Farmland Partners Inc. (ticker: FPI)

2023-12-24

Farmland Partners Inc. (FPI) is a real estate investment trust (REIT) that specializes in the ownership, management, and acquisition of high-quality farmland across North America. The company's portfolio includes a diverse range of crops and properties, which are typically rented out to experienced farmers on a triple-net lease basis, meaning tenants are responsible for most of the property expenses. FPIs strategy is geared towards capitalizing on the rising global demand for food and the relative scarcity of arable land, aiming to provide investors with steady income streams along with potential long-term capital appreciation. The organization operates with an emphasis on maintaining the fertility and value of the land, adhering to sustainable farming practices. As a publicly-traded entity, FPI offers shareholders the opportunity to invest in farmland without the complexities of direct farm ownership, and the company typically distributes dividends consistent with REIT requirements, making it an attractive option for income-focused investors. Farmland Partners Inc. is traded on the New York Stock Exchange, allowing for ease of investment and providing liquidity to an asset class that is inherently illiquid.

Farmland Partners Inc. (FPI) is a real estate investment trust (REIT) that specializes in the ownership, management, and acquisition of high-quality farmland across North America. The company's portfolio includes a diverse range of crops and properties, which are typically rented out to experienced farmers on a triple-net lease basis, meaning tenants are responsible for most of the property expenses. FPIs strategy is geared towards capitalizing on the rising global demand for food and the relative scarcity of arable land, aiming to provide investors with steady income streams along with potential long-term capital appreciation. The organization operates with an emphasis on maintaining the fertility and value of the land, adhering to sustainable farming practices. As a publicly-traded entity, FPI offers shareholders the opportunity to invest in farmland without the complexities of direct farm ownership, and the company typically distributes dividends consistent with REIT requirements, making it an attractive option for income-focused investors. Farmland Partners Inc. is traded on the New York Stock Exchange, allowing for ease of investment and providing liquidity to an asset class that is inherently illiquid.

| As of Date: 12/25/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 614.85M | 501.04M | 597.69M | 568.01M | 680.12M | 688.22M |

| Enterprise Value | 1.03B | 913.33M | 1.03B | 997.56M | 1.08B | 1.09B |

| Trailing P/E | 38.67 | 39.46 | 69.63 | 66.88 | 46.15 | 140.78 |

| Forward P/E | 50.76 | - | 64.10 | 119.05 | 46.08 | 45.25 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 11.46 | 9.20 | 10.79 | 8.91 | 10.18 | 9.73 |

| Price/Book (mrq) | 1.19 | 0.95 | 1.06 | 0.98 | 1.17 | 1.24 |

| Enterprise Value/Revenue | 17.85 | 78.62 | 88.66 | 78.72 | 49.49 | 83.21 |

| Enterprise Value/EBITDA | 20.58 | 74.51 | 64.38 | 118.18 | 80.75 | 163.00 |

| Address 1 | 4600 South Syracuse Street | Address 2 | Suite 1450 | City | Denver |

| State | CO | Zip Code | 80237-2766 | Country | United States |

| Phone | 720 452 3100 | Fax | 720 398 3238 | Website | https://www.farmlandpartners.com |

| Industry | REIT - Specialty | Sector | Real Estate | Full Time Employees | 28 |

| Previous Close | 12.6 | Open | 12.68 | Day Low | 12.64 |

| Day High | 12.88 | Dividend Rate | 0.24 | Dividend Yield | 0.0188 |

| Payout Ratio | 72.73% | Five Year Avg Dividend Yield | 2.56 | Beta | 0.951 |

| Trailing PE | 38.67 | Forward PE | -182.29 | Volume | 329,005 |

| Average Volume | 464,522 | Average Volume 10 Days | 676,790 | Market Cap | 622,305,216 |

| 52 Week Low | 9.44 | 52 Week High | 13.655 | Price to Sales (Trailing 12 Months) | 10.78 |

| Enterprise Value | 1,137,163,392 | Profit Margins | 34.92% | Shares Outstanding | 48,185,900 |

