Cameco Corporation (ticker: CCJ)

2023-12-16

Cameco Corporation (ticker: CCJ) is one of the world's largest publicly traded uranium companies, headquartered in Saskatoon, Saskatchewan, Canada. The company is involved in multiple facets of the uranium mining industry, including the extraction, processing, and manufacturing of uranium for use in nuclear power plants worldwide. Established in 1988, Cameco has established a strong presence in the uranium market, with its operation portfolio encompassing both high-grade uranium production and long-term contracts with electricity generating companies. Its key operating properties include the high-grade uranium deposits in northern Saskatchewan's Athabasca Basin and a range of assets in the United States, Kazakhstan, and elsewhere. As nuclear energy gains traction as a reliable and low-carbon source of electricity, Cameco is positioned to capitalize on the growing demand for nuclear fuel. Moreover, the company plays a significant role in the clean energy sector as its products enable the generation of clean, baseload electricity without greenhouse gas emissions. The strategic significance of uranium for energy security also underscores the company's importance in the global energy supply chain.

Cameco Corporation (ticker: CCJ) is one of the world's largest publicly traded uranium companies, headquartered in Saskatoon, Saskatchewan, Canada. The company is involved in multiple facets of the uranium mining industry, including the extraction, processing, and manufacturing of uranium for use in nuclear power plants worldwide. Established in 1988, Cameco has established a strong presence in the uranium market, with its operation portfolio encompassing both high-grade uranium production and long-term contracts with electricity generating companies. Its key operating properties include the high-grade uranium deposits in northern Saskatchewan's Athabasca Basin and a range of assets in the United States, Kazakhstan, and elsewhere. As nuclear energy gains traction as a reliable and low-carbon source of electricity, Cameco is positioned to capitalize on the growing demand for nuclear fuel. Moreover, the company plays a significant role in the clean energy sector as its products enable the generation of clean, baseload electricity without greenhouse gas emissions. The strategic significance of uranium for energy security also underscores the company's importance in the global energy supply chain.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 19.46B | 17.31B | 13.57B | 11.33B | 9.79B | 10.68B |

| Enterprise Value | 18.40B | 16.40B | 12.63B | 10.38B | 9.71B | 10.54B |

| Trailing P/E | 98.83 | 243.10 | 106.46 | 160.90 | 105.97 | 241.70 |

| Forward P/E | 25.91 | 24.39 | 40.32 | 36.23 | 31.65 | 31.15 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 11.52 | 10.91 | 8.00 | 7.71 | 6.79 | 8.12 |

