J.P. Morgan Nasdaq Equity Premium Income ETF (ticker: JEPQ)

2023-12-16

The J.P. Morgan Nasdaq Equity Premium Income ETF (ticker: JEPQ) is an innovative exchange-traded fund designed to provide investors with a source of income while simultaneously offering potential for capital appreciation. This ETF attempts to achieve its investment objectives by maintaining a portfolio of equities listed on the NASDAQ, which are expected to deliver steady dividends and growth over time. Additionally, JEPQ employs an options strategy, specifically selling covered call options on its equity holdings, to generate an additional stream of income. This combination of dividend income and premiums from the option strategy is intended to offer investors an attractive total return profile, with the potential added benefit of reducing overall portfolio volatility compared to a straightforward long-only equity investment. It's important for potential investors to understand the risks associated with such a strategy, which include but are not limited to, the funds shares potentially not appreciating as much as the overall stock market, and the possibility of the options strategy not providing the expected amount of income during periods of market turbulence.

The J.P. Morgan Nasdaq Equity Premium Income ETF (ticker: JEPQ) is an innovative exchange-traded fund designed to provide investors with a source of income while simultaneously offering potential for capital appreciation. This ETF attempts to achieve its investment objectives by maintaining a portfolio of equities listed on the NASDAQ, which are expected to deliver steady dividends and growth over time. Additionally, JEPQ employs an options strategy, specifically selling covered call options on its equity holdings, to generate an additional stream of income. This combination of dividend income and premiums from the option strategy is intended to offer investors an attractive total return profile, with the potential added benefit of reducing overall portfolio volatility compared to a straightforward long-only equity investment. It's important for potential investors to understand the risks associated with such a strategy, which include but are not limited to, the funds shares potentially not appreciating as much as the overall stock market, and the possibility of the options strategy not providing the expected amount of income during periods of market turbulence.

Upon examining the latest technical analysis data for JEPQ, the following insights emerge in light of the indicators provided on the last trading day:

Upon examining the latest technical analysis data for JEPQ, the following insights emerge in light of the indicators provided on the last trading day:

- The Moving Average Convergence Divergence (MACD) stands at 0.462114 with a positive histogram value of 0.036985, indicating that the stock is currently in a bullish momentum phase. The MACD histogram remaining positive also suggests increasing upward momentum.

- The Relative Strength Index (RSI) is 70.253533, which is near the overbought threshold of 70. This could signal a potential for a pullback or consolidation in the near future.

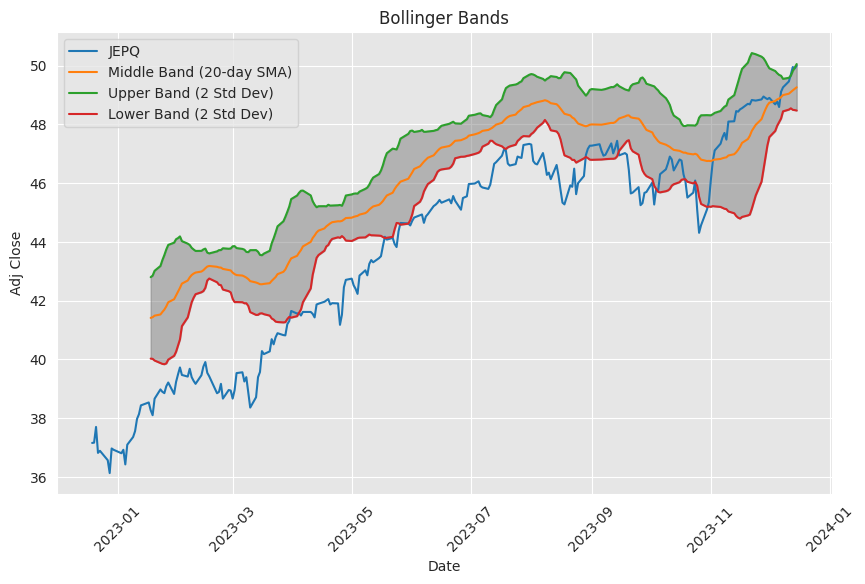

- Bollinger Bands (BB) indicate that the stock is trading near the upper band, which typically suggests the stock is in a strong uptrend. However, it can also mean that the stock is overextended and may revert to mean.