| Shares Short | 3,042,424 | Shares Percent Shares Out | 6.31% | Held Percent Insiders | 9.698% |

| Held Percent Institutions | 54.117% | Short Ratio | 5.91 | Book Value | 10.753 |

| Price to Book | 1.19 | Net Income to Common | 17,045,000 | Trailing EPS | 0.33 |

| Forward EPS | -0.07 | Enterprise To Revenue | 19.70 | Enterprise To Ebitda | 36.24 |

| 52 Week Change | 1.592% | Current Price | 12.76 | Target High Price | 14.00 |

| Target Low Price | 12.00 | Target Mean Price | 13.10 | Target Median Price | 13.00 |

| Recommendation Mean | 2.2 | Total Cash | 8,190,000 | Total Cash Per Share | 0.171 |

| Total Debt | 420,918,016 | Quick Ratio | 0.785 | Current Ratio | 2.33 |

| Total Revenue | 57,716,000 | Debt To Equity | 66.803 | Revenue Per Share | 1.114 |

| Return On Assets | 1.342% | Return On Equity | 3.102% | Gross Profits | 47,106,000 |

| Operating Cash Flow | 14,027,000 | Earnings Growth | 9.7 | Revenue Growth | -11.6% |

| Gross Margins | 77.61% | Ebitda Margins | 54.363% | Operating Margins | 33.239% |

The technical and fundamental analysis of a company's stock provides a comprehensive overview of its potential future performance. Examining the provided technical indicators for the last trading session alongside a review of the company's financials offers important insights into the likely trajectory of the stock price in the following months.

Technical Indicators: - The Parabolic SAR (PSAR) did not indicate a reversal on the last trading day, as evidenced by the absence of PSARs (Parabolic SAR sell signals). This lack of a bearish reversal point could signify a continuing uptrend. - The On-Balance Volume (OBV) has exhibited a steady increase over time, ending at 0.25228 million on the last trading day, suggesting growing buying pressure and potentially higher future prices. - The Moving Average Convergence Divergence (MACD) histogram, nearing the zero line, implies that the momentum is waning. The negative histogram value, which appears to be converging towards zero, suggests a potential bullish crossover in the future, which could herald upwards price momentum.

Fundamentals: - Market Cap showed a decrease from the highest value in September, indicating a reduction in valuation which might have been caused by a pullback in stock price or market correction. - The Trailing P/E ratio has seen a decrease from the mid-year peak, which could present the stock as more attractively priced compared to earnings. - A high Price/Sales ratio reflects that the stock could be overvalued based on its current sales. - The consistent Enterprise Value indicates a recognition of consistent future earnings potential, despite fluctuations in Market Cap. - Considering the financials (EBITDA, net income, and revenue), the company appears to maintain a solid operational backbone, with increased normalized income and EBITDA compared to previous years.

Having evaluated both technical indicators and fundamental data, it is anticipated that the stock price movement over the next few months could see a continued uptrend bolstered by positive investor sentiment from the apparent solid financials. The potential bullish crossover suggested by the MACD, combined with the uptrend supported by OBV, corroborate this expectation. The recent pullback in Market Cap may be seen as a temporary correction, after which an appreciation in stock price could occur as fundamentals indicate robust financial health and potential undervaluation in comparison to earnings.

However, this is tempered by the high price to sales ratio, signaling a premium that the market is willing to pay above the company's sales numbers. Investors should monitor both market-based technical indicators and company fundamentals closely, as fluctuations in market sentiment and financial performance could significantly impact stock prices.

It is important to closely monitor upcoming earnings reports, news, sector trends, and broader market conditions, as these could all influence the stock's performance. Although the technical indicators and fundamentals highlight a positive outlook, stock prices are inherently unpredictable and subject to market dynamics. Investors making trading decisions should continue to assess changes in these indicators and company performance over time.

