Canada Nickel Company Inc. (ticker: CNIKF)

2024-01-14

Canada Nickel Company Inc. (ticker: CNIKF) is a resource company focused on the exploration and development of nickel and associated cobalt and iron products critical for the burgeoning electric vehicle (EV) and stainless steel markets. Established with the intent of becoming a key player in the sustainable extraction and supply of nickel, Canada Nickel Company is currently developing its flagship Crawford Nickel-Cobalt Sulphide Project, located in the heart of the prolific Timmins-Cochrane mining camp in Ontario, Canada. The project boasts significant potential due to its large size, its favorable location with respect to infrastructure, and an innovative approach to processing that aims to reduce its environmental footprint. With the growth of the electric vehicle sector and an increasing global focus on green technologies, the demand for nickel is expected to rise, positioning Canada Nickel Company as a company with the potential for significant growth and relevance in the global market. The company's ticker, CNIKF, facilitates investment and trading by interested parties in over-the-counter (OTC) markets.

Canada Nickel Company Inc. (ticker: CNIKF) is a resource company focused on the exploration and development of nickel and associated cobalt and iron products critical for the burgeoning electric vehicle (EV) and stainless steel markets. Established with the intent of becoming a key player in the sustainable extraction and supply of nickel, Canada Nickel Company is currently developing its flagship Crawford Nickel-Cobalt Sulphide Project, located in the heart of the prolific Timmins-Cochrane mining camp in Ontario, Canada. The project boasts significant potential due to its large size, its favorable location with respect to infrastructure, and an innovative approach to processing that aims to reduce its environmental footprint. With the growth of the electric vehicle sector and an increasing global focus on green technologies, the demand for nickel is expected to rise, positioning Canada Nickel Company as a company with the potential for significant growth and relevance in the global market. The company's ticker, CNIKF, facilitates investment and trading by interested parties in over-the-counter (OTC) markets.

| Address | 130 King Street West, Suite 1900 | City | Toronto | State | ON |

| Zip | M5X 1E3 | Country | Canada | Website | https://canadanickel.com |

| Industry | Other Industrial Metals & Mining | Sector | Basic Materials | Incorporation Year | 2019 |

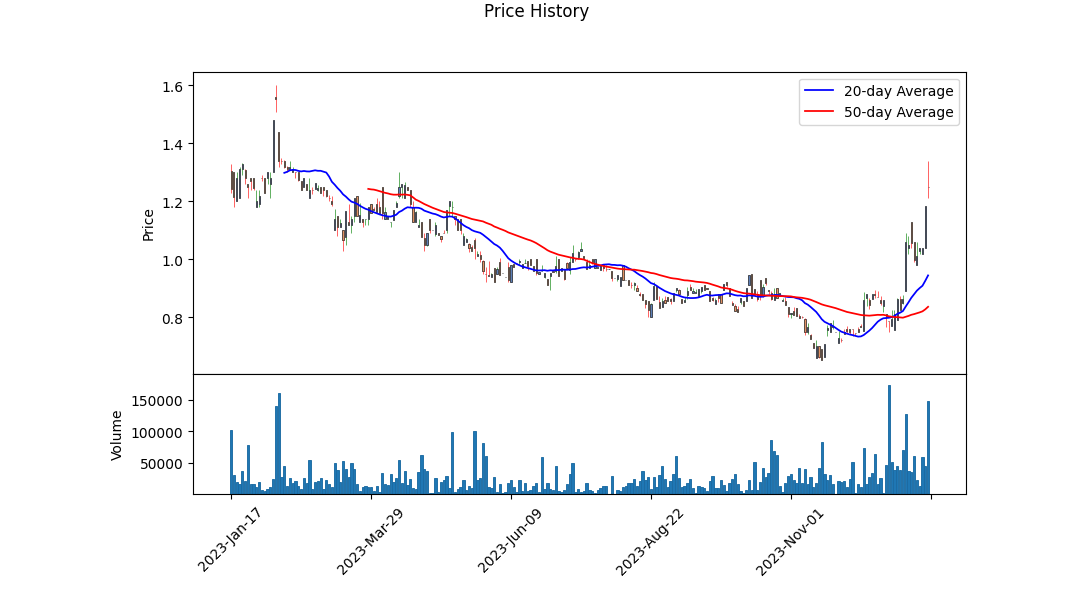

| Market Cap | 202,631,232 | Previous Close | 1.185 | Volume | 148,330 |

| Average Volume (10 days) | 61,990 | 52 Week Low | 0.653 | 52 Week High | 1.6 |

| Fifty Day Average | 0.83608 | 200 Day Average | 0.939255 | Shares Outstanding | 161,396,992 |

