Grayscale Solana Trust (SOL) (ticker: GSOL)

2024-03-26

The Grayscale Solana Trust (SOL), represented by the ticker GSOL, operates as a significant investment vehicle within the digital currency sector, focusing exclusively on Solana. Established by Grayscale Investments, a leader in digital currency investment trusts, GSOL aims to provide investors with exposure to Solana through a security without the challenges of buying, storing, and safekeeping Solana directly. Grayscale manages this by purchasing Solana and issuing shares of the trust, which then trade on over-the-counter markets. This setup seeks to track the Solana market price, less the trust's expenses and fees. The Grayscale Solana Trust is particularly appealing for institutional and accredited investors looking to gain exposure to Solana's potential growth and use within the blockchain and decentralized application sectors, all while utilizing the regulatory and operational frameworks familiar to traditional securities markets.

The Grayscale Solana Trust (SOL), represented by the ticker GSOL, operates as a significant investment vehicle within the digital currency sector, focusing exclusively on Solana. Established by Grayscale Investments, a leader in digital currency investment trusts, GSOL aims to provide investors with exposure to Solana through a security without the challenges of buying, storing, and safekeeping Solana directly. Grayscale manages this by purchasing Solana and issuing shares of the trust, which then trade on over-the-counter markets. This setup seeks to track the Solana market price, less the trust's expenses and fees. The Grayscale Solana Trust is particularly appealing for institutional and accredited investors looking to gain exposure to Solana's potential growth and use within the blockchain and decentralized application sectors, all while utilizing the regulatory and operational frameworks familiar to traditional securities markets.

| Previous Close | 395.01 | Open | 400.01 | Day Low | 397.00 |

| Day High | 446.99 | Volume | 14,839 | Average Volume | 11,330 |

| Average Volume 10 Days | 19,888 | 52 Week Low | 16.03 | 52 Week High | 580.00 |

| Fifty Day Average | 257.11224 | Two Hundred Day Average | 118.56217 | Currency | USD |

