Linde plc Ordinary Share (ticker: LIN)

2023-12-26

Linde plc Ordinary Share (ticker: LIN) is a pivotal player in the global industrial gases and engineering sector. Headquartered in Dublin, Ireland, Linde operates with a strong presence in more than 100 countries. The company provides atmospheric gases such as oxygen, nitrogen, and argon, along with process gases like hydrogen and helium, for various industries, including healthcare, petroleum refining, manufacturing, food processing, and electronics. In addition, Linde is a leader in developing technology solutions for green energy, encompassing hydrogen energy and carbon capture to aid in climate change mitigation. With its merger with Praxair in 2018, Linde has asserted itself even further as a dominant force in the market. The stock, trading under the symbol LIN on the New York Stock Exchange, reflects Linde's financial health and is a closely watched barometer of the company's ongoing performance and strategic initiatives in an increasingly environmentally conscious global economy.

Linde plc Ordinary Share (ticker: LIN) is a pivotal player in the global industrial gases and engineering sector. Headquartered in Dublin, Ireland, Linde operates with a strong presence in more than 100 countries. The company provides atmospheric gases such as oxygen, nitrogen, and argon, along with process gases like hydrogen and helium, for various industries, including healthcare, petroleum refining, manufacturing, food processing, and electronics. In addition, Linde is a leader in developing technology solutions for green energy, encompassing hydrogen energy and carbon capture to aid in climate change mitigation. With its merger with Praxair in 2018, Linde has asserted itself even further as a dominant force in the market. The stock, trading under the symbol LIN on the New York Stock Exchange, reflects Linde's financial health and is a closely watched barometer of the company's ongoing performance and strategic initiatives in an increasingly environmentally conscious global economy.

| As of Date: 12/25/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 199.16B | 181.69B | 185.95B | 174.26B | 160.66B | 133.28B |

| Enterprise Value | 213.27B | 195.82B | 199.76B | 187.61B | 172.25B | 145.67B |

| Trailing P/E | 33.97 | 32.55 | 42.39 | 43.19 | 43.20 | 39.07 |

| Forward P/E | 26.60 | 24.51 | 27.86 | 26.60 | 25.25 | 20.66 |

| PEG Ratio (5 yr expected) | 1.48 | 3.02 | 3.51 | 3.29 | 2.68 | 2.27 |

| Price/Sales (ttm) | 6.26 | 5.59 | 5.72 | 5.37 | 4.91 | 4.24 |

| Price/Book (mrq) | 5.12 | 4.52 | 4.65 | 4.35 | 4.27 | 3.36 |

| Enterprise Value/Revenue | 6.57 | 24.01 | 24.35 | 22.90 | 21.81 | 16.56 |

| Enterprise Value/EBITDA | 18.01 | 64.29 | 66.23 | 64.12 | 63.77 | 53.73 |

| City | Woking | Country | United Kingdom | Phone | 44 14 8324 2200 |

| Industry | Specialty Chemicals | Sector | Basic Materials | Full-time Employees | 66,442 |

| CEO Name | Mr. Sanjiv Lamba | CEO Age | 58 | CEO Total Pay | $6,032,011 |

| Previous Close | 409.13 | Open | 410.59 | Day Low | 408.7645 |

| Day High | 412.28 | Market Cap | $199,163,707,392 | Shares Outstanding | 484,889,984 |

| Dividend Rate | 5.1 | Dividend Yield | 1.24% | Payout Ratio | 41.32% |

| Beta | 0.894 | Trailing PE | 34.00 | Forward PE | 26.62 |

| Book Value | 80.22 | Price to Book | 5.12 | Profit Margins | 18.44% |

| Enterprise Value | $214,612,918,272 | Operating Cashflow | $8,673,000,448 | Revenue | $32,451,000,320 |

| Earnings Growth | 22.9% | Revenue Growth | -7.3% | Ebitda Margins | 36.34% |

Executive Summary:

A comprehensive analysis of the technical and fundamental data for LIN indicates prospective trends for the stock price in the coming months. Following the evaluation of the provided information, the synthesized outcome reveals several key points: - An ascending trend in open and close prices has been observed over the analysis period, indicating robust upward momentum. - The On-Balance Volume (OBV) showed a marked increase, suggesting that volume is confirming the uptrend. - The Moving Average Convergence Divergence (MACD) histogram values depict a bearish divergence towards the end of the period, suggesting a potential reversal or a slowdown in upward momentum.