Farmland Partners Inc. (FPI), a real estate investment trust specializing in agricultural land, enters the investment spotlight against the uneasy backdrop of Ray Dalio's stark warnings about potential global conflict. Dalio, a prominent hedge fund manager, has raised the alarm over the growing likelihood of a significant global war, suggesting that the chances of a major conflict have increased from 35% to 50% within two years. This unsettling forecast is built on historical patterns of world order and the progression of skirmishes into broader wars, potentially implicating major powers like the United States and China.

Dalio's LinkedIn post, "Another Step Toward International War," associates recent geopolitical tensions, including those between Israel and Hamas, with the systemic tensions of a world order in flux. He points to increased great power confrontations that could ensnare even non-combatant nations if unchecked. As Dalio pragmatically nods to the difficulty in collaborative global leadership to avert such outcomes, the investment community must grapple with planning for an event laden with profound implications for financial markets and the global economy.

In light of such global uncertainties, the attractive fundamentals of Farmland Partners Inc. (FPI) have prompted a reevaluation of investment strategies aimed at resilience and value retention. With the specter of military conflict threatening significant market volatility, investors are recalibrating their portfolios toward assets less vulnerable to economic downturns. The significance of Farmland Partners in this climate cannot be overstated, as the intrinsic value of land remains steadfast, even as other markets may falter.

FPI has seized on this strategic positioning with the acquisition of Murray Wise Associates LLC, intensifying its already formidable presence within the ag-sector. The sale announced by A&G Real Estate Partners and Murray Wise Associates LLC encompasses Spring Born's ingenious hydroponic growing operations and ranch land in Silt, Colorado. This venture underlines not only investment potential but also innovation within sustainable agriculture and the broader farmland market.

Spring Born's fully automated facility and preparatory work for future expansion underscore a proactive approach to agrarian modernization. The operation's strong track record for water conservation and its USDA organic certification further bolsters its appeal, adding strategic dimensions to FPI's investment rationale. The distribution reach to retailers such as Whole Foods Market sketches a robust picture of integration within regional food economies.

Amid experiences of market uncertainty, the recent activities of Farmland Partners Inc. reflect a commitment to operational expansion and asset management acumen. Despite a reported dip in shares by The Motley Fool, largely attributed to a conservative growth forecast and anticipated declines in operating earnings, the company's lease renewals and asset transactions throughout 2022 demonstrate market demand for farmland and an ability to navigate complex economic landscapes.

Farmland Partners' financial data offer a blend of growth and caution. The adjusted funds from operations (FFO) per share saw a decline, yet the company has been proactive in reducing total debt and increasing lease renewals at an impressive rate. This balancing act between growth and the broader pressures of interest rates and inflation indicates a sophisticated strategy in an unpredictable financial period.

Furthermore, FPI appears cognizant of long-term trends that favor agricultural investment. The global demand for food, linked to an ever-growing population and the inherent value of strategically located farms, appears to underpin a corporate ethos of perseverance and optimism. While near-term headwinds are acknowledged, the outlook for premium farms remains buoyant, with anticipation of continuous demand for high-quality agricultural land.

The brokerage successes facilitated by Murray Wise Associates, now under FPI's banner, further emphasize the strength of the farmland market. The multi-parcel auction method has proven effective in maximizing farmland value, a testament to MWA's expertise and FPI's shrewd acquisition. The resilience of farmland as an asset class, undeterred by economic tumult such as heightened interest rates, speaks to a broader investor confidence and desire for stable, tangible asset investments.

FPI's strategic acquisitions and market activities indicate not just financial maneuvering but intrinsic growth within the agricultural sector. In the context of market sentiment and economic conditions, the robust performance of FPI's farmland transactions shines as a beacon for prospective growth and stability within this segment of the real estate market. It suggests that despite broader uncertainties, certain segments of the market, like agricultural real estate, continue to offer appealing prospects.

The agricultural landscape is evolving, and with it, Farmland Partners has continued to explore the potential within various property sectors. Not all REITs are equally exposed to the same market vagaries, as highlighted by investment stalwart Charlie Munger's comments on the challenges within commercial real estate. Farmland Partners Inc. represents a segment of the REIT market that diverges from property sectors facing direct challenges from the pandemic-related shifts.

