Comcast Corp (ticker: CMCSA)

2023-12-16

Comcast Corporation (ticker symbol: CMCSA) is a global media and technology company divided into three primary businesses: Comcast Cable, NBCUniversal, and Sky. Comcast Cable, operating under the Xfinity brand, is one of the United States' largest providers of video, high-speed internet, voice, and security and automation services to residential customers. It also provides these services to businesses and has a wireless mobile network under Xfinity Mobile. NBCUniversal is a diverse media company that includes a valuable portfolio of news, entertainment, and sports cable networks, the NBC and Telemundo broadcast networks, television production operations, television station groups, Universal Pictures, and Universal Parks and Resorts. In 2018, Comcast expanded internationally by acquiring Sky, a leading entertainment and communications company that serves customers primarily in Europe, providing direct-to-consumer television and broadband services, along with content creation. The company focuses on technology and innovation, with ongoing investments in its network infrastructure to provide a reliable customer experience and support the increasing demand for high-speed internet and new services.

Comcast Corporation (ticker symbol: CMCSA) is a global media and technology company divided into three primary businesses: Comcast Cable, NBCUniversal, and Sky. Comcast Cable, operating under the Xfinity brand, is one of the United States' largest providers of video, high-speed internet, voice, and security and automation services to residential customers. It also provides these services to businesses and has a wireless mobile network under Xfinity Mobile. NBCUniversal is a diverse media company that includes a valuable portfolio of news, entertainment, and sports cable networks, the NBC and Telemundo broadcast networks, television production operations, television station groups, Universal Pictures, and Universal Parks and Resorts. In 2018, Comcast expanded internationally by acquiring Sky, a leading entertainment and communications company that serves customers primarily in Europe, providing direct-to-consumer television and broadband services, along with content creation. The company focuses on technology and innovation, with ongoing investments in its network infrastructure to provide a reliable customer experience and support the increasing demand for high-speed internet and new services.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 178.96B | 182.91B | 171.69B | 158.44B | 151.19B | 126.81B |

| Enterprise Value | 275.02B | 273.26B | 261.69B | 248.50B | 237.95B | 213.53B |

| Trailing P/E | 12.38 | 27.89 | 31.01 | 31.33 | 29.64 | 9.55 |

| Forward P/E | 10.38 | 10.54 | 11.89 | 10.15 | 9.36 | 7.52 |

| PEG Ratio (5 yr expected) | 0.38 | 0.76 | 0.84 | 0.72 | 0.72 | 0.57 |

| Price/Sales (ttm) | 1.55 | 1.57 | 1.50 | 1.38 | 1.30 | 1.10 |

| Price/Book (mrq) | 2.17 | 2.14 | 2.08 | 1.96 | 1.84 | 1.39 |

| Enterprise Value/Revenue | 2.28 | 9.07 | 8.58 | 8.37 | 7.79 | 7.15 |

| Enterprise Value/EBITDA | 7.16 | 27.28 | 25.50 | 24.78 | 29.32 | 333.11 |

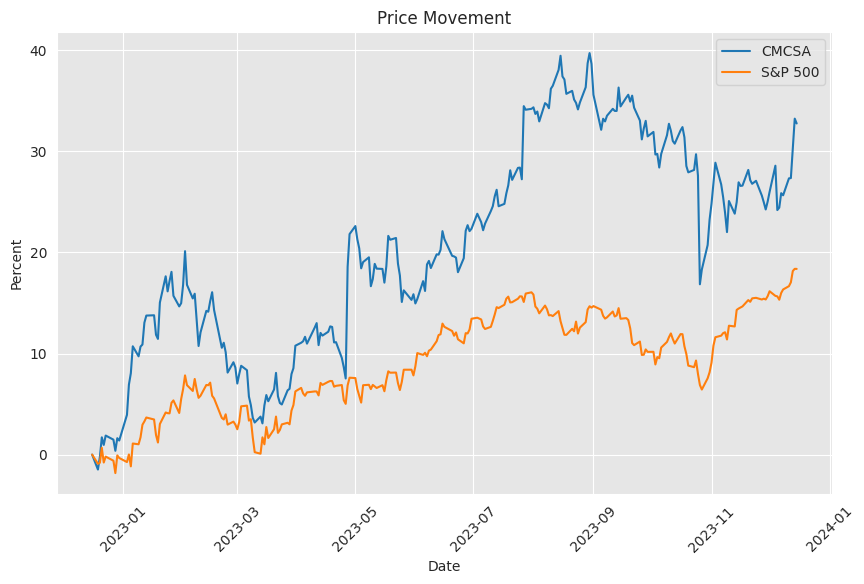

Based on the provided technical analysis data and company fundamentals, a comprehensive examination of the stock price movement for Comcast Corporation (NASDAQ: CMCSA) suggests a potentially positive outlook heading into the upcoming months.

