Marathon Petroleum Corporation (ticker: MPC)

2024-01-10

Marathon Petroleum Corporation (MPC) is a leading, integrated, downstream energy company headquartered in Findlay, Ohio. It operates the nation's largest refining system with more than three million barrels per day of crude oil processing capacity across 16 refineries. Marathon Petroleum's marketing system includes branded locations across the United States, including Marathon branded outlets. MPC's comprehensive spectrum also encompasses Speedway LLC, a top convenience store chain in the nation, which was recently sold to 7-Eleven, Inc. In addition to refining and marketing, MPC's midstream operations are conducted through MPLX LP, a high-quality master limited partnership that owns and operates gathering, processing, and fractionation assets, as well as logistics infrastructure including pipelines, storage terminals, and waterborne transport. The company is recognized for its robust business strategy that focuses on operational efficiency, robust financial discipline, and the safety of its operations. With a commitment to sustainability and community engagements, Marathon Petroleum plays a significant role in meeting the nation's energy needs while adhering to high environmental and safety standards.

Marathon Petroleum Corporation (MPC) is a leading, integrated, downstream energy company headquartered in Findlay, Ohio. It operates the nation's largest refining system with more than three million barrels per day of crude oil processing capacity across 16 refineries. Marathon Petroleum's marketing system includes branded locations across the United States, including Marathon branded outlets. MPC's comprehensive spectrum also encompasses Speedway LLC, a top convenience store chain in the nation, which was recently sold to 7-Eleven, Inc. In addition to refining and marketing, MPC's midstream operations are conducted through MPLX LP, a high-quality master limited partnership that owns and operates gathering, processing, and fractionation assets, as well as logistics infrastructure including pipelines, storage terminals, and waterborne transport. The company is recognized for its robust business strategy that focuses on operational efficiency, robust financial discipline, and the safety of its operations. With a commitment to sustainability and community engagements, Marathon Petroleum plays a significant role in meeting the nation's energy needs while adhering to high environmental and safety standards.

| Address | 539 South Main Street | City | Findlay | State | OH |

| Zip Code | 45840-3229 | Country | United States | Phone | 419 422 2121 |

| Website | https://www.marathonpetroleum.com | Industry | Oil & Gas Refining & Marketing | Sector | Energy |

| Full Time Employees | 17,800 | CEO | Mr. Michael J. Hennigan | CEO Age | 64 |

| CEO Total Pay | $6,767,016 | President | Ms. Maryann T. Mannen | President Age | 59 |

| President Total Pay | $2,831,005 | Previous Close | 156.26 | Open | 155.98 |

| Day Low | 153.89 | Day High | 156.125 | Volume | 2,718,412 |

| Dividend Rate | 3.3 | Dividend Yield | 2.14% | Payout Ratio | 11.32% |

| Five Year Avg Dividend Yield | 3.69 | Beta | 1.498 | Market Cap | 58,591,043,584 |

| Fifty Two Week Low | 104.32 | Fifty Two Week High | 162.31 | Price To Sales TTM | 0.3836275 |

| Enterprise Value | 81,054,089,216 | Profit Margins | 7.563% | Float Shares | 378,892,319 |

| Shares Outstanding | 379,696,992 | Shares Short | 10,193,909 | Held Percent Insiders | 0.29% |

| Held Percent Institutions | 77.62% | Book Value | 67.00 | Price To Book | 2.3031342 |

| Net Income To Common | 11,470,000,128 | Trailing EPS | 26.51 | Forward EPS | 15.29 |

| Total Cash | 13,056,000,000 | Total Debt | 28,583,000,064 | Total Revenue | 152,728,993,792 |

