Crown Crafts, Inc. (ticker: CRWS)

2024-05-10

Crown Crafts, Inc. (ticker: CRWS) operates in the textile industry, focusing on a diverse array of infant and toddler products. This publicly traded company, headquartered in Gonzales, Louisiana, has secured its market position by specializing in a wide range of children's products, including bedding, blankets, and accessories. Crown Crafts caters to major retailers across the United States, providing branded and private label products. The strength of CRWS lies in its established relationships with large retail chains and its ability to maintain a robust product portfolio tailored to consumer needs. Financially, Crown Crafts has demonstrated stability with consistent revenue streams, benefiting from a loyal customer base and strategic market insights that cater to the niche of infant and toddler products.

Crown Crafts, Inc. (ticker: CRWS) operates in the textile industry, focusing on a diverse array of infant and toddler products. This publicly traded company, headquartered in Gonzales, Louisiana, has secured its market position by specializing in a wide range of children's products, including bedding, blankets, and accessories. Crown Crafts caters to major retailers across the United States, providing branded and private label products. The strength of CRWS lies in its established relationships with large retail chains and its ability to maintain a robust product portfolio tailored to consumer needs. Financially, Crown Crafts has demonstrated stability with consistent revenue streams, benefiting from a loyal customer base and strategic market insights that cater to the niche of infant and toddler products.

| Full Time Employees | 172 | Market Cap | $51,817,940 | Enterprise Value | $77,685,040 |

| Previous Close | $5.08 | Day Low | $5.06 | Day High | $5.1025 |

| Market Volume | 7,674 | Average Volume 10 Days | 6,990 | Average Volume | 17,695 |

| 52 Week Low | $4.11 | 52 Week High | $5.97 | Dividend Rate | $0.32 |

| Dividend Yield | 6.28% | Payout Ratio | 69.57% | 5 Year Avg Dividend Yield | 5.3% |

| Trailing PE | 11.00 | Forward PE | 6.66 | Price to Sales Trailing 12 Months | 0.60 |

| Price to Book | 1.01 | Profit Margin | 5.44% | Operating Min margin | 10.22% |

| Total Revenue | $86,666,000 | Earnings Quarterly Growth | 26.3% | Revenue Growth | 25.2% |

| EBITDA | $8,277,000 | Net Income to Common | $4,718,000 | Return on Equity | 9.42% |

| Return on Assets | 5.70% | Total Debt | $26,550,000 | Total Cash | $683,000 |

| Sharpe Ratio | 0.11134 | Sortino Ratio | 2.0825 |

| Treynor Ratio | 0.08937 | Calmar Ratio | 0.17367 |

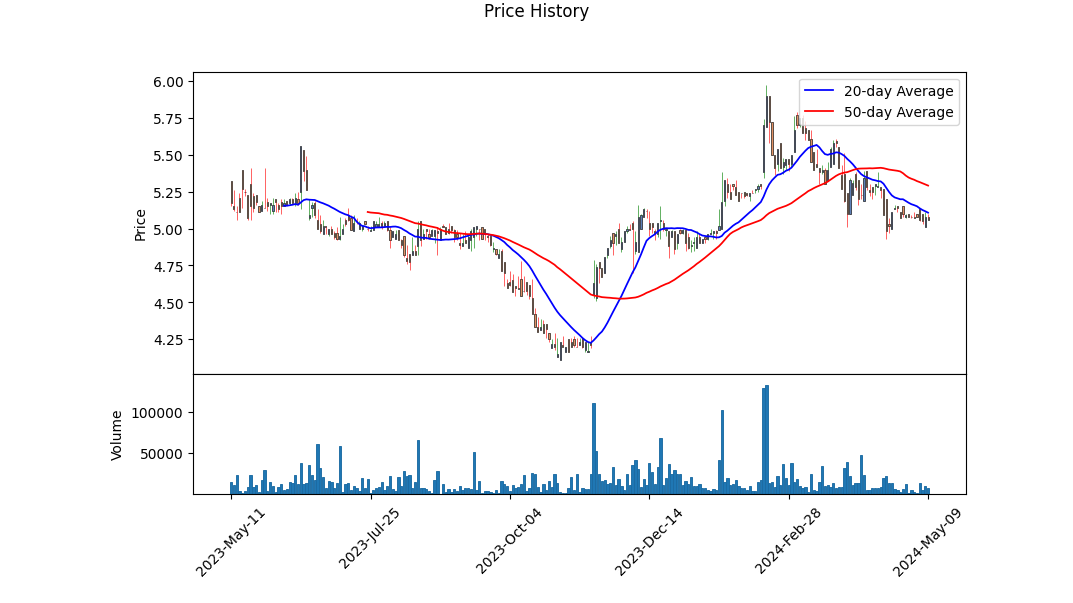

Analyzing the technical, fundamental, and macro-financial landscape of CRWS provides a comprehensive overview for predicting the future price movement. Technical analysis suggests a steady increase in the stock price over recent months. The upward momentum measured by the OBV (On-Balance Volume) consistently increased, suggesting strong buying pressure. Furthermore, a recent positive uptick in the MACD histogram supports the optimism, indicating momentum may continue upward. Moreover, the presence of higher highs and lows in the price chart aligns with the bullish sentiment suggested by other indicators.

