CSX Corporation (ticker: CSX)

2023-12-24

CSX Corporation, trading under the ticker symbol CSX, is a premier transportation company in the United States, specializing in rail-based freight transportation services. As one of the nation's leading railroad operators, CSX's rail network spans approximately 21,000 route miles, connecting major metropolitan areas in the eastern United States and Canada. The company offers traditional rail service and the transport of intermodal containers and trailers, catering to a diverse customer base across various market sectors, including energy resources, industrial products, and consumer goods. CSX Corporation has demonstrated a strong commitment to safety, environmental sustainability, and innovative technology, which has played a crucial role in its operational efficiency and profitability. With its strategic Eastern network, CSX plays a critical role in the North American transportation infrastructure, enabling trade and economic growth across multiple regions. Financially, the company maintains a solid performance track record with a focus on maximizing shareholder value through disciplined capital investment, cost management, and returning capital to shareholders through dividends and share repurchases.

CSX Corporation, trading under the ticker symbol CSX, is a premier transportation company in the United States, specializing in rail-based freight transportation services. As one of the nation's leading railroad operators, CSX's rail network spans approximately 21,000 route miles, connecting major metropolitan areas in the eastern United States and Canada. The company offers traditional rail service and the transport of intermodal containers and trailers, catering to a diverse customer base across various market sectors, including energy resources, industrial products, and consumer goods. CSX Corporation has demonstrated a strong commitment to safety, environmental sustainability, and innovative technology, which has played a crucial role in its operational efficiency and profitability. With its strategic Eastern network, CSX plays a critical role in the North American transportation infrastructure, enabling trade and economic growth across multiple regions. Financially, the company maintains a solid performance track record with a focus on maximizing shareholder value through disciplined capital investment, cost management, and returning capital to shareholders through dividends and share repurchases.

| As of Date: 12/24/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 68.43B | 61.69B | 68.42B | 60.87B | 65.13B | 56.01B |

| Enterprise Value | 85.94B | 79.05B | 85.35B | 77.32B | 81.27B | 71.88B |

| Trailing P/E | 18.32 | 15.53 | 16.72 | 15.35 | 16.48 | 14.88 |

| Forward P/E | 17.30 | 15.02 | 17.48 | 15.75 | 16.13 | 13.32 |

| PEG Ratio (5 yr expected) | 2.98 | 2.52 | 2.77 | 2.73 | 2.18 | 1.60 |

| Price/Sales (ttm) | 4.80 | 4.24 | 4.74 | 4.32 | 4.63 | 4.21 |

| Price/Book (mrq) | 5.73 | 5.03 | 5.55 | 4.83 | 4.97 | 4.27 |

| Enterprise Value/Revenue | 5.84 | 22.13 | 23.07 | 20.86 | 21.79 | 18.45 |

| Enterprise Value/EBITDA | 11.56 | 45.75 | 44.57 | 40.74 | 42.86 | 36.05 |

| Full Time Employees | 23,000 | Previous Close | 34.46 | Open | 34.55 |

|---|---|---|---|---|---|

| Day Low | 34.535 | Day High | 34.81 | Dividend Rate | 0.44 |

| Dividend Yield | 0.0127 | Payout Ratio | 22.75% | Five Year Average Dividend Yield | 1.26 |

| Beta | 1.192 | Trailing PE | 18.32 | Forward PE | 17.49 |

| Volume | 6,262,838 | Average Volume | 12,812,550 | Average Volume 10 days | 13,689,830 |

| Bid | 34.58 | Ask | 34.79 | Bid Size | 3,200 |

| Ask Size | 3,200 | Market Cap | $68,433,387,520 | Fifty Two Week Low | 27.6 |

| Fifty Two Week High | 34.84 | Price to Sales Trailing 12 Months | 4.6531 | Fifty Day Average | 31.779 |

| Two Hundred Day Average | 31.4501 | Trailing Annual Dividend Rate | 0.43 | Trailing Annual Dividend Yield | 0.012478236 |

| Enterprise Value | $86,106,415,104 | Profit Margins | 26.158% | Float Shares | 1,969,451,712 |

| Shares Outstanding | 1,976,130,048 | Shares Short | 25,932,559 | Shares Short Prior Month | 17,196,859 |

