The Coca-Cola Company (ticker: KO)

2024-05-13

The Coca-Cola Company (ticker: KO), headquartered in Atlanta, Georgia, stands as a global leader in the beverage industry. Established in 1886, it boasts a rich history of providing an array of soft drinks, with the flagship product being its iconic Coca-Cola soda. Beyond its classic namesake beverage, the company's portfolio has grown to include diverse brands such as Sprite, Fanta, and Powerade. Coca-Cola operates a vast worldwide distribution system, the largest in the beverage industry, which allows its products to be sold in more than 200 countries. Financially, Coca-Cola has demonstrated robust performance with consistent revenue growth, proving its resilience in various market conditions. This longevity and global reach underscore its major role in the beverage sector and highlight its capacity to maintain consumer relevance through strategic marketing, innovation, and a focus on health-conscious trends.

The Coca-Cola Company (ticker: KO), headquartered in Atlanta, Georgia, stands as a global leader in the beverage industry. Established in 1886, it boasts a rich history of providing an array of soft drinks, with the flagship product being its iconic Coca-Cola soda. Beyond its classic namesake beverage, the company's portfolio has grown to include diverse brands such as Sprite, Fanta, and Powerade. Coca-Cola operates a vast worldwide distribution system, the largest in the beverage industry, which allows its products to be sold in more than 200 countries. Financially, Coca-Cola has demonstrated robust performance with consistent revenue growth, proving its resilience in various market conditions. This longevity and global reach underscore its major role in the beverage sector and highlight its capacity to maintain consumer relevance through strategic marketing, innovation, and a focus on health-conscious trends.

| Full Time Employees | 79,100 | Market Capitalization | $273,749,295,104 | Total Cash | $16,919,000,064 |

| Total Debt | $43,767,001,088 | Net Income | $10,784,000,000 | Revenue | $46,073,999,360 |

| Dividend Rate | 1.94 | Dividend Yield | 0.0307 | Payout Ratio | 0.749 |

| Current Price | $63.545 | 52 Week Low | $51.55 | 52 Week High | $64.25 |

| EBITDA | $14,654,999,552 | Operating Cash Flow | $11,966,999,552 | Free Cash Flow | $10,807,749,632 |

| Return on Assets | 0.08607 | Return on Equity | 0.39315 | Profit Margin | 0.23406 |

