Brinker International, Inc. (ticker: EAT)

2024-02-28

Brinker International, Inc. (ticker: EAT) is a prominent entity in the hospitality industry, primarily known for its ownership, operation, and franchising of various restaurant brands. Among its most recognizable brands are Chili's Grill & Bar and Maggiano's Little Italy, which collectively span a significant number of locations not only across the United States but also internationally. The company prides itself on offering a diverse menu range that caters to a wide array of tastes and preferences, emphasizing quality food, customer service, and a vibrant dining atmosphere. Over the years, Brinker International has demonstrated a keen ability to adapt to changing market dynamics, including enhancing its digital presence and to-go services, a strategic move that has proven crucial in navigating the challenges presented by the global pandemic. Financially, Brinker International has shown resilience and adaptability, maintaining a steady performance amidst fluctuating economic conditions. With a business model that continues to evolve in response to customer needs and technological advancements, Brinker International, Inc. remains a key player in the global dining experience, symbolized by its commitment to growth, innovation, and customer satisfaction.

Brinker International, Inc. (ticker: EAT) is a prominent entity in the hospitality industry, primarily known for its ownership, operation, and franchising of various restaurant brands. Among its most recognizable brands are Chili's Grill & Bar and Maggiano's Little Italy, which collectively span a significant number of locations not only across the United States but also internationally. The company prides itself on offering a diverse menu range that caters to a wide array of tastes and preferences, emphasizing quality food, customer service, and a vibrant dining atmosphere. Over the years, Brinker International has demonstrated a keen ability to adapt to changing market dynamics, including enhancing its digital presence and to-go services, a strategic move that has proven crucial in navigating the challenges presented by the global pandemic. Financially, Brinker International has shown resilience and adaptability, maintaining a steady performance amidst fluctuating economic conditions. With a business model that continues to evolve in response to customer needs and technological advancements, Brinker International, Inc. remains a key player in the global dining experience, symbolized by its commitment to growth, innovation, and customer satisfaction.

| City | Dallas | State | TX | Zip | 75019 |

| Country | United States | Phone | 972 980 9917 | Website | https://brinker.com |

| Industry | Restaurants | Sector | Consumer Cyclical | Full Time Employees | 64,323 |

| Current Price | 46.71 | 52 Week High | 47.3 | 52 Week Low | 28.23 |

| Market Cap | 2,065,847,808 | Enterprise Value | 4,135,449,088 | Total Revenue | 4,245,299,968 |

| Total Cash | 22,700,000 | Total Debt | 2,092,300,032 | Net Income | 154,200,000 |

| EBITDA | 405,700,000 | Trailing EPS | 3.42 | Forward EPS | 4.03 |

| Shares Outstanding | 44,227,100 | Book Value | -2.477 | Shares Short | 5,525,805 |

| Profit Margins | 0.03632 | Gross Margins | 0.13471 | EBITDA Margins | 0.09556 |

| Operating Margins | 0.06033 | Return on Assets | 0.05907 | Revenue Growth | 0.054 |

