Chubb Limited (ticker: CB)

2024-01-11

Chubb Limited, trading under the ticker CB on the New York Stock Exchange, stands as one of the world's largest publicly traded property and casualty insurance companies. With a history dating back to 1882, Chubb has grown into a global entity with operations in 54 countries and territories. The company offers a diverse array of insurance products including commercial and personal property & casualty insurance, personal accident and supplemental health insurance, reinsurance, and life insurance. As a leader in the insurance industry, Chubb is noted for its extensive product offerings, strong capital base, and a history of consistent financial performance. The company serves multinational corporations, mid-size and small businesses with property and casualty insurance, affluent and high-net-worth individuals with substantial assets to protect, and individuals purchasing life insurance and personal accident insurance. Its reputation for underwriting excellence and claims service, along with a well-established international presence, has positioned Chubb as a stable and respected institution in the competitive insurance market.

Chubb Limited, trading under the ticker CB on the New York Stock Exchange, stands as one of the world's largest publicly traded property and casualty insurance companies. With a history dating back to 1882, Chubb has grown into a global entity with operations in 54 countries and territories. The company offers a diverse array of insurance products including commercial and personal property & casualty insurance, personal accident and supplemental health insurance, reinsurance, and life insurance. As a leader in the insurance industry, Chubb is noted for its extensive product offerings, strong capital base, and a history of consistent financial performance. The company serves multinational corporations, mid-size and small businesses with property and casualty insurance, affluent and high-net-worth individuals with substantial assets to protect, and individuals purchasing life insurance and personal accident insurance. Its reputation for underwriting excellence and claims service, along with a well-established international presence, has positioned Chubb as a stable and respected institution in the competitive insurance market.

| City | Zurich | Country | Switzerland | Industry | Insurance - Property & Casualty |

| Sector | Financial Services | Full Time Employees | 40,000 | Executive Chairman & CEO | Mr. Evan G. Greenberg |

| President & COO | Mr. John W. Keogh | Executive VP & CFO | Mr. Peter C. Enns | Vice Chairman | Mr. John Joseph Lupica |

| Global Controller, VP & Chief Accounting Officer | Ms. Annmarie T. Hagan | Previous Close | $225.25 | Market Cap | $92,903,407,616 |

| Volume | 1,533,848 | Average Volume | 1,955,232 | Dividend Rate | $3.44 |

| Dividend Yield | 1.53% | Beta | 0.618 | Trailing PE | 13.34 |

| Forward PE | 10.72 | Market Cap | $92,903,407,616 | FiftyTwo Week Low | $183.40 |

| FiftyTwo Week High | $231.37 | Price to Sales Trailing 12 Months | 1.925 | Book Value | $128.37 |

| Price to Book | 1.774 | Net Income to Common | $7,105,999,872 | Trailing EPS | 17.07 |

| Forward EPS | 21.24 | Shares Outstanding | 407,990,016 | Total Revenue | $48,255,000,576 |

| Total Debt | $19,406,999,552 | Total Cash | $8,040,000,000 | EBITDA | $9,379,000,320 |

| Gross Profits | $10,626,000,000 | Operating Cashflow | $12,088,999,936 | Revenue Growth | 15.3% |

| Earnings Growth | 161.9% | Return on Assets | 2.697% | Return on Equity | 13.511% |

| Gross Margins | 27.344% | EBITDA Margins | 19.436% | Operating Margins | 17.759% |

