Meta Platforms, Inc. Class A Common Stock (ticker: META)

2023-12-16

Meta Platforms, Inc., commonly known by its ticker symbol META, stands as one of the most influential players in the social networking and technology sphere. As the parent company of Facebook, Instagram, WhatsApp, and Oculus, it plays a central role in how people connect, share, and experience digital content. The Class A Common Stock of Meta Platforms, Inc. represents the publicly traded shares that confer voting rights and ownership in the company. Investors holding these shares are positioned to benefit from the companys financial performance, reflected in metrics such as revenue growth, profitability, and market share expansion. However, they are also subject to the risks inherent in the technology sector, including regulatory challenges, privacy concerns, and the rapidly changing competitive landscape. META's performance in the stock market often serves as a bellwether for investor sentiment regarding the future of social media and the monetization of digital platforms. As of the knowledge cutoff in 2023, Meta continues to innovate, investing heavily in areas such as artificial intelligence and augmented/virtual reality, to maintain its dominance and secure future growth opportunities.

Meta Platforms, Inc., commonly known by its ticker symbol META, stands as one of the most influential players in the social networking and technology sphere. As the parent company of Facebook, Instagram, WhatsApp, and Oculus, it plays a central role in how people connect, share, and experience digital content. The Class A Common Stock of Meta Platforms, Inc. represents the publicly traded shares that confer voting rights and ownership in the company. Investors holding these shares are positioned to benefit from the companys financial performance, reflected in metrics such as revenue growth, profitability, and market share expansion. However, they are also subject to the risks inherent in the technology sector, including regulatory challenges, privacy concerns, and the rapidly changing competitive landscape. META's performance in the stock market often serves as a bellwether for investor sentiment regarding the future of social media and the monetization of digital platforms. As of the knowledge cutoff in 2023, Meta continues to innovate, investing heavily in areas such as artificial intelligence and augmented/virtual reality, to maintain its dominance and secure future growth opportunities.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 857.97B | 772.49B | 738.40B | 543.84B | 315.56B | 361.59B |

