Invesco KBW Bank ETF (ticker: KBWB)

2023-12-28

Invesco KBW Bank ETF, trading under the ticker symbol KBWB, is an exchange-traded fund that seeks to replicate the performance of the KBW Nasdaq Bank Index. This index is composed of leading national money center banks and regional banking institutions in the United States. The ETF was designed to provide investors with exposure to the banking sector, which typically includes a range of large-cap, regional, and industry-specific banks. The fund does this by investing at least 90% of its total assets in the securities that comprise the index. Managed by Invesco, KBWB offers a way for investors to gain diversified exposure to the banking industry without having to invest in individual bank stocks directly. The ETF pays dividends to the holders that typically arise from the dividends it receives from the underlying bank stocks, making it a potential income-generating investment. Its performance is subject to the economic conditions affecting the banking sector, including interest rate changes, regulatory developments, and the overall health of the economy. As of the knowledge cutoff date, KBWB is a popular choice for investors looking to tap into the dynamic financial services arena through a liquid and transparent vehicle.

Invesco KBW Bank ETF, trading under the ticker symbol KBWB, is an exchange-traded fund that seeks to replicate the performance of the KBW Nasdaq Bank Index. This index is composed of leading national money center banks and regional banking institutions in the United States. The ETF was designed to provide investors with exposure to the banking sector, which typically includes a range of large-cap, regional, and industry-specific banks. The fund does this by investing at least 90% of its total assets in the securities that comprise the index. Managed by Invesco, KBWB offers a way for investors to gain diversified exposure to the banking industry without having to invest in individual bank stocks directly. The ETF pays dividends to the holders that typically arise from the dividends it receives from the underlying bank stocks, making it a potential income-generating investment. Its performance is subject to the economic conditions affecting the banking sector, including interest rate changes, regulatory developments, and the overall health of the economy. As of the knowledge cutoff date, KBWB is a popular choice for investors looking to tap into the dynamic financial services arena through a liquid and transparent vehicle.

| Previous Close | $49.39 | Open | $49.24 | Day Low | $49.24 |

| Day High | $49.5601 | Trailing P/E | 9.754 | Volume | 448,863 |

| Average Volume | 1,078,459 | Average Volume 10 days | 934,960 | Bid | $49.55 |

| Ask | $49.56 | Bid Size | 1,000 | Ask Size | 900 |

| Yield | 3.64% | Total Assets | $1,374,639,104 | Fifty Two Week Low | $36.19 |

| Fifty Two Week High | $59.50 | Fifty Day Average | $42.7502 | Two Hundred Day Average | $41.78795 |

| Year-To-Date Return | -0.76% | Beta 3 Year | 1.15 | Three Year Average Return | 2.91% |

| Five Year Average Return | 5.59% | NAV Price | $49.35 |

Upon reviewing the provided technical analysis (TA) data for KBWB, particularly for the last trading day on record, a pattern emerges that suggests potential future price movements. The dataset ends with the stock at a closing price of $49.509998, after a climb from an open of $49.240002, and the presence of key indicators warrants a closer look.

The TA data presents an upwards trend based on the closing prices over the last period. A steady increase in price, along with higher lows, suggests a bullish sentiment. Here are some specific observations:

- The On Balance Volume (OBV) has increased, indicating buying pressure. The OBV rose from -0.052020 (in millions) to 0.366156 (in millions) over the last few months, suggesting rising investor confidence and increasing volume on up days.

- There is a positive MACD histogram value of 0.011218. A positive MACD histogram indicates that the short-term momentum is up and could potentially signal further bullish movements.

- The Parabolic SAR (Stop and Reverse) does not have any values for the short side (PSARs_0.02_0.2) in the end dates. This absence indicates that the downtrend has not been signaled and that the bullish trend is prevailing.

Concerning the technical performance indicators, the lack of data in the summary of fundamentals and financials section means reliance solely on TA for predictions. Although the presence of fundamentals is a key aspect in informed decision-making, the existing TA data portrays a robust bullish signal as seen by the observed price action and confirmed by volume and momentum indicators.

