Digital Realty Trust, Inc. (ticker: DLR)

2023-12-24

Digital Realty Trust, Inc. (ticker: DLR) is a real estate investment trust (REIT) that specializes in the ownership, acquisition, development, and management of data center properties. The company operates a global network of data centers, providing colocation, interconnection, and digital infrastructure services to businesses across diverse industries. DLR's portfolio includes data centers in North America, Europe, Asia-Pacific, and Latin America, catering to the growing demand for data storage and processing capabilities driven by the increasing digitization of the global economy. As a REIT, Digital Realty is required by law to distribute at least 90% of its taxable income to shareholders in the form of dividends, making it a potentially attractive investment for income-seeking investors. The company's commitment to sustainability and energy efficiency in its data center operations is also a noteworthy aspect of its business strategy. With the rise of cloud computing, artificial intelligence, and the Internet of Things, Digital Realty Trust, Inc. is well-positioned to benefit from the ever-expanding need for data center infrastructure.

Digital Realty Trust, Inc. (ticker: DLR) is a real estate investment trust (REIT) that specializes in the ownership, acquisition, development, and management of data center properties. The company operates a global network of data centers, providing colocation, interconnection, and digital infrastructure services to businesses across diverse industries. DLR's portfolio includes data centers in North America, Europe, Asia-Pacific, and Latin America, catering to the growing demand for data storage and processing capabilities driven by the increasing digitization of the global economy. As a REIT, Digital Realty is required by law to distribute at least 90% of its taxable income to shareholders in the form of dividends, making it a potentially attractive investment for income-seeking investors. The company's commitment to sustainability and energy efficiency in its data center operations is also a noteworthy aspect of its business strategy. With the rise of cloud computing, artificial intelligence, and the Internet of Things, Digital Realty Trust, Inc. is well-positioned to benefit from the ever-expanding need for data center infrastructure.

| As of Date: 12/24/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 40.92B | 36.63B | 34.07B | 28.64B | 28.83B | 28.52B |

| Enterprise Value | 58.87B | 56.39B | 53.99B | 47.30B | 46.51B | 44.86B |

| Trailing P/E | 46.75 | 95.29 | 104.47 | 88.57 | 20.55 | 21.66 |

| Forward P/E | 100.00 | 101.01 | 121.95 | 86.21 | 59.52 | 55.56 |

| PEG Ratio (5 yr expected) | 3.14 | 2.78 | 2.89 | 2.01 | 1.87 | 1.73 |

| Price/Sales (ttm) | 7.77 | 7.26 | 7.02 | 6.24 | 6.40 | 6.26 |

| Price/Book (mrq) | 2.34 | 2.17 | 2.07 | 1.70 | 1.79 | 1.74 |

| Enterprise Value/Revenue | 11.02 | 40.21 | 39.52 | 35.33 | 37.72 | 37.63 |

| Enterprise Value/EBITDA | 19.41 | 43.56 | 79.12 | 77.06 | 88.92 | 62.00 |

| Full Time Employees | 3,412 | Previous Close | 134.91 | Open | 135.36 |

| Day Low | 134.16 | Day High | 136.09 | Dividend Rate | 4.88 |

| Dividend Yield | 0.0361 | Payout Ratio | 1.6886 | Five Year Avg Dividend Yield | 3.54 |

| Beta | 0.57 | Trailing PE | 46.754322 | Forward PE | 115.48718 |

| Volume | 1,094,242 | Average Volume | 1,996,654 | Average Volume 10 Days | 2,336,150 |

| Bid | 130.46 | Ask | 138.5 | Bid Size | 900 |

| Ask Size | 1,000 | Market Cap | 41,731,948,544 | Fifty Two Week Low | 86.33 |

| Fifty Two Week High | 139.35 | Price to Sales Trailing 12 Months | 7.8553085 | Fifty Day Average | 130.4112 |

| Two Hundred Day Average | 115.1899 | Trailing Annual Dividend Rate | 4.88 | Trailing Annual Dividend Yield | 0.036172263 |

| Enterprise Value | 60,764,565,504 | Profit Margins | 0.17401 | Float Shares | 302,385,698 |

| Shares Outstanding | 302,852,000 | Shares Short | 14,858,232 | Shares Short Prior Month | 15,411,584 |

| Held Percent Insiders | 0.00208 | Held Percent Institutions | 1.0385 | Short Ratio | 8.76 |

