CSX Corporation (ticker: CSX)

2024-01-01

CSX Corporation, trading under the ticker symbol CSX, is a premier transportation company in the United States, specializing in the rail-based transportation of freight and intermodal containers. With a network that stretches across more than 20,000 miles of track, the enterprise operates predominantly in the eastern part of the country, serving major markets and ports, and providing an essential link between suppliers and consumers. As a key player in the North American rail industry, CSX boasts a diverse cargo portfolio, including agricultural products, automotive cargo, chemicals, energy products, and other important industrial goods. The corporation also focuses on sustainability and innovation to enhance its operational efficiency and maintain competitive edge. CSX's performance is often seen as an indicator of the broader economic health, given that its freight volumes can reflect trends in various economic sectors. Investors and analysts closely watch the company's financial results, operational metrics, and strategic initiatives as they have significant implications for the transportation sector and the economy at large.

CSX Corporation, trading under the ticker symbol CSX, is a premier transportation company in the United States, specializing in the rail-based transportation of freight and intermodal containers. With a network that stretches across more than 20,000 miles of track, the enterprise operates predominantly in the eastern part of the country, serving major markets and ports, and providing an essential link between suppliers and consumers. As a key player in the North American rail industry, CSX boasts a diverse cargo portfolio, including agricultural products, automotive cargo, chemicals, energy products, and other important industrial goods. The corporation also focuses on sustainability and innovation to enhance its operational efficiency and maintain competitive edge. CSX's performance is often seen as an indicator of the broader economic health, given that its freight volumes can reflect trends in various economic sectors. Investors and analysts closely watch the company's financial results, operational metrics, and strategic initiatives as they have significant implications for the transportation sector and the economy at large.

| Address | 500 Water Street, 15th Floor, Jacksonville, FL, 32202, United States | Phone | 904 359 3200 | Website | https://www.csx.com |

| Industry | Railroads | Sector | Industrials | Full Time Employees | 23,000 |

| Previous Close | 34.74 | Day's Range | 34.55 - 34.775 | Volume | 6,712,075 |

| Market Cap | 68,512,423,936 | Beta | 1.192 | PE Ratio (TTM) | 18.34 |

| Dividend Rate | 0.44 | Dividend Yield | 1.27% | Payout Ratio | 22.75% |

| EPS (TTM) | 1.89 | Profit Margins | 26.16% | Gross Profits | 7,390,000,000 |

| Revenue (TTM) | 14,707,000,320 | Total Cash (MRQ) | 1,439,000,064 | Total Debt (MRQ) | 19,107,999,744 |

