EPR Properties (ticker: EPR)

2023-12-25

EPR Properties, trading under the ticker symbol EPR on the New York Stock Exchange, is a specialty real estate investment trust (REIT) with a distinctive investment portfolio. EPR focuses primarily on properties in the entertainment, recreation, and education sectors, recognizing the enduring demand for experiential consumer spending. The company's assets include megaplex theatres, family entertainment centers, ski resorts, and private schools, among others, which are typically operated by third-party tenants under long-term triple-net leases. This structure shifts most operating expenses, including property taxes, insurance, and maintenance, to the tenants, allowing EPR to generate a stable stream of rental income. The firm is regarded for its ability to identify and invest in non-traditional niche properties that provide unique experiences, drawing consumers despite broader economic headwinds. As of the latest reports, EPR Properties continues to demonstrate a commitment to shareholder value with regular dividends, backed by its focused strategy of investing in properties with experienced operators and strong visitor appeal.

EPR Properties, trading under the ticker symbol EPR on the New York Stock Exchange, is a specialty real estate investment trust (REIT) with a distinctive investment portfolio. EPR focuses primarily on properties in the entertainment, recreation, and education sectors, recognizing the enduring demand for experiential consumer spending. The company's assets include megaplex theatres, family entertainment centers, ski resorts, and private schools, among others, which are typically operated by third-party tenants under long-term triple-net leases. This structure shifts most operating expenses, including property taxes, insurance, and maintenance, to the tenants, allowing EPR to generate a stable stream of rental income. The firm is regarded for its ability to identify and invest in non-traditional niche properties that provide unique experiences, drawing consumers despite broader economic headwinds. As of the latest reports, EPR Properties continues to demonstrate a commitment to shareholder value with regular dividends, backed by its focused strategy of investing in properties with experienced operators and strong visitor appeal.

| As of Date: 12/25/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 3.65B | 3.13B | 3.53B | 2.87B | 2.83B | 2.69B |

| Enterprise Value | 6.52B | 6.08B | 6.48B | 5.81B | 5.71B | 5.57B |

| Trailing P/E | 25.08 | 22.33 | 20.89 | 18.77 | 18.31 | 19.70 |

| Forward P/E | 17.86 | 16.95 | 18.35 | - | - | 14.81 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 5.52 | 4.91 | 5.63 | 4.68 | 4.76 | 4.66 |

| Price/Book (mrq) | 1.47 | 1.26 | 1.39 | 1.13 | 1.11 | 1.04 |

| Enterprise Value/Revenue | 9.85 | 34.72 | 39.80 | 35.86 | 35.29 | 37.12 |

| Enterprise Value/EBITDA | 14.19 | 46.64 | 72.59 | 44.39 | 49.44 | 44.39 |

| Full Time Employees | 55 | Previous Close | 48.52 | Open | 48.68 |

| Day Low | 48.26 | Day High | 49.03 | Dividend Rate | 3.3 |

| Dividend Yield | 6.82% | Payout Ratio | 170.98% | Beta | 1.649 |

| Trailing PE | 25.08 | Forward PE | 19.06 | Volume | 268,810 |

| Average Volume | 617,479 | Average Volume 10days | 648,220 | Market Cap | 3,654,984,192 |

| 52 Week Low | 33.92 | 52 Week High | 49.1 | Price to Sales (TTM) | 5.18 |

| Enterprise Value | 6,523,097,600 | Profit Margins | 24.06% | Float Shares | 73,883,862 |

| Shares Outstanding | 75,329,400 | Shares Short | 1,883,867 | Shares Percent Shares Out | 2.5% |

| Held Percent Insiders | 1.852% | Held Percent Institutions | 80.398% | Short Ratio | 2.87 |

| Short Percent of Float | 3.63% | Book Value | 32.84 | Price to Book | 1.474 |

| Last Fiscal Year End | 1672444800 | Most Recent Quarter | 1696032000 | Earnings Quarterly Growth | 10.8% |

| Net Income to Common | 145,699,008 | Trailing EPS | 1.93 | Forward EPS | 2.54 |

| PEG Ratio | 3.38 | Enterprise to Revenue | 9.241 | Enterprise to EBITDA | 11.781 |

