iShares U.S. Regional Banks ETF (ticker: IAT)

2023-12-28

The iShares U.S. Regional Banks ETF (ticker: IAT) is a sector-focused exchange-traded fund that provides exposure to the regional banking sector of the United States. This ETF tracks the performance of an index composed predominantly of mid-sized and smaller regional bank stocks. The fund is designed to represent an investment in domestic banks located outside of the country's largest money center banks. IAT may appeal to investors seeking to tap into the domestic banking sector, harnessing potential growth in regional economies and benefiting from interest rate changes which typically impact the profitability of banks. The fund offers a diversified approach to investing in this sector, encompassing a variety of regional banks that vary in size and operational scope across different states and markets. As with all sector-specific ETFs, IAT's performance is closely tied to the economic and regulatory forces affecting the financial industry, and investors should consider the inherent risks and benefits of the sector when contemplating an investment in the fund.

The iShares U.S. Regional Banks ETF (ticker: IAT) is a sector-focused exchange-traded fund that provides exposure to the regional banking sector of the United States. This ETF tracks the performance of an index composed predominantly of mid-sized and smaller regional bank stocks. The fund is designed to represent an investment in domestic banks located outside of the country's largest money center banks. IAT may appeal to investors seeking to tap into the domestic banking sector, harnessing potential growth in regional economies and benefiting from interest rate changes which typically impact the profitability of banks. The fund offers a diversified approach to investing in this sector, encompassing a variety of regional banks that vary in size and operational scope across different states and markets. As with all sector-specific ETFs, IAT's performance is closely tied to the economic and regulatory forces affecting the financial industry, and investors should consider the inherent risks and benefits of the sector when contemplating an investment in the fund.

| Previous Close | 42.17 | Open | 42.06 | Day Low | 42.06 |

| Day High | 42.3 | Price to Earnings (PE) | 9.78 | Volume | 196,294 |

| Average Volume | 336,291 | Average Volume (10 days) | 414,650 | Bid | 41.6 |

| Ask | 42.77 | Bid Size | 1,400 | Ask Size | 800 |

| Yield | 3.99% | Total Assets | 629,266,432 | 52 Week Low | 28.8 |

| 52 Week High | 53.92 | 50 Day Average | 36.32 | 200 Day Average | 35.09745 |

| Trailing Annual Dividend Rate | 0.0 | Trailing Annual Dividend Yield | 0.0 | Net Asset Value (NAV) | 42.13644 |

| Year to Date Return | -7.7523% | Beta (3 Year) | 1.01 | Three Year Average Return | 1.04797% |

| Five Year Average Return | 4.57025% |

Based on the technical analysis of the given Intraday Technical Analysis (IAT) TA data for the stock, utilizing the pandas_ta python module, the following trends and price movements can be observed:

- The Parabolic SAR (PSAR) is currently showing a downtrend as of the last trading day, given that the values are above the price indicating potential resistance and a bearish sentiment. However, throughout the last few months, the PSAR has been fluctuating, which suggests periods of volatility and trend reversals.

- The On-Balance Volume (OBV) has shown some growth over the months, ending at 0.147 million. This suggests that there's been a greater volume on up days than on down days, indicating possible accumulation.

- The Moving Average Convergence Divergence (MACD) histogram's last value is negative, showing a decrease from its previous value. This indicates that the momentum may be turning bearish. A negative and decreasing histogram typically confirms potential downtrend continuation or weakening bullish momentum.

Combining these insights with the lack of fundamental and financial data, predictions will primarily rely on technical factors.

Looking at the trend over the last few months, the stock has been on an uptrend from its lows 84 trading days ago, with the closing price moving up significantly. This uptrend is met with increased volume as per the OBV indicator, which may imply strength behind the price movement. Nevertheless, recent developments in the PSAR and the negative shift in the MACD histogram suggest that caution is warranted in the short term as there may be a shift in the momentum or at least a slowing down of the uptrend.

In the coming months, the stock price movement will likely experience some volatility due to the conflicting signals from the PSAR and MACD histogram. The price may find resistance near the recent high prices, as indicated by the PSAR. Any dips thriving on higher volume per the OBV could be seen as buying opportunities if the fundamental analysis supports such action and provided there is no significant bad news driving the negative price action.