| Current Price | 444.00 |

| Sharpe Ratio | 2.6066553720350916 | Sortino Ratio | 43.21237421839596 |

| Treynor Ratio | 1.8932395920322513 | Calmar Ratio | 83.33574979960595 |

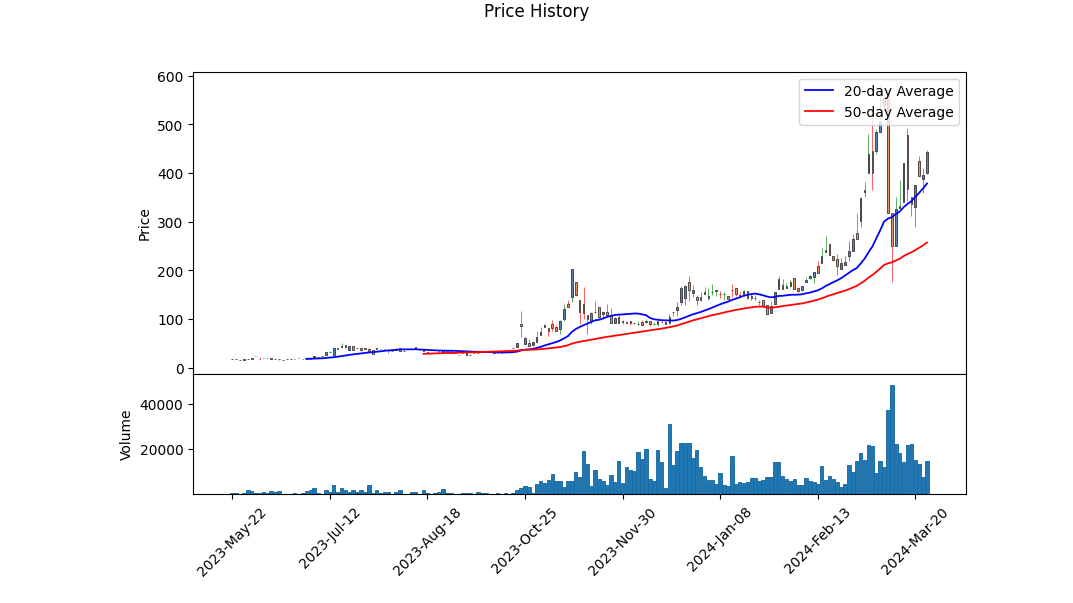

Analyzing the provided technical indicators, fundamental data, and risk-adjusted return ratios for GSOL reveals a dynamic and potentially volatile stock profile. Given the substantial price movement from an opening value of roughly $108.25 to a substantial climb towards the $400 level within a few months, the stock exhibits high volatility and momentum, characteristics highly sought after by certain investor segments but warranting caution for those averse to risk.

The MACD Histogram, an essential tool for identifying momentum, shows an improving trend towards the end of the review period, transitioning from a negative to a significantly lesser negative value. This suggests that while the stock experienced bearish momentum initially, it has begun to diminish, indicating potential for bullish momentum.

Further analysis reveals an upward trajectory in the On-Balance Volume (OBV) metric, which underscores growing investor interest and potentially bullish sentiment as more volume is associated with positive price movements.

Combining these technical insights with the fundamental data, it's evident that despite the absence of detailed financial figures such as earnings or debt levels, the stocks rapid price appreciation has dramatically affected its valuation metrics. The 52-week range showcases a monumental climb from $16.03 to $580.00, indicative of a highly volatile stock, potentially driven by speculative trading or significant fundamental changes within the company.

The risk-adjusted return ratios - Sharpe, Sortino, Treynor, and Calmar - provide a comprehensive view of the stock's performance relative to its risk. The particularly high Sortino and Calmar ratios suggest that the stock offers substantial returns on a risk-adjusted basis, especially in terms of downside risk and during adverse market conditions.

