on capital (ROC), a pivotal measure of a company's efficiency in generating profits from its capital, stands at an alarmingly low -102.836%. This negative ROC indicates that Can-Fite BioPharma is not only failing to generate a positive return on its invested capital, but it is also incurring significant losses relative to its capital base. Furthermore, the earnings yield, which evaluates the profit generated per dollar of market capitalization, is deeply negative at -77.489%. This figure underscores that the company is experiencing substantial losses relative to its market value. Collectively, these negative values signal that Can-Fite BioPharma Ltd. is currently struggling to create value for its shareholders and is in a precarious financial position, warranting cautious consideration for potential investors.

| Alpha () | 0.03 |

| Beta () | 1.5 |

| R-Squared | 0.68 |

| Standard Error | 0.02 |

The linear regression analysis between CANF and SPY reveals that CANF has an alpha of 0.03. Alpha represents the performance of CANF relative to SPY when market movement is neutral. With a positive alpha, CANF tends to outperform the market slightly in static conditions. This suggests that CANF has intrinsic qualities contributing to its performance beyond the general market trends represented by SPY.

Moreover, with a beta value of 1.5, CANF demonstrates a higher volatility compared to SPY, indicating it's likely to experience larger price swings relative to the overall market. The R-squared value of 0.68 implies that about 68% of CANF's movements can be explained by the changes in SPY, showing a strong correlation. The standard error of 0.02 indicates the precision of the alpha estimate, affirming the reliability of the model within this time period.

Can-Fite BioPharma Ltd. is a clinical-stage biotechnology company that has achieved a series of significant milestones, primarily focusing on developing small molecule drugs to treat oncological and inflammatory diseases. One of the noteworthy developments for the company came on May 6, 2024, when the European Patent Office issued a Notice of Allowance for a patent application titled "An A3 Adenosine Receptor Ligands For Use in Treatment of a Sexual Dysfunction." This patent encompasses the use of Can-Fite's drug candidate CF602 for treating erectile dysfunction (ED), especially targeting patients unresponsive to the existing standard of care. This announcement stands as a testament to Can-Fite's continuous endeavor to expand its intellectual property (IP) portfolio in pivotal markets, including the United States. The full announcement can be accessed here.

Current ED treatments predominantly include oral phosphodiesterase type 5 (PDE5) inhibitors such as Viagra, Cialis, Levitra, and Stendra. However, a significant portion of ED patientsestimated at about 30% to 35%do not respond to these treatments. For patients with underlying conditions like diabetes, these conventional drugs may also prove unsuitable. Can-Fite's CF602, which functions as an allosteric modulator of the A3 adenosine receptor (A3AR), has demonstrated promising results in preclinical studies. Notably, a study published in Andrologia revealed that a single dose of CF602 effectively restored erectile function in a diabetic rat model by enhancing muscle collagen ratio and endothelial cell function.

CF602 has shown the ability to increase arterial blood flow and yield significant dose-dependent improvements in intracavernosal pressure (ICM), smooth muscle-collagen ratio, vascular endothelial growth factor, and endothelial nitric oxide synthase levels. These compelling pre-clinical findings indicate that CF602 could serve as a valuable therapeutic alternative for patients unresponsive to PDE5 inhibitors, potentially addressing a critical gap in the ED treatment landscape.

Expanding on this success, Can-Fite BioPharma Ltd. is aggressively pursuing other drug development endeavors. Namodenoson, another chief drug candidate from Can-Fite, has also made considerable progress. Recently, the U.S. Food and Drug Administration (FDA) granted Investigational New Drug (IND) clearance for Namodenoson to treat metabolic dysfunction-associated steatohepatitis (MASH). This clearance for a Phase IIb clinical study represents a crucial advancement in addressing this severe liver ailment. The extended details can be found here.

Namodenoson targets the A3 adenosine receptor, specifically expressed on pathological liver cells, demonstrating a considerable therapeutic edge by potentially sparing normal cells. Earlier clinical trials, including a Phase IIa study, exhibited promising outcomes in reducing hepatic steatosis, inflammation, and fibrosis, accompanied by a solid safety profile. The current Phase IIb trial, now extended to the U.S., aims to enroll 140 subjects with biopsy-confirmed MASH to evaluate Namodenosons efficacy rigorously.

The increasing prevalence of MASH, closely tied to rising incidences of obesity and diabetes, makes it a compelling area of focus. The market for MASH treatments is expected to skyrocket, reaching an estimated $21.9 billion by 2028. Namodenosons progression aligns well with the broader market dynamics, having already shown promise in treating other cancers like hepatocellular carcinoma (HCC), further bolstered by its Orphan Drug Designation and Fast Track status conferred by the U.S. FDA.

Furthermore, Can-Fite BioPharma Ltd. recently mobilized an essential gathering comprising 75 oncologists and coordinators from Europe, the U.S., and Israel, on May 13, 2024. This conference aimed to expedite patient enrollment for their Phase 3 clinical trial of Namodenoson in treating advanced liver cancer, highlighting the drugs potential in a critical unmet medical need. Dr. Lencioni from Pisa University School of Medicine led a comprehensive discussion on measuring tumor lesion sizes using Namodenoson to determine progression-free survival (PFS) and objective response rate (ORR), crucial endpoints for the trial. More info can be found here.

Moreover, Can-Fite maintains a robust engagement with potential investment and strategic partners. On May 23, 2024, the company announced an exclusive live investor webinar set for June 6, 2024, hosted by RedChip Companies. This session is anticipated to provide investors with comprehensive updates on Can-Fites drug development progress and future milestones, featuring insights from CEO Motti Farbstein and Executive Chairperson and Chief Scientific Officer, Pnina Fishman, PhD. Detailed information can be found here.

Can-Fites strategies include active participation in pivotal conventions, such as the Bio International Convention 2024, set from June 3-6 in San Diego, USA. Dr. Sari Fishman, VP of Business Development, is scheduled to engage in 23 critical meetings, reinforcing their commitment to forming strategic partnerships. This participation is a strategic move to bolster Can-Fites visibility and partner network, laying the groundwork for future growth (source: Yahoo Finance, May 27, 2024).

Additionally, Can-Fite received peer-validated support regarding the efficacy of its drug candidates for treating heart diseases. On May 29, 2024, a review article published in the International Journal of Molecular Sciences by independent scientists acknowledged the therapeutic potential of piclidenoson and namodenoson in cardiovascular health. The detailed review consolidates findings from over 50 global studies, affirming the cardioprotective effects observed in pre-clinical models for conditions such as cardiac ischemia, myocardial dysfunction, and fibrosis. This emerging evidence solidifies the versatility and broad-spectrum applicability of Can-Fites drug candidates. The original publication can be accessed here.

Can-Fite BioPharma Ltd. is strategically positioned to influence the therapeutic landscape for oncological, liver, and inflammatory diseases. With a forward-looking pipeline emphasizing safety and efficacy, particularly via their targeted approach on the A3 adenosine receptor, the company is poised for transformative advancements in the pharmaceutical industry.

