iRobot Corporation (ticker: IRBT)

2024-01-30

iRobot Corporation, trading under the ticker symbol IRBT, is a leader in designing and building consumer robots. The company, headquartered in Bedford, Massachusetts, USA, was founded in 1990 by three MIT graduates. iRobot is best known for its Roomba vacuum cleaning robots, which have become synonymous with robot vacuums worldwide. These innovative products have revolutionized the way consumers engage in home cleaning tasks by providing autonomous, high-efficiency cleaning solutions. Besides the popular Roomba line, iRobot's portfolio includes the Braava series of mopping robots, offering similarly automated solutions for wet floor cleaning. The company has continually invested in research and development to maintain its competitive edge, integrating advanced technologies such as artificial intelligence, machine learning, and navigation systems into its products. This focus on innovation has enabled iRobot to maintain substantial market share in the home robotics industry. Additionally, the company is involved in educational initiatives, promoting STEM education through its robots that are used in classrooms around the world. Financially, iRobot has experienced both growth and challenges as it navigates a competitive landscape and varying consumer demand within the tech sector.

iRobot Corporation, trading under the ticker symbol IRBT, is a leader in designing and building consumer robots. The company, headquartered in Bedford, Massachusetts, USA, was founded in 1990 by three MIT graduates. iRobot is best known for its Roomba vacuum cleaning robots, which have become synonymous with robot vacuums worldwide. These innovative products have revolutionized the way consumers engage in home cleaning tasks by providing autonomous, high-efficiency cleaning solutions. Besides the popular Roomba line, iRobot's portfolio includes the Braava series of mopping robots, offering similarly automated solutions for wet floor cleaning. The company has continually invested in research and development to maintain its competitive edge, integrating advanced technologies such as artificial intelligence, machine learning, and navigation systems into its products. This focus on innovation has enabled iRobot to maintain substantial market share in the home robotics industry. Additionally, the company is involved in educational initiatives, promoting STEM education through its robots that are used in classrooms around the world. Financially, iRobot has experienced both growth and challenges as it navigates a competitive landscape and varying consumer demand within the tech sector.

| Full Time Employees | 1,126 | Previous Close | 16.99 | Open | 14.07 |

| Day Low | 13.8 | Day High | 16.25 | Volume | 18,272,475 |

| Average Volume | 1,918,867 | Beta | 1.188 | Market Cap | 473,715,648 |

| 52 Week Low | 13.8 | 52 Week High | 51.49 | Price to Sales (TTM) | 0.30269623 |

| 50 Day Average | 33.0384 | 200 Day Average | 37.3649 | Enterprise Value | 467,773,376 |

| Profit Margins | 0.01942 | Shares Outstanding | 27,865,600 | Shares Short | 2,921,530 |

| Shares Short Prior Month | 2,950,403 | Held Percent Insiders | 0.01667 | Held Percent Institutions | 0.82916 |

| Book Value | 26.539 | Price to Book | 0.5840461 | Net Income to Common | 30,390,000 |

| Trailing EPS | -10.77 | Forward EPS | -3.98 | Revenue | 1,564,987,008 |

| Total Cash | 189,648,992 | Total Debt | 238,474,000 | Current Ratio | 1.995 |

| Revenue Growth | -0.331 | Gross Margins | 0.35241002 | EBITDA Margins | 0.029059999 |

| Operating Margins | -0.3181 | Return on Assets | 0.0076200003 | Return on Equity | 0.03996 |

| Sharpe Ratio | -6.948017652258924 | Sortino Ratio | -114.71156711293561 |

| Treynor Ratio | 211.19365766115183 | Calmar Ratio | -0.9447982480126401 |

The recent performance of iRobot Corporation (IRBT) presents a multifaceted picture, requiring a comprehensive analysis of technicals, fundamentals, balance sheets, cash flows, analyst expectations, as well as proprietary scores. The synthesis of this data will guide our expectations for the company's stock price movement over the next few months.

