EQT CORP (ticker: EQT)

2023-12-22

EQT Corporation (ticker: EQT) is a leading natural gas production company in the United States, with a primary focus on the Appalachian Basin, which spans across Pennsylvania, West Virginia, and Ohio. As of the latest data available, EQT has positioned itself as the largest producer of natural gas in the U.S. The company's operations are centered on the exploration, development, and production of natural gas, natural gas liquids, and crude oil. EQT's strategy involves the deployment of advanced horizontal drilling and completion technologies, which enable it to access and produce natural gas from the Marcellus and Utica shales efficiently. The company's emphasis on operational efficiency, cost reduction, and sustainability has facilitated robust production while managing environmental impacts. EQT continues to optimize its portfolio through strategic acquisitions and divestitures, focusing on core areas where it can leverage its operational expertise and scale to maximize shareholder value. The company also emphasizes adherence to safety standards and is committed to reducing its carbon footprint as part of its broader environmental, social, and governance (ESG) initiative. With its significant resource base and commitment to responsible energy development, EQT Corporation remains a key player in the domestic energy sector.

EQT Corporation (ticker: EQT) is a leading natural gas production company in the United States, with a primary focus on the Appalachian Basin, which spans across Pennsylvania, West Virginia, and Ohio. As of the latest data available, EQT has positioned itself as the largest producer of natural gas in the U.S. The company's operations are centered on the exploration, development, and production of natural gas, natural gas liquids, and crude oil. EQT's strategy involves the deployment of advanced horizontal drilling and completion technologies, which enable it to access and produce natural gas from the Marcellus and Utica shales efficiently. The company's emphasis on operational efficiency, cost reduction, and sustainability has facilitated robust production while managing environmental impacts. EQT continues to optimize its portfolio through strategic acquisitions and divestitures, focusing on core areas where it can leverage its operational expertise and scale to maximize shareholder value. The company also emphasizes adherence to safety standards and is committed to reducing its carbon footprint as part of its broader environmental, social, and governance (ESG) initiative. With its significant resource base and commitment to responsible energy development, EQT Corporation remains a key player in the domestic energy sector.

| As of Date: 12/22/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 16.05B | 16.69B | 14.87B | 11.54B | 12.42B | 15.00B |

| Enterprise Value | 21.90B | 20.14B | 18.22B | 15.79B | 17.10B | 20.00B |

| Trailing P/E | 5.35 | 4.51 | 3.57 | 7.29 | 5.41 | - |

| Forward P/E | 13.99 | 8.84 | 15.38 | 5.21 | 3.77 | 4.34 |

| PEG Ratio (5 yr expected) | 0.52 | 0.35 | 2.20 | 0.19 | 0.14 | 0.17 |

| Price/Sales (ttm) | 2.64 | 1.89 | 1.47 | 1.07 | 1.03 | 1.44 |

| Price/Book (mrq) | 1.13 | 1.39 | 1.23 | 1.03 | 1.28 | 1.66 |

| Enterprise Value/Revenue | 3.49 | 19.98 | 21.33 | 8.60 | 6.65 | 5.41 |

| Enterprise Value/EBITDA | 3.93 | 1.41k | -469.56 | 9.73 | 7.34 | 22.23 |

| City | Pittsburgh | State | PA | Zip Code | 15222-3111 |

| Country | United States | Phone Number | 412 553 5700 | Employees | 744 |

| Industry | Oil & Gas E&P | Sector | Energy | CEO Total Pay | $780,001 |

| Previous Close | $39.02 | Market Open | $39.08 | Day Low | $38.80 |

| Day High | $39.33 | Dividend Rate | $0.63 | Dividend Yield | 1.61% |

| Payout Ratio | 8.22% | 5 Year Avg Dividend Yield | 0.49% | Beta | 1.067 |

| Trailing PE | 5.34 | Forward PE | 11.14 | Volume | 2,487,278 |

| Market Cap | $16,039,890,944 | 52 Week Low | $28.11 | 52 Week High | $45.23 |

| Price to Sales Trailing 12 Months | 2.596 | Price to Book | 1.129 | Profit Margins | 47.67% |