Based on the provided technical analysis data and company fundamentals, a comprehensive examination of the stock price movement for Comcast Corporation (NASDAQ: CMCSA) suggests a potentially positive outlook heading into the upcoming months.

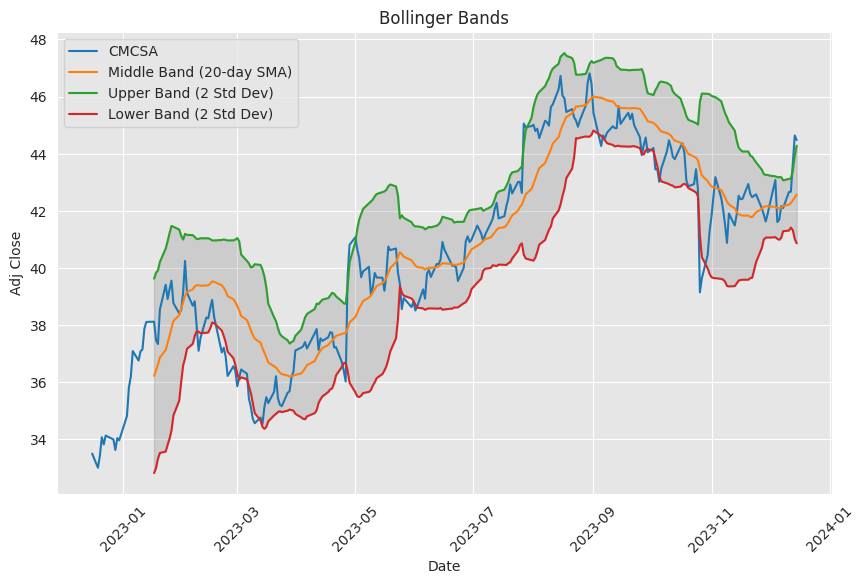

Technical Indicators: - The Adjusted Closing Price on the last trading day showed strength at 44.48 USD. - The Moving Average Convergence Divergence (MACD) is positive, with the MACD histogram indicating increasing momentum, which is a bullish signal. - The Relative Strength Index (RSI) is above 60 but has not yet crossed into the overbought territory (above 70), suggesting that the stock has room for further gains before it might face pressure from sellers. - Bollinger Bands reveal the price closing near the upper band, indicating a strong price trend and potential continuation. - The stock price is above both the Simple Moving Average (SMA) for 20 days and the Exponential Moving Average (EMA) for 50 days, showing sustained, medium-term bullish sentiment. - On-Balance Volume (OBV) is high, demonstrating strong buying interest and accumulation by investors. - The Stochastic Oscillator (STOCH) shows the stock in overbought territory, which typically indicates strong buying interest but can also signal a possible pullback if buying pressure wanes. - The Average Directional Index (ADX) is below 25, suggesting that the trend strength is moderate and not yet fully established. - The Williams %R is in the overbought territory, which often accompanies strong price moves but can also precede a reversal if buyers become exhausted. - The Chaikin Money Flow (CMF) is positive, indicating buying pressure and inflow of money into the stock. - The Parabolic SAR (Stop and Reverse) is below the price, supporting the bullish trend.

Fundamentals: - The market capitalization shows a steady increase over the past quarters, reflecting confidence in the stock from the market participants. - Price-to-earnings (P/E) ratios, both trailing and forward, indicate the stock is reasonably valued compared to its earnings, and the decreasing forward P/E suggests expectations of higher profitability. - The PEG ratio is below 1, indicating potential undervaluation based on earnings growth prospects. - Price-to-Sales (P/S) and Price-to-Book (P/B) ratios have shown an increase, potentially indicating that the market is willing to pay more per unit of sales and book value, a positive sentiment indicator. - Enterprise Value multiples such as EV/Revenue and EV/EBITDA provide mixed signals, with some values increasing possibly due to the debt or changing market conditions but still within a reasonable range.

Financial Performance: - Tax Effect of Unusual Items shows volatility in financial items which may not recur, potentially distorting earnings. - Net Income trends are essential to observe, as they indicate profitability. The most recent 2022 figures demonstrate a substantial drop from the previous year, requiring decomposition to understand the underlying factors. - Reconciled Cost of Revenue and Operations expenses provide insights into the company's efficiency and margins. - The stability in Reconciled Depreciation suggests consistent capital expenditure over the periods. - Other income and expense items, such as non-operating interest and operating income, must be analyzed for non-recurring events that could impact comparative performance.