The resilience of the agricultural sector is underscored by the essential need for food production and the enduring value of farmland. FPI's specialization within a finite and essential asset class offers a compelling case for steady rental incomes and serves as a hedge against inflation. This sector-specific investment rationalization is further bolstered by the disconnect between FPI's operational performance and the broader market valuation sentiment, potentially indicating an undervalued asset ripe for strategic investment consideration.

The remarkable partnership between Farmland Partners Inc. and Ducks Unlimited is indicative of FPI's broader commitment to sustainability and ecological stewardship. By transferring land of critical environmental importance to DU, FPI has not only contributed to the preservation of key wildlife habitats but has also likely cemented favorable relations with a sector of the market increasingly attracted to sustainable and socially responsible investment opportunities. This transaction, reflective of FPI's wider strategy, augments the firm's sustainability credentials, potentially enhancing its appeal to a growing demographic of environmentally conscious investors.

FPI acknowledges that the market's future landscape is filled with uncertainty. Variables like geopolitical tensions, supply chain dynamics, and interest rate fluctuations all have the potential to significantly impact performance. However, the company's forward-looking stance and operational adjustments display an agility and preparedness aimed at positioning FPI favorably, irrespective of the capricious nature of future market trends.

Instances of "short-and-distort" attacks present a complex facet of market dynamics that Farmland Partners Inc. is all too familiar with. As witnessed in the broader REIT sector, companies targeted by such campaigns can experience both immediate and lasting consequences. The distinction between arguments based on reasoned critiques and those manufactured to incite fear and market manipulation cannot be overstated.

For Farmland Partners, successfully defending against such an attack in court proved both the company's resilience and the reality of the financial system's exposure to malign intent. Despite prevailing legally, the incident underscores a persistent risk to investors and organizations alike. FPI's subsequent recovery and stock price resilience illustrate that the company's underlying value proposition remains intact and that Farmland Partners can withstand such challenges and emerge with strengthened market confidence.

The farmland market's dynamics, marked by active buyer interest and high-value transactions, continue to affirm the sector's robust nature. FPI's participation through its subsidiary MWA Agribusiness Inc. in the sale of prime farmland in Iowa reinforces this sentiment. The calculated use of the multi-parcel method and the sale's success amidst broader economic factors like rising interest rates signify a market that values quality farmland and views it as a resilient and strategic investment, which aligns with Farmland Partners' investment philosophy.

This strategy of careful asset management, combined with the pursuit of relevant market opportunities, points to a nuanced understanding of farmland as both a tangible and versatile investment. The capability to adjust the portfolio in response to market conditions, all the while maintaining a steady outlook on the sustained demand for quality farmland, aligns with FPI's identity as an agile and forward-thinking entity within the agribusiness real estate market.

In 2023, the performance of Farmland Partners Inc. has garnered attention due to its unique market positioning and alternative approach within the REIT sector. The commitment to both commodity crop and renewable energy generation on its farmland presents an investment vehicle attuned to sustainable and long-term trends in agriculture and energy. Farmland Partners has managed to maintain financial health, boasting assets exceeding liabilities by a significant margin, lending further credibility to its operational model.

Farmland Partners' diversification sets it apart, as does its proactive management team, who have a personal investment in the company's success. With solid foundations in farmland asset management and a prescient eye on future challenges such as food security and sustainable land management, FPI presents a noteworthy investment proposition for those seeking exposure to a sector fundamental to global ecosystems and economies.

Arbor Realty Trust's (ABR) recent experience with an aggressive short attack illustrates the volatility and risk that can quickly impact a company's market performance and investor perceptions. Information asymmetry, as was evident in ABR's case, can cause significant damage to a company's stock price, particularly when claims of financial mismanagement or malfeasance are made public.

The situation at ABR mirrored a previous incident faced by Farmland Partners, where allegations against the company led to a prominent drop in its stock price. However, FPI's subsequent legal victories indicated that the market had unfairly penalized the company, and Farmland Partners' recovery highlights the capacity for rebound when fundamental values of transparent and sound operations are maintained.