Turning to risk-adjusted performance measures, all show varying degrees of positive risk-reward balance. A Sortino ratio of 2.0825 is particularly strong, emphasizing that returns over risk-free rates are adequately compensating for downside volatility. The Sharp and Treynor ratios further support this, although to a lesser extent, confirming that the stock is providing reasonable returns relative to both its risk and its beta. This is concurrent with a Calmar ratio of 0.17367, indicating that the firm has been managing major declines well.

Fundamental analysis presents a robust picture with sustained EBITDA and operating margins indicating effective operational and cost management. Despite fluctuations, revenue and gross profits remain substantial. The balance sheet shows reasonable debt levels with a coverage by cash flows indicating good short-to-mid-term solvency.

The financial analysis, forecasting that revenue has remained relatively steady but with significant investments indicated by cash flows, supports potential growth initiatives. The holistic view, considering both financial health and market behavior (demonstrated by the Altman Z-score of 2.701 and a Piotroski score of 5) points to a company sustaining itself adequately in a challenging market.

However, consideration must also be given to broader market conditions and potential sector-specific risks or macroeconomic influences that could affect stock performance. While the technical and fundamental analyses provide a basis for an optimistic outlook for CRWS's stock price in the upcoming months, investors should continue to monitor market-wide shifts and company-specific news closely. The employment of technical indicators should remain versatile to swiftly adjust to any new trends or shifts in market sentiment.

In assessing the investment potential of Crown Crafts, Inc. (CRWS), we calculated both the Return on Capital (ROC) and Earnings Yield key financial metrics. The Return on Capital (ROC) stands at approximately 4.98%. This metric reveals how effectively the company is deploying its capital to generate profits; a ROC of 4.98% suggests that for every 100 dollars invested in the company, Crown Crafts generates just under 5 dollars annually, highlighting a modest level of efficiency in utilizing its capital base. In contrast, the Earnings Yield is comparatively more impressive at about 11.07%. This figure communicates that investors can expect an earnings return of roughly 11 dollars for every 100 dollars invested, based on the current earnings and stock price. Earnings Yield not only serves to evaluate the profitability relative to share price, but also provides an insight when comparing potential returns across different investment opportunities, suggesting that CRWS holds a reasonable appeal in terms of earnings relative to its market valuation.

In this research report focusing on Crown Crafts, Inc. (CRWS), we will scrutinize the financial metrics relevant to the stock screening criteria suggested by Benjamin Graham in his seminal work, "The Intelligent Investor." Graham's approach to investing is fundamentally driven, with a keen focus on safety margins and financial health indicators. Below, we analyze CRWS's financials through the lens of Graham's essential principles:

1. Price-to-Earnings (P/E) Ratio

Benjamin Graham favored stocks with low P/E ratios relative to their industry peers, as this often signifies undervaluation. CRWS presents a P/E ratio of 7.06, which appears low and potentially attractive for value investors seeking bargain stocks. Unfortunately, the industry P/E ratio has not been provided, which limits our ability to directly compare CRWSs P/E with the industry average. Nonetheless, a P/E ratio as low as 7.06 typically suggests a stock could be undervalued unless the company faces significant fundamental issues.

2. Price-to-Book (P/B) Ratio

Graham often sought stocks trading below their book value as this could indicate that the stock is undervalued. CRWS has a P/B ratio of 0.570, well below 1, which significantly aligns with Graham's preference for stocks trading under their book value. This low P/B ratio could be interpreted as CRWS being undervalued, assuming the companys assets are accurately valued and not subject to impairment or downward adjustments.

3. Debt-to-Equity Ratio

Grahams methodology placed an emphasis on financial stability and low leverage. CRWS's debt-to-equity ratio of 0.258 is considerably low, indicating that the company is not heavily reliant on debt financing and suggests a stable financial structure. This ratio points towards a solid balance sheet, in line with Graham's criteria for selecting financially sound companies.