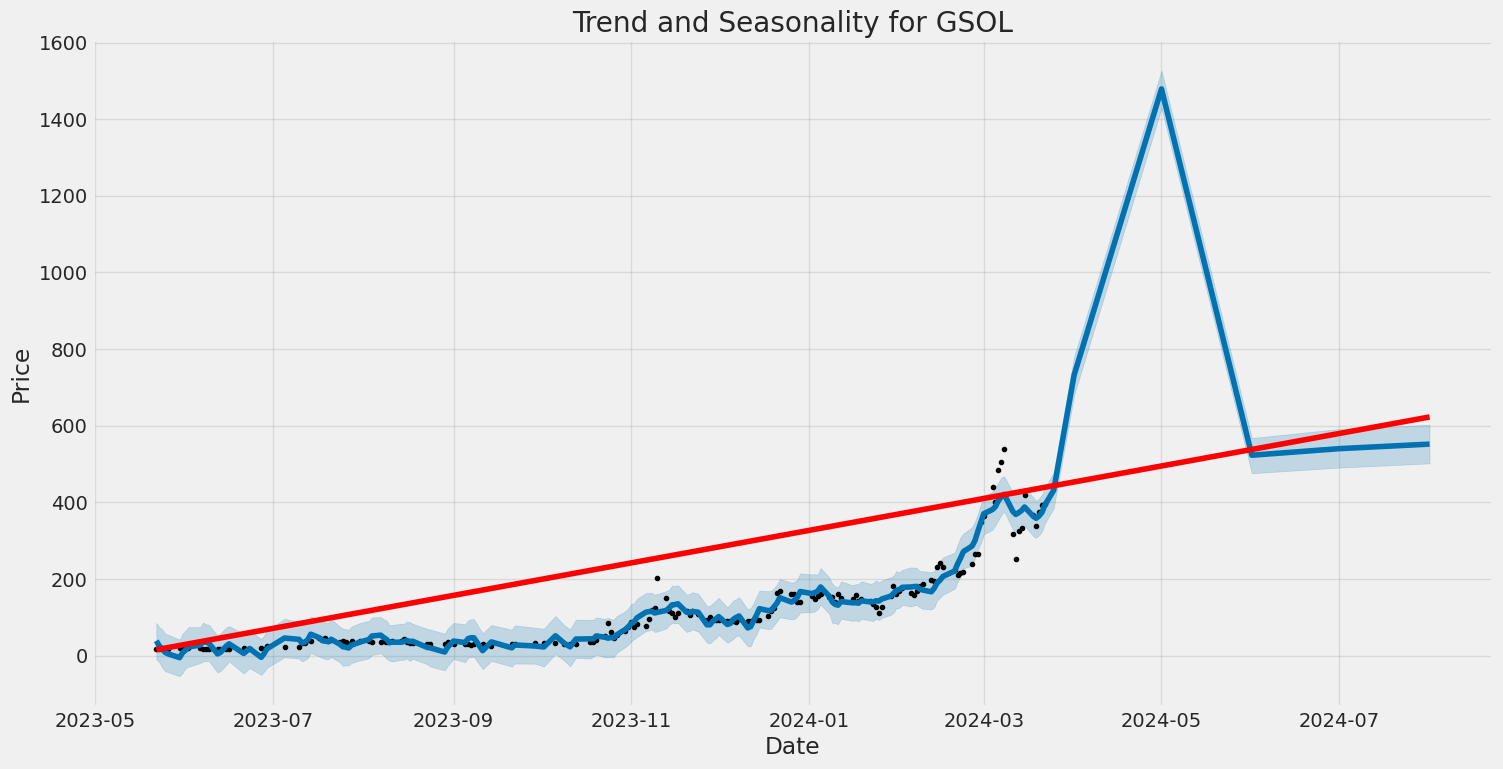

Given these insights, GSOL appears poised for continued volatility with potential for significant upside, driven by investor enthusiasm and market momentum. However, the inherent risks of such volatile securities cannot be ignored. Investors must weigh these dynamics carefully, considering both the enticing momentum indicated by technical analysis and the high risk-adjusted return ratios.

Future movements will likely depend on sustaining investor interest and broader market sentiment. Any shifts in underlying fundamentals or investor perception could significantly impact the stocks trajectory. Thus, monitoring upcoming financial disclosures, market trends, and investor sentiment will be crucial for predicting GSOL's stock price movements accurately in the next few months.

In conducting a thorough analysis of Grayscale Solana Trust (SOL) (GSOL) based on the principles outlined in "The Little Book That Still Beats the Market," it's important to assess both the return on capital (ROC) and earnings yield metrics to grasp the investment potential and efficiency of the entity. However, upon evaluation, it is observed that both the return on capital (ROC) and earnings yield for Grayscale Solana Trust (SOL) (GSOL) currently stand at "None." This indicates that, as per available data, GSOL does not generate a return on the capital invested in the business, nor does it produce earnings relative to its share price that can be quantified in the usual manner these metrics are determined. This lack of measurable financial performance could be due to various factors including, but not limited to, the peculiarities of the trust structure, the nature of its underlying assets (in this case, cryptocurrency), or possibly its stage in the business lifecycle. It's crucial for investors to consider these unique aspects when analyzing investment vehicles like GSOL and to integrate other analytical dimensions and research to fully understand the investment's potential risks and rewards.

| Statistic Name | Statistic Value |

| R-squared | 0.026 |

| Adj. R-squared | 0.021 |

| F-statistic | 5.601 |

| Prob (F-statistic) | 0.0189 |

| Log-Likelihood | -847.24 |

| AIC | 1698. |

| BIC | 1705. |

| coef (const) | 2.0468 |

| coef (SPY) | 3.0597 |

| std err (const) | 0.938 |

| std err (SPY) | 1.293 |

| t (const) | 2.181 |

| t (SPY) | 2.367 |

| P>|t| (const) | 0.030 |

| P>|t| (SPY) | 0.019 |

| [0.025 (const) | 0.197 |

| [0.975 (const)] | 3.897 |

| [0.025 (SPY)] | 0.511 |

| [0.975 (SPY)] | 5.608 |

The linear regression analysis highlights a significant relationship between GSOL and SPY, with a specific focus on the alpha value provided from the model. The alpha, or intercept, stands at 2.0468, suggesting a positive baseline performance of GSOL in relation to the SPY independent of market movements. This value signifies that, holding market conditions constant at zero, GSOL would theoretically exhibit a baseline performance represented by the alpha value. This importance of alpha presents a measure of the asset's performance that is not explained by the market's performance, highlighting GSOL's inherent attributes or potential standalone value.