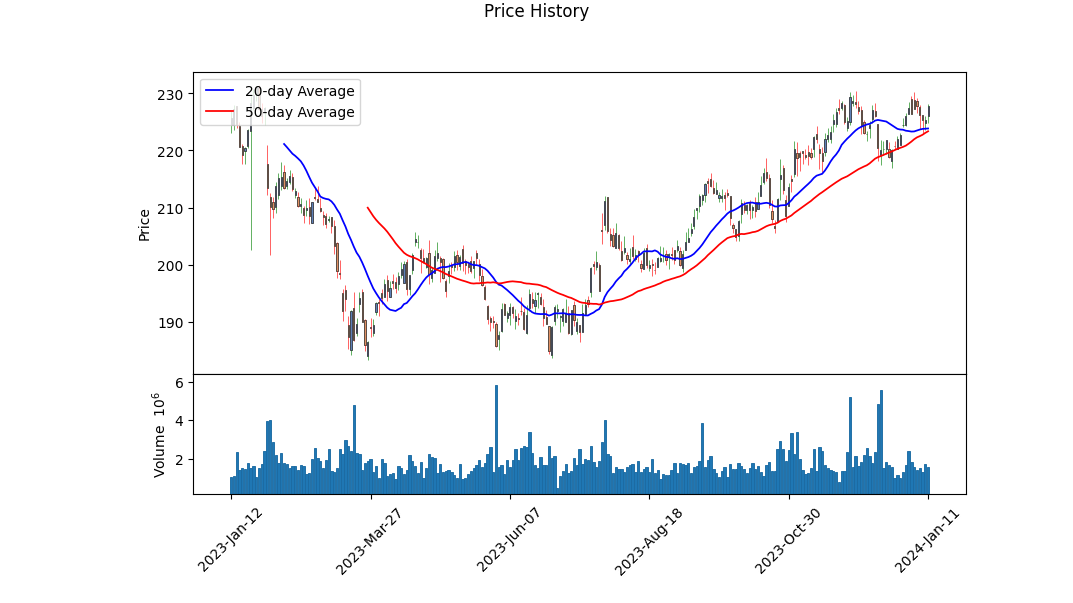

Technical Analysis: - Price Action: The stock price has exhibited a steady uptrend since the start of the year, closing at 227.71 with higher highs and lows. - Volume: Steady trading volume suggests solid investor interest, with recent volume averaging around 1.5 million shares traded per day. - Parabolic SAR (PSAR): With the PSAR dot flipping to above the price, this could indicate a potential short-term reversal or consolidation. - On-Balance Volume (OBV): The OBV has increased over the period, indicating buying pressure and positive volume flow. - MACD Histogram: The MACD histogram shows a positive value, which implies that the current momentum is bullish. The decreasing histogram indicates momentum might be waning.

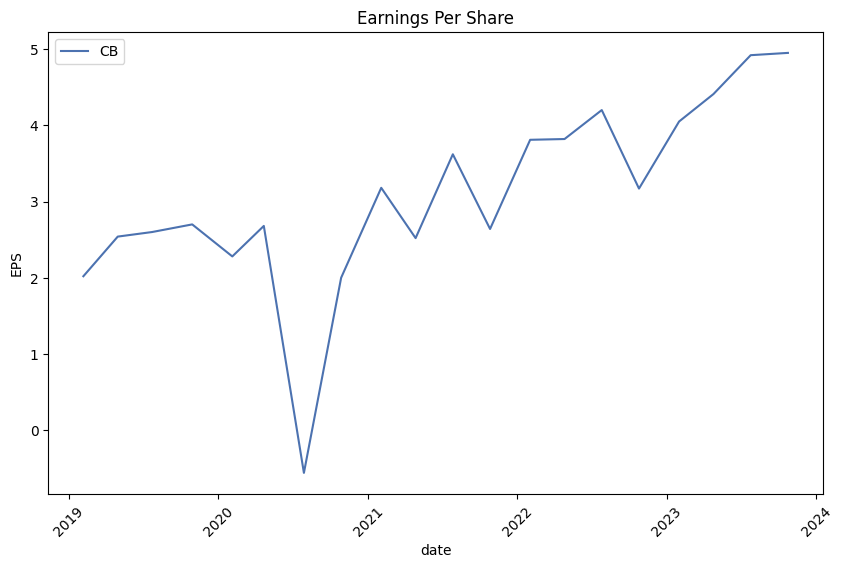

Fundamental Analysis: - Strong Gross and EBITDA Margins: The company has healthy gross and EBITDA margins of 27.34% and 19.43%, respectively, indicating efficient operations. - Consistent Net Income: Although there was a noticeable drop from 2021 to 2022, the company's net income has remained substantial. - Trailing PEG Ratio: The trailing PEG ratio of 0.6701 suggests the stock could be undervalued based on predicted earnings growth.

Balance Sheet Strength: - Debt Levels: Theres a noticeable decrease in net debt from 2021 to 2022, indicating the company has reduced its debt burden. - Equity: Common stock equity remains strong despite a slight decrease from 2021, suggesting continued company value for shareholders.