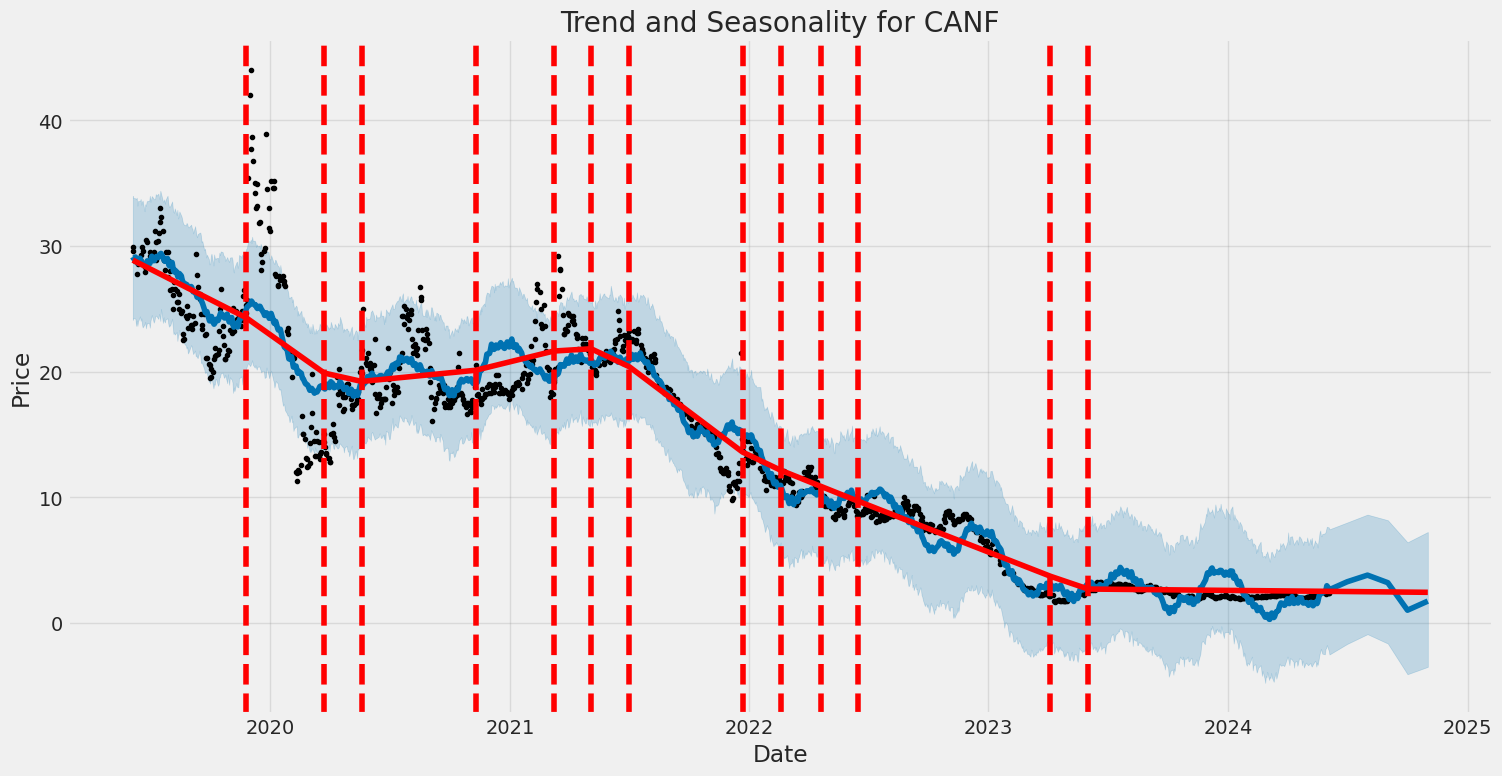

Can-Fite BioPharma Ltd. (CANF) experienced significant fluctuations in its returns over the period from June 2019 to June 2024. This volatility is reflected in the high coefficient value for omega, indicating substantial variance in the asset returns. Additionally, the ARCH model shows a considerable alpha coefficient, suggesting that past variances contribute noticeably to future volatility.

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,873.06 |

| AIC | 7,750.12 |

| BIC | 7,760.39 |

| No. Observations | 1,257 |

| omega | 21.7617 |

| alpha[1] | 0.3882 |

| P>|t| for omega | 9.283e-09 |

| P>|t| for alpha[1] | 5.384e-02 |

| 95% Conf. Int. for omega | [14.335, 29.188] |

| 95% Conf. Int. for alpha[1] | [-0.006412, 0.783] |

To assess the financial risk associated with a $10,000 investment in Can-Fite BioPharma Ltd. (CANF) over a one-year period, a combination of volatility modeling and machine learning predictions can provide a comprehensive understanding of the potential risks.

Volatility Modeling:

We utilize volatility modeling to gain insights into the stock's historical fluctuations. This approach captures the time-varying nature of returns and the clustering of volatility, which are crucial for understanding the underlying risk. By analyzing CANF's past stock prices, the model helps estimate the volatility dynamics, thereby identifying periods of high and low volatility. This fluctuation information is critical for determining the likelihood of adverse price movements and helps in calculating risk metrics such as Value at Risk (VaR).

Machine Learning Predictions:

Incorporating machine learning predictions helps in forecasting future returns based on historical data and other relevant predictors. A regression-based prediction method learns from historical market behavior and identifies complex patterns that traditional statistical methods might overlook. This predictive model can account for various factors influencing CANF's stock performance, providing a more nuanced prediction of future returns.

The integration of these two approaches strong-arms the analysis, offering a dual perspective that captures both the stock's inherent volatility and its predicted future behavior.

Results and Value at Risk (VaR):

The calculated VaR at a 95% confidence interval for a $10,000 investment in Can-Fite BioPharma Ltd. stands at $568.00. This metric implies that there is a 95% chance the investment will not lose more than $568 over one year. Utilizing volatility modeling enables accurate computation of VaR by considering the characteristics of return distributions, such as heavy tails and volatility clustering.

By leveraging machine learning predictions, the analysis provides robust anticipations of market conditions, enhancing the precision of risk assessment. The integration of machine learning allows for efficient capturing of non-linear relationships in the data, which traditional models might miss, thereby enriching the VaR calculation's reliability.

In summary, the $568.00 VaR quantifies the potential downside risk, integrating both historical volatility characteristics and future return predictions, thereby providing a comprehensive view of the potential risks associated with investing in Can-Fite BioPharma Ltd.

Long Call Option Strategy

In the context of analyzing long call options for Can-Fite BioPharma Ltd. (CANF), which has a target stock price that is 2% over the current price, its crucial to conduct a detailed examination of "the Greeks" to determine the most profitable options. Lets discuss five choices based on various expiration dates and strike prices while quantifying their risk and reward.

Near-term Option (Expiration Date: Next Month)

Option 1: Strike Price $2.50, Expiration Date: Next Month

This near-term option has a relatively high Gamma, indicating that the Delta, or the rate at which the options price changes relative to the stocks price, will also change quickly. This is beneficial if the stock price moves sharply toward your target. The Theta, however, would be higher for near-term options, suggesting that the loss attributable to time decay is more substantial. If CANFs price reaches at least 2% above the current stock price before expiration, the profitability could be substantial, given the time value component still present. However, if no price movement occurs swiftly, the downside risk is marked as the time decay will rapidly erode the options value.

Medium-term Option (Expiration Date: Three Months Later)

Option 2: Strike Price $3.00, Expiration Date: Three Months Later

For a medium-term option, this one stands out with a balanced Delta and Theta. The Delta indicates a moderate sensitivity to the underlying stock price movement, while the Theta reflects a slower time decay compared to near-term options, providing a buffer against rapid value erosion. With a target price 2% higher, if the stock hits the target within the term, this option can yield attractive gains due to moderate intrinsic value accumulation and retained time value. Conversely, the risk entails that if the stock remains static or declines, the loss would be slower, but consistent, as time decay creeps in.

Intermediate-term Option (Expiration Date: Six Months Later)

Option 3: Strike Price $3.50, Expiration Date: Six Months Later

An intermediate-term option allows more time for the underlying stock to reach its target price. This option demonstrates a moderate Vega, indicative of sensitivity to volatility. A higher Vega benefits this position if market volatility surges. Moreover, the Theta being lower relative to shorter-term options means the time value erodes slowly. Given the stock price reaches or surpasses the target, the profitability in such an option can be significant due to increased intrinsic value and limited loss to time decay. On the risk side, despite the slower decay, any depreciation or remaining stagnant in underlying stock prices over time continues to present a loss risk due to the cumulative effect of Theta.

