SPDR Gold Trust, SPDR Gold Shares (ticker: GLD)

2024-01-03

The SPDR Gold Trust, commonly referred to by its ticker GLD, is one of the largest and most popular exchange-traded funds (ETFs) that provides investors with an opportunity to gain exposure to the gold market without the necessity of taking physical delivery of the precious metal. GLD aims to track the price of gold bullion, with each share representing a fractional undivided beneficial ownership in the Trust. The fund is backed by physical gold held in secure vaults, and its value fluctuates with the market price of gold. It is considered a cost-effective and liquid means for investors to hedge against economic uncertainty, inflation, and currency fluctuations. Established in November 2004 and listed on the New York Stock Exchange, GLD has been a key instrument for both institutional and retail investors who wish to include gold in their investment portfolios.

The SPDR Gold Trust, commonly referred to by its ticker GLD, is one of the largest and most popular exchange-traded funds (ETFs) that provides investors with an opportunity to gain exposure to the gold market without the necessity of taking physical delivery of the precious metal. GLD aims to track the price of gold bullion, with each share representing a fractional undivided beneficial ownership in the Trust. The fund is backed by physical gold held in secure vaults, and its value fluctuates with the market price of gold. It is considered a cost-effective and liquid means for investors to hedge against economic uncertainty, inflation, and currency fluctuations. Established in November 2004 and listed on the New York Stock Exchange, GLD has been a key instrument for both institutional and retail investors who wish to include gold in their investment portfolios.

| Previous Close | 190.72 | Open | 188.77 | Day Low | 188.16 |

| Day High | 189.8596 | Volume | 8,623,103 | Average Volume | 8,060,603 |

| Average Volume (10 days) | 5,630,480 | Bid | 189.26 | Ask | 189.09 |

| Bid Size | 1,000 | Ask Size | 800 | Total Assets | 57,341,988,864 |

| 52 Week Low | 168.19 | 52 Week High | 193.18 | 50 Day Average | 185.98 |

| 200 Day Average | 182.049 | NAV Price | 191.59431 | Currency | USD |

| YTD Return | -0.2354% | Beta (3 Year) | 0.13 | 3 Year Average Return | 2.25854% |

| 5 Year Average Return | 9.4676% | Exchange | PCX | Quote Type | ETF |

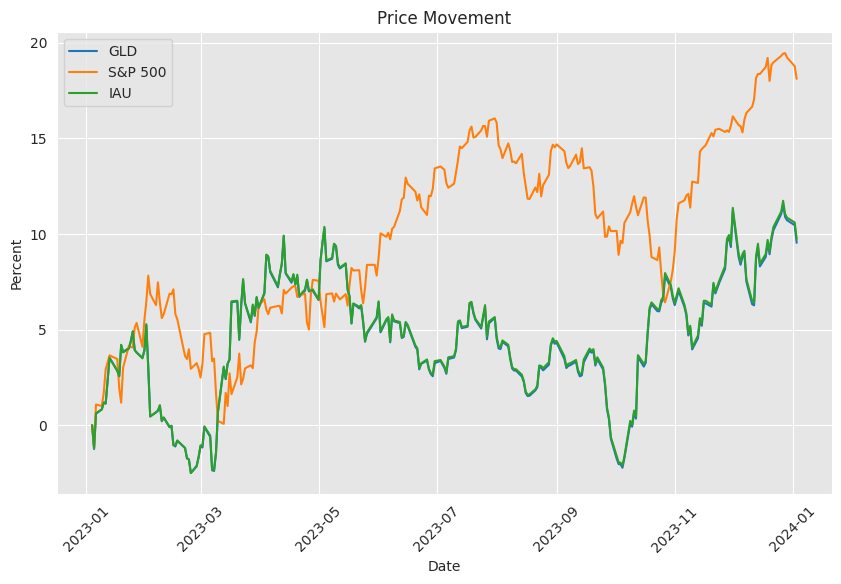

The technical analysis of SPDR Gold Shares (GLD) suggests a nuanced outlook for the forthcoming months. GLD, an exchange-traded fund designed to track the price of gold, has recently exhibited a blend of bullish and bearish signals in its price action and technical indicators that must be analyzed for a comprehensive forecast.

The technical analysis of SPDR Gold Shares (GLD) suggests a nuanced outlook for the forthcoming months. GLD, an exchange-traded fund designed to track the price of gold, has recently exhibited a blend of bullish and bearish signals in its price action and technical indicators that must be analyzed for a comprehensive forecast.