| Short Percent of Float | 0.058000002 | Book Value | 57.648 | Price to Book | 2.3438802 |

| Last Fiscal Year End | December 31, 2022 | Next Fiscal Year End | December 31, 2023 | Most Recent Quarter | September 30, 2022 |

| Earnings Quarterly Growth | 2.094 | Net Income to Common | 883,705,024 | Trailing EPS | 2.89 |

| Forward EPS | 1.17 | PEG Ratio | -5.89 | Enterprise to Revenue | 11.438 |

| Enterprise to EBITDA | 25.755 | S&P 52 Week Change | 0.24166095 | Last Dividend Value | 1.22 |

| Total Cash | 1,094,531,968 | Total Cash Per Share | 3.614 | EBITDA | 2,359,310,080 |

| Total Debt | 18,359,175,168 | Quick Ratio | 0.84 | Current Ratio | 0.842 |

| Total Revenue | 5,312,579,072 | Debt to Equity | 91.627 | Revenue Per Share | 18.04 |

| Return on Assets | 0.010190001 | Return on Equity | 0.04773 | Gross Profits | 2,660,775,000 |

| Free Cash Flow | 1,974,540,416 | Operating Cash Flow | 1,628,898,944 | Earnings Growth | 2.097 |

| Revenue Growth | 0.172 | Gross Margins | 0.53158003 | EBITDA Margins | 0.4441 |

| Operating Margins | 0.11999 |

Based on the provided technical analysis (TA) data and the company's fundamentals, we can attempt to predict the future price movement for DLR's stock in the coming months. However, it is important to note that predictions are not guarantees and that stock prices are influenced by a multitude of factors, both predictable and unforeseeable.

The technical indicators reveal the following:

- The Adjusted Closing price is at 135.119995, which suggests the stock has recently experienced a slight downtrend as it is below the 5-day Bollinger Band middle (BBM_5_2.0) at 133.926001.

- The Moving Average Convergence Divergence (MACD) is positive at 0.546948, but the MACD histogram is negative at -0.482181, indicating that while the overall trend may be bullish, we are currently in a pullback or consolidation phase.

- The Relative Strength Index (RSI_14) is moderate at 53.897285, suggesting the stock is neither overbought nor oversold.

- The Stochastic oscillator percent K at 41.293208 is not in the oversold territory but is below the percent D (3-day moving average of %K) at 36.146732, indicating that the stock might not have strong bullish momentum.

- The Average Directional Index (ADX_14) at 20.218499 is close to the threshold of 25, which suggests the trend strength is relatively weak.

- On Balance Volume (OBV) is 2.538200 million, which would need more context to interpret accurately, as it depends on the previous trend.

- The stock is trading below the Parabolic SAR (PSARs_0.02_0.2) at 136.849808, often considered a bearish signal.

From the fundamental perspective:

- The Market Cap indicates growth over the past year, showing investor confidence and possibly a bullish outlook for the company's future.

- The Trailing P/E has normalized from previous higher levels, which might suggest the stock had been overvalued and is now at a more sustainable level.

- The Forward P/E is currently quite high, suggesting that investors expect higher earnings in the future, although this could also mean the stock is overvalued at the moment.

- The Enterprise Value multiples show significant volatility over the periods noted, which could suggest that the company has experienced fundamental changes or that market perception has shifted dramatically.

- The financial health of the company as detailed in the summary of financials indicates growth in operating revenue and a stable net income, which is a positive indicator for investors concerning the company's profitability.

Considering both the technical indicators and the company's fundamentals, we anticipate that DLR's stock price may experience mild bullish movements in the coming months, supported by some underlying positive fundamentals. However, the high Forward P/E and the mixed signal from the technical indicators, especially with a weak ADX and a negative MACD histogram, indicate that while the long-term perspective may be positive, the stock might face short-term volatility and consolidation before resuming any significant upward trend.

The exact trajectory of DLR's stock price will also depend on broader market conditions, sector-specific trends, and developments within the company. Investors should keep a close watch on changes in the fundamental financial metrics, as they tend to lag behind the technicals but provide a more comprehensive view of the company's future prospects. Additionally, monitoring news and other market sentiment indicators will be crucial for making more informed predictions as conditions evolve.