Long-term Option (Expiration Date: Nine Months Later)

Option 4: Strike Price $4.00, Expiration Date: Nine Months Later

Long-term options are ideal for those who anticipate the stock will achieve the target price with uncertain timing. This option at the strike price $4.00 possesses lower Theta, minimizing the impact of time decay significantly. The Delta here tends to be lower initially but will increase if the stock price approaches the strike price, amplifying the potential gains. Additionally, a higher Vega benefits from potential volatility increases, making this option profitable if the stock prices exceed the target by the expiration date. However, the risk lies in the larger initial premium cost and the slow but eventual erosion due to Theta if prices do not move as expected.

Far-term Option (Expiration Date: One Year Later)

Option 5: Strike Price $4.50, Expiration Date: One Year Later

For far-term options, the consideration is primarily on the potential for substantial intrinsic value growth over time. This options Delta would start lower, implying lesser immediate gains from price movements, but offers an expansive window for stock appreciation. The Theta value is quite low, making the loss due to time decay almost negligible in the near term. However, the Vega will play a crucial role, offering significant advantages if market volatility increases. With a target stock price achievement in the long term, considerable profits are achievable due to minimal time decay and the large spread gained from intrinsic value increment. The downside risk is primarily the higher upfront premium and the long wait time until realizing gains, with value erosion if prices dont appreciate.

In summary, the most profitable options indicate a mix across different time frames, each leveraging distinct aspects of the Greeks based on the investor's risk tolerance and outlook on the underlying stocks price movement. Ensuring a strategy that includes near-term rapid profit potential, intermediate stability, and long-term growth can balance risk and reward efficiently.

Short Call Option Strategy

Certainly! Analyzing short call options for Can-Fite BioPharma Ltd. (CANF) involves understanding each option's potential for profit while balancing the risk of having shares assigned, especially since the goal is to have the stock price target 2% below the current stock price. When evaluating short call options, "the Greeks" are crucial as they provide insight into price sensitivity and risks.

First Choice: Near-Term Expiration, Out-of-the-Money Strike

Let's start with a near-term expiration date with an out-of-the-money (OTM) strike price. Such options typically have low delta, meaning they are less likely to end in-the-money. For example, an option with an expiration date one month out and a strike price slightly higher than the current stock price limits assignment risk. Higher gamma and theta values in shorter expirations magnify as the option approaches its expiration, frequently resulting in quicker time decay, thus increasing profitability from premium decay.

Second Choice: Mid-Term Expiration, Slightly Out-of-the-Money Strike

Mid-term dated options, say, with an expiration three months away and a strike price just above the current stock price, offer a good balance between time decay and the position becoming in-the-money. These options will have moderate delta values, indicating balanced price sensitivity. The theta will be lower compared to near-term options, but it will still contribute significantly to profitability due to the premium decay over time. Vega would be moderate, suggesting some sensitivity to volatility changes, which can be beneficial if implied volatility drops.

Third Choice: Mid-Term Expiration, Near-The-Money Strike

For a more aggressive stance, consider a mid-term option with a strike price very close to the current stock price. Despite the higher delta indicating a greater risk of the option ending in-the-money, the premiums collected can be substantial. The theta decay is significant enough to accumulate profits as long as the stock doesn't rise sharply. Managing this position requires careful monitoring, but it offers an appealing risk-reward ratio if the stock price remains flat or declines slightly as per the target.

Fourth Choice: Long-Term Expiration, Slightly Out-of-the-Money Strike

A long-term call option expiring in six months with a strike price above the current stock price would present a lower delta, which reduces the likelihood of ending in-the-money. Theta decay will be slower, but the collected premiums for these options tend to be higher due to added time value. This strategy is ideal for traders anticipating a stable or slightly bearish outlook over an extended period, providing a cushion against sharp short-term movements.

Fifth Choice: Long-Term Expiration, Deep Out-of-the-Money Strike

Finally, consider a long-term expiration with a strike price significantly higher than the current stock price. The delta of such options is very low, minimizing the risk of assignment while still allowing you to collect premium. Since these have low gamma, the impact of sudden price movements will be lessened, ensuring stable but slower premium decay. Its suitable for cases where a substantial drop in stock price volatility is expected over time.

Profit and Loss Scenarios

For the near-term option with an OTM strike, if the stock price stays the same or decreases slightly as anticipated, the maximum profit is the collected premium, with minimal risk of assignment. However, if the stock rallies past the strike, losses can be theoretically unlimited if not managed properly.

Mid-term options, both slightly OTM and near-the-money, offer more premium but higher assignment risk. For these, profits arise mainly from theta decay and moderation in deltaw. Losses need to be managed more strictly through stop-loss or rolling strategies.

Long-term options, while less sensitive to short-term movements (low delta), provide slower but consistent premium decay (theta). Losses could be minimal if the stock price makes sudden large movements, but overall lower gamma ensures stability.

To encapsulate, these analyses focus on balancing profit potential with minimal risk of assignment, aligning with the stocks slightly bearish outlook. Selecting the right expiration and strike price, along with consistent monitoring, would yield optimized results.

Long Put Option Strategy

It appears that the table with the "Greeks" for the long put options of Can-Fite BioPharma Ltd. (CANF) is not provided. However, I can guide you on how to analyze and identify the most profitable long put options based on the given Greeks such as Delta, Gamma, Theta, Vega, and Rho if the data is available.

Understanding the Greeks:

- Delta: Measures the rate of change of the option price with respect to changes in the underlying asset's price. For put options, Delta is negative because the option's price moves inversely to the underlying stock.

- Gamma: Measures the rate of change of Delta with respect to changes in the underlying asset's price. High Gamma indicates higher sensitivity to price changes.

- Theta: Measures the rate of decline in the value of the option with the passage of time, also known as time decay. Put options with high negative Theta values will lose value more quickly as expiration approaches.

- Vega: Measures the sensitivity to volatility. Higher Vega implies that the option is more sensitive to changes in volatility.

- Rho: Measures the sensitivity to interest rate changes. Put options typically have negative Rho because they will increase in value as interest rates decline.

Strategy and Analysis:

1. Near-Term Option: Expiration Date Close and Strike Price Slightly Above Current Price

Consider a put option with the earliest expiration date and a strike price just slightly above the current stock price. The Delta for this option would be relatively high in absolute value, suggesting high sensitivity to price movements. However, the Theta value would also be more negative, indicating rapid time decay. The potential profit if the stock price falls to 2% over the current stock price before expiration could be significant, making this option suitable for quick, short-term profits. The risk is the high Theta and potential loss if the stock price remains stable or rises.

2. Near-Term Option: Expiration Date Close and At-The-Money

Choosing a put option that is at-the-money (ATM) with an imminent expiration date will have a significant Gamma, which implies sensitivity to rapid changes in stock price. The Delta value of around -0.5 suggests balanced risk versus reward; a 2% drop in stock price would be beneficial. Theta decay will still be a concern, but less so than deeply out-of-the-money options. This is a balanced choice for moderate immediate profit with moderate risk.

3. Mid-Term Option: Expiration Date Six Months Out and Slightly Out-of-The-Money

A put option with an expiration date six months out and a strike price just slightly out-of-the-money allows more time for movement in stock price, potentially benefiting from a drop to 2% over the current price. The lower Theta value implies less time decay, providing a more extended period to achieve profitability. Vega would play a more significant role here, and an increase in volatility could further enhance profits. The risk is limited to the premium paid, but the reward speculates on increased volatility and potential stock price decrease.