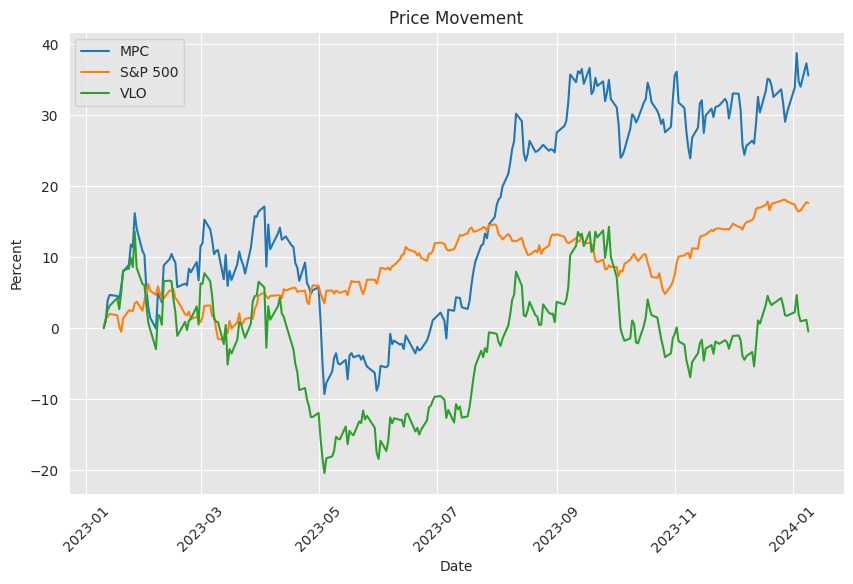

Based on the provided data, we can attempt to forecast the possible stock price movement for MPC over the next few months by analyzing technical indicators, fundamentals, and balance sheet strength.

Technical Analysis:

- The Parabolic SAR (PSAR) indicator, known for its utility in identifying potential reversals in the market price direction, suggests a bullish trend (PSAR below price) for most of the recent days, with some fluctuations that hint at market indecision.

- On Balance Volume (OBV), which combines price and volume to show buying and selling pressure, has shown some decrease recently, implying selling pressure might be present.

- The Moving Average Convergence Divergence (MACD) histogram, which can indicate momentum and potential trend reversals, has fluctuated recently but remains generally positive, a bullish signal.

Based on these technical indicators, recent price action appears mixed with a slight bullish bias, but it is crucial to incorporate fundamental and balance sheet analysis to provide a more comprehensive forecast.

Fundamentals:

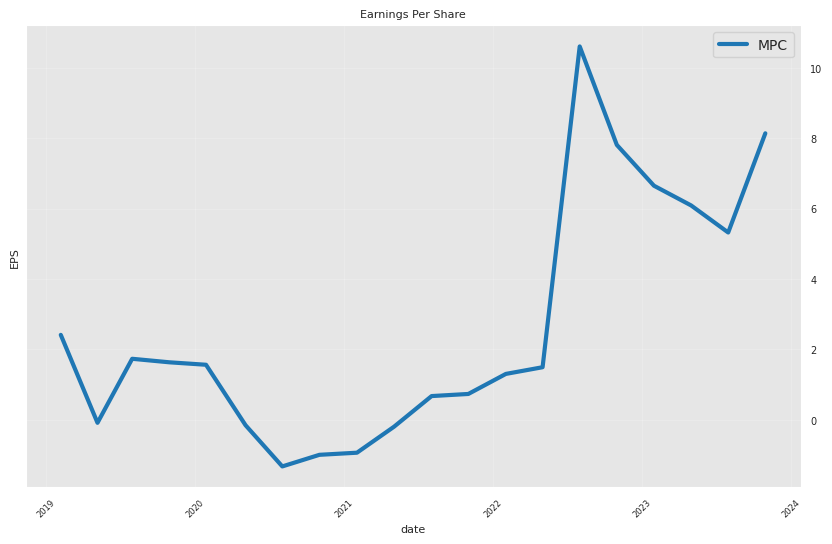

- The company shows positive EBITDA and net income figures, with a trend of increasing EBITDA over the most recent quarters, indicating the company's operational profitability.

- The gross, EBITDA, and operating margins are positive, even if not exceptionally high, which shows the company manages to retain a portion of its revenues as profits.

Balance Sheet:

- The net debt situation shows a decreasing trend, which is positive as it suggests the company is successfully reducing its leverage over time.

- Assets such as cash and short-term investments have increased, providing financial flexibility.

Cash Flows:

- The free cash flow figure is strong, indicating the company has healthy liquidity to sustain operations, invest, and return value to shareholders.

- Debt issuance and repayment figures show the company is actively managing its debt profile, possibly optimizing its capital structure.

