Cleveland-Cliffs Inc. (ticker: CLF)

2023-12-16

Cleveland-Cliffs Inc. (NYSE: CLF), founded in 1847, has established itself as a prominent player in the North American iron ore and steel industries. As the largest flat-rolled steel producer and the largest supplier of iron ore pellets on the continent, Cleveland-Cliffs operates a vertically integrated business model. Its operations span mining, pelletizing, as well as steel and finished product manufacturing, including carbon, stainless, electrical, and plate steel products. Cleveland-Cliffs has undergone significant expansion and diversification, particularly with the acquisitions of AK Steel and ArcelorMittal USA in 2020, which enabled the company to expand its footprint in steelmaking and gain considerable market share. Its commitment to environmentally friendly practices is evidenced by the production of Direct Reduced Iron (DRI) and hot briquetted iron (HBI) products that help reduce greenhouse gas emissions from steelmaking. The company's stock, CLF, is actively traded and is considered a bellwether for the domestic manufacturing and construction sectors, as its performance is closely tied to the health of these economic segments.

Cleveland-Cliffs Inc. (NYSE: CLF), founded in 1847, has established itself as a prominent player in the North American iron ore and steel industries. As the largest flat-rolled steel producer and the largest supplier of iron ore pellets on the continent, Cleveland-Cliffs operates a vertically integrated business model. Its operations span mining, pelletizing, as well as steel and finished product manufacturing, including carbon, stainless, electrical, and plate steel products. Cleveland-Cliffs has undergone significant expansion and diversification, particularly with the acquisitions of AK Steel and ArcelorMittal USA in 2020, which enabled the company to expand its footprint in steelmaking and gain considerable market share. Its commitment to environmentally friendly practices is evidenced by the production of Direct Reduced Iron (DRI) and hot briquetted iron (HBI) products that help reduce greenhouse gas emissions from steelmaking. The company's stock, CLF, is actively traded and is considered a bellwether for the domestic manufacturing and construction sectors, as its performance is closely tied to the health of these economic segments.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 9.44B | 7.95B | 8.53B | 9.44B | 8.30B | 6.94B |

| Enterprise Value | 12.87B | 11.88B | 13.03B | 13.66B | 12.72B | 11.56B |

| Trailing P/E | 27.91 | 33.98 | 18.22 | 7.19 | 3.49 | 2.05 |

| Forward P/E | 9.59 | 8.01 | 11.19 | 10.18 | 7.32 | 5.61 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 0.44 | 0.37 | 0.39 | 0.42 | 0.36 | 0.30 |

| Price/Book (mrq) | 1.18 | 1.01 | 1.13 | 1.21 | 1.18 | 1.03 |

| Enterprise Value/Revenue | 0.59 | 2.12 | 2.18 | 2.58 | 2.52 | 2.05 |

| Enterprise Value/EBITDA | 7.15 | 19.10 | 16.61 | 51.95 | 97.10 | 24.29 |

Analyzing the technical data and fundamentals provided for CLF, we can draw several conclusions to forecast the potential movement of the stock price in the upcoming months.

Analyzing the technical data and fundamentals provided for CLF, we can draw several conclusions to forecast the potential movement of the stock price in the upcoming months.