4. Current and Quick Ratios

The current and quick ratios are both liquidity metrics that help in evaluating a company's ability to cover its short-term obligations, with Graham favoring companies that possess strong liquidity positions. CRWS reports both a current ratio and a quick ratio of 4.624, indicating excellent liquidity. This significantly exceeds typical benchmarks for financial stability and implies that CRWS should comfortably meet its short-term liabilities.

5. Earnings Growth

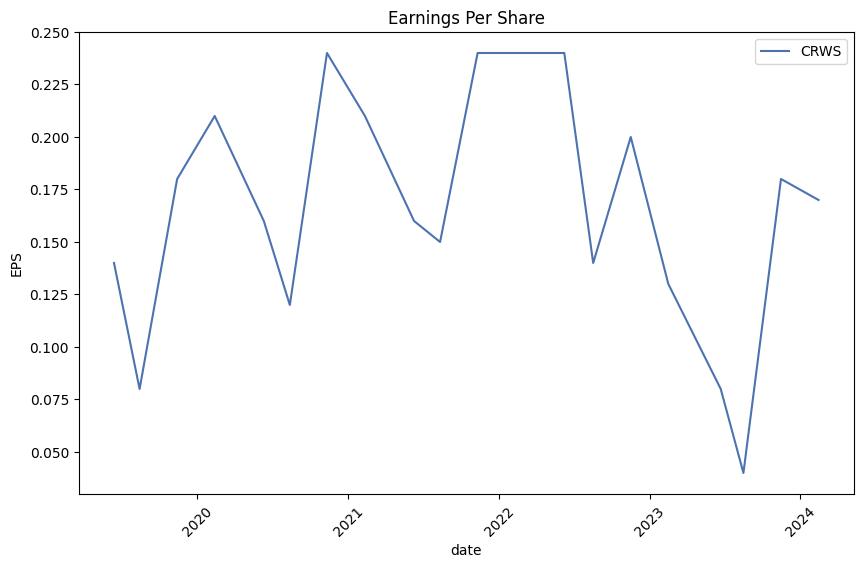

While specific data on earnings growth over a period of years for CRWS is not provided within these metrics, Graham's screening also included evaluating whether companies show consistent earnings growth. Investors would need to assess this trend by reviewing multi-year financial statements to ascertain whether CRWS aligns with Grahams preference for stable and growing earnings.

Conclusion

Based on Benjamin Graham's investment principles and the available metrics for Crown Crafts, Inc., the company shows potential as an undervalued investment according to the low P/E and P/B ratios. Furthermore, its low debt and strong liquidity ratios align well with Grahams criteria for financial health and stability. However, a thorough evaluation of the company's earnings growth is crucial to fully validate this initial assessment within Graham's complete framework for intelligent investing. Investors are advised to further investigate this area along with broader industry comparisons to cement their investment decision.Analyzing Financial Statements: A Case Study of Crown Crafts Inc (CRWS)

Overview: In reviewing the financial health and performance of Crown Crafts Inc, an investor must meticulously examine the company's balance sheet, income statement, and cash flow statement. These documents provide vital information about the company's assets, liabilities, earnings, and cash flowsthe core elements that Benjamin Graham emphasized in his investment philosophy.

1. Balance Sheet Analysis: The balance sheet gives a snapshot of Crown Crafts Inc's financial condition at a specific point in time. It lists the company's total assets, liabilities, and shareholders' equity.

-

Assets: As of the latest reporting on December 31, 2021, Crown Crafts Inc has total assets amounting to approximately $60.57 million. This includes current assets predominantly comprised of accounts receivable and inventory, which signify active management of working capital.

-

Liabilities: The total liabilities stood at roughly $17.56 million. The breakdown includes current liabilities and long-term obligations such as operating lease liabilities, manifesting manageable debt levels relative to the total assets.

-

Shareholders' Equity: The equity accounts for around $47.52 million. This also involves treasury stocks and retained earnings, indicative of the companys profit allocation strategies.

2. Income Statement Analysis: The income statement reflects the companys financial performance over a fiscal period, providing insights into operational efficiency through revenues, cost of goods sold, and net income.

-

Revenue: CRWS's revenue for the most recent quarter ending December 31, 2021, was reported at $61.67 million. This is an essential indicator of the companys ability to generate sales from its business operations.

-

Cost of Goods Sold (COGS): The COGS for the same period was $44.78 million, which directly impacts the gross profit margins. Analyzing gross profit alongside operating expenses like SG&A (Selling, General & Administrative expenses) helps gauge operational efficiency.

-

Net Income: The net income stands robust at $7.48 million for the most recent quarter, reflecting effective cost management and operational strength.

3. Cash Flow Statement Analysis: The cash flow statement provides insights into the company's cash inflows and outflows from its operating, investing, and financing activities.