- The stock closed at an Adjusted Close price of 50.00, which is above both the Simple Moving Average (SMA_20) at 49.2615 and Exponential Moving Average (EMA_50) at 48.5715, affirming an established upward trend.

- A high On-Balance Volume (OBV) of 3.873450 million indicates strong buyer enthusiasm and could mean continued interest in pushing the stock price up.

- The Stochastic oscillators (STOCHk and STOCHd) are in the overbought zone, which often signals high momentum but also the possibility of a forthcoming correction.

- The Average Directional Index (ADI) at 28.208742 shows that the trend is gaining strength, yet it is not excessively strong, suggesting there is room for the trend to continue before it becomes overextended.

- The Williams %R (WILLR_14) indicates the stock is currently overbought, which can be a leading indicator of a potential downturn.

- The positive Chaikin Money Flow (CMF_20) value highlights strong buying pressure could suggest continued bullish sentiment.

- The Parabolic SAR (PSAR) indicates an uptrend since the 'PSARl_0.02_0.2' is below the current price, and no 'PSARs_0.02_0.2' value suggests the absence of a downtrend signal.

Taking these indicators into account, here is a synthesized likely trajectory for JEPQs stock over the next few months:

The overall technical analysis suggests that JEPQ is currently experiencing a strong uptrend with buying pressure supporting recent gains. The MACD and positive PSAR values, combined with the OBV and CMF figures, suggest that there is substantial bullish sentiment driving the price upwards. However, indicators like the RSI, Stochastic oscillators, and Williams %R identify the stock as being in or approaching overbought territory, which implies that the stock could face a pullback or consolidation period in the near term.

The sustained closing of the stock above the SMA_20 and EMA_50 illustrates a bullish trend. Nonetheless, with multiple indicators pointing toward overbought conditions, there exists a risk of a trend reversal or sideways movement as traders might take profits, and new buyers may be hesitant to enter at higher levels.

In the absence of fundamental data, such as earnings, P/E ratios, or company news, the technical analysis suggests that in the short term, JEPQ might see some price volatility with a potential for retracement due to the overbought conditions. However, the robust uptrend implies that any pullback may be temporary, with the prevailing bullish sentiment likely to resume over the ensuing months if the volume and money flow stay positive. Investors should closely monitor the technical levels, as a breakout above current levels could signify continued bullish momentum, while a breakdown below key moving averages might indicate a changing trend.

In the world of income-oriented investment portfolios, the desire for simplicity often carries significant weighta sentiment that echoes the ethos of Caravaggios art and Ockham's Razor. This desire for straightforwardness is particularly relevant to the J.P. Morgan Nasdaq Equity Premium Income ETF (JEPQ), designed with the intention of becoming a key component within an income-generating portfolio. The rationale for favoring investment structures such as Closed-End Funds (CEFs) and Exchange-Traded Funds (ETFs) over more complex financial instruments lies in their straightforward proposition: They offer investors a clear-cut avenue for achieving a steady stream of dividends and distributions, with the transparent trade-off of not prioritizing market-beating performances.

JEPQ appeals to investors looking for high-dividend yielding instruments, and decisions to include it in a portfolio are influenced by in-depth research and assessments of its benefits versus potential drawbacks. Evaluation criteria often involve Morningstar ratings and historical performance metrics, such as Net Asset Value (NAV) performance. Nonetheless, the potential for market sector collapses and volatility, which can significantly affect such investmentshighlighted by events like the collapses of SVB and Credit Suisseremain top of mind for investors considering funds like JEPQ.