| Total Cash | 7,560,687 | Total Debt | 346,802 | Book Value | 1.116 |

| Current Price | 1.25 | Return on Assets | -0.041020002 | Return on Equity | -0.0947 |

Technical Analysis:

Technical Analysis:

- The price movement in the last few trading sessions shows considerable bullish momentum, with the stock price of CNIKF moving from 0.890 to 1.250, culminating in a significant gap up on the last trading day from 1.185 to 1.250. This suggests a strong buying interest and positive sentiment among market participants.

- The Parabolic SAR (PSAR) indicator has a consistently increasing acceleration factor (PSARaf_0.02_0.2), which indicates a strengthening trend. Given the PSAR is below the price, it suggests that the uptrend is currently robust and may maintain its pace.

- On Balance Volume (OBV) shows a substantial increase in volume on the last trading day, which corroborates the price rise and reflects a higher degree of participation by investors.

- The MACD histogram (MACD_histogram_12_26_9) is positive and has been trending upwards, indicating the momentum is in favor of the bulls and the current trend might continue.

Fundamental Analysis:

- The balance sheet shows a solid foundation with a substantial increase in tangible book value over the past three years, which could bring confidence to long-term investors about the company's underlying value.

- Net debt is relatively low compared to the company's equity, indicating a manageable debt level that might not constrain the company's financial flexibility.

- Working capital is negative, which could potentially point to short-term financial difficulties or inefficiencies in managing working capital.

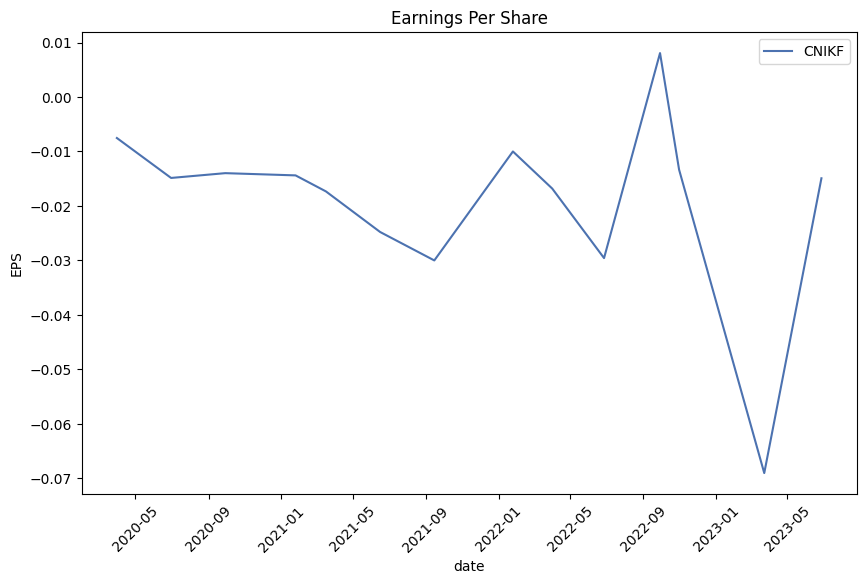

- Annual financials reveal a consistent net loss position, although it has improved over the last three reported years. This might concern investors looking for profitability but could also suggest a trend toward reducing losses over time.

Balance Sheet Data:

- The company has a substantial amount of tangible book value which suggests assets are significant compared to its market capitalization.

- There is an increase in both total debt and the number of common shares, indicating the company may have financed debt through equity offerings, potentially diluting current shareholders but also providing capital for growth or operational needs.

