Lamar Advertising Co (ticker: LAMR)

2023-12-27

Lamar Advertising Co (ticker: LAMR) is a prominent outdoor advertising company that specializes in billboards, digital signage, and transit advertising displays. Founded in 1902 and headquartered in Baton Rouge, Louisiana, the company has built an extensive network of over 351,000 displays in the United States and Canada, making it one of the largest outdoor advertising firms in North America. Its inventory consists of traditional and digital billboards, which are strategically located along highways and city streets, as well as transit advertisements found on buses, benches, and shelters, catering to a diverse set of advertisers. Lamar Advertising Co operates under a REIT (Real Estate Investment Trust) structure, focusing on generating revenue through selling advertising space to businesses and organizations, ranging from local enterprises to large national corporations. This structure provides potential tax advantages and requires the company to distribute a substantial portion of its taxable income to shareholders as dividends. The company's financial performance and stock market valuation are influenced by factors such as ad spending trends, occupancy rates of advertising spaces, and the impact of digital media on outdoor advertising demand.

Lamar Advertising Co (ticker: LAMR) is a prominent outdoor advertising company that specializes in billboards, digital signage, and transit advertising displays. Founded in 1902 and headquartered in Baton Rouge, Louisiana, the company has built an extensive network of over 351,000 displays in the United States and Canada, making it one of the largest outdoor advertising firms in North America. Its inventory consists of traditional and digital billboards, which are strategically located along highways and city streets, as well as transit advertisements found on buses, benches, and shelters, catering to a diverse set of advertisers. Lamar Advertising Co operates under a REIT (Real Estate Investment Trust) structure, focusing on generating revenue through selling advertising space to businesses and organizations, ranging from local enterprises to large national corporations. This structure provides potential tax advantages and requires the company to distribute a substantial portion of its taxable income to shareholders as dividends. The company's financial performance and stock market valuation are influenced by factors such as ad spending trends, occupancy rates of advertising spaces, and the impact of digital media on outdoor advertising demand.

| As of Date: 12/27/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 10.89B | 8.51B | 10.12B | 10.18B | 9.60B | 8.39B |

| Enterprise Value | 15.53B | 13.09B | 14.68B | 11.18B | 13.94B | 12.75B |

| Trailing P/E | 26.43 | 20.36 | 23.97 | 23.18 | 19.34 | 18.33 |

| Forward P/E | 29.50 | - | - | - | - | - |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 5.21 | 4.10 | 4.92 | 5.00 | 4.82 | 4.32 |

| Price/Book (mrq) | 9.18 | 7.27 | 8.72 | 8.52 | 7.54 | 6.76 |

| Enterprise Value/Revenue | 7.43 | 24.13 | 27.13 | 23.72 | 26.03 | 24.17 |

| Enterprise Value/EBITDA | 16.03 | 49.60 | 58.06 | 58.05 | 53.72 | 51.27 |

| Address | 5321 Corporate Boulevard | City | Baton Rouge | State | LA |

|---|---|---|---|---|---|

| ZIP | 70808 | Country | United States | Phone | 225 926 1000 |

| Fax | 225 926 1005 | Website | https://www.lamar.com | Industry | REIT - Specialty |

| Sector | Real Estate | Full Time Employees | 3,500 | Previous Close | 106.76 |

| Open | 107.04 | Day Low | 106.7992 | Day High | 108.06 |

| Dividend Rate | 5.00 | Dividend Yield | 4.68% | Payout Ratio | 122.52% |

| Five Year Avg Dividend Yield | 4.31% | Beta | 1.476 | Trailing PE | 26.50 |

| Forward PE | 20.63 | Volume | 210,556 | Average Volume | 529,400 |

| Average Volume 10 days | 614,550 | Bid | 98.75 | Ask | 112.43 |

| Market Cap | 10,921,946,112 | 52 Week Low | 77.21 | 52 Week High | 112.34 |

| Price to Sales Trailing 12 Months | 5.2169 | Fifty Day Average | 95.9794 | Two Hundred Day Average | 94.1984 |

| Trailing Annual Dividend Rate | 4.95 | Trailing Annual Dividend Yield | 4.6366% | Enterprise Value | 15,531,144,192 |

