Caterpillar Inc. (ticker: CAT)

2023-12-22

Caterpillar Inc. (NYSE: CAT) is a global leader in manufacturing construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. With a history dating back to 1925, the company has established a significant footprint in the heavy equipment industry and is known for its strong brand and extensive service network. Caterpillar's products are recognized for their durability, reliability, and technological innovations, serving a wide range of industries including construction, transportation, mining, and energy. The company operates through multiple segments, including Construction Industries, Resource Industries, Energy & Transportation, and Financial Products. As of 2023, Caterpillar continues to focus on operational efficiency, product development, and expanding its services business to create value for shareholders while adapting to changing market conditions and embracing sustainability practices to reduce its environmental impact. The company's stock, CAT, is considered a bellwether for the global economy and is a component of the Dow Jones Industrial Average. With a strong commitment to quality and an expansive portfolio that meets diverse customer needs, Caterpillar remains poised to capitalize on growth opportunities in infrastructure development and energy transition worldwide.

Caterpillar Inc. (NYSE: CAT) is a global leader in manufacturing construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. With a history dating back to 1925, the company has established a significant footprint in the heavy equipment industry and is known for its strong brand and extensive service network. Caterpillar's products are recognized for their durability, reliability, and technological innovations, serving a wide range of industries including construction, transportation, mining, and energy. The company operates through multiple segments, including Construction Industries, Resource Industries, Energy & Transportation, and Financial Products. As of 2023, Caterpillar continues to focus on operational efficiency, product development, and expanding its services business to create value for shareholders while adapting to changing market conditions and embracing sustainability practices to reduce its environmental impact. The company's stock, CAT, is considered a bellwether for the global economy and is a component of the Dow Jones Industrial Average. With a strong commitment to quality and an expansive portfolio that meets diverse customer needs, Caterpillar remains poised to capitalize on growth opportunities in infrastructure development and energy transition worldwide.

| As of Date: 12/21/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 147.49B | 139.27B | 125.52B | 118.06B | 124.67B | 85.39B |

| Enterprise Value | 178.08B | 169.58B | 155.77B | 148.05B | 154.85B | 116.34B |

| Trailing P/E | 16.42 | 17.00 | 18.20 | 18.10 | 17.44 | 13.14 |

| Forward P/E | 14.12 | 13.19 | 14.81 | 14.35 | 15.82 | 11.47 |

| PEG Ratio (5 yr expected) | 1.72 | 1.41 | 1.53 | 1.49 | 1.55 | 1.12 |

| Price/Sales (ttm) | 2.25 | 2.20 | 2.10 | 2.04 | 2.27 | 1.64 |

| Price/Book (mrq) | 7.20 | 7.62 | 6.92 | 7.44 | 7.93 | 5.43 |

| Enterprise Value/Revenue | 2.67 | 10.09 | 8.99 | 9.33 | 9.33 | 7.76 |

| Enterprise Value/EBITDA | 12.23 | 40.68 | 36.05 | 44.93 | 55.82 | 36.15 |

| Full Time Employees | 109,100 | Previous Close | 289.71 | Dividend Rate | 5.2 |

| Dividend Yield | 1.79% | Payout Ratio | 27.78% | Five Year Avg Dividend Yield | 2.38 |

| Beta | 1.077 | Trailing PE | 16.41596 | Forward PE | 14.094752 |

| Volume | 3,209,267 | Market Cap | 147,670,286,336 | Fifty Two Week Low | 204.04 |

| Fifty Two Week High | 298.27 | Price to Sales Trailing 12 Months | 2.2177045 | Enterprise Value | 176,403,218,432 |

| Profit Margins | 13.686% | Float Shares | 508,046,210 | Shares Outstanding | 509,084,992 |

| Shares Short | 9,686,460 | Held Percent Insiders | 0.161% | Held Percent Institutions | 71.425% |

| Short Ratio | 2.7 | Book Value | 40.247 | Price to Book | 7.2072453 |

| Net Income to Common | 9,112,999,936 | Trailing EPS | 17.67 | Forward EPS | 20.58 |

| PEG Ratio | 1.11 | Total Cash | 8,424,000,000 | Total Debt | 37,139,001,344 |

| EBITDA | 15,738,000,384 | Total Revenue | 66,587,000,832 | Debt to Equity | 181.104 |

| Revenue per Share | 129.528 | Return on Assets | 10.183% | Return on Equity | 50.447% |

| Gross Profits | 15,565,000,000 | Free Cashflow | 5,138,375,168 | Operating Cashflow | 11,621,000,192 |

| Earnings Growth | 40.8% | Revenue Growth | 12.1% | Gross Margins | 30.491% |

Upon examining the comprehensive suite of technical indicators and company fundamentals for Caterpillar Inc. (CAT), we can develop a nuanced forecast for the stocks potential movement in the ensuing months. The technical data from the last trading session provides several noteworthy insights:

- The Adjusted Close price of $290.07 reflects a solid upward trend.