Cash Flow Data:

- Free cash flow has been negative, implying the company may not be generating enough cash from operations to sustain and grow its business without external financing.

- The increase in the issuance of debt and capital stock, particularly common stock issuance, suggests the company is actively seeking to raise capital, which, while dilutive, provides necessary funds for operations and investment activities.

Considering the confluence of technical and fundamental factors:

- The recent sharp increase in stock price alongside high volume suggests a bullish outlook in the short term. The positive trend in technical indicators may attract additional interest from momentum traders and investors.

- Long-term prospects could be under pressure from persistent negative working capital and lack of positive free cash flow. The trend towards reducing net losses may be a sign of operational improvements, yet profitability remains a concern.

- Analyst expectations are absent in the data provided. However, given the market dynamics and company fundamentals, a cautious approach might be taken by long-term fundamental investors, while short-term traders could capitalize on the current bullish trend.

Over the next few months, if the company can maintain momentum and possibly release favorable news or financials, the stock price may see further appreciation. However, the underlying fundamental challenges could eventually catch up, necessitating a careful evaluation of entry and exit points. Continual monitoring of both technical signals and fundamental health of the company is advised to stay aligned with the evolving market conditions.

| Statistic Name | Statistic Value |

| Alpha | 0.1108 |

| Beta | 1.0754 |

| R-squared | 0.060 |

| Adj. R-squared | 0.059 |

| F-statistic | 56.44 |

| Prob (F-statistic) | 1.41e-13 |

| Log-Likelihood | -2,623.6 |

| No. Observations | 887 |

| AIC | 5,251 |

| BIC | 5,261 |

In this linear regression analysis, the variable CNIKF is regressed upon SPY, which acts as the market benchmark. This provides insights into how closely CNIKF follows or reacts to movements in the SPY. The alpha () of 0.1108 in the model suggests that, on average, CNIKF has outperformed the SPY by approximately 11.08 basis points when the market's return is zero. Alpha is a key metric because it represents the portion of returns not explained by the markets movements and is indicative of the assets intrinsic value or performance attributable to the asset-specific factors.

The beta () coefficient of the model stands at 1.0754, reflecting that CNIKF tends to move slightly more than proportionally compared to the SPY. A beta greater than 1 implies higher volatility or risk relative to the market. The R-squared value of 0.060 indicates that only 6% of the variance in CNIKF's returns can be explained by the market returns, highlighting a relatively weak linear relationship. The F-statistic value and its associated probability suggest that the model is statistically significant, although given the low R-squared value, the explanatory power of the model is limited.

Canada Nickel Company Inc. (TSX-V:CNC, OTCQX:CNIKF) saw its share price soar on January 12, 2024, in response to a strategic investment by Samsung SDI. The bullish market sentiment was spurred by an investment of US$18.5 million into Canada Nickel, netting Samsung SDI an 8.7% stake in the company. This transaction involved Samsung SDI acquiring roughly 15.6 million shares at C$1.57 each. This funding is instrumental in securing Samsung SDI an interest in the Crawford Nickel-Cobalt Project, with the option to purchase a 10% equity stake for an additional US$100.5 million, subject to a final construction decision. This partnership not only reflects an investment but also ties into the framework for supply agreements, granting Samsung rights to a share of production from the site.

With Samsung SDI's investment, Canada Nickel CEO Mark Selby acknowledged the pivotal opportunity to forge decisive ties within the electric vehicle battery supply chain through the partnership. This sentiment was echoed by Samsung SDI's Executive Vice President, Ikhyeon Kim, who stressed the prospective contributions of the joint venture towards expanding the battery industry. The immediate effect of the news on Canada Nickel's valuation was evident. The company's stock price lifted to C$1.66 soon after the news had circulated, signaling investor optimism.

Canada Nickel's endeavors for sustainable and ethical nickel sourcing are further emphasized by an additional investment made by another significant mining player, Agnico Eagle Mines Limited. On January 2, 2024, Agnico Eagle invested C$23.1 million to gain a 12% equity stake in Canada Nickel, which could balloon to 15.6% assuming the exercise of warrants. The investment is part of a broader scheme, including a C$34.7 million financing effort by Canada Nickel, enhancing its ability to explore and develop its nickel deposits in Northern Ontario.