| Sharpe Ratio | 0.6274463959694784 | Sortino Ratio | 10.447619726181456 |

| Treynor Ratio | 0.2191400992815105 | Calmar Ratio | 0.8007482347161771 |

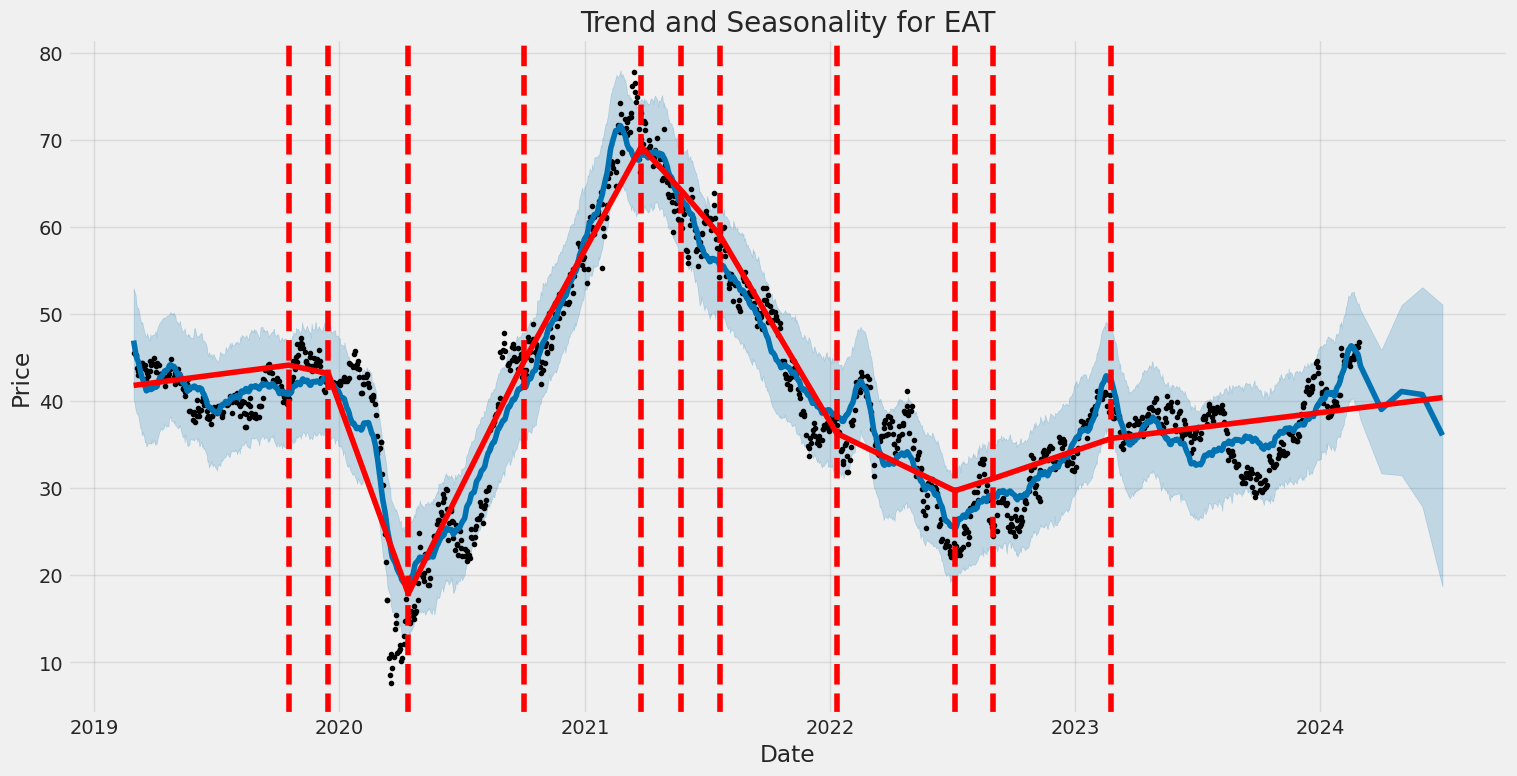

Based on a comprehensive review of the technical indicators, fundamentals, balance sheet data, and various financial ratios provided for EAT, the following analysis provides insights into the stock's future price movement over the subsequent months.

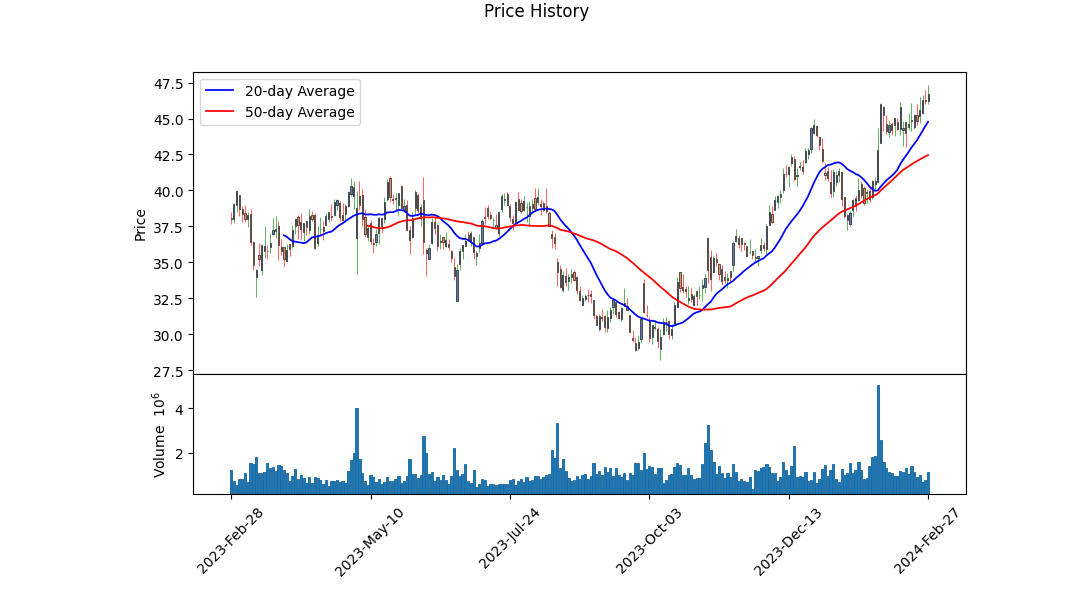

The observed technical indicators exhibit positive momentum with an increasing On-Balance Volume (OBV) which suggests growing buying pressure. The Moving Average Convergence Divergence (MACD) histogram values, particularly the latest reading of 0.081404, indicates a bullish trend. Historically, such patterns often correlate with sustained upward price movements when accompanied by solid fundamentals and improving company financials.