Cash Flows: - Free Cash Flow: Positive free cash flow positions the company for reinvestment, dividends, and other corporate activities. - Reduced Share Repurchase: A decrease in repurchases in 2022 suggests the company may be conserving cash for other opportunities or debt reduction.

Analyst Expectations: - Earnings Growth: Analysts expect a bullish trend in earnings per share moving into the next two quarters and fiscal years. - Sales Growth: Sales estimates showing double-digit percentage growth into the next two quarters and fiscal years highlight potential growth.

Inferred Stock Price Movement: The confluence of strong technical signals, sound fundamentals, reduced debt, and positive cash flow suggest that the stock is in a good position for continued appreciation over the next few months. Consistently rising earnings estimates indicate robust future profitability, which typically translates into share price growth. However, the recent PSAR indications could mean that investors should prepare for a period of consolidation or a mild pullback before the uptrend resumes.

The technical uptrend, underpinned by sound financial health as seen in the balance sheet and cash flow statement, combined with favorable analyst expectations, creates an overall bullish case for the stock. Provided the company meets or exceeds analyst earnings and revenue expectations, one can anticipate a continuation of the bullish momentum with healthy price appreciation over the subsequent months. That said, market sentiment, geopolitical issues, and industry-specific news could introduce volatility and potentially impact the stock's trajectory.

Investors should continue to monitor technical indicators, particularly the MACD histogram for signs of momentum shifts and PSAR for trend changes, along with any fundamental news or shifts in financial health, as these will provide important cues to the stocks mid to long-term price movement.

| R-squared | 0.391 |

| Adj. R-squared | 0.390 |

| F-statistic | 805.5 |

| Prob (F-statistic) | 2.72e-137 |

| Log-Likelihood | -2,209.7 |

| AIC | 4,423 |

| BIC | 4,434 |

| Alpha | 0.0128 |

| Beta | 0.8534 |

| No. Observations | 1,257 |

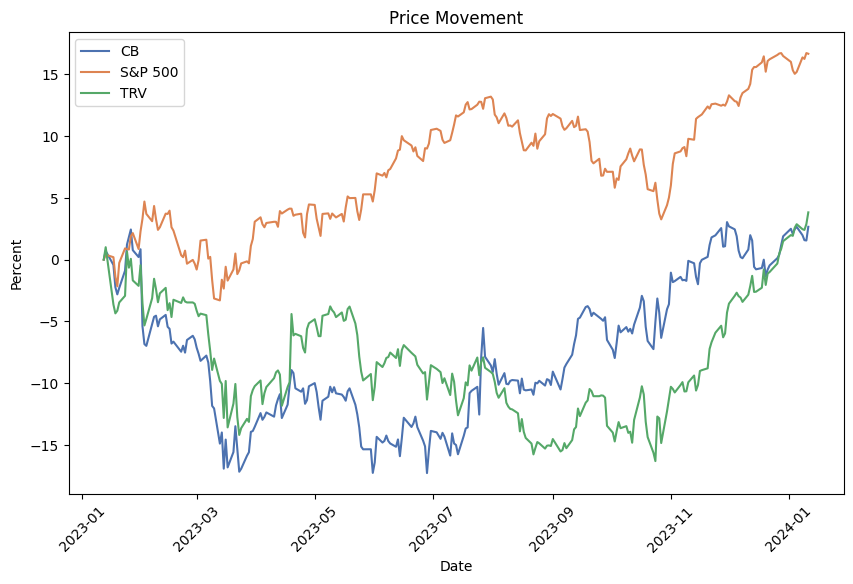

The linear regression model suggests that there is a significant relationship between CB (Chubb Limited stock) and SPY (a stock that represents the S&P 500 index, and by extension, the broader market). A positive beta value of approximately 0.8534 implies that for every 1% increase in SPY, the model predicts an 0.8534% increase in the value of CB, signifying a strong positive correlation, albeit not a perfect one-to-one relationship. The R-squared value of 0.391 indicates that around 39.1% of the variability in CB's returns can be explained by the movements in SPY. This suggests that SPY is a significant but not exhaustive factor in explaining the variance in CB's returns.