Digital Realty Trust, Inc. (DLR) stands as a leading real estate investment trust (REIT) in the prolific sector of data center properties, capitalizing on the ever-accelerating demand for digital infrastructure. The necessity for colocation and peering services grows parallel to the technological advancements that shape our economy, endorsing DLR's critical role in supporting this digital era.

The stock's identification by a Wall Street analyst as a REIT with significant growth potential traces back to its agile strategic maneuvers aimed at portfolio expansion and diversification. Highlighting a 20% stock price upside, this optimistic projection draws from DLR's proactive approach to growthwhich recently included the substantial $9.3 billion all-stock transaction to absorb Spirit Realty Capital. This bold acquisition enriches Digital Realty's portfolio with vital industrial properties and enhances its geographic spread, signaling confident strides in market opportunity leverage and shareholder value enhancement through diversification.

DLR's commitment to expansion is further substantiated by the formation of a joint venture dedicated to data center development, wherein the company has secured an 80% equity interest. This venture is more than a display of growth initiative; it signifies the company's understanding of the increasing reliance on data centers, a sector that has begun to claim an indispensable place in the technology-dependent economy.

Amidst fluctuating market tides that previously saw Digital Realty's share price descend to a near four-year low, the REIT's subsequent rebound underscores the merit of strategic investment initiatives and analyst upgrades that exude bullish confidence. These advancements position DLR advantageously within the broader trends of the REIT sector, with data processing and storage solutions firmly anchored in its growth narrative.

Another aspect that bolsters Digital Realty's appeal is the significant dividend yield, estimated at approximately 5.5%. The potential capital gains combined with income generation through dividends carve out Digital Realty as a desirable investment option. Investors especially value the trust's historical dividend growth, marked by its 123rd increment since 1994a demonstration of commitment to consistent shareholder returns.

The robust foundation laid down by Digital Realty's strategic expansions and its focus on vital digital infrastructure positions the company as a beacon of growth within the tech-dominated economic landscape. Echoing the analyst's forecast of a 20% stock price upside, market observers anticipate that DLR will persist in its trajectory of harmonizing growth-driven capital appreciation with stable, escalating dividends. The trust's earnest ability to spot and execute growth opportunities while sustaining substantial income is a compelling narrative.

In the forthcoming year, a forthcoming dividend payment of $1.22 per share is scheduled for January 19, 2024, adding another layer to Digital Realty's reputation as a respected dividend achiever. The consistency of dividend increase since 2004 punctuates its investor appeal. Despite the perceived uncertainty around the payout ratio, marked at 1.69 as of September 30, 2023, the company's substantial profitabilitya glowing seven out of ten ranking per GuruFocusmay indicate a sustainable future for its generous dividend distributions.

Digital Realty's fiscal acumen is also present in its growth rank, standing favorable at seven out of ten. Although the last few years have seen undulating earnings with an average annual decline, Digital Realty's revenue narrative tells a different storyone of robust, steady progression. This strength, coupled with a trailing dividend yield of 3.59%, supports the view of a company with a reliable revenue model and promising growth potential.

The joint venture with Realty Income Corp reflects Digital Realty's inventive investment strategies within the data center segment. With a significant $200 million infusion from Realty Income for an 80% equity interest, the joint venture responds to the swelling demand for data storage and cloud services. Realty Income's resilient operating strategy, projected to increase revenue by 20.4% in the current year, endorses DLR's venture into an area ripe with growth prospects.

Financially, the stability of Realty Income, supported by $4.5 billion in liquidity and low leverage, coupled with strong coverage metrics, anchors a foundation for Digital Realty's expansion within the competitive data center market. Further confidence for Digital Realty comes from Realty Income's aggressive dividend strategy, underpinning the notion that the financial synergy of the partnership is likely to benefit both parties and attract eager investors.

The joint venture to develop data centers with the global investment firm Blackstone marks another strategic milestone for Digital Realty. The $7 billion collaboration is poised to capitalize on the relentless demand for digital infrastructure, fostering the development of data center campuses across key metro areas. Blackstone's 80% stake, starting with a $700 million contribution, leaves Digital Realty with a 20% interest, delegating the management of the venture to the latter.

This partnership permits Digital Realty to cushion the capital expenditures typically involved in establishing data centers, thereby channeling funds into balance sheet fortification and dividend yield sustenance. With such initiatives in place, DLR not only seizes upon the data center industry's growth but also stands on a solid financial ground, crucial for accommodating the surge in interest rates experienced in the prior year.