The inclusion of JEPQ in investment portfolios is partly driven by a strategy to offset the unpredictable stock market and the shortcomings of relying solely on individual economic forecasts. Furthermore, tax considerations are integral to crafting investment strategies. For Italian investors, for example, the dual tax imposition from U.S. withholding tax and Italian taxes on American CEFs and ETFs is an important factor. However, treaties such as the one between Italy and the U.S. provide certain benefits, suggesting that tax efficiency can be optimized depending on individual circumstances.

A fundamental principle of building an income portfolio, as exhibited by JEPQ and similar instruments, involves a long-term perspective based on reliable dividend payouts. Even in contexts where market prices offer enticing returns, the approach is to weather downturns and count on continuous income from investments. This method illustrates how, although guided by simplicity, the crafted investment strategies are informed by deep knowledge and recognition of financial complexities, effectively aiming to maximize income.

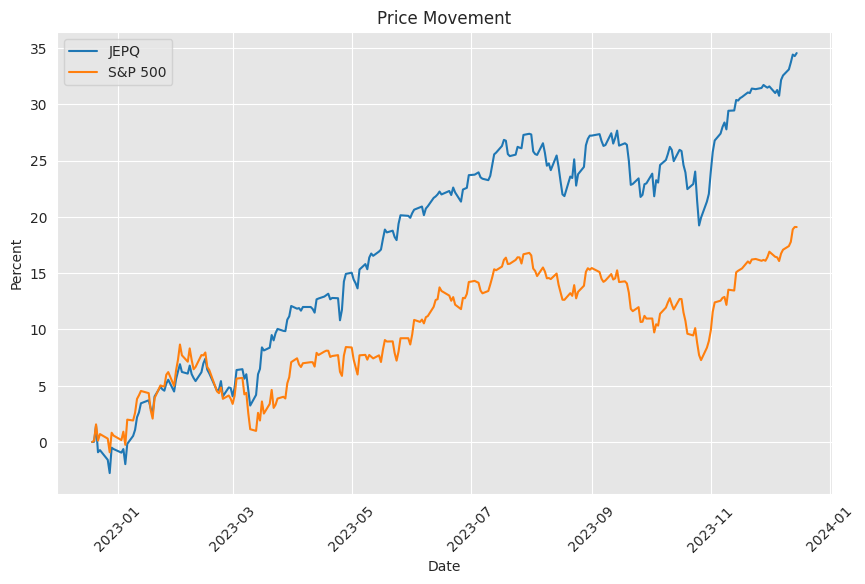

Turning to JEPQ specifically, this ETF boasts a compelling unique feature: high yield paid monthly with relatively lower volatility compared with benchmarks like the S&P 500. Since its launch, JEPQ has produced an attractive average yield of about 9.3% and a commendable annual return of 13.4%. This performance, along with 37% less volatility than the S&P 500 and experiencing 50% smaller peak declines, posits JEPQ as a potential balance between stable income and capital preservation. However, JPMorgan's more conservative outlook suggests future yields of 5% to 8% and annual returns of 6% to 10%.

A significant portion of JEPQ's dividends derives from an unconventional sourceequity-linked notes (ELNs), derivative instruments linked to stock performance. These ELNs have been instrumental in the ETF's income distribution, offering resilience during market downturns. Yet, they introduce counterparty risk, which becomes salient during financial crises with institutions potentially defaulting, threatening the income stream for investors. This underscores the importance of fully understanding JEPQ's operational intricacies.

Tax implications bear heavily on the outcomes for investors in JEPQ. The ordinary income characterization of most income generated by JEPQ can mean varied tax treatments, potentially eroding yield if held outside of tax-advantaged accounts. Furthermore, sustainability of the initial investment's principal value relies upon the strategic reinvestment of earnings. The lack of reinvestment could lead to a deterioration of the inflation-adjusted value of the initial investment, as observed in similar high-yield, covered call ETFs over the long term.