Considering these factors, fundamentals appear stable and the balance sheet shows a company in a reasonably solid financial state, which typically supports a positive outlook on stock price.

Forecast:

The blend of positive technical indications, solid fundamentals, and a strong balance sheet position suggests that the stock could potentially see an uptrend over the next few months. However, the market environment, investor sentiment, and external economic factors can influence stock prices significantly.

Investors should also consider broader market trends, the sector performance, and any geopolitical or economic events that might impact the company's performance. Additionally, changes in the energy sector, given MPC's operations, can highly influence the stock's movement.

In summary, technical, fundamental, and financial analysis suggests MPC's stock may have a slight bullish tendency in the upcoming months. This forecast considers historical data and quantifiable aspects of the company's performance and does not account for unpredictable market-wide or geopolitical events which could significantly impact stock prices. Traders and investors are encouraged to maintain ongoing vigilance and consider updates in data for the most informed decision-making.

| Statistic Name | Value |

| Prior R^2 | 0.226197 |

| R^2 Std. Dev (Prior) | 0.011124 |

| Training R^2 | 0.376887 |

| R^2 Std. Dev (Training) | 0.011556 |

| Test R^2 | 0.428254 |

| R^2 Std. Dev (Test) | 0.023908 |

| Expected Loss on a $20,000 Position | $40.91 |

| Maximum Possible Loss | -$4921.23 |

| Maximum Possible Profit | $4940.77 |

Analysis of the linear regression model reveals a dynamic relationship between the MPC stock and the SPY index, where SPY represents the broader market. The model's predictive power, as indicated by the R-squared (R^2) value, suggests moderate strength in explaining the variation of MPC's returns by the returns of SPY. Specifically, the prior R^2 value stands at 0.226197, showing that previously, around 22.6% of the variability in MPC's returns could be accounted for by the market as represented by SPY. This connection is bolstered in the training phase with an R^2 of 0.376887, indicating an improved ability of the model to capture the relationship during this period. Similarly, the test R^2 value furthers this trend at 0.428254, suggesting that nearly 42.8% of the variance in the test data can be explained by the model, implying a somewhat strong relationship between MPC and SPY for the examined time frame.

Focusing on the alpha () of the model, which indicates the stock's performance independent of the market, suggests that MPC has its own unique performance characteristics separate from the broader market trends represented by SPY. When considering the financial implications of this relationship, the expected loss on a theoretical $20,000 investment position based on current model predictions stands at approximately $40.91, indicating a relatively low level of risk. However, this investment also holds a potential for significant swings, with the maximum possible loss extending to around -$4921.23 and the maximum possible profit reaching approximately $4940.77, which underscores the inherent uncertainty and risk that comes with financial investment decisions.

Summary of Marathon Petroleum Corporation's Third Quarter 2023 Earnings Call

Introduction: Marathon Petroleum Corporation (MPC) held its third quarter 2023 earnings call, with operator Sheila initiating the proceedings. Kristina Kazarian welcomed everyone and indicated that the slides for the call were available on the company website. CEO Mike Hennigan, CFO Maryann Mannen, and other executives were present. Forward-looking statements were highlighted, emphasizing that actual results may differ. Refining capacity utilization figures now included STAR's 40,000 barrel per day addition in the Gulf Coast region.

Refining Environment and Results: Mike Hennigan provided an overview of the strong refining environment during the quarter, bolstered by firm demand and supply constraints. Diesel margins were robust due to inventory tightness and suboptimal European production. Global demand reached a record high, and supply additions lagged, particularly in areas where MPC operates. Moderate butane blending and expected turnover periods were projected to support refining cracks. OPEC+ production cuts and more substantial Western Canadian Select (WCS) differentials were strategic for MPC's heavy crude operations across various regions. Hennigan predicted an enhanced mid-cycle environment for 2024 in the U.S. due to favorable global supply-demand fundamentals and competitive advantages. The company reported powerful cash generation across its businesses, with $4.4 billion in refining and marketing segment adjusted EBITDA at 94% utilization and $1.5 billion from the midstream segment. MPLXs notable cash flows contributed to increasing its quarterly distribution by 10%, henceforth expecting MPC to receive $2.2 billion annually from MPLX distributions. The focus was to invest sustainably, grow dividends, and return additional capital through share repurchases.