| Profit Margins | 19.72% | Float Shares | 86,774,935 | Shares Outstanding | 87,578,096 |

| Shares Short | 3,007,700 | Shares Percent Shares Out | 2.95% | Held Percent Insiders | 0.864% |

| Held Percent Institutions | 96.34% | Short Ratio | 5.5 | Short Percent of Float | 4.0599% |

| Implied Shares Outstanding | 101,998,000 | Book Value | 11.635 | Price to Book | 9.2033 |

| Last Fiscal Year End | 1672444800 | Most Recent Quarter | 1696032000 | Earnings Quarterly Growth | -4.20% |

| Net Income to Common | 412,416,000 | Trailing EPS | 4.04 | Forward EPS | 5.19 |

| PEG Ratio | 7.47 | Last Split Factor | 3:2 | Last Split Date | 888796800 |

| Enterprise to Revenue | 7.418 | Enterprise to EBITDA | 16.384 | 52 Week Change | 14.18% |

| S&P 52 Week Change | 26.21% | Last Dividend Value | 1.25 | Exchange | NMS |

| Current Price | 107.08 | Target High Price | 112.00 | Target Low Price | 92.00 |

| Target Mean Price | 103.00 | Target Median Price | 105.00 | Recommendation Mean | 2.60 |

| Number of Analyst Opinions | 3 | Total Cash | 39,395,000 | Total Cash Per Share | 0.386 |

| EBITDA | 947,948,992 | Total Debt | 4,681,147,904 | Quick Ratio | 0.506 |

| Current Ratio | 0.548 | Total Revenue | 2,093,574,016 | Debt to Equity | 394.42 |

| Revenue Per Share | 20.557 | Return on Assets | 5.62% | Return On Equity | 33.61% |

| Gross Profits | 1,369,167,000 | Free Cash Flow | 484,445,760 | Operating Cash Flow | 773,926,976 |

| Earnings Growth | -4.70% | Revenue Growth | 2.70% | Gross Margins | 67.08% |

| EBITDA Margins | 45.28% | Operating Margins | 34.59% | Currency | USD |

Upon reviewing the technical indicators and company fundamentals for LAMR, it is evident that the stock's trajectory has been positive over the recent months, with the price moving from the low 90s to above 107. However, there is a marked decline in the MACD histogram, which suggests that the momentum behind this upward trend may be waning. In combination with the On-Balance Volume (OBV) indicator, which has shown some fluctuation but remains on the higher end, there is a signal that buying pressure has been sufficient to support the stock's rise. However, the recent tapering in the OBV could also indicate a potential slowdown in buying activity.

The fundamentals of LAMR paint an interesting picture. The company has seen an appreciable increase in its market cap over the year, along with an increase in the trailing P/E ratio, indicating that the company is valued higher by the market relative to its earnings compared to the previous year. This could suggest investor optimism about the future earnings potential of the company. However, the forward P/E ratio is high, which might imply that the market expects slower growth in earnings or is willing to accept lower yields from future earnings. The absence of a PEG ratio (5 yr expected) makes it difficult to ascertain if the stock's growth rate is expected to match its P/E justification, suggesting a need for caution.

The Price/Sales (ttm) and Price/Book (mrq) ratios are also elevated relative to the past, possibly indicating the stock is becoming more expensive against these metrics. The Enterprise Value/Revenue and Enterprise Value/EBITDA ratios are lower than one year prior, suggesting some improvement from the standpoint of scale and operating performance.

As for financials, normalized EBITDA and operating income show healthy figures, indicating solid operational efficiency. The increase in EBITDA and operating incomes implies that the company is managing its operational costs and leveraging its revenues effectively. The net income trend is also positive which contributes to the stock's attractive appearance to fundamental-focused investors.

Taking into account the technical indicators and fundamentals together, the upward trend in LAMR's stock price over the preceding months may experience pressure in the upcoming months. The elevated valuation ratios suggest that the market has high expectations for the stock, which could be a double-edged sword if future earnings reports do not meet these expectations.

Investors should monitor several key factors, including the OBV for signs of continued investor support, the MACD histogram for momentum shifts, and fundamental announcements that might impact the P/E and other valuation ratios. Future price movements can also be influenced by macroeconomic conditions, market sentiment, and industry-specific news.