In synthesizing the technical and fundamental data, CMCSA exhibits signs of continued bullishness with room for growth. Technical indicators mostly signal strength and a positive trend, albeit with caution due to some overbought conditions which could prompt periodic retracements. From a fundamental perspective, the valuation metrics point towards a fairly valued enterprise with healthy profitability metrics. The consistent growth in market cap supports the notion of investor confidence. Nevertheless, careful attention should be paid to the detailed fundamental elements, such as changes in net income and non-recurring financial items, which may affect investor sentiment.

In conclusion, the combination of technical analysis and solid company fundamentals suggest that CMCSA is poised for a continuation of its positive trend in the short to medium term, assuming that the market conditions remain favorable and no significant negative developments arise. Investors should closely monitor the evolving financial performance and market sentiment for any signs of divergence from these expectations. It's important to note that TA is not a guarantee of performance and should be used in conjunction with other investment due diligence.

Comcast Corporation, a global media and technology company, has established itself as a prominent player in the telecommunications industry. Headquartered in Philadelphia, Pennsylvania, the company's operations are divided into two primary businesses: Comcast Cable and NBCUniversal. Comcast Cable is one of the United States' largest providers of video, high-speed internet, and phone services to residential customers under the Xfinity brand, while NBCUniversal's portfolio includes news, entertainment, and sports cable networks, the NBC and Telemundo broadcast networks, television production operations, and a suite of digital properties.

Comcast has consistently focused on expanding its broadband services and has made significant investments in network infrastructure to support the delivery of faster internet speeds and improved connectivity. This strategy is reflective of the increasing importance of high-speed internet in both residential and commercial markets, and Comcast's concerted efforts to deliver value-added services such as cybersecurity and smart home offerings, leveraging the synergies of its extensive network.

At the core of Comcast's success in the broadband domain is the company's innovative Xfinity xFi platform, which offers customers enhanced control over their home Wi-Fi networks. xFi gives users the ability to manage their network settings, monitor data usage, and implement parental controls, which have become essential features for modern internet users seeking robust digital experiences.

In the media content sector, NBCUniversal has become a prominent content generator and distributor. This is evident through the company's substantial content library and its involvement in the production and distribution of both film and television programming. NBCUniversal's content is not only distributed through traditional cable and broadcast channels but also through various digital platforms, including the company's own streaming service, Peacock. Launched in July 2020, Peacock has emerged as a key player in the streaming landscape, offering a mix of original programming, movies, and reruns, as well as news, sports, and pop culture content.

Comcast's acquisition strategy has played a pivotal role in its expansive market presence. Past acquisitions, such as the purchase of Sky, have not only extended Comcast's reach into international markets but also opened up new avenues for content creation and distribution. Sky, which operates in several European countries, provides Comcast with a broad platform for distributing its media assets and harnessing additional subscriber revenues.

Advertising also continues to be a critical revenue stream for Comcast, particularly within NBCUniversal's broadcast and cable networks. The ability to reach a wide audience through its various media outlets provides advertisers with value, and Comcast with a reliable source of income. The company has also ventured into addressable advertising, providing a more personalized advertising experience to viewers and thereby driving higher engagement and value for advertisers.

In relation to customer retention and growth, Comcast has made considerable steps in enhancing customer service and satisfaction. The company recognizes that high-quality customer service is essential for maintaining subscriber loyalty in a competitive environment. By investing in customer experience and support, including the implementation of more effective problem-resolution processes and the use of artificial intelligence for customer interactions, Comcast aims to reduce churn and solidify its customer base.

Financially, Comcast has consistently delivered robust results with healthy revenue growth and strong cash flow generation. The company's financial strength has enabled it to invest in new technologies, expand its services, and return value to shareholders through dividends and share buybacks. The commitment to maintaining a sound financial position has positioned Comcast well for tackling future investments and weathering economic downturns.

The company's strategic emphasis on innovation is seen through its technology arm, Comcast Technology Solutions, which offers a suite of services to broadcasters, advertisers, and content providers. These services range from video management to ad delivery solutions, reflecting the company's forward-thinking approach in anticipating the evolving needs of the industry.

Comcast has placed a strong emphasis on corporate social responsibility, engaging in various initiatives that enhance digital literacy, increase internet accessibility, and promote sustainability. Programs like Internet Essentials have been instrumental in bridging the digital divide by providing low-cost internet service to millions of individuals and families.

In summary, Comcast's diverse portfolio, strategic investments, and commitment to innovation and customer satisfaction have established it as a forerunner in both the media and telecommunications sectors. The company's efforts have paid off in the form of a robust customer foundation, growing digital capabilities, and an expanding global footprint, which together position Comcast for continued success in a rapidly changing industry landscape.

News Links:

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: HPVMtc

https://reports.tinycomputers.io/CMCSA/CMCSA-2023-12-16.html