Looking at recent price trends, a few key observations stand out:

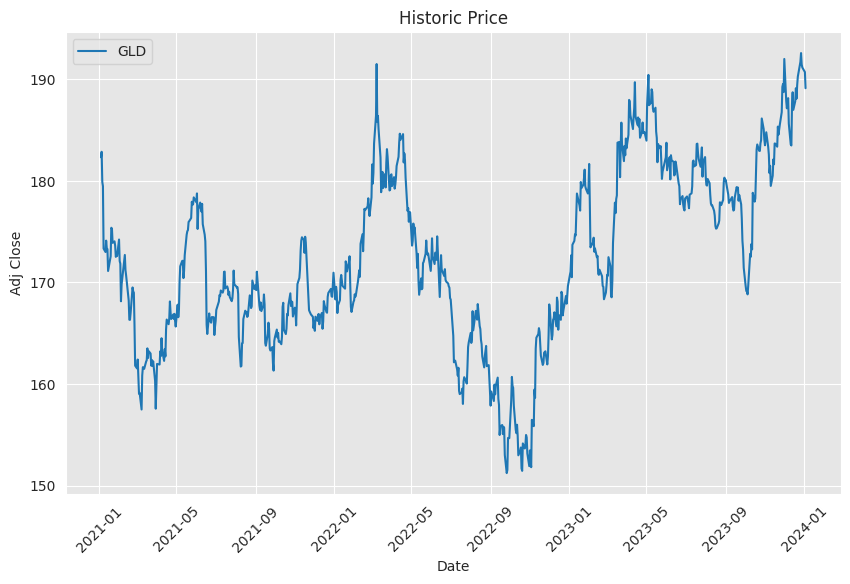

- The price of GLD has seen an upward trajectory over the last several months, moving from a low around $178 up to a peak near $193, before closing at $189.13 recently. This suggests that GLD has been in a medium-term uptrend.

- However, there was a notable decrease in price on the final trading day, with the day's opening at $191.44 and closing at $189.13, indicating a potentially bearish sentiment among traders as we moved into the close.

- The volume has been mixed, with some days showing higher volume on upticks, which typically indicates strength, whereas other days saw increased volume on downticks which can signal weakness.

Technical Indicators:

- The parabolic SAR (Stop and Reverse), a trend-following indicator, is currently not indicating a stop and reverse signal as the 'PSARr_0.02_0.2' is at 0 in the latest records, implying that the current uptrend has not been breached yet.

- The On-Balance Volume (OBV) has generally been increasing, pointing to buying pressure and accumulation of shares. Nonetheless, the latest drop in the OBV could be a potential sign that this may be reversing or at least pausing.

- The Moving Average Convergence Divergence (MACD) histogram is showing a dip into the negative, indicating a possible loss of momentum in the uptrend and even a potential bearish crossover.

When we overlay these technical insights with the fundamentals of GLD, we see that:

- The ETF has maintained a relatively stable price range, with a 52-week low of $168.19 and a high of $193.18, suggesting solid support and resistance levels.

- GLDs significant total assets underline strong market confidence and liquidity, which is positive for price stability.

- The gold market does not provide a yield, instead serving as a hedge against inflation and market uncertainty. Consequently, the performance of GLD is often correlated with the strength of the US dollar and real interest rates.

- The relatively low beta of 0.13 confirms that GLD is less volatile than the broader market, which is typical for gold and commodity-related investments.

- The year-to-date return is slightly negative, and consistent dividends are not a feature of this ETF, as it is designed to replicate the performance of gold prices.

Given the context above, the potential movement for GLDs stock price in the next few months seems to be tilting towards a more conservative or bearish outlook. The recent decrease in the MACD histogram and the sell-off on the last trading day could prelude a shift in the momentum, hinting at a pullback or consolidation phase going forward. However, the overall trend remains up, and buyers may find value at support levels identified by recent lows or technical oscillators such as the moving averages.

It is vital to note that the prospective path of gold prices and thus GLD can be significantly influenced by macroeconomic factors such as inflation reports, interest rate changes, and global economic stability. Investors may look to gold as a safe haven during times of market uncertainty or inflationary pressures. Conversely, a strengthening dollar and rising interest rates can often weigh negatively on gold prices.

