Crown Holdings Inc. (ticker: CCK)

2023-12-16

Crown Holdings Inc., trading under the ticker symbol CCK, is a leading global manufacturer of packaging products for consumer goods. Founded in 1892, the company's historical roots lie in the manufacture of crown cork bottle caps, from which its name is derived. Today, Crown Holdings operates in numerous countries around the world, focusing primarily on metal packaging for food, beverage, household, and other consumer products. Its wide range of products includes steel and aluminum cans for drinks, metal closures, and aerosol packaging. The company has demonstrated a commitment to sustainability, with innovations aimed at producing lightweight packaging and increasing the recyclability of its products. Despite facing competitive pressures and fluctuating raw material costs, Crown Holdings has maintained its position as a key player in the packaging industry by leveraging its extensive manufacturing network, consistent product quality, and strategic acquisitions that expand its product offerings and global reach. Financially, CCK has shown resilience, though it is subject to the cyclical nature of the markets it serves. Investors and analysts often track Crown Holdings for its performance in the consumer cyclical sector and its adaptability to the changing preferences and needs of the packaging sector.

Crown Holdings Inc., trading under the ticker symbol CCK, is a leading global manufacturer of packaging products for consumer goods. Founded in 1892, the company's historical roots lie in the manufacture of crown cork bottle caps, from which its name is derived. Today, Crown Holdings operates in numerous countries around the world, focusing primarily on metal packaging for food, beverage, household, and other consumer products. Its wide range of products includes steel and aluminum cans for drinks, metal closures, and aerosol packaging. The company has demonstrated a commitment to sustainability, with innovations aimed at producing lightweight packaging and increasing the recyclability of its products. Despite facing competitive pressures and fluctuating raw material costs, Crown Holdings has maintained its position as a key player in the packaging industry by leveraging its extensive manufacturing network, consistent product quality, and strategic acquisitions that expand its product offerings and global reach. Financially, CCK has shown resilience, though it is subject to the cyclical nature of the markets it serves. Investors and analysts often track Crown Holdings for its performance in the consumer cyclical sector and its adaptability to the changing preferences and needs of the packaging sector.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 10.87B | 10.68B | 10.43B | 9.93B | 9.86B | 9.72B |

