Impala Platinum Holdings Limited (ticker: IMPUF)

2024-03-25

Impala Platinum Holdings Limited (IMPUF) stands as a significant entity within the global mining sector, primarily focusing on the production of platinum group metals (PGMs), including platinum, palladium, rhodium, and associated elements such as nickel, copper, and cobalt. With its operations concentrated in South Africa, the company plays a crucial role in the mining industry, contributing extensively to the global supply of these critical minerals. Impala Platinum's activities span from mining and processing to refining and selling these metals, positioning it as an integrated producer within the PGM market. The importance of its product portfolio has been underscored by the growing industrial demand for PGMs, particularly in automotive applications for emission-control devices, as well as in electronics and jewelry. Moreover, the company's strategic initiatives toward sustainable mining practices and community engagement highlight its commitment to addressing the environmental and social implications of its operations. As a publicly traded entity on the OTC markets under the ticker symbol IMPUF, Impala Platinum Holdings Limited continues to navigate the volatile commodities market, adapting to the dynamic demands of the global economy while aiming to maximize shareholder value through efficient operations and strategic growth opportunities.

Impala Platinum Holdings Limited (IMPUF) stands as a significant entity within the global mining sector, primarily focusing on the production of platinum group metals (PGMs), including platinum, palladium, rhodium, and associated elements such as nickel, copper, and cobalt. With its operations concentrated in South Africa, the company plays a crucial role in the mining industry, contributing extensively to the global supply of these critical minerals. Impala Platinum's activities span from mining and processing to refining and selling these metals, positioning it as an integrated producer within the PGM market. The importance of its product portfolio has been underscored by the growing industrial demand for PGMs, particularly in automotive applications for emission-control devices, as well as in electronics and jewelry. Moreover, the company's strategic initiatives toward sustainable mining practices and community engagement highlight its commitment to addressing the environmental and social implications of its operations. As a publicly traded entity on the OTC markets under the ticker symbol IMPUF, Impala Platinum Holdings Limited continues to navigate the volatile commodities market, adapting to the dynamic demands of the global economy while aiming to maximize shareholder value through efficient operations and strategic growth opportunities.

| Address 1 | 2 Fricker Road | City | Sandton | Zip | 2196 |

| Country | South Africa | Phone | 27 11 731 9000 | Fax | 27 11 731 9254 |

| Website | https://www.implats.co.za | Industry | Other Precious Metals & Mining | Sector | Basic Materials |

| Previous Close | 4.04 | Open | 4.1 | Day Low | 4.04 |

| Day High | 4.04 | Dividend Rate | 0.18 | Dividend Yield | 0.0435 |

| Market Cap | 3,889,865,472 | Volume | 230 | Average Volume (10days) | 40 |

| FiftyTwo Week Low | 3.25 | FiftyTwo Week High | 10.145 | Price to Sales | 0.04217937 |

| Total Cash | 9,226,999,808 | Total Debt | 3,539,000,064 | Current Ratio | 3.37 |

| Total Revenue | 92,221,997,056 | Operating Cash Flow | 10,394,999,808 | Free Cash Flow | -9,634,624,512 |

| Sharpe Ratio | -0.9658970031037777 | Sortino Ratio | -7.449245823703005 |

| Treynor Ratio | -1.4990931199220843 | Calmar Ratio | -0.8221799295417149 |

Analyzing the recent financial data, technical indicators, and fundamental assessments of IMPUF stock provides significant insights into its possible future movement in the stock market. Based on the comprehensive review, several critical observations can be delineated.