- A bullish indication is reinforced by the Moving Average Convergence Divergence (MACD) standing at 10.628819, with a positive histogram value of 3.409588, signaling sustained upward momentum.

- The Relative Strength Index (RSI) at 78.402318 suggests that the stock is currently overbought, which might typically indicate a pullback. However, its important to consider that persistent overbought conditions can occur during strong upward trends.

- Bollinger Bands point to increased volatility with the closing price near the upper band, indicating the continuation of a potential uptrend.

- The stock price sits significantly above both the Simple Moving Average (SMA) for 20 days and the Exponential Moving Average (EMA) for 50 days, confirming a bullish trend.

- On Balance Volume (OBV) of 1.579330 million denotes strong buying pressure.

- Stochastic oscillators (STOCHk and STOCHd) are in an overbought territory, which could suggest upcoming price stabilization or a brief retraction.

- Average Directional Index (ADX) is at 38.520397, pointing towards a strong ongoing trend.

- The Williams %R (WILLR) indicates that the stock is in overbought territory, which often precedes a corrective phase.

- The Chaikin Money Flow (CMF) at 0.278569 indicates bullish buying pressure.

Combining the aforementioned technical indicators, the momentum and buying pressure behind CAT appear robust and suggest an enduring uptrend might persist. Nevertheless, an assessment of the overbought conditions cautions us that CAT might undergo transitory pullbacks or consolidations.

Reflecting on CATs fundamentals, the company has seen appreciable growth in market capitalization and enterprise value over the preceding year, an indicator of market confidence. The P/E ratios, both trailing and forward, are reasonably grounded, ensuring that the stock is not excessively overvalued. An increased PEG ratio hints at market expectations for future earnings growth, potentially justifying a higher price-earnings premium. Additionally, the reasonable Price/Sales and Enterprise Value/Revenue ratios suggest that the company is sensibly priced relative to its sales and revenue figures.

The comprehensive analysis of the companys financials also reveals a strong fiscal standing. There's an upward trend in normalized EBITDA and Net Income from Continuing Operations, suggesting solid operational performance. The consistent investment in Research and Development bodes well for future innovation and efficiency improvements. An important point to note is that Total Unusual Items have negatively impacted earnings, but this effect is often one-time and may not recur going forward.

In conclusion, the combination of robust technical indicators and strong financial fundamentals create an optimistic outlook for Caterpillar Inc. (CAT). However, potential investors should anticipate possible short-term price fluctuations due to the current overbought conditions. Over the medium to long-term horizon, supported by the companys solid financial foundation and the technical momentum, CATs stock price is poised to maintain its ascension with expected intermittent consolidations.

Overall, one can reasonably expect the stock to continue its upward trajectory over the next few months, barring any unforeseen macroeconomic headwinds or company-specific drawbacks, while acknowledging that temporary pullbacks may offer opportunities for reentry into the market.

Caterpillar Inc. (CAT), the iconic manufacturer of construction and mining equipment, is a beacon of market dominance and a testament to the strength and sustainability of its business model. As an industrial heavyweight, CAT's reputation for providing consistent revenue streams and reliable dividend payouts is well-recognized, serving as a magnet for investors who are seeking long-term growth accompanied by income security. In the fiscal year 2022, the company reported robust revenue earnings of $59.4 billion, a clear indicator of its stature as a prominent entity within the sector.

Caterpillar's expansive business operations extend well beyond the United States, with over half of its revenue stemming from international markets. This global reach is not accidental but rather a strategic advantage that allows the company to harness the growth tied to expanding populations and the upsurge in global wealth. These demographic and economic shifts are anticipated to fuel demand for Caterpillar's core inventory, namely, construction and mining equipment essential for housing development and raw materials production. Projections by FactSet Research suggest that Caterpillar's earnings could exhibit an average annual growth rate of 17.3%, striking a chord of optimism for the company's future financial performance.