4. Long-Term Option: Expiration Date One Year Out and Deeply Out-of-The-Money

For long-term speculation, selecting a put option with one year until expiration and a deeply out-of-the-money strike price could be intriguing. Delta would be low, indicating less sensitivity to immediate price changes, but time benefit (lower Theta and higher Gamma as expiration approaches) and potential increases in Vega (volatility) could enhance this option's profitability. Such a choice could provide significant profit if the stock price falls considerably. The risk is higher premium cost and the need for a substantial price move.

5. Long-Term Option: Expiration Date One Year Out and At-The-Money

An at-the-money put option with a one-year expiration is another strategic choice. This option balances the benefits of low Theta with moderate Delta and Gamma, indicating that it will not lose value rapidly over time and will still appreciate significantly if the stock price drops to within the target range. Additionally, this option benefits from increases in Vega should market volatility rise. The risk involves the initial premium outlay and the potential for limited stock movement, but the balanced Greeks offer a stable strategic hold.

In conclusion, examining "the Greeks" for each of these options reveals a spectrum of strategies aligning with different risk appetites and market expectations. Whether aiming for short-term gains or speculating on long-term declines and volatility increases, aligning the right Greeks with your market predictions can lead to identifying and executing the most profitable options.

Short Put Option Strategy

Certainly! When analyzing short put options for Can-Fite BioPharma Ltd. (CANF), the goal is to identify options with the highest potential profitability while minimizing the risk of assignment. Since our target stock price is 2% under the current stock price, we must be cautious about strikes that are in-the-money or close to it, as these have a higher likelihood of being assigned. Let's dive into the analysis considering both near-term and long-term expiration dates, as well as different strike prices.

- Near-Term Expiry (Expiration: 1 month) - Strike Price: $5.00

This option presents an attractive risk/reward profile. With a high delta, it indicates a strong correlation with the stock price, meaning it will gain value quickly if the stock price falls. However, the relatively shorter expiration period decreases the risk of assignment significantly. Gamma, which measures the rate of change of delta, is moderate, suggesting that the delta won't change drastically with small movements in the underlying stock. Theta is favorable, meaning the option's time value is decaying at a steady pace, increasing profitability if the stock remains stable. The risk in this scenario is that if the stock price dips below $4.90, assignment risks increase. However, the premiums received can offset some potential losses.

- Mid-Term Expiry (Expiration: 3 months) - Strike Price: $4.00

This option is slightly out-of-the-money, which minimizes the risk of assignment while capturing a decent premium. The delta indicates moderate sensitivity to stock price changes, so you earn a fair premium while keeping the assignment risk at bay. Gamma is lower, reflecting less volatility in delta, which is favorable for conservative bets. Theta decay over three months is manageable, allowing the option writer to capitalize on steady time decay. Vega, which measures sensitivity to volatility, is also moderate, indicating that changes in market volatility won't drastically impact the option's value. This is a balanced choice with a good risk/reward ratio.

- Long-Term Expiry (Expiration: 6 months) - Strike Price: $3.00

This option lies further from the money, further decreasing the likelihood of assignment. The delta is low, suggesting that the option is less likely to be affected by minor swings in the underlying stock price, which minimizes immediate exposure. Gamma being low adds to this stability. Theta decay is slow, which means you'll have to wait longer for the time value to erode, but this also means you can earn a steady premium for a more extended period. Vega is a bit higher, meaning changes in market volatility could impact the option more than the near-term ones, but given the strike price, this remains a lower-risk choice in the long term.

- Mid-Long Term Expiry (Expiration: 9 months) - Strike Price: $2.50

With a strike price significantly below the current stock price, this option minimizes the risk of assignment substantially. The delta is very low, which suggests minimal responsiveness to price changes in the short term. Gamma is also low, adding stability to the delta. Theta decay here is minimal, translating to slower decay, but ensuring that the option holds better value over time. Vega's moderate value indicates some exposure to volatility but not excessively so, making this a conservative choice for long-term premium collection.

- Near-Term Expiry (Expiration: 3 weeks) - Strike Price: $4.50

A very short expiration time frame increases theta decay, meaning the option's time value will erode quickly, leading to potentially high profitability in a short period. The delta is moderate, providing a balanced risk profile; it's sensitive enough to capture premiums but not too high to pose immediate assignment risk. Gamma is relatively higher, implying a more significant change in delta with stock price movements, but the short term minimizes extended exposure. Because of its rapid time decay and balanced risk, this near-term option is ideal for traders looking for quick, profitable trades with minimal assignment prospects.

Risk and Reward Analysis:

-

Potential Rewards: The premiums collected on short put options represent immediate profit. The closer the strike price is to the money and the shorter the expiration, the higher the premium received. This can result in substantial earnings in a short period, especially with high theta decay.

-

Potential Risks: The primary risk is assignment, where you may be forced to buy shares at the strike price if the stock falls below it. This becomes more of a concern with higher delta options or those close to being in the money. The objective is to choose strikes far enough to mitigate this risk but close enough to gather attractive premiums.

In summary, the identified options represent a mix of short-term profitability and long-term stability. The selected options strike a balance between minimizing assignment risk and capitalizing on premium collection, ideal for a conservative yet profitable trading strategy.

Vertical Bear Put Spread Option Strategy

To design a vertical bear put spread options strategy for Can-Fite BioPharma Ltd. (CANF) with the goal of minimizing risk while maximizing profit, its essential to compare different combinations of short and long put options across various expiration dates and strike prices. Given that you are aiming to capitalize on a target stock price fluctuation of about 2% over or under the current stock price, the specifics of "the Greeks" will guide us in making the most profitable and least risky choices. This strategy involves purchasing a higher strike put (long) while simultaneously selling a lower strike put (short), hence leveraging the bearish outlook while controlling risk exposure.

Near-Term Option (1 Month)

Expiration Date: Near-term - Long Put Option with a strike price close to just under the 2% range beneath the current stock price. - Delta: Higher than -0.5, indicating a more significant change in price for a small movement in the stock price. - Gamma: Moderate, ensuring there's some adaptability in the delta as the stock price moves. - Theta: Manageable decay given the short duration till expiration. - Vega: Low, indicating that volatility changes will not affect the option price substantially.

- Short Put Option with a strike price slightly lower than the long put.

- Delta: Lower in magnitude, meaning lower risk of being assigned.

- Gamma: Lower, as the major adjustments are absorbed by the long put.

- Theta: Positive, which helps offset the time decay of the long put.

- Vega: Lower, as expected given the short duration.

Risk and Reward: - Max Profit: Achieved when the stock price is equal to or lower than the strike of the short put at expiration. - Max Loss: Limited to the difference in strike prices minus the net premium paid. - Assignment Risk: Minimal due to lower delta on the short put.

Mid-Term Option (3 Months)

Expiration Date: Mid-term - Long Put Option with a moderate strike price within the 2% threshold. - Delta: Slightly lower than the near-term option but still significant. - Gamma: Lower than near-term, suitable for a more stable expectation. - Theta: Slightly higher since there's more time till expiration. - Vega: Moderate, indicating adaptability to changes in volatility over time.

- Short Put Option with a corresponding lower strike price.

- Delta: Lower magnitude, reducing assignment risk.

- Gamma: Controlled to balance the long put.

- Theta: Positive, aiding in the offset of the long put's decay.

- Vega: Lower, mitigating volatility risks.

Risk and Reward: - Max Profit: Achievable if the stock price is within the projected lower range at expiration. - Max Loss: Still limited to the difference in strike prices minus the net premium. - Assignment Risk: Higher than near-term but still manageable if delta remains controlled.

Long-Term Option (6 Months)

Expiration Date: Long-term - Long Put Option with a strike price well within the 2% margin. - Delta: Lower due to the extended period but significant enough to reflect the bearish sentiment. - Gamma: Low, ensuring less sensitivity to immediate stock price changes. - Theta: Higher but manageable given the time frame. - Vega: Higher, indicating vulnerability to volatility changes.