Based on the technicals and current fundamentals, the outlook for LAMR in the next few months is cautiously optimistic. However, given the recent weakening momentum, a period of consolidation or mild correction could occur before any further sustained upward price movement. Close attention should be paid to both upcoming earnings reports and broader market trends, as these could significantly influence the stock's direction. Investors should remain agile, ready to adjust their perspectives as new data comes to light.

Lamar Advertising Company, alongside OFG Bancorp and Landsea Homes Corporation, has recently garnered attention due to new analyst coveragea development that signifies potential investor interest and the prospect of future value in the company. Analyst coverage plays a critical role in the investment decision-making process, providing access to a wealth of information and data that can help forecast a company's prospects. Analysts offer an intermediary perspective that is often valued by investors, especially when it comes to companies like Lamar that previously had limited coverage.

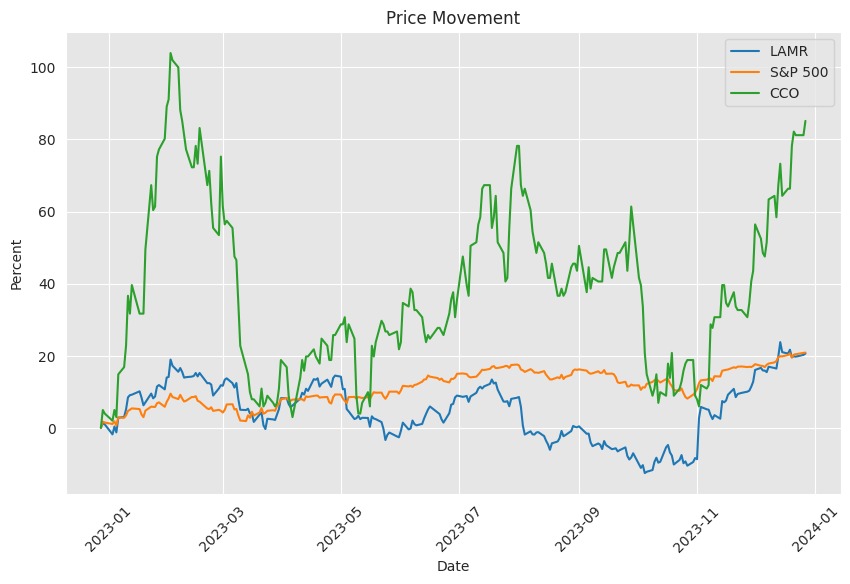

Known for its extensive footprint across North America, Lamar manages approximately 363,000 displays, including billboards, interstate logos, transit options, and airport displays. These assets service the advertising needs of both local businesses and national brands. Against an industry backdrop that saw a 2.9% decline over the past year, Lamar's stock performance has shown resilience with a 10.6% gaina testament to the companys strong market positioning.

This upward trend has been acknowledged by analysts who have begun to cover the company. Recommendations from these analysts often have a tangible impact on stock prices, with new coverage or positive ratings typically causing an upward price movement. Lamar currently holds a Zacks Rank #2 (Buy), indicative of analysts' confidence in its value and future growth prospects. The companys projected earnings per share (EPS) year-over-year growth rate stands at 5.1% for 2024, with EPS estimates for the same year having been revised upward, reflecting a positive sentiment about the companys earning potential.

The investment strategy informed by analyst coverage emphasizes identifying stocks with increased analyst attention and improved ratings. Lamar exceeds the criteria for investor interest with a stock price over $5 and an average daily volume over 100,000 shares, making the company a more attractive consideration for investors looking for newly-covered stocks that show promise.

Recently, Cohen & Steers, Inc. made an announcement of critical importance to stakeholders in the real estate investment sector, pertaining to the Realty Majors Portfolio Index (RMP) and the Global Realty Majors Portfolio Index (GRM). Lamar Advertising Co. was added to these indexes, while Healthpeak Properties Inc. was removed. This change signifies the index's focus on diversification and the recognition of real estate-related asset classes that move beyond traditional property ownership. Cohen & Steers' confidence in Lamar Advertising Co. reflects its relevance to the securitization of real estate globally.