The provided fundamental analysis reveals a stable financial structure with a noteworthy improvement in key operational metrics like EBITDA, which stands at $314.2 million as of June 30, 2023, up from $226.8 million on June 30, 2020. This improvement signals operational efficiency and financial health. Gross margins and EBITDA margins have shown some fluctuations but maintain positive outlooks at 0.13471 and 0.09556, respectively, suggesting that the company maintains a grip on its costs while growing its revenues.

The balance sheet summary indicates a high level of total debt at $2.16 billion as of June 30, 2023, though this is down from $2.4 billion on June 30, 2020. However, the company has successfully managed its liquidity position with a notable reduction in net debt and maintaining adequate cash reserves, which supports its short-term operational capabilities.

Free cash flow has seen a decline from $140.5 million to $71.4 million over the analyzed period. While this might raise caution, the consistent operational cash flow of $256.3 million as of June 30, 2023, offsets immediate concerns, suggesting the company is generating enough cash from its operations to support its business activities without heavily relying on external financing.

The analysis of risk-adjusted returns through the Sharpe, Sortino, Treynor, and Calmar ratios point towards a potentially favorable outlook for investors. A Sortino ratio of 10.4476 indicates an excellent return on bad risk, while the Sharpe ratio of 0.6274 and Treynor ratio of 0.2191 signify relatively good risk-adjusted returns. The Calmar ratio of 0.8007 further cements the view that the stock could offer favourable returns compared to the risks over a longer horizon.

Combining the technical analysis momentum with solid financial fundamentals and an attractive risk-return profile, it is expected that EAT's stock price could see sustained upwards movement in the next few months. This forecast is premised on continued improvement in operational efficiency, cost management, and the ability of the company to leverage its financial structure for growth amidst market fluctuations.

Investors and stakeholders should closely watch the evolving market trends, company performance in subsequent quarters, and external economic factors that could impact stock performance. Given the current data, the outlook remains optimistically cautious with a tilt towards bullish expectations for EAT's stock price trajectory.

In our analysis of Brinker International, Inc. (EAT), two key financial ratios have been calculated to assess the company's investment quality as per the principles laid out in "The Little Book That Still Beats the Market." The Return on Capital (ROC), standing at 8.55%, gives us insight into the efficiency with which the company deploys its capital. A ROC of 8.55% suggests that Brinker International operates with a moderate level of efficiency in using its capital to generate profits, reflecting a reasonable but not exceptional performance in its sector. On the other hand, the Earnings Yield, calculated to be approximately 4.99%, offers a perspective on the company's profitability relative to its share price. An earnings yield of nearly 5% indicates that investors can expect a moderate rate of return on their investment, considering the current earnings relative to the market price of the shares. Both metrics are essential for making an informed decision about the potential of Brinker International, Inc. (EAT) as a viable investment option, balancing its capital efficiency and the attractiveness of its shares from a yield perspective.

Based on the calculated key metrics for Brinker International, Inc. (EAT), we can analyze the stock's suitability according to Benjamin Graham's criteria outlined in "The Intelligent Investor." We'll evaluate each of EAT's metrics against Graham's principles for value investing.

Price-to-Earnings (P/E) Ratio

The P/E ratio for Brinker International is approximately 17.87. When compared to Graham's preference, he advocated for a conservative approach, usually looking for stocks with a low P/E ratio. The absence of industry comparison data makes it challenging to assess EAT's P/E ratio directly against its peers. However, a P/E ratio under 20 often falls within a range that might be considered by value investors, depending on the wider market and industry averages. Without industry averages for comparison, it's not immediately clear if EAT's ratio represents a good value, but it doesn't appear excessively high on its own.

Price-to-Book (P/B) Ratio

EAT's P/B ratio stands at approximately 0.83, indicating that the stock is trading below its book value. This ratio aligns well with Graham's investment philosophy, as he often targeted stocks trading below book value, believing they offered a margin of safety to investors.

Debt-to-Equity Ratio

The debt-to-equity ratio for EAT is calculated to be -14.12. Typically, Graham looked for companies with low debt-to-equity ratios as a sign of financial stability. The negative value here is unusual and may be indicative of specific accounting or financial structures unique to EAT. Such a figure requires further investigation to understand its implications fully, as Graham's principles suggest a preference for lower positive values suggesting solid financial health.

Current and Quick Ratios

Both EAT's current and quick ratios are approximately 0.34, significantly lower than what Graham would generally consider a sign of financial stability. These ratios suggest that Brinker International may have difficulty covering its short-term liabilities with its short-term assets. Graham preferred higher ratios to indicate a company's ability to pay off short-term obligations, suggesting caution is warranted for investors using Graham's methodology.