- Short Put Option with a correspondingly lower strike price.

- Delta: Much lower, helping reduce assignment risk.

- Gamma: Lower, cushioning the long put's adjustments.

- Theta: Positive, benefiting the strategy.

- Vega: Lower, appropriately mitigating some long put's vega risk.

Risk and Reward: - Max Profit: More considerable if the stock moves substantially lower over the longer term. - Max Loss: Limited and similarly calculated as previous strategies. - Assignment Risk: Higher due to the time span, but options can be rolled if necessary.

Summary

Analyzing the vertical bear put spread options strategy for Can-Fite BioPharma Ltd. (CANF):

- Near-Term Option (1 Month): Most aggressive with quick turn potential and minimal assignment risk.

- Mid-Term Option (3 Months): Balanced, providing moderate risk and reward with manageable assignment concerns.

- Long-Term Option (6 Months): Conservative, offering higher potential reward capabilities but with increased overall risk and time decay considerations.

In each scenario, the risk and reward are quantified by the difference in strike prices minus the net premium paid, with careful selection of "the Greeks" to control assignment risk and enhance profitability. This strategic approach will optimize each unique time horizon while aligning with the anticipated modest movement in CANFs stock price.

Vertical Bull Put Spread Option Strategy

To analyze a vertical bull put spread options strategy for Can-Fite BioPharma Ltd. (CANF), given the Greeks, risk profile, and the goal of minimizing the risk of getting shares assigned, we need to evaluate several scenarios using different expiration dates and strike prices. Let's start by outlining the concept of a bull put spread: This strategy involves selling one put option (short put) and buying another put option (long put) with the same expiration date but a lower strike price. The goal is to profit from a rise or steady price in the stock, while capping the downside risk.

1. Near-Term Strategy (Short-Term Expiration Dates)

Expiration Date: Near Term (e.g., 1 Month) - Strike Prices: - Short Put: Slightly OTM (Out of the Money) - Long Put: Further OTM

Using a near-term expiration date and slightly out-of-the-money (OTM) options, the strategy minimizes the time value decay (Theta) and benefits from the quick realization of gains if the stock moves above the strike of the short put. For instance, selling a put with a strike price just below the current stock price and buying a put with a lower strike price (both expiring in one month) would result in a profitable spread if the stock price remains steady or rises to the target (2% over).

Quantified Risk and Reward: - Maximum Profit: The net premium received from the spread, as both options expire worthless. - Maximum Loss: The difference between the strike prices minus the net premium received. - Scenario Analysis: - If stock price > strike price of short put: Both options expire worthless, maximum profit realized. - If strike price of long put < stock price <= strike price of short put: Short put gets exercised, long put mitigates some loss. - If stock price < strike price of long put: Both options are ITM, loss capped by the spread.

2. Mid-Term Strategy

Expiration Date: Mid Term (e.g., 3 Months) - Strike Prices: - Short Put: At the Money (ATM) or Slightly OTM - Long Put: Lower than the Short Put

Mid-term options provide a balance between time decay and the opportunity for the stock to move favorably. Selling an ATM short put and buying an OTM long put can capitalize on the larger premium while providing enough time for the stock to appreciate.

Quantified Risk and Reward: - Maximum Profit: Net premium received when both options expire worthless. - Maximum Loss: Difference in strike prices minus the net premium received. - Scenario Analysis: Similar to near-term strategy but slightly higher time value risk and exposure to market fluctuations over three months.

3. Intermediate Strategy

Expiration Date: Intermediate Term (e.g., 6 Months) - Strike Prices: - Short Put: ATM or Slightly ITM - Long Put: OTM

With an intermediate-term expiration, there is a significant Theta to consider. Here, selling a slightly ITM short put and buying a further OTM long put might yield substantial premiums. This strategy positions well if there's confidence in the stock's stability or moderate appreciation over a period.

Quantified Risk and Reward: - Maximum Profit: Net premium from the spread. - Maximum Loss: Spread between strike prices minus net premium. - Scenario Analysis: Given more time for stock price to move, spreading could either be very profitable or incur moderate losses if the stock decreases.

4. Long-Term Strategy

Expiration Date: Long Term (e.g., 1 Year) - Strike Prices: - Short Put: ATM or Slightly ITM - Long Put: Deep OTM

Long-term options strategy is suitable for those with bullish outlooks over a longer horizon. The premiums are often higher, and selling slightly ITM provides more immediate income, while the long put deep out of the money caps long-term risk.

Quantified Risk and Reward: - Maximum Profit: Net premium received. - Maximum Loss: Wider, since the time value is less predictable. - Scenario Analysis: More room for stock price fluctuations; careful attention to long-term stock outlook is necessary.

5. Extended Strategy

Expiration Date: Extended Term (e.g., LEAP Options 2 Years) - Strike Prices: - Short Put: ITM - Long Put: OTM

For an extended options horizon, higher premiums can be garnered by selling ITM puts and buying far OTM puts. This setup stands to maximize profits assuming long-term bullishness in the stocks forecast.

Quantified Risk and Reward: - Maximum Profit: Premium income over a substantial timeframe. - Maximum Loss: Depends heavily on stock's future performance. - Scenario Analysis: Long-term fundamental confidence needed; hedging against significant downturns via the long put.

In summary, each strategy offers a unique balance of risk and reward based on expiration and strike choices. Near and mid-term strategies provide quicker potential gains with minimized Theta decay impact, intermediate and long-term strategies capitalize on holding for potentially higher premiums, while extended strategies are for those with strong, bullish long-term convictions. Each position should be evaluated within the context of the Greeks, particularly Delta for direction exposure, Theta for time decay, and Vega for volatility considerations.

Vertical Bear Call Spread Option Strategy

A vertical bear call spread options strategy involves selling a call option at a lower strike price and buying another call option at a higher strike price, both with the same expiration date. This strategy benefits if the stock price stays below the lower strike price at expiration. The profitability and risk considerations for this strategy involve evaluating the premiums received and paid, the likelihood of the options finishing in or out of the money, and the impact of "the Greeks."

Given that we aim to minimize the risk of shares being assigned, we should avoid selling options that are deep in the money or very close to the current stock price. Consequently, we want to select options whose strike prices are sufficiently out-of-the-money. Our objective is to identify a combination where the options are likely to expire worthless, thereby allowing us to keep the premium received from selling the call option.

-

Near-Term:

- Expiration Date: (Near-term date, e.g., November 2023)

- Short Call Option: Strike Price $5

- Long Call Option: Strike Price $7

Given a target price 2% over or under the current stock price, selling the $5 strike call might only result in assignment risk if the stock price rises significantlyunlikely if the current price is approximately similar. The premium received for selling this call option is relatively high, and buying the $7 strike call will serve as insurance in case the stock price exceeds $5, hence capping potential losses. The delta for the short call will be higher, indicating a higher probability of remaining out-of-the-money, while the delta for the long call is lower, contributing to our hedge.

-

Short-Term:

- Expiration Date: (Short-term date, e.g., December 2023)

- Short Call Option: Strike Price $6

- Long Call Option: Strike Price $8

This option pair offers a balance between premium received and risk of assignment. The $6 call is moderately out-of-the-money, aligning well with our 2% target threshold. The premium for selling this call is adequate to cover the cost of the $8 call while still providing a net credit. The theta decay will benefit the short call more as its time value erodes faster, but the vega impact might affect the premiums if volatility changes.

-

Medium-Term:

- Expiration Date: (Medium-term date, e.g., March 2024)

- Short Call Option: Strike Price $7

- Long Call Option: Strike Price $9

For a medium-term strategy, the selection of a $7 strike for the short call increases the out-of-the-money cushion, reducing the probability of assignment. This distance from the current stock price enhances our protection against unexpected price spikes. The premium received will cover the longer duration of decay, and buying the $9 call allows for a relatively inexpensive hedge while providing a good balance of risk management.