| Enterprise Value | 833.07B | 755.26B | 728.54B | 529.69B | 299.68B | 337.17B |

| Trailing P/E | 29.47 | 34.99 | 35.56 | 24.67 | 11.48 | 11.25 |

| Forward P/E | 19.57 | 18.18 | 23.81 | 21.01 | 15.04 | 11.31 |

| PEG Ratio (5 yr expected) | 0.76 | 0.72 | 0.99 | 2.03 | 2.65 | 1.60 |

| Price/Sales (ttm) | 6.92 | 6.57 | 6.52 | 4.91 | 2.79 | 3.16 |

| Price/Book (mrq) | 6.01 | 5.76 | 5.92 | 4.33 | 2.53 | 2.88 |

| Enterprise Value/Revenue | 6.56 | 22.12 | 22.77 | 18.49 | 9.32 | 12.17 |

| Enterprise Value/EBITDA | 17.53 | 44.38 | 60.64 | 54.32 | 34.15 | 43.01 |

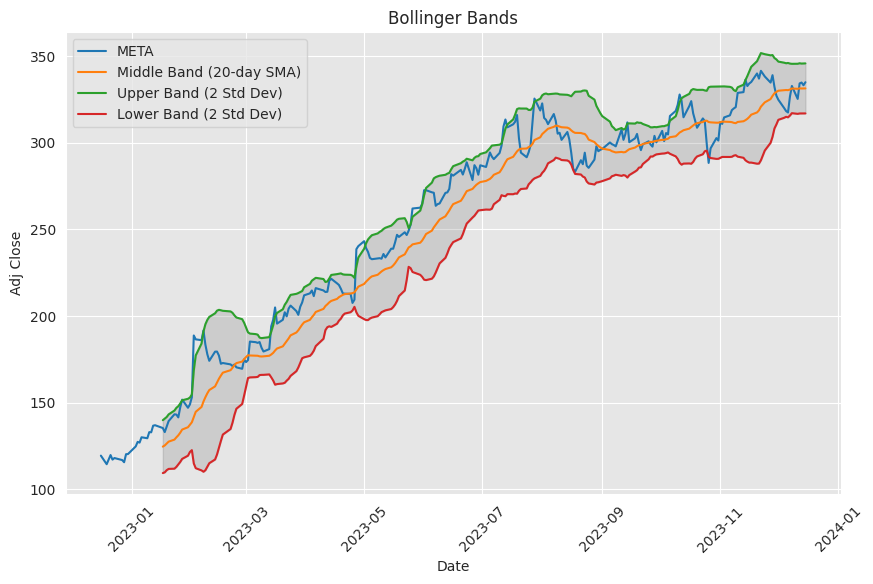

Based on the technical analysis data provided, the stock price movement for META in the upcoming months presents a cautiously optimistic outlook. The key technical indicators suggest that the stock is currently in a bullish trend but also points towards the need for vigilance due to potential overbought conditions:

Based on the technical analysis data provided, the stock price movement for META in the upcoming months presents a cautiously optimistic outlook. The key technical indicators suggest that the stock is currently in a bullish trend but also points towards the need for vigilance due to potential overbought conditions:

- The price is above the 20-day Simple Moving Average (SMA_20) and the 50-day Exponential Moving Average (EMA_50) which generally indicates a positive trend.

- Bollinger Bands show the stock closing near the upper band, which could indicate high buying pressure in the short term.

- The Moving Average Convergence Divergence (MACD) is positive, with the MACD histogram slightly above zero, hinting at bullish momentum.

- The Relative Strength Index (RSI) is above the midpoint (50), suggesting the stock has more buyers than sellers, albeit nearing overbought territory (above 70).

- The Stochastic RSI is quite high, with %K above %D, which indicates buying momentum but similarly warns of an overbought scenario.

- Accumulation/Distribution, represented by On-Balance Volume (OBV), shows positive volume flow.

- The Average Directional Index (ADI) is relatively low, indicating a weaker trend strength which could lead to potential volatility or consolidation.

- Chaikin Money Flow (CMF) is positive, indicating buying pressure.

- The Parabolic SAR (PSAR) indicates an uptrend as it's below the current price.

- The Williams %R also indicates an overbought condition, which generally calls for a careful assessment of potential trend reversals.

From a fundamental standpoint, META has witnessed a significant increase in Market Capitalization over the last year, suggesting increased investor confidence. The Trailing P/E ratio has declined, indicating improved valuation levels, with Forward P/E presenting an investment at a relatively reasonable future earnings outlook. Revenue and EBITDA demonstrate a healthy financial status, but research and development along with the sales, general, and administrative expenses need to be monitored as significant increases could affect profit margins.

Combining the technical and fundamental analyses, the outlook for the META stock price movement in the following months can be articulated as cautiously bullish. The technical indicators point towards a currently positive trend with healthy buying pressure, but caution is advised due to the signs of potential overbought conditions which could lead to a price pullback or consolidation before a continuation of the trend. Fundamentally, the company shows strength which could underpin the bullish sentiment conveyed by technical indicators.

Investors should monitor key support levels such as the SMA_20 and EMA_50, which could act as potential pivot points in the event of any downward price correction. Additionally, keeping an eye on company expenditures, upcoming earnings reports, and significant industry news will be critical to understanding the potential impact on stock price movement. It is recommended to consider scaling into positions with vigilance and to closely manage risk, particularly in the context of broader market conditions and sentiment.

In recent market dynamics, technology firms including Meta Platforms, Inc. have faced pressure with noticeable drops in stock prices. On a day when the broader market indicated stability with the S&P 500 index climbing by a modest 0.1%, tech stocks displayed a different story. Meta Platforms (META), along with peers such as Alphabet and Amazon, underwent sharp declines. Particularly for Meta, the trading day started with a concerning 3.8% fall and closed with a 2.8% decrease. It was a day of heavy losses where collectively, the market cap of these tech giants plunged well over $60 billion.

The downturn can be attributed to a cluster of factors relevant to each entity. Alphabet's setback, for one, was rooted in the aftermath of unveiling its AI model Gemini, which initially excited investors about potentially closing the gap with the likes of OpenAI and Microsoft in AI innovation. However, the veneer of optimism quickly faded when Alphabet confessed to overstating the model's abilities, including misleading performance and underestimated input requirements. This admission triggered a clear dent in investor confidence.