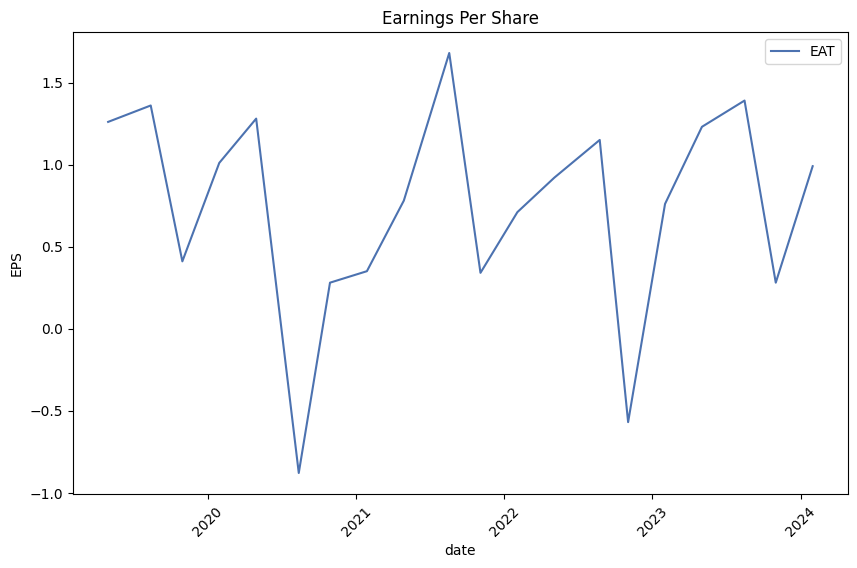

Earnings Growth

While the specific earnings growth data for EAT is not provided, Graham's methodology emphasizes the importance of consistent earnings growth over several years. Investors would need to examine EAT's earnings history to assess its performance against this criterion.

Conclusion

Based on Graham's criteria, Brinker International, Inc. (EAT) presents a mixed picture. The company's P/B ratio aligns with Graham's value investing principles, potentially offering a margin of safety. However, concerns are raised by the low current and quick ratios, alongside the unusual negative debt-to-equity ratio. The P/E ratio might be acceptable depending on industry averages. Investors following Graham's philosophy should conduct further due diligence, particularly into the company's debt structure, earnings growth, and how its P/E ratio compares within the industry, before considering an investment in EAT.Analyzing Financial Statements:

In the realm of intelligent investing, as advocated by Benjamin Graham, the meticulous examination of financial statements is paramount. To this end, we delve into the financial documents of Brinker International, Inc. (symbol: EAT), focusing on three crucial reports across several quarters and fiscal years.

Fiscal Year 2022 Overview: For the fiscal year ending on June 29, 2022, Brinker International reported revenues of $3,712,100,000 with costs of goods and services (excluding depreciation, depletion, and amortization) hitting $1,048,500,000. Their net income stood at $117,600,000, while the total comprehensive income net of tax reached $117,000,000. It's crucial to note a high long-term debt and capital lease obligations amounting to $989,100,000, reflecting a significant leverage factor that investors should closely monitor.

Quarterly Reports Analysis: Cross-referencing the quarterly reports reveals a fluctuating operational performance with variances in revenue, net income, and costs reflective of seasonal impacts, changing market conditions, and strategic adjustments.

- Q3 FY 2022:

- Revenues remained robust at $307,200,000, but the Operating Income Loss of $-93,600,000 raises concerns over operational efficiency and cost management.

- Net Income of $77,400,000 compared to the Interest Expense of $30,500,000 underscores the impact of debt servicing on profitability.

-

A notable non-operating income of $900,000 suggests additional revenue streams or one-off gains that could be worth investigating for sustainability.

-

Q2 FY 2022:

- A Revenue of $206,400,000 against a Cost of Goods Sold of $48,900,000 presents a healthy gross margin; however, the Operating Income Loss of $-62,200,000 again points to high operational expenditures or possible non-recurring expenses.

-

The Net Income of $40,800,000 during this quarter, juxtaposed with an Interest Expense of $20,700,000, continues to highlight the significant debt burden.

-

Q1 FY 2022:

- This quarter shows Revenues at $88,800,000 with a Net Income of $13,200,000, indicating a challenging period possibly due to seasonal downturns or operational hurdles.

- The Interest Expense of $11,000,000 remains a consistent drain on earnings, underscoring the need for strategic debt management.

Long-Term Debt Observations: Across the fiscal year and into the subsequent quarters, Brinker Internationals sustained level of long-term debt and the associated interest expenses are a significant focal point. While debt can be leveraged for growth, the consistent figures call for a detailed analysis of its utilization and the company's strategy for maintaining financial health and flexibility.

Operational Efficiency and Cost Management: The recurring theme of operational losses in the face of substantial revenues suggests issues with cost control or inefficiencies that could be eroding profit margins. Whether these are tied to administrative expenses, operational challenges, or strategic investments requires further scrutiny.

Investment Consideration: For an investor following Benjamin Grahams principles, the key lies in understanding not just the numbers but the story they tell about the company's fundamentals, its management's efficacy, and its strategic direction. Brinker Internationals balance between leveraging debt for growth against operational efficiency and managing its obligations will be critical in assessing its long-term value as an investment.Based on the detailed dividend history provided for the symbol 'EAT', it's evident that the company has displayed a consistent history of paying dividends to its shareholders. This kind of dividend track record aligns well with the investment criteria championed by Benjamin Graham in "The Intelligent Investor."