Cohen & Steers' indexes serve as benchmarks, stock selection universes, and foundations for derivative instruments. They are modified market capitalization-weighted, offering reflections of select real estate equity securities. With index weightings independently calculated by Standard & Poor's, the modifications to these indexes set to take effect at the close of business on November 17, 2023, could affect the visibility and perceptions of Lamar Advertising among investors and analysts.

Lamar Advertising's third-quarter results in 2023 reported an adjusted funds from operations (AFFO) per share of $2.04, which exceeded the Zacks Consensus Estimate of $1.91. The year-over-year increase in AFFO per share indicates a solid financial base for the company. Despite slight variations in net revenues and increased interest expenses, the company's increase in operating income and EBITDA demonstrates robust operations. The CEO, Sean Reilly, showed optimism by stating a potential to exceed the higher end of the companys revised guidance for the full-year diluted AFFO per share.

Shifting focus to the stock market trends, Lamar Advertising has performed impressively over the past three months, with stock value rising by 19.1%, overshadowing the industry's growth. The companys national presence, leadership in the digital billboard market, expansion efforts, robust cash flow, and efficient reinvestment strategies embodied in its ROE suggest strong growth potential. A consistent track record of dividend raises further bolsters investor attractiveness.

Artisan Value Income Fund, in its investor letter, stated concerns about a deceleration in client engagement regarding contract renewals and new agreements for Lamar. However, the company's long-term outlook and consistency in generating steady free cash flow and growing dividends contribute positively to its investment appeal. The slight decrease in hedge fund portfolios holding Lamar does not predominate the interest from this sector.

Lastly, Lamar's recent investor communications reflect operational resilience and agility. CEO Sean Reilly expounded on the measures taken to enhance revenue and reduce expenses, demonstrating prudent management during economic challenges. The focused expansion in digital billboard displays and selective acquisitions underscore Lamar's strategic direction. Furthermore, CFO Jay Johnson provided financial insights into the company's performance and affirmed the continuation of strong operating expense management and a consistent dividend policy.

In light of contrasting views on the real estate sector, with the likes of Charlie Munger issuing warnings and Barry Sternlicht recognizing opportunities, it is clear that market dynamics and prospects can vary significantly across different property sectors. Lamar Advertising operates within a niche that is distinct from Munger's troubled office and retail spaces. The demand for outdoor advertising and strategic placements may safeguard REITs in this segment from broader market turmoil.

Consequently, Lamar Advertising Company's announcement of a quarterly cash dividend of $1.25 per share highlights the company's financial stability and its assurance in its cash flow and profitability. With a robust mix of traditional and digital advertising capabilities, Lamar exhibits promising growth and innovation. However, it is crucial for investors to consider the forward-looking statements involved, recognizing both potential and risks.

In summary, Lamar's consistent dividend history and pronounced growth rates make it an attractive prospect for income-focused investors. Its high dividend payout ratio merits observation, contrasting with its strong profitability and expansion capabilities. Investors must, therefore, continuously assess the company's financial health and the potential impacts of market changes on the sustainability of dividend payments.

Similar Companies in Marketing Services:

Clear Channel Outdoor Holdings, Inc. (CCO), OUTFRONT Media Inc. (OUT), National CineMedia, Inc. (NCMI)

News Links:

https://finance.yahoo.com/news/cohen-steers-announces-changes-realty-210500710.html

https://finance.yahoo.com/news/3-stocks-focus-analyst-coverage-144300882.html

https://finance.yahoo.com/news/lamar-lamr-stock-3-1-144800521.html

https://finance.yahoo.com/news/wise-add-lamar-lamr-stock-152900063.html

https://finance.yahoo.com/news/lamar-advertising-company-nasdaq-lamr-122515441.html

https://finance.yahoo.com/news/hold-lamar-advertising-company-lamr-133250556.html

https://finance.yahoo.com/news/lamar-advertising-cos-dividend-analysis-100938060.html

https://finance.yahoo.com/news/lamar-advertising-company-announces-cash-210500348.html

https://seekingalpha.com/article/4607070-billionaire-investor-says-sell-real-estate

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: a8tLvND

https://reports.tinycomputers.io/LAMR/LAMR-2023-12-27.html Home