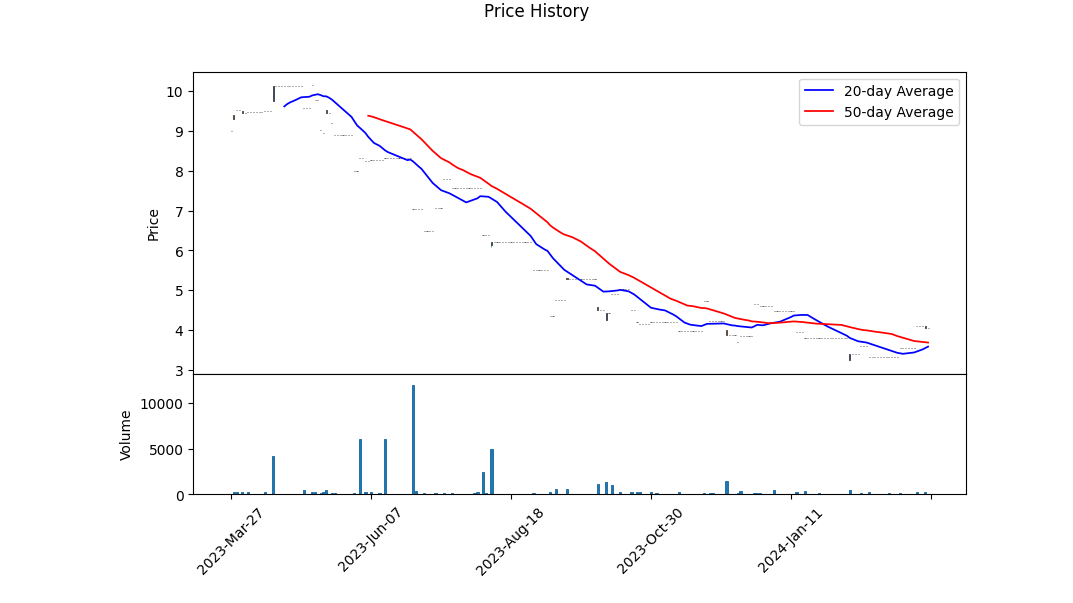

The technical analysis, revealing a consistent but cautious trade volume with the On-Balance Volume (OBV) indicator fluctuating near zero, hints at a steady but guarded interest in the stock. This is further evidenced by a positive trend in the MACD histogram, indicating a potential bullish momentum in the stock. However, the absence of robust spikes suggests that any upward movement will be gradual and might face several resistance levels.

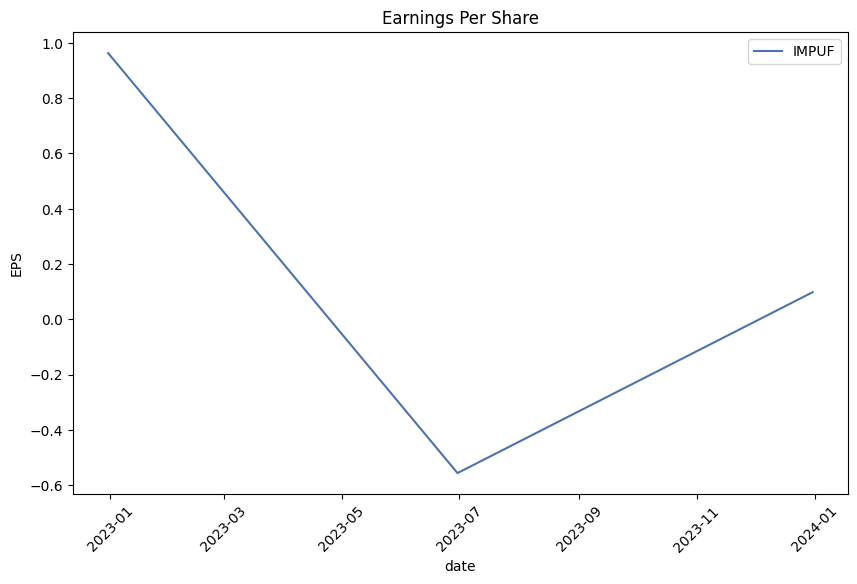

The fundamental analysis, incorporating a detailed examination of balance sheets, cash flows, and other financial metrics, delivers a mixed sentiment. The company's tangible book value and cash holdings exhibit a firm foundation, supported by a significant operating cash flow. Nonetheless, the sharp contrasts in net income, operating margins, and the apparent fluctuations in unusual items, costs, and debt levels reveal a landscape marked by both opportunities and challenges. This balance between strength in assets and liabilities underlines a cautious optimism but requires a meticulous consideration of market and economic factors that could influence the stock's trajectory.