Forecasting the stock price movement for the next few months, based on TA, points towards a continued bullish sentiment, with minor corrections expected due to the nature of market fluctuations. The upward trend appears to have stable momentum which, if sustained, could result in new price highs. Nevertheless, it is essential to be aware that markets are dynamic and subject to a myriad of external influences; hence continual monitoring of price action, volume, and emerging patterns remains imperative.

Investors and traders must also consider that despite the bullish indicators, market conditions can change rapidly due to unforeseen events or shifts in broader market sentiment. It's advisable to watch for price consolidations and breakout patterns that could suggest continuation or reversal and monitor how the stock behaves relative to market indices and its sector peers.

Given the technical trends observed, the likely scenario for the next few months, should the indicators hold their strength and barring any significant external shocks, is a continued uptrend with prices striving for higher highs. Regular reassessment of the TA readings would be essential to adapt to any new developments that surface.

The Invesco KBW Bank ETF (KBWB) provides investors with a targeted approach to accessing the banking sector, reflecting an investment in large capitalization banking companies in the United States. This sector-focused ETF reflects the performance of the industry and, hence, reacts to the overarching economic conditions and monetary policies affecting the sector. One economic indicator usually monitored for signs of the sector's future trajectory is the US 10-year minus 3-month yield spread. Historically, a negative yield spread has been a harbinger of recessions, and its profound negative shift at the beginning of 2023 raised red flags amongst the investor community.

The significance of the yield spread cannot be underestimated, as it is tied to lending activities and, therefore, to banks' profitability, potentially impacting the performance of KBWB. The recessionary signal implicated by the yield spread gains credence when viewed alongside other markers of economic downturns, such as declining PC shipments, reduced average work hours, and downturns forecasted by the IMF for global growth.

Despite these indicators, the central banks globally, including the Federal Reserve, have maintained a posture of monetary tightening to address inflation. Economic history suggests this phase will likely shift towards easing should a full economic contraction take hold, yet investors must be waryhistorical trends indicate that bear markets have often initiated during phases of easing.

The KBWB is particularly susceptible to such shifts. Recent discussions surrounding the transformative impacts of emerging technologies and political influences add to the varied perspectives investors need to consider. Those with stakes in the ETF should be prepared for the potential impacts of monetary policy decisions on market valuations, which can affect the performance of financial sector investments during economic recessions and recoveries.

But, the delicate balance between curbing inflation and ensuring financial system stability has been tested recently. Following a consistent pattern of rate hikes by the Federal Reserve to tackle inflation, the pace began to decelerate in early 2023, highlighted by consecutive 25 basis point hikes in January and March following more substantial hikes in the prior year. This shift came as a response to new economic challenges, including recent bank failures which recalled the tensions of the 2008 financial crisis.

The SVB and Signature Bank collapses rattled confidence, but the Federal Reserve and Treasury's backstops to prevent a broader systemic impact are noteworthy. Still, banks' solvency remains at risk in a rising interest rate environment, potentially leading to more bank failures or the requirement of further intervention by the Federal Reserve.

The banking crisis raises concerns about lending practices and their knock-on effects across the economy. While there might be an expectation for immediate asset repricing and optimistic 'policy pivot' interpretations, historical patterns have shown that the initial rate cuts often correspond with the onset of bear markets, warning investors in the KBWB that the path to investment recovery may not be direct or immediate.

Investors should note the potential for credit tightening and restrictions on lending, which have been leading indicators of recessions. While rate cuts or quantitative easing may ultimately be necessary, the initial signals may indeed confirm the recession's onset and not, as some posit, its end.

The KBWB, aligned with the broader health of its represented sector, could experience these effects first-hand. Therefore, an evaluation of the ongoing narrative suggests that banking sector indicators such as credit tightening, deposit levels, and expectations of rate hikes or cuts are crucial to understanding the health of the ETF's underlying assets.

The Invesco KBW Bank ETF offers diversification within the banking sector which could protect against the risks associated with individual banks encountering financial difficulties. The recent stress tests provide a measure of confidence in the overall health and resilience of the larger banking system, potentially reducing the risk to the ETF.

The broader economic conditions discussed at a cyclical forum in London and fluctuating yield curves have implications for KBWB, pointing to a period of economic contraction following peak growth. Monetary policy at the global level appears to be reaching the end of its tightening phase, with rate hikes nearing the end in several countries. Diversification of investments becomes key as economies cool and fiscal stimuli's effects fade, providing a backdrop against which bank ETFs like KBWB may be accessed.