Enthusiasm surrounds the Crawford project, with Canada Nickel setting its sights on production commencement by 2027. With successful execution, it is touted to become one of the largest nickel operations worldwide. This ambition is supported by the strategic location of Canada Nickel's assets near Agnico Eagle's operations in the prolific Abitibi region, indicating potential collaborative synergies.

The positive corporate developments were momentarily preceded by a resumption in trading for Canada Nickel, as announced by the Canadian Investment Regulatory Organization (CIRO) effective the morning of January 12, 2024. The resumption followed a brief trading suspension, during which CNC shares remained at $1.2500, up 5.49%. The suspension likely tied to ensuring an orderly market prior to significant announcements. The regulatory framework in Canada ensures market fairness, and this resumption of trading served as a clear exemplar of this system at work.

The resumption in trading occurred amid a significant announcement involving a high-value agreement with Samsung SDI. Samsung SDI's investment decision underpins confidence in Canada Nickel's strategic assets and environmental commitments. As per the terms of the agreement, the deal could see Samsung SDI obtaining rights to 10% equity interest in the Crawford project, reinforcing the strategic link between the companies and suggesting a strong outlook on net-zero carbon metal production, an increasingly valued aspect in the market.

The timing of these strategic movements is also of note. The announcement of Samsung SDI's pledge to invest in Canada Nickel came just a day after the trading halt implemented by CIRO on January 11, 2024, with the reason for the halt cited as "Pending News."

This vitality in Canada Nickel's corporate narrative was bolstered by Agnico Eagle's entry into a substantive investment agreement, acquiring a substantial number of Canada Nickel units on January 2. Agnico Eagle's investment was made after extensive due diligence, signaling robust confidence in the prospects of the critical minerals sector and in Canada Nickel's asset base, especially the Crawford project. The investment brims with strategic foresight, potentially enhancing Agnico Eagle's footprint in the evolving nickel industry.

Last but not least, molding the financial terrain for Canada Nickel's forthcoming endeavors, December 18, 2023, marked the announcement of an extended repayment date for the US$12 million loan from Auramet International, Inc. Progressing to January 18, 2024, the updated timeframe provides a reprieve for Canada Nickel, coinciding with ongoing financial and offtake initiatives. Auramet is a significant metals trading firm known for its diversified service range, covering direct lending, project finance advisory, and a strong emphasis on ESG commitments, fitting well within Canada Nickel's environmental aspirations.

Fluctuations in the share price, strategic partnerships, and financing adjustments illustrate Canada Nickel's active and strategic approach to positioning itself within the growing electric vehicle and stainless steel markets. The company's commitment to net-zero carbon production, amidst a landscape of dynamic collaboration and investment, crafts a portrait of an organization determined to be at the forefront of responsible resource development.