Market participants should weigh these technical analyses and fundamental perspectives to calibrate their expectations and investment strategies accordingly. While the technical indicators provide a snapshot of past and current market sentiment, the inherently unpredictable nature of financial markets calls for continuous analysis and assessment of evolving macroeconomic conditions and geopolitical events that directly impact the gold market.

In their 10-Q filing for the quarterly period ending June 30, 2023, SPDR Gold Trust, sponsored by World Gold Trust Services, LLC, provides detailed financial information about its activities associated with holding gold and issuing SPDR Gold Shares (GLD). The Trust's primary goal is for the shares to reflect the price of gold bullion, less the Trust's expenses. As of August 4, 2023, 313,700,000 shares were outstanding.

The Trust's financial statements show that as of June 30, 2023, the total assets were valued at $56,980,255,000, which represents an increase from $50,693,257,000 on September 30, 2022. This increase is primarily due to the appreciation in the market value of gold owned by the Trust. During this period, there was a net increase in liabilities which went from $202,797,000 to $320,089,000. Consequently, the net assets increased from $50,490,460,000 to $56,660,166,000, and the net asset value per share rose from $155.69 to $177.56.

The schedules of investments reveal that as of June 30, 2023, the Trust held 29,797.5 ounces of gold with a cost of $49,807,018,000 and a fair value of $56,980,255,000, which denoted 100.56% of net assets. This signifies the Trust's overall positive investment performance during the quarter.

In the operational perspective, the Trust incurred sponsor fees totaling $59,093,000 over three months and $165,464,000 over nine months, contributing to a net investment loss of $59,093,000 for the three-month period and $165,464,000 for the nine-month period. Its important to note that the Trusts strategy does not involve active management of the gold assets, which means the Trustee neither sells at high prices with the expectation of price increases nor hedges against potential price decreases, potentially impacting the Trust's performance and the value of the Shares.

The SPDR Gold Trust's cash flow statement displays no cash on hand at the end of the period, correlating with its policy of holding minimal cash and primarily gold. The Trust's cash flows are a result of selling small amounts of gold as needed to cover operational expenses. It suggests that the Trust operates a lean structure where gold is periodically sold to cover expenses, keeping cash balances at or near zero.

The Trust's internal controls and procedures are described as effective with no notable changes reported within the quarter, indicating a robust mechanism to ensure accurate financial reporting and compliance with regulatory requirements.

In summary, the Trust's 10-Q filing indicates an increase in the value of assets, primarily driven by the appreciation of gold prices. The financial condition and results indicate a solid operational foundation, with effective controls in place to manage the Trust's unique structure focused on reflecting the value of gold bullion via share offerings.

Gold prices have recently declined in Asian trade, with the dollar gaining strength, leading to gold relinquishing some of its recent gains. This shift comes amid market speculation regarding the timing of the Federal Reserve's interest rate cuts, expected sometime in 2024. Gold had previously been on a bullish trend, buoyed by anticipation that the Federal Reserve might begin reducing interest rates as early as March 2024. Despite these gains, spot gold stabilized at around $2,064.16 an ounce, while February gold futures saw a mild drop to $2,072.40 an ounce, both declining approximately 0.3% from the previous session.

Market participants were cautiously awaiting the release of the minutes from the Fed's December meeting, hoping for insights into the central bank's approach to rate cuts. Although the Fed signaled potential rate reductions, the specifics on timing and magnitude remained unclear, with Federal Reserve Chair Jerome Powell providing limited guidance. Several Fed officials expressed skepticism regarding early rate cuts, pointing to robust inflation and job market statistics. Still, traders factored in a nearly 70% likelihood of a 25 basis point cut in March 2024.

The optimism over impending rate cuts contributed to financial markets ending the year positively, with gold concluding December with a significant rally and projected continued upward momentum. Lower interest rates typically benefit gold investments, as they reduce the opportunity cost of holding the non-yield-bearing metal.

Industrial metals, like copper, showed a decrease in prices, continuing to tumble after weak economic data from China. March copper futures edged down from a five-month high seen in late December, influenced by a stronger dollar. The anticipated economic rebound in China has yet to materialize, causing investor concern for the outlook of industrial metals.