The risk-adjusted performance ratios such as the Sharpe, Sortino, Treynor, and Calmar ratios paint a picture of a stock with a high risk-return profile over the past year. The negative Sharpe and Sortino ratios suggest that the stock has underperformed on a risk-adjusted basis, which may continue to pose concerns among risk-averse investors. The negative Treynor and Calmar ratios reinforce this sentiment, indicating that the stock's excess return has not compensated for the risk taken by investors.

Considering the analyst expectations and score metrics like the Altman Z-Score and Piotroski Score, there is a significant concern related to financial distress and operational efficiency. A Piotroski Score of 3 points towards poor financial health, whereas an Altman Z-Score of 1.9123053624212758 situates the company in a grey zone, hinting at potential bankruptcy risks over the next few years. The modest market capitalization, juxtaposed with high working capital and total assets, provides a nuanced outlook; suggesting that while the company holds valuable assets, it struggles to translate these into sustained profitability and growth.

In light of these analyses, the future stock price movement of IMPUF seems to be inclined towards a cautiously optimistic path, with potential for moderate growth tempered by awareness of inherent financial and operational risks. Investors should be prepared for volatility, driven by market dynamics and the company's responsive strategies to address its financial health and operational efficiency. Close monitoring of quarterly financial results, management commentary, and sector-specific developments will be crucial for informed investment decisions concerning IMPUF.

In our analysis of Impala Platinum Holdings Limited (IMPUF), two key financial metrics have been carefully calculated to assess its investment potential, following the principles outlined in "The Little Book That Still Beats the Market." Firstly, our calculation for the Return on Capital (ROC) yielded a result of 14.191%, which suggests that the company is effectively utilizing its capital to generate profits, a favorable sign for investors looking for companies with efficient capital management. Secondly, the Earnings Yield has been calculated to be exceptionally high at 142.82%, indicating that compared to the company's share price, its earnings are substantial. This unusually high earnings yield could suggest that the stock is undervalued or that the company is generating a high level of profits relative to its share price. Both of these metrics - the robust ROC and the remarkably high Earnings Yield - suggest that Impala Platinum Holdings Limited presents an intriguing opportunity for investment, aligning with the investment philosophy proposed by Joel Greenblatt in his influential book, focusing on companies with high returns on capital and attractive earnings yields. Investors should, however, consider other factors and current market conditions alongside these metrics before making investment decisions.

Impala Platinum Holdings Limited (IMPUF) presents an intriguing case when evaluated through the lens of Benjamin Graham's value investing criteria. The analytics computed for the company showcase a promising investment potential, based on Grahams principles of prudent investment. Below, we discuss each key metric and how it corresponds to Grahams criteria, to present a comprehensive analysis of Impala Platinum Holdings Limited.

1. Price-to-Earnings (P/E) Ratio: Impala Platinum Holdings Limited has a remarkably low P/E ratio of 0.11621440214785696. In comparison to Benjamin Grahams preference for stocks with low P/E ratios relative to their industry peers, Impala Platinum Holdings Limited's P/E ratio suggests the stock is significantly undervalued. Although the provided data lacks specifics on the industry P/E ratio, the extremely low P/E ratio of Impala itself is indicative of a potentially substantial margin of safety, a key principle in Grahams philosophy.

2. Price-to-Book (P/B) Ratio: With a P/B ratio of 0.02146502578111532, Impala Platinum Holdings Limited also significantly underlines Graham's guidelines for stock selection. Graham often looked for stocks trading below their book value, believing such stocks might represent a safe investment option. The exceptionally low P/B ratio of Impala suggests the stock is trading well below its book value, providing potential investors a substantial margin of safety.