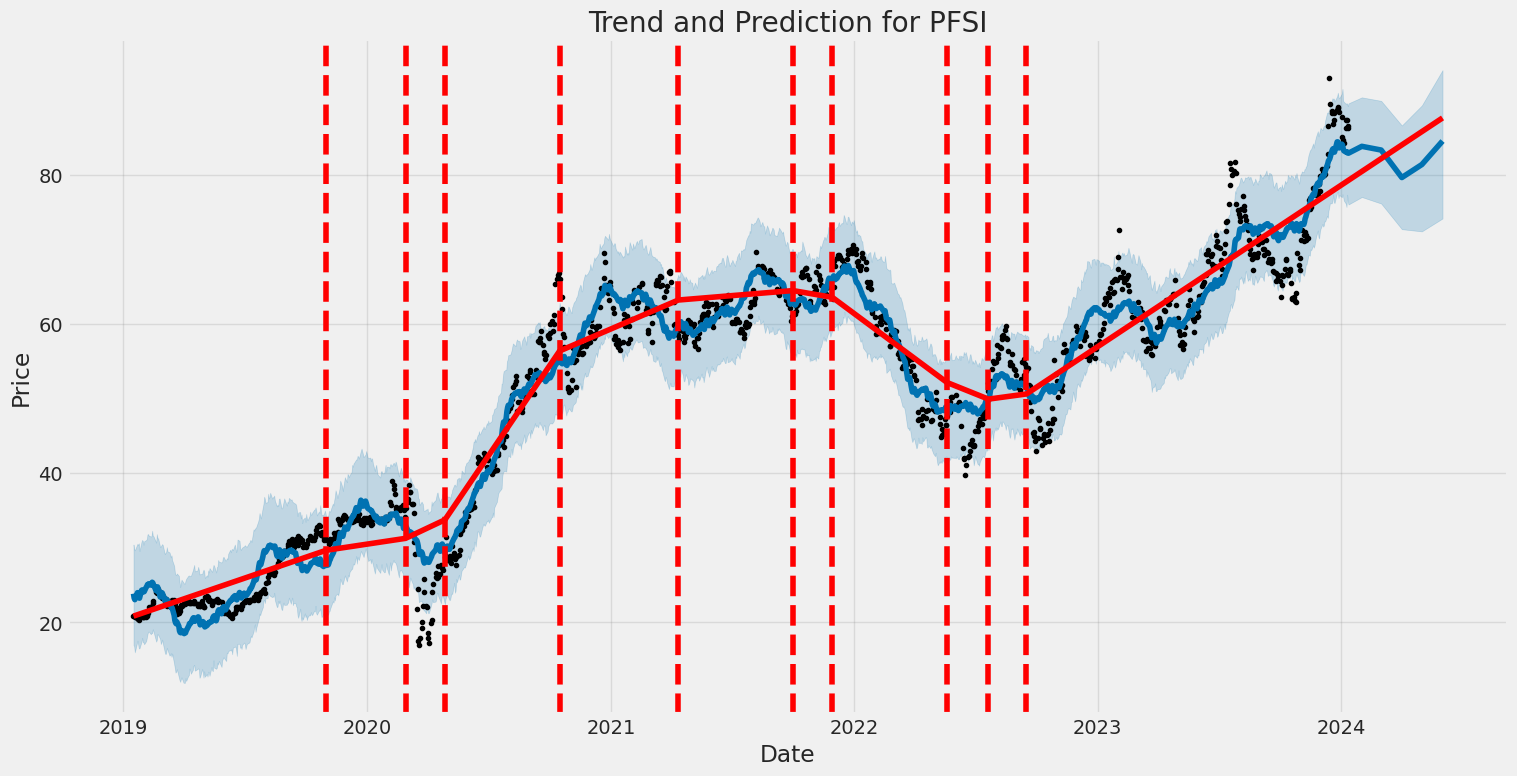

Canada Nickel Company Inc. (CNIKF) experienced significant price movements from July 2020 to January 2024. The company's stock returns showed notable fluctuations, indicating an unstable investment environment. Despite efforts at prediction, the statistical model indicates that the returns are hard to forecast with zero mean implying an absence of a stable average return over the period analyzed.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2537.71 |

| AIC | 5079.42 |

| BIC | 5088.99 |

| No. Observations | 887 |

| Df Residuals | 887 |

| omega | 12.7608 |

| alpha[1] | 0.4398 |

The financial risk analysis of a $10,000 investment in Canada Nickel Company Inc. (CNIKF) over a 30-day period requires a detailed examination of the stock's past performance to gauge its future risk profile. The approach used combines volatility modeling and machine learning predictions to analyze the stock's potential price movements and the associated risk.

Volatility modeling is employed to understand the dynamics of Canada Nickel Company Inc.'s stock price fluctuations. This econometric technique is particularly adept at capturing the 'clustering' effect of volatility, meaning periods of high volatility tend to be followed by high volatility and vice versa for low volatility periods. By fitting this model to the historical stock price data, one can estimate the variance (i.e., volatility squared) of the stock returns, which changes over time according to past variances and residuals.