| Short Ratio | 2.19 | Short Percent of Float | 1.32% | Book Value | 6.047 |

| Price To Book | 5.7268 | Last Fiscal Year End | 1672444800 | Most Recent Quarter | 1696032000 |

| Earnings Quarterly Growth | -23.9% | Net Income To Common | $3,847,000,064 | Trailing EPS | 1.89 |

| Forward EPS | 1.98 | PEG Ratio | 2.8 | Last Split Factor | "3:1" |

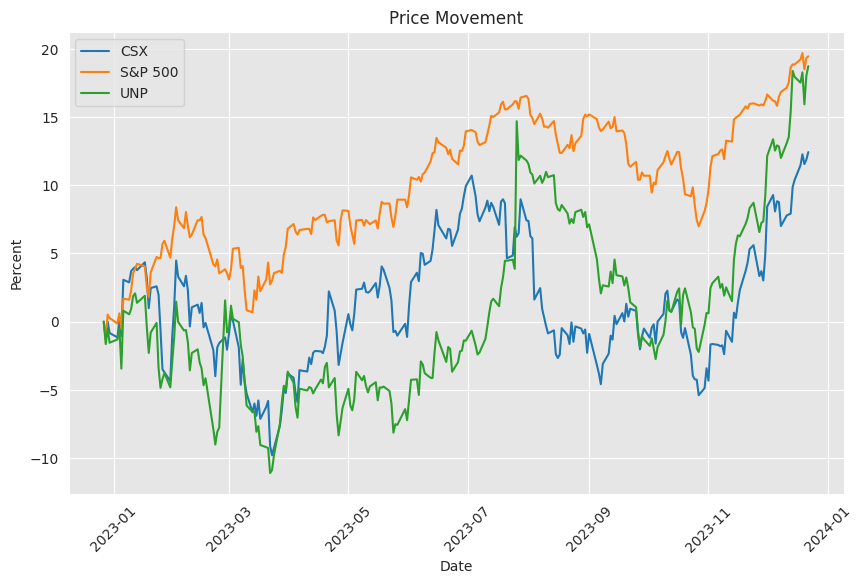

| Enterprise To Revenue | 5.855 | Enterprise To EBITDA | 11.839 | 52 Week Change | 10.851467% |

| Current Price | 34.63 | Target High Price | 42.0 | Target Low Price | 25.0 |

| Target Mean Price | 36.38 | Target Median Price | 37.0 | Recommendation Mean | 2.0 |

| Total Cash | $1,439,000,064 | Total Cash Per Share | 0.728 | EBITDA | $7,272,999,936 |

| Debt To Equity | 159.846 | Revenue Per Share | 7.225 | Return On Assets | 8.452% |

| Return On Equity | 30.978% | Gross Profits | $7,390,000,000 | Free Cash Flow | $2,427,249,920 |

Technical Analysis: - The Adjusted Close price of CSX is $34.63, indicating the current market sentiment. - The MACD is positive at 0.780610 with a MACD histogram value of 0.051710, suggesting a continued bullish momentum. - The Relative Strength Index (RSI) is above 70, specifically at 71.325843, indicating that the stock may be overbought which can lead to a potential price pullback or consolidation. - The price is currently above the middle Bollinger Band (BBM_5_2.0) of $34.472001 and near the upper Bollinger Band (BBU_5_2.0) of $34.707764, indicating a strong uptrend. - The Simple Moving Average (SMA_20) and Exponential Moving Average (EMA_50) are $33.410500 and $32.374610, respectively. The stock price is above both averages, reinforcing the bullish trend. - On Balance Volume (OBV) in millions is at 15.587090, showcasing buying interest and positive volume dynamics. - The Stochastic Oscillator %K (STOCHk_14_3_3) is high at 83.975355, and the %D (STOCHd_14_3_3) is at 87.216769, which suggests that the stock may be in overbought territory. - The Average Directional Index (ADX_14) stands at 34.508718, indicating a strong trend presence. - The Williams %R (WILLR_14) at -10.194124 is also suggesting an overbought condition. - The Chaikin Money Flow (CMF_20) is positive at 0.182860, indicating buying pressure. - The Parabolic SAR (stop and reverse) (PSARl_0.02_0.2) is at 33.443963, confirming the current uptrend.