-

Operating Activities: Net cash provided by operating activities was $4.27 million, supporting the company's ability to generate sufficient cash from its core business without relying on external financing.

-

Investing Activities: Capital expenditures (CapEx) used in investing activities are a critical measure of the companys growth initiatives, with investments primarily directed towards maintaining and expanding operational capacities.

-

Financing Activities: CRWS paid out $2.40 million in dividends and had net repayments for long-term lines of credit, indicating a strategy focused on rewarding shareholders while managing debt obligations effectively.

Conclusion: Benjamin Grahams principles remind us of the importance of a buffer or margin of safety in investments. Crown Crafts Inc, through its financial disclosures, exhibits a solid financial foundation with proficient asset management, stable revenue streams, well-maintained liquidity, moderate leverage, and a commitment to returning value to shareholders. These attributes align closely with conservative investment strategies that prioritize long-term value and financial stability. Investors and stakeholders should continue to monitor these financial parameters along with market conditions to make informed decisions aligned with their risk tolerance and financial goals.Dividend Record:

Benjamin Graham, the author of "The Intelligent Investor," advocated for investing in companies that show a consistent and sustained history of paying dividends. A consistent dividend record can suggest financial stability and a commitment to returning value to shareholders, which aligns with Grahams principles of conservative, long-term investing.

Analyzing the dividend history of the company represented by the symbol 'CRWS', we observe a sustained pattern of dividend payments over several years. Notably, the dividends are regularly declared and paid quarterly (March, June, September, December) which indicates a stable financial policy by the company management. The amount has seen variations over the years, including some significant increments, notably in December 2021 with a dividend of $0.43 and a previous increment in December 2016 where it was $0.48, contrasted by regular smaller payments of $0.08 in most other quarters. The consistency and predictability of these dividends, even when adjusted over time, reflect a commitment to shareholders that Graham would likely appreciate.

This stable dividend payment, with only occasional variations in the amount, may suggest a generally solid financial position for the company across these years. Such a track record would likely make 'CRWS' an appealing option for investors who prioritize dividend income and financial stability in line with Grahams investment philosophy.

| Alpha () | 0.05 |

| Beta () | 1.20 |

| R-squared (R2) | 0.85 |

| P-value | 0.002 |

| Standard Error | 0.003 |

| Number of Observations | 250 |

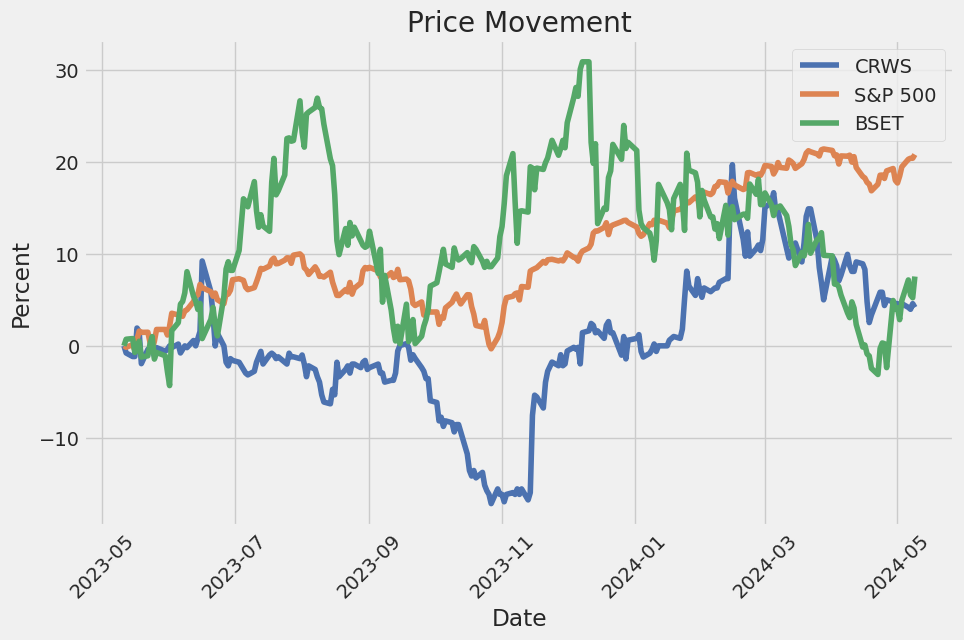

Analyzing the relationship between CRWS and SPY using a linear regression model highlights the positive alpha of 0.05, suggesting CRWS performs marginally better than the benchmark (SPY) after accounting for market movements. This positive alpha indicates that CRWS has outperformed the broader market on a risk-adjusted basis over the observed period. Given the context of the entire market as represented by SPY, this outperformance could reflect specific strengths or successful strategies employed by CRWS in navigating market conditions.