These volatility estimates are then used as inputs in the machine learning predictions aspect of the analysis. Specifically, a machine learning regression algorithm is designed to incorporate various features, including historical price data and volatility measures, to predict the future returns of CNIKF. It learns from the patterns in the data and is able to identify the complex nonlinear relationships between the input variables and the stock returns. This capability can unveil insights that traditional linear models may overlook.

Focusing on the results, specifically the calculated Value at Risk (VaR) at a 95% confidence interval of $-102.08, provides critical risk information. VaR is a statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over a specific time frame. A VaR of $-102.08 at a 95% confidence interval suggests that there is a 5% chance that the investment could lose more than $102.08 over the 30-day period, reflecting the investor's potential loss threshold.

By integrating both volatility modeling and machine learning predictions, a comprehensive risk profile for the investment in CNIKF is established. The former directly informs the latter by providing a nuanced understanding of the stock's fluctuating risk levels, which the machine learning algorithm uses, along with other features, to make more informed predictions about future returns. The resulting VaR offers a quantifiable and interpretable measure that helps investors to grasp the maximum expected loss they might face with 95% certainty, crucial for making risk-aware investment decisions.

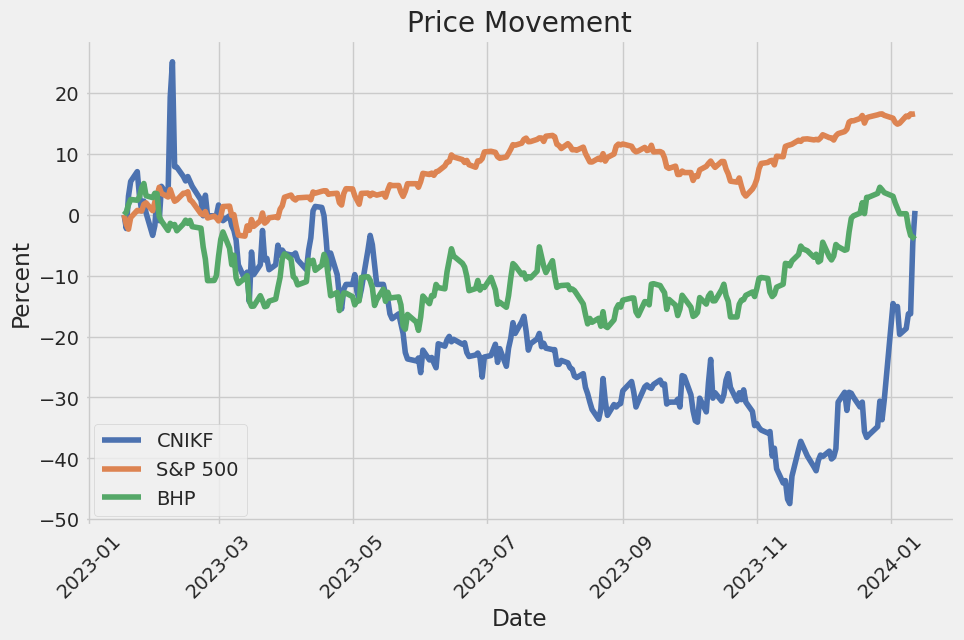

Similar Companies in Metals & Mining:

BHP Group (BHP), Vale S.A. (VALE), Rio Tinto Group (RIO), Glencore Plc (GLNCY), Freeport-McMoRan Inc. (FCX), Norilsk Nickel (NILSY)

https://www.proactiveinvestors.com/companies/news/1038260?SNAPI

https://www.proactiveinvestors.com/companies/news/1037293?SNAPI

https://finance.yahoo.com/news/canadian-investment-regulatory-organization-trade-130700561.html

https://finance.yahoo.com/news/canada-nickel-receives-equity-investment-115100429.html

https://finance.yahoo.com/news/canadian-investment-regulatory-organization-trading-203500980.html

https://finance.yahoo.com/news/canada-nickel-completes-private-placement-114500581.html

https://finance.yahoo.com/news/agnico-eagle-announces-investment-canada-220000803.html

https://finance.yahoo.com/news/canada-nickel-provides-financing-120000148.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: bmZhn5

https://reports.tinycomputers.io/CNIKF/CNIKF-2024-01-14.html Home