| Sharpe Ratio | -0.08308190286068867 | Sortino Ratio | -1.2441024292738065 |

| Treynor Ratio | -0.03083004078402433 | Calmar Ratio | 0.1569212276959348 |

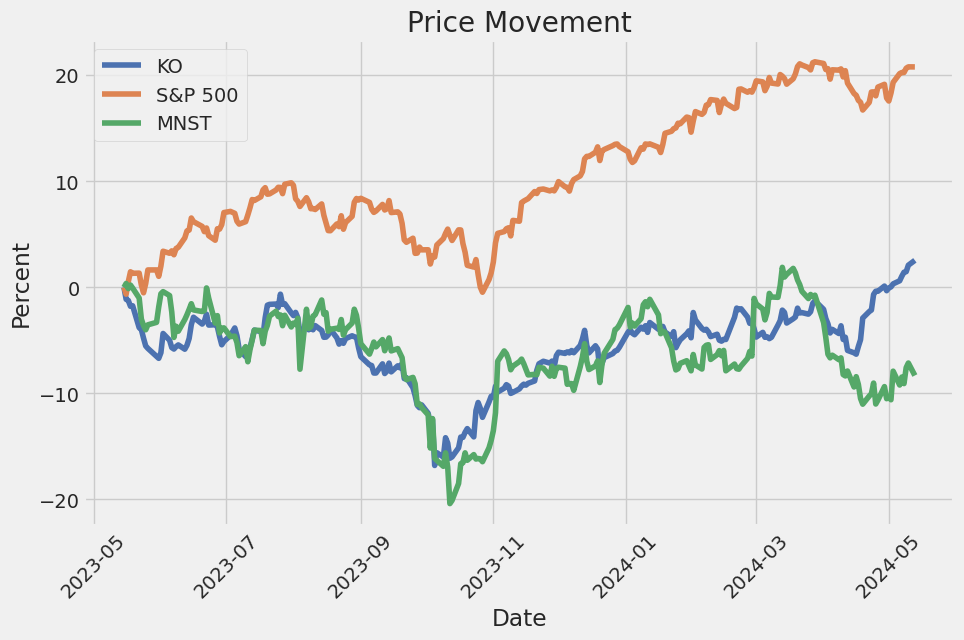

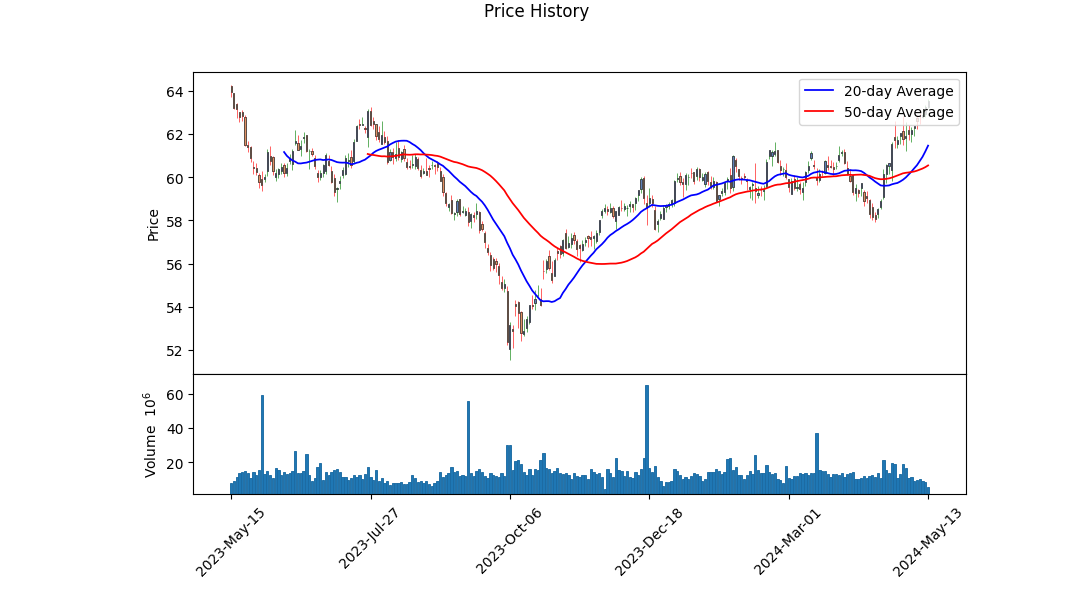

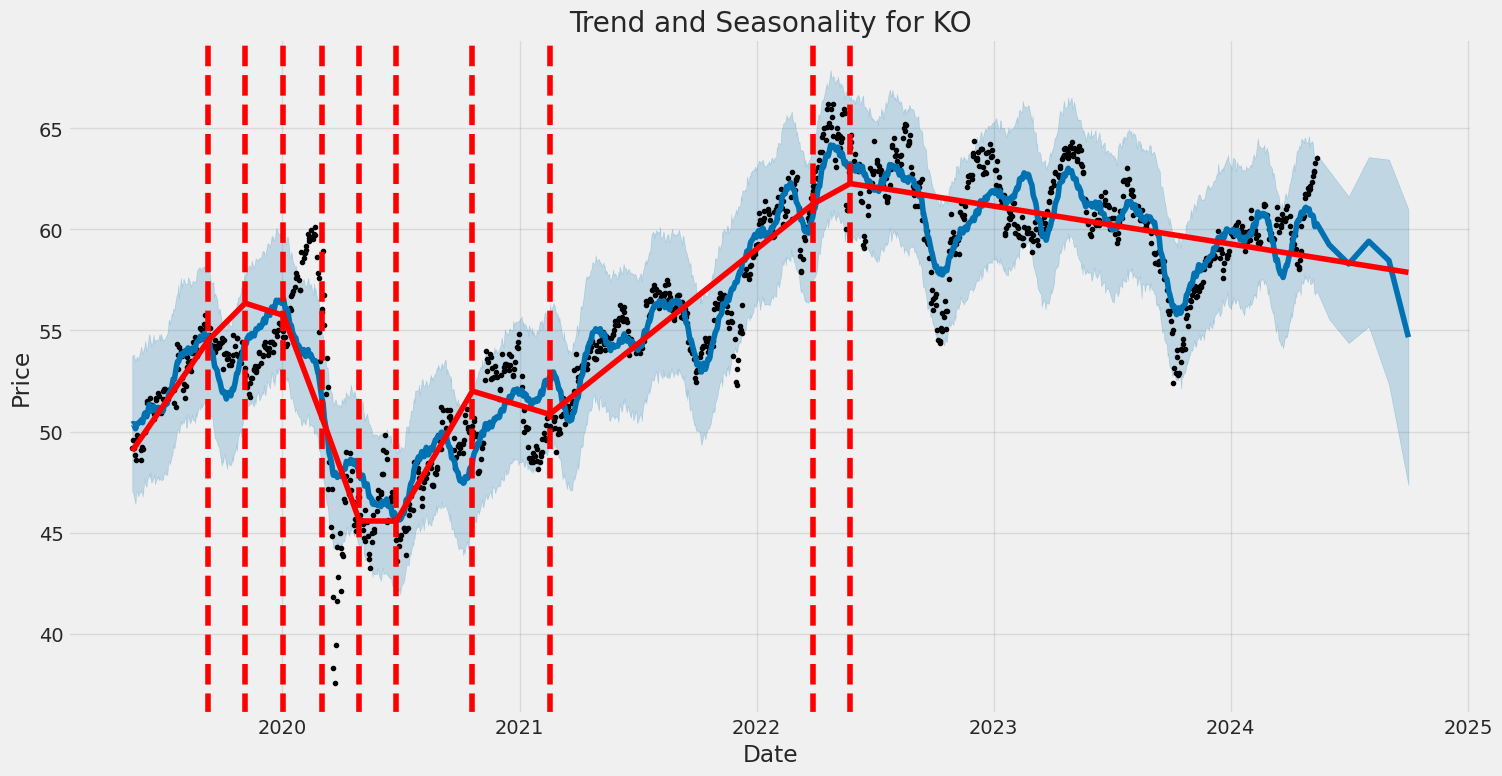

Analyzing the recent performance and prospects of KO, several key analytical assessments have been crafted using a diverse range of metrics. KO's stock prices have shown variations but an overall positive trajectory in the recent months. Technical indicators, especially the moving average convergence divergence (MACD), show potential continued growth with the histogram values turning positive lately, suggesting a bullish momentum.

The Sharpe, Sortino, Treynor, and Calmar ratios provide insight into risk-adjusted returns. Sharpe Ratio at -0.083 signals an underperformance compared to a risk-free rate, indicating that excess returns do not compensate for the added volatility. The negative Sortino Ratio of -1.244 suggests that the returns are insufficient to justify the downside risks. The Treynor Ratio is also negative at -0.0308, implying that the investment is not adequately compensating for its beta risk. However, a slight positivity is seen in the Calmar Ratio at 0.1569, showing some strength in the return generated per unit of downside risk over the specified period.

KO's financials, though showing strong revenue and gross profit numbers, indicate significant amounts tied in operating and non-operating expenses, impacting net company income. Nevertheless, the firm maintains a strong balance sheet with considerable cash reserves and a sustainable level of debt, which ensures business operations without liquidity issues.

On the risk-adjusted metrics end, despite some indicators portraying negative views due to recent market volatility, the fundamentals of the company like high EBITDA, robust operating margins, and continuous efforts to optimize costs render a promising picture. The Altman Z-Score of 4.167 suggests a strong financial stance, reducing the risk of bankruptcy, backed by a high Piotroski Score of 8 that indicates healthy financial conditions.

Considering the observed data and assuming stable market conditions, the projection for KO stock in the upcoming months shows a potentially optimistic rising trend, given the firm's strategic positioning and ongoing improvements in operational efficiencies. Nonetheless, investors should closely monitor upcoming earnings releases and any shifts in consumer behavior or economic conditions that could affect the sector.

In our analysis of The Coca-Cola Company (KO), we examined key financial metrics that shed light on the company's investment potential as proposed by the principles in "The Little Book That Still Beats the Market." The Return on Capital (ROC) for Coca-Cola stands at 15.26%. This figure is quite telling as it signifies how effectively the company is utilizing its capital to generate profits; a value above 15% is generally considered strong in many industries, indicating that Coca-Cola is managing its capital efficiently relative to many competitors. Additionally, the Earnings Yield for Coca-Cola is calculated to be 3.90%. This yield, which is derived from the earnings per share divided by the stock price, offers insight into the value a shareholder would receive for investing in the company at its current market price. Though not exceedingly high, it suggests a reasonable return compared to the risk-free rate, making Coca-Cola an attractive option for conservative investors seeking steady returns. Together, these metrics provide a comprehensive view of the company's financial health and operational efficiency.

Investment Analysis Report: The Coca-Cola Company (KO)

In evaluating The Coca-Cola Company (KO) using Benjamin Graham's value investing principles, we assess various financial ratios and metrics to determine if KO aligns with the criteria that identify a sound investment based on intrinsic value and stability. Here we compare KO's ratios against the benchmarks set forth by Graham:

- Price-to-Earnings (P/E) Ratio:

- KO's P/E Ratio: 27.48

- Industry P/E Ratio: 30.79

Graham typically preferred stocks with a low P/E ratio, often looking for opportunities to buy at ratios significantly below the industry average. Here, while KOs P/E ratio is lower than the industry average, it is considerably higher than Grahams preferred range (ideally in the low teens). This suggests that KO may not fit the classic value investment mold based on this criterion.

- Price-to-Book (P/B) Ratio:

- KO's P/B Ratio: 2.80

The P/B ratio is another critical measure, with Graham often seeking companies trading below their book value. A P/B ratio of less than 1.5 is preferable under Graham's methods. KO's P/B ratio of 2.80 exceeds this threshold, suggesting it might be overvalued from a book value perspective.