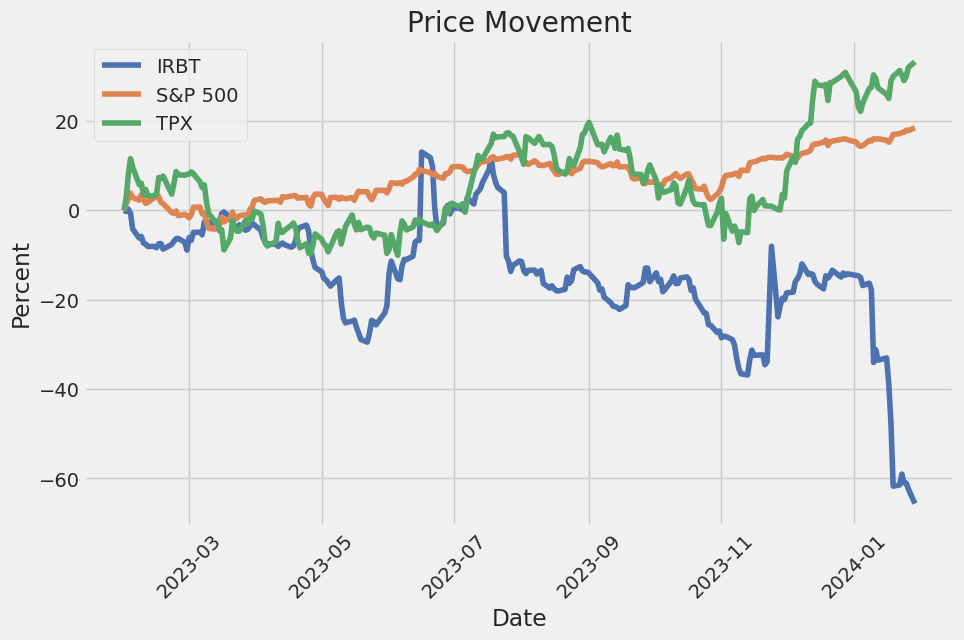

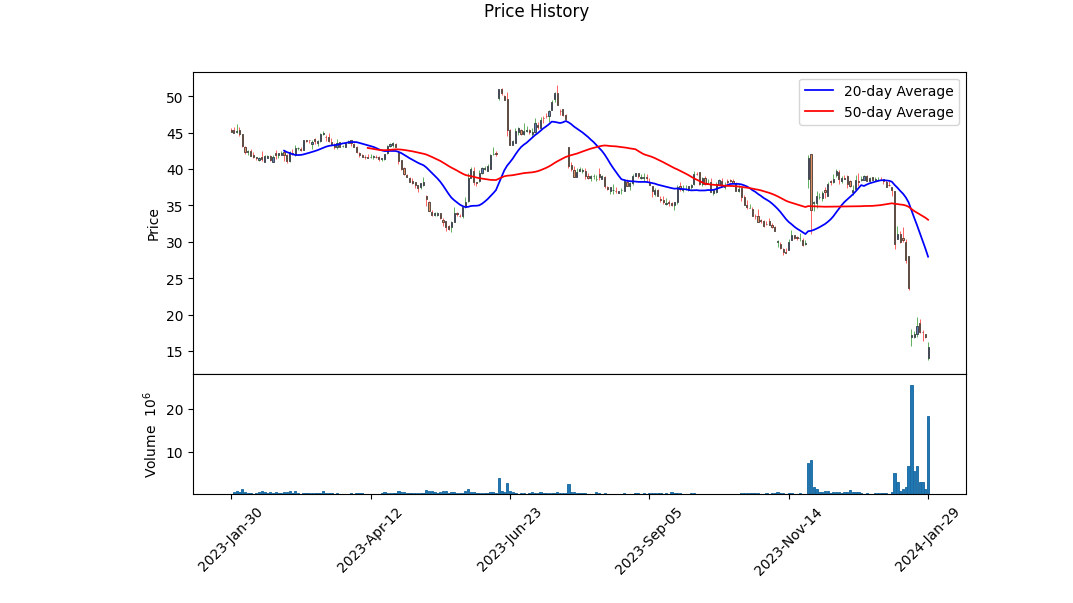

Seasoned technical analysis reflects notable observation in IRBT's technical indicators. A significant downturn is clear from the high of approximately $38 near the beginning of the observed period to a closing near $16 at the end of the period. OBV (On-Balance Volume) shifted from slightly positive to negative, indicating a strong selling pressure over buying interest, which suggests a bearish sentiment has materialized. The MACD histogram declined, reinforcing the persistent bearish outlook.