| Enterprise Value | 17.35B | 17.59B | 17.59B | 16.59B | 16.59B | 16.14B |

| Trailing P/E | 21.19 | 22.12 | 17.03 | 13.81 | - | - |

| Forward P/E | 12.41 | 12.18 | 14.14 | 13.14 | 12.00 | 8.86 |

| PEG Ratio (5 yr expected) | 2.34 | - | - | - | - | - |

| Price/Sales (ttm) | 0.89 | 0.86 | 0.82 | 0.78 | 0.78 | 0.80 |

| Price/Book (mrq) | 4.64 | 4.78 | 5.14 | 5.37 | 5.92 | 5.59 |

| Enterprise Value/Revenue | 1.43 | 5.73 | 5.66 | 5.58 | 5.51 | 4.95 |

| Enterprise Value/EBITDA | 10.23 | 36.12 | 37.12 | 42.99 | 47.68 | 40.95 |

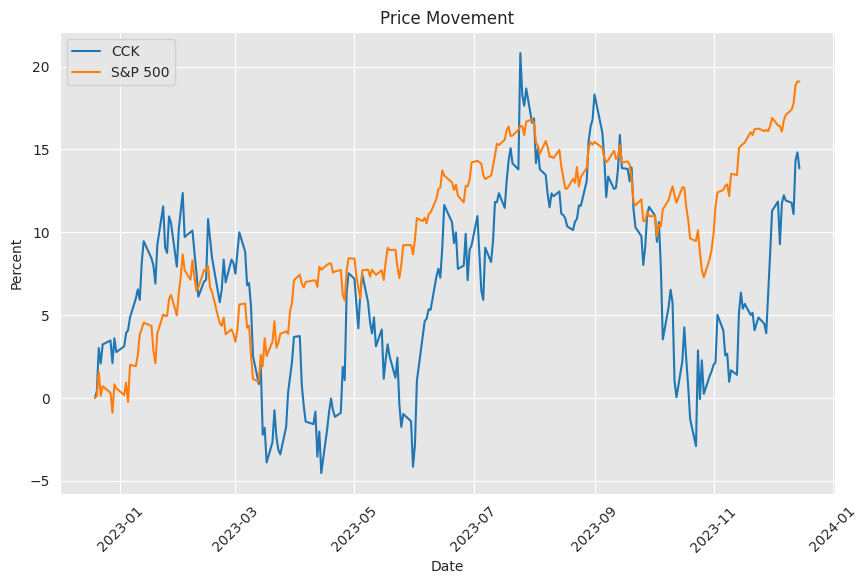

Based on the provided technical analysis data and company fundamentals, a comprehensive review of the stock price movement for the upcoming months can be conducted. The technical indicators suggest a positive momentum, while the fundamentals give us insight into the company's valuation and financial health.

Based on the provided technical analysis data and company fundamentals, a comprehensive review of the stock price movement for the upcoming months can be conducted. The technical indicators suggest a positive momentum, while the fundamentals give us insight into the company's valuation and financial health.

Technical Analysis Insights:

- The Moving Average Convergence Divergence (MACD) shows a value of 1.943066 with a positive histogram at 0.397332, indicating a bullish upward momentum in price.

- Relative Strength Index (RSI) is at 64.497887, which is below the overbought threshold of 70 but still indicates strong buyer interest.

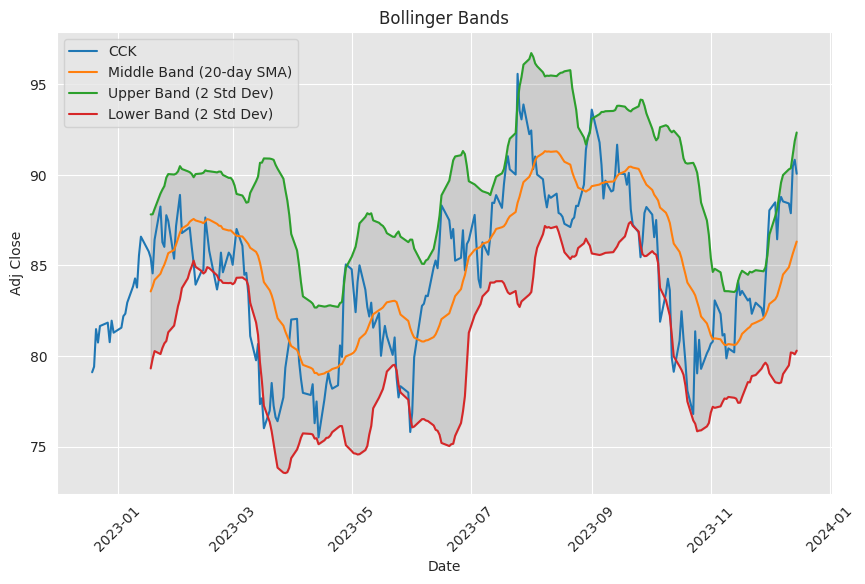

- Bollinger Bands (BBL, BBM, and BBU) are tight with the closing price above the middle band, suggesting strength in the current uptrend.

- Simple Moving Average (SMA) for 20 days and Exponential Moving Average (EMA) for 50 days are both below the last closing price, further validating the bullish trend.

- On Balance Volume (OBV) at 0.577920 million demonstrates good volume supporting the recent price action.

- Stochastic Oscillator values (STOCHk and STOCHd) are in the overbought region, suggesting possible short-term retracements or consolidation.

- The Average Directional Index (ADX) indicates a moderate trend strength at 27.842694.

- Williams %R (WILLR_14) is not in the oversold region, indicating there is still room for upward price movement.

- Accumulation/Distribution indicator, Chaikin Money Flow (CMF), is positive, signifying buying pressure.