In light of the technical indicators, the bullish momentum in CSX's stock price is evident, but with multiple overbought signals from RSI, Stochastic, and Williams %R, a near-term retracement or consolidation might occur. The strong trend confirmed by the ADX and the position above moving averages may support the continuation of the uptrend once the overbought condition is alleviated. The support established by the middle Bollinger Band and the PSAR indicate that pullbacks might be seen as buying opportunities.

Fundamentals Analysis: - The market capitalization of CSX has grown from $56.01B to $68.43B over the past year, indicating a growing company value in the eyes of investors. - Trailing P/E has seen a slight increase over the past year which may reflect investors' willingness to pay more for earnings, perhaps in anticipation of future growth. - The Forward P/E is lower than the Trailing P/E, suggesting expectations of increased earnings. - The PEG Ratio is higher than industry benchmarks, which implies that investors may be expecting higher future growth compared to the company's peers. This sentiment could support future price appreciation if the company meets or exceeds these growth expectations. - The Price/Sales ratio has also increased, reflecting a premium that investors are willing to pay for the company's sales. - The increase in Enterprise Value alongside the Enterprise Value/Revenue and Enterprise Value/EBITDA indicates the market is valuing the company highly relative to its revenue and EBITDA.

Analyzing the financials, EBITDA and operational income reported significant growth, reinforcing the company's strong operational performance. Normalized income and net income have shown substantial growth, confirming the company's profitability. These strong financials may bolster investor confidence and support higher stock valuations.

Considering the technical and fundamental data at hand, it would seem plausible that CSX's stock price may continue its upward trajectory in the coming months, albeit potentially tempered with periods of consolidation due to the overbought technicals. The stocks' foundation appears robust based on operational performance, and with strong growth rates and market valuation, the possible expansion of the price could be anticipated. However, market conditions and external economic factors should be continually monitored as they could significantly impact the stock performance.

In the current financial landscape, CSX Corporation emerges as a significant player in the transportation sector, drawing investors to what is perceived as a haven of stability in an era marred by uncertainties. The company, with a broad portfolio that spans rail services, intermodal transportation, and logistics, has shown resilience to market fluctuations, a quality that reverberates through its recent financial statements and strategic endeavors.

Driven by increased export coal volumes and a robust uptick in domestic intermodal shipments, CSX has experienced revenue growth. Notably, the year 2022 marked a 36% rise in coal revenues, aided by heightened export coal prices and a surge in fuel surcharge revenuesa trend that is forecasted to persist in the short term and as a net positive for CSX's revenue.

The focus on providing value to its shareholders is apparent in various strategic moves by CSX, such as the 10% rise in dividends in February 2023, resulting in a payout of 11 cents per share. This shareholder-first philosophy also manifested in the form of significant buybacks and dividends, with the company returning approximately $5,583 million to its shareholders throughout 2022.

CSX's financial solidity is notably apparent when examining its performance by the end of the third quarter of 2023. With cash and cash equivalents amounting to $1,439 million and a manageable current debt of $559 million, its ability to cover short-term liabilities is evident. The company's current ratio outpaces the industry average, indicating a strong liquidity framework that supports the company's operations and debt management strategies.

However, obstacles lie ahead for CSX. The company has not been immune to the wide-reaching effects of supply chain disruptions, which have manifested in the form of labor shortfalls and equipment scarcities, hampering overall performance. The semiconductor shortage, in particular, has had a pronounced impact on CSX's merchandise segment. Furthermore, a 13% dip in intermodal revenues year-over-year in the first nine months of 2023 signals susceptibility to broader economic headwinds.

Operating expenses remain a concern for CSX, primarily due to increased outlays on labor, services, and fuel. The year 2021 saw an 11% increase in expenses, and this upward trajectory persisted in 2022, culminating in a 27% hike largely attributed to a considerable jump in fuel costs. The company did initiate cost-containment measures, but the third quarter of 2023 still witnessed a 2% inflation in operating expenses on a year-over-year basis.

Investing in the future has translated into substantial capital expenditure for CSX. From $1.63 billion in 2020, these investments have steadily grown, reaching $2.1 billion in 2022. Projected capital expenditures for 2023 stand at about $2.3 billion. These investments, necessary for long-term growth and maintaining operational efficiency, reflect added pressure on the company's financial resources.