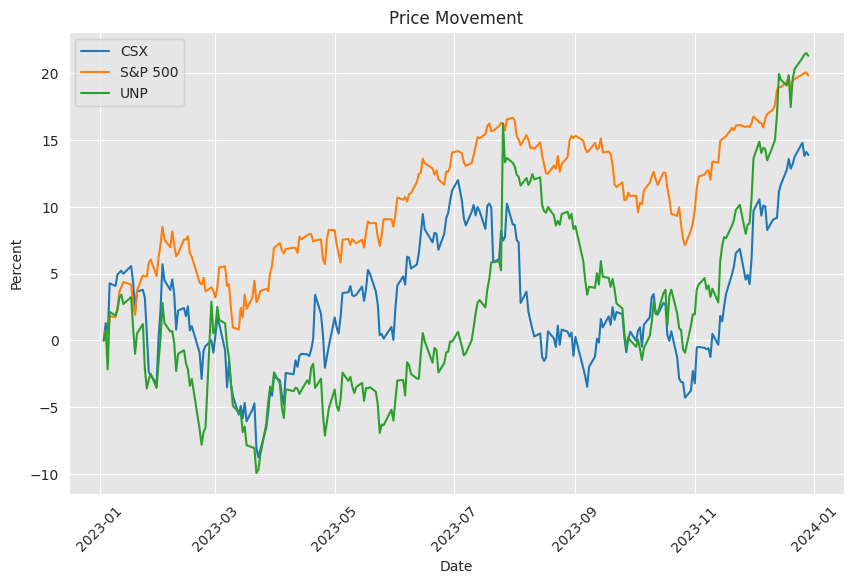

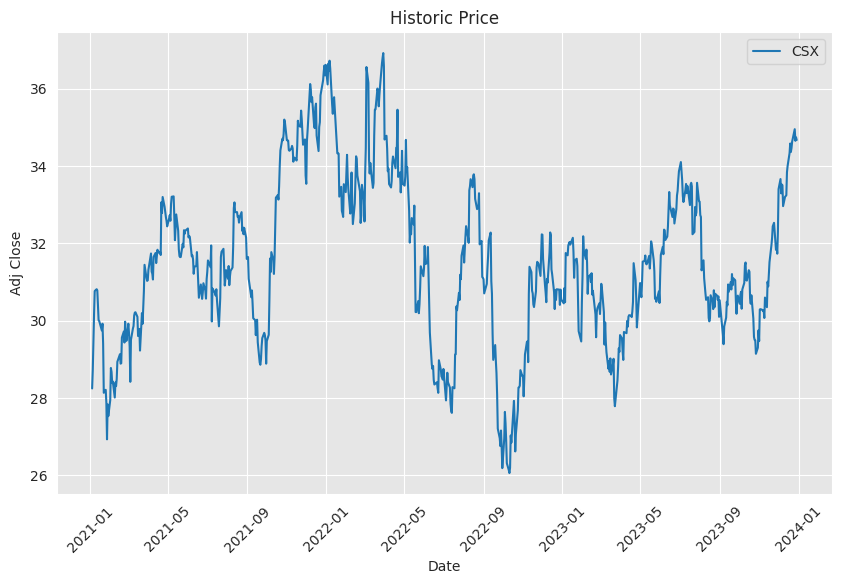

Based on the provided technical analysis data, fundamentals, and balance sheet information for CSX, the stock's potential movement over the next few months can be assessed. Favorable fundamentals such as a steady increase in net income, an increase in EBITDA, and free cash flow improvement reflect a solid financial footing for the company.

Based on the provided technical analysis data, fundamentals, and balance sheet information for CSX, the stock's potential movement over the next few months can be assessed. Favorable fundamentals such as a steady increase in net income, an increase in EBITDA, and free cash flow improvement reflect a solid financial footing for the company.

The technical analysis points to the presence of bullish indicators with PSAR (Parabolic Stop and Reverse) positioned below the price, which typically suggests an uptrend. Additionally, the OBV (On-Balance Volume) trend shows a rising volume on up days, implying accumulation. However, toward the end of the period, the MACD (Moving Average Convergence Divergence) histogram has dipped below the signal line, suggesting recent momentum may be slowing, potentially indicating a pullback or consolidation phase ahead.

Taking a closer look at the latest data, the closing price has been trending upward over the last quarter but has shown volatility within a narrow range, as evidenced by the high and low price points. With the stock closing the last trading day below the high, it suggests a slight retreat from the upward push.

Considering these details along with the company's robust fundamentals, we expect that CSX's stock price may continue its general rising pattern over the next few months, backed by ongoing positive sentiment around company performance. However, the stock may be due for a short-term period of consolidation or slight retraction based on the latest signals from MACD. Investors should watch for the stock to hold key support levels indicated by PSAR to maintain confidence in the continuation of its uptrend.

The fundamental analysis underscores the companys solid financial performance, with growing gross profit and operating income over the past three fiscal years. Improved financial health is also evident in reduced total debt levels and continued return of capital to shareholders through dividends and share repurchases, albeit this has led to an increase in net debt. The balance sheet demonstrates a strong tangible book value that has grown year over year, offering additional comfort to investors.