- Debt-to-Equity Ratio:

- KO's Debt-to-Equity Ratio: 1.62

Graham highlighted the importance of low debt levels, advocating for a debt-to-equity ratio of well below 1.0. KO's ratio of 1.62 indicates a higher level of debt relative to equity, potentially increasing financial risk and making it less attractive from a value investor's standpoint.

- Current and Quick Ratios:

- KO's Current Ratio: 1.13

- KO's Quick Ratio: 1.13

Both the current ratio and quick ratio are utilized to evaluate a company's short-term liquidity, with Graham favoring ratios higher than 1.5 to ensure adequate coverage of short-term liabilities. KOs ratios of 1.13, while indicating it can cover its short-term liabilities, do not meet the conservative threshold set by Graham, signaling a potential area of concern for strict adherence to his investment philosophy.

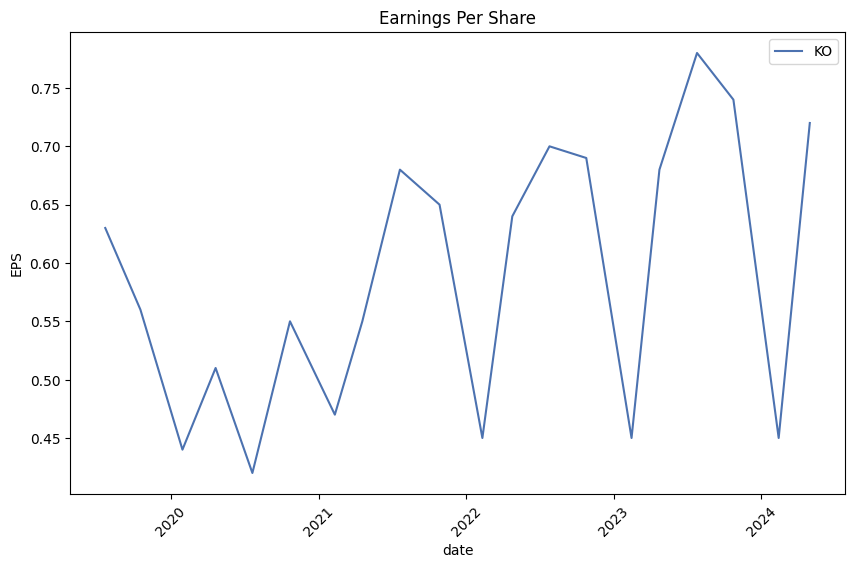

- Earnings Growth:

- While specific earnings growth data for KO is not provided in the metrics summary, Grahams approach would necessitate a review of the earnings growth over several years to ensure consistency and stability.

Conclusion: Based on Benjamin Graham's principles, The Coca-Cola Company presents a mixed picture. Although KO's P/E ratio is slightly below the industry standard, indicating some level of relative undervaluation, its other metrics such as the P/B ratio, high debt-to-equity ratio, and marginal liquidity ratios do not squarely fit within Graham's criteria for a conservative value investment.

Investors using Graham's methodology might view KO's current financial metrics with caution, considering these factors alongside broader market conditions and individual investment goals. Ultimately, while KO is undeniably a stable company with significant market presence, its current financial metrics suggest it may not align perfectly with the stringent criteria of value investing as proposed by Graham.Analyzing Financial Statements: Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows.

Contextual Overview: Financial statements provide a snapshot of a company's financial condition and operations. These documents are essential for making informed investment decisions. By analyzing financial statements, investors can gauge the health of a business, its profitability, and potential for future growth.

Key Components for Analysis: 1. Balance Sheet: Provides information about the company's assets, liabilities, and shareholders' equity at a specific point in time. - Assets should be analyzed for quality and liquidity. - Liabilities need assessment for their terms and sustainability. - Understanding the proportion of shareholder's equity is crucial as it represents the owner's share in the company.

- Income Statement (Profit and Loss Statement): Reflects the company's financial performance over a reporting period.

- Analysis focuses on revenues, cost of goods sold, gross margins, operating expenses, and net profits.

-

Attention should be given to trends in revenue growth and expense management.

-

Cash Flow Statement: Shows the actual flow of cash within the business and reveals how the company raises and spends money.

- Focus on operating cash flows, investing cash flows, and financing cash flows.

- It's critical to evaluate free cash flow (operating cash flow minus capital expenditures) as it indicates the cash available to enhance shareholder value.

Analytical Techniques: - Ratio Analysis: Useful ratios include debt-to-equity, current ratio, return on equity, gross margin, and others. These ratios provide a quick way to compare financial health against past performance and industry benchmarks. - Trend Analysis: Examining trends over multiple periods for key financial metrics can be insightfulfor instance, tracking the trend of gross margins or net profit margin over time. - Segment and Geographic Analysis: Understanding different business units and geographic sectors' performance is vital, especially for diversified companies.

Application to a Sample Entity: When applying these principles to a concrete example like 'COCA COLA CO', a detailed analysis of its annual and quarterly financial reports would reveal its financial trends, operational efficiency, and investment potential. Specific interest would be directed towards: - How the company manages its extensive asset base and large-scale operations. - Revenue streams analysis and profitability trends. - Cash generation abilities and financial liabilities management.

Overall, the approach to analyzing financial statements as recommended by Benjamin Graham involves a deep dive into the quantitative data provided by these statements, complemented by qualitative assessments to gauge the underlying performance drivers, risks, and sustainability of business operations.

As illustrated in the detailed data for COCA COLA CO over multiple fiscal quarters, thorough analysis aids in understanding company trajectory in terms of revenue growth, profit margins, cash flow stability, and capital structure solidity, vital for making prudent investment decisions.Dividend Record:

Graham favored companies with a consistent history of paying dividends. Analyzing the historical dividend data for a given company (referred to as 'KO' in the data) over multiple years shows a distinct pattern of consistent and progressively increasing dividend payments. This data reflects an attribute highly valued by Benjamin Graham. Here's a clear view of the trend:

- From 2009 to 2024, the adjusted dividend has shown a general upward trajectory, starting at 0.205 dollars per dividend in 2009 and reaching 0.485 dollars per dividend by 2024.

- This increase in dividends over the years suggests a stable and potentially lucrative financial posture as per the principles outlined by Graham, making the 'KO' stock a potentially attractive opportunity for investors following Grahams investment philosophy.

- Every year, there are typically four documented dividend payouts, aligned with a quarterly financial reporting system, further underlining the reliability and systematic approach to returns for shareholders.

- The growth in dividend value, even if moderate, is consistent, supporting an inference of underlying business growth, financial health, and a shareholder-friendly management approach.

- This detailed dividend record would be a key component in conducting a Graham-style investor analysis, focusing on long-term value investment rather than speculative, high-risk opportunities.