Amid economic uncertainty, the appeal of index-based ETFs like KBWB lies in the diversification and reduction of individual stock risk offered by the collective strength of the index it tracks. The ETF offers exposure to the banking sector without the intricate analysis required for stock picking, reflecting broad industry trends rather than single-entity performance.

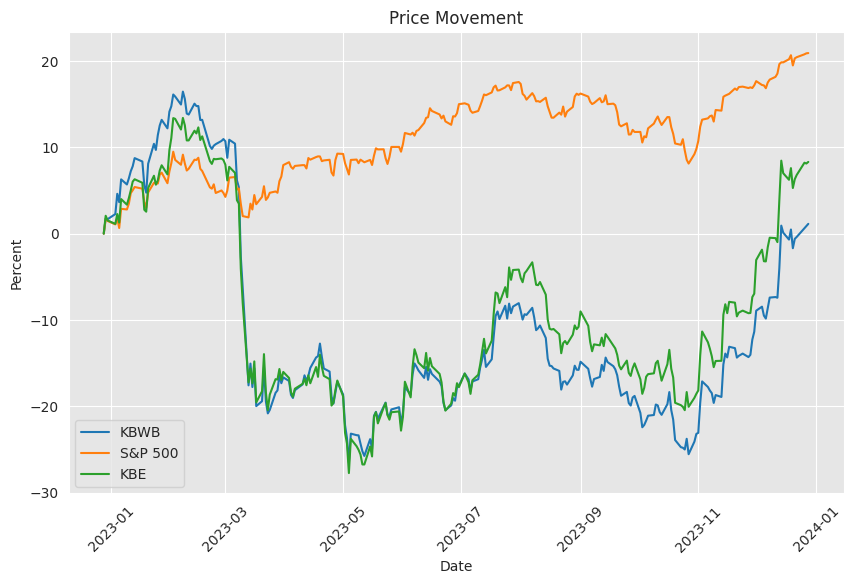

However, the dynamics within the banking sector and economy have presented challenges for the ETF. 2023 started with the collapse of several U.S. banks that sent ripples through the industry, impacting associated ETFs. Despite early headwinds, the outlook later in the year improved with expectations of a more favorable yield curve and potential interest rate cuts by the Federal Reserve. These factors, alongside lower valuations, may set the stage for a rebound in the performance of bank ETFs, including KBWB, as we move towards 2024.

Despite the current challenges, the KBWB, with over $1.25 billion in assets, maintains a substantial presence in the market, offering a less expensive option with an expense ratio of 0.35% and a 12-month trailing dividend yield that is attractive to income-focused investors. With its holdings reflecting some of the most significant players in the U.S. banking industry, the ETF's performance is contingent upon the resilience and adaptability of the sector to macroeconomic shifts, providing a potentially strategic investment opportunity in the face of evolving market conditions.

Similar Companies in Exchange-Traded Fund:

SPDR S&P Bank ETF (KBE), iShares U.S. Regional Banks ETF (IAT), Financial Select Sector SPDR Fund (XLF), Vanguard Financials ETF (VFH)

News Links:

https://seekingalpha.com/article/4591667-banking-crisis-is-how-it-starts-recession-is-how-it-ends

https://seekingalpha.com/article/4594030-recession-anatomy-lagged-effects-of-rate-hikes-started

https://seekingalpha.com/article/4591422-qe-qt-and-deposits

https://seekingalpha.com/article/4640564-cyclical-outlook-october-2023-post-peak

https://www.fool.com/investing/2023/10/31/you-dont-have-to-pick-a-winner-in-banks-heres-why/

https://finance.yahoo.com/news/4-reasons-why-bank-etfs-130000962.html

https://finance.yahoo.com/m/d6561507-f441-31bf-bdc7-4306fa438494/you-don%27t-have-to-pick-a.html

https://finance.yahoo.com/news/invest-invesco-kbw-bank-etf-112006189.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 7OOdADH

https://reports.tinycomputers.io/KBWB/KBWB-2023-12-28.html Home