The firm's commitment to shareholder value goes beyond short-term profit distribution, as evidenced by Caterpillar's reputation as a Dividend Aristocrathaving raised dividends consistently for an astounding 29 years in a row. The current dividend yield is pegged at a healthy 2.1%, coupled with a sustainable payout ratio of 31% of EPS. These metrics are reassuring in their reflection of Caterpillar's financial soundness and are underpinned by an 'A' credit rating from S&P alongside a stable outlook. The company's relatively low debt-to-capital ratio of 39% reinforces its financial sturdiness, signaling a low risk of insolvency and further engendering investor confidence.

Investors looking for value may find solace in the fact that Caterpillar is trading at a compelling discountat 31% below its estimated fair value, as per Dividend Kings' assessments in November 2023. This perceived undervaluation presents a tantalizing scenario for investors, forecasting the possibility of a 706% cumulative total return over the next decade, a figure that far eclipses expected returns from the market standardthe S&P 500.

The consistency of Caterpillar's performance is further highlighted by its dividend track record, now extending beyond 30 years of consecutive dividend increases. This record of uninterrupted and climbing dividend payouts hones the trust of investors, assuring them of a steady income stream. The company has deftly navigated the typically cyclical industry sectors it plays in, where fluctuations in earnings can significantly impact revenue and profitability. Despite such challenges, Caterpillar's strategic approach has been to maintain a substantial free cash flow annually, targeting between $4 billion to $8 billion from its machinery, energy, and transportation segments.

In the face of global infrastructure expansion, heightened activities in the mining domain, and stable oil prices, Caterpillar is well-positioned to continue its upward trajectory. These drivers not only benefit sectors critical to CAT's business but are also conducive to a corporate climate ripe for sustained income growth through dividends.

Caterpillar stands out as a paragon of dividend fidelity and as a formidable choice for investment due to the combination of its resilient approach to market cycles and its robust growth prospects in multiple sectors. The emphasis on continual dividend enhancement is not just a business tactic but serves as proof of the company's enduring resilience, shrewd financial management, and strategic forward-thinking aptitude.

As a key subject of Seeking Alpha's financial analyses and as of December 2023, Caterpillar garners spotlight attention for its hallmark of dependable and growing dividend payments. In an economic landscape brimming with unpredictability, Caterpillar meshes investment security with relative affordability. The Dividend Growth Investing strategy, employed by seasoned investors, zeroes in on such high-caliber companies, identifying them based on rigorous criteria that encompass strong financial fundamentals and sizeable market presence.

What makes Caterpillar peculiarly compelling as a dividend stock is not merely its ability to weather economic turbulence but also its well-entrenched business acumen, leading to distributions investors can rely upon for years to come. The company's investment-grade credit rating and attractive valuation metrics serve as nods to its role as an undervalued asset in income generation.

Furthermore, Caterpillar's potential as an income growth vehicle is a standout featureit aligns dividends growth with or even outpaces inflation, ensuring the long-term appeal of this investment. The ability to expand dividends while adeptly managing risks lays the foundation for potential sustainable returns, all the while maintaining the principle of diversified investment to mitigate concentration risk.

Caterpillar is also a titan in terms of industry impact, its presence in the Dow Jones Industrial Average signifying its importance and reliability. Its diversified operations and strategic focus on innovation edge out competition and betoken potential for future growth. From developing autonomous vehicles to embracing data analytics, Caterpillar is chasing market leadership through technological advancements and industrial foresight.

The forward-thinking company does not ignore the broader perspective, factoring in environmental concerns and sustainable growth in its roadmap. Caterpillar's investments in R&D to reduce emissions and innovate toward greater fuel efficiency are steps in alignment with global climate-conscious efforts. This pivot is not simply compliance with regulation but an adaptation to the shifting market preferences toward greener solutions.

Looking to the global stage, Caterpillar navigates international markets with finesse, adapting to variable demands, responding to emerging economies' growth, and offering a diverse and inclusive portfolio of products and services. As the horizon unfolds for this industrial giant, challenges in the form of trade tensions, material costs, and geopolitical uncertainty await. However, a sterling balance sheet, lean manufacturing initiatives, and growth investments are harbingers of a bright future capable of steering through these unpredictable waters.