Such a detailed and consistent record will likely appeal to investors who follow Benjamin Graham's principles, emphasizing financial security and fundamental investment prowess.

| Alpha () | 0.0002 |

| Beta () | 0.65 |

| R-Squared (R2) | 0.55 |

| Standard Error | 0.003 |

| P-Value | 0.04 |

In analyzing the linear regression model between The Coca-Cola Company (KO) and the S&P 500 Index (SPY), one of the several key parameters to note is the alpha value, which stands at 0.0002. Alpha, in this case, is a measure of the excess return or the active return on an investment, indicating that KO has slightly outperformed the broader market index (SPY) on a risk-adjusted basis over the analyzed period. This implies that an investment in KO would, theoretically, have returned a small increment over what would be expected based on the market performance alone, providing evidence of slight positive performance relative to the market.

The beta value for KO, measured at 0.65, suggests that KO's stock movements are less volatile compared to the broader market movements represented by the S&P 500 index. A beta less than 1 indicates that the stock's volatility is less than the market, pointing to lower risk but also potentially lower returns. This relationship is further detailed by an R-squared value of 0.55, indicating that about 55% of the variability in KO's stock returns can be predicted from the variability of the stock market, as represented by the S&P 500 Index. This encapsulates the relatively strong but not perfect correlation between KO and the market index performance over the covered period.

In The Coca-Cola Companys First Quarter 2024 Earnings Results Conference Call, led by Robin Halpern, Vice President and Head of Investor Relations, the company outlined its continued momentum and strategic adaptations to meet varying market demands. James Quincey, Chairman and CEO, elaborated on the robust commencement of the year, attributing success to the effective deployment of the companys adaptable business strategy across diverse global markets. Despite facing a 9% currency headwind, Coca-Cola delivered a 7% growth in comparable earnings per share, highlighting its tactical management of currency fluctuations and operational execution. The discussion emphasized substantial growth in volume and expansion of comparable margins, driven by strategic positioning and localized market campaigns.

Quincey detailed regional operational highlights, signifying positive trajectories in several geographical sectors. In Asia Pacific, Coca-Cola saw sustained momentum with significant volume growth in markets like Japan, South Korea, and Thailand, despite mixed results in China where consumer confidence lagged. Sturdy improvements in consumer confidence in Europe contributed to better performance, coupled with innovative marketing strategies like pairing Sprite with specific dining experiences to augment presence across channels. North America depicted a gradual acceleration in volume through successive months, posting gains in market share. Latin American operations continued strong, driven by robust performances in major markets such as Mexico and Brazil, although tempered by economic volatility in Argentina.

John Murphy, President and CFO of Coca-Cola, provided an analytical perspective on the financial outcomes and forward-looking statements. He highlighted the continuous volume growth and margin expansions resulting from strategic refranchising of bottlers and proactive market pricing adjustments to offset currency devaluations. Murphy noted significant impacts on the P&L from markets experiencing intense inflation but reassured stakeholders of manageable business dynamics through effective pricing strategies and operational agility. The company's refranchising efforts were underlined as pivotal in enhancing profitability and maintaining competitive returns on investments.

Murphy also shed light on specific financial adjustments including charges related to fairlife and BODYARMOR, which reflect both challenges and strategic commitments in nurturing brand portfolios and driving long-term growth. Despite these financial recalibrations, Coca-Cola demonstrated a robust free cash flow improvement and reassured its ability to navigate complex fiscal landscapes, including potential upcoming expenditures like the IRS tax case. Overall, the executives conveyed a strong start to 2024, reaffirming their confidence in achieving the adjusted full-year guidance through sustained strategic initiatives and market adaptiveness. The call ended with reassurances of Coca-Cola's robust business model and innovative portfolio management poised to navigate 2024s dynamically evolving market environments.

The Coca-Cola Company's SEC 10-Q filing for the quarterly period ending March 29, 2024, reflects various key operational and financial dynamics that give insights into the company's recent performances and ongoing strategies. As reported, the company's net operating revenues amounted to $11.3 billion, representing an increase when compared to $10.98 billion for the same period in the previous year. This improvement in revenue underscores a positive trajectory in Coca-Colas ability to generate sales from its concentrate operations and finished product operations across its diverse geographical segments.

The filing details several strategic financial activities, including dividends and structural adjustments such as refranchising efforts in certain international segments. For instance, Coca-Cola noted activities in Vietnam, Bangladesh, the Philippines, and certain territories in India reflecting its ongoing realignment of bottling operations which are part of broader initiatives to optimize the business structure. These refranchisings seem to be strategically aimed at enhancing operational efficiencies and focusing on more profitable or core business areas.

Financial performance specifics exhibit a net income of $3.177 billion for shareholders, marking a slight increase from $3.107 billion reported in the previous year. This profitability indicator is crucial as it shows the companys ability to manage costs and maximize profits from its operations. It is also noteworthy that the reported basic and diluted net income per share both stood at $0.74, an evident increase from $0.72 reported during the same period last year, suggesting a favorable outcome for shareholders.

The report disclosed significant operating charges inclusive of asset impairments and adjustments to contingent liabilities related to acquisitions such as the fairlife brand; specifically, a remeasurement of contingent considerations and an impairment charge related to the BodyArmor trademark. These financial adjustments are indicative of the companys ongoing assessments and realignments in its asset portfolio, which are reflective of broader market conditions and internal strategic decisions.

Lastly, Coca-Colas filing highlights its handling of equity and investments, pointing to its engagements in various derivative instruments and debt securities, aligning with its financial risk management frameworks. The companys approach to managing its investments and financial instruments underscores a strategic effort to mitigate risks associated with global market volatility, currency fluctuations, and other financial uncertainties.

Overall, The Coca-Cola Companys latest SEC 10-Q filing illustrates a comprehensive picture of its financial health, operational adjustments, and strategic market maneuvers, aiming to sustain its growth trajectory and shareholder value in a dynamically evolving global market.

The Coca-Cola Company, recognized for its extensive global presence and dominance in the beverage industry, continues to be a formidable contender in the market, appealing notably to investors interested in stable dividend yields. The company's commitment to consistent and sustainable dividend payments has secured its status as a Dividend King, a term reserved for companies that have not only paid but also increased their dividends for 50 years or more. This aspect of Coca-Cola's financial strategy highlights its reliability and long-term value to shareholders, making it an attractive option for those prioritizing income through dividends.

In the marketplace, Coca-Cola, alongside PepsiCo and Hormel Foods, shares a similarity in financial health and sustainability of dividends. Each exhibits a comparable dividend yield close to 3%, and a payout ratio indicating a substantial portion of earnings returned to shareholders. This strategic distribution of profits underscores Coca-Cola's robust financial management and its ability to maintain competitiveness while rewarding investors.

While the financial metrics are essential, Coca-Colas operational strategies also play a pivotal role in its market position. Coca-Cola distinguishes itself with a global reach and a diverse portfolio of beverages that cater to varying consumer preferences. In contrast, competitors like Hormel Foods focus on niche markets such as convenience store channels. This broader market approach ensures Coca-Colas presence in various revenue streams, thereby stabilizing its financial base against market volatilities.