| Shares Outstanding | 411,332,000 | Shares Short | 22,712,414 | Short Percent of Float | 7.05% |

| Held Percent Insiders | 6.524% | Held Percent Institutions | 96.354% | Short Ratio | 4.7 |

| Book Value | $34.527 | Net Income To Common | $2,945,158,912 | Trailing EPS | $7.30 |

| Forward EPS | $3.50 | PEG Ratio | 0.62 | Enterprise Value | $21,909,516,288 |

| Total Cash | $64,750,000 | Total Debt | $5,915,866,112 | Total Revenue | $6,178,088,960 |

| Debt to Equity | 41.633 | Revenue Per Share | $16.776 | Return on Assets | 10.834% |

| Return on Equity | 24.693% | Gross Profits | $9,722,660,000 | Free Cash Flow | $424,590,240 |

| Operating Cash Flow | $3,618,266,112 | Total Cash Per Share | $0.157 | Gross Margins | 63.495% |

| EBITDA Margins | 92.715% | Operating Margins | 2.409% | Recommended Mean | 2.2 |

Based on the technical analysis data provided, the following is an assessment of EQT's possible stock price movement in the upcoming months:

Technical Indicators: - The MACD (Moving Average Convergence Divergence) is currently negative, suggesting a bearish momentum in recent trading sessions. However, the positive histogram value indicates that bearish momentum is losing strength, and a potential bullish crossover might occur if the trend continues. - RSI (Relative Strength Index) sits at 50.01, indicating a neutral market stance with no clear signs of being overbought or oversold. - Bollinger Bands show that the closing price was close to the middle band. There is no immediate signal of significant price movement from Bollinger Bands alone. - The stock price is sitting slightly above the SMA (Simple Moving Average) of 20 days, suggesting a tentative bullish signal. - The EMA (Exponential Moving Average) for 50 days is higher than the last closing price, indicating that the stock is currently in a minor downtrend over the intermediate term. - The On-Balance Volume (OBV) is negative, suggesting that recent trading volume has been more bearish. - The Stochastic Oscillator is trending towards overbought territory, which might suggest the price might face downward pressure in the short term. - ADX (Average Directional Index) shows a moderate trend strength, implying that the current trend is not extremely strong, hence large price movements are not anticipated imminently. - Williams %R indicates that the stock was in the overbought area in the recent trading period, often a precursor to a potential reversal or corrective price action. - The Chaikin Money Flow (CMF) presents a positive indication, implying some buying pressure. - Parabolic SAR indicates the stock is currently in an uptrend, although this signal is less strong than others due to its lagging nature.

Fundamentals: - The trailing P/E ratio shows the stock is currently trading at a lower multiple of earnings compared to the sector average, which might indicate undervaluation or a lack of investor confidence in future growth. - The forward P/E ratio suggests an expectation of higher earnings in the future. - The PEG Ratio is below 1, which potentially signals that the stock may be undervalued relative to its growth expectations. - Price/Sales and Price/Book ratios are relatively low, suggesting that the stock may not be overvalued from a book or sales perspective. - The Enterprise Value multiples (EV/Revenue and EV/EBITDA) are reasonable, suggesting a fair valuation relative to revenue and earnings before interest, taxes, depreciation, and amortization. - Financial statements indicate the company has experienced unusual items affecting earnings. However, the normalized EBITDA is strong, showing underlying earning power.

Combining the technical analysis and fundamental data, it appears that EQT is exhibiting mixed signals. The technical indicators show a generally bearish short-term outlook with some signs of potential reversal, while fundamental analysis points towards a company that may be undervalued.

Investors and traders may anticipate some level of volatility in the near term based on the technical outlook. Given the relatively strong earnings but some complexity in their income statement due to unusual items, a thorough investigation into the company's operations and strategic plans would be prudent.