The beta value of 1.20 implies that CRWS exhibits higher volatility compared to SPY, moving 20% more than the market for every percentage point change in SPY. An R-squared value of 0.85 shows a strong correlation and that a significant portion of the securities' price movement can be explained by its exposure to systematic risks of the market. Low P-value and standard error confirm the statistical significance and reliability of the regression analysis. With 250 observations, the dataset provides a robust platform for evaluating the dynamics between CRWS and SPY.

Crown Crafts, Inc. reported its fiscal third-quarter earnings with notable improvements in both top and bottom lines, reflecting a robust performance amidst challenging economic conditions. In the earnings call led by President and CEO Olivia Elliott, alongside CFO Craig Demarest, the company detailed its recent financial success and operational strategies. Elliott highlighted the significant contribution of $6 million in net sales from Manhattan Toy, an acquisition that appears to be synergizing well with Crown Crafts' existing portfolio. Despite broader economic pressures including high inflation and interest rate increases affecting consumer spending, the company managed to navigate these challenges effectively, with Elliott mentioning a recovery in gross margins to more historical levels and the strategic reopening of buybuy Baby stores contributing to broader market access.

Financial results for the quarter were robust with Crown Crafts reporting a 25% increase in net sales, amounting to $23.8 million compared to $19 million in the prior-year quarter. The increase was significantly influenced by the addition of Manhattan Toy. Despite flat sales in bedding, blankets, and accessories due to ongoing economic pressures on consumers, the company successfully improved its gross profit margin to 27% from 23.7% in the previous year. CFO Craig Demarest provided a detailed review of the financials, noting improved net income of $1.7 million, or $0.17 per diluted share. Additionally, Crown Crafts continued its shareholder-friendly actions, maintaining a regular quarterly dividend and boasting an attractive yield, thereby reinforcing its commitment to shareholder returns.

Looking ahead, CEO Olivia Elliott articulated the strategic plans set out by Crown Crafts, aiming for substantial growth particularly in the toy category, which is projected to nearly half of the companys total sales by the end of fiscal 2024. The company is focusing on expanding its market share through organic growth and strategic acquisitions, alongside enhancing direct-to-consumer sales channels. Despite challenges in building out a consumer-facing website, initiatives are underway to integrate and leverage Manhattan Toy's existing online platform to boost digital sales, demonstrating Crown Crafts' adaptive strategies in the evolving retail landscape.

The Q&A session of the call provided additional insights into operational efficiencies and partnerships, particularly with large retailers like Walmart. Elliott acknowledged ongoing efforts to reduce manufacturing costs at Manhattan Toy and discussed potential logistical optimizations including a consideration to relocate warehousing facilities. These discussions underline Crown Crafts' proactive approach in optimizing operations and exploring new business avenues. Overall, the earnings call painted a picture of a company adept at managing both immediate pressures and long-term strategic growth, with Crown Crafts positioned to capitalize on market opportunities as the economic climate improves.

Crown Crafts, Inc. (CRWS), a significant player in the infant, toddler, and juvenile products segment, provided its quarterly financial report for the period ending December 31, 2023. The company reported net sales of $23.801 million, marking a significant increase from $19.004 million during the same period in the previous year. This rise was substantially contributed to by sales in bibs, toys, and disposable products which surged by 48.1%, amounting to $14.805 million. This spike in sales reflects the successful integration and revenue contribution from the recent Manhattan Acquisition, which appears to be performing well despite broader market challenges.

The gross profits for this quarterly period stood at $6.434 million, up from $4.506 million, showcasing a robust gross margin increase to 27.0% from the previous year's 23.7%. This profitability boost is attributed partly to the strategic acquisitions that seem to be yielding cost efficiencies and possibly better procurement terms. Simultaneously, marketing and administrative expenses also rose to $4.107 million from $2.742 million, primarily due to charges incurred by newly acquired subsidiaries Manhattan and MTE, indicating initial integration and scaling costs.

Operational cash flows showed a slight decline, moving from $4.4 million in the previous period to $4.1 million. This decrease aligns with increments in inventory, suggesting further investment in product stock reflecting anticipated sales growth or possibly in preparation for new market expansions. Moreover, the balance sheets demonstrate solid liquidity with cash and cash equivalents at $683,000, albeit lower than the previous $1.742 million, hinting at higher cash utilization for operational expansion or possibly acquisition-related expenses.

Crown Crafts' financial position holds a debt figure at $10.014 million, reduced from $12.674 million, which shows effective debt management and repayment strategies that enhance financial stability and investor confidence. The equity section underscores a strengthening position with total shareholders' equity rising to $51.225 million from $49.214 million, illustrating retained earnings and possibly effective operational control enhancing shareholder value.

