Altria Group, Inc. (ticker: MO)

2023-12-20

Altria Group, Inc. (ticker: MO) is a renowned holding company which, through its subsidiaries, operates as one of the largest producers and marketers of tobacco, cigarettes, and related products in the United States. The company's flagship subsidiary, Philip Morris USA, is known for popular cigarette brands like Marlboro, which holds a commanding presence in the U.S. tobacco market. Altria's portfolio also extends to smokeless tobacco products and wine through companies like U.S. Smokeless Tobacco Company and Ste. Michelle Wine Estates, respectively. Furthermore, the company has diversified its interests to embrace the burgeoning market for reduced-risk products, including investments in vaping and cannabis. With a business model primarily hinged on addictive consumer goods, Altria has faced increased regulatory scrutiny and public health concerns, yet it has maintained a strong financial performance, underlined by a reliable dividend payout to shareholders, making it a fixture in the portfolios of income-focused investors. The company's strategies reflect an ongoing adaptation to shifting consumer habits and regulatory landscapes, emphasizing innovation and harm reduction in its product development.

Altria Group, Inc. (ticker: MO) is a renowned holding company which, through its subsidiaries, operates as one of the largest producers and marketers of tobacco, cigarettes, and related products in the United States. The company's flagship subsidiary, Philip Morris USA, is known for popular cigarette brands like Marlboro, which holds a commanding presence in the U.S. tobacco market. Altria's portfolio also extends to smokeless tobacco products and wine through companies like U.S. Smokeless Tobacco Company and Ste. Michelle Wine Estates, respectively. Furthermore, the company has diversified its interests to embrace the burgeoning market for reduced-risk products, including investments in vaping and cannabis. With a business model primarily hinged on addictive consumer goods, Altria has faced increased regulatory scrutiny and public health concerns, yet it has maintained a strong financial performance, underlined by a reliable dividend payout to shareholders, making it a fixture in the portfolios of income-focused investors. The company's strategies reflect an ongoing adaptation to shifting consumer habits and regulatory landscapes, emphasizing innovation and harm reduction in its product development.

| As of Date: 12/19/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 74.64B | 74.62B | 80.44B | 79.70B | 81.92B | 72.43B |

| Enterprise Value | 98.20B | 100.94B | 101.92B | 102.35B | 105.73B | 97.55B |

| Trailing P/E | 8.61 | 11.07 | 14.57 | 13.99 | 17.79 | 41.20 |

| Forward P/E | 8.47 | 8.22 | 9.20 | 8.92 | 9.22 | 8.08 |

| PEG Ratio (5 yr expected) | 6.31 | - | - | - | - | - |

| Price/Sales (ttm) | 3.66 | 3.64 | 3.94 | 3.89 | 4.01 | 3.54 |

| Price/Book (mrq) | - | - | - | - | - | - |

| Enterprise Value/Revenue | 4.78 | 19.13 | 18.74 | 21.49 | 20.80 | 18.02 |

| Enterprise Value/EBITDA | 8.04 | 31.33 | 32.61 | 37.55 | 34.52 | 133.26 |

| Full Time Employees | 6,300 |

|---|---|

| Previous Close | $42.20 |

| Open | $42.38 |

| Day Low | $42.145 |

| Day High | $42.45 |

| Dividend Rate | $3.92 |

| Dividend Yield | 0.0929 |

| Payout Ratio | 77.55% |

| Five Year Avg Dividend Yield | 7.63 |

| Beta | 0.698 |

| Trailing PE | 8.66 |

| Forward PE | 9.05 |

| Volume | 11,417,057 |

| Average Volume | 8,687,633 |

| Average Volume 10 Days | 11,484,620 |

| Market Cap | $75,061,501,952 |

| Fifty Two Week Low | $39.07 |

| Fifty Two Week High | $48.11 |

| Price to Sales Trailing 12 Months | 3.65 |

| Enterprise Value | $98,672,361,472 |

| Profit Margins | 42.61% |

| Shares Outstanding | 1,768,649,984 |

| Held Percent Insiders | 0.094% |

| Held Percent Institutions | 59.379% |

| Short Ratio | 1.6 |

| Book Value | -$1.925 |

| Earnings Quarterly Growth | 8.67 |

| Net Income to Common | $8,743,999,488 |

| Trailing EPS | 4.9 |

| Forward EPS | 4.69 |

| Total Cash | $1,536,999,936 |

| Total Debt | $25,098,000,384 |

| Total Revenue | $20,561,000,448 |

| Free Cashflow | $12,060,999,680 |

| Operating Cashflow | $8,679,000,064 |

| Earnings Growth | 8.922 |

| Revenue Growth | -2.5% |

| Gross Margins | 69.437% |

| EBITDA Margins | 60.921% |

| Operating Margins | 59.314% |

Technical Analysis Overview:

Based on the provided technical indicators and company fundamentals for the MO (Altria Group) stock on the last trading day, the analysis suggests a cautiously optimistic outlook for the stock price movement over the next few months:

-

The adjusted closing price was 42.44, indicating the stock is trading in a relatively stable range.