3. Debt-to-Equity Ratio: The company's debt-to-equity ratio stands at 0.022551742753402354, indicating Impala Platinum Holdings Limited operates with significantly low financial risk, precisely what Graham recommended. A low debt-to-equity ratio is a sign of a financially stable company, capable of withstanding downturns and less reliant on debt for growth. This ratio makes Impala an attractive choice following Grahams principles.

4. Current and Quick Ratios: Both the current ratio and quick ratio for Impala are recorded at 3.8344273426889997, far exceeding the minimum threshold of 1 that Graham advised for assessing a company's short-term financial health. These ratios indicate that Impala has more than enough short-term assets to cover its short-term liabilities, asserting its strong financial stability and liquiditya green flag for potential investors.

5. Earnings Growth: While specific data on Impalas earnings growth over the years is not provided, Graham's method emphasizes the importance of consistent earnings growth as a sign of a company's financial health and long-term prospects. Investors would need to assess Impalas earnings history to fully apply Grahams criteria.

Based on the provided metrics, Impala Platinum Holdings Limited exhibits characteristics of a potentially strong investment aligned with Benjamin Graham's principles of value investing. The companys exceedingly low P/E and P/B ratios, combined with its minimal debt and strong liquidity ratios, present a compelling case for its undervaluation. Following Graham's methodology, these indicators suggest that Impala could offer a substantial margin of safety for investors, making it a candidate worth considering for those who adhere to Grahams investment philosophy. However, investors should also take into account other factors such as the company's earnings growth history, competitive position, and future prospects before making any investment decision.Analyzing financial statements is an essential exercise in applying the principles that Benjamin Graham outlines in "The Intelligent Investor." Graham, often hailed as the father of value investing, underscores the importance of a thorough examination of a company's financial health before making any investment decisions. To do this, investors must delve into three critical documents: the balance sheet, the income statement, and the cash flow statement. Each of these financial statements offers a unique view into the company's financial standing and operational efficiency, allowing for a comprehensive analysis of its investment potential.

Balance Sheet Analysis

The balance sheet provides a snapshot of a company's financial position at a given point in time. It lists assets, liabilities, and shareholders' equity. Graham emphasized the importance of understanding a company's assets, which include both current assets (cash, marketable securities, receivables, and inventories) and fixed assets (property, plant, and equipment). The liabilities section is equally important, containing both current liabilities (debts due within one year) and long-term liabilities (debts due in more than a year). By subtracting liabilities from assets, investors can determine the company's net worth or shareholder equity.

Graham advised investors to look for companies with a strong balance sheet, characterized by a high proportion of tangible assets and a conservative level of debt. This financial stability suggests a lower risk of bankruptcy and could indicate a margin of safety in the investment.

Income Statement Analysis

The income statement, or profit and loss statement, chronicles a company's revenues, expenses, and profits over a specific period, typically a quarter or a year. It starts with the top line (revenue) and deducts various costs to arrive at the bottom line (net income).

Graham placed a premium on earnings consistency and growth. He looked for companies with a steady history of generating profits and regarded earnings quality as a fundamental measure of a company's investment potential. Investors should scrutinize the income statement for one-time items, non-operating revenues, and other anomalies that might distort the picture of the company's ongoing profitability.

Cash Flow Statement Analysis

The cash flow statement provides insight into the companys cash inflows and outflows over a period, divided into operating, investing, and financing activities. Understanding how a company generates and uses its cash is crucial because cash flow directly impacts its ability to pay debts, return money to shareholders, and finance future growth.

Graham recognized the significance of positive cash flow from operations as a sign of a healthy company. Investors should be wary of firms that consistently need to finance operations by issuing debt or selling equity, as these are not sustainable practices in the long term.

Conclusion

In addition to analyzing these financial statements individually, Graham advocated for the use of ratios and metrics, such as the price-to-earnings (P/E) ratio, the debt-to-equity ratio, and the current ratio, to compare a company's financial performance against its historical records and its industry peers.