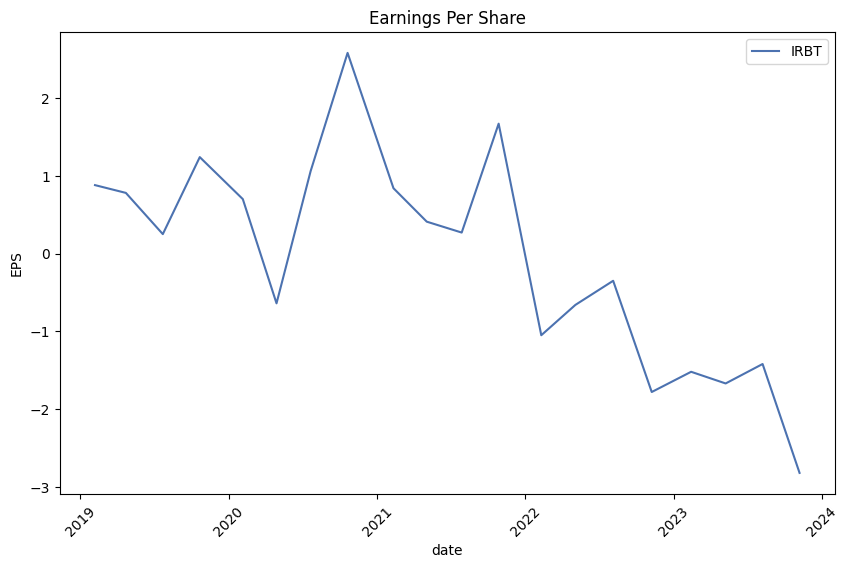

Analyzing the firm's financial health through its fundamental and balance-sheet data reveals concerns. The company has experienced significant net income losses and an alarming operating margin in the negative, which doesn't bode well for its near-term financial stability. Though the tangible book value provides some form of asset-backing, the decrease in retained earnings and the negative EBIT indicate a troubling operational performance. This, in conjunction with a diminished cash position and negative free cash flow, exacerbates the concern for liquidity and solvency.

The stark negative Sharpe, Sortino, and Calmar ratios imply that the company's stock has substantially underperformed on a risk-adjusted basis over the past year, further evidenced by a negative return on both the operating and non-operating levels. However, the Treynor Ratio is positive, which, while normally would be a good indicator, is potentially misleading due to the company's high beta and the extreme negative movements reflected in other ratios.

Analyst expectations seem to provide a faint glimmer of hope, forecasting an improvement in earnings and sales growth for the next year. This optimistic view should be taken cautiously given the current trajectory and the company's recent performance. Moreover, the proprietary scores highlight the risk within the company's financial structure, as illustrated by a low Piotroski score and a troubling Altman Z-Score, signifying a potential risk of bankruptcy.

Considering the weight of evidence, the financial analysis and prevailing negative sentiment suggest that IRBT may continue to face significant headwinds in the forthcoming months. While external market forces and unforeseen company initiatives could potentially alter this trajectory, from the currently available data, there is no strong indication of a reversal in the downward trend in stock price. Therefore, investors should maintain a vigilant stance and potentially seek opportunities with stronger fundamental and technical outlooks.

In my analysis of iRobot Corporation (IRBT), two key financial metrics were calculated: Return on Capital (ROC) and Earnings Yield. The Return on Capital (ROC) for iRobot is currently -44.58%, which indicates that the company is experiencing a loss on the capital it has invested in its business operations. This negative figure suggests that iRobot is not generating positive earnings from its capital base, which could be a red flag for potential investors, as it implies the company's operations are not adding value to the invested capital.

Similarly, the Earnings Yield for iRobot is calculated to be -67.87%. This metric is effectively the inverse of the Price-to-Earnings (P/E) ratio, representing the earnings generated for each dollar of market price. A negative earnings yield indicates that the company has negative earnings or losses, which in turn reflects that iRobot's share price does not yield positive earnings for its investors. It's important to note that both of these metrics are negative, underscoring that iRobot Corporation is currently facing financial challenges that could impact its profitability and attractiveness to investors. When considering these figures, it is crucial to also look at the broader context, including industry trends, the company's strategic initiatives, and potential for future recovery, to make a comprehensive assessment for investment decisions.