Financial Highlights and Segment Performance: CFO Maryann Mannen shared financial highlights with adjusted earnings per share standing at $8.14, adjusted to remove certain gains and outage response costs. Cash flow from operations before working capital changes totaled over $4.3 billion. Throughout the quarter, $2.8 billion in shares were repurchased, and $297 million was returned to shareholders via dividends. The Refining & Marketing segment ran at 94% utilization, with improved margins and operational costs at $5.14 per barrel despite unplanned outages impacting their largest refineries, Galveston Bay and Garyville. Midstream results were solid, attributing to the decision to raise MPLX's quarterly distribution. Corporate expenses climbed due to stock compensation expenses, and the tax provision was roughly $1 billion.

Guidance and Capital Allocation: Guidance for the fourth quarter included expected crude throughput volumes at over 2.6 million barrels per day, utilization projected at 90% due to increased turnaround activity. Operating costs per barrel were predicted to rise to $5.60, and distribution costs were estimated at around $1.4 billion. MPC maintained commitment to superior shareholder returns, representing a 72% payout of operating cash flow.

Low Carbon Initiatives and Shareholder Returns: MPC updates its progress on low carbon projects, such as the Martinez Renewables facility, which is expected to produce 730 million gallons of renewable diesel yearly by the end of 2023. The Dickinson facility operated well with 75% advantaged feed, and further developments were highlighted in RNG and other investments aligned with reducing carbon intensity. Hennigan reaffirmed investing in asset performance, and capital discipline was crucial for positioning MPC for long-term advantages in the market.

In summary, MPC focused on refined operations, capitalized on the strong refining environment, invested in future growth opportunities, including low carbon projects, and maintained a robust approach towards returning value to shareholders, achieving significant share buybacks, and increasing dividends, all while conserving a disciplined approach to capital allocation and investments.

Marathon Petroleum Corporation (MPC) has made significant strides in corporate responsibility, especially with the publication of its 2022 Sustainability Report. The document accentuates MPC's dedication to community engagement and sustainable development, capturing a comprehensive view of the companys initiatives toward societal betterment and environmental stewardship. This commitment is evident in their investment strategy focused on meaningful projects that resonate with stakeholders' values and contribute to long-term community prosperity, spanning workforce development and sustainability.

The strategy embraces not just financial contributions to charitable causes but also motivates employees to contribute through the MPC Giving and Volunteerism Programs. These efforts are not in isolation but sync with MPCs broader goals to align business practices with societal needs and affirm their role as a responsible corporate citizen. The multimedia sustainability reporting and transparency in ESG practices are indicative of MPCs pledge towards not only acknowledging but actively reducing its corporate footprint while magnifying positive social impacts.

Amidst a volatile energy market tarred by the effects of the coronavirus pandemic, and significant swings in oil prices, MPC emerges as a beacon of fiscal stability. Drawing benefits from solid refining fundamentals and having the largest refining system in the U.S., MPC boasts a dividend yield exceeding 2%, signifying financial soundness and investor confidence. By committing to dividend payments, MPC appeals to investors seeking stability in the unruly energy market and offers a glimmer of predictability through disciplined capital allocation.

Recent shifts in the U.S. gasoline market have spotlighted MPC's versatility in adapting to global supply-chain fluctuations. The surplus in gasoline has allowed MPC to export to markets not traditionally within its purview, such as delivering significant shipments of gasoline to Australia and Mozambique. These movements illustrate the corporation's capability to manage domestic supply effectively while remaining competitive on the international stage. This adaptability is critical in light of global fuel dynamics and highlights MPCs strategic operational prowess.

Looking at leadership developments, significant changes are underway with Maryann T. Mannen preparing to take over as President, and John Quaid stepping in as CFO from 2024. This management reshuffle is aimed at bolstering MPC's strategic direction amid an evolving energy landscape. The company's steady standing, with a Zacks Rank #3 (Hold), reflects a balanced perspective on its financial health and market outlook compared to industry peers.