FPI's aggressive share repurchases in response to low valuations also reflect the belief in the company's intrinsic potential for appreciation. As macroeconomic factors pressure global food systems, the argument for the appreciation of farmland as a scarce resource strengthens. Farmland Partners has shown prudence in capital allocations, engaging in profitable sales of non-core assets and, where advantageous, employing the proceeds in both share repurchases and debt management.

This comprehensive approach by Farmland Partners' management demonstrates a clear strategy that prioritizes shareholder value, with the potential for significant gains upon a normalization of market conditions. It stands in testament to an investment thesis that looks beyond immediate fluctuations and positions for long-term value based on the enduring and increasing importance of agricultural real estate.

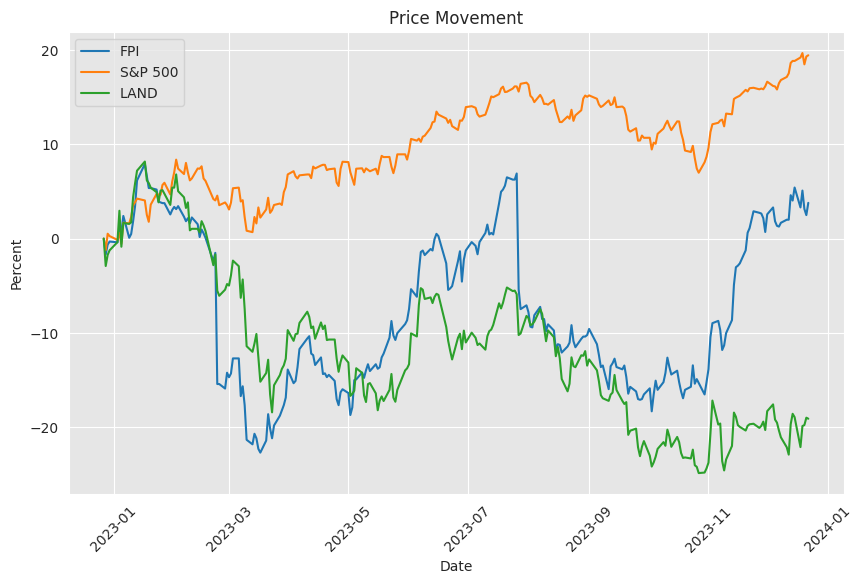

Similar Companies in REIT - Agricultural:

Gladstone Land Corporation (LAND), American Farmland Company (AFCO), Agree Realty Corporation (ADC), Cresud S.A.C.I.F. y A. (CRESY)

News Links:

https://finance.yahoo.com/news/colorado-greenhouse-ranch-market-ag-182900266.html

https://www.fool.com/investing/2023/02/27/why-farmland-partners-stock-dropped-last-week/

https://finance.yahoo.com/news/mwa-auctions-illinois-farm-14-121000607.html

https://seekingalpha.com/article/4607070-billionaire-investor-says-sell-real-estate

https://finance.yahoo.com/news/farmland-partners-ducks-unlimited-complete-121000862.html

https://finance.yahoo.com/news/mwa-completes-12-2-million-120000639.html

https://www.fool.com/investing/stock-market/market-sectors/real-estate-investing/best-stocks/

https://seekingalpha.com/article/4592353-arbor-realty-trust-power-of-information-asymmetry

https://finance.yahoo.com/news/crisis-opportunity-3-agriculture-stocks-122033324.html

https://finance.yahoo.com/news/owns-more-farmland-bill-gates-200014217.html

https://finance.yahoo.com/news/5-reits-paying-special-dividends-170011486.html

https://seekingalpha.com/article/4569813-sell-alert-3-reits-that-likely-will-cut-their-dividends

https://seekingalpha.com/article/4655205-2-reits-aggressively-repurchasing-shares

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 7VdeDH

https://reports.tinycomputers.io/FPI/FPI-2023-12-24.html Home