Based on the data provided for iRobot Corporation (IRBT), we can assess the company against several of Benjamin Graham's criteria for selecting stocks:

PE Ratio (Price-to-Earnings Ratio): The given PE ratio for iRobot is negative (-11.09785202863962), which indicates that the company has negative earnings. Since a PE ratio is only meaningful when a company has positive earnings, iRobot would not meet the typical Graham criteria for investment, as he looked for stocks with low but positive PE ratios.

PB Ratio (Price-to-Book Ratio): With a PB ratio of 0.5169913447117278, iRobot is trading below its book value. This would typically be attractive to Graham, as one of his strategies included looking for stocks with PB ratios under 1.0, implying that the stock might be undervalued.

Debt-to-Equity Ratio: iRobot has a debt-to-equity ratio of 0.08127117860235938, conveying that the company has low levels of debt relative to its equity. This is favored by Graham's principles, which advocate for investing in companies with lower debt as they pose less financial risk.

Dividend History: The data shows a 'historical' dictionary with an empty list [], suggesting that iRobot has no history of dividend payments. Consistent dividend payments would be preferred by Graham, as they can be a sign of a company's financial stability and a commitment to returning value to shareholders. Therefore, the lack of dividend history would be a negative point in Graham's screening process for a defensive investor.

When considering Benjamin Graham's investment philosophy, iRobot Corporation would present a mixed picture. On one hand, the company's low PB ratio and low debt-to-equity ratio might be appealing to an investor looking for undervalued companies with solid financial structures. On the other hand, the lack of a dividend history and a negative PE ratio suggest that iRobot might not align with Graham's criteria for safety and would not appeal to an investor looking for established earnings or income through dividends.

It's important to note that Graham's philosophy also entails the qualitative analysis of a company's management, competitive advantages, and industry conditions, none of which have been addressed in this quantitative analysis. Additionally, Graham's principles serve as guidelines rather than hard-and-fast rules; therefore, each investor might weigh these factors differently depending on their individual investment objectives and tolerance for risk. As such, while some of Graham's criteria appear to be met, further in-depth analysis would be necessary to form a comprehensive investment opinion on iRobot Corporation.

| Alpha () | -0.1249 |

| Beta () | 0.8403 |

| R-squared | 0.090 |

| Adjusted R-squared | 0.089 |

| F-statistic | 123.6 |

| Prob (F-statistic) | 1.89e-27 |

| Log-Likelihood | -3,363.9 |

| No. Observations | 1,256 |

| AIC | 6,732 |

| BIC | 6,742 |

The linear regression model analyzing the relationship between iRobot Corporation's stock (IRBT) and the SPY, which represents the S&P 500 index as a proxy for the overall market, yields an alpha value of -0.1249. This negative alpha suggests that IRBT, on average, underperformed the market by approximately 0.1249 units after controlling for market movements. A positive alpha would indicate outperformance relative to the market, but in this case, the negative value denotes underperformance. The beta value for IRBT in this model is 0.8403, which indicates how much the stock moves relative to the market. A beta greater than 1 would mean the stock is more volatile than the market, while a beta of less than 1, as shown here, suggests that IRBT is less volatile than the overall market.

The R-squared value of 0.090 indicates that only 9% of IRBT's stock price movement is explained by movements in the SPY index. This relatively low R-squared value implies that the majority of the stock's fluctuations are due to factors specific to iRobot Corporation or its industry, rather than being in sync with the broad market trends. Adjusted R-squared, which takes the number of predictors into account, is also at 0.089, reinforcing the assertion that market-wide movements are not the primary drivers of IRBT's stock performance. This analysis is based on a dataset of 1,256 observations, and the model's F-statistic, with a highly significant p-value, suggests that the regression model is overall statistically significant.