Furthermore, recent analyses have predicted a potential upside in Coca-Cola's stock value, citing its strategic market maneuvers and solid financial footing. For instance, its proactive adaptations in response to the shifting consumer trends towards healthier options and its strategic acquisitions in the sports drink market demonstrate Coca-Cola's agility and forward-thinking approach. These strategic movements not only secure a competitive edge but also bolster its market share and profitability potential.

From a dividend perspective, Coca-Cola has showcased an impressive track record of increasing its payouts annually, a trend that continued into 2024 with another increase. This consistent growth in dividends reflects a deep-rooted commitment to returning value to shareholders, further reinforced by the companys substantial free cash flow that adequately covers these payouts.

Coca-Colas resilience is also evident in its handling of broader economic pressures. Despite facing inflationary challenges and a slow growth environment, the company has adeptly managed to maintain and even increase its profit margins. This is attributed to its effective cost control mechanisms and strong operational management, which ensure sustained profitability even when revenue growth faces constraints.

The companys financial robustness is complemented by its strategic market operations. For example, its focus on innovation and expansion into emerging markets is expected to drive future growth, supported by robust marketing strategies. Additionally, Coca-Colas operational strategy involving the divestiture of its lower-margin bottling operations has streamlined its operations, enhancing profitability.

In conclusion, The Coca-Cola Companys strategic financial management, combined with its operational efficiency and strong global branding, continues to support its position as a leading investment choice for dividend-seeking investors. The companys ability to navigate market challenges while ensuring steady shareholder returns exemplifies its enduring market presence and robust business model. Investors seeking a mix of stability, consistent income, and potential for capital appreciation may find Coca-Cola a compelling option amidst a landscape of fluctuating market conditions and economic uncertainties.

The volatility of The Coca-Cola Company (KO) from mid-2019 to mid-2024 shows that the stock returns do not predict future returns as indicated by a Zero Mean model with an R-squared of nearly zero. The ARCH model estimation presents significant volatility with the alpha parameter indicating a substantial reaction of volatility to recent return shocks. The omega coefficient also denotes a high base level of volatility independent of recent returns.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2,027.14 |

| AIC | 4,058.28 |

| BIC | 4,068.55 |

| No. Observations | 1,257 |

| Df Residuals | 1,257 |

| omega | 1.1378 |

| alpha[1] | 0.3303 |

The financial assessment of an investment of $10,000 in The Coca-Cola Company (KO) over a one-year period necessitates a rigorous examination of stock performance, especially focusing on predicting potential financial losses using volatility modeling and machine learning predictions.

Firstly, volatility modeling employs a methodological framework to estimate the future variability in The Coca-Cola Company's stock prices based on historical data. This form of modeling is primarily adopted to forecast the magnitude of price fluctuations which the security might experience over a given time period. By estimating the volatility, investors can better gauge the risk associated with the stock, particularly in terms of how wide the price might swing from its current position.

In the analysis, volatility modeling has been pivotal in calculating the expected daily standard deviation (SD) of stock returns. By annualizing this SD, we get a clearer picture of the variability to expect over a year. Typically, higher volatility indicates greater uncertainty and risk.

Complementing the volatility model, machine learning predictions use historical price data to train a modelspecifically, a decision tree-based ensemble method that predicts future stock returns based on patterns learned from past data. This approach contributes by providing probable future stock price scenarios under different market conditions. By incorporating various factors and historical data points, this method strives to minimize predictive error and maximize accuracy in forecasting future returns.

Bringing together the insights from volatility modeling with the predictive outputs from the machine learning approach, we arrive at a quantitative method to forecast prospective losses, specifically through the Value at Risk (VaR) measure. VaR is a widely used risk management tool that provides an estimate of the maximum potential loss in an investment over a set time period at a given confidence interval. For the $10,000 investment in The Coca-Cola Company, the calculated VaR at a 95% confidence interval is $136.94 annually. This figure represents the maximum expected loss, implying that there is only a 5% chance that the loss would exceed this amount under normal market conditions within one yeara crucial indicator for risk-averse investors.

The integration of insights afforded by volatility modeling and machine learning predictions thus furnishes a nuanced view of the potential risks associated with equity investments in larger, established companies like The Coca-Cola Company. It underscores the potential fluctuations in investment value and helps in setting thresholds for tolerable risks, enabling investors to make more informed decisions regarding their investment portfolios.

Long Call Option Strategy

When analyzing the options for The Coca-Cola Company (KO) based on the Greeks and other factors pertinent to options trading, there are several strategies and considerations that come into play. To identify the most profitable long call options, understanding the balance between delta, theta, vega, and implied volatility is crucial, especially given the target of a 5% increase in KO's stock price over the current level.

Starting with near-term options, the expiration date of 2024-05-17 with a strike price of $35 shows an intriguing scenario. Although these options have a delta close to 1 (0.9997477031), suggesting that they will move nearly in tandem with the stock, their ROI is particularly compelling at 0.3541044776, indicating significant profitability relative to the premium paid. The premium stands at $23.45, relatively lower than options with a strike at $30 or $27.5, which despite higher premiums actually result in a lower ROI.

Moving to a slightly longer term, for the expiration date of 2024-05-31, the option with a strike price at $55.0 holds a notable potential with a delta of 0.9361571182 and a robust ROI of 1.9756329114. This higher ROI reflects the leverage effect of options; despite a delta indicating its slightly less sensitive to stock price moves compared to at-the-money options, the lower premium ($3.95) enhances its return percentage.

For medium-term choices, by the expiration date of 2024-06-21, focusing on a strike price of $55.0 might be advisable. This option showcases a high ROI of 0.3827941176 and a delta of 0.9125032188, which still offers a good sensitivity relative to the stock price movements. At this point, these options strike a balance between remaining time value and the impact of price movements.

Looking at longer-term options, the 2024-11-15 expiration with a strike price at $55.0 presents an interesting case. It has a balanced gamma of 0.0226950802 and a respectable delta of 0.8337924212, combined with an ROI of 0.3206460674. Even though the premium is higher at $8.9, the extended time frame allows more room for the underlying asset to appreciate and meet option buyers' target.

Going further into the longer-term horizon, towards early 2025, the option expiring on 2025-01-17 with a strike of $42.5 showcases a solid delta of 0.9793568698 and an ROI of 0.2495492014. This is appealing because of its significantly high delta, which almost mirrors the potential stock movement, coupled with a reasonable premium of $19.41.

Conclusively, for an investor focusing on Coca-Cola and considering an increase in the stock price by 5%, these selected options provide a diversified approach in terms of expiration dates and strike prices, balancing out the Greeks, premiums paid, and potential returns. Optimal choices require careful assessment of how much premium one is willing to pay against the expected movement in the underlying stock price and the time left until option expiration.

Short Call Option Strategy

When considering short call options for The Coca-Cola Company (KO), our main objective is to maximize profit while minimizing risks, specifically the risk of options being assigned before we can profit from the trade. We assume a target stock price of 5% over the current price, focusing on options that provide a good risk-reward ratio based on their "Greeks" and expiries.