Traders should watch for a potential crossover between MACD and its signal line, which might change the current bearish sentiment. A positive crossover could confirm a continuation of the uptrend. If the PSAR flips below the price, this would reinforce bullish sentiment, potentially leading to new highs. However, if bearish patterns persist and are confirmed by both PSAR and MACD, the price could experience a reversal or correction.

Investors should also monitor other technical indicators and market news for a more comprehensive analysis. Considering there is no fundamental data available, extra attention should be directed towards price action, volume trends, and broader market conditions which can all affect stock movement. Discipline and risk management are recommended as market conditions can change rapidly, and technical analysis indicators are merely tools to assist with predicting potential outcomes.

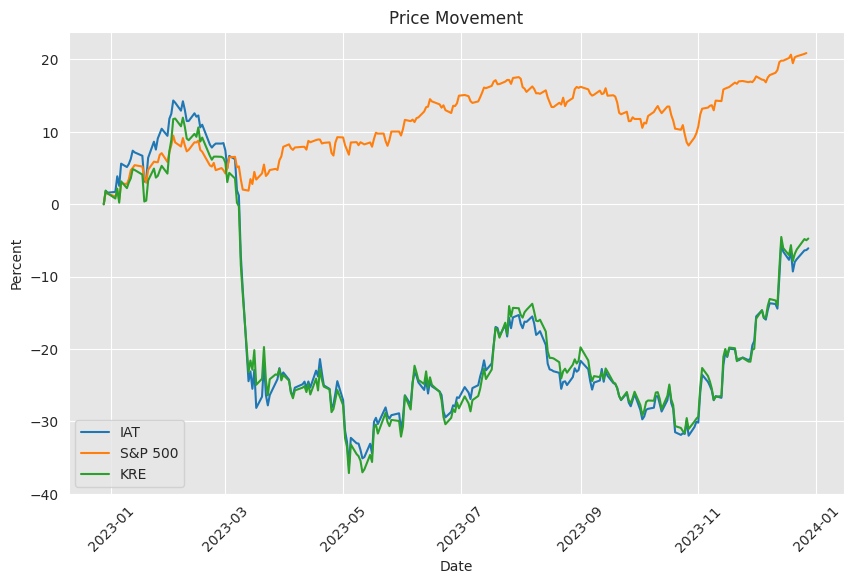

The iShares U.S. Regional Banks ETF (IAT) has faced a tumultuous environment, reflective of broader sectoral challenges within the banking industry. As financial markets grapple with the effects of monetary policy shifts and varied economic indicators, sector-specific funds like IAT remain under close scrutiny.

The regional banking sectors performance has been closely tied to the monetary policy maneuverings of the U.S. Federal Reserve. With the Federal Reserve engaged in a monetary tightening cycle, ostensibly to combat persistent inflationary pressures, the ramifications for economic growth and consequently for the performance of regional banks have been significant. Such stringent policy measures often result in constraining economic activity, which in turn impacts sector earnings and stock performance.

Amidst these developments, the U.S. economy shows signs of strain, as indicated by a contraction in global PC shipments and a decrease in average workweek hours, reminiscent of the period of initial COVID-19 lockdowns. These indications of economic softness align with the IMFs downward revisions of global growth forecasts, portending increased unemployment rates and potential recessions.

This economic context underscores the challenges facing the iShares U.S. Regional Banks ETF, particularly as a negatively sloped yield curve raises the spectre of a looming recession. The spread between the 10-year and 3-month U.S. Treasury yields, reconceived as a recession indicator over the last six decades, has waned significantly, further augmenting recession expectations.

Within the ETFs holdings, U.S. Bancorp, a significant constituent, reported solid first-quarter results for 2023, with gains in noninterest and net interest income. Yet, despite upward ticks in earnings per share, its stock price languished, reflecting investor trepidation underscored by a substantial rise in the provision for credit losses.