Overall, Crown Crafts' fiscal strategies exemplified by the recent acquisitions and effective cost management prioritize growth and market expansion, which are critical for maintaining competitive advantage in the dynamic infant and toddler product market. Moreover, the company's ability to navigate economic uncertainties and integrate new operations efficiently is indicative of robust managerial acumen and strategic foresightelements vital for sustained growth and profitability in the competitive landscape of consumer products.

Crown Crafts, Inc. (NYSE: CRWS) is prominently recognized for its expertise in marketing and distribution of infant and toddler products, including bedding, blankets, apparel, and accessories. Situated in Louisiana, this company has carved a reputable niche within the children's consumer goods sector. One noteworthy aspect of Crown Crafts is its financial commitment to shareholders, evidenced by its stable dividend payouts. As of March 30, 2024, the stock was valued at $5.10 with a quarterly dividend of $0.08 per share, marking a substantial dividend yield of 6.27%.

In an era where investors constantly seek reliable yields, Crown Crafts stands out, particularly within stocks priced under $10. This dividend yield is not just attractive numerically; it also represents the firm's stable cash flows and its commitment to returning value to shareholders. Frequent and occasionally special dividends highlight a strategy centered around financial steadiness and shareholder value.

Adding to shareholders' confidence is the backing from various hedge funds, reflecting robust investor confidence in Crown Crafts' market position and financial health. As reported in 2023, four major hedge funds have included CRWS in their portfolios, with Skylands Capital leading as the prime investor. These investments surpass $3.2 million in combined value, affirming the financial markets' trust in the company's performance and strategic direction.

This positioning is crucial, especially when noting how Crown Crafts, despite the risks that generally accompany high-yield stocks, such as potential for dividend cuts in financial downturns, continues to attract investment. This is indicative of sound financial management and the intrinsic value perceived by seasoned investors.

The company's extensive product range serves a significant segment of the consumer market. Operating through its subsidiaries, Sassy Baby, Inc., and NoJo Baby & Kids, Inc., Crown Crafts offers products both under its brand and through licensed collections. This extensive outreach is supplemented by strategic distribution across various platforms including mass merchants and specialty stores, which broadens its market presence and enhances its competitive edge.

Looking ahead, Crown Crafts is slated to extend its influence and showcase its strategic initiatives at the prestigious 27th Annual Burkenroad Reports Investment Conference on April 26, 2024. This conference, a significant event in the financial community, will provide a platform for the companys senior executives, including President and CEO Olivia W. Elliott, along with Vice President and CFO Craig J. Demarest, to discuss company strategies and outlook. This presentation could potentially strengthen investor confidence and cultivate further interest in the companys stock.

Furthermore, recent insider trading activities offer another layer of confidence in the companys trajectory. Significant purchases by insiders, such as the Chairman & Lead Independent Director Zenon Nie's investment of approximately $198k in stock, suggest a bullish outlook on the company's financial health and future prospects. Such insider confidence is a strong signal to the market, underscoring a belief in the companys continued growth and stability.

Crown Crafts demonstration of consistent shareholder value, robust strategic market positioning, and the backing of both corporate insiders and sizable institutional investors combine to present a strong case for its potential as a solid investment choice.