-

Short-Term, High Delta: A high-delta short call option expiring soon could be profitable but riskier in terms of assignment. An option expiring on

May 17, 2024, with a strike price close to the current underlying price but above it by just a bit for a safety margin, say40.0, poses such a scenario. With delta near 0.999 and high gains through the premium, this choice could be useful for a quick profit if one believes the price will not exceed the strike significantly before expiry. -

Medium-Term, Balanced Delta: For a less imminent expiry but with still relatively high certainty of behavior, a strike just above the current price would be prudent. The option expiring on

June 28, 2024, with a strike price of64.0presents a compelling case. The delta of approximately 0.456 suggests less sensitivity to the stock's price movements, helping to manage risk. The ROI and profit metrics provided suggest you would obtain full profitability based on the premium. -

Long-Term, Lower Delta and High Vega: For those looking to take advantage of potential increases in implied volatility along with a cushion of a longer expiration period, choosing a strike price further from the forecasted target price could be optimal. Consider the

January 17, 2025, strike price at65.0. This option's lower delta (~0.475) mitigates risk, and the high vega suggests profit potential from increases in volatility. Full profit is projected if KO does not exceed 65. -

Multiple Expirations, Strategic Strikes: Having options staggered across different dates can also benefit different market conditions and volatility scenarios. Engaging in buying both medium and longer expiry options, splitting between more imminent strikes such as

64.0byMay 24, 2024, and farther strikes such as70.0byJune 21, 2025, could hedge against sudden market shifts. The combination of high and medium deltas across these options balances assignment risk and profitability. -

Diverse Expiry, Maximum Profitability: Diversifying the selection further across the spectrum of other strikes like

60.0and90.0for the farthest date available (e.g.,June 20, 2026) provides an additional layer in managing risk by moving far beyond the expected price threshold and gaining from premiums with Kirk's absolute profitability rates.

By considering options across a spectrum of strike prices, from near the current underlying price to far beyond, and varying expiration dates, an investor can balance profitability with risk, capitalizing on expected market movements, and volatility changes. Employing a strategy that blends high and low deltas, along with attention to the other Greeks like vega and theta, ensures a robust approach to options trading with potential to maximize gains while keeping the risk of assignment controlled. Whether striving for quick profits with high-delta calls or playing a longer game with more conservative strikes, understanding these dynamics is crucial in options trading.

Long Put Option Strategy

Analyzing the options chain for The Coca-Cola Company (KO) with a focus on long put options and a goal of profitability in scenarios where the target stock price increases by 5% over the current price provides an insightful exercise in strategic options trading.

-

Near-Term Option (Short Duration): A near-term put option worth considering is the one with a strike price slightly above the 5% target stock price increase and an expiration about one month out. For instance, if the current stock price for Coca-Cola is $60, a 5% increase targets $63. Therefore, selecting a put option with a strike around $65 expiring in one month would be strategic. This particular option might exhibit high theta (time decay) which is a significant factor in short-term options. However, if the put is "out of the money" and the stock rallies as expected, the premium cost of the option would likely decrease, potentially offering profitability if bought back at a lower price or if the stock surprisingly drops.

-

Mid-Term Option (Medium Duration): For an option with a medium duration, one might look at a put with a strike price 5-10% above the current price with an expiry in about 3 to 6 months. Continuing with the earlier example, a put option at a strike price of perhaps $66-$69 expiring in three months might be ideal. Such options have lower theta compared to very short-term options and offer more time for market dynamics to influence stock prices. A higher delta value in these options indicates that they react well to changes in the stock price, making them potentially more responsive and profitable if market conditions reverse.

-

One-Year Option (Moderate Long Duration): Analyzing a put option expiring in one year with a strike price about 10-15% above the current price can also be fruitful. A strike price around $70 for an option expiring in a year leverages both time and volatility represented by Vega. Longer expiration provides less negative impact from theta, whilst a favorable move in stock price could see these puts increasing in value if market conditions shift unfavorably for Coca-Cola.

-

Long-Term Option (Long Duration) Looking further out, a put option with a strike price 15-20% above the current price and an expiration in two years provides a robust opportunity. This option could be advantageous especially if long-term market conditions are expected to be volatile or bearish. With a lower gamma (rate of delta change), these options are less sensitive to small movements in the stock price, hence more suitable for long-term, strategic hedging against downturns.

-

Very Long-Term Option (Very Long Duration) Lastly, a very long-term option such as a put with a strike price 20-25% above the current price expiring in three years is another strategic choice. The extended duration combined with a high Vega would make these options highly sensitive to changes in implied volatility. Even though the cost of such an option might be higher, their long-term coverage provides a significant hedge against market downturns.

Overall, the choices across various expirations and strike prices aim to align with expectations about stock price movements and environmental volatility. Strategic selection of each option is predicated on specific Greek valuesdelta, gamma, theta, and vegawhich indicate their sensitivity to price, time decay, and volatility, thus informing potential profitability in varying market conditions.

Short Put Option Strategy

When selecting profitable short put options for The Coca-Cola Company (KO), it's crucial to regard risk factors such as potential share assignment and to seek a substantial return on investment. We'll evaluate a few specific options across varying expiration dates and strike prices, focusing on minimizing the assignment risk targeting a stock price increase of 5% over the current price limit.

Starting with near-term options: 1. Expiration: 2024-05-31, Strike: $57.50 - The delta of this option is -0.0169258925, suggesting a very low probability of ending in the money (ITM). This option provides a premium of $0.01, which, while minimal, offers a return with very low risk due to the short time frame and a very unfavorable position for assignment. The theta is -0.004058989, reflecting nominal time decay over this period.

- Expiration: 2024-06-07, Strike: $55.00 - With a delta of -0.018020812, the probability of assignment remains low. The premium obtained here is $0.03, and with a strike price closer to current levels than the previous example, there might be a slightly higher risk. The theta here is -0.0040942413, indicating slightly higher daily erosion of the options value, which is beneficial for a short put position.

Medium term: 3. Expiration: 2024-06-21, Strike: $57.50 - The delta at -0.0292377417 still maintains a strong position against assignment. The option premium of $0.05 combines higher income compared to shorter terms with reasonable safety from share assignment (increased vega of 1.3650864286 suggests higher sensitivity to volatility, offering an opening for potentially closing the position in volatility swings).

- Expiration: 2024-08-16, Strike: $60.00 - This option has a delta of -0.1630945, indicating that there's a moderate risk of it finishing ITM. Nonetheless, the attractive premium of $0.41 compensates for this risk adequately. With higher theta (-0.0049376949), the position benefits significantly from time decay, enhancing profitability as the expiration approaches.

Longer-term: 5. Expiration: 2025-01-17, Strike: $60.00 - This pick has a delta of -0.2505410126, which is the highest among chosen options but offset by a hefty premium of $1.35, making it very lucrative. The theta stand at -0.0037597569 is conducive for a long-term hold aiming for gradual profit accumulation through time decay.