Thus, while near-term price movements may be influenced by technical factors, long-term investors should remain mindful of the fundamentals, which appear to suggest the potential for growth. Caution should be taken considering the broader market conditions that could significantly affect the stock's performance.

In the following months, barring any major catalysts or shifts in market sentiment, EQT's stock price movement might reflect a combination of short-term technical pressure with a possibility of long-term appreciation if the market begins to price in the fundamentals more heavily. As with all technical analysis and market predictions, these assessments should be considered in the context of broader market trends and individual investment strategies.

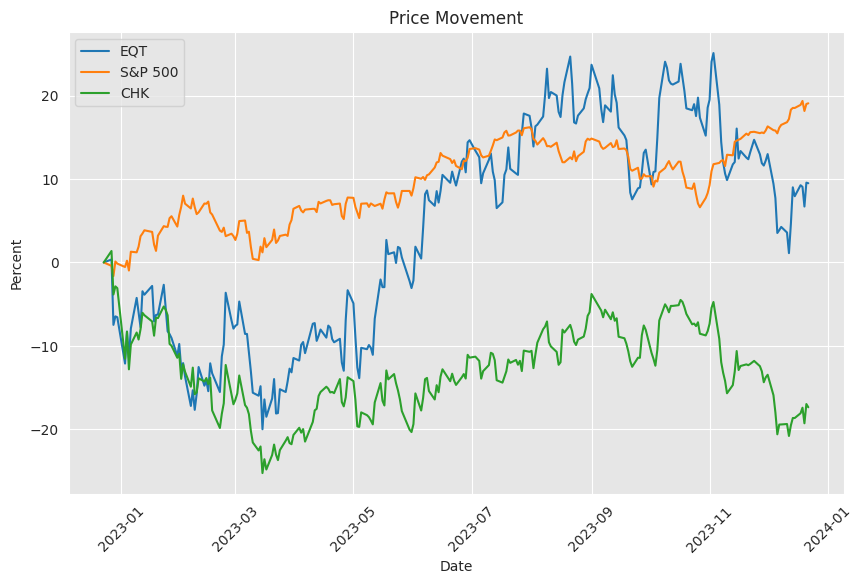

EQT Corporation, with its headquarters situated in Pittsburgh, Pennsylvania, has firmly established itself as the United States' largest natural gas producer, particularly since its strategic acquisition of Rice Energy in 2017. This transformative merger pushed the company to the forefront of the energy sector, seeing it doubling its market value since 2018an impressive feat that saw its performance soaring past the S&P 500 index. EQT managed to exhibit annualized gains of 14.6% against the S&P's 10.6%, dividends included, during this period. Despite operating in an industry typically overshadowed by its oil and renewable energy counterparts, EQT has managed to assert its dominance and financial robustness without drawing considerable investor fanfare.

The significant shift in EQT's trajectory can be partially attributed to a proxy fight that brought a change in leadership in 2019. Toby Rice, a former executive of Rice Energy, ascended to the CEO position with a vision to unlock the full potential of EQTs extensive natural gas assets. His approach was rooted in amplifying operations and cost-cutting to boost free cash flow. True to this vision, under Rice's helm, EQT undertook a series of scale-enhancing acquisitions, fortifying the company's market presence and financials. The acquisition of Chevrons Appalachian basin assets for $735 million and the nearly $3 billion purchase of Alta Resource Development are testaments to the companys aggressive expansion strategy.

To further drive efficiency and profitability, EQT Corporation has actively partaken in strategic midstream deals. Evincing their commitment to optimizing gas production value, the company inked two major firm sales agreements to ship gas via the Mountain Valley Pipeline, securing advantageous pricing in sought-after markets. Moreover, EQT did not overlook the lucrative opportunities in foreign markets, cementing an export agreement with Commonwealth LNG as part of its broader market strategy.

The culmination of these endeavors is apparent in EQT's establishment as a cash flow leader. An impressive feat in the form of $642 million in free cash flow was generated within the first nine months of a notable fiscal year, enabling the initiation of a dividend and a buyback program ramping up to $2 billion. The fiscal responsibility showcased by the corporation also extends to its efforts in decreasing debt, with $1.9 billion repaid, solidifying its balance sheet.