Summary of iRobots First Quarter 2022 Earnings Call

During the first quarter of 2022, iRobot Corporation (IRBT) reported a decrease in revenue to $292 million, a 4% decline from the previous year, leading to an operating loss of $18.5 million and a net loss per share of $0.66. Despite these results, the quarter's profitability exceeded February projections thanks to recent tariff exemptions and effective cost management. Growth was observed in the U.S. and Japan markets, which helped balance out the decline in the EMEA region. Nevertheless, recent complications in the global consumer market, particularly in the EMEA, have prompted a more cautious revenue and EPS outlook for FY 2022. Factors such as increased inflation and reduced customer confidence tied to the Russia-Ukraine conflict have influenced these revisions, although the company slightly raised the high end of its full-year operating profit and EPS targets.

iRobots CEO, Colin Angle, emphasized the company's strategy termed "INNOVATE, GET, KEEP, GROW," focusing on product innovation, winning new customers, retaining product usage, and increasing customer lifetime value. Angle highlighted the significant growth in connected customer numbers and the uptake of new software capabilities, particularly in the Roomba j7 series. Direct-to-consumer revenue grew by 17% in Q1, and Angle expects these trends to support planned D2C growth over the coming years.

Julie Zeiler, Executive Vice President and CFO, offered a detailed analysis of the companys financials. She outlined the impact of shifts in product mix, promotional intensity, and tariff exemptions on gross margin, which reached 34.5%. She also described cost-saving measures, such as careful spending management, resulting in operating expenses that were more modest than expected. Notably, Zeiler mentioned a tariff exclusion that is expected to yield iRobot refunds amounting to approximately $30 million, to be received as multiple payments over the next 12 months.

Looking ahead, Zeiler provided a revised FY '22 revenue target ranging from $1.64 billion to $1.74 billion, with a significant amount of this revenue anticipated in the second half of the year. Gross margins are expected to rise in the latter half, and the company plans to continue optimizing costs. Although Europe poses uncertainties due to geopolitical events, their confidence for the latter half of the year remains, with expectations of substantial gains in gross margin and operating income.

In closing, Angle reiterated the company's commitment to both short-term adaptations and long-term growth. He discussed measures to improve operational efficiency, supply chain resilience, and the ongoing development of new robotic products aimed at different market categories. These initiatives form part of iRobots strategy to position the company for an anticipated second-half revenue surge and improved profitability, despite the current less-than-optimal conditions. The management team remains optimistic about maintaining a robust competitive position and achieving long-term financial goals.

As of September 30, 2023, iRobot Corporation (iRobot or the Company) reported a decrease in revenue and operating performance compared to the previous year. Specifically, total revenue for the nine months ended September 30, 2023, was $583.0 million, a decline of 29.4% from $825.5 million for the same period in 2022. The decrease in revenue was attributed to reduced orders from retailers and distributors largely because of a decline in consumer sentiment, which influenced spending, and increased pricing competition in the market. Additionally, the Company noted that product availability of their new products shifted some orders from Q3 2023 into Q4 2023.

The report indicates actions taken to align operations with the lower revenue level, including a restructuring of operations in August 2022, followed by a reduction of approximately 85 employees in February 2023 (7% of the global workforce). As a result of these measures and the termination of a sublease agreement for portions of the Companys headquarters, operating expenses reduced by $70.5 million for the nine months ending September 30, 2023, compared to the same period in the previous year.

In Q3 2023, research and development expenses decreased by 10.1%, and selling and marketing expenses decreased by 30.7%, mainly due to scaled-back media activities and demand generation. General and administrative expenses decreased by 10.0% for the same period, despite an increase of 6.7% for the nine months ended September 30, 2023. The report also covers the impact of a new $200.0 million Term Loan entered into on July 24, 2023, where total proceeds were $188.2 million net of debt issuance costs. This loan will fund ongoing operations and has contributed to the Company ending Q3 2023 with $189.6 million in cash and cash equivalents, up from $117.9 million at the end of fiscal 2022.

Furthermore, on July 24, 2023, the Company amended the Merger Agreement with Amazon.com, Inc., which involves a revised merger consideration from $61.00 to $51.75 per share. The Company's shareholders approved the amended agreement, and the adjustment in the merger consideration reflects the incurrence of the Term Loan. As per the agreement, if consummated, iRobot's common stock will be delisted from the Nasdaq Stock Market LLC and deregistered under the Securities Exchange Act of 1934.