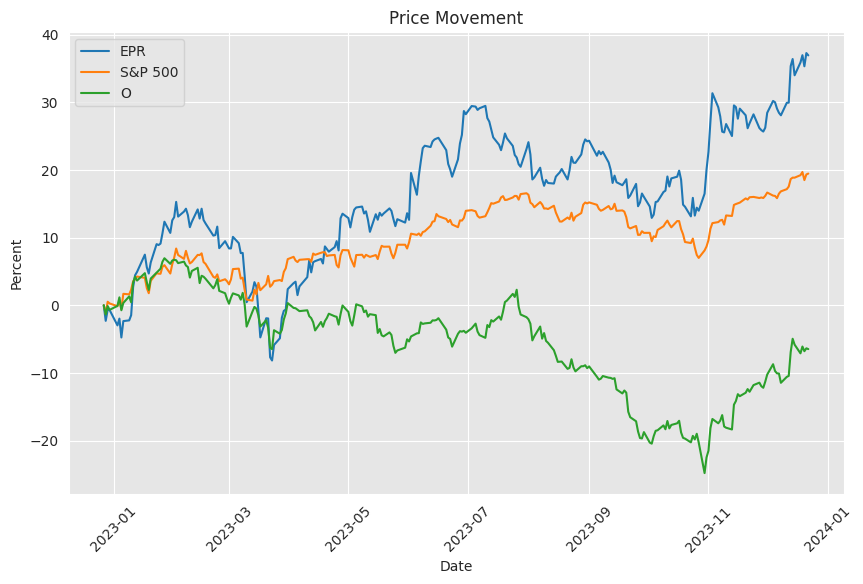

| 52 Week Change | 26.47% | S&P 52 Week Change | 24.17% | Last Dividend Value | 0.275 |

| Total Cash | 174,446,000 | Total Cash Per Share | 2.316 | EBITDA | 553,715,968 |

| Total Debt | 3,045,419,008 | Quick Ratio | 2.211 | Current Ratio | 2.519 |

| Total Revenue | 705,880,000 | Debt to Equity | 122.808 | Revenue Per Share | 9.389 |

| Return on Assets | 4.19% | Return on Equity | 6.737% | Gross Profits | 599,376,000 |

| Free Cashflow | 341,049,632 | Operating Cashflow | 462,132,992 | Earnings Growth | 10.6% |

| Revenue Growth | 17.2% | Gross Margins | 92.001% | EBITDA Margins | 78.443% |

| Operating Margins | 55.929% | Current Price | 48.4 | Target High Price | 51.0 |

| Target Low Price | 42.0 | Target Mean Price | 47.65 | Target Median Price | 48.0 |

| Recommendation Mean | 2.6 | Number of Analyst Opinions | 10 | Total Cash | 174,446,000 |

| Total Cash Per Share | 2.316 | EBITDA | 553,715,968 | Total Debt | 3,045,419,008 |

The technical analysis (TA) of a stock combines historical price action and trading volumes to predict future market trends. Supplementing this analysis with fundamental data provides a broader perspective on a company's valuation and its potential for long-term growth or decline. Here we analyze the TA data and fundamentals for the stock "EPR" to forecast its possible stock price movement in the ensuing months.

Technical Indicators Analysis:

-

The On-Balance Volume (OBV) indicator has shown fluctuations over the observed period. On the last trading day, the OBV is in negative territory at -0.04278 million, suggesting potential distribution or selling pressure. However, a single data point does not determine a trend; hence, it is critical to observe OBV over the next sessions to confirm any ongoing trend.

-

The Moving Average Convergence Divergence (MACD) histogram indicates a value of 0.159054, which represents the difference between the MACD line and its signal line. Positive values typically denote upward momentum. Although, the declining histogram values towards the most recent date suggest that the momentum may be waning.