- The Parabolic SAR (PSAR) values suggest the trend is currently bullish, with support levels being respected.

Company Fundamentals:

- An increase in Market Cap suggests a growing confidence in the company's value.

- Forward P/E at 12.41 is relatively lower than the trailing P/E of 21.19, implying expectations of increased earnings.

- Price/Sales and Enterprise Value/Revenue ratios indicate that the stock is reasonably valued in relation to its sales.

- The EBITDA and net income figures show the company is profitable with potential for sustained growth.

- A stable interest coverage and EBIT figures show decent financial health and operational efficiency.

Anticipated Price Movement:

Taking into consideration the bullish signals from the MACD, RSI, Bollinger Bands, OBV, and PSAR, it is likely that the stock will continue its upward momentum in the short term. The SMA and EMA also reflect a longer-term uptrend. However, the Stochastic Oscillator suggests that we may expect some short-term pullbacks or consolidations, which are healthy in a continuing uptrend.

The positive technical outlook is complemented by the company's fundamental data. The relatively lower forward P/E hints at an anticipation of improved earnings, which could attract more investors, potentially driving the price up further. Additionally, the increase in Market Cap and stable financials indicate underlying business strength which is conducive to sustained price growth.

In summary, the technical indicators aligned with strong company fundamentals suggest the potential for continued upward price movement over the next few months. However, as with any market analysis, it is crucial to continuously monitor the market for any changes in both technical patterns and fundamental data, which could adjust this outlook. Investors should also consider broader market trends, sector performance, and economic indicators that might influence stock behavior.

Crown Holdings Inc. (CCK), a titan in the metals and packaging industry, has recently drawn a sharp intake of breath from the investment community as its shares witnessed a steep 31% decline in just a single week. This jarring drop came on the heels of a quarterly earnings report which decidedly missed the mark; earnings per share (EPS) settled at $1.06 against an estimated consensus of $1.79. This shortfall took place in the context of revenues tallying $3.26 billion, ominously short of the anticipated $3.32 billion.

Confronted with such unsettling figures, the company has seen its year-to-date stock price diminish by 37%, signaling investor disenchantment and broader concern about its near-term prospects. It is instructive to delve into the causative factors behind these disappointing numbers, not least among them, the negative foreign currency fluctuations which cut a $127 million swath through earnings. This headwind is not a solitary force, but rather one aspect of a spectrum of global economic complexities, from skyrocketing inflation to intensified interest rates, and the reverberations of geopolitical turmoil like the Ukraine conflict. The upshot, an ascendant U.S. dollar's impact on international market dynamics, has exerted further pressure.

Yet, within this landscape of fiscal upheaval, Crown's initiatives suggest a pivot to longer-term resilience and growth. Forthcoming are two new manufacturing facilities in Virginia and Nevada, undertaking strategically to upsurge production capacity. Such developments underscore a narrative of endurance and evolutionary adaptation in spite of jarring market realities.

Contemplating the tremors that have rippled through the fiscal fabric of the company, Crown is not standing idly by. Proactive management has set about sculpting its approach to safeguard financial stability, embracing strategies like trimming capital expenditures and staff restructuring. The adoption of these cost containment efforts characterizes a responsive management attitude, keenly attuned to the hairpin bends of the current economic trajectory.

Cast in the light of investment appeal, there is a particular essence to Crown that continues to intrigue investors. With a potent foothold as a premier supplier of aluminum cans to the burgeoning beverage industry, the company is poised to harness market normalization and subsequent volume growth. The market restructuring has poised its price-to-earnings ratio at an appealing 10.4 by current estimates, which may signify undervalued stock with room for recuperation.

Turning to industry position and market dynamics, Crown stands shoulder to shoulder with companies like Ardagh Metal Packaging and Ball Corporation, both in market approach and value assessment. These companies have seen increased investor focus, partly due to their ability to maintain a profit in a challenging environment. Ardagh, for one, has garnered attention for profitability combined with its considerable dividend yield, which markedly surpasses the average. Crown's parallel financial prudence is indicated by its forward price-to-earnings ratio, which echoes Ardaghs compelling valuations.