Technical Analysis:

Analyzing the price trend over the past few months shows that LIN has been in an uptrend with higher highs and higher lows, a classic bullish pattern. The closing prices on the last trading day suggest strength, as the close was near the upper end of the trading range. Furthermore, the increasing OBV indicates significant buying pressure backing the recent price gains.

However, despite the strong uptrend, the MACD histogram's negative values and their increase in negativity towards the latest date are of concern. This divergence can often precede a reversal or at least signal a consolidation phase where the price may trade sideways or pull back slightly.

Fundamental Analysis:

The fundamental snapshot presents a robust situation for LIN with an increasing market cap over the recent quarters, pointing to solid investor confidence. The trailing and forward P/E ratios are relatively high, which can be interpreted as the market pricing in growth expectations or possibly an overvaluation, depending on context and industry benchmarks. The PEG ratio, while lower than a year prior, indicates that growth is still not fully reflected in the stock price.

The Price/Sales (ttm) ratio has increased over the year, showing the stock is becoming pricier relative to its sales performance. Likewise, the Price/Book (mrq) has increased, revealing the stock could be accumulating a premium above its book value.

Moreover, the financials display steady operating income and net income growth, with EBITDA remaining robust. The normalized income and operating income suggest that the core business is performing well.

Conclusion:

Combining the TA and fundamental analysis, LIN shows a strong performance with potential concerns about its current valuation. The positive uptrend could continue in the near term, supported by solid financial performance and investor sentiment. However, the negative divergence in the MACD histogram advises caution. It would be reasonable to expect some consolidation or a minor pullback following the recent gains before any potential resumption of the uptrend.

Investors should monitor subsequent volume and price action for confirmation of trend continuation or potential trend weakness. In summary, while the technical and fundamental picture for LIN is favorable, the heightened valuations could limit significant short-term appreciation until the stock's growth can justify the increased P/E and P/S ratios.

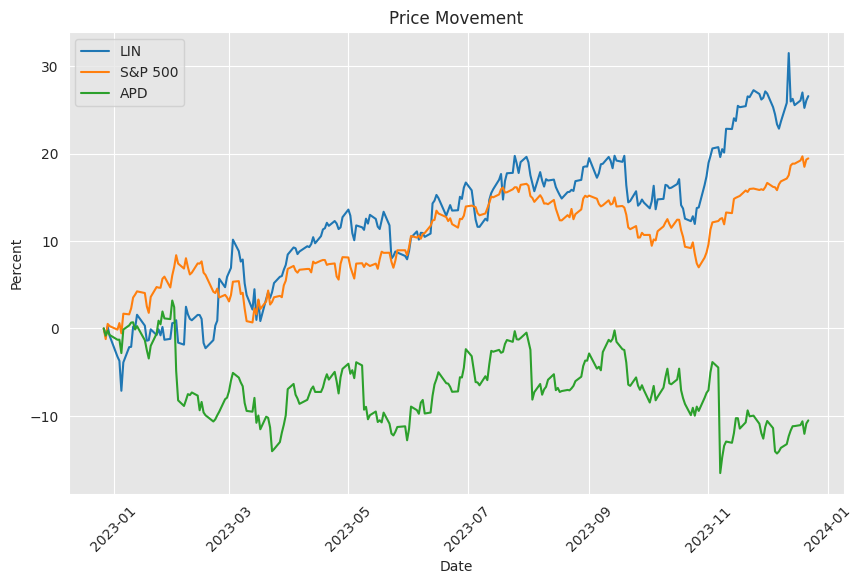

Linde plc, a leading industrial gases company, has garnered less attention from the average investor despite its impressive stock performance. Since 2018, the company has witnessed a meteoric rise in its share price, with an 186% increase that substantially outpaces the S&P 500 index's 90% total return over the same period. This remarkable growth trajectory speaks volumes about Linde's robust business model and its ability to deliver shareholder value consistently.

The achievement in stock performance is mirrored by Linde's market leadership and potential for continued expansion. Renowned for its global presence and being the largest industrial gases company by market capitalization, it has erected a formidable production and distribution network. The industrial gases sector is characterized by high entry barriers, and Linde leverages this to maintain a significant competitive advantage over potential new entrants.