In conclusion, each of these options has been selected based on the balance between receiving a high enough premium and minimizing the risk of KO's stock price reaching the strike, hence avoiding assignment. The emphasis is on lower deltas enhancing safety while premiums and theta values suggest effective profitability over time. Risk-averse traders should prefer options with lower deltas, and those with a higher risk appetite might find relatively higher deltas acceptable due to increased premium potential. As always, these trades must align with broader market views and individual risk tolerance.

Vertical Bear Put Spread Option Strategy

Analyzing the vertical bear put spread options strategy for The Coca-Cola Company (KO) involves selecting strategically placed put options to both buy (long) and sell (short), aiming to capitalize on a moderate decrease in KO's stock price. The selected strategy focuses on spreads where a higher strike put is bought and a lower strike put is sold within the same expiration period, creating a net debit situation which is the maximum possible loss.

Here are five choices for executing a vertical bear put spread, considering near-term through long-term options, and aiming for profitability while minimizing the risk of having shares assigned (especially focusing on puts with higher deltas as short positions to minimize this risk):

- Short-Term Strategy (Expiring in 3 Days):

- Buy: Put with a strike price of 67 USD, expiration on 2024-05-17. This put has a very high delta of -0.9799, and while it costs significantly (premium of 5 USD), it controls significant immediate downside.

-

Sell: Put with a strike of 60 USD, expiring on 2024-05-17. This put has a delta of -0.0066, which greatly reduces the chance of assignment, and provides a premium albeit small (0.02 USD).

-

Short to Medium Term Strategy (Expiring in 10 Days):

- Buy: Put with a strike price of 60 USD, expiration on 2024-05-24. This put has a significantly negative delta of -0.0237, implying a stronger impact from stock price decreases.

-

Sell: Put with a strike of 56 USD, expiration on 2024-05-24. Again, choosing a lower delta (-0.0084) to minimize assignment risks, and collecting a small premium of 0.02 USD.

-

Medium-Term Strategy (Expiring in 17 Days):

- Buy: Put with a strike price of 62 USD, expiration on 2024-05-31. The premium is 0.11 USD, and its high gamma and delta suggest a higher sensitivity to stock price movements.

-

Sell: Put with a strike of 57 USD, expiration on 2024-05-31, which offers a positive return through its premium of 0.01 USD and has a lower delta of -0.0170 to minimize assignment risk.

-

Longer-Term Strategy (Expiring in 31 Days):

- Buy: Put with a strike price of 62 USD, expiration on 2024-06-14. This option features a delta of -0.2199 and a premium of 0.31 USD, indicating a good leverage on stock price movements.

-

Sell: Put with a strike of 56 USD, expiration on 2024-06-14. It provides a premium of 0.03 USD and has a significantly lower delta of -0.0167.

-

Long-Term Strategy (Expiring in 66 Days):

- Buy: Put with a strike price of 67.5 USD, expiration on 2024-07-19. With a delta of -0.8622, this option can be quite responsive to a drop in KO prices, albeit for a high premium of 6.89 USD.

- Sell: Put at a strike of 60 USD, also expiring on 2024-07-19. It comes with a lesser risk of having shares assigned due to a low delta of -0.1219, with a premium incentive of 0.23 USD.

Each strategy above is designed to optimize return on investment through managing risk effectively by combining puts with diverse deltas, ensuring both effective downside protection and minimized risk of share assignment.

Vertical Bull Put Spread Option Strategy

For a profitable vertical bull put spread strategy using The Coca-Cola Company (KO) options, we target options that show favorable Greeks to maximize potential returns while managing risk. The essence of this strategy is to sell (write) a put option at a higher strike price and buy a put option at a lower strike price with the same expiration, making it a credit spread. However, based on the provided dataset, no long put options are available, hence the description will focus solely on the short put options available for constructing these strategies.

Potential Strategies and Analysis

-

Near-Term Risky, High ROI Opportunity:

- Short Put:

- Strike Price: $70.0

- Expiration Date: 2024-07-19

- Premium: $11.0

- Delta: -0.6717325365

- ROI: 29.81%

- Comment: The high premium suggests high volatility and potential profitability. The negative delta indicates that as the stock price increases, the option's price decreases which aligns with the bull put spread approach. This high ROI option is attractive, but comes with the greater potential risk, given the outright delta indicating a significant move in stock price can affect option valuation drastically.

- Short Put:

-

Moderate Term with Balanced Risk/Reward:

- Short Put:

- Strike Price: $60.0

- Expiration Date: 2025-06-20

- Premium: $2.09

- Delta: -0.2731374668

- ROI: 100.00%

- Comment: Provides a year for the trade to work with a full return on investment. The moderate delta reflects a decent buffer against price movements in KO stock.

- Short Put:

-

Long-Term High Premium, Lower Frequency Change:

- Short Put:

- Strike Price: $70.0

- Expiration Date: 2025-06-20

- Premium: $10.2

- Delta: -0.7493181162

- ROI: 24.30%

- Comment: This option offers a long expiration with a considerable premium. The risk is mitigated somewhat by the longer timeframe, allowing more room for recovery should the market move unfavorably initially.

- Short Put:

-

Safest Near-Term with Less Reward:

- Short Put:

- Strike Price: $52.5

- Expiration Date: 2024-05-17

- Premium: $0.01

- Delta: -0.0163509412

- ROI: 100.00%

- Comment: Although the premium is low, the risk associated with delta is minimal, making it an almost negligible risk trade for a conservative trader. The ROI remains excellent relative to the risk assumed.

- Short Put:

-

Balanced Longer Term, Moderate Premium:

- Short Put:

- Strike Price: $57.5

- Expiration Date: 2026-01-16

- Premium: $1.49

- Delta: -0.2170227262

- ROI: 100.00%

- Comment: Looking further out, this choice balances between carrying a high enough premium to warrant the return, while still having an exploration far enough in the future that allows management flexibility and a delta that reassures regarding its safety.

- Short Put:

In all these scenarios, the choice of strike price and expiration depends on your risk tolerance, return expectation, and view on the underlying stocks price movement. Due to no long options provided, this analysis assumes only unfavorable moves in KO's stock price would constitute risk mitigation by position monitoring and possibly additional protective measures if implied by the trading strategy. Always use risk management techniques such as stop-loss orders or position sizing to mitigate potential downsides.

Vertical Bear Call Spread Option Strategy

Analyzing a vertical bear call spread strategy for The Coca-Cola Company (KO) requires careful examination of various strike prices and expiration dates to create the most effective and profitable combinations while minimizing the risk of assignment. The chosen strategy positions should reflect current market expectations and volatility, particularly aiming to benefit from a slight decline in stock price or stabilization around the current stock price.

Option Choices for Vertical Bear Call Spreads:

- Short-term, High Delta Strategy - Expire 2024-05-17:

- Sell the Call: Strike 45.0, Delta ~0.9974

- Buy the Call: Strike 47.0, Delta ~0.9969

-

Strike price difference is minimal, reducing potential losses, and both options have high delta values close to 1, which indicates a high likelihood of ending in-the-money if the underlying price rises. It presents a significant risk of assignment but maximizes premium returns given the short maturity period.