By methodically analyzing a company's balance sheet, income statement, and cash flow statement, investors equipped with Graham's principles can identify undervalued companies with strong financial health, a crucial step towards making intelligent investment choices. This disciplined approach to financial analysis helps investors uncover potential hidden gems in the market and avoid costly mistakes.Based on the information provided, let's evaluate the suitability of the company (symbol: IMPUF) against Benjamin Graham's criteria focusing on the dividend record:

Dividend Record of IMPUF:

- September 20, 2023: Dividend of $0.086955 paid.

- March 22, 2023: Dividend of $0.226 paid.

- September 21, 2022: Dividend of $0.594 paid.

- March 16, 2022: Dividend of $0.348 paid.

- September 21, 2021: Dividend of $0.812 paid.

- March 17, 2021: Dividend of $0.672 paid.

Analysis:

Benjamin Graham, in his seminal work "The Intelligent Investor," emphasizes the importance of a consistent dividend record as a key factor in the selection of investments. Focusing on the above-listed dividends paid by IMPUF over the last few years, we notice a variance in the dividend amounts. The adjustments seem significant, implying potential volatility in the company's dividend payouts.

While there has been a consistent payout twice a year, which aligns with Graham's preference for companies demonstrating a commitment to returning value to shareholders through dividends, the inconsistency in the dividend amount could be a point of consideration. Graham likely would have advocated for more stability in this area, as it reflects on the company's financial health and predictability of returns to investors.

For an investor following Graham's principles closely, the fluctuations in dividend amounts may warrant a deeper investigation into the reasons behind these changes. They might consider factors such as the company's earnings stability, the payout ratio, and any external economic factors that could have influenced these dividend adjustments.

Conclusion:

While IMPUF displays a history of consecutive dividend payments which may catch the interest of an investor applying Graham's criteria, the variability in dividend amounts calls for a more detailed analysis into the company's overall financial health and operating environment. Investors prioritizing dividend stability and predictability might exercise caution and conduct further research before making an investment decision.

| Statistic Name | Statistic Value |

| Alpha | 0.2243 |

| Beta | 0.2188 |

| R-squared | 0.002 |

| Adj. R-squared | 0.001 |

| F-statistic | 2.251 |

| Prob (F-statistic) | 0.134 |

| No. Observations | 1,256 |

| AIC | 8,386 |

| BIC | 8,396 |

The analysis of the linear regression model between IMPUF and SPY reveals a slight but not statistically significant relationship over the examined period. The alpha value of 0.2243 indicates a baseline performance of IMPUF independent of the market movements represented by SPY. This suggests that IMPUF is expected to generate a return of approximately 22.43% regardless of market conditions if the linear model holds true. However, this performance metric must be interpreted with caution given the model's very low R-squared value of 0.002, indicating that only a minuscule fraction of the variations in IMPUF's return can be explained by movements in the SPY.

Beta, another critical parameter indicated by the model, stands at 0.2188. This relatively low beta suggests that IMPUF exhibits a lower level of volatility in comparison to the broader market's movements. The F-statistic is recorded at 2.251 with a Prob (F-statistic) value of 0.134, implying that the model is not statistically significant at common significance levels. The high AIC and BIC values, along with a non-statistically significant F-test, suggest that the linear model might not be the best fit for analyzing the relationship between IMPUF and SPY. Despite these statistical insights, investors and analysts must integrate broader market analysis, as predictive accuracy solely based on this model appears limited.

Impala Platinum Holdings Limited (Implats) is a leading producer and supplier of platinum group metals (PGMs), including platinum, palladium, rhodium, and others. The company, with its primary operations situated in the Bushveld Complex of South Africa, plays a pivotal role in the global supply of these critical industrial metals. Implats' strategies and performance are closely watched by investors, industry analysts, and stakeholders within the mining and precious metals sectors.

Implats' operational positioning in the Bushveld Complex, an area harboring the world's largest reserves of PGMs, is a significant advantage. This geological marvel not only ensures access to extensive ore reserves but also places Implats at the forefront of PGM production globally. The company's mining operations are complemented by its refining capabilities, which add substantial value to the extracted ores.