-

The MACD (Moving Average Convergence Divergence) value is positive at 0.219808, with a histogram value of 0.063113, suggesting a current bullish trend.

-

The RSI (Relative Strength Index) is at 60.76, indicating that the stock is neither overbought nor oversold, but approaching overbought levels. Traders should monitor for any potential reversals.

-

Bollinger Bands show the price is currently trading closer to the upper band (42.555238) than the lower band (41.652763), signifying that the price is in the higher realm of its recent price range.

-

The SMA (Simple Moving Average) 20-day and EMA (Exponential Moving Average) 50-day are at 41.77 and 41.792127, respectively, both below the last closing price, implying a short-term uptrend.

-

The OBV (On-Balance Volume) is at -6.128834 million, indicating that there may be a divergence as the volume is not supporting the current price trend robustly.

-

The stochastic oscillator presents a %K line at 58.5 and a %D line at 53.833389, both close to the midpoint of 50, reinforcing a neutral view with the potential for price momentum either way.

-

The ADX (Average Directional Index) is at 17.958240, showing a weak trend strength, which could imply that the current trend is not very strong.

-

The Williams %R is at -26.000023, just out of the typical overbought territory, which supports a cautiously bullish sentiment.

-

The Chaikin Money Flow (CMF) is slightly above zero at 0.029363, suggesting a minimal inflow of money into the stock.

-

The Parabolic SAR (Stop and Reverse) is indicating an uptrend since the last trading day's low (41.071146) is below the current price level.

Fundamental Analysis Overview:

Reviewing the company's fundamentals:

-

The market capitalization has seen a decline since the end of the previous year, which may reflect overall market sentiment or internal company performance issues.

-

The Trailing P/E and Forward P/E ratios are low at 8.61 and 8.47 respectively, which could indicate the stock is undervalued relative to earnings, making it appealing to value investors.

-

The PEG (Price/Earnings to Growth) ratio is significantly high at 6.31, which may imply that the market is expecting slower growth relative to the company's earnings.

-

The EV/Revenue and EV/EBITDA multiples are moderate, informing us that company's enterprise value is relatively balanced with their revenue and earnings before interest, taxes, depreciation, and amortization.

Projected Price Movement Analysis:

Considering the favorable positions of the MACD, RSI nearing overbought levels, the price's proximity to the upper Bollinger Band, and the positive but cautious indicators from stochastic oscillators, ADX, and CMF, along with a currently bullish PSAR, the technical outlook for MO appears mildly bullish in the short term. However, the weak volume reflected in the OBV suggests that any bullish trend may not have strong conviction.

The fundamental analysis raises some concerns with a decrease in market cap over time and a high PEG ratio. However, the low P/E ratios, both trailing and forward, could attract investors looking for stocks that are potentially undervalued based on their earnings.

With all the said indicators combined, a careful analysis suggests that the MO stock could experience moderate price appreciation in the next few months. However, the mixed signals from weak trend strength (low ADX) and a not-so-strong volume indicator highlight that investors should remain cautious. Keeping abreast of any fresh technical signs or fundamental developments is recommended, as these can significantly affect the directional movement of the stock's price.

Note that while this analysis reflects the current snapshot of MO's technical and fundamental position, market dynamics are subject to change, and ongoing analysis should incorporate the latest data and market news.

Altria Group, Inc. (MO), commonly known as Altria, is an investment consideration for many, particularly for those inclined towards income-generating equities. The company's status as a Dividend King is underscored by its consistent history of raising dividend payouts despite the well-documented decline in cigarette sales over recent decades. Altria's management has succeeded in maintaining a strong market position, primarily due to its flagship brand, Marlboro, which remains a leader in the United States. The ability of the company to continue raising prices to offset declining volumes is a testament to the enduring power of its brand and reflects a regulatory environment that challenges the emergence of new competitors.

The resilience of Altria is further highlighted by its proactive approach to market shifts, such as its diversification into non-combustible products. Altria's pursuit of growth avenues beyond traditional tobacco is exemplified by the strategic acquisition of NJOY, a significant player in the e-vapor market. NJOY's e-vapor products have received marketing authorization from the U.S. Food and Drug Administration (FDA), signifying Altria's intent to remain an influential figure in a rapidly changing industry.

Financially, Altria has deftly managed its revenue streams. Despite an 8% decline in cigarette volumes in the U.S. during the first nine months of 2023, the company's total revenue experienced only a minimal decrease, decreasing by 1.4% year over year. This outcome can be attributed to a combination of price increases and a rise in sales of non-combustible products. Additionally, Altria has employed share buybacks, contributing to a 3.3% growth in adjusted earnings per share over the same period.