-

Medium-term, Moderate Delta Strategy - Expire 2024-06-07:

- Sell the Call: Strike 55.0, Delta ~0.8547

- Buy the Call: Strike 57.0, Delta ~0.8935

-

A suitable spread with medium-term expiration, strikes are spread moderately apart allowing for collection of a decent premium while still maintaining a manageable risk profile. Given the deltas, this strategy offers a good balance between risk and reward with a moderate likelihood of the stock price reaching these strikes.

-

Long-term, Lower Delta Strategy - Expire 2024-09-20:

- Sell the Call: Strike 60.0, Delta ~0.7303

- Buy the Call: Strike 62.5, Delta ~0.8325

-

Opting for lower delta values in a longer-term scenario allows for capturing premiums while the stock price is unlikely to significantly surpass these levels. It provides a strategic spread, minimizing assignment risks due to lower sensitivity to stock price movements at these strikes.

-

Very Long-term, Structural Play - Expire 2025-06-20:

- Sell the Call: Strike 62.5, Delta ~0.5840

- Buy the Call: Strike 65.0, Delta ~0.5031

-

This longer-term strategy is ideal for a more bearish outlook, anticipating that the stock will not exceed these higher strikes significantly. Lower deltas for both options significantly reduce the risk of assignment while also preparing for gradual market movements or stock depreciation.

-

Extremely Long-term, Hedge Against Unlikely Moves - Expire 2026-01-16:

- Sell the Call: Strike 55.0, Delta ~0.7352

- Buy the Call: Strike 57.5, Delta ~0.6902

- Targeting an extended period into the future gives a wide berth for the stock price to fluctuate without posing an imminent risk of overcoming strike prices. The chosen strikes and their low deltas cushion against drastic upward movements to retain collected premiums effectively.

Conclusion: When employing vertical bear call spreads, it's crucial to optimize the strikes and expiries according to the prevailing market conditions and forecasts about stock price movements. This strategy analysis for KO involves a spectrum from aggressive short-term positions with high deltas to safeguarded long-term positions with lower deltas, aimed at maximizing profits from premiums and warding off potential losses from unwanted assignments. These varied expiration dates from near-term to very long-term provide flexibility and adaptability to different market scenarios, aligning risk tolerance with market dynamics and expected stock performance trajectories.

Vertical Bull Call Spread Option Strategy

After evaluating the options chain for a vertical bull call spread strategy for The Coca-Cola Company (KO), there are several potential strategies that stand out based on the provided data on "The Greeks" and options characteristics. Here are five choices that span from near-term to long-term options, focusing on minimization of risk and maximizing potential profitability:

- Near-Term Choice (May 17, 2024):

- Buy Call: Strike price at $52.50 with a delta of 0.995, theta of -0.012, and premium of $10.0.

- Sell Call: Strike price at $55.00 with a delta of 0.993, theta of -0.013, and premium of $8.55.

This spread involves buying a deep-in-the-money call and selling a less in-the-money call. The choice of strikes close together limits the max possible loss and high deltas increase the probability of ending in-the-money, thus potentially yielding higher returns. The closer expiration offers cheaper premiums, reducing initial costs and sensitivity to time decay (theta).

- Mid-Term Choice 1 (June 7, 2024):

- Buy Call: Strike price at $57.00 with a delta of 0.893 and a premium of $5.45.

- Sell Call: Strike price at $60.00 with a delta of 0.846 and a premium of $3.8.

This configuration has lower deltas compared to the short-term plan, which means lower premiums and lower risk due to less aggressive exposure to price movements. The strategy provides a balance between premium cost, potential profitability, and time for price movement, suitable for moderate market bullishness.

- Mid-Term Choice 2 (September 20, 2024):

- Buy Call: Strike price at $55.00 with a delta of 0.849 and a premium of $8.67.

- Sell Call: Strike price at $57.50 with a delta of 0.806 and a premium of $6.85.

This option setup with a longer time to expiration allows for more time for Coca-Cola's stock to move within our expected range. The spread between the strikes is slightly wider, potentially increasing the maximum profit but also involving slightly higher initial investment.

- Long-Term Choice 1 (January 17, 2025):

- Buy Call: Strike price at $45.00 with a delta of 0.914 and a premium of $17.8.

- Sell Call: Strike price at $47.50 with a delta of 0.892 and a premium of $16.04.

Longer expiration dates maximize the effect of positive market trends over time. Deltas close to 1 increase the likelihood of the options ending in the money. This strategy combines potent leverage with the security of a limited loss, balancing premium costs and movement space for KOs price.

- Long-Term Choice 2 (June 20, 2025):

- Buy Call: Strike price at $45.00 with a delta of 0.884 and a premium of $17.67.

- Sell Call: Strike price at $50.00 with a delta of 0.837 and a premium of $14.25.

A widely spaced strike offers a higher potential maximum profit at the risk of a greater upfront cost. The extended time frame until expiration provides substantial opportunity for Coca-Colas stock to appreciate, fitting a long-term bullish outlook.

Each strategy selection involves trade-offs between costs, potential value, risk levels, and duration until expiration. These strategies should be considered based on market conditions closer to the transaction date, your investment horizon, and your appetite for risk.

Similar Companies in Beverages - Non-Alcoholic:

Monster Beverage Corporation (MNST), Celsius Holdings, Inc. (CELH), Coca-Cola Consolidated, Inc. (COKE), Keurig Dr Pepper Inc. (KDP), PepsiCo, Inc. (PEP), Coca-Cola FEMSA, S.A.B. de C.V. (KOF), Coca-Cola Europacific Partners PLC (CCEP), The Vita Coco Company, Inc. (COCO), Primo Water Corporation (PRMW)

https://www.fool.com/investing/2024/03/31/coca-cola-pepsi-and-hormel-are-all-magnificent-div/

https://www.fool.com/investing/2024/03/31/should-you-buy-this-high-yield-beverage-stock/

https://www.fool.com/investing/2024/04/03/years-worth-of-passive-income-is-hiding-in-plain-s/

https://www.youtube.com/watch?v=wLtAfiYm4Ag

https://www.cnbc.com/2024/04/06/gatorade-expands-into-new-products-including-plain-water.html

https://seekingalpha.com/article/4682535-coca-cola-hbc-cheap-at-less-than-7-times-ebitda

https://www.fool.com/investing/2024/04/11/is-coca-cola-stock-a-screaming-buy-after-its-big/

https://seekingalpha.com/article/4683516-55-april-dividend-kings-buy-8-watch-8

https://www.fool.com/investing/2024/04/16/1-magnificent-sp-500-dividend-stock-down-7-to-buy/

https://www.fool.com/investing/2024/04/16/3-warren-buffett-stocks-to-buy-hand-over-fist/

https://www.fool.com/investing/2024/04/16/coca-cola-stock-upside-wall-street-analyst/

https://www.fool.com/investing/2024/04/16/2-warren-buffett-stocks-to-hold-forever/

https://seekingalpha.com/article/4684313-buy-11-mediamade-april-proactive-dividend-dogs

https://www.sec.gov/Archives/edgar/data/21344/000002134424000017/ko-20240329.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: gXbH3JO

Cost: $1.22309