Given the technical and fundamental factors, investors may take advantage of price dips as buying opportunities, as the company's overall trajectory suggests strength. However, market conditions must also be considered, as external economic events can influence stock behavior irrespective of the companys individual metrics.

By monitoring both technical patterns and updating the analysis as new quarterly results are released, investors can adjust their expectations for CSX's stock performance. It is, therefore, advisable for investors to remain vigilant and responsive to both technical signals and changes in company fundamentals as they develop.

CSX Corporation - 2023 Q3 SEC Form 10-Q Summary

Overview: CSX Corporation, headquartered in Jacksonville, FL, is a leading railroad company providing rail-based transportation services such as traditional rail service, intermodal containers, and other related services. It operates mainly in the eastern U.S., with a network covering approximately 20,000 route miles.

Financial Highlights: - Revenue: Decreased by $323 million, or 8%, compared to the same quarter in 2022. - Expenses: Decreased by $39 million, or 2%, compared to the same quarter in 2022. - Operating Income: $1.3 billion, a decrease of $284 million (18%) compared to the previous year. - Operating Ratio: Increased by 430 basis points to 63.8%. - Earnings per Share: Decreased by $0.10 or 19% to $0.42, compared to 2022. - Revenue Ton-Miles: Workload remained relatively stable with a slight 2% increase on an annual basis.

Volume and Revenue: - Both volume and revenue experienced decreases across several areas, including intermodal and coal services, but increased in areas such as automotive. - Trucking revenue and other revenue categories saw significant declines due to various factors like lower fuel recovery and the conclusion of certain property rights agreements.

Operating Costs: - Labor and fringe benefits reduced slightly due to prior out-of-period labor costs, while purchased services and other expenses increased marginally due to inflation and operating support costs. - Fuel expenses decreased significantly due to lower locomotive fuel prices. - Equipment and other costs also saw a slight decline. Property disposition gains dropped as well.

Financial Position and Liquidity: - Cash & cash equivalents decreased by $598 million over the nine months. - Cash generation from operating activities was $206 million lower than last year, primarily due to increased wage payouts following labor agreement settlements. This reduction was partially offset by delayed federal tax payments following Hurricane Idalia. - Investments in property increased, and long-term debt saw a modest rise due to new issuances. - Share repurchases totaled approximately $2.9 billion for the year. - A new $5 billion share repurchase program was approved in October 2023.

Commitments and Legal Proceedings: - CSX discussed various commitments, including pending legal proceedings and contingent liabilities. - Detailed environmental contingencies in partnership with government authorities that could potentially exceed $1 million.

Strategic Initiatives: - CSX is committed to continuous improvement and effective management of business risks. - The company focuses on safety, security, and environmental stewardship, along with fostering new growth opportunities.

Outlook: - The summary anticipates continued commitment to strategic growth with oversight of potential risks and economic conditions impacting the railroad industry.

Substantial portions of this summary would serve as independent sections within a larger report on CSX Corporations Q3 financial performance for 2023.

CSX Corporation's stellar reputation as a Dividend Champion has been bolstered by its indisputable record of regular and increasing dividend payouts to its shareholders. This respected status positions CSX among the league of over 700 companies that have consistently demonstrated reliability in dividend growth, a critical factor for investors who prioritize income-generating stocks. As an updated monthly roster, the Dividend Champions list is an esteemed index for those looking to invest in dividend stalwarts.

Recently, CSX announced a dividend of $0.11 per share. To partake in this dividend, investors were required to hold CSX shares before the ex-dividend date of November 29, 2023. Payment of this dividend would follow on December 15, 2023. An integral aspect to consider is the annualized yield, which, at the time of the announcement, stood at 1.35%, a reasonable forecast of the annual income an investor could expect relative to the cost of CSX's stock. Such figures underscore CSXs capability to maintain financial health and deliver value to its shareholders through sustained cash flows.