Altria Group's dividend growth is especially remarkable. It has raised its dividend payout for the 58th time in 54 years, signaling a strong commitment to delivering shareholder value. The recent 4.3% increase in the dividend during the summer is indicative of the company's ability to consistently deliver returns that can potentially outpace inflation.

Investors are also drawn to Altria's sizeable current dividend yield, which is an impressive 9.4%. This figure rewards current shareholders and attracts potential investors looking for steady income streams. The dividend yield reflects the company's commitment to financial health and a consistent ability to return value to shareholders.

As we move forward into 2024, Altria may attract income-focused investors, particularly those who favor high-yield dividend stocks that merge attractive payouts with perceived safety in volatile markets. Altria's steep dividend history and strategic product diversification make it a formidable enterprise with the potential for long-term stability. Its enduring brand strength and extensions into the nicotine market suggest it could be regarded as a stable dividend-growth stock.

Altria's price-to-earnings (P/E) ratio of around 8 is suggestive of the market's recognition of the challenges faced by the tobacco industry and may factor into establishing a foundation for the stock that could limit downside risks. This valuation, coupled with the company's robust yield of 9.39% at the time of the report, is particularly attractive for investors.

Despite the stigma attached to tobacco products, Altria's transition towards innovative and less harmful alternatives, coupled with sound financial strategies, continues to attract attention from income-focused investors. Given Altria's robust approach to managing regulatory and social challenges, the company may have the potential to outperform in the long-term.

Altria is currently grappling with the general decline in smoking rates, as evidenced by the reduction of cigarette shipment volume by 11.6% in the third quarter and the broader cigarette consumption trends in the U.S., which have seen a significant decline from 21% to approximately 11.5% among adults from 2005 to 2021. While the company's pricing power has historically offset volume declines, there is an undeniable imperative for Altria to diversify its income sources beyond traditional tobacco products.

Altria's financial position is relatively stable, showcasing less long-term debt compared to some industry peers. Yet, the company does rely on leveraging to sustain operations, a factor which is considered in the valuation and investor confidence. This is because Altria's high dividend yield, sitting at 9.3%, comes with industry headwinds that imply a maintained high payout might be challenged without significant alternative revenue streams.

Altria's high dividend yield has made it a prominent consideration for many dividend portfolios. Market analysts, however, are beginning to point investors towards alternative high-yield dividend stocks that may offer stable growth prospects and clearer strategic paths forward. It is within this context that Altria is sized up against companies like AT&T, which has been showing clear vision for expansion in technology infrastructure that is in line with contemporary trends.

Though Altria offers enticing dividend yields, the evolving market, the company's challenges, and the contrast in trajectories among dividend-giving companies have led some investors to weigh their options. These considerations concern the balance between yield and growth potential and highlight the necessity for Altria to innovate and find new avenues for growth beyond traditional tobacco products.

Altria Group holds close to a 9.5% dividend yield, exceeding the average yield of the S&P 500 index substantially. Despite this attractive yield, a high dividend rate can sometimes raise concerns over potential financial distress or hint at a future cut. Nevertheless, the financial indicators, including the free cash flow and a payout ratio of 77%, suggest that the dividend is manageable in the short term.

Yet, Altria's primary revenue stream from smokeable products, constituting 89% of the total revenue, is a cause for concern, with shipment volumes experiencing a decline. Additionally, Altria's market share has seen slight erosion. Despite price increases to offset reduced volumes, revenue decline could not be fully compensated. These factors, combined with a share price decrease of 9.8% over the past year, have led to a reduced P/E ratio, while earnings per share have remained flat.

While Altria's dividend yield is high, the company's declining cigarette sales trend and slow earnings growth may offset the benefits of its high dividend payments. An analysis suggests a cautious approach regarding Altria shares, due to the industry headwinds and sluggish growth prospects.

Altria Group's exploration of dividends as a strategy for wealth generation has often been the centerpiece of the company's investment appeal. However, recent studies indicate that holding dividend stocks solely for the purpose of income without reinvesting dividends could sometimes lead to underwhelming returns, especially when considering company-specific risks or overall market downturns. In Altria's case, these risks are magnified by the possibility of regulatory changes and a societal push against smoking.

In light of these considerations, diversified investment vehicles such as ETFs are suggested as an alternative. Vanguard ETFs stand out for their ability to deliver a balance between income generation and capital appreciation. An investment spread equally across Vanguard's ETFs like VOO, VYM, VYMI, and VIG, which sport low expense ratios, has historically resulted in robust total returns.