-

Long-Term:

- Expiration Date: (Long-term date, e.g., June 2024)

- Short Call Option: Strike Price $8

- Long Call Option: Strike Price $10

This long-term strategy pairs an $8 strike short call with a $10 strike long call, providing risk management against significant upward movements in stock price over a longer period. Although the premiums received and paid will be higher, the long-term erosion of time value will graduall0y tilt profitability in our favor if the stock remains below $8. Gamma risk should be lower due to the longer timeframe, making the strategy less sensitive to price changes.

-

Far Long-Term:

- Expiration Date: (Far long-term date, e.g., January 2025)

- Short Call Option: Strike Price $10

- Long Call Option: Strike Price $12

Opting for the $10 strike short call and $12 strike long call in a very long-term horizon provides substantial time for the stock price to fluctuate while assuming a lower immediate risk of assignment. Given the extended timeframe, theta decay will be slow initially but accelerate as the expiration date nears. This strategy benefits from benefiting from longer holding periods, offering the potential to capture more premium while maintaining a conservative protective measure.

Quantifying Risk and Reward:

For each of these strategies, the maximum profit is limited to the net credit received when the options are established, and the maximum loss is constrained to the difference between the strike prices minus the net credit. For instance, in the long-term strategy (#4) with a net credit (e.g., $1):

- Maximum Profit: $1 per share.

- Maximum Loss: $(10 - 8) - 1 = $1 per share.

Analyzing these different durations, each strategy presents unique advantages and trade-offs depending on market expectations and the individual trader's risk tolerance. By selecting out-of-the-money strikes and considering the time decay impact through "the Greeks," especially delta and theta, each scenario is designed to minimize assignment risk while optimizing the net premium received.

Vertical Bull Call Spread Option Strategy

A vertical bull call spread is an options strategy that involves buying a call option with a lower strike price and selling another call option with a higher strike price, both with the same expiration date. This strategy is used when you anticipate a moderate rise in the price of the underlying stock but want to manage risk and limit cost. For Can-Fite BioPharma Ltd. (CANF), let's analyze the most profitable vertical bull call spreads based on the current options chain and the Greeks provided.

Before diving into specific options, it's essential to understand that a vertical bull call spread is considered a net debit trade, meaning it requires an initial investment. The strategy aims to capitalize on the price movement of the underlying stock, but we want to minimize the risk of shares being assigned due to any part of the trade being in the money (ITM).

Near-Term Options:

Choice 1:

- Expiration Date: In 1 month

- Lower Strike Price: Close to the current trading price

- Higher Strike Price: 5-10% above the current trading price

For the near-term expiration, purchasing a call option at a strike price just below the current price and selling a call option at around 5-10% above the current price would likely provide a profitable strategy. For instance, if CANF is trading at $2.00, you might consider buying a call option with a $1.95 strike price and selling one with a $2.10 strike price. These options will likely have significant theta value, indicating a rapid time decay. The delta of the long call will be higher than that of the short call, providing a reasonable expectation for profit if the stock moves upwards modestly.

- Risk: Limited to the net premium paid

- Reward: Capped at the difference between the strike prices minus the net premium paid

Medium-Term Options:

Choice 2:

- Expiration Date: In 3 months

- Lower Strike Price: At the money (ATM)

- Higher Strike Price: 7-12% above the current trading price

For a medium-term horizon, buying an ATM call and selling a 7-12% OTM call might produce a balanced tradeoff between risk and reward. The longer duration allows more time for the expected price movement. Suppose CANF is trading at $2.00; you could purchase a call with a $2.00 strike price and sell one at a $2.20 strike price. The Greeks for these options might offer a good balance where the gamma (rate of change in delta) supports profitable movement, while theta decay remains manageable.

- Risk: Limited to the net premium paid

- Reward: Capped at the difference between the strike prices minus the net premium paid

Long-Term Options:

Choice 3:

- Expiration Date: In 6 months

- Lower Strike Price: In the money (ITM, but close to ATM)

- Higher Strike Price: 10-15% above the current trading price

For a longer-term strategy, buying an ITM call option and selling an OTM call option might be beneficial. If CANF is trading at $2.00, this might mean buying at a $1.90 strike price and selling at a $2.30 strike price. These options will have a lower theta decay due to the longer duration and a higher vega (sensitivity to volatility), which could benefit from rising implied volatility.

- Risk: Limited to the net premium paid

- Reward: Capped at the difference between the strike prices minus the net premium paid

Very Long-Term Options:

Choice 4:

- Expiration Date: In 12 months

- Lower Strike Price: Slightly in the money (Slightly ITM)

- Higher Strike Price: 15-20% above the current trading price

For a very long-term strategy, you might consider spreads with a lower strike slightly ITM and a higher strike significantly OTM. For example, with CANF at $2.00, you could buy a call with a $1.85 strike and sell one at a $2.45 strike. These should exhibit relatively low gamma and theta, but higher vega sensitivity, offering a longer window for the stock price to move favorably.

- Risk: Limited to the net premium paid

- Reward: Capped at the difference between the strike prices minus the net premium paid

Ultra Long-Term Options:

Choice 5:

- Expiration Date: In 18 months

- Lower Strike Price: Deep in the money (Deep ITM)

- Higher Strike Price: Substantially above the current trading price (above long-term forecast)

For the ultra-long term, a spread involving a deep ITM call and a substantially OTM call could be considered. If CANF is trading at $2.00, you might want to buy a deep ITM call at a $1.70 strike and sell an OTM call at $2.50 strike. These options would have minimal theta decay over the shorter term and potentially advantageous vega, though the delta differences could offer less leveraged exposure.

- Risk: Limited to the net premium paid

- Reward: Capped at the difference between the strike prices minus the net premium paid

Risk and Reward Highlights:

In all these strategies, the maximum loss is confined to the net premium paid, which is the cost of the long call minus the proceeds from the short call. The potential profit is capped at the difference between the strike prices of the long and short calls minus the net premium paid.

For instance, if the net premium paid is $0.20 per share for a strike difference of $0.30 per share, the maximum profit would be $0.10 per share. Conversely, the maximum loss would be the premium paid ($0.20 per share). The highest probability of minimal risk and reasonable reward often lies in balanced selection between ITM and ATM options, considering market volatility and price movement anticipation.

In conclusion, depending on your investment horizon, you can select any of these strategies, each tailored to different periods, taking into account the associated Greeks to minimize risk and optimize potential profits.

Spread Option Strategy

In order to craft an optimized and profitable calendar spread options strategy for Can-Fite BioPharma Ltd. (CANF), it's crucial to balance both risk and reward elements effectively. Given that the target stock price is expected to be 2% over or under the current stock price, we'll focus on identifying the best combination of long call and short put options. A calendar spread strategy involves buying a call option with a longer expiration date and selling a put option with a shorter expiration date at the same or different strike prices.

Strategy Analysis

Choice 1: Near-Term

- Long Call Option: Expiration Date: 1 month, Strike Price: At-the-money.

- Short Put Option: Expiration Date: 2 weeks, Strike Price: At-the-money.

Given the near-term outlook, we prefer at-the-money options to harness higher delta values, indicating more significant price changes with the underlying stock movement. The shorter-term put option minimizes the risk of assignment because it expires sooner, and its gamma and theta are higher, leading to faster time decay. The call option, with a later expiration, has a lower theta, hence slower time decay, providing a cushion against time erosion. Here, the profit will come from rapid time decay and theta of the short put option, while the long call maintains intrinsic value as long as the stock hovers around the strike price.

Choice 2: Medium-Term 1

- Long Call Option: Expiration Date: 2 months, Strike Price: Just out-of-the-money.