The alpha value of the regression equation, approximately 0.0128, represents the expected return on CB when SPY's return is zero. It can be interpreted as the excess return that CB generates over what would be predicted by its relationship with the broader market as represented by SPY. In this context, although the alpha is statistically positive, its low magnitude and high p-value suggest that it may not be significantly different from zero, meaning that CB's performance is closely tied to the market and does not consistently outperform or underperform the market after accounting for systemic risk.

Summary of Chubb Limited's Third Quarter 2023 Earnings Call

Overall Performance: Chubb Limited demonstrated a robust performance in the third quarter of 2023, with Chairman and CEO Evan Greenberg highlighting the company's double-digit global P&C premium growth and strong underwriting results, including an 88.4% combined ratio. The company saw record net investment income and robust life operating income, culminating in record operating earnings per share. Core operating income significantly increased compared to the previous year, and the annualized core operating return on equity (ROE) was a notable 13.5%. Growth was broadly based, with commendable contributions from commercial and consumer businesses in both North American and international operations.

Underwriting and Reserve Development: Chubb's underwriting performance benefited from a mix of earned premium growth and solid underwriting margins, as well as average catastrophe (cat) losses relative to expectations. The positive prior period reserve development in both North America and Overseas General reflected the company's conservative approach. Greenberg reiterated Chubb's cautious stance on recognizing potential bad news promptly while being slower to acknowledge favorable developments. This prudent approach underscores the importance Chubb places on maintaining a strong balance sheet and robust loss reserves.

Investment Performance and Acquisitions: The company reported an impressive adjusted net investment income, which rose substantially from the prior year due to increasing portfolio yields and a strong reinvestment rate. Chubb's liquidity remains robust, ensuring steady growth of investment income without altering its prudent investment profile. Additionally, Chubb increased its ownership stake in Huatai Group above 72%, with expectations to further increase it in the near future. CFO Peter Enns provided further details on financial items, including catastrophe impact, reserve development, and the financial effects of Huatai on overall earnings.

Growth, Pricing, and Rate Environment: Chubb's consolidated net premiums grew significantly in the quarter, with considerable expansion in the P&C and Life divisions. Premium growth was observed across various lines, with notable progress in agriculture year-to-date despite a higher combined ratio due to early recognition of crop conditions. The P&C rate environment remained strong, particularly for commercial lines across North America and international operations, although financial lines experienced rate decreases. Retention rates remained high, and new business acquisitions grew. Internationally, the premium growth was pronounced, with all major regions contributing. The company continues to observe favorable pricing dynamics and manages loss cost inflation diligently.

Closing Remarks:

CEO Evan Greenberg concluded the call expressing confidence in Chubb's ability to continue growing revenue and operating earnings globally. CFO Peter Enns wrapped up with comments on the company's milestones, including the increase in invested assets and net investment income, a positive outlook from Moody's, and the impact of the Huatai consolidation. Chubb's disciplined approach to growth, risk management, and underwriting conditions was underscored as key factors in maintaining the company's favorable performance trajectory. Finally, the floor was opened to questions, with discussions around reserving, cyber insurance, reinsurance business, property pricing, financial lines, and regional growth opportunities, particularly in Asia.

Chubb Limited, a leading global provider of insurance and reinsurance products, filed its Form 10-Q for the quarterly period ended September 30, 2023. The financial results and accompanying notes reflect several significant activities and changes within the company during the period, including the consolidation of Huatai Group and the adoption of new accounting guidance for long-duration contracts (LDTI).

The financial highlights include Chubb's total revenue of $13.85 billion for the quarter, representing an increase from the $12.12 billion reported in the same period of the previous year. Net income attributed to Chubb was $2.04 billion, an increase from $792 million in the comparative quarter in 2022. Notably, net premiums written increased to $13.10 billion from $12.01 billion in Q3 2022, and net premiums earned rose to $12.67 billion from $11.53 billion. However, the company reported an overall comprehensive income of $268 million, a rebound from a comprehensive loss of $2.66 billion reported for the same period the previous year.