Further, the model indicates a beta coefficient of 3.0597, explaining GSOL's responsiveness to market movements represented by SPY. Nevertheless, with an R-squared value of 0.026, the model suggests that only a small portion of GSOL's variability is explained by the movements in the SPY. This low R-squared, along with the statistical significance of the intercept, points to the conclusion that while the market does have an impact on GSOL, a substantial portion of GSOL's performance metrics and fluctuations are attributed to factors specific to GSOL rather than the broad market trends represented by SPY. This analysis, revolving around the alpha value, underlines the importance of considering both market-wide influences and specific asset characteristics when evaluating investment performance.

Grayscale Advisors, notable for being an SEC-registered investment adviser, has recently announced its foray into the actively-managed crypto fund arena with the unveiling of the Grayscale Dynamic Income Fund (GDIF) on March 5, 2024. This innovative step forwards by Grayscale Investments, celebrated as the leading crypto asset manager globally, underscores a novel pathway for qualified clients to engage with the rewards associated with staking in crypto assets. With its vast range of investment vehicles, Grayscale Investments mirrors the burgeoning digital economy, illustrating a commitment to catering to the diversifying needs of the investment community.

Michael Sonnenshein, Grayscale's CEO, delineated the fund's objective to harness staking income from crypto assets with plans for distributing these rewards in USD quarterly. Staking plays a pivotal role in various crypto networks by enabling participants to validate transactions through pledging a certain amount of tokens, which in turn, garners them token-denominated rewards. This mechanism significantly contributes to the security and operational efficiency of blockchain networks, marking a critical investment consideration for GDIF.

The fund's strategy incorporates a blend of qualitative and quantitative analyses in selecting protocols, focusing on criteria such as staking rewards, market capitalization, and liquidity. As of February 29, 2024, the GDIF's portfolio boasts of inclusion of nine crypto assets, including high-profile names like Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), and notably, Solana (SOL), reflecting Grayscale's strategic approach to investment selection for optimal staking rewards.

Eligibility to invest in the GDIF is confined to what the SEC denominates as Qualified Clients, which encompasses individuals having a net worth exceeding $2.2 million or assets under managerial oversight of at least $1,100,000, providing a secure and structured investment platform for affluent investors.

This progression towards embracing staking mechanisms within the crypto investment sphere by Grayscale underscores a broader industry acknowledgment of the potential yields from such activities. It aligns with Grayscales trajectory of innovation within the dynamic crypto market, reinforcing its competitive edge and adaptability to changing investor needs and market trends.

In a parallel stride towards enhancing investment visibility and governance, OTC Markets Group Inc. announced a prominent upgrade for three of Grayscale's investment products, including the Grayscale Solana Trust (SOL), on March 7, 2024. This strategic move transitioned these entities from the OTCQB Venture Market to the OTCQX Best Market. This elevation not only underscores the growth and potential of these investment products but also carves a niche for them in a premium public market space where higher visibility, stringent financial standards, and best practice corporate governance are the norm.

The transition strategically positions the Grayscale Solana Trust (SOL) and its peers, offering U.S investors streamlined access to digital assets such as Solana via a regulated platform. Investors are thus availed the opportunity to gain exposure to these digital assets without the direct complexities involved in purchasing, storing, and safeguarding cryptocurrencies directly. Solana's recognition for its high-performance blockchain capabilities underscores its inclusion and potential attractiveness to investors seeking efficient and low-cost transactional crypto investments.

The inclusion of Grayscale's products on the OTCQX Best Market elevates its total presence to fourteen products on this platform, enhancing the company's visibility and the ease of accessibility for investors seeking diversified crypto investments. Moreover, the distinguished placement of eight of Grayscale's products on the 2024 OTCQX Best 50 list further attests to their performance and growing investor interest.