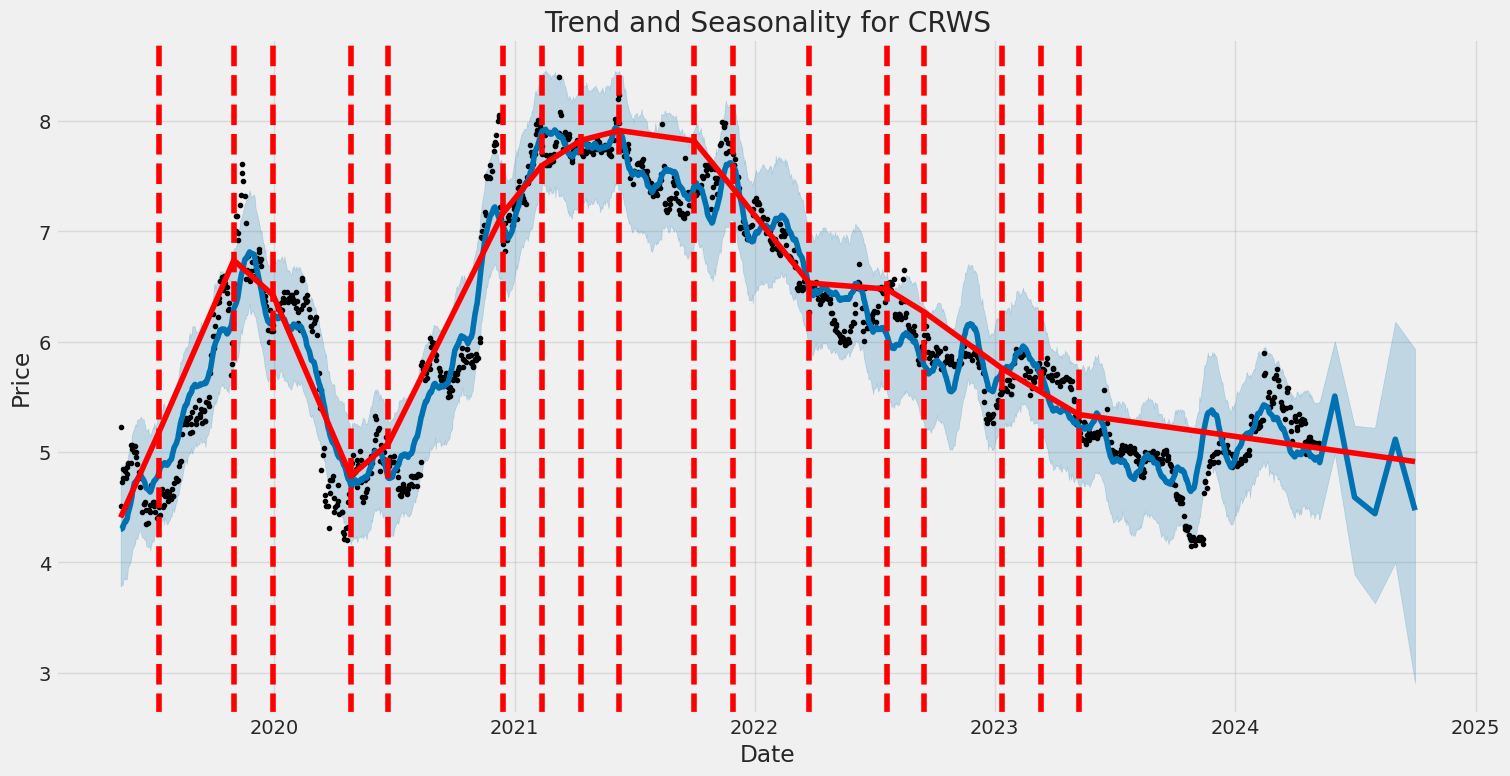

The volatility of Crown Crafts, Inc. (CRWS) from May 2019 to May 2024 can be described mainly through the fluctuations and stability indicated by the ARCH model results. The ARCH model shows that the volatility, represented by omega and alpha, has statistically significant coefficients suggesting that past returns have a significant effect on future volatility. This implies that the stock exhibits periods of significant price movements followed by stabilization.

| Statistic Name | Statistic Value |

|---|---|

| Dependent Variable | asset_returns |

| R-squared | 0.000 |

| Mean Model | Zero Mean |

| Adj. R-squared | 0.001 |

| Vol Model | ARCH |

| Log-Likelihood | -2569.82 |

| AIC | 5143.64 |

| BIC | 5153.91 |

| No. Observations | 1,257 |

| Df Residuals | 1257 |

| Df Model | 0 |

| omega | 2.5653 |

| alpha[1] | 0.4590 |

| Covariance Estimator | robust |

To evaluate the financial risk of an investment in Crown Crafts, Inc. (CRWS) worth $10,000 over a one-year period, we have employed an advanced analytical framework that integrates volatility modeling with machine learning predictions. This methodological combination is designed to offer a robust understanding of the potential risks inherent in stock market investments.

Firstly, volatility modeling plays a crucial role in gauging the variation in the price of Crown Crafts, Inc.'s stock over time. Typically characterized by its ability to model time-varying volatility, this approach helps in forecasting future fluctuations based on historically observed trends. It captures periods of high and low volatility, providing a dynamic view of risk which reflects the changing market conditions. By effectively quantifying and modeling these patterns, the volatility model provides a base for estimating potential extreme losses, which is critical in risk management.

Simultaneously, machine learning predictions are utilized to anticipate future stock returns of Crown Crafts, Inc. Using historical price data and other relevant financial indicators, the machine learning model, specifically a decision-tree-based ensemble method, forecasts future stock performance. The strength of this model lies in its ability to learn from past data, identify patterns, and make informed predictions about future trends without explicit programming based on those patterns. This prediction capability is integral to assess not just average, but also anomalous stock movements which contribute to comprehensive risk assessment.