| Price/Book (mrq) | 4.28 | 3.88 | 3.02 | 2.63 | 2.72 | 2.92 |

| Enterprise Value/Revenue | 8.11 | 28.51 | 26.21 | 15.11 | 18.54 | 27.11 |

| Enterprise Value/EBITDA | 28.77 | 62.13 | 129.38 | 41.36 | 359.20 | 488.22 |

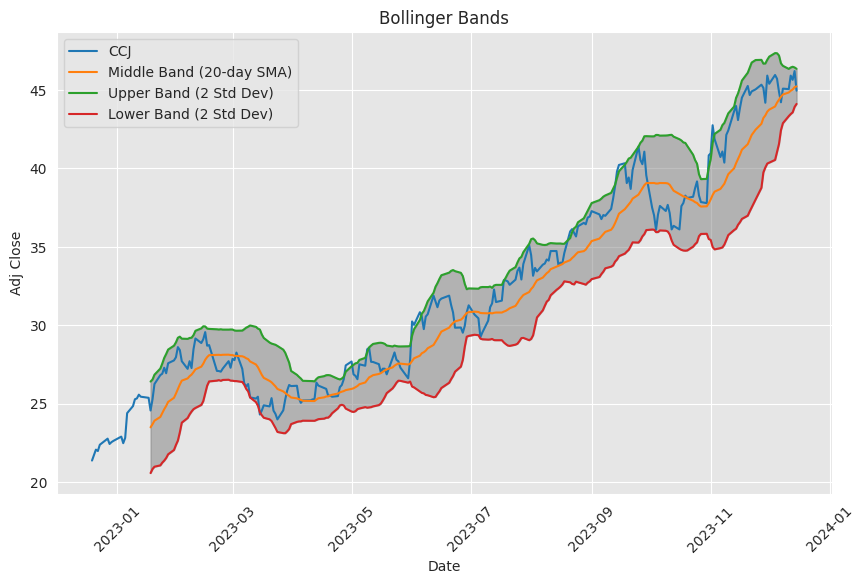

Upon analyzing the provided technical indicators for the stock of interest as of the latest trading day, we can draw several inferences that may inform the stock's future price movement:

Upon analyzing the provided technical indicators for the stock of interest as of the latest trading day, we can draw several inferences that may inform the stock's future price movement:

- The Adjusted Close price of 44.95 suggests the stock closed near the upper band of the short-term Bollinger Bands (BBU_5_2.0 at 46.53), which may indicate a relatively strong position within the current price range.

- The MACD value of 0.919469 with a negative histogram value (-0.193183) signals that while the momentum has been bullish, it is potentially weakening as the MACD line may be converging with its signal line, signifying a potential slowdown or reversal in trend.

- An RSI (Relative Strength Index) of 53.91 is slightly above the neutral threshold of 50, indicating neither overbought nor oversold conditions, suggesting moderate momentum in the stock's movement.

- The stock's Stochastic %K (57.75) is trending above its %D (61.23), conveying a moderating bullish sentiment among market participants.

- The ADX (Average Directional Index) at 21.80 is indicative of a mild trend strength, and the presence of both a potential support level at the Parabolic SAR lower (44.10) and absence of an active Parabolic SAR short signal indicate that the current trend may have room to continue.

- Notably, the On-Balance Volume (6.537810 million) indicates reasonable buying pressure which is supportive of a continuation of the uptrend, given its upward trajectory.

- A Chaikin Money Flow (CMF) of 0.087767 suggests that buying pressure is modest but present.

In conjunction with technical analysis, evaluating the company's fundamentals provides a more comprehensive outlook: - The Market Cap shows an upward trend from previous periods, which might reflect growing investor confidence or expansion in the company's valuation. - The Trailing P/E is high at 98.83, reflecting a premium on earnings, which could either suggest an overvaluation or expectant future growth that is not yet reflected in earnings. - The Forward P/E is significantly lower at 25.91, indicating analyst expectations for an increase in earnings. - The P/S and P/B ratios are elevated, further suggesting that the stock may be trading at a premium relative to sales and book values. - The EV/Revenue and EV/EBITDA are considerably lower than previous periods, depicting a more favorable valuation in relation to its revenue and earnings before interest, taxes, depreciation, and amortization. - Analysis of financials indicates a stable net income and positive EBITDA, which underpin a healthy financial condition. A closer look at EBITDA trends could be informative for cash-flow-based analysis.