The collaboration with Blackstone serves investor interests as it infuses income and growth prospects, potentially enhancing dividends and fortifying shareholder returns over time. Digital Realty and Blackstone intersecting in the high-conviction investment avenue of data centers augurs a future ripe with opportunities as technological advancements continuously evolve, heralding a positive outlook for long-term investment stakes.

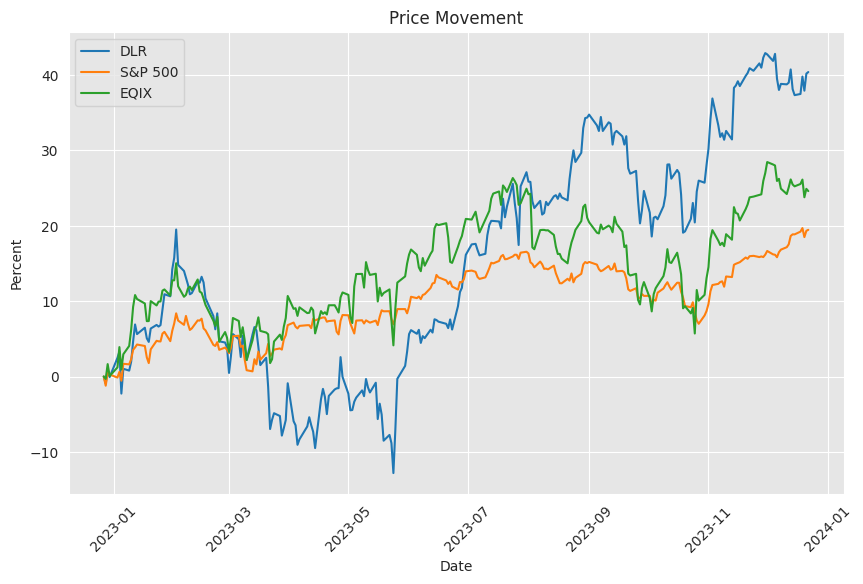

Digital Realty Trust, commanding more than 300 data centers globally, is an embodiment of durability within the digital economy landscape, with clients encompassing technology leaders such as Oracle and IBM. The trust's strategy ensures annual recurring revenue, essential amidst the compounding demand for data processing and storage. Financially, DLR reflects its investor commitment with an attractive 3.6% dividend yield and an impressive 31% surge in its stock YTD, asserting its balance between dividend yield and share appreciation within an unpredictable market.

As investors continue to scrutinize the commercial real estate sector, DLR shines for its specialization in data centersa critical infrastructure for burgeoning advancements like AI. With positive investor sentiment buoyed by DLR's commercial standing and its potential for capital appreciation, Digital Realty emerges as a compelling investment avenue for those seeking stable income and growth.

The company's innovation in data center development is further emphasized through its joint venture with Realty Income Corporation. The collaboration, which sees Digital Realty retaining a 20% equity interest, is a strategic ingress into the data center sector. Realty Income's financial solidity, headlined by $4.5 billion in liquidity and its A-grade credit ratings, provides a stable backdrop for Digital Realty's ambitions.

Observing competitive activities such as Tanger Factory Outlet Centers and Urban Edge Properties, both experiencing positive FFO per share adjustments, underscores the sector's dynamic environment. Digital Realty's acumen in identifying and capitalizing on strategic partnerships entails a formidable market position, dictating a tale of potential long-term value creation in a swiftly transforming real estate and digital realm.

Continuing the narrative of strategic partnership, Digital Realty's alignment with Blackstone signifies a forward-thinking venture into developing data centers. With a combined capacity of 500 megawatts of IT load under development, this joint venture is a testament to Digital Realty's insight into the ever-growing demand for digital infrastructure. Blackstone's investment thrust into the digital landscape and Digital Realty's extensive experience in data center operations empower both parties to capture market opportunities in the digital economy, offering prospects for long-term investor benefits.

At the crossroads of growth and dividend consistency, Digital Realty Trust epitomizes the sought-after symbiosis for investors. The REIT's specialization within data centers gifts it an edge in a data-intensive business environment, while the reliable increases in shareholder returns evoke a narrative of steadfast prosperity. Indeed, Digital Realty's stock is not just an investment vehicle but a representation of the company's intrinsic value and growth potential in the tech-inclined economies of the future.