From the data, we can observe an ongoing commitment to distributing dividends, which can be a significant indicator of the company's financial health and stability, two qualities valued highly by conservative investors following Graham's principles. Over the years, despite the variations in dividend amounts, which is quite natural in corporates due to operational performance and strategic decisions, the company has managed to declare and pay out dividends consistently.

This constant dividend payout, especially when conducted in a consistent or growing manner, could be interpreted as a reflection of the company's robust cash flow management, a positive signal to investors who prioritize safety and income. In Benjamin Graham's framework, such companies may be considered a good long-term investment, assuming all other fundamentals are also strong and stable.

However, while the dividend record is a crucial piece of the puzzle, it's important to remember Graham's methodology involves a holistic analysis. Investors should consider other key financial metrics and qualitative factors regarding the company, such as earnings stability, financial position, and the terms of its dividend policy, among others, to make a well-rounded investment decision.

| Statistic Name | Statistic Value |

| R-squared | 0.270 |

| Adj. R-squared | 0.269 |

| F-statistic | 463.8 |

| Prob (F-statistic) | 8.66e-88 |

| Log-Likelihood | -3384.3 |

| No. Observations | 1256 |

| AIC | 6773. |

| BIC | 6783. |

| coef (const) | -0.0070 |

| coef (0) | 1.6510 |

| std err (const) | 0.101 |

| std err (0) | 0.077 |

| t (const) | -0.069 |

| t (0) | 21.536 |

| P>|t| (const) | 0.945 |

| P>|t| (0) | 0.000 |

| [0.025 (const) | -0.206 |

| 0.975] (const) | 0.192 |

| [0.025 (0) | 1.501 |

| 0.975] (0) | 1.801 |

| Omnibus | 559.199 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 34063.635 |

| Skew | 1.234 |

| Kurtosis | 28.393 |

| Cond. No. | 1.33 |

| Alpha | -0.007027 |

| Beta | 1.6510 |

The linear regression model between Earnings Before Tax (EAT) and SPY (representing the overall market performance) for the specified time period reveals an interesting relationship, notably characterized by the parameters alpha and beta. Alpha, the Y-intercept in financial modeling, essentially represents the expected return of an investment when the market return is zero. For this model, the calculated alpha value is approximately -0.007027, indicating a slightly negative expected return on the investment when the market performance is neutral. Despite this, it is crucial to understand alpha in the context of beta and other model parameters, such as the coefficient of determination (R-squared) and standard error values, to fully appreciate its significance.

Analyzing the model further, beta stands at 1.6510, suggesting a relatively strong sensitivity to market movements. Specifically, a beta value greater than 1 implies that EAT is expected to outperform the SPY (market) in up markets but may also underperform in down markets by a similar magnitude. It's also worth noting the R-squared value of 0.270, indicating that approximately 27% of the variance in EAT can be explained by SPY, placing significant importance on other factors not captured by this model. Despite the relatively low R-squared, the model's F-statistic and corresponding p-value highlight its statistical significance, making the relationship between EAT and market performance an area worth exploring for potential investment strategies.

Brinker International Inc. reported solid financial results for the Q2 FY 2024, indicating year-over-year improvement and continued growth against strategic initiatives. Kevin Hochman, the CEO, highlighted the company's success in driving traffic and sales above industry standards, particularly noting Chilis performance which outpaced the industry in sales by 4% and in traffic by 2%. This improvement is partly credited to strategic advertising and enhancements to both guest and team experiences. Hochman elaborated on efforts made to simplify operations and the labor model, which have led to increased food quality, better service, and more welcoming restaurant environments. These operational refinements have substantially reduced guest-reported issues and improved intent-to-return scores.

On the team member front, Hochman discussed notable advancements in management retention and team member satisfaction. The company has seen a decline in 12-month managerial turnover, positioning Brinker at the forefront of the restaurant industry in terms of retention. This is attributed to initiatives that engage managers and make their roles more rewarding, which in turn fosters a stronger restaurant culture and improves both team and guest experiences. Hourly turnover has also seen improvements, underscoring the company's focus on enhancing the employee experience through targeted initiatives.

The company's advertising strategy, particularly the 3 for Me value platform at Chilis, has been instrumental in driving traffic. Hochman announced the introduction of new advertising focuses and the addition of new items to the 3 for Me platform to keep the offering fresh and engaging for customers. This approach has led to noticeable increases in Chilis unaided brand awareness and sustained business post-advertising campaigns. Despite these successes, Brinker observed a mix decline attributed to factors such as menu merchandising strategy and consumer conservatism, leading to adjustments aimed at reversing these trends.