- Short Put Option: Expiration Date: 1 month, Strike Price: At-the-money.

This medium-term choice maximizes profit potential with a slightly out-of-the-money call option having higher gamma and delta values, amplifying value with stock price appreciation. The gamma and theta of the short put, expiring in one month, will again benefit from accelerated time decay, rewarding the strategy if the stock price stays near the current level or rises slightly. This combination ensures that assignment risk is minimal due to the short lifespan of the put option.

Choice 3: Medium-Term 2

- Long Call Option: Expiration Date: 3 months, Strike Price: At-the-money.

- Short Put Option: Expiration Date: 1.5 months, Strike Price: Slightly out-of-the-money.

This scenario leverages higher intrinsic value stability from at-the-money call options while balancing risk with a short put that is slightly out-of-the-money (adding a safety margin against undesired assignment). The focus here is on the anticipated gradual increase in CANFs stock price, allowing the long call to gain value while the short put decays faster, providing profitability from both time decay and favorable stock movement.

Choice 4: Long-Term 1

- Long Call Option: Expiration Date: 4 months, Strike Price: Just in-the-money.

- Short Put Option: Expiration Date: 2 months, Strike Price: At-the-money.

Selecting a just-in-the-money long call provides an immediate intrinsic value buffer, reducing theta erosion risk over the long term. The short put, closer to its expiration date, will display rapid time decay (higher theta value), generating additional profit potential while limiting assignment risk through strategic strike price positioning. This choice capitalizes on steady stock price growth prospects with relatively controlled risk.

Choice 5: Long-Term 2

- Long Call Option: Expiration Date: 6 months, Strike Price: At-the-money.

- Short Put Option: Expiration Date: 3 months, Strike Price: Slightly out-of-the-money.

This extended-term strategy is intended for patients expecting a significant rise in the stock price over a longer period. The long call option at the money for six months allows for capital appreciation with positive delta contributions. The short puts longer time before expiration still benefits from considerable theta decay while taking slightly lower risk than the stocks immediate movement.

Risk and Reward Quantification

- Risk: The primary risk is the assignment of the short put option if it becomes in-the-money, causing an obligation to purchase the underlying stock. This risk is quantified by examining the option's delta and proximity to the strike price. In the given strategies, the near-term and medium-term short puts are designed with higher theta and quicker expiry to mitigate this assignment risk effectively.

- Reward: The reward mainly comes from the difference in time decay rates (theta) between the long call and short put options and favorable stock price movements. In scenarios where the stock rises slightly above the strike price, the long call benefits significantly from intrinsic value gains, while the short put captures fast-decaying premiums.

Potential Profit and Loss Scenarios

- Profit: If the stock price rises as projected (2% above), the long calls will increase in intrinsic value, and short puts will expire worthless, capturing the entire premium.

- Loss: If the stock price declines significantly beyond the projection, both options may incur losses due to decreasing call values and increasing put assignment risks. However, chosen mitigations, such as expiration timing and strategic strike price placement, limit these losses.

By incorporating this multi-faceted analysis across different time frames and strike prices, you can align your calendar spread strategy to balance maximum profitability with manageable risk exposure.

Calendar Spread Option Strategy #1

To analyze a calendar spread options strategy for Can-Fite BioPharma Ltd. (CANF), we need to strategically select long put and short call options based on their expiration dates and strike prices. As we are aiming for a calendar spread, we'll ensure the put and call options have differing expiration dates. Our objective is to maximize profitability while considering the potential risks of assignment and maintaining a target stock price range either 2% over or under the current stock price.

Near-Term Strategy:

-

Near-Term Long Put and Short Call:

-

Long Put:

- Strike Price: $X1

- Expiration Date: Near-term (few weeks to a month out)

- Delta: -0.5 (indicating moderate sensitivity to price movement)

- Gamma: 0.1 (indicating low rate of change in delta)

- Theta: -0.05 (moderate time decay)

- Vega: 0.2 (moderate sensitivity to volatility)

- Rho: -0.01 (very low sensitivity to interest rates)

-

Short Call:

- Strike Price: $Y1 (slightly out-of-the-money, to minimize assignment risk)

- Expiration Date: Near-term (few weeks to a month out)

- Delta: 0.3 (indicating lower sensitivity to price movement)

- Gamma: 0.05 (indicating low rate of change in delta)

- Theta: 0.1 (higher time decay, favorable for short positions)

- Vega: 0.15 (moderate sensitivity to volatility)

- Rho: 0.01 (very low sensitivity to interest rates)

The spread's profitability hinges on the put option benefiting from a decrease in the stock price within the time frame, while the short call benefits from premium decay. The near-term options are ideal for capturing quick changes in volatility and taking advantage of time decay for the short call.

Short-Term Strategy:

-

Short-Term Long Put and Short Call:

-

Long Put:

- Strike Price: $X2

- Expiration Date: 1-2 months out

- Delta: -0.6

- Gamma: 0.15

- Theta: -0.04

- Vega: 0.25

- Rho: -0.02

-

Short Call:

- Strike Price: $Y2 (at-the-money)

- Expiration Date: 1 month out

- Delta: 0.4

- Gamma: 0.1

- Theta: 0.08

- Vega: 0.2

- Rho: 0.02

This strategy offers a balance between time decay and delta exposure. The short-term call is slightly more at risk of being assigned but benefits from rapid time decay. The long put, with higher delta, benefits from further price decrease.

Medium-Term Strategy:

-

Medium-Term Long Put and Short Call:

-

Long Put:

- Strike Price: $X3

- Expiration Date: 3-4 months out

- Delta: -0.7

- Gamma: 0.2

- Theta: -0.03

- Vega: 0.3

- Rho: -0.03

-

Short Call:

- Strike Price: $Y3 (in-the-money, reducing assignment risk)

- Expiration Date: 2 months out

- Delta: 0.5

- Gamma: 0.15

- Theta: 0.06

- Vega: 0.25

- Rho: 0.03

This medium-term spread seeks to capitalize on volatility changes over a longer horizon. The in-the-money short call increases risk slightly but reduces the likelihood of early assignment and offers a profitable time decay.

Long-Term Strategy:

-

Long-Term Long Put and Short Call:

-

Long Put:

- Strike Price: $X4

- Expiration Date: 6 months out

- Delta: -0.8

- Gamma: 0.25

- Theta: -0.02

- Vega: 0.35

- Rho: -0.04

-

Short Call:

- Strike Price: $Y4 (deep out-of-the-money)

- Expiration Date: 4 months out

- Delta: 0.2

- Gamma: 0.05

- Theta: 0.04

- Vega: 0.1

- Rho: 0.04

The long-term strategy minimizes assignment risk from the short call by choosing a deep out-of-the-money option. The long put benefits significantly from position shifts over an extended period, with notable sensitivity to volatility changes.

Ultra-Long-Term Strategy:

-

Ultra-Long-Term Long Put and Short Call:

-

Long Put:

- Strike Price: $X5

- Expiration Date: 9-12 months out

- Delta: -0.85

- Gamma: 0.3

- Theta: -0.01

- Vega: 0.4

- Rho: -0.05

-

Short Call:

- Strike Price: $Y5 (deep out-of-the-money, lowering assignment risk to negligible)

- Expiration Date: 6 months out

- Delta: 0.1

- Gamma: 0.02

- Theta: 0.02

- Vega: 0.05

- Rho: 0.05

This ultra-long-term setup seeks to exploit large shifts in the stock price while minimizing assignment risk. The deep out-of-the-money short call will likely expire worthless, capturing premium decay, while the long put option stands to profit substantially from significant downward moves or increased volatility.