The company's focus on sustainable mining practices is another cornerstone of its operational philosophy. Understanding the environmental impact of mining activities, Implats has committed to reducing its carbon footprint and ensuring the welfare of communities in its operational vicinities. This commitment to sustainability is not just about corporate responsibility but also aligns with global trends demanding more environmentally friendly and socially responsible mining practices.

Financially, Implats has shown resilience and adaptability in navigating the volatile markets associated with precious metals. Fluctuations in the prices of platinum and other PGMs can significantly impact the company's revenue and profitability. However, Implats has leveraged its operational efficiency and strategic market positioning to maintain financial health, as evidenced by its financial reports and market analyses.

The global demand for PGMs, driven by their use in automotive catalytic converters, electronics, and jewelry, presents both opportunities and challenges for Implats. On the one hand, the transition to cleaner energy and stricter emission controls worldwide bolsters the demand for palladium and platinum, used in manufacturing catalytic converters. On the other hand, the company must navigate the complex and sometimes unpredictable changes in global markets, including the economic impacts of geopolitical events and economic policies.

Implats' strategy for growth involves not only increasing its mining output but also expanding its refining capabilities and exploring strategic acquisitions and partnerships. The company's growth initiatives are carefully planned to ensure they align with its sustainability goals and enhance its market competitiveness.

Research and development (R&D) play a crucial role in Implats' future. Investing in technology to improve ore extraction efficiency, reduce environmental impact, and explore new applications for PGMs are key areas of focus. These R&D efforts are critical for staying ahead in a competitive market and for meeting the evolving demands of various industries reliant on PGMs.

Market trends indicate a promising future for PGMs, with increasing applications in green technologies such as hydrogen fuel cells and renewable energy systems. Implats is well-positioned to leverage these trends given its resources, expertise, and commitment to innovation.

In the realm of corporate governance, Implats places a strong emphasis on ethics, transparency, and accountability. The company's governance structures and practices are designed to ensure that it operates not only in compliance with regulatory requirements but also in a manner that earns the trust of its stakeholders.

Investors and stakeholders in Implats can expect the company to continue its focus on operational excellence, sustainable practices, and strategic growth. The uncertainties of global markets and the challenges of mining operations are considerable, but Implats' track record and strategies indicate a forward-looking approach equipped to navigate these complexities.

Overall, Impala Platinum Holdings Limited represents a significant entity in the global PGM market, with a business model that emphasizes sustainability, innovation, and strategic growth. As demand for PGMs evolves, particularly with the emphasis on cleaner technologies, Implats is likely to remain at the forefront of supply, benefiting from its substantial reserves, technological investments, and commitment to responsible mining.