Given the competitive landscape, CSX Corporation is positioned at a Zacks Rank of #3 (Hold), indicative of a neutral stance amidst its sector. The transport sector includes better-ranked candidates, as represented by Air Canada and SkyWest, which bear Zacks Ranks of #1 (Strong Buy) and #2 (Buy), respectively. These counterparts to CSX navigate through changes within the industry and experience positive market reception vis-a-vis rising consensus earnings estimates and strategic initiatives.

An episode that starkly highlighted the risks inherent in the transportation of hazardous materials was the train derailment incident in eastern Kentucky. This unfortunate event involved a CSX Corporation train and necessitated a complex and coordinated response from CSX, emergency services, and state officials. The aftermath saw CSX swiftly addressing the environmental implications, prioritizing the mishap's cleanup and the community's safety, and reflecting corporate responsiveness and duty.

The railroad industry within United States territory is characterized by a duopolistic arrangement, with major entities such as Berkshire Hathaway's BNSF Railway and CSX Corporation exerting dominance in their respective territories. While CSX operates primarily in the Eastern U.S., it is a formidable rival to BNSF on the other side of the Mississippi River. The financial results and operations of these industry giants, specifically CSX's considerable revenue generation from freight including consumer goods, industrial commodities, and coal, inform the valuation of their competitors and provide insights into the sector's overall prognosis.

The incident in Kentucky was an acutely challenging situation for CSX Corporation. The aftermath of 16 derailed rail cars, including those containing hazardous substances like molten sulfur, required an agile and comprehensive response from CSX and public safety officials. The subsequent clean-up operations and service restoration, along with the scrutiny it brought to railroad safety standards and emergency response protocols, emphasized the complex responsibilities that companies operating in the railroad industry bear.

Looking at the financial side, CSX Corporation's reputation as a dividend-paying enterprise is long-established. The company has displayed a dedication to consistent dividend payouts since 1986 and has evolved into a dividend achiever, annually raising dividends since 2002. This policy reflects confidence in its financial stability and business model resilience, making it a solid contender for investors seeking sustainable dividend streams.

CSX Corporation's investment in heritage and community development is exemplified by its involvement with the B&O Railroad Museum. CEO Joe Hinrichs's leadership of the capital campaign and CSX's $5 million contribution to the "CSX Bicentennial Garden" highlight the company's commitment to preserving railroading history and enhancing community engagement. This interweaving of historical preservation with ambitious development plans marks CSX's approach to balancing corporate growth with cultural stewardship and community vitality.

The derailment near Livingston, Kentucky, is a critical incident for CSX, shedding light on the inherent risks of rail transportation, especially of hazardous materials. The swift action taken by CSX, alongside emergency responders, ensured a prompt containment and mitigation of the incident. These responses not only reflect CSX's adherence to safety protocols but also their commitment to environmental stewardship and community safety.

CSX Corporation's market positioning remains compelling for investors seeking long-term value. Hedge fund interest and consistent dividend payouts underscore the railroad operator's financial health and growth potential. CSX's sector relevance, efficient scale, and responsiveness to economic trends position it favorably within both the railroad industry and as a potential stock for long-term holdings.

Similar Companies in Railroads:

Union Pacific Corporation (UNP), Norfolk Southern Corporation (NSC), Kansas City Southern (KSU), Canadian National Railway Company (CNI), Canadian Pacific Railway Limited (CP), Berkshire Hathaway Inc. (BRK.A)

News Links:

https://finance.yahoo.com/news/heres-why-investors-hold-csx-172800243.html

https://finance.yahoo.com/news/csx-train-derailment-kentucky-prompts-145616178.html

https://www.fool.com/investing/2023/12/03/apple-is-far-less-important-to-berkshire-hathaway/

https://finance.yahoo.com/m/78cd6f77-c7cf-329b-b1d3-d05df2106bab/crews-extinguish-fire-after.html

https://finance.yahoo.com/news/csx-corps-dividend-analysis-100638577.html

https://finance.yahoo.com/news/joe-hinrichs-president-ceo-csx-213000079.html

https://finance.yahoo.com/news/csx-eyes-wheel-bearing-cause-150457501.html

https://finance.yahoo.com/news/15-stocks-under-50-buy-143729771.html

https://finance.yahoo.com/news/14-most-profitable-industrial-stocks-064810498.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: YCECGTJa

https://reports.tinycomputers.io/CSX/CSX-2023-12-24.html Home