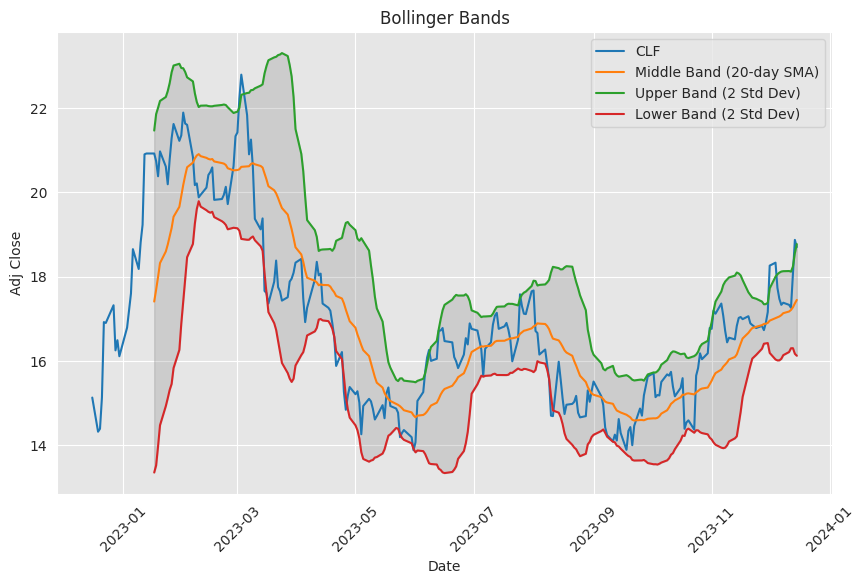

Technical Analysis: - The Adjusted Close price is indicating that the stock closed the last trading day at $18.70. - The Moving Average Convergence Divergence (MACD) is positive, with the MACD line above the signal line, which implies bullish momentum. The MACD histogram also supports this momentum with a positive value. - The Relative Strength Index (RSI) is nearing the overbought territory at 68.38, suggesting that the stock may be due for a pullback or consolidation in the near term. - Bollinger Bands show the stock is trading near the upper band, which may indicate the stock is overextended to the upside in the short-term context. - The stock is trading above both the 20-day Simple Moving Average (SMA) and the 50-day Exponential Moving Average (EMA), signaling an established near-term and medium-term uptrend. - The On-Balance Volume (OBV) shows reasonably high accumulation, indicative of continued investor interest. - Stochastics are in overbought territory with STOCHk higher than STOCHd, typically a sign of a strong uptrend but also a potential for a forthcoming pullback. - The Average Directional Index (ADX) is above 25, which signals a strong trend in place. - The Williams %R indicator suggests that the stock is not in oversold or overbought territory. - The Chaikin Money Flow (CMF) is slightly negative, hinting at a slight reduction in buying pressure. - Parabolic SAR (Stop and Reverse) is below the price, acting as a potential support level that aligns with the current trend.

Fundamental Analysis: - The Market Cap shows a growth trend, indicating increased company valuation over time. - The Trailing P/E ratio is higher than the Forward P/E, which can be interpreted as the market expecting earnings to grow or recognizing that the stock is currently overpriced. - Price/Sales and Price/Book ratios are low, which may suggest the stock is undervalued based on these measures. - Enterprise Value/Revenue and Enterprise Value/EBITDA are currently lower than historical comparisons, which could indicate a potential undervaluation of the company. - The company's financial stability seems solid with growing Net Income, although unusual items and non-operating income expenses present some volatility. - Increase in operating income and gross profit are strong indicators of the company's improving operational efficiency.

Considering both the technical analysis and the fundamentals, it seems likely that CLF's stock price could continue its upward movement in the medium term, riding on the bullish indicators provided by MACD, SMA/EMA, OBV, and ADX. However, the high RSI and proximity to the upper Bollinger Band may suggest a possible short-term retracement or consolidation before the continuation of the uptrend.

Longer-term forecasts must be viewed with the understanding that market dynamics can be influenced by a wide array of unforeseen events, including economic changes, industry shifts, or company-specific news. Therefore, while the trend seems to be positive based on the data available, investors need to stay vigilant and responsive to new information as it becomes available.

Investors should also consider the apparent misalignment between the technical overbought indications and the undervaluation suggested by the fundamental ratios. This might point to a market correction once the broader market deciphers the intrinsic value based on fundamentals.

In conclusion, while short-term fluctuations are likely, the combination of strong technical indicators and supportive fundamentals suggests a positive outlook for CLF stock over the coming months. Continued monitoring of both technical and fundamental aspects will be key to identifying sustained growth versus temporary price spikes.

On October 24, 2023, Cleveland-Cliffs Inc. (NYSE: CLF), a leader in the North American steel industry, conducted its Q3 2023 earnings call, cementing its reputation as a resilient and forward-thinking company. Lourenco Goncalves, the charismatic Chairman, President, and CEO, along with the competent CFO, Celso Goncalves, presented a robust financial picture and shared strategic insights that reveal a company in a strong position despite market challenges.

The firm reported a healthy revenue of $5.6 billion for the third quarter, backed by an impressive adjusted EBITDA of $614 million, and demonstrated solid profitability with GAAP earnings per share of $0.52. The total shipments for the quarter reaching 4.1 million net tons is a testament to the company's extensive capabilities and market demand for its high-quality steel products.

A key achievement of the quarter was the record-setting shipments to the automotive sector, which interestingly coincided with a UAW strike affecting three of Cleveland-Cliffs' clients. This not only signifies the company's resilience and strategic partnerships but also its ability to mitigate and navigate complex labor market scenarios effectively.

Financially, Cleveland-Cliffs has continued to strengthen its balance sheet, generating $605 million of free cash flow during the quarter. This robust cash generation enabled the company to reduce its net debt down to $3.4 billion. In addition to debt reduction, boosting total liquidity to a record $4.4 billion provides the firm with substantial financial flexibility.

Shareholders have reasons to be optimistic as well, with Cleveland-Cliffs demonstrating a commitment to returning value through the repurchase of 3.9 million shares, totaling approximately $60 million. This reflects confidence in the long-term value of the company and an acknowledgement of the importance of delivering shareholder value.

One of the remarkable stories within this quarter's performance was the company's successful cost-control efforts. The year-over-year reduction in unit costs by $165 per net ton, translating to an enormous $2.7 billion in annual savings, positions the company favorably in an industry where cost management is a critical determinant of profitability. Further cost reductions on the horizon, including $250 million in metallurgical coal and $150 million in natural gas, add to an outlook of continued fiscal prudence and operational efficiency.