The dividend payout is reflective of a remarkable 19-year stretch of consecutive dividend increases, exhibiting the company's unwavering commitment to its shareholders. Implied in this consistency is a long-term strategy that embraces the power of compounding dividends, catering to those investors seeking enduring returns. This reliable dividend growth is a bellwether of the organization's resiliency and prioritization of shareholder interests, even as it juggles the complexities inherent in the rail freight business landscape.

As company's stature amongst Dividend Champions, Contenders, and Challengers paints a picture of CSXs past and present financial successes. Attracting those who seek regular income from their investments, this categorization shines light on the value and robustness of the company's dividend policy. It also suggests that CSX has the leverage and operational efficiency required to sustain such a policy for the foreseeable future.

Despite this strong financial footing, CSX confronted unwelcome headlines due to a train derailment in Kentucky. On November 27, 2023, a CSX train suffered a mechanical incident resulting in the spill of molten sulfur and drawing both local and national concern. Swift action by CSX and coordination with local and federal authorities mitigated what could have been far-reaching repercussions to public safety and the environment. The Kentucky Governors declaration of a state of emergency expedited support from state agencies, encapsulating the seriousness of the circumstances while illustrating CSX's capacity for rapid crisis management.

The environmental and public health perils presented by the derailment were met with prompt and extensive cleanup operations. By the following weekend, service along the main line was reinstated, following the removal of derailed cars and significant site remediation efforts. Of the derailed cars, two carried magnesium hydroxide, and while they were potentially hazardous, they remained intact, containing any further risk. The remaining cars, either empty or used for non-hazardous cargo, somewhat limited the extent of possible damage.

In a move exemplifying transparency, CSX's routine updates and accessible communication about the incident established trust with stakeholders. The swift actions and comprehensive reporting, covered by news outlets such as FreightWaves, emphasized the serious approach CSX takes to safety and environmental stewardship, reaffirming their reputable standing despite the operational hiccup.

The incident highlights the critical nature of safety and maintenance in the rail industry and the necessity of a robust emergency plan. It brings to the fore the continuous efforts needed to maintain safety standards and the diligent response required when incidents occur. As the sector moves forward, such occurrences prompt a reevaluation of protocols to reinforce the safety and efficiency of rail transport.

Following broader market trends, CSX is amidst companies whose stock is valued under $50, garnering attention for their potential for long-term growth. Such stocks, popular among hedge funds and institutional investors, offer a low-cost avenue to diversify portfolios and tap into multiple economic sectors. Market analyses from data-driven entities like Insider Monkey reveal a penchant for stocks like CSX, which have a high market capitalization and earn favorable analyst recommendations, amongst other positive attributes.

When scanning across other sectors such as energy, financial services, and consumer goods, similar investment vectors have emerged. Companies traded below the $50 price point but bearing large market caps and hedge fund interest underscore the opportunity that stocks like CSX offer. Their modest price tags have not dampened their appeal, with companies like BP and Altria Group also showcasing a balance of yield and growth prospects.

The recognition of CSX's railroad services has been accentuated by a post-COVID-19 economic revival. Catering to diverse commodity needs such as chemicals and agricultural products, CSX has seen a momentum shift in business, mirrored in the appreciation of its stock price and a modest dividend yield. Thus, even as markets undulate, CSX remains a choice for investors leveraging the companys market position and growth trajectory.

The dividends of CSX Corporation curate an image of fiscal prudence and reflect a strategy that favors incremental but assured shareholder returns. With a payout ratio comfortably low, there is a distinct signal that CSX is managing its earnings astutely, keeping enough on hand to fuel future expansion while also providing shareholders with their due share. Striking this balance necessitates a careful assessment of capital allocation, ensuring dividends are not just sustainable but poised for potential growth. Such financial metrics bode well for CSX's ability to approach its dividend policy with the same efficiency it employs in its core logistics operations.

CSX's stature in the railway market, aligning with industry giants like BNSF and Union Pacific, is indicative of its formidability in the Eastern United States. This presence emphasizes the companys value within the freight transportation sector. The strategic significance of CSX's operations gains further relevance when considered against the backdrop of other major conglomerates, like Berkshire Hathaway, which demonstrate the considerable economic value that efficiently managed railroads offer to diversified portfolios.