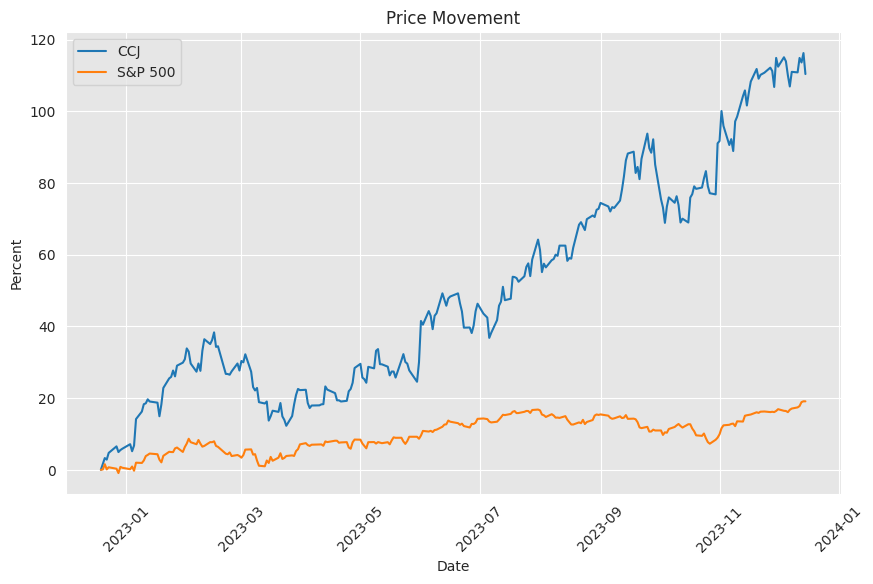

Projecting forward, the interplay of these technical indicators coupled with solid fundamentals suggests that the stock is likely to continue its uptrend, albeit with potential for volatility and adjustments. The decreasing forward P/E ratio compared to the trailing P/E hints at an expectation for stronger earnings, which may result in continuous investor interest propelling the share price upward.

However, the high P/S and P/B ratios, combined with a relatively high current P/E, suggest the stock is trading at a premium. This may leave it susceptible to corrections should future earnings reports not meet heightened expectations or if market sentiment shifts. Given the moderate level recorded by indicators such as RSI and ADX, the next few months could see some consolidation with potential for incremental gains, provided the company continues to post positive financial results.

In conclusion, an optimistic, yet cautious stance is recommended when considering stock price movements over the next few months. It is advisable to monitor for potential shifts in market sentiment or changes in the company's fundamental outlook, as these could significantly influence the stock's trajectory. The convergence of technical analysis and fundamental performance appears to provide a relatively positive outlook, but vigilance in monitoring the evolving market context remains crucial.

Cameco Corporation (TSX: CCO:CA)(NYSE: CCJ) is a global leader in the uranium mining industry and a vital supplier of fuel for nuclear power plants. Its strategic position is underscored by its substantial uranium reserves, notably from high-grade ore deposits found in the McArthur River and Cigar Lake mines in Saskatchewan, Canada. These premier mining assets put Cameco at the forefront of a burgeoning nuclear renaissance as the world grapples with the need for clean, reliable, and secure energy sources.

At the heart of the global transition from fossil fuels to electrification is the anticipated tripling of electricity demand by 2050. This projection is spurred by the widespread adoption of electric vehicles, advancements in low-carbon steel production, and the shift towards cleaner sources of electricity in industrial and transportation sectors. Uranium and nuclear energy are poised to play a pivotal role in this transformation, offering a stable and emissions-free power generation solution.

Asia, especially China and India, is leading the charge in nuclear power generation as part of their efforts to phase out coal and gas generation and accommodate substantial economic growth and large-scale electrification. Similarly, in light of the recent energy crisis, the European Union (EU) now faces a defining moment in its nuclear power strategy with some member states exploring a potential nuclear power revival as a potential alternative to conventional Russian energy sources.

Cameco's integrated capabilities are not limited to just mining but also span the nuclear fuel cycle with facilities like the Blind River Refinery and the Port Hope Conversion Facility, which are essential for producing fuel assemblies for nuclear reactors. These facilities position Cameco to handle an uptick in demand as nations diversify their nuclear energy supply chains previously reliant on Russia.

Amid volatile uranium market prices, Cameco's business model utilizing a mix of fixed and variable price contracts grants it revenue stability. These long-term contracts insulate the company from fluctuations in the spot market, allowing Cameco to plan ahead and align its production and sales rates with evolving market demands.

Recent geopolitical tensions have underscored the importance of energy security. Potential sanctions on Rosatom, Russia's state nuclear entity, have made uranium prices a focal point of market uncertainty. In these times, Cameco's stable production, particularly from its joint venture with Kazakhstans Inkai project, ensures reliable supply to meet market conditions and contract commitments.

Cameco's financial performance and market capitalization, currently at around a $20 billion valuation with a price-to-earnings multiple of 70, indicates investor confidence in the companys growth outlook. However, it is paramount to interpret this valuation within the context of the uranium markets prospective growth, which has historically been cyclical and influenced by prolonged industry downturns.