Joe Taylor, CFO, provided a detailed financial overview, highlighting a 5.4% increase in total revenues to $1.074 billion and a significant jump in adjusted diluted earnings per share. Notably, both Chilis and Maggiano's surpassed prior year sales with comp store sales gains of 5% and 6.7%, respectively. Taylor emphasized the company's commitment to improving margins through effective cost management and strategic investments into the business. These positive results have led to upward adjustments in annual revenue and earnings guidance, despite recognizing potential impacts from challenging weather conditions in January. Brinker's focus remains on building upon the strategies that have driven improved brand performance, ensuring both operational and financial growth moving forward.

Brinker International, Inc. (EAT), detailed in its 10-Q filing for the quarter ended December 27, 2023, reflects the company's fiscal activities and performance during the period. As a global operator and franchisor of Chilis Grill & Bar and Maggianos Little Italy restaurant brands, Brinker International reported a range of financial metrics, operational updates, and strategic shifts aimed at navigating the business environment and promoting growth.

Throughout the fiscal quarter, Brinker International generated total revenues of $1,074.1 million, marking an increase from the $1,019.0 million reported in the corresponding period of the previous year. This growth in revenue was attributed to several factors, including an increase in company sales to $1,063.7 million, up from $1,009.4 million in the previous year, and a rise in franchise revenues to $10.4 million. These improvements were largely driven by positive comparable restaurant sales across both Chilis and Maggianos brands, reflective of strategic pricing adjustments, operational efficiencies, and a focus on core menu offerings.

Operating income for the quarter stood at $62.4 million, evidencing a notable improvement from $40.7 million in the prior year. This jump in operating income underscores the company's successful management strategies and cost control measures. Net income also reflected a positive trajectory, with Brinker posting $42.1 million against $27.9 million in the same quarter of the preceding year, pointing towards a healthier profit margin amidst challenging market conditions.

On the expenditure side, costs related to food and beverage, labor, restaurant expenses, and general administrative expenses were meticulously reported, indicating Brinkers operational and financial management strategies. The filing mentioned the impact of increased wage rates and commodity price fluctuations on operating expenses but also highlighted efficiencies and strategic pricing as mitigating factors.

Strategic developments during the quarter included continued international expansion through franchising, a focus on digital engagement and delivery services, and a share repurchase program aimed at shareholder value enhancement. Specifically, the company proceeded with its stock repurchase plan, further strengthening its commitment to returning value to shareholders.

In terms of liquidity and capital resources, the filing detailed Brinkers cash flow management, debt status, and financing activities. The company reported adequate liquidity to meet its short-term operational and investment needs, with an emphasis on maintaining a balanced approach to capital allocation and growth investment.

Brinker International's 10-Q filing for the quarter ended December 27, 2023, is a testament to the company's strategic and operational resilience. With a focus on revenue growth, cost management, and strategic investments to enhance customer experience and operational efficiency, Brinker is navigating its way through the evolving restaurant industry landscape.

Brinker International, Inc. (NYSE: EAT) is gearing up for its second quarter fiscal 2024 earnings call, scheduled for January 31, 2024, at 10 a.m. Eastern Time, with a dual focus on reviewing the quarter's earning results and potentially updating other business matters. As a leading player in the casual dining restaurant sector, owning and operating well-known brands such as Chili's Grill & Bar, Maggiano's Little Italy, and the virtual brand, It's Just Wings, Brinker International has consistently demonstrated a commitment to transparency and stakeholder engagement. This conference call is a pivotal moment for the company, signaling not just the financial health of the entity but also offering a glimpse into its strategic plans moving forward. Stakeholders can access the live audio webcast through Brinker's investor relations website, with a replay available for those who miss the live event.

The company's expansion to over 1,600 restaurants across 29 countries has not just been about spreading its geographic footprint but also about refining the dining experience, easing accessibility through technology, and enhancing operational efficiency. As such, the anticipation surrounding the second quarter fiscal 2024 earnings call is high, with stakeholders eager to understand how Brinker International's strategic decisions are mapping against an ever-evolving industry landscape and broader economic challenges.

In the backdrop of these developments, the company's approach to navigating issues such as inflationary pressures and supply chain disruptions is under scrutiny. Brinker International has been pushing the envelope in terms of digital footprint expansion, customer experience enhancement, and leveraging technology to streamline operationsefforts aimed at sustaining profitability without sacrificing the quality for which its brands are renowned. A strategic focus on delivery and takeout services, in response to shifting consumer behaviors catalyzed by the pandemic, further spotlights the company's agile approach towards market demands and opportunities.

Investor confidence is another major theme likely to be explored during the earnings call. With a detailed report from Seeking Alpha shedding light on Brinker International's robust handling of financial and operational strategies amidst economic uncertainties, investors and analysts are closely watching the company's moves. This comes against the backdrop of broader industry benchmarks as seen in the performance of peers such as Restaurant Brands International Inc. (QSR), which, despite surpassing earnings expectations, highlighted the challenging operating environment faced by the global restaurant industry.