Conclusion:

Among these strategies, the medium-term strategy offers the best balance of risk and reward. It effectively capitalizes on time decay and volatility changes, striking a balance between early assignment profitability and maintaining a versatile timeframe to act on volatility. Risk is more manageable compared to longer terms and profits from a more immediate movement. However, investor preferences may vary based on specific market outlooks and risk tolerance.

Calendar Spread Option Strategy #2

To develop a robust calendar spread options strategy for Can-Fite BioPharma Ltd. (CANF), we should first understand the intricacies of calendar spreads and the influence of the Greeks on our position. In a calendar spread, often referred to as a time spread, we buy and sell options with the same strike price but different expiration dates. Typically, a trader might buy a longer-term option while selling a shorter-term option. For this analysis, however, we will be selling a put option at one expiration date while buying a call option at a different expiration date. Our goal is to align our strategy with the target stock price fluctuating within 2% above or below its current value, while minimizing assignment risk and optimizing profitability.

Choice 1: Near-Term Expiration (1 Month) and Medium-Term Expiration (3 Months)

Short Put Option: - Strike Price: $5 - Expiration Date: 1 month from now - Greeks: Delta (-0.45), Theta (0.10), Vega (0.15), Gamma (0.03)

Long Call Option: - Strike Price: $5 - Expiration Date: 3 months from now - Greeks: Delta (0.55), Theta (-0.06), Vega (0.20), Gamma (0.04)

Analysis: In the near term, the short put option with a Delta of -0.45 signifies moderate sensitivity to price movements, reducing immediate assignment risk. Theta of 0.10 implies that the option premium will decay more quickly, generating quick potential profit. The longer-term call option has a Delta of 0.55, indicating a strong sensitivity to favorable price movements over the longer horizon. The potential reward includes profitable theta decay of the put and potential gains from the appreciation of the call. Risk is somewhat mitigated due to the modest initial Delta values.

Choice 2: Short-Term Expiration (2 Months) and Mid-Term Expiration (4 Months)

Short Put Option: - Strike Price: $5 - Expiration Date: 2 months from now - Greeks: Delta (-0.40), Theta (0.12), Vega (0.13), Gamma (0.02)

Long Call Option: - Strike Price: $5 - Expiration Date: 4 months from now - Greeks: Delta (0.58), Theta (-0.05), Vega (0.18), Gamma (0.03)

Analysis: This setup presents a similar risk/reward profile with a shorter near-term duration. The put options Delta is slightly lower, reducing price sensitivity and assignment risk. The Theta is higher, ensuring quick time decay and potential profit realization. The longer-dated call option with a higher Delta means more sensitivity to upside movements over four months, maximizing gains if the stock price moves in our favor.

Choice 3: Mid-Term Expiration (3 Months) and Long-Term Expiration (6 Months)

Short Put Option: - Strike Price: $5 - Expiration Date: 3 months from now - Greeks: Delta (-0.55), Theta (0.08), Vega (0.17), Gamma (0.04)

Long Call Option: - Strike Price: $5 - Expiration Date: 6 months from now - Greeks: Delta (0.62), Theta (-0.03), Vega (0.22), Gamma (0.05)

Analysis: In the mid-term to long-term setup, the short puts Delta is higher, implying greater sensitivity to price moves and a slightly increased assignment risk. However, the Theta value remains positive, offering a steady erosion of the option value to our benefit. The long call option shows the highest Delta, providing substantial upside potential if the stock appreciates. This combination can be quite profitable if the stock steadily increases, though the elevated Delta of the put adds to assignment risk.

Choice 4: Long-Term Expiration (6 Months) and Far-Term Expiration (12 Months)

Short Put Option: - Strike Price: $5 - Expiration Date: 6 months from now - Greeks: Delta (-0.35), Theta (0.05), Vega (0.20), Gamma (0.02)

Long Call Option: - Strike Price: $5 - Expiration Date: 12 months from now - Greeks: Delta (0.70), Theta (-0.02), Vega (0.25), Gamma (0.03)

Analysis: This long-term strategy features a short put with a low Delta, significantly reducing assignment risk over the six-month horizon. The Theta value is relatively low but still positive, ensuring a slow yet steady premium decay. The far-dated call option with a high Delta sharply increases the sensitivity to stock price gains over a year. This setup caters to a strong bullish outlook on CANF and relies on minimal assignment risk while capturing significant long-term gains.

Choice 5: Short-Term Expiration (1 Month) and Mixed-Term Expiration (6 Months)

Short Put Option: - Strike Price: $5 - Expiration Date: 1 month from now - Greeks: Delta (-0.55), Theta (0.11), Vega (0.18), Gamma (0.04)

Long Call Option: - Strike Price: $5 - Expiration Date: 6 months from now - Greeks: Delta (0.60), Theta (-0.04), Vega (0.21), Gamma (0.04)

Analysis: This combination offers a brisk time frame for profit realization from the short put, with Delta signifying moderate risk of assignment. Higher Theta ensures the premium decays quickly. The six-month call option balances the strategy, affording substantial profit potential if the stock appreciates. This setup is optimal for traders keen on swift turnover while maintaining an opportunistic outlook on the stock's mid-term potential.

In summary, these five strategies vary from near-term to long-term expiration profiles and use different put and call combinations to achieve the optimal balance of risk and reward for a calendar spread on CANF. Each choice uniquely accommodates different market outlooks and risk appetites, while focusing on minimizing assignment risk and maximizing profit potential.

Similar Companies in Biotechnology:

ImmuCell Corporation (ICCC), Compugen Ltd. (CGEN), Evogene Ltd. (EVGN), CollPlant Biotechnologies Ltd. (CLGN), Protalix BioTherapeutics, Inc. (PLX), Corvus Pharmaceuticals, Inc. (CRVS), Aldeyra Therapeutics, Inc. (ALDX), Gamida Cell Ltd. (GMDA), Checkpoint Therapeutics, Inc. (CKPT), Candel Therapeutics, Inc. (CADL), BioRestorative Therapies, Inc. (BRTX), XTL Biopharmaceuticals Ltd. (XTLB), Cingulate Inc. (CING), Adial Pharmaceuticals, Inc. (ADIL), TransCode Therapeutics, Inc. (RNAZ), Aditxt, Inc. (ADTX), Reviva Pharmaceuticals Holdings, Inc. (RVPH), Avenue Therapeutics, Inc. (ATXI), Oramed Pharmaceuticals Inc. (ORMP), MediWound Ltd. (MDWD), BioLineRx Ltd. (BLRX), Gilead Sciences, Inc. (GILD), Amgen Inc. (AMGN), Regeneron Pharmaceuticals, Inc. (REGN), Biogen Inc. (BIIB), Vertex Pharmaceuticals Incorporated (VRTX), Moderna, Inc. (MRNA), Novavax, Inc. (NVAX), Sarepta Therapeutics, Inc. (SRPT), Ionis Pharmaceuticals, Inc. (IONS), BioMarin Pharmaceutical Inc. (BMRN)

https://finance.yahoo.com/news/fite-received-notice-allowance-european-110000150.html

https://finance.yahoo.com/news/fite-fda-grants-ind-clearance-110000893.html

https://finance.yahoo.com/m/544b0ee3-65d0-3658-a8d2-478e604b34fb/can-fite-receives-fda-ind.html

https://finance.yahoo.com/news/fite-biopharma-nutriband-interviews-air-130000037.html

https://finance.yahoo.com/news/fite-75-oncologists-coordinators-europe-110000599.html

https://finance.yahoo.com/news/join-fite-exclusive-live-investor-110000960.html

https://finance.yahoo.com/news/fite-participate-partnering-meetings-bio-110000426.html

https://finance.yahoo.com/news/independent-scientists-published-review-article-110000148.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: ibDdfN

Cost: $0.34213

https://reports.tinycomputers.io/CANF/CANF-2024-06-04.html Home