J.P. Morgan Nasdaq Equity Premium Income ETF (ticker: JEPQ)

2023-12-28

The J.P. Morgan Nasdaq Equity Premium Income ETF, trading under the ticker JEPQ, presents an investment strategy seeking to provide investors with a stream of income through premium yield, while simultaneously offering potential for capital appreciation. The fund operates by investing in a diversified portfolio comprised primarily of Nasdaq-listed equities, and it utilizes an options strategy known as a covered call to generate additional income. This approach involves holding a stock and selling call options on that same stock to collect the premiums. This strategy is particularly attractive to investors looking for regular income and those who are willing to trade off some potential upside for reduced volatility and partial downside protection. The ETF's performance is contingent on the balance between earning premium income and the performance of its equity holdings. As with all investments, potential investors should consider the ETFs objectives, risks, charges, and expenses before investing.

The J.P. Morgan Nasdaq Equity Premium Income ETF, trading under the ticker JEPQ, presents an investment strategy seeking to provide investors with a stream of income through premium yield, while simultaneously offering potential for capital appreciation. The fund operates by investing in a diversified portfolio comprised primarily of Nasdaq-listed equities, and it utilizes an options strategy known as a covered call to generate additional income. This approach involves holding a stock and selling call options on that same stock to collect the premiums. This strategy is particularly attractive to investors looking for regular income and those who are willing to trade off some potential upside for reduced volatility and partial downside protection. The ETF's performance is contingent on the balance between earning premium income and the performance of its equity holdings. As with all investments, potential investors should consider the ETFs objectives, risks, charges, and expenses before investing.

| Previous Close | 49.9275 | Open | 50.09 | Day Low | 49.96 |

|---|---|---|---|---|---|

| Day High | 50.09 | Price Hint | 2 | PE Ratio (Trailing) | 31.29446 |

| Volume | 2,853,464 | Average Volume | 2,594,980 | Average Volume (10 days) | 2,676,620 |

| Bid | 50.0 | Ask | 50.01 | Bid Size | 4,000 |

| Ask Size | 1,300 | Fund Yield | 0.1077% | Total Assets | $7,660,537,344 |

| 52 Week Low | 40.031 | 52 Week High | 50.33 | 50-Day Average | 48.4522 |

| 200-Day Average | 47.28445 | NAV Price | 50.3058 | YTD Return | 0.3623 |

| Beta 3 Year | 0.0 | Fund Inception Date | 1651536000 | Legal Type | Exchange Traded Fund |

Based on the technical indicators and fundamentals provided for JEPQ, it appears that the stock is positioned in a relatively stable uptrend. At the end of the last trading session, the stock closed slightly lower at 49.98 USD, down from its high of 50.330002 USD reached the previous day. The Parabolic SAR (PSAR) indicates a bullish trend, as evidenced by the PSAR being below the price for the observed period, despite a slight setback on the final day when the PSAR value was 49.883027 USD.

The On-Balance Volume (OBV) shows a healthy increase in volume paired with rising prices, suggesting accumulation from a volume perspective. The OBV ending in 4.112434 million is a positive sign, indicating strong buying pressure. This accumulation is generally considered a bullish sign.

However, the Moving Average Convergence Divergence (MACD) histogram presents a slight cause for pause, signified by the number moving from a positive to a negative value in the last trading session. This could indicate a short-term decrease in bullish momentum, but given that the downtick is relatively small (-0.019339), it is not necessarily a strong indicator of a reversal but rather a potential slowing of the current trend.

The fundamentals of JEPQ suggest a company that has a sizeable market presence, with total assets amounting to over 7.6 billion USD. The fund also shows a positive yield of 0.1077, indicating the possibility of dividends or other payouts. The fund seems to have a focus consistent with the objective of capital appreciation and income generation. The ETF's relatively high P/E ratio of over 31 might be a point of concern for value-based investors; however, the trailing P/E ratio could also be interpreted as the market pricing in future growth expectations.