Linde's dominance is particularly evident in its key markets; the United States and China contribute sizably to its revenue, with 32% and 8%, respectively, as noted in its 2022 financial report. The company's commercial strategy is diverse, tapping into sectors such as healthcare, food and beverage, electronics, mining, etc. The breadth of its customer base insulates Linde from downturns in any single industry, allowing for robust cash flow generationa critical indicator of financial well-being.

When compared with close competitor Air Products, Linde showcases superior free cash flow metrics, which is more indicative of a company's ability to grow and finance dividends and expansions over EPS figures that can be more sensitive to accounting practices. Linde's free cash flow performance indicates a strong ability to reinvest in the business and distribute returns to shareholders.

One of the most exciting prospects for Linde is its investment in the hydrogen economy. The company has committed to hydrogen production along with its suite of industrial gases, which includes oxygen, nitrogen, and argon. Linde is further solidifying its position in the U.S. hydrogen market with increased production at the Alabama facility, intending to meet the rising local demand. Additionally, the construction of a blue hydrogen plant in Texas, set to commence operations in 2025, underscores Linde's strategic endeavors to lead in this emerging field.

A review of Linde's recent financials indicates sales reaching $33 billion in 2022. Engaged in the production of clean hydrogen and carbon capture systems, the company's vast range of industries served includes chemicals and energy, making it integral to the global energy transition. Linde prides itself on offering solutions, technologies, and services that not only drive customer success but also promote sustainability, evidenced by its carbon capture initiatives.

Highlighting the company's unwavering growth and commitment to environmental stewardship, Linde continues to expand its hydrogen production capabilities, most notably with the upgrade of its McIntosh, Alabama facility. This project aims to produce up to 30 tons of liquid hydrogen per day, meeting the demands of varied sectors like manufacturing and mobility. The investment of approximately $90 million in the facility showcases Linde's role as a leading liquid hydrogen supplier in the country and its broader strategic vision for a robust supply network throughout the United States.

From a market activity standpoint, Linde plc shares, after reaching record highs, experienced a pullback with a 5% drop on one Wednesday morning, erasing much of the gains from the previous session. Nonetheless, the company's overall annual performance remains potent, with the share price dip seen as a regular market retracement rather than a reflection of any fundamental weaknesses. Encouragingly, analyst forecasts remain positive, with upgrades from financial firms like Morgan Stanley, which adjusted Linde's stock price target upward by $30 to $450.

On a different note, Pfizer's shares have faced a downward trend, with the disclosure of projected declines in sales of their COVID-19 related products for 2024. This has affected not only Pfizer but the vaccine industry at large. Such occurrences highlight the diverse factors influencing stock valuations and the sensitivity of the market to corporate projections and economic signals.

Another facet of Linde's performance is its sustainability efforts. The company has consistently scored in the top echelon of the chemical sector in the Corporate Sustainability Assessment by S&P Global. Lindes transparency in reporting emissions, including all categories of Scope 3 emissions, and adherence to sustainability targets, such as a certain reduction in GHG emissions by 2035 and climate neutrality by 2050, place it at the forefront of sustainable industrial practices.

Linde is also a prominent player when it comes to rewarding shareholders, as evidenced by its inclusion on the Dividend Champions list for its track record of consistent dividend payment. This recognition fortifies Linde's image as a staple in portfolios seeking both income generation and growth potential. Its continuous dividend growth signals operational excellence and a commitment to shareholder returns.

Looking at the experience of an investor with substantial holdings in Linde, the decision to sell some shares to finance a new home can reflect the ever-present balance faced by investors between financial strategies and personal lifestyle choices. This investor's experience illustrates the flexibility required to accommodate significant life changes within the framework of an investment strategy that, in this case, has been centered on dividend growth stocks, such as Linde, for passive income generation.

Linde plc recently gained attention as a rare 'Buy' or 'Strong Buy' recommendation highlighted in Seeking Alpha's "Rare Stock Picks In November 2023" series. Analysts have held a selective stance in positively endorsing stocks that show promising upside amid a seemingly sustained market rally. This selective bullish advocacy illustrates the discerning nature of investment recommendations and points to the significance of Linde plc within the investment landscape.