Chubb's total investments at the end of the quarter stood at $129.96 billion, demonstrating a significant portion of its asset base and a solid increase from the $113.55 billion reported at the end of December 2022. A considerable part of this increase is attributed to the consolidation of Huatai Group and its subsidiaries starting July 1, 2023, following an increase in Chubb's holding from approximately 64.2 percent to approximately 69.6 percent. This strategic move led to a notable shift in the balance sheet as Huatai-related assets, liabilities, revenue, and expenses were included in Chubb's consolidated financial statements for the first time.

The adoption of LDTI at the beginning of 2023 resulted in several adjustments to Chubb's financial statements, including updates to the liability for future policy benefits, market risk benefits, and amortization of deferred acquisition costs. These accounting changes were adopted retrospectively or on a modified retrospective basis and required restatements of various balance sheet and income statement items.

Additionally, shareholders' equity increased to $57.50 billion, up from $50.52 billion reported at the end of the previous year. The increase is partly attributed to the positive net income and also reflects the impact of the Huatai Group consolidation and the LDTI adoption adjustments.

Chubb reported significant cash flows from operations, totaling $9.45 billion for the nine months ended September 30, 2023, confirming robust operational performance and liquidity management. Total assets were reported at $222.75 billion, a substantial increase from $199.02 billion as of December 31, 2022, demonstrating the company's asset growth and, to some extent, the effects of consolidating Huatai Group.

The filings also touched on Chubb's investment in securities and private debt, noting purchases, sales, maturities, and redemptions, which are critical components of the company's investment strategy. Chubb's cash and cash equivalents, including restricted cash, stood at $2.78 billion at the end of the quarter.

Moreover, Chubb addressed changes in its accounting policies as a result of the consolidation of Huatai, detailing how revenues and expenses from asset management activities, including fees and performance-related gains, are recognized.

Overall, Chubb Limited's 10-Q filing for Q3 2023 presents a picture of a company in a strong financial position, with significant premium growth. The consolidation of Huatai Group has substantially enlarged the scope of operations and financials reflected in the report, while the adoption of LDTI has refined the company's accounting for long-duration contracts.

In the financial services sector, Chubb Limited has successfully positioned itself as a major player, standing as the world's largest publicly traded property and casualty insurance company. With operations spanning 54 countries and territories, Chubb provides a broad array of products and services, including commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance, and life insurance. The diverse offerings and expansive clientele are supported by Chubb's robust financial position and extensive distribution capabilities, reinforcing its status in the industry.

Chubb's established approach to underwriting, risk assessment, and claims management has earned them a reputation for settling claims promptly and fairly. This operational hallmark has been key in solidifying Chubb's stature within the insurance market. The upcoming fourth quarter earnings conference call on January 31, 2024, is anticipated to shine light on the company's financial health and strategic direction. This information will be essential for current and potential investors to evaluate Chubb's performance in a competitive and dynamic sector.

The anticipated earnings release will be closely watched by market analysts and investors, particularly as Chubb is a notable component of the S&P 500 index. The company's shares, listed on the New York Stock Exchange under the ticker symbol CB, act as a barometer of its market standing. Located in key global cities like Zurich, New York, and London, Chubb utilizes its corporate reach and approximately 40,000 employees to maintain a powerful service network.

Chubb's successful expansion into specialized insurance lines such as marine, medical risk, and environmental insurance has further diversified its portfolio. The acquisition of The Chubb Corp in January 2016 was a transformative move that contributed to the company's international imprint and reinforced its venture into various specialty insurance sectors.

The financial community has recognized Chubb's potential for growth and profitability, reaffirmed by Zacks Equity Research's designation of Chubb as a top-ranked value stock with a #1 (Strong Buy) rating. This assessment is supported by the positive trend in analyst opinions and an upward revision of earnings estimates, further evidenced by a 6.5% average earnings surprise and an appealing Value Style Score of B within the Zacks system.

Moreover, Chubb's strategic approach to leverage has made it an attractive option for investors seeking low-leverage stock picks in the current financial climate. The anticipation of interest rate hikes has investors turning toward companies like Chubb that present a relatively lower risk profile. The low debt-to-equity ratio and solid financial management are attributes that have positioned Chubb as a conservative investment choice.