One of the strategic moves marking Cameco's expansion within the nuclear fuel cycle is its partnership with Brookfield Asset Management to acquire a 49% stake in Westinghouse Electric Company. This investment broadens Camecos reach to include nuclear technology solutions across various business segments, enhancing its revenue streams and solidifying its position in the nuclear energy ecosystem.

Additionally, Cameco's recent stock performance has been noteworthy, buoyed by favorable industry developments. The stock surged by 31% in July, following a 12.5% increase in June. The Canadian government's planned nuclear power expansion and new projects in the United States have cast a spotlight on nuclear energy's potential, reflected in investor confidence.

The company's ability to navigate challenges is evident from its recent partnership with Brookfield Renewable to acquire a major stake in Westinghouse Electric. This move not only diversifies Camecos presence in the nuclear service industry but also establishes a long-term revenue source through service contracts. Despite temporary shareholder uncertainly caused by regulatory scrutiny of the transaction, the outlook remains optimistic for the companys growth trajectory.

Even as the global market undergoes turbulence, notably seen in the drop of Brookfield Renewables stock price, Cameco continues to fortify its position within the nuclear energy sector. Its pursuit of strategic acquisitions and collaborations point towards a deliberate strategy to stand at the vanguard of an industry experiencing renewal and increasing demand.

Furthermore, recent stock gains by Cameco reflect the companys strategic importance in an era prioritizing cleaner energy and reduced reliance on Russian oil and gas. With its expansive operations across key geographic locations, Cameco is uniquely positioned to address the Western world's urgent need for stable and diversified uranium supplies.

The interplay of governmental fiscal measures, cultural advocacy for nuclear power, and the drive for decarbonization creates a fertile environment for Cameco's continued success. Legislative efforts like the Fiscal Responsibility Act of 2023, which supports clean energy initiatives, directly benefit nuclear power projects and uranium suppliers like Cameco. These developments, combined with a positive portrayal of nuclear power in mainstream media, are poised to bolster public and investor support for the industry.

Cameco's recent activities, including the prominent Westinghouse Electric acquisition, signal a strategic pivot that synergizes with global energy trends. The company's expansion into nuclear energy services and dedication to sustainable energy production align with its objectives to grow and deliver shareholder value. By securing a steady dividend payout coupled with prospects for increased demand for nuclear power, Cameco demonstrates its intent to be not just a dividend-paying entity, but a progressive force within the energy sector poised for long-term growth.

Similar Companies in Uranium Mining:

Kazatomprom (KAP), BHP Group (BHP), Rio Tinto Group (RIO), Energy Resources of Australia Ltd (ERA), Paladin Energy (PDN), NexGen Energy (NXE), Ur-Energy Inc. (URG), Energy Fuels Inc. (UUUU), Denison Mines Corp (DML), Uranium Energy Corp (UEC)

News Links:

https://seekingalpha.com/article/4617971-cameco-stock-digging-precious-uranium-ore

https://seekingalpha.com/article/4656748-cameco-time-to-book-some-profits

https://www.fool.com/investing/2023/08/08/why-cameco-stock-soared-31-in-july/

https://www.fool.com/investing/2023/08/02/why-brookfield-renewable-stock-is-falling-today/

https://www.fool.com/investing/2023/03/24/why-uranium-energy-stock-keeps-going-down/

https://www.fool.com/investing/2022/11/06/this-high-yield-dividend-stock-has-massive-growth/

https://www.fool.com/investing/2022/10/14/brookfield-renewable-stock-fall-week-opportunity/

https://www.fool.com/investing/2023/06/01/why-shares-of-uranium-energy-cameco-and-energy-fue/

https://www.fool.com/investing/2022/11/01/3-dividend-stocks-buy-hand-over-fist-in-november/

https://seekingalpha.com/article/4632771-got-uranium-why-cameco-remains-unstoppable

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: IhvqBd