As Altria ventures into new industries, the company has made a noticeable investment in cannabis through its stake in Cronos Group Inc. This move aligns with the shifting political climate in the U.S., where proposed legislative changes could pave the way for legal cannabis markets. Altria's investment in Cronos, alongside its operational strength reflected in steady revenue increase and margin expansion, marks a strategic initiative that promises potential for new revenue streams and business longevity.

Altria's financial metrics, including a stable revenue increase and robust cash flow, suggest the company has a sound footing to cover dividends and buybacks. Its diversification into non-combustible products has seen success, and the move to invest in the promising cannabis market aligns with Altria's strategy for expansion and brand refueling, which may redefine the company's industry status.

The company's financial health, marked by its ability to generate excess cash flows and its commitment to delivering dividends, contrasts the evolving landscape of the tobacco industry. With changing societal attitudes and regulatory pressures, Altria's long-term growth potential may be influenced by its ability to adapt to market shifts and maintain its high-yield paying status.

Altria Group's response to the decline in cigarette demand has been to diversify its portfolio while leveraging its strong market positioning to implement price increases. The company has also made strategic investments in alternative tobacco and nicotine delivery products, signifying Altria's proactive efforts to address changing consumer preferences.

In the investment landscape, Altria's attractive dividend yield and status as a Dividend King make it relevant, especially to passive income investors. The stock's current low valuation and strategic diversification efforts offer a potentially resilient long-term outlook for investors willing to weather industry headwinds.

Facing negative consumer sentiment towards smoking and pressures from vaping and other alternatives, Altria has undertaken efforts to diversify its product offerings. Despite high dividend yields, which could appear as a haven for shareholders, the company's performance indicates that careful consideration is necessary given the enduring societal and market challenges affecting traditional cigarette sales.

In conclusion, Altria Group Inc. is continually adapting to meet the challenges of a shifting industry, maintaining its impressive market share while exploring new avenues for growth. Its strong pricing power, dividend history, and strategic diversification reflect a company actively navigating market trends and preparing for future developments.

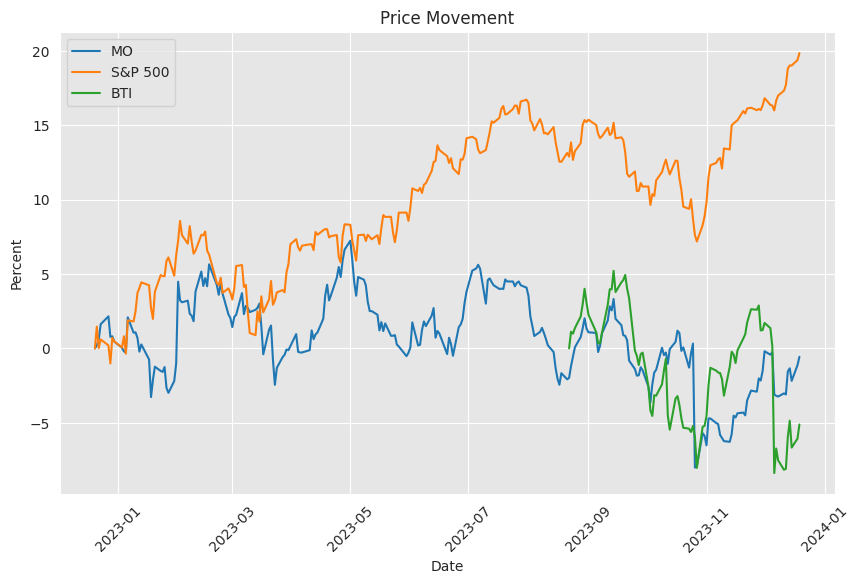

Similar Companies in Tobacco:

British American Tobacco (BTI), Imperial Brands PLC (IMBBY), Philip Morris International Inc. (PM), Vector Group Ltd. (VGR), Turning Point Brands, Inc. (TPB), 22nd Century Group, Inc (XXII)

News Links:

https://www.fool.com/investing/2023/12/19/3-unstoppable-dividend-growth-stocks-you-can-buy-n/

https://www.fool.com/investing/2023/12/19/5-safest-high-yield-dividend-stocks-to-buy-in-2024/

https://www.fool.com/investing/2023/12/18/forget-altria-x-ultra-high-yield-dividend-stocks-i/

https://www.fool.com/investing/2023/12/17/altria-group-stock-buy-sell-or-hold/

https://www.fool.com/investing/2023/12/16/4-vanguard-etfs-that-can-serve-as-a-complete-incom/

https://www.fool.com/investing/2023/12/16/want-to-gain-1000-of-annual-dividend-income-2024/

https://www.fool.com/investing/2023/12/14/looking-for-passive-income-this-dividend-stock-loo/

https://www.fool.com/investing/2023/12/13/why-is-everyone-talking-about-altria/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: zzc7wt