The SPDR Gold Trust, also known as SPDR Gold Shares (GLD), offers investors exposure to the gold market. This gold ETF is designed to track the price of gold bullion, acting as a hedge against economic uncertainty and inflation, rather than providing income through dividends. In contrast, the Seeking Alpha article discussed dividend stocks that may provide stability in the shifting macroeconomic landscape. Stocks like Energy Transfer LP, Barrick Gold Corporation, W. P. Carey Inc., Nutrien Ltd., and NextEra Energy Partners were highlighted as attractive for their yields and potential stability.

On a notable Friday, spot gold approached the upper boundary of its trading range, appreciating to $2,049.20 an ounce, with gold futures also increasing. These gains contributed to gold being on track for a weekly gain of over 1%. The dollar's weakness, alongside revised GDP figures and jobless claims from the US, set expectations for a cooling labor market, impacting monetary policy and indirectly influencing gold prices.

Amid expectations of deflationary pressures outlined by High Yield Investor, investors have begun to reassess their portfolio allocations. The Five Horsemen of DeflationDemographics, Technology, Over-indebtedness, Globalization, and Inequalitymay herald a period of lower prices, influencing the Federal Reserve's rate decisions, and affecting investments such as SPDR Gold Trust.

Avi Gilburt's analysis of a potential bear market raises questions for investors looking to navigate these market predictions. With careful attention to resistance and support levels in various sectors and commodities, Gilburt advises tailored investment actions according to individual risk appetites, citing opportunities in energy and metals.

Following the Federal Reserve's meeting on December 13, 2023, where rates were maintained but signaled potential reductions in 2024, investors reacted with a surge in stocks and a drop in Treasury yields. ETFs like the SPDR Gold Trust experienced gains in response to softened rate cut outlooks and a weakened US dollar, highlighting the relationship between Fed policies and investment instruments such as gold ETFs.

Gold's role as an investment option has gained renewed attention due to declining bond yields and a weaker dollar, with expert forecasts suggesting a continued upward trajectory, especially as the Federal Reserve moves toward a potential reduction in borrowing costs. The SPDR Gold Trust ETF, a major gold ETF, stands out as a principal option for investment, with AUM of $56 billion and significant daily trading volumes.

Assessing the performance of ETFs and their growth prospects, the SPDR Gold Trust ETF presents an important aspect of diversified investment strategies with the Federal Reserve's potential end to the rate hiking cycle. Sector-specific ETFs that are sensitive to interest rate fluctuations, such as the Real Estate Select Sector SPDR ETF and Consumer Discretionary Select Sector SPDR Fund, may also benefit from projected policy shifts.

Gold prices have showcased stability, near record highs, in anticipation of rate cuts by the Federal Reserve. This stability has contributed to a cautiously optimistic investor sentiment that weighs the strength of gold against competing asset classes and evolving macroeconomic indicators.

Lastly, the recent restrained fluctuation in gold prices reflects the mixed sentiment surrounding the Federal Reserve's interest rate decision pathway for 2024. Copper prices have also remained stable, near their four-month peak, as investors contemplate global economic stimuli and supply constraints. The interplay between these commodities and financial markets remains a focal point for investors as they navigate the uncertainties of monetary policies and economic resilience.

Similar Companies in Exchange Traded Fund:

iShares Gold Trust (IAU), Aberdeen Standard Physical Gold Shares ETF (SGOL), VanEck Vectors Gold Miners ETF (GDX), VanEck Vectors Junior Gold Miners ETF (GDXJ), GraniteShares Gold Trust (BAR), Perth Mint Physical Gold ETF (AAAU)

News Links:

https://seekingalpha.com/article/4658423-major-market-disruption-underway-how-to-invest-2024

https://finance.yahoo.com/news/gold-prices-rise-strong-start-000615307.html

https://finance.yahoo.com/news/gold-prices-surge-dollar-hits-005028065.html

https://finance.yahoo.com/news/gold-prices-dip-dollar-rebounds-002525772.html

https://finance.yahoo.com/news/gold-etfs-set-shine-2024-160500232.html

https://finance.yahoo.com/news/fed-views-steeper-rate-cuts-130000804.html

https://finance.yahoo.com/news/putting-etf-tree-wealth-brighten-150000599.html

https://finance.yahoo.com/news/gold-prices-steady-above-2-010629851.html

https://seekingalpha.com/article/4660183-gold-ready-for-blast-off

https://finance.yahoo.com/news/gold-prices-rangebound-markets-gauge-011555044.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: LgpXH7

https://reports.tinycomputers.io/GLD/GLD-2024-01-03.html Home