DLR's narrative is enriched by the company's financial prudence and strategic investment decisions. Operating on an interconnected global stage, Digital Realty is deftly maneuvering through the commercial real estate sector's current and future challenges. The company's resilience amidst short-seller attention, coupled with its adoption of a strategic focus to meet burgeoning technological demands, shows a REIT able to withstand market volatility and capitalize on enduring sector growth.

As the REIT sector continues to witness economic variability, entities like DLR are steered by the knowledge that digital transformation underpins future commercial property demand. Digital Realty's allegiance to data center growth sectors positions it to surmount short-term market shifts and thrive in the long run, as the globe edges toward increased digital and cloud service reliance.

In the context of a potential 'Santa Claus REIT Rally', Digital Realty's past acquisition strategies and continued performance amidst market challenges evoke a narrative of resilient growth. The collaborative deals with Realty Income Corporation and Blackstone serve as harbingers of strategic development in the data center domain. Digital Realty's trajectory, combined with a financial discipline that strives toward reduced debt leverage, illustrates a balanced approach to capital growth and return, irrespective of broader sector downturns.

Analyzing Brad Thomas's commentary on the REIT landscape moving into 2024 underscores the importance of strategic foresight in investment decisions. Thomas's recommendations revolve around identifying REITs with established scale, capital advantages, and robust financial health. These insights resonate with Digital Realty's profile as the company leverages its expansive global presence and keen industry insights to grow and protect earnings while poised to take advantage of market window for mergers and acquisitions.

Digital Realty Trust emerges as an eminent contender in the AI infrastructure market as the company's data centers serve as critical hubs enabling the computing power and networking capacity that AI workloads demand. DLR's extensive metropolitan coverage positions the company to supply the low-latency requirements integral for AI's real-time execution. Coupled with competitive valuations and a dividend yield that signals growth potential, DLR represents an investment opportunity bridging the present with impending technological frontiers.

In the overarching realm of digital economy infrastructure, Digital Realty Trust's expansive portfolio makes it a formidable force in the data center sector. The company's cloud-enabling services ensure value provisioning to global tech leaders. With an enduring, resilient appeal, DLR's investment profile combines yield and growth prospects, making it a noteworthy stock choice as companies increasingly depend on cloud storage and data management services.

Enclosed by a framework of firm financial performance and strategic joint ventures, Digital Realty Trust, Inc. (DLR) harnesses the burgeoning digital infrastructure demand to position itself as a solid investment opportunity within the real estate sector. The company's aptitude for innovation and resilience in a high-interest-rate landscape is a testament to its adaptability. DLR's engagement in pivotal transactions and recognition by hedge fund investors as a favorable business model amplify the trust's capacity to thrive as it capitalizes on the growing importance of digital infrastructure in the global economy.

Similar Companies in REIT - Specialty:

Equinix, Inc. (EQIX), CyrusOne Inc. (CONE), CoreSite Realty Corporation (COR), QTS Realty Trust (QTS), Iron Mountain Incorporated (IRM)

News Links:

https://www.fool.com/investing/2023/12/13/this-hot-reit-stock-still-has-20-upside/

https://finance.yahoo.com/news/digital-realty-trust-incs-dividend-101233942.html

https://finance.yahoo.com/news/key-reasons-add-realty-income-143800804.html

https://www.fool.com/investing/2023/12/11/these-dividend-stocks-are-joining-forces-in-a-7-bi/

https://finance.yahoo.com/news/3-most-attractive-dividend-stocks-224658089.html

https://finance.yahoo.com/news/realty-income-o-rewards-investors-160300536.html

https://seekingalpha.com/article/4653756-realty-income-is-going-down-a-concerning-path

https://seekingalpha.com/article/4659268-know-when-to-fold-em

https://seekingalpha.com/article/4653037-whos-shorting-reits

https://www.fool.com/investing/2023/12/11/lets-look-back-on-3-commercial-real-estate-trends/

https://seekingalpha.com/article/4657310-whos-ready-for-a-santa-claus-reit-rally

https://www.fool.com/investing/2023/11/19/tech-companies-cant-stop-spending-on-artificial-in/

https://finance.yahoo.com/news/don-t-wait-3-fearless-233757153.html

https://finance.yahoo.com/news/13-most-profitable-real-estate-103956623.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: Ansx1C

https://reports.tinycomputers.io/DLR/DLR-2023-12-24.html Home