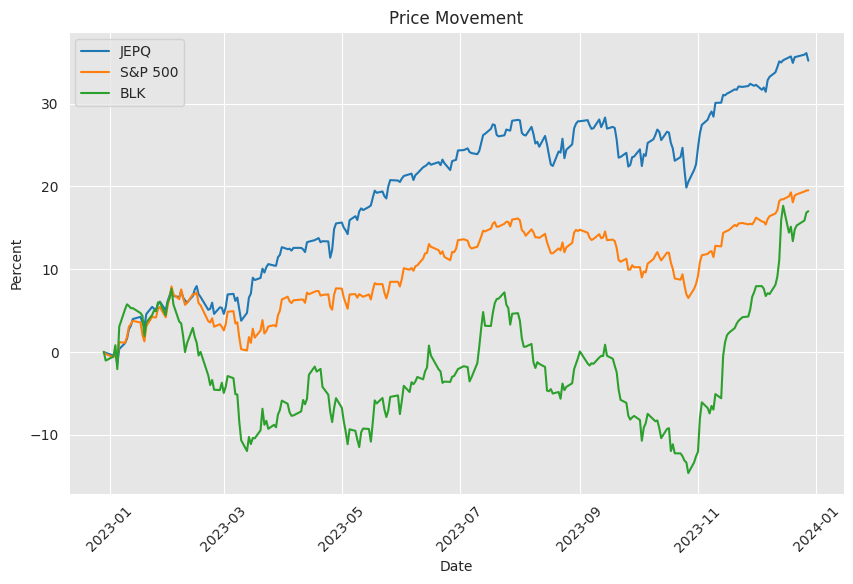

The past year's performance data demonstrates a solid year-to-date return of over 36%, indicating strong performance in the current year. However, a beta of 0.0 suggests that the fund may not correlate to market movements, which could be a point of consideration for risk-averse investors looking for diversification benefits.

Considering these factors, the expected stock price movement over the next few months could maintain the overall uptrend with periods of consolidation or slight pullbacks, as suggested by the OBV and PSAR indicators. Investors might exercise caution due to the negative tick in the MACD histogram, possibly indicating a slowdown in the near term.

It is crucial for any investors or interested parties to monitor the technical indicators, particularly the MACD and OBV developments, as these can provide early warning signs of changes in the prevailing trend. The fundamentals and the desirable yield suggest that the stock could continue to offer capital appreciation potential backed by the steady collection of dividends or income over the mid-term, barring any adverse market or economic events that could impact the broader market or the sectors the ETF is exposed to.

Amidst a climate of uncertainty regarding the tech-dominated "Magnificent Seven," investors have been exploring alternative investment vehicles to provide attractive returns, particularly through dividends. The JPMorgan Equity Premium Income ETF (JEPI) and the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) stand out for their use of covered call strategies to bolster dividend payouts. Both exhibit similar expense ratios and operational approaches; however, their underlying portfolios differ, with JEPI's diversified strategy providing broader sector exposure, and JEPQ's portfolio leaning heavily on technology stocks, including significant allocations to the "Magnificent Seven."

JEPI's strategy encompasses a mix of 133 holdings, granting it more sector diversity and potentially more resilience against market fluctuations compared to JEPQ's tech-centric 93 holdings. Such a diversified approach may prove beneficial in the context of tech sector skepticism, making JEPI an attractive choice for investors seeking consistent monthly income without overexposure to market leaders that are presumed overvalued.

JEPQ's launch aimed to provide a means for capital appreciation and current income, with the fund delivering an 11.76% yield and a lower volatility relative to the Nasdaq 100. However, compared to QQQ and SVOL, JEPQ has underwhelmed in total returns. Moreover, there are concerns regarding the tax implications of JEPQ's dividends for those in taxable accounts, reducing its appeal for some investors.

When considering downsides, JEPQ offers reduced volatility compared to benchmarks but does not necessarily provide significant downside protection - an area possibly better served by dedicated funds like BTAL or TAIL. Despite its unique sector allocation, differentiating slightly from QQQ with the inclusion of financials, JEPQ's income generation strategy has been outperformed by competitors like SVOL.

The ETF market expansion, led by firms such as JPMorgan and iShares, addresses the growing demand for income. Todd Rosenbluth's insights point to the influx of funds into fixed-income ETFs and new introductions, such as JPMorgan's Hedge Equity Laddered Overlay ETF (HELO), which focuses on downside protection. Their active management and sector diversification provide flexible and defensive options that enrich JPMorgan's lineup.