While the performance of JEPQ since its inception is laudable, enhancing its allure as a 'dream' income fund, several critical considerations must be taken into account. These include ELN-related risks, the implications of high dividend tax rates for those in upper tax brackets, and the importance of dividend reinvestment to preserve initial investment value. Investors must carefully weigh these factors, mindful of their investment horizons, tax situations, and income needs, bearing in mind that JEPQ is not a one-size-fits-all solution for retirement funding, but a potential element of a diversified income portfolio.

The relevance of JEPQ within a broader income-generating investment portfolio is multifold. As a recent addition to the ETF sphere, launched in 2022, it adheres to a covered-call strategy on the Nasdaq, deemed attractive for those looking for income through an ETF that capitalizes on Nasdaq-listed companies' growth prospects while potentially providing option premium derived income. As part of the Giotto Income Portfolio, JEPQ contributes to the goal of a consistent income stream. Despite stock market volatility and events impacting the financial markets, like the March banking sector crisis, JEPQ has exhibited positive performance in tandem with its benchmark index.

Within the Giotto Income Portfolio, JEPQ has been key to achieving the goal of an approximate 9% annual yield. However, certain securities have incurred paper losses relative to their purchase prices. Investors in this context have been displaying patience, suggesting a long-term approach and a strategic understanding of the complexities of tax impacts on financial instruments, a factor that is particularly pronounced in Italy. This realization influences decisions to either sell or maintain various positions within the portfolio and prompts cautious management.

The decision to retain JEPI, despite its volatility in dividend distribution, and potentially reallocating investments from other ETFs like XYLD to safer options like SGOV, illustrates a proactive and adaptive management style. It underscores the importance placed on maintaining income, managing risk, and capitalizing on market opportunities, with the acknowledgment that perfection in investing remains an elusive aim.

Investigating the J.P. Morgan Nasdaq Equity Premium Income ETF unveils a strategy that marries capital appreciation with current income. By focusing on large-cap growth stocks within the Nasdaq 100, combined with an options-writing overlay, the fund aims to capture a mix of income generation and growth. Notably, JEPQ's allure is magnified by its yielding strength, currently boasting a yield of 11.76%, and its reported lower volatility compared to the benchmark Nasdaq 100 Index.

However, there are performance considerations to be wary of. JEPQ has seen underperformance in total returns against other investment strategies and its benchmark ETF, QQQ. And while JEPQ may offer a less burdensome tax situation concerning ordinary dividends versus capital gains from QQQ sales, this has not fully compensated for the lower total returns. Furthermore, other strategies focusing on volatility capture, like SVOL, have shown superiority in delivering both higher and more stable income, casting doubt on JEPQ as the optimal choice for those whose primary aim is income generation.

Moreover, JEPQ's appeal of reduced volatility does not necessarily justify its inclusion in a portfolio over other ETFs better tailored for downside protection and volatility mitigation. When it comes to equity exposure, the diversification within JEPQ's portfolio, including sectors like financials absent from the Nasdaq 100 Index, suggests an attempt to balance and potentially add value through a modified equity selection technique.

Evaluating an additional innovation in the field of dividend-focused ETFs, the SoFi Weekly Dividend ETF (WKLY) has introduced the concept of weekly income distributions, a novelty that seeks to accelerate the compounding effect for shareholders. Structured to invest in reliable dividend-paying companies, WKLY affords its investors the prospect of weekly returns, a model influenced by the monthly dividend payout structure of J.P. Morgan's funds, including JEPQ. Yet, when considering performance, WKLY has delivered returns that are less attractive than benchmarks like the S&P 500, prompting investors to prioritize total return analyses over yields. Additionally, the expense ratio and sector allocations may not fully align with the market's leading sectors, potentially accounting for some performance lags.

Investors interested in WKLY must rigorously evaluate factors beyond the unique proposition of weekly dividends, including dividend sustainability, overall return potential, and investment costs. Thus, while offerings like WKLY and JEPQ showcase different facets in terms of return profiles and dividend distribution frequencies, it's paramount for investors to align their investment choices with their specific income needs and risk appetites.