Lourenco Goncalves teased the market with hints of a "potential exciting and transformational opportunity," intriguing stakeholders and signaling that big moves might be on the horizon. This declaration of intent showcases a company not content with the status quo but rather one that has its sights set on growth and industry leadership.

On the environmental front, Cleveland-Cliffs continues to make strides toward becoming a greener steel producer. The company's negotiations and contracts around metallurgical coal and natural gas and the integration of HBI and scrap into blast furnaces are moves that result in reduced carbon intensity. With the emphasis on clean hydrogen innovations, Cleveland-Cliffs also anticipates playing a significant role in the U.S. Department of Energy's initiative to create hydrogen hubs, having already committed to purchasing a considerable output from the Midwest hydrogen hub.

The automotive industry, ever critical to Cleveland-Cliffs, remains a strong point, with the management team expressing confidence in their ability to maintain a competitive edge, notwithstanding increasing competition and the pressures of steel importation and material substitution. The commitment to excellence in client relations and just-in-time delivery were highlighted as part of the strategic advantage the company holds.

During a period of transformation within the steel industry, financial analysts from The Motley Fool have spotlighted Cleveland-Cliffs as a prime candidate for investors seeking strong dividend stocks. Amidst the cycles of fluctuating commodity prices and varying demand, CLF is seen as a strong contender for stable dividends, an attractive proposition for yield-seeking shareholders.

The Motley Fool further adds that Cleveland-Cliffs' diverse portfolio, fortified by its strategic acquisitions, bolsters its ability to withstand industry volatilities and maintain dividends. This sustainable dividend capacity underscores CLF's financial strength and the efficiency of its management, making it a compelling option when compared to other industry players like ExxonMobil and Chevron.

The company's market standing also becomes intriguing when considering the recent bid to acquire competitor United States Steel (X). The proposed bid of $35 per share, a combination of cash and stock, showcases the company's aggressive growth strategy. While U.S. Steel rejected the offer, favoring another private buyer, the bid itself shows Cleveland-Cliffs' intent to reshape the industry's competitive landscape. However, the ultimate impact on shareholders is multifaceted, with U.S. Steel shareholders facing a decision between selling at a premium or waiting for possibly higher offers.

Cleveland-Cliffs' approach to United States Steel represents a bold attempt to boost its position in the global steel production market significantly. This fervor for expansion comes amidst a somewhat challenging financial performance in the preceding year. The expected downturn in net income, EBITDA, and earnings per share for 2022 reveals a company confronting increased costs and grappling with factors such as renegotiated labor agreements.

With regard to the United States Steel scenario, Cleveland-Cliffs is set to contend with significant financial decisions, including the funding of the acquisition, which may involve leveraging U.S. Steel's cash reserves or assuming further debt. The implications of this potential deal for both Cleveland-Cliffs and the broader steel industry are considerable.

The electrification of the automotive industry presents new opportunities for Cleveland-Cliffs, especially when factoring in the increased demand for steel in the manufacturing of electric vehicles (EVs). Key analysts at The Motley Fool, such as Jason Hall and Tyler Crowe, recognize Cleveland-Cliffs' important role in this growing segment. While EV stocks have experienced volatility, Cleveland-Cliffs provides a more stable opportunity due to its pivotal supplier status. The long-term prospects, boosted by governmental environmental initiatives, bode well for the company.

Despite temporary setbacks in stock value later in the year, Cleveland-Cliffs bounced back with strategic moves and labor agreements that suggest a strong communication channel with unions. This can be pivotal when undergoing significant strategic shifts such as company takeovers. The company's aggressive actions in the wake of unfavorable economic signals demonstrate its willingness to seek growth avenues and economies of scale even in an industry known for its intense competition.

Lastly, Cleveland-Cliffs is navigating a dynamic industry landscape marked by technological investments and strategic acquisitions. Its interest in United States Steel's operations shows a willingness to embrace modernization and potentially realize economies of scale. While there are ongoing strategic pursuits such as the bid for United States Steel, investors and analysts are intently watching Cleveland-Cliffs' next steps, which could reshape the steel industry in North America.

News Links:

https://www.fool.com/investing/2023/09/14/bargain-hunting-for-dividend-stocks-this-high-yiel/

https://www.fool.com/investing/2023/08/21/you-cant-control-acquisitions-but-you-can-control/

https://www.fool.com/investing/2023/08/18/why-united-states-steel-stock-soared-367-this-week/

https://seekingalpha.com/article/4636682-cleveland-cliffs-us-steel-step-too-far

https://www.fool.com/investing/2023/09/15/bargain-hunting-in-2023-a-sneaky-ev-stock-to-buy-o/

https://www.fool.com/investing/2023/09/05/why-cleveland-cliffs-stock-fell-in-august/

https://www.fool.com/investing/2023/11/09/this-industrial-stock-is-finally-ready-to-shine-is/

https://seekingalpha.com/article/4636492-wall-street-breakfast-podcast-fedex-pops

https://www.fool.com/investing/2023/10/07/united-states-steel-buy-sell-or-hold/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: iBDjafy