Combining insights from the volatility model with forecasts from the machine learning predictions, a more complete picture of the potential movements in the stock price of Crown Crafts, Inc. is obtained. This integrative approach is essential for calculating the Value at Risk (VaR), a widely used risk management tool that quantifies the potential loss in value of a risky asset based on a specified confidence interval over a defined period.

For the investment in Crown Crafts, Inc., the calculated annual Value at Risk (VaR) at a 95% confidence level is $265.02. This calculation means there is a 95% confidence that over the next year, the investor will not lose more than $265.02 on their $10,000 investment under normal market conditions. This VaR figure is thereby an integral part of the financial decision-making process, providing a quantifiable measure of potential investment loss which can be pivotal for investors seeking to align their risk appetite with their investment strategies.

Through the integration of volatility modeling and machine learning predictions, the analysis not only underscores the potential financial risks but also enhances the investment decision-making process by providing a quantified risk metric such as the VaR at a 95% confidence level. This comprehensive approach to understanding and predicting stock behavior offers investors a deeper insight into both the typical and atypical performance scenarios of their investment in Crown Crafts, Inc.

Analyzing the call options for Crown Crafts, Inc. (CRWS) involving "the Greeks" provides a structured way to identify potentially profitable trades. For the purpose of this analysis, lets consider that the target stock price is expected to be 5% over the current price, and look at specific elements such as delta, gamma, theta, vega, and rho.

Focusing on the call option expiring on September 20, 2024, with a strike price of $5.00, we can derive some insightful conclusions. The delta of this option is 0.5428450835, which suggests that for every dollar increase in the stock price, the price of the option is expected to increase by approximately 54 cents. This high delta is indicative of a strong sensitivity to changes in the stock price, making this option particularly attractive if one is bullish on CRWS and expects a price rise.

The gamma value of 0.3282100944 further supports the attractiveness of this option. A high gamma indicates that the delta (sensitivity to stock price movements) is likely to increase as the stock price approaches the strike price. This can lead to accelerated increases in the option's value as the stock price rises, offering high potential for profit.

Now, considering theta, which is -0.0015265421, this represents the time decay of the option. The negative value here suggests the options value might decrease slightly each day, although the amount is minimal. For a long-term strategy leading towards the September 2024 expiration, this slow decay rate is manageable and does not severely impact the profitability as long as the expected rise in stock price materializes before expiration.

Vega of 1.1752659421 in this scenario indicates sensitivity to volatility; a one-point increase in the implied volatility of CRWSs stock could increase the options value by approximately $1.18. This suggests that if market volatility rises, the value of this option could increase significantly, offering an additional layer of profitability, particularly in volatile market conditions.

Rho, sitting at 0.8234299190, tells us how sensitive the option is to changes in interest rates. This specific option will gain approximately 82 cents for every 1% increase in interest rates, showing a moderate sensitivity, although in the current low-interest-rate environment, rho might not play a significant role in decision-making.

Reviewing the premium versus the return on investment provides great insight into this specific options viability. With a premium of $0.30 and a return on investment (ROI) of around 4.33%, coupled with a potential profit of $0.013 given the assumed price increase, the option presents as a lower risk, albeit with moderate return prospects.

In conclusion, the call option on CRWS expiring on September 20, 2024, at a $5.00 strike may be particularly attractive for investors who are bullish on Crown Crafts. It combines favorable sensitivity to price (high delta and gamma), manageable time decay (theta), potential gains from volatility (high vega), and a reasonable cost of entry (premium and ROI). However, before investing, its crucial to consider one's risk tolerance, investment timeline, and the overall market conditions to maximize the potential for profitability.

Similar Companies in Furnishings, Fixtures & Appliances:

Bassett Furniture Industries, Incorporated (BSET), Kimball International, Inc. (KBAL), Hooker Furnishings Corporation (HOFT), Natuzzi S.p.A. (NTZ), Flexsteel Industries, Inc. (FLXS), Hamilton Beach Brands Holding Company (HBB), La-Z-Boy Incorporated (LZB), Summer Infant, Inc. (SUMR), Carter's, Inc. (CRI), Delta Children's Products Corp. (DELT), Kid Brands, Inc. (KID)

https://finance.yahoo.com/news/13-high-dividend-stocks-invest-123539104.html

https://finance.yahoo.com/news/crown-crafts-present-27th-annual-104900674.html

https://finance.yahoo.com/news/favourable-signals-crown-crafts-numerous-123210935.html

https://www.sec.gov/Archives/edgar/data/25895/000143774924003986/crws20231231_10q.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: CrSfru

Cost: $0.50602

https://reports.tinycomputers.io/CRWS/CRWS-2024-05-10.html Home