The report also mentioned a deferred tax expense of $5.1 million for the nine months ended September 30, 2023, reflecting an effective tax rate of (2.1)%. The Company continues to deal with tariff-related challenges but received a temporary exclusion from Section 301 List 3 tariffs reinstated in March 2022, which has now been extended until December 31, 2023.

The 10-Q filing highlights the efforts by iRobot to navigate through a challenging market environment while managing costs, restructuring operations, and securing additional financing through the Term Loan to support continuous operations. The anticipated acquisition by Amazon is a significant future transition for the Company that could potentially impact its operations and stock status.

In a startling turn of events, iRobot Corporation has found itself navigating a tumultuous period, marked by a humbling retreat from a once-anticipated acquisition by Amazon. As reported by Yahoo Finance on January 29, 2024, the $1.7 billion deal faced an insurmountable roadblock as European Union regulators voiced antitrust concerns. Amazon, confronting steadfast opposition and the apparent impossibility of a turnaround, deemed it best to pull the plug, accepting the financial burden of a $94 million termination fee in lieu of further entanglement.

This disruption cascaded through iRobot's financial channels as its stock took a nosedive, culminating in a 7% fall immediately post-announcement and a more severe 60% decline over the span of the year. This was not an isolated incident, as earlier reports by The Wall Street Journal presaged the stock's freefall with revelations of the EU's regulatory hesitations. The transactions within the market exposed iRobot's vulnerable position as it grappled with the weight of pending losses and increased debt levels.

Further exacerbating the already precarious situation was the decision of co-founder, chairman, and CEO Colin Angle to step down, prompting an executive reshuffle. Glen Weinstein assumed the helm as interim CEO amidst company-wide tumult. The extensive challenges, accentuated by this leadership transition, are evident through consecutive quarterly losses post-2021, amassing to over half a billion, and accompanied by a fresh $200 million debt burden.

In an assertive, albeit circumspect, countermeasure, iRobot embarked on a comprehensive restructuring plan aimed at staunching the fiscal bleed. These austerity measures forecast a slashing of operating costs by upwards of $150 million, seeking efficiencies in contracts, R&D expenditure cuts, marketing spend reductions, and downsizing its real estate investments.

The plan wielded heavy implications for iRobot's workforce as approximately 31%translating to 350 individualsfaced the reality of imminent layoffs. The initiative represented a fundamental shift, with Angle taking a step back into a senior advisory capacity for one year, seemingly opening the horizon for fresh perspectives and directives.

As iRobot steers through the murky waters of an aborted takeover and operational instability, investor and market confidence hang in the balance. The company, now endeavoring to advance without Amazon's formidable support, faces crucial questions regarding its roadmap to recovery and sustained viability.

While the EU's hardline stance on competition and fair trade practices served as the deal's death knell, it also underscored the growing global aversion to unchecked expansion by tech behemoths. Both the UK's explicit approval of the deal and the US Federal Trade Commission's ongoing inquiry reflect the complex and disparate reactions across international regulatory landscapes.

The politic echoed throughout the tech industry, presenting a cautionary benchmark for similar acquisition pursuits. Amazon's outlook, albeit impacted, remains robust, given its considerable reservoirs and penchant for innovation. However, iRobot must contend with a more isolated path forward, tasked with reaffirming its place in the evolving consumer robotic space.

The fall from grace witnessed by iRobot initiates a broader discourse on regulatory landscapes and their implicit influence on corporate trajectories. These dynamics resonate not just within industry corridors but also ripple into the stock markets, where the push and pull of regulatory factors and corporate gambles come to bear on investor decisions and company fortunes.

The CNBC report on the same day charted similar territory, noting the consequential layoffs and Angle's resignationsharp moves by a company once perched on the brink of a transformative merger. Amidst the realignment, iRobot articulated intentions to refine its strategic focus, pulling back from non-floor care initiatives to redirect energies into its core product lines.

This broadside serves as a microcosm of jockeying influence and enterprise resiliencean episode resonating beyond iRobot's ecosystem into the sectorial and investment communities. As regulatory thresholds are recalibrated and corporate strategies dissected, the iRobot saga exemplifies the interwoven consequences of deals made and unmade in the global tech theater.