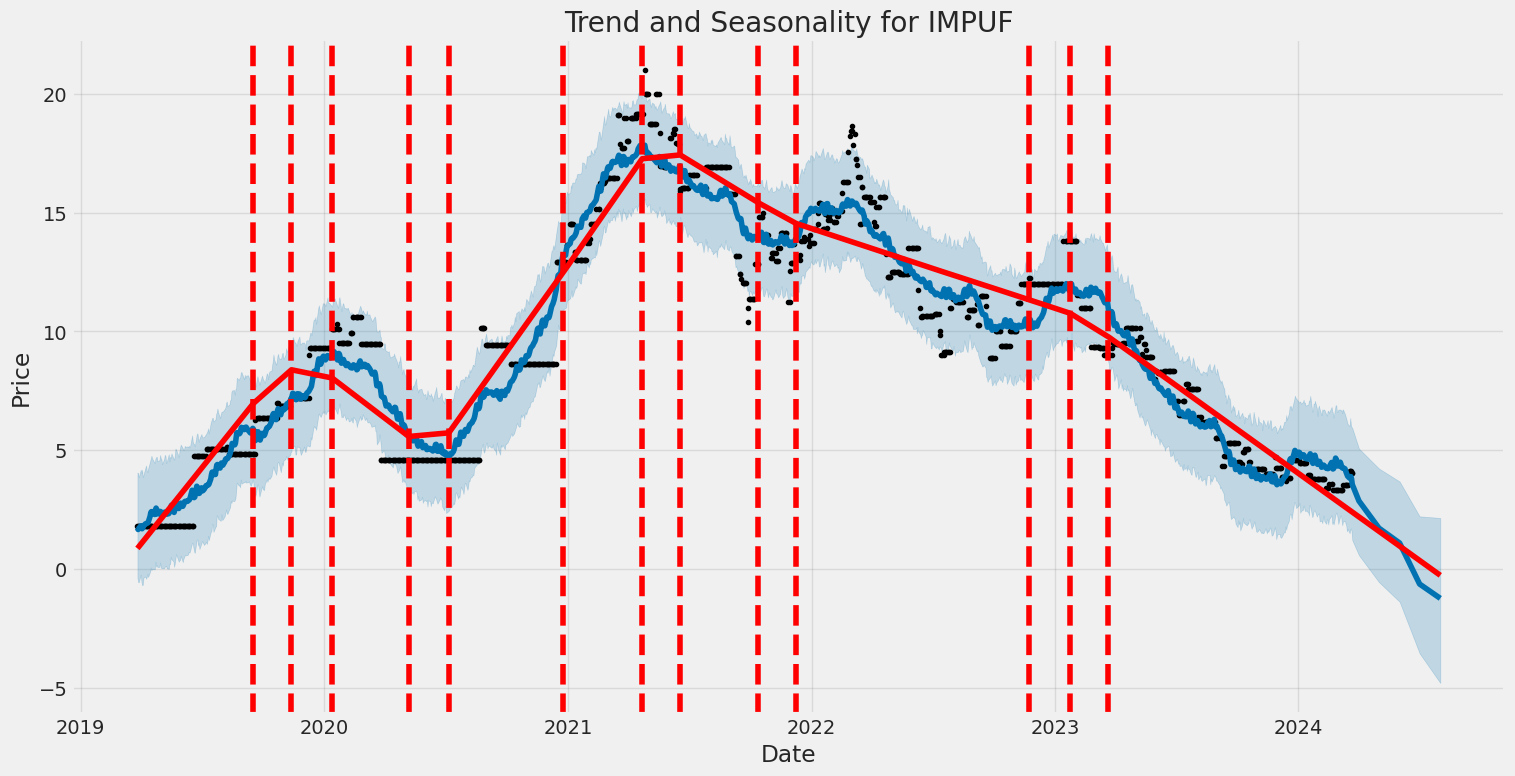

Impala Platinum Holdings Limited (IMPUF) has experienced notable volatility from 2019 to 2024, as indicated by financial modeling. The volatility model, specifically the ARCH model, highlights how unpredictable the asset returns can be, with significant changes potentially occurring in a short period. Key features of this volatility include a considerable omega value, suggesting a base level of volatility, and an alpha value near zero, indicating that past returns have little to no effect on future volatility, making it challenging to predict.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -4,192.17 |

| AIC | 8,388.35 |

| BIC | 8,398.62 |

| No. Observations | 1,256 |

| omega | 46.4141 |

| alpha[1] | 0.0000 |

Analyzing the financial risk associated with an investment in Impala Platinum Holdings Limited (IMPUF) over a one-year period requires a sophisticated approach that integrates both volatility modeling and machine learning predictions. This melding of methodologies offers a nuanced view of the potential upsides and the downsides, particularly focusing on the investment's susceptibility to market changes and the inherent uncertainties in forecasting future returns.

Volatility modeling is employed to dissect and understand the intricacies of Impala Platinum Holdings Limiteds stock price movements. By analyzing historical price fluctuations, this method provides a statistical measure of the stock's volatility, which is crucial in assessing the risk profile of the investment. The essence of volatility modeling lies in its ability to capture the persistence of volatility clustering in financial time series, allowing for a more informed estimate of future volatility. This is particularly valuable in the context of precious metals and mining companies like Impala Platinum Holdings Limited, whose stock prices can be significantly influenced by external factors such as commodity prices, geopolitical tensions, and changes in regulations.