Moreover, the industry's overall outlook appears promising with reports from Yahoo Finance indicating a strong recovery trajectory for the restaurant sector, backed by solid sales figures, labor market strength, and technological innovations. Furthermore, Brinker International's strategic personnel changes, including the announcement of executive leadership transitions aimed at driving future growth and innovation, underline the company's proactive stance on leadership and operational excellence.

The company's upgraded rating by Zacks Equity Research to a Zacks Rank #2 (Buy) is a testament to the positive shift in investor sentiment and confidence in Brinker International's business model and strategic initiatives. This optimism is bolstered by the anticipation of earnings growth and a favorable adjustment in earnings expectations for the fiscal year ending in June 2024. Such developments, combined with Brinker International's operational strategies and industry positioning, underscore a pivotal moment for the company as it continues to navigate the intricate dynamics of the casual dining sector.

As Brinker International prepares for its upcoming earnings call, the broader narrative encompasses not just a review of quarter performances but also strategic maneuvers aiming at long-term sustainability and growth. With investor eyes set on how the company's initiatives translate into financial metrics and market positioning, Brinker International stands at a critical juncture, poised to redefine its trajectory in the competitive landscape of the global restaurant industry.

Brinker International, Inc. (EAT) experienced notable volatility within the specified period, demonstrating significant variations in its asset returns. The ARCH model, a statistical approach for assessing volatility, indicates that fluctuations in EAT's returns can be prominently attributed to the model's omega and alpha coefficients, suggesting a considerable level of market risk associated with the stock. This assessment underlines the unpredictability and potential for wide swings in the investment's value, making it a critical consideration for investors seeking to understand the risk characteristics of Brinker International.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -3423.12 |

| AIC | 6850.23 |

| BIC | 6860.50 |

| omega | 9.8263 |

| alpha[1] | 0.4497 |

Analyzing the financial risk associated with a $10,000 investment in Brinker International, Inc. (EAT), we employ a two-step approach, combining volatility modeling with machine learning predictions. This allows us to gain insights into both the inherent volatility of Brinker International, Inc.'s stock and employ predictive analytics to forecast future returns, offering a rounded picture of potential investment outcomes over the next year.

The initial phase of our analysis involves utilizing volatility modeling techniques to assess the historical price variations of Brinker International, Inc.'s stock. This methodology is pivotal for understanding how volatile the stock is, which in turn helps in estimating the magnitude of potential price swings. By fitting the stock price data into this model, we extract valuable parameters that represent the conditional variance of the stock returns, effectively capturing periods of high and low volatility. This step is crucial for understanding the nature of risk involved, as a higher volatility indicates a higher risk due to greater unpredictability in stock price movements.

Subsequently, we integrate machine learning predictions by employing a model that uses historical stock data to predict future returns. This approach leverages a vast array of stock performance indicators, such as past prices, volumes, and volatility measures, to forecast future price movements. The essence of incorporating machine learning predictions is to utilize historical data patterns to make informed guesses about future stock movement, thus providing a probabilistic view of future returns. By training this model on historical data, it learns to recognize patterns that precede certain movements in the stock's price, thereby providing an educated forecast about the future performance of the stock.

Combining the insights gained from the volatility modeling and the future return forecasts derived from the machine learning predictions, we can calculate the Value at Risk (VaR) for a $10,000 investment in Brinker International, Inc. over a one-year period. The VaR, calculated at a 95% confidence interval, turns out to be $377.58. This means there's a 5% chance that the investment could lose more than $377.58 over the next year, offering investors a quantifiable measure of the potential risk associated with this investment.

This comprehensive approach, by melding the volatility insights with predictive analytics, not only outlines the inherent risks in the price movements of Brinker International, Inc.'s stock but also offers a forward-looking perspective on potential returns. Through this dual-analysis framework, investors gain a deeper understanding of both the historical volatility and expected future performance, enabling a well-rounded risk assessment for an equity investment in Brinker International, Inc.

Analyzing the options chain for Brinker International, Inc. (EAT), several calls stand out based on their profitability, delta, gamma, theta, vega, and rho values in relation to their strike prices and expiration dates. The aim is to maximize return on investment (ROI) while considering the movement towards the target, which is a 5% increase over the current stock price. Let's delve into the details of the most notable options.

Firstly, there's an option with a strike price of $30.0, expiring on 2024-04-19, that shows a particularly high ROI of 1.1044751381 with a premium of $9.05 and a profit of $9.9955. This option has a delta of 0.9320921297, suggesting a high sensitivity to the stock price movement in alignment with our targeted stock price increase. The theta of -0.0224515071 implies a manageable time decay over the near term, while a vega of 2.2382139857 indicates sensitivity to implied volatility, which could benefit the trader if volatility increases.