Fundamentals Analysis:

-

The market capitalization has shown growth from $2.69B to $3.65B over the year, implying positive investor sentiment and a possible expansion in the company's valuation.

-

The trailing Price-to-Earnings (P/E) ratio has increased from 18.31 to 25.08, indicating that the stock may be becoming more expensive relative to its earnings, which could deter value-focused investors.

-

Revenue and EBITDA figures have demonstrated stability and slight growth, which can be construed as fundamentally positive.

-

There is an increase in operating income, which is favorable. However, the company also shows interest expenses and other non-operating costs that could impact its net income.

Integrating the Fundamentals and Technicals:

While the OBV indicates selling pressure, the waning MACD histogram suggests that the bullish momentum might not be as strong as before. These technical signals, when considered alongside the increased P/E ratio, suggest that the stock might experience reduced buying interest or a price consolidation in the short term.

The company's fundamental stability and growth in market capitalization hint at underlying strength, which can provide support to the stock price. However, the high enterprise value to revenue and EBITDA ratios suggest that the company might be overvalued at current levels.

Price Movement Forecast:

Considering the mixed technical signals and the fundamental valuation concerns, the expected stock price movement for EPR over the next few months can be cautiously optimistic but with potential for volatility. The key will be to watch for the following signals:

-

A consistent improvement in OBV would suggest accumulation, whereas a downtrend or high volatility in the indicator could point towards further distribution.

-

The MACD histogram's direction will provide insights into the momentum; a shift back into positive growth or crossing above its signal line may reaffirm a bullish stance.

-

Fundamental financial performance in subsequent quarters will be crucial. Positive results could reinforce investor confidence, while any declines or misses could precipitate a reassessment of the stock's value.

Overall, EPR's stock price movement in the next few months will likely be shaped by the delicate balance between technical momentum indicators and evolving investor sentiment as influenced by fundamental performance. It will be essential for investors to stay alert to changes in these indicators and adjust their expectations and strategies accordingly.

EPR Properties has established itself as a REIT that primarily deals in experiential properties, an area that has seen considerable fluctuations, especially during the recent pandemic. The COVID-19 outbreak posed significant challenges for EPR Properties. With exposure to real estate relying on group gatherings, the pandemic necessitated the temporary closure of many of their properties, following government mandates designed to enforce social distancing and slow the spread of the virus.

The REIT's strategy during this time included suspending its dividend, a move that, in retrospect, ensured the preservation of capital during a precarious period. With economic circumstances gradually normalizing and their venues reopening, EPR's tenants are reportedly recovering and showing signs of improvement. Rental coverage ratios are starting to improve, lending credence to the resilience of EPR's business model, particularly as societies across the globe adapt to living with the virus.

However, the recovery has not been even across all segments. EPR Properties' notable concentration in movie theatersroughly 39% of the portfolio is an area still seeing underperformance. Given the changing consumer preferences even prior to the pandemic, the future of movie theaters is an area of concern for EPR. To minimize the risk and ensure more stability, the management team has engaged in strategic deliberation with the intent to reduce dependence on this sector. Yet, the process is likely to be gradual, given the complexity when dealing with numerous properties and associated lease agreements.

The shift in portfolio dynamics has investors looking forward to significant changes over the next five years. With economies adapting and showing resilience against the pandemic's impact, EPR has returned to issuing dividends, signaling its recovery and a willingness to address the concentration risks associated with the movie theater sector. An attractive dividend yield adds to the appeal of EPR Properties as an investment during this transition.

The company's focus on experiential real estate places it squarely in the path of an ongoing trend toward experiential spending, regarded as resilient even in a digitized age. With long-term net leases in place and annual rent hikes contractually set, the company stands to benefit from steady, predictable rental income. Such structures form a solid foundation for continued financial performance, notwithstanding the ongoing concerns about certain portfolio segments.