The broader economic conditions of 2022 have catalyzed a shift towards more conservative investment strategies. Through these shifting tides, Crown has been adept at navigating, as evinced by its reasonable valuation metrics. The company's valuation of roughly 12 times forward earnings presents a thoughtful consideration in an era when many former SPACs are grappling with valuation pressures.

Noteworthy is the fact that storied investors like Carl Icahn have been drawn to the company, with Icahn acquiring a substantive stake. This engagement by a legend of the investment world may signal a latent value in the packaging and metal manufacturing sphere, potentially buttressing the company's stable status and the sectors investment charm.

Crown's place in its market segment points to adeptness in leveraging opportunities through fiscal maneuvers such as share buy-backs and cautious dividend management. While not expressly noted for these strategies, their position as a profitable entity in a domain where such maneuvers are routine points to a calculated focus on maximization of shareholder value.

In an intriguing turn, the third quarter of 2022 witnessed hedge fund behemoth Third Point, the brainchild of investor Dan Loeb, ratcheting up the value of its portfolio from about $4.22 billion to $5.53 billion. Amid this portfolio augmentation, Third Point offloaded its position in Crown Holdings, although the specifics of this divestiture remain obscured. That Third Point would cast off CCK could imply either a strategic shift or reassessment of future growth potential.

The mastheads of Third Point's portfolio, accounting for a salient 42%, are positions in behemoths like Colgate-Palmolive, PG&E Corp, and Danaher Corp. An activist engagement in the direction of Colgate-Palmolive, advocating for a splintering of the Hill Pet Nutrition business, is demonstrative of the proactive, highly involved investment posture that has become a hallmark of Third Points management style.

The hedge fund diversification is exemplified in Third Point's assorted portfolio, stretching from the traditional equities present in its reports to noteworthy ventures in companies such as Shell and Sony through Third Point Ventures and Third Point Offshore. Paired with hedges against an array of investment conditions, the diversity of asset allocation allows Third Point ample flexibility.

Moreover, Icahn's entrance into the story of Crown Holdings as a significant investor aligns with his historical archetype as an activist investor identifying undervalued opportunities. Crown's sturdy footprint in the beverage packaging sector ostensibly affords both stability and exposure to varied markets a combination that an investor of Icahn's caliber may find appealing. Icahns investment move is suggestive of confidence in Crowns potential to optimize shareholder worth.

Yet, Icahn too has espoused broader market caution, articulating a bearish stance that has seen him assume short positions in companies like GameStop and broader indices such as the S&P 500. This cautious investment posture, particularly in light of market turbulence and his GameStop position held during the meme-stock chaos of 2021, paints the picture of a tactical investor navigating with prudence amid the risks of an inflation-struck economy.

Bringing the story of Crown Holdings full circle is its appearance on the "Rare Stock Picks In November 2023" by Seeking Alpha, a testament according to Equanimity Investing to not only its allure as an investment but also to the potential rebound of profitability latent within. The materials sector, with its characteristic cyclicality, augurs well for companies such as Crown Holdings that may encounter considerable upswings after marked fallbacks.

To capsulize, Crown Holdings Inc., despite financial headwinds and a sharp downturn in stock prices, remains embroiled in a narrative of adjustment and prospective growth. As investors deliberate over the long-term prospects, the account of Crown Holdings unpacks a tale replete with strategic positioning, activist interest, and the quest to transform current volatility into future stability and profit.

News Links:

https://www.fool.com/investing/2022/10/28/why-crown-holdings-stock-plunged-this-week/

https://www.fool.com/investing/2022/12/29/this-stock-is-a-diamond-in-the-rough-and-its-yield/

https://seekingalpha.com/article/4561897-tracking-dan-loeb-third-point-portfolio-q3-2022-update

https://seekingalpha.com/article/4559779-wall-street-breakfast-icahn-vs-gamestop

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: IZv6Bf