The P&C insurance industry, of which Chubb partakes, has demonstrated resilience in the face of challenges. The sector achieved a year-to-date rise of 12.2%, outpacing both the S&P 500 composite and the Finance sector's growth. Chubb stands alongside major players like The Progressive Corporation (PGR), demonstrating competitive financial metrics and healthy growth projections that cater to diverse investor objectives.

Comparatively, Chubb's financial diligence and strategic initiatives have set it apart within the insurance market. When juxtaposed with entities like Hanover Insurance Group, Chubb's forward price-to-earnings (P/E) ratio and PEG ratio suggest a balanced view of its current valuation and growth prospects, making it an attractive option for value investors.

The performance of peers such as American International Group, Inc. (AIG), which has seen share prices rise due to underwriting improvements, highlights the positive trajectory of the industry. Similarly, companies like Arch Capital Group Ltd. (ACGL) and Kinsale Capital Group Inc. (KNSL) have shown impressive growth, with the former outperforming its industry's growth, and the latter capitalizing on its specialization in the Excess & Surplus lines market.

In conclusion, the comparative analysis of industry players such as Chubb, AIG, ACGL, and KNSL provide a panorama of growth and stability in the insurance industry. Chubb's efficient operational model, strong financial metrics, and strategic market positioning underscore its role as a formidable player in the sector. The company's disciplined approach and focus on technology and innovation are likely to continue driving growth and profitability, underscoring its appeal to investors looking for consistency and value within their portfolios.

Chubb Limited (CB) experienced measurable volatility between January 14, 2019, and January 11, 2024. The statistical analysis using an ARCH model shows no predictability in return movements based on past data, but significant variations in price as indicated by the model coefficients. The model estimates suggest that volatility shocks are quite persistent, with a coefficient for the alpha term that signifies a substantial impact of past volatility on current volatility.

Here is the HTML table summarizing the ARCH model results:

| Dep. Variable: | asset_returns | R-squared: | 0.000 | ||

|---|---|---|---|---|---|

| Mean Model: | Zero Mean | Adj. R-squared: | 0.001 | ||

| Vol Model: | ARCH | Log-Likelihood: | -2,372.38 | ||

| Distribution: | Normal | AIC: | 4,748.75 | ||

| Method: | Maximum Likelihood | BIC: | 4,759.03 | ||

| No. Observations: | 1,257 | ||||

| Date: | Thu, Jan 11 2024 | ||||

| Time: | 22:30:37 | ||||

| Df Residuals: | 1,257 | ||||

| Volatility Model | |||||

| coef | std err | t | P>|t| | 95.0% Conf. Int. | |

| omega | 1.6749 | 0.168 | 9.963 | 2.205e-23 | [1.345, 2.004] |

| alpha[1] | 0.5360 | 0.106 | 5.042 | 4.597e-07 | [0.328, 0.744] |

Covariance estimator: robust

Similar Companies in Property & Casualty Insurance:

The Travelers Companies, Inc. (TRV), Allstate Corporation (ALL), Progressive Corp (PGR), American International Group, Inc. (AIG), Hartford Financial Services Group Inc (HIG), Berkshire Hathaway Inc. (BRK-A), Cincinnati Financial Corporation (CINF), W. R. Berkley Corporation (WRB), Markel Corporation (MKL), CNA Financial Corporation (CNA)

https://www.zacks.com/stock/news/2208268/chubb-cb-is-a-top-ranked-value-stock-should-you-buy

https://finance.yahoo.com/news/chubb-limited-hold-fourth-quarter-180000686.html

https://www.zacks.com/stock/news/2193085/cb-or-thg-which-is-the-better-value-stock-right-now

https://www.zacks.com/stock/news/2193383/buy-these-5-low-leverage-stocks-as-rate-hike-fear-subsides

https://www.zacks.com/stock/news/2202749/aig-rises-9-6-in-three-months-what-lies-ahead-for-investors

https://finance.yahoo.com/news/heres-why-kinsale-knsl-stock-163000676.html

https://finance.yahoo.com/news/heres-why-cincinnati-financial-cinf-153300676.html

https://www.zacks.com/stock/news/2199953/is-chubb-limited-cb-stock-undervalued-right-now

https://finance.yahoo.com/news/heres-why-add-arch-capital-164500374.html

https://www.sec.gov/Archives/edgar/data/0000896159/000089615923000016/cb-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 3UWOpI