The JEPI ETF, with its attractive 12% yield paid monthly, became the eighth most popular ETF in 2022, appealing especially to those in retirement planning. Utilizing equity-linked notes (ELNs) to take advantage of market volatility, JEPI's strategy departs from traditional covered call methods and aims for consistent income alongside moderate capital appreciation. The ETF has delivered a compelling yield and low volatility, although investors must be mindful of tax implications and ELN counter-party risk.

JEPI's popularity has soared, with $29 billion in AUM, surpassing its peers' combined AUM. Its portfolio, however, has underperformed when compared to the S&P 500, partly due to its methodology of writing covered calls against the index while holding low beta stocks. This structural design means that JEPI may suffer in bull markets if its holding performance lags behind the index.

In the meantime, the SoFi Weekly Dividend ETF (WKLY) by Toroso Investments has introduced a novel weekly dividend payout approach. Its diversified and globally-orientated portfolio aims for consistent dividends, challenging the monthly distribution model like that of JEPI and JEPQ.

An individual investor's diversified income portfolio, including JEPQ, balances CEFs, ETFs, BDCs, and ETNs, aiming for robust dividend generation amid the market's unpredictable nature. This portfolio demonstrates a pragmatic approach that accommodates tax complexities and emphasizes the psychological aspects of investing. Despite downturns, the portfolio maintained a total yield above 9%, showcasing resilience inherent in a diversified and strategically managed investment strategy.

The JEPQ ETF is the newest addition to JPMorgan's suite, offering an 11.4% dividend yield with limited historical data. It follows JEPI's two-part strategy of selecting stocks with potential for returns and an option overlay for income and volatility reduction. However, rising interest rates and decreasing volatility pose challenges to such funds, potentially impacting their ability to maintain strong performance metrics.

Recent data indicates JEPQ's performance has been bolstered by heavyweight tech stock holdings, managed via an active strategy that can adapt swiftly to market shifts. Even with lower implied volatility affecting covered call funds, JEPQ's higher tech stock volatility has allowed it to maintain a comparatively high dividend yield. Yet, reliance on high-valuation tech stocks introduces risks that need careful consideration from potential investors.

J.P. Morgan's liquidation of two ETFs, CIRC and UPWD, reflects the dynamic nature of investment offerings and strategic portfolio management within the organization. The firm advises shareholders on the procedures ahead of the December 2023 delisting date, recommending consultations with tax advisors regarding the tax implications of liquidation.

Investor Guido Persichino's philosophy centers around maintaining a straightforward, income-focused approach, largely utilizing CEFs and ETFs in his investment strategies. His portfolio encompasses various instruments, selected based on their income generation capabilities and tax efficiencies. The high-dividend yield of his portfolio has proven to be resilient, even amid market swings, yet his investment considerations remain grounded in historical wisdom, advocating for simplicity in investment choices despite diverse market opinions. Persichino engages with his audience actively, with a focus on long-term income maximization rather than total returns, highlighting the relevance of a personalized investment approach tailored to individual objectives and circumstances.

Similar Companies in Asset Management:

BlackRock, Inc. (BLK), The Vanguard Group, Inc. (VFINX), Fidelity Investments Inc. (FDGRX), Charles Schwab Corporation (SCHW), T. Rowe Price Group (TROW), State Street Corporation (STT)

News Links:

https://finance.yahoo.com/video/jpmorgan-ishares-expand-fixed-income-165124698.html

https://seekingalpha.com/article/4612582-wkly-get-paid-every-week

https://seekingalpha.com/article/4630135-my-9-percent-income-portfolio-nobody-is-perfect

https://seekingalpha.com/article/4633261-jepq-lessons-from-jepi

https://seekingalpha.com/article/4591946-my-income-portfolio-keep-it-simple-sweetheart

https://finance.yahoo.com/news/j-p-morgan-asset-management-220000288.html

https://seekingalpha.com/article/4649592-jepq-continues-to-deliver-outsized-returns

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 8JRj0Y

https://reports.tinycomputers.io/JEPQ/JEPQ-2023-12-28.html Home