While Alphabet's AI fumble was a strike against it, META faced its tribulation with actions from CEO Mark Zuckerberg, who sold $228 million-worth of stock since the start of November. This marked Zuckerberg's first major sale since 2021. Although maintaining controlling interest, the market generally perceives insider sales skeptically, posing a potential red flag to the market on confidence in META's short-term prospects.

Conversely, no direct news seemed to justify the downturn in Amazon's stock specifically. Still, stock correlations within tech heavyweights often result in a synchronized market response. Notably, Amazon maintained solid fundamentals, with signs of robust retail sales data and sustained profitability from its cloud computing segment, Amazon Web Services.

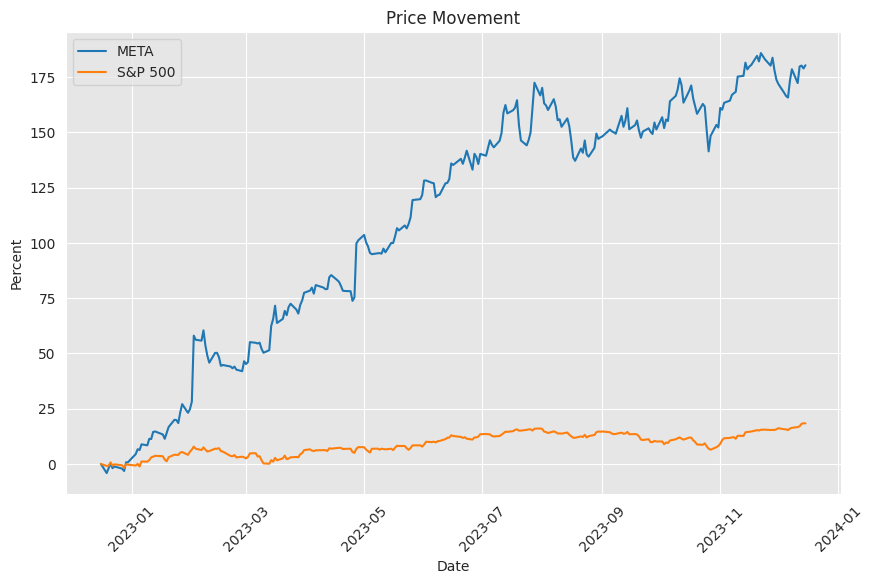

Looking at a wider slice of time, tech companies, Meta included, had previously outshined the S&P 500 over an annual window. Such retraction in stock prices might simply reflect market corrections and profit-taking maneuvers, rather than a harbinger of any systemic decline.

Stepping into the context of Alibaba Group Holding Limited (BABA), broadly comparing with Meta Platforms, offers an interesting juxtaposition. Alibaba's stock had plummeted from its apex in late 2020, mostly due to regulatory pressures initiated by provocative commentary from its founder, Jack Ma. Even after fines and enforced donations to common prosperity efforts, Alibaba maintained a formidable financial status. With revenue growth, a solid balance sheet, and substantial net cash positions, the valuation appeared exceedingly low especially when contrasting NTM market cap/free cash flow and P/E ratios with industry standards.

Despite setbacks and a bearish sentiment, Alibaba, much akin to Meta post-negative sentiment period, showed revival potential. The Chinese economy anticipated a boost from policy adjustments, including lower interest rates and fiscal expansion. For Meta Platforms and Alibaba alike, such broader economic rebounds are vital growth catalysts.

Diving deeper into Meta Platforms, the company's financial evaluations signal that it could be undervalued amid its peers. Sustained efforts in AI and an ambitious leap to the metaverse through Reality Labs are counterbalanced by a traditionally powerful advertising segment. Additionally, political campaign spending, anticipated to hit new highs, could further solidify its dominant digital presence, pushing revenue higher.

Meta's ambitions dont stop at maintaining its advertising fortress; the companys proactive investment in AI and the metaverse are strategic moves that indicate potential for future value creation. Despite the pricey investment in Reality Labs, Meta's forward P/E ratio could be enticing for long-term growth seekers.

The stock's present multiples, trading below a 10-year average, broadcast a dissonance with Meta's value proposition. As 2024 beckons with political ad spending as a potential catalyst, the promise for Meta looks financially encouraging. The Motley Fool, aligning with institutional voices, discerns Metas current undervaluation as a beckoning for strategic investment approaches like dollar-cost averaging.