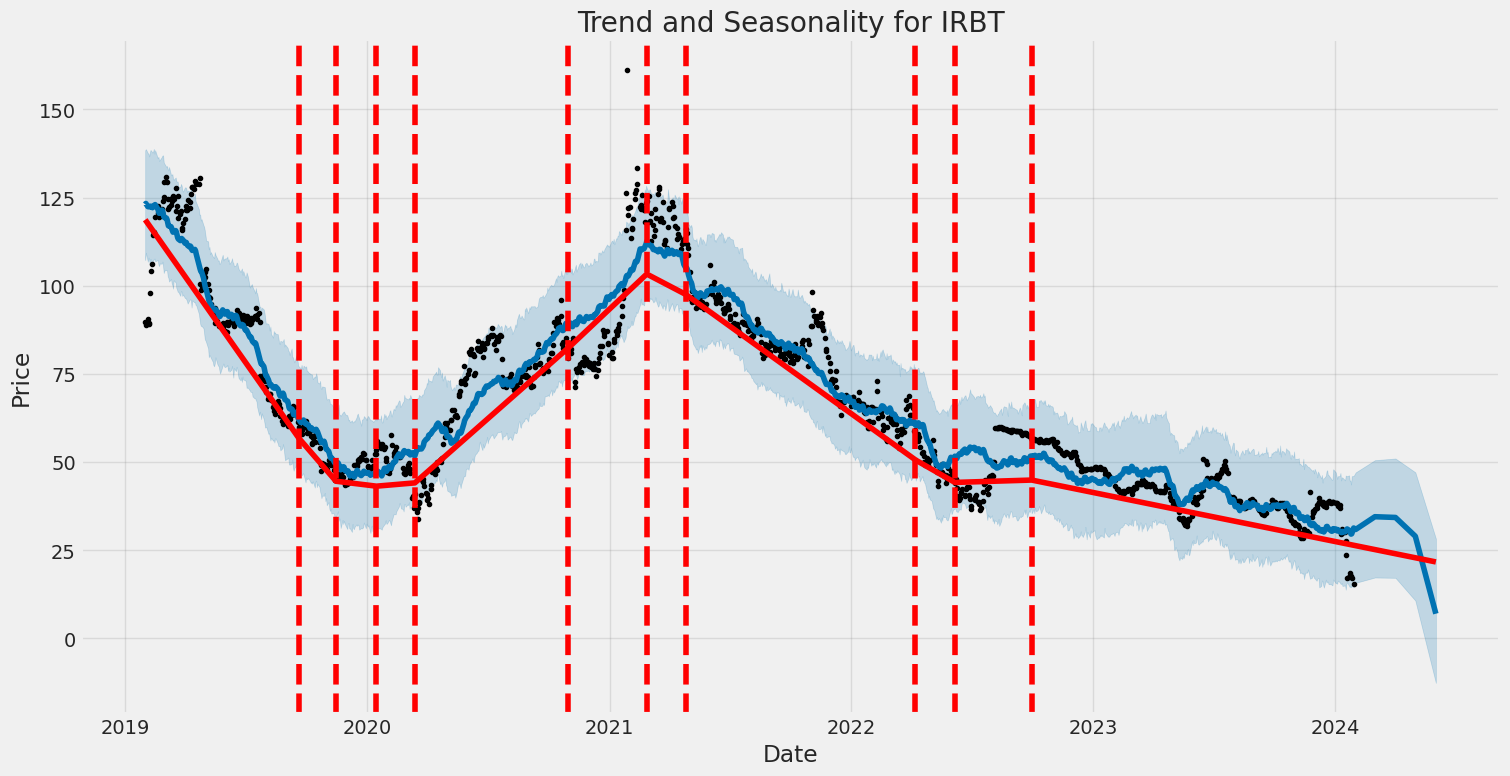

Over the specified period between January 31, 2019, and January 29, 2024, iRobot Corporation experienced significant fluctuations in its stock prices. The company's volatility, as represented by an ARCH model, was notably affected by market events, indicating a susceptibility to quick changes in value. This instability is quantified by a positive alpha parameter in the volatility model, suggesting that past shocks have a meaningful impact on future volatility.