On the other hand, machine learning predictions leverage a data-driven approach to forecast future stock returns. By examining an array of features including historical prices, market indicators, and even global economic indicators, the machine learning model, specifically the one akin to RandomForestRegressor, is adept at navigating through the noise to predict future movements. This approach adds a layer of sophistication to our analysis by incorporating pattern recognition and statistical learning to refine our predictions of future returns.

When these two methodologies converge, they offer a comprehensive view of the investment's risk profile. By understanding both the historical volatility and utilizing predictive algorithms, investors can gauge not only how the stock might behave but also its potential future returns. This dual perspective is crucial in making informed investment decisions.

The calculated Value at Risk (VaR) for a $10,000 investment in Impala Platinum Holdings Limited at a 95% confidence interval is $696.08. This figure represents the potential loss that could occur with 95% certainty, meaning there is a 5% chance that losses could exceed this amount. The VaR metric is a critical component of risk assessment, providing a succinct yet powerful quantification of potential financial loss over a specified time frame. In the context of the integrated use of volatility modeling and machine learning predictions, the VaR figure underscores the effectiveness of this combined approach in elucidating the financial risks involved in equity investment, giving investors a quantifiable risk parameter that aids in the decision-making process.

By extrapolating the outcomes from the volatility modeling and the machine learning predictions, investors are equipped with a detailed analysis of the risk entailed in investing in Impala Platinum Holdings Limited. This comprehensive approach allows for a deeper understanding of both the expected volatility and the predictive future returns, which are fundamental in assessing the investments overall risk landscape.

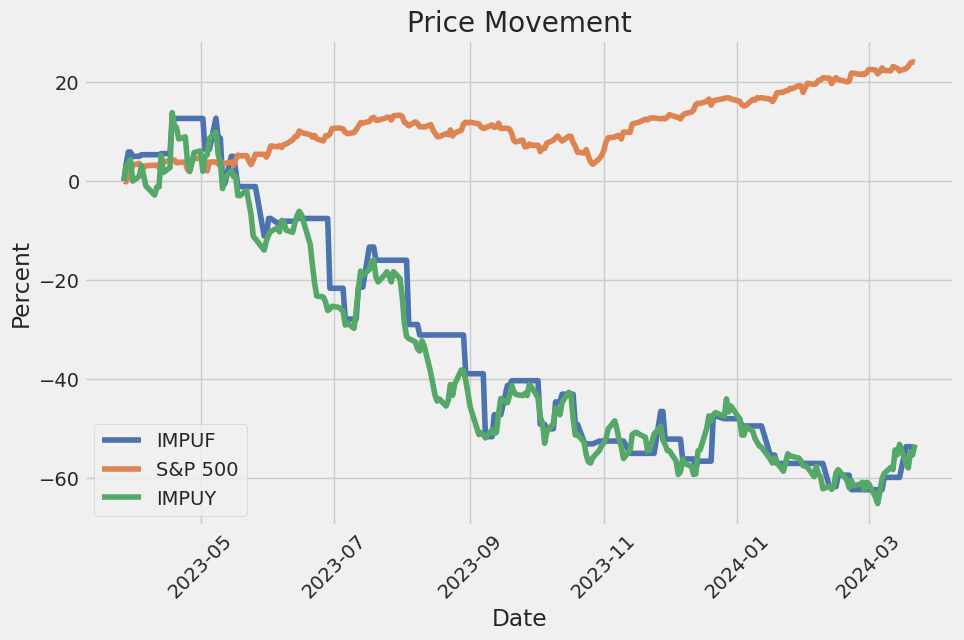

Similar Companies in Metals & Mining - Other Precious:

Impala Platinum Holdings Limited (IMPUY), Platinum Group Metals Ltd. (PLG), AbraSilver Resource Corp. (ABBRF), Empress Royalty Corp. (EMPYF), Anglo American Platinum Limited (ANGPY), Sibanye Stillwater Limited (SBSW)

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: AEsa1B

Cost: $0.14714

https://reports.tinycomputers.io/IMPUF/IMPUF-2024-03-25.html Home