Advanced Micro Devices (AMD), with a significant stride into AI chip technology, chose 2023 to launch its MI300X and MI300A AI accelerators, antagonizing Nvidia's terrain. The MI300X touted impressive specifications, doubling the memory offering over Nvidia's, and the MI300A, though less powerful, was efficient, projecting high performance in comparison with preceding models. Subsuming software ecosystem dynamics, AMD emphasized its ROCm platform, beefing it up for competitive resilience against Nvidias CUDA.

The market responded positively to AMD's new offerings, drawing interest from Microsoft and Meta. Tech enterprises like Oracle, Dell, and Lenovo showcased alignment with AMD's AI prospects, indicating confidence in the companys capabilities.

AMDs strategic market posturing positions it as a serious competitor to Nvidia. However, the openness of the AI chip market, coupled with potential price compressions, signal volatility. AMD ambitiously seeks to scratch a $2 billion sales mark in AI accelerators by 2024. With a market anticipated to boom to $400 billion by 2027, a significant positioning for AMD seems viable, handset on growth in AI chip demand.

2023 was an interesting year for Meta Platforms, which, despite an unsteady entry, made significant stock price gains. Cost-cutting measures, solid advertising sales, and resurging investor interest anchored this rebound. However, skepticism remained; with elevated valuations and interest rate hikes, the company's stock price warranted critical examination.

Lingering over Meta's horizon were regulatory shadows which could impose substantial impacts on the company's operating margins and practices. These concerns, paired with technical analysis pointing towards a momentum slowdown, invoked a degree of caution among investors, with suggestions considering avoiding META in the near to mid-term.

An essential component of the digital advertising market, Meta Platforms, Inc., competes with Alphabet and Amazon in a landscape shifting towards privacy and regulatory modifications. Although not a direct e-commerce participant, Meta's platforms facilitate commercial transactions through advertising and customer interaction. Expanding features like Instagram's integrated shopping capabilities align with e-commerce trends, carving new growth paths for the company.

Meta's vitality in the market also comes from its commitment to innovating in emerging technologies like VR and AR, marked by its Oculus developments and the broader metaverse vision. These ventures articulate a long-term strategy embedding Meta in new markets and potentially expanding revenue streams.

META's share price will be shaped by factors including user engagement, AI advancements, and advertising revenue. With the digital advertising market set for expansion and AI innovations gaining traction, META could represent an enticing investment, marked by the stock trading below future earnings expectations.

Despite broader economic uncertainties, Meta Platforms has adapted impressively, paring down costs while growing its net income dramatically. Although perpetual growth at such rates isn't anticipated, market dynamics and technological advancements provide a backdrop for moderate but consistent progression. With digital ad markets expected to burgeon and AI driving new efficiencies, the stock's valuation presents a compelling investment case.

As Meta Platforms stands poised to harness emerging opportunities in technology and social media, its position in the tech sector signals room for growth and innovation. The multitude of factors influencing META's stock, including its advertising stronghold, AI advancements, and the metaverse exploration, are key considerations for anyone assessing the stock's investment potential. As the tech landscape continues to evolve, Meta's role remains significantly relevant and ripe with possibilities for shareholders.

News Links:

https://www.fool.com/investing/2023/12/11/why-big-tech-stocks-alphabet-amazon-and-meta-dropp/

https://seekingalpha.com/article/4657089-alibaba-at-72-per-share-makes-no-sense

https://www.fool.com/investing/2023/12/15/why-this-ai-stock-looks-dirt-cheap/

https://www.fool.com/investing/2023/12/10/amds-ai-superchip-is-finally-here/

https://seekingalpha.com/article/4657359-meta-platforms-large-price-dump-may-be-2024s-reality

https://seekingalpha.com/article/4658196-only-analysis-amazon-you-will-ever-need

https://www.fool.com/investing/2023/12/09/this-is-the-most-important-ai-company-youve-never/

https://www.fool.com/investing/2023/12/13/magnificent-seven-stocks-crushed-wall-street-2024/

https://www.fool.com/investing/2023/12/15/2-stocks-down-15-and-55-to-buy-right-now/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: aCtXNT