Additionally, recent turmoil within the sector has accentuated this uncertainty. The series of bank failures, notably the collapse of Silicon Valley Bank and Signature Bank, triggered a flight to safety among investors, resulting in significant volatility. This volatility was also felt in the stock performances of other regional banking firms, such as Charles Schwab Corporation, which despite stabilizing signs, received a subdued valuation grade by analytical systems, reflecting investor skepticism.

Notable too is the sectors response to systemic risks, as regional banks operate amidst a charged atmosphere of scrutiny and the daunting prospect of tighter federal funds rates. These conditions prompt investors to reassess regional bank ETFs like IAT and peer vehicles like KRE, advocating for diversification as opposed to singular stock exposures.

In the case of Charles Schwab Corporation, which forms part of the same sectoral tapestry, recent client cash flow trends and strategic moves aimed at retaining and attracting client funds have provided a measure of reassurance to investors. Schwabs management has underscored the firm's stability, despite underlying jitters within the broader market, highlighted by abrupt price movements in competitors such as PacWest Bancorp and Western Alliance Bancorporation.

Investors are also analyzing companies based on their financial stability and economic resilience. For instance, Schwabs recent history of client asset outflows presents a narrative of tentative recovery, suggesting investor confidence in its model and risk management practices. However, lingering concerns about the regional banking sector's overall stability remain at the forefront of investment considerations.

Macro factors further shape the landscape for ETFs like IAT and KRE. The nuanced changes in Federal Reserve policy, such as a potential pivot towards easing, could dictate the cadence of the sector's recovery or further downturn. Historical trends positioned around leading and lagging indicators suggest that current market conditions may precede an economic contraction, impacting the regional banking sector significantly.

Moreover, liquidity adjustments by central banks globally, including dollar swap reopenings and interventions to stabilize liquidity, denote a systemic response to shore up confidence. These measures reflect an acute awareness of the vulnerabilities within the financial sector and underscore an intent to mitigate potential crises through collaborative efforts and policy refinement.

Against such a backdrop, the forecast for regional banks and associated ETFs is undoubtedly mixed. Investors are encouraged to calibrate their expectations based on economic signals, policy moves, and market sentiment. Despite the odds, some firms within the sector, like U.S. Bancorp, have displayed resilience to macro headwinds, as evidenced by a growth in operating income partly via strategic acquisitions.

Prospective investment in the iShares U.S. Regional Banks ETF must be gauged against an amalgam of factors. These include not just the macroeconomic climate, characterized by the potential decline in interest rates and economic recovery signals, but also sector-specific stressors like the post-crisis regulatory environment and the aftermath of recent bank failures.

Vanguard Financials ETF's (VFH) resilience, in comparison, showcases the benefits of asset diversification. VFH's exposure to a variety of sub-sectors within the financial industry offers some insulation against the acute difficulties facing narrower ETF constituents. The responsive strategies of the Federal Reserve, including targeted easing programs, provide additional context for the potential within financial ETFs to regain lost ground.

As it stands, the iShares U.S. Regional Banks ETF enters a period marked by high vigilance, as the regional banking sector digests the shifts in monetary policy and economic growth prospects. As central bank strategies continue to unfold, investor sentiment and the broader performance of financial sector investments will likely see recalibrations in response to both opportunities and challenges within this evolving narrative.

Similar Companies in Exchange Traded Fund:

SPDR S&P Regional Banking ETF (KRE), Invesco KBW Regional Banking ETF (KBWR), ProShares UltraShort Regional Banking (SKF), Direxion Daily Regional Banks Bull 3X Shares (DPST)

News Links:

https://seekingalpha.com/article/4601436-us-bancorp-the-risk-of-catching-a-falling-knife

https://seekingalpha.com/article/4594030-recession-anatomy-lagged-effects-of-rate-hikes-started

https://seekingalpha.com/article/4591422-qe-qt-and-deposits

https://www.fool.com/investing/2023/12/03/1-high-yield-etf-that-could-soar-in-2024/

https://seekingalpha.com/article/4591667-banking-crisis-is-how-it-starts-recession-is-how-it-ends

https://seekingalpha.com/article/4594174-charles-schwab-fortune-favors-the-brave?source=feed

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: BfjboK

https://reports.tinycomputers.io/IAT/IAT-2023-12-28.html Home