The performance of JEPQ has been bolstered by a tech-heavy portfolio encompassing significant stakes in companies like Microsoft, Apple, Amazon, and Nvidia. The ETF's strategy aims to capitalize on the robust performance of the tech sector, particularly stocks listed on the Nasdaq, differing from strategies like JEPI that integrate low-beta stocks, providing some protection during volatile market periods.

JEPQ's active management, which incorporates a strategy of selling options at strikes slightly out of the money, positions the ETF to capture some potential upside while generating income. Weekly reviews and adjustments to its positions allow JEPQ to adapt swiftly to market shifts, highlighting the importance of an active and strategic approach. However, the ETF's success is somewhat tied to the volatility of the tech sector, where sudden market trends can impact fund performance.

Despite its strengths and compelling yield, JEPQ's heavy reliance on high-valuation tech stocks implies risk, especially if the tech sector faces a downturn. Additionally, the rise of new covered call funds indicates a belief in the option premium income strategy's longevity within the investment landscape. Investors keen on JEPQ should thus align with a growth-oriented, tech-focused investment philosophy and feel comfortable with the risks entwined with the tech sector.

In comparing JEPQ with the JPMorgan Equity Premium Income ETF (JEPI), it's clear that each has different strategic profiles. JEPI stands out with its focus on low volatility stocks, a strategy that found success during bearish periods like 2022. A low beta portfolio offers stability during downturns but may underperform during market upswings. Covered calls against the S&P 500 index and its choice of low-beta holdings, while not covered in the traditional sense, can lead to underperformance against benchmarks such as the S&P 500 in a consistently buoyant market.

The importance of understanding JEPI and JEPQ's respective strategies cannot be overstated, especially with an outlook that suggests bear markets are often shorter and less frequent than bull markets. This indicates potential long-term underperformance for a low beta portfolio. Investors must weigh this against the balance sought between capital appreciation and income generation, aligning investment expectations with anticipated market dynamics.

JEPQ enters the market as an intriguing option for income-oriented investors, leveraging a covered call strategy focused on the Nasdaq 100. While offering an attractive yield, one must recognize its newness and the absence of extensive historical data to fully evaluate its resilience. Its yield, higher than peer funds and its older relative, JEPI, prompts comparison and reflection on performance history. Investors, therefore, should carefully consider the macroeconomic climate impacting funds like JEPQ and JEPI. The prevailing high-interest rates and a subdued volatility index may pressurize income from options, and the strategies' upside cap presents another aspect for investors to consider.

Lastly, the views of prominent investors like Jeffrey Gundlach and Peter Lynch on technology stock valuations and their potential impact on funds like JEPQ and JEPI are salient. The concerns over the high valuations of leading tech companies suggest a cautious approach might prefer the diversification and seemingly more defensive positioning of JEPI over JEPQ. The diverse sector allocation and broader spread of securities within JEPI's portfolio could present a more balanced risk profile, potentially offering greater stability amidst speculations of an uncertain economic future. Investors opting for a consistent income amid market volatilities might lean towards JEPI's diversification as a safer choice, maintaining an attentive gaze on economic indicators that could influence future investment decisions between these two funds.

Similar Companies in Asset Management:

State Street Global Advisors (SPYD), Vanguard Group (VYM), BlackRock (HDV), Invesco (SPHD), Schwab U.S. Dividend Equity ETF (SCHD), WisdomTree (DHS), First Trust (FTHI), Global X SuperDividend ETF (SDIV)

News Links:

https://seekingalpha.com/article/4591946-my-income-portfolio-keep-it-simple-sweetheart

https://seekingalpha.com/article/4630135-my-9-percent-income-portfolio-nobody-is-perfect

https://seekingalpha.com/article/4612582-wkly-get-paid-every-week

https://seekingalpha.com/article/4649592-jepq-continues-to-deliver-outsized-returns

https://seekingalpha.com/article/4633261-jepq-lessons-from-jepi

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: vGmAz2