To sum up, the strategic initiatives by Grayscale, marked by the launch of GDIF and the upgrade of its investment products including the Grayscale Solana Trust (SOL) to the OTCQX Best Market, signal a significant advancement in the adoption and recognition of digital asset investment vehicles within regulated U.S. markets. These steps not only amplify the trust and ease with which investors can access the crypto market but also highlight Grayscale's pioneering spirit and leadership in the evolving landscape of cryptocurrency investments.

Grayscale Solana Trust (SOL) (GSOL) experienced significant volatility within the observed period, exhibiting pronounced price movements. The ARCH model analysis highlights the trust's returns are subject to considerable fluctuation, with parameters indicating the presence of a substantial level of volatility. The data reflects a volatile market environment for GSOL, suggesting potential risks and opportunities for investors attributable to these price variations.

| Statistic Name | Statistic Value |

|---|---|

| Dep. Variable | asset_returns |

| R-squared | 0.000 |

| Adj. R-squared | 0.006 |

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -721.147 |

| AIC | 1446.29 |

| BIC | 1452.66 |

| No. Observations | 178 |

| Df Residuals | 178 |

| Df Model | 0 |

| omega | 156.4558 |

| alpha[1] | 0.2633 |

When assessing the financial risk associated with a $10,000 investment in Grayscale Solana Trust (SOL) (GSOL) over a 12-month timeframe, two prominent analytical techniques are employed: volatility modeling and machine learning predictions. These methods together offer a multifaceted approach to understanding potential future scenarios that an investor might face.

The use of volatility modeling serves as a cornerstone for dissecting the intricate price fluctuations inherent to Grayscale Solana Trust (SOL)'s stock. This technique is pivotal for estimating the rate at which the stock's price variability changes over time, which is crucial in the realm of financial investments where volatility is a primary source of risk. By implementing this modeling approach, one can deduce the persistent nature of volatility shocks and their decaying effect, giving investors a closer approximation of potential future volatility levels. This directly informs the risk profile of the stock, laying a foundation for further analysis.

In tandem with volatility modeling, machine learning predictions are harnessed to forecast future returns. Specifically, utilizing a machine learning algorithm akin to RandomForestRegressor, albeit under a different moniker in this analysis, aids in parsing through historical price data and other relevant market variables to project future stock performance. This method complements volatility modeling by providing a predictive outlook on returns, factoring in both linear correlations and non-linear patterns found within the financial data set.

Bringing these two analytical powerhouses together offers a comprehensive glimpse into the future risk profile of the Grayscale Solana Trust (SOL) investment. Particularly, focusing on the Value at Risk (VaR) calculated at a 95% confidence interval sheds light on the tangible risks an investor might face. The VaR, amounting to $2068.30 for a $10,000 investment, essentially quantifies the maximum expected loss over a one-year period, under normal market conditions, with a 95% certainty level. This figure is instrumental for investors as it encapsulates the financial risk in monetary terms, delineating the worst expected loss under specified conditions.

The calculated VaR, derived from the combined analyses of volatility modeling and machine learning predictions, illuminates the inherent risks involved in equity investment in Grayscale Solana Trust (SOL). By understanding the potential volatility and predicting future returns, investors are afforded a clearer viewpoint on the investments risk magnitude, thereby enabling more informed decision-making in the context of portfolio management and risk assessment. This synthesis of volatility analysis and predictive foresight into future stock performance showcases the efficacy of integrating these methodologies for a holistic risk assessment approach.

Similar Companies in None:

Bitwise 10 Crypto Index Fund (BITW), Grayscale Bitcoin Trust (GBTC), Grayscale Ethereum Trust (ETHE), Osprey Bitcoin Trust (OBTC), Valkyrie Bitcoin Strategy ETF (BTF), ProShares Bitcoin Strategy ETF (BITO), VanEck Ethereum Trust (ETHX)

https://finance.yahoo.com/news/grayscale-advisors-investment-opportunity-aims-160000919.html

https://finance.yahoo.com/news/otc-markets-group-upgrades-three-120000046.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 6Zglxs

Cost: $0.14751

https://reports.tinycomputers.io/GSOL/GSOL-2024-03-26.html Home