Marathon Petroleum underlined its operational competency by entering into a two-year time charter agreement with Performance Shipping Inc., utilizing the M/T P. Long Beach vessel. The fixed-rate deal not only provides financial predictability and operational efficiency but also illustrates MPCs advance planning and astuteness in dealing with the logistics and transportation of its products.

Within the broader energy sector, companies such as The Williams Companies (WMB) and Murphy USA Inc. (MUSA), holding a Zacks Rank #1 (Strong Buy), as well as Archrock, Inc. (AROC) with a Zacks Rank #2 (Buy), emerge as potent investing alternatives. They, alongside MPC, are navigating the industry's challenges and pursuing opportunities for growth, underlined by their strong strategies and operational achievements.

MPC continued to beat earnings expectations, reflected in the last quarter's performance that outstripped the Zacks Consensus Estimate by 4.49%. This streak of positive earnings surprises, propelled by a favorable Earnings ESP of +1.66%, hints at a potential continuation of outperforming market predictions for Marathon Petroleum. As the company anticipates its earnings report on January 30, 2024, investor focus zeroes in on whether MPC can sustain its momentum, reinforcing its market standing and investor confidence.

However, Marathon Petroleum's stock price experienced a decline on December 15, 2023, despite the gains in broader market indices. Investors remain keenly observant as the company's earnings release approaches, with projections projecting decreases in EPS and revenue. Yet, when considering the overall market conditions, the Zacks Rank #3 (Hold) and valuation metrics imply a stable outlook for MPC, despite the anticipated revenue contraction.

MPC's master limited partnership, MPLX LP, stands out as a lucrative investment choice for those interested in substantial dividend yields. With a distribution yield of 9.5%, MPLX overshadows the average S&P 500 index yield, bolstered by stable cash flows from its diverse midstream asset portfolio and a solid track record of incrementally growing distributions. MPLXs ongoing infrastructure projects further strengthen its position for sustained growth, including ventures into evolving energy domains like hydrogen and carbon capture.

As MPLX LP transitions its executive team, welcoming C. Kristopher Hagedorn as the new CFO, this shift sets the stage for a new chapter in financial leadership and growth aspirations. While the general partnership of MPLX holds a Zacks Rank #3 (Hold), indicating a stable outlook, other entities in the industry such as WMB and SUN rank more favorably as per Zacks Rank. Hagedorn's experience and orientation might set the stage for MPLX's strategic advance in the midstream sector and influence the partnerships future industry standing.

In conclusion, Marathon Petroleum Corporation reflects strength not only in financial terms and operational adaptability but also in its corporate governance and community-centric initiatives. Through strategic planning, solid leadership transitions, and an unwavering commitment to sustainable practices, MPC asserts its role as a dominant force and a stable investment prospect within the dynamic energy sector.

Similar Companies in Oil & Gas Refining & Marketing:

Valero Energy Corporation (VLO), Phillips 66 (PSX), Chevron Corporation (CVX), Exxon Mobil Corporation (XOM), HollyFrontier Corporation (HFC), PBF Energy Inc. (PBF), BP p.l.c. (BP), Royal Dutch Shell plc (RDS-A), TotalEnergies SE (TTE), ConocoPhillips (COP)

https://www.zacks.com/stock/news/2202094/marathon-mpc-performance-shipping-ink-time-charter-deal

https://finance.yahoo.com/news/cheap-us-gasoline-heads-australia-050100998.html

https://finance.yahoo.com/news/marathon-mpc-appoints-mannen-president-115500208.html

https://finance.yahoo.com/news/sustainability-report-mpc-community-investment-164500586.html

https://www.zacks.com/stock/news/2195365/3-dividend-stocks-to-watch-in-a-volatile-energy-market

https://finance.yahoo.com/news/marathon-petroleum-mpc-keep-earnings-171011067.html

https://www.fool.com/investing/2023/12/14/looking-to-boost-your-income-you-have-to-check-out/

https://www.zacks.com/stock/news/2202459/mplx-names-c-kristopher-hagedorn-as-cfo-in-leadership-shift

https://finance.yahoo.com/news/marathon-petroleum-mpc-stock-falls-230017332.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: aCtBNK

https://reports.tinycomputers.io/MPC/MPC-2024-01-10.html Home