In further industry comparisons, one can observe Barrick Gold Corporation's (GOLD) Q3 2023 results, which yielded mixed financial performance. With net earnings surpassing expectations, yet sales and copper production falling short of estimates, Barrick showcases the diversity in performance metrics across different sectors. The financial stability and year-over-year earnings growth forecast by analysts for Linde plc stand in contrast to Barrick's more varied results and highlight Linde's ongoing potential within the industrials sector.

Linde's performance against industry benchmarks is a noteworthy aspect. With shares advancing ahead with a 21.8% year-to-date increase, Linde's business strategy has been adept at securing stable revenue through long-term contracts with on-site customers with minimum purchase guarantees. Despite potential vulnerabilities, such as competitive pressures and global uncertainties, Linde's strategic positioning and commitment to innovation lend it a commendable growth outlook.

As large corporations formulate acquisition strategies that impact related sectors, ExxonMobil's strategy, which includes significant investments in Denbury Resources and Pioneer Natural Resources, may signal beneficial opportunities for Linde. The emphasis on carbon capture and sequestration technologies following these mergers could reinforce potential partnerships and further Linde's environmental technology ventures.

Including Linde plc in a million-dollar diversified portfolio presents a strategic investment in the industrial gas sector. With its dual strengths in capital growth and income generation, Linde is poised to be a compounder in an investment strategy focused on long-term cash flow compounding and shareholder value. This approach aligns with both market performance and sector-wise diversification.

Amidst the volatility of hydrogen-focused stocks, industrial giant Linde plc emerges as an appealing alternative for investors seeking exposure to the hydrogen market without the associated financial risks. Its profitable history and diversified operations contrast sharply with other companies like Plug Power, which have struggled with profitability challenges.

Comparable companies in the Basic Materials sector, such as Celanese Corporation (CE), have faced their own set of challenges including demand conditions and competitive factors, yet managed to report earnings exceeding expectations. Despite sales falls short of projections, companies like Linde plc have continued to exhibit sustainable growth, as evidenced by their performance and growth forecasts.

Finally, Linde's continuous recognition in the Dow Jones Sustainability World Index serves as an emblem of its dedication to sustainable operations and corporate governance. With an aim to help customers reduce carbon emissions and a comprehensive sustainability agenda, Linde is a key player in the industrial sectors push towards environmental stewardship and responsible business practices.

With Linde plc's importance in the UK market, the company stands as a reliable investment amidst the current economic climate. Sharing the space with other corporate giants in the UK, Linde endures as a financial stronghold, drawing institutional investors and hedge funds despite market fluctuations. Its essential role in a variety of industries ensures its place as a top investment option in the UKs economic landscape.

Similar Companies in Specialty Chemicals:

Air Products and Chemicals, Inc. (APD), Air Liquide (AIQUY), Praxair, Inc. (LIN), Messer Group GmbH (MG), Taiyo Nippon Sanso Corporation (TYO:4091)

News Links:

https://www.fool.com/investing/2023/12/15/this-stock-is-up-162-since-2018-and-most-investors/

https://finance.yahoo.com/news/linde-increases-hydrogen-production-southeast-111500908.html

https://www.fool.com/investing/2023/12/13/2-big-name-stocks-are-falling-wednesday-heres-why/

https://finance.yahoo.com/news/linde-recognized-sustainability-leader-p-113000930.html

https://seekingalpha.com/article/4654898-why-i-made-big-changes-to-my-dividend-growth-portfolio

https://finance.yahoo.com/news/barrick-gold-q3-earnings-surpass-135900510.html

https://finance.yahoo.com/news/top-research-reports-linde-airbnb-191900618.html

https://www.fool.com/investing/2023/11/06/why-exxonmobil-is-so-excited-about-its-nearly-70-b/

https://seekingalpha.com/article/4642255-how-id-invest-1-million-right-now

https://www.fool.com/investing/2023/11/26/tired-of-money-losing-hydrogen-stocks-2-winning-al/

https://finance.yahoo.com/news/celanese-ce-q3-earnings-surpass-150100311.html

https://finance.yahoo.com/news/linde-included-dow-jones-sustainability-111000667.html

https://finance.yahoo.com/news/12-best-uk-stocks-buy-231614980.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: pzkrlW

https://reports.tinycomputers.io/LIN/LIN-2023-12-26.html Home