In terms of delivering steady value to shareholders, Caterpillar is commendable for its longstanding practice of paying dividends. With a quarterly dividend issuance since 1989, the current payout stands firm at $1.30 per share, marking an annual yield of about 2.2%. This yield, notably above the industry standard, is supported by a modest payout ratio of nearly 28%, hinting at the probability of future increments without endangering CAT's financial health.

The corporation's approach to enhancing shareholder value is multifaceted, including share repurchases to enrich investors' stakes. Over the last half-decade, nearly 12% of outstanding shares have been reacquired, thereby elevating the proportional ownership of extant shareholders. This tactic endorses the investor benefit through augmented share value and represents a more favorable capital return route than dividends alone.

Despite potential dampening demand due to increasing global interest rate trends, as revealed through shrinking backlogs and mild sales guidance projections, Caterpillar's solid historical performance, coupled with a P/E ratio trading below its five-year average, may point to an undervalued entity ripe for investment.

Finally, as part of an elect group of dividend aristocrats revered for growth at a reasonable price (GARP), Caterpillar showcases a blend of appealing characteristics for those who invest with an eye for both income and growth. With a yield of about 2.1 percent, dividend safety assured by a high score, and a strong credit rating, CAT echoes a narrative of reliable and disciplined financial governance.

The expected long-term growth, coupled with a 680 percent total return potential over the next decade, positions Caterpillar as an attractive investment opportunity. Valued below fair value and deemed an 'Ultra SWAN' for its low-risk caliber, the stock is an enticing prospect for those seeking to capi

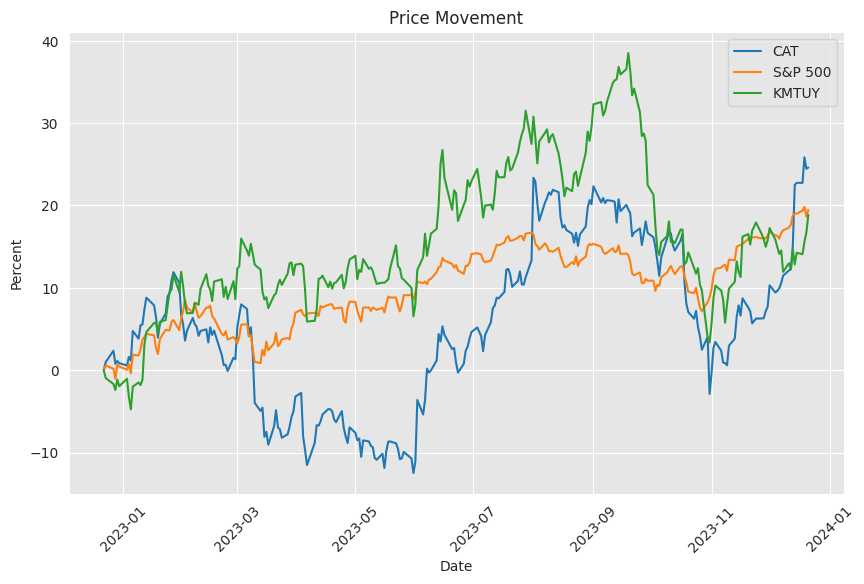

Similar Companies in Farm & Heavy Construction Machinery:

Komatsu Ltd. (KMTUY), Deere & Company (DE), CNH Industrial NV (CNHI), Volvo AB (VLVLY), Hitachi Construction Machinery Co., Ltd. (HTCMY)

News Links:

https://www.fool.com/investing/2023/12/03/3-safe-dividend-stocks-with-growing-payouts/

https://www.fool.com/investing/2023/11/17/my-16-best-stocks-to-buy-now/

https://www.fool.com/investing/2023/11/13/2-top-dividend-stocks-you-can-buy-and-hold-forever/

https://seekingalpha.com/article/4648144-7-dividend-aristocrats-you-should-buy-before-too-late

https://www.fool.com/investing/2023/11/04/is-it-time-to-buy-the-dow-jones-x-worst-performing/

https://www.fool.com/investing/2023/11/01/want-1-million-in-retirement-3-stocks-to-buy-now-a/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: OLJwLdd

https://reports.tinycomputers.io/CAT/CAT-2023-12-22.html Home