The rail industry's comparative advantage and synergy as part of larger portfolios coalesce around entities like CSX. With a stable source of income and integration within broader economic rhythms, CSX forms a vital fragment of the market ecosystem, pivotal for the transport of essential commodities and goods and as an investment asset.

CSX Corporations resilience in the industrial sector is underscored by the steady financial performance it has cultivated over time. As a flagship of the industrials segment, CSXs consistent declaration of dividends, yielding 1.28% as of December 18th, 2023, caters to investors seeking unfaltering income. This enduring commitment to shareholder value is further underlined by hedge fund interest, a signal of informed confidence in the company's trajectory of profitability.

Notwithstanding the broader industry's tepid performance relative to other market sectors, CSX reports impressive net earnings that emphasize its critical economic footprint. CSXs potential for sustained growth also finds resonance in federal objectives focusing on infrastructure revitalization and national production capabilities. This context portends a lenitive effect on industrial stocks like CSX, placing it within the purview of investors and market analysts as a tenable and perhaps flourishing venture.

In the wake of operational setbacks like the Kentucky train derailment, CSX has demonstrated commendable crisis management and environmental stewardship. The comprehensive recovery efforts and quick resumption of service post-accident exemplifies CSX's capacity to efficiently navigate and manage industrial emergencies. This level of commitment to public and environmental well-being is integral to the trust and reliability that stakeholders place in CSX, reinforcing its overall corporate reputation.

On the cusp of a very significant jubilee the 200th anniversary of American railroading CSXs investment in the transformation of the B&O Railroad Museum in Baltimore pledges not only to align with a historical celebration but also promotes technological progress and community revitalization. CSX's role in these development plans, earmarked by a significant financial pledge, illustrates the companys allegiance to its historical roots and eagerness to support to the sector's future.

Finally, the fiscal agility demonstrated by CSX, with an increase in its quarterly dividends and an ongoing share buyback program, reflects healthy liquidity and a proficient balance sheet. The robust liquidity position, along with substantial top-line growth driven by enhanced coal revenues and other segments, underscores CSXs capacity to generate shareholder value despite headwinds such as rising operational costs and supply chain strains.

The company's determination to preserve a strong financial standing amidst intensified capex requirements speaks to the strategic investment in the future of CSX's operations. Watching CSX's market trajectory, analysts have maintained a neutral stance, indicative of its steady foothold in a fluctuating market. This outlook, combined with robust investor returns, positions CSX as a company to watch, balancing tactical growth with shareholder satisfaction.

Similar Companies in Railroads:

Union Pacific Corporation (UNP), Norfolk Southern Corporation (NSC), Kansas City Southern (KSU), Canadian National Railway Company (CNI), Canadian Pacific Railway Limited (CP), Berkshire Hathaway Inc. (BRK.A)

News Links:

https://www.fool.com/investing/2023/12/03/apple-is-far-less-important-to-berkshire-hathaway/

https://finance.yahoo.com/news/csx-eyes-wheel-bearing-cause-150457501.html

https://finance.yahoo.com/news/14-most-profitable-industrial-stocks-064810498.html

https://finance.yahoo.com/news/csx-corps-dividend-analysis-100638577.html

https://finance.yahoo.com/news/15-stocks-under-50-buy-143729771.html

https://finance.yahoo.com/news/joe-hinrichs-president-ceo-csx-213000079.html

https://finance.yahoo.com/news/heres-why-investors-hold-csx-172800243.html

https://finance.yahoo.com/m/78cd6f77-c7cf-329b-b1d3-d05df2106bab/crews-extinguish-fire-after.html

https://finance.yahoo.com/news/csx-train-derailment-kentucky-prompts-145616178.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: sx8tjj

https://reports.tinycomputers.io/CSX/CSX-2024-01-01.html Home