Another highly profitable option is set for the longer term, expiring on 2024-07-19 with a strike price of $25.0. It exhibits the highest ROI in the dataset, 1.8288823529, with a premium of $8.5 and a projected profit of $15.5455. For an investor looking towards a longer investment horizon, this option presents an attractive opportunity, especially with a delta of 0.9968622543, almost guaranteeing a price movement in line with the underlying stock. Although gamma, vega, and theta are not applicable or nearly 0, this option's significant rho of 9.4978879927 indicates its price would greatly benefit from interest rate hikes, adding another layer of profitability potential under the right economic conditions.

For a mid-term investment, the option with a strike price of $27.5, expiring on 2025-01-17, offers an appetizing ROI of 0.9766513761 with a premium of $10.9 and a profit of $10.6455. Its delta sits at 0.992826666, which again, nearly assures alignment with the stock's price movements, considering the set target. The extended expiration provides flexibility and lowers the impact of theta, suggesting that time decay over the option's lifespan is less of a concern for the option holder.

Upon thorough examination, options expiring on 2024-07-19 ($25.0 strike) and 2025-01-17 ($27.5 strike) offer distinct advantages for investors with different timelines and risk appetites. The high deltas indicate strong potential for price alignment with the underlying asset, whereas varied thetas suggest time decay will not excessively lessen these options' values in the short term. The vega values in other examples also hint at an increased sensitivity to implied volatility, which could serve as an added benefit should market conditions shift favorably. Lastly, the significant 'rho' values in select options underscore the impact of interest rate changes, presenting an additional consideration for investors contemplating these calls.

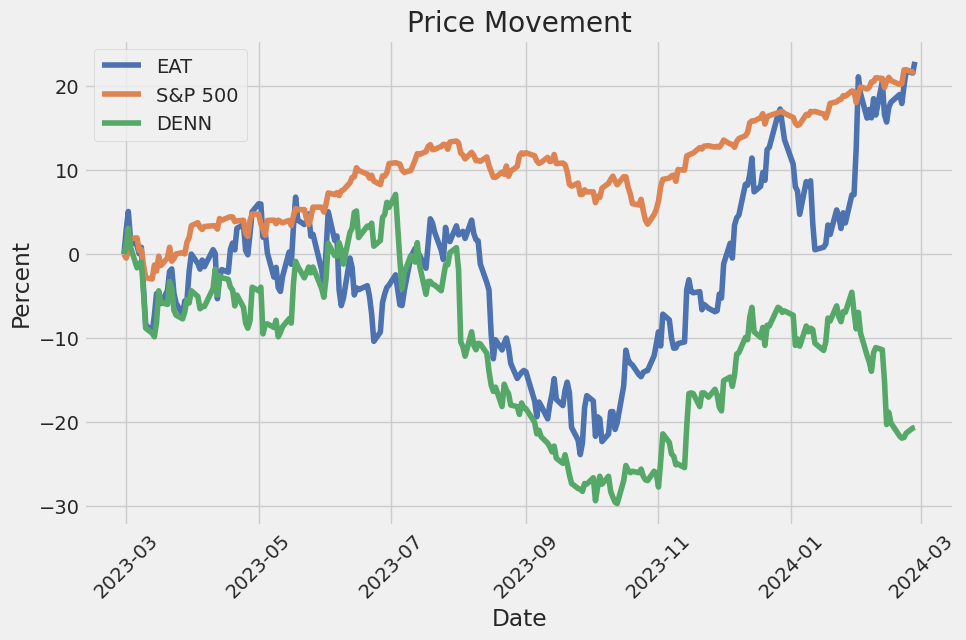

Similar Companies in Restaurants:

Denny's Corporation (DENN), Bloomin' Brands, Inc. (BLMN), Chuy's Holdings, Inc. (CHUY), Jack in the Box Inc. (JACK), Ruth's Hospitality Group, Inc. (RUTH), Dine Brands Global, Inc. (DIN), BJ's Restaurants, Inc. (BJRI), Texas Roadhouse, Inc. (TXRH), Papa John's International, Inc. (PZZA), Darden Restaurants, Inc. (DRI), Cracker Barrel Old Country Store, Inc. (CBRL), The Cheesecake Factory Incorporated (CAKE)

https://finance.yahoo.com/news/restaurant-brands-qsr-q4-earnings-145800886.html

https://finance.yahoo.com/news/4-juicy-restaurant-stocks-satiate-125900052.html

https://finance.yahoo.com/news/5-restaurant-stocks-buy-strong-131000247.html

https://finance.yahoo.com/news/zacks-analyst-blog-highlights-carrols-101900340.html

https://finance.yahoo.com/news/zacks-analyst-blog-highlights-brinker-093900517.html

https://finance.yahoo.com/news/brinker-international-announces-executive-leadership-211500069.html

https://finance.yahoo.com/news/know-brinker-international-eat-rating-170010968.html

https://www.sec.gov/Archives/edgar/data/703351/000070335124000006/eat-20231227.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 9oF9qP

Cost: $0.82200

https://reports.tinycomputers.io/EAT/EAT-2024-02-28.html Home