Across the REIT market, there is a mix of sentiment. A representative diversified REIT portfolio with attractive dividend yields that weigh EPR among other types has garnered attention. Investors seeking monthly dividend income are drawn to such portfolios for their balance of yield and growth potential. Moreover, the REIT marketexperiencing attractive yields due to depressed share pricesprovides an interesting entry point for investors interested in the segment.

The strength of EPR Properties and similar REITs on portfolio income is significant. EPR's ability to uphold and grow its dividends is paramount, especially given the dual goals of income and value appreciation pursued by most investors within this sector. Such high-yield strategies carry their risks, but they promise substantial potential for continued and increasing dividends alongside appreciation in REIT market sentiment.

EPR's specialization in experience-driven properties calls for vigilant oversight of consumer trends and market conditions that can sway rental income predictability. However, despite these potential fluctuations, EPR's diversified approach and conservative financial management practices bode well for its future prospects.

The recent announcement of its dividend distribution plan reflects a commitment to financial health and investor returns. Monthly cash dividends are reaching common shareholders, with quarterly dividends catered to preferred shareholders. The declaration of dividends is both a testament to EPR's vigorous financial position and a signal to the market of stable future earnings expectations.

Diversification stands as a core tenet of EPR's investment strategy, spanning across a spectrum of locations and property types within its niche in experiential real estate. The focus has shifted to underwriting properties that adhere to stringent industry, property, and tenant cash flow standards, aiming to yield stable and attractive returns despite the industry-specific upheavals encountered during recent years.

On the horizon, investors see an EPR that is shaping up to capitalize on its resilience and strategic foresight. Projections hint at a company that is primed to harness its operational tailwinds, potentially leading to a rebound in equity valuations, making for a compelling investment narrative within the REIT landscape. As EPR sets its sights on growth post-pandemic recovery and strategic shifts, the emphasis on monthly dividends maintains its reputation as a stalwart income stock option for shareholders.

Similar Companies in Retail REIT:

Realty Income Corporation (O), Simon Property Group, Inc. (SPG), National Retail Properties (NNN), Store Capital Corporation (STOR), Kimco Realty Corporation (KIM), Regency Centers Corporation (REG), Federal Realty Investment Trust (FRT), Weingarten Realty Investors (WRI), Tanger Factory Outlet Centers, Inc. (SKT)

News Links:

https://www.fool.com/investing/2023/12/20/where-will-epr-properties-be-in-5-years/

https://seekingalpha.com/article/4653673-portfolio-reveal-5-reits-earn-every-month

https://seekingalpha.com/article/4657945-5-reits-to-add-to-your-christmas-shopping-list

https://finance.yahoo.com/news/epr-properties-declares-monthly-dividend-211500931.html

https://seekingalpha.com/article/4654160-3-top-reit-picks-for-2024

https://www.fool.com/investing/2023/12/01/a-bull-market-is-coming-3-stocks-to-buy-without-an/

https://finance.yahoo.com/m/fb9dc206-2349-3d72-9d8b-c50f812b39ae/my-6-highest-yielding-stocks.html

https://finance.yahoo.com/m/ce6175aa-4b49-3396-99bf-9413862e9233/where-will-epr-properties-be.html

https://www.fool.com/investing/2023/12/08/looking-to-lock-in-some-high-yields-for-2024-3-sto/

https://finance.yahoo.com/m/3e902ddf-9bec-3006-9c16-0d68e93bd5cd/looking-to-lock-in-some-high.html

https://www.fool.com/investing/2023/12/03/believe-it-or-not-these-stocks-cut-you-a-monthly/

https://finance.yahoo.com/m/f6b8d460-baf1-3638-83ae-314bba84c7a9/believe-it-or-not%2C-these.html

https://finance.yahoo.com/news/insider-sell-alert-director-lisa-060500222.html

https://www.fool.com/investing/2023/12/12/did-the-santa-claus-rally-start-early/

https://seekingalpha.com/article/4657939-2-reits-all-investors-should-buy

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: dr4UwR

https://reports.tinycomputers.io/EPR/EPR-2023-12-25.html Home