Foresight has EQT predicting a generation of $14 billion in cumulative free cash flow through 2028a projection representing about 60% of the companys current enterprise valueassuming stability in natural gas prices. EQT aims to leverage this substantial cash flow to fortify shareholder value via dividends, share repurchases, and debt management, affirming the company's commitment to shareholder returns.

However, it's not all smooth sailing for EQT, as volatility in the market can have sudden impacts as reflected by a notable 13% fall in the company's stock price on the Wall Street Breakfast update from Seeking Alpha. This was part of a broader fluctuation in the market, even as sectors like technology experienced a rally. EQT's decrease emerged amidst U.S. markets witnessing a rally, following certain stabilizations in Treasury yields after comments from Federal Reserve Chairman Jerome Powell suggested a possible hike in interest rates.

EQT Corp, in this varied economic landscape, saw its stock amongst those that lost ground. The energy sector itself fell by 3.8%, reflecting a certain market nervousness that may be linked to oscillating demands, regulatory considerations, and broader economic challenges. The performance of EQT in this context points toward a need for strategic calibration to stay resilient to market and regulatory changes, aiming for continued efficiency in operations.

As part of broader efforts to transition to clean energy, the Biden administration's decision to allocate $7 billion towards building seven regional hydrogen hubs offers EQT Corp an opportunity to branch out into the clean energy sector while leveraging its natural gas expertise. Being one of the selected partners in the Appalachian Hydrogen Hub, EQT stands to receive $925 million, which could signal a strategic shift or expansion in the companys core business practices.

Amid rising natural gas prices, EQT Corporation's stock has witnessed a strengthening position, fueled by an uptrend in Henry Hub futures and heightened demand expectations due to forecasts of a cold Northern Hemisphere winter. Furthermore, with the United States LNG capacity expected to significantly increase within the next few years, there lies potential for additional demand and consequent production growth, positively impacting natural gas producers including EQT.

With financial health bolstered by a strong balance sheet, effective hedging strategies, and focused value creation, EQT navigates the market with confidence. Not only does the company provide dividends and sustain a buyback program, but it also demonstrates operational excellence by maintaining high capital efficiency. Analysts predict an applaudable increase in the companys free cash flow, supporting the optimistic view that EQT will continue to be a conservative yet potentially rewarding investment in the natural gas sector.

In the wider economic climate of 2023, the second quarter presented challenges across the S&P 500, impacting company performances with respect to earnings and revenues. Companies like EQT Corp experienced a complex environment, characterized by trimmed expectations as the economic landscape was lined with inflationary pressures and potential reductions in demand. While sectors like Health Care and Information Technology showcased resilience and growth, sectors such as Energy faced difficulties, calling for vigilant management and strategic positioning.

It's important to note that, despite the absence of explicit details on EQT in the quarterly review by Seeking Alpha, the broader market insights suggest the company, like others in the energy sector, will have to exhibit adaptability and robust strategy execution to navigate through inflation-adjusted economic conditions. Therefore, stakeholders must maintain a watchful eye on EQT's forthcoming financial disclosures to better comprehend its performance trajectory in an unpredictable market milieu.

Similar Companies in Oil & Gas E&P:

Chesapeake Energy Corporation (CHK), Range Resources Corporation (RRC), Antero Resources Corporation (AR), Cabot Oil & Gas Corporation (COG), Southwestern Energy Company (SWN)

News Links:

https://www.fool.com/investing/2023/12/10/this-dividend-stock-has-doubled-since-2018-heres-w/

https://seekingalpha.com/article/4650730-wall-street-breakfast-what-moved-markets

https://www.fool.com/investing/2023/10/20/the-biden-administration-is-spending-7-billion-on/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: JsaPEw

https://reports.tinycomputers.io/EQT/EQT-2023-12-22.html Home