Here is the HTML table with the statistics of the volatility model:

| Statistic Name | Value |

|---|---|

| Log-Likelihood | -3,354.86 |

| AIC | 6,713.72 |

| BIC | 6,723.99 |

| No. Observations | 1,256 |

| omega | 10.2782 |

| alpha[1] | 0.2640 |

When analyzing the financial risk of a $10,000 investment in iRobot Corporation (IRBT) over a one-year period, an integrated approach employing volatility modeling paired with machine learning predictions provides a comprehensive understanding of the stock's risk profile.

Volatility modeling is instrumental in capturing the time-varying nature of the stock's volatility. This statistical approach allows for a more precise characterization of the variability in returns by adapting to recent market information, thereby providing a dynamic risk assessment. In the context of iRobot Corporation, this modeling would process historical stock prices to infer patterns of fluctuation, which are essential to predict future volatility. The volatility inferred from this model lays the groundwork for risk quantification by framing the expected range of the stock's movements, accounting for periods of both high and low market turbulence.

On the other hand, machine learning predictions contribute to the analysis by using historical data to forecast future stock returns. These algorithms take multiple factors into account, including past returns and volatility, to project the likely direction of the stock price. By training a model like the machine learning regressor, the predictive capacity on future returns is harnessed, potentially leading to more informed investment decisions.

When the volatility modeling and machine learning predictions are combined, they offer a robust framework to assess the risk of an investment. The calculated Value at Risk (VaR) at a 95% confidence interval is a statistical measure that estimates the maximum potential loss with a certain degree of confidence. For the $10,000 investment in iRobot Corporation, the VaR has been estimated at $775.08.

This figure means that, based on these modeling techniques, there is a 95% chance that the investment will not lose more than $775.08 over the next year. It is critical to note that while VaR is a valuable risk metric, it does not account for losses exceeding this threshold. As such, investors are warned that in 5% of all projected scenarios, losses may exceed this value, and those losses could be significantly higher.

Similar Companies in Furnishings, Fixtures & Appliances:

Tempur Sealy International, Inc. (TPX), La-Z-Boy Incorporated (LZB), Purple Innovation, Inc. (PRPL), MasterBrand, Inc. (MBC), Ethan Allen Interiors Inc. (ETD), Sleep Number Corporation (SNBR), Leggett & Platt, Incorporated (LEG), Mohawk Industries, Inc. (MHK), Kimball International, Inc. (KBAL), Bassett Furniture Industries, Incorporated (BSET), American Woodmark Corporation (AMWD), The Lovesac Company (LOVE), SharkNinja Operating LLC (NINJA), Samsung Electronics Co., Ltd. (SSNLF), Dyson Ltd (Private)

https://www.cnbc.com/2024/01/10/irobot-shares-dip-on-report-amazon-wont-offer-eu-concessions.html

https://www.proactiveinvestors.com/companies/news/1038041?SNAPI

https://www.fool.com/investing/2024/01/10/why-irobot-stock-plunged-today/

https://www.youtube.com/watch?v=cHM08ilmh0Q

https://www.youtube.com/watch?v=4bkSuRLIEf8

https://www.fool.com/investing/2024/01/29/irobot-drops-188-after-amazon-acquisition-falls-ap/

https://www.fool.com/investing/2024/01/29/irobot-stock-got-cheaper-today-is-it-a-buy/

https://finance.yahoo.com/news/amazon-walking-away-1-7-193045982.html

https://finance.yahoo.com/m/4f54ed50-fa38-332b-a5ef-3bd7327a4881/irobot-stock-got-cheaper.html

https://finance.yahoo.com/news/amazon-failed-irobot-deal-european-200115491.html

https://finance.yahoo.com/video/m-activity-outlook-2024-termination-210352008.html

https://finance.yahoo.com/video/evergrande-lucid-amazon-irobot-trending-211359613.html

https://finance.yahoo.com/m/7ec82eb1-cd80-3392-bf61-c34fc260dfc7/irobot-stock-tumbles-after.html

https://finance.yahoo.com/m/99c9819a-8c93-3126-9faf-001e00dc6d4b/stocks-pick-up-afternoon.html

https://www.sec.gov/Archives/edgar/data/1159167/000115916723000069/irbt-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: LtpcHX

Cost: $0.88307

https://reports.tinycomputers.io/IRBT/IRBT-2024-01-30.html Home