Marathon Oil Corporation (ticker: MRO)

2024-01-10

Marathon Oil Corporation, trading under the ticker symbol MRO, is a notable independent exploration and production company primarily focused on the exploration, production, and marketing of crude oil, natural gas, and natural gas liquids. Established in 1887 and based in Houston, Texas, Marathon Oil has a rich history in the energy sector and operates internationally with significant operational emphasis in the United States, leveraging unconventional resource plays. The company's strategic approach is centered around cost-effective resource development and a disciplined capital allocation to maximize shareholder value, with a concentrated footprint in some of the most prolific US basins, including the Eagle Ford, Bakken, and Permian. In addition to its exploration and production activities, Marathon Oil is also committed to corporate responsibility, emphasizing sustainability, environmental stewardship, safety, and community engagement. As energy markets evolve, Marathon Oil continues to adapt its operations and strategy in response to changing demand dynamics, technological advancements, and regulatory pressures within the energy landscape.

Marathon Oil Corporation, trading under the ticker symbol MRO, is a notable independent exploration and production company primarily focused on the exploration, production, and marketing of crude oil, natural gas, and natural gas liquids. Established in 1887 and based in Houston, Texas, Marathon Oil has a rich history in the energy sector and operates internationally with significant operational emphasis in the United States, leveraging unconventional resource plays. The company's strategic approach is centered around cost-effective resource development and a disciplined capital allocation to maximize shareholder value, with a concentrated footprint in some of the most prolific US basins, including the Eagle Ford, Bakken, and Permian. In addition to its exploration and production activities, Marathon Oil is also committed to corporate responsibility, emphasizing sustainability, environmental stewardship, safety, and community engagement. As energy markets evolve, Marathon Oil continues to adapt its operations and strategy in response to changing demand dynamics, technological advancements, and regulatory pressures within the energy landscape.

| Address | 990 Town and Country Boulevard | City | Houston | State | TX |

| Zip | 77024-2217 | Country | United States | Phone | 713 629 6600 |

| Website | https://www.marathonoil.com | Industry | Oil & Gas E&P | Sector | Energy |

| Full Time Employees | 1,570 | Market Cap | $13,372,893,184 | Volume | 9,239,824 |

| Average Volume | 9,860,321 | Average Volume (10 days) | 8,740,500 | Previous Close | $23.21 |

| Day Low | $22.68 | Day High | $23.18 | Dividend Rate | $0.44 |

| Dividend Yield | 1.90% | Payout Ratio | 14.18% | Five Year Avg Dividend Yield | 1.58% |

| Beta | 2.199 | Trailing PE | 8.31 | Forward PE | 7.03 |

| Shares Outstanding | 585,246,976 | Enterprise Value | $19,243,591,680 | Profit Margins | 26.06% |

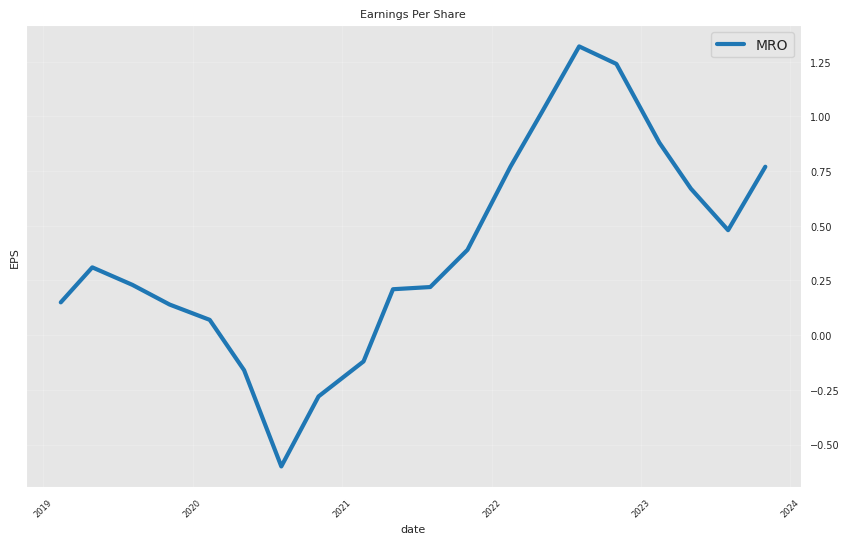

| Trailing EPS | $2.75 | Forward EPS | $3.25 | Gross Profits | $6,152,000,000 |

| Book Value | $19.03 | Price to Book | 1.20 | Debt to Equity | 52.06 |

| Revenue Per Share | $10.401 | Operating Margins | 35.81% | Earnings Quarterly Growth | -44.60% |

| Return on Assets | 7.41% | Return on Equity | 15.01% | Free Cash Flow | $1,255,124,992 |

Marathon Oil Corporation (MRO), an independent energy company specializing in exploration and production, presents several indicators that shape expectations on its stock price movement over the coming months. A thorough examination of technical indicators, fundamental analysis, and balance sheet components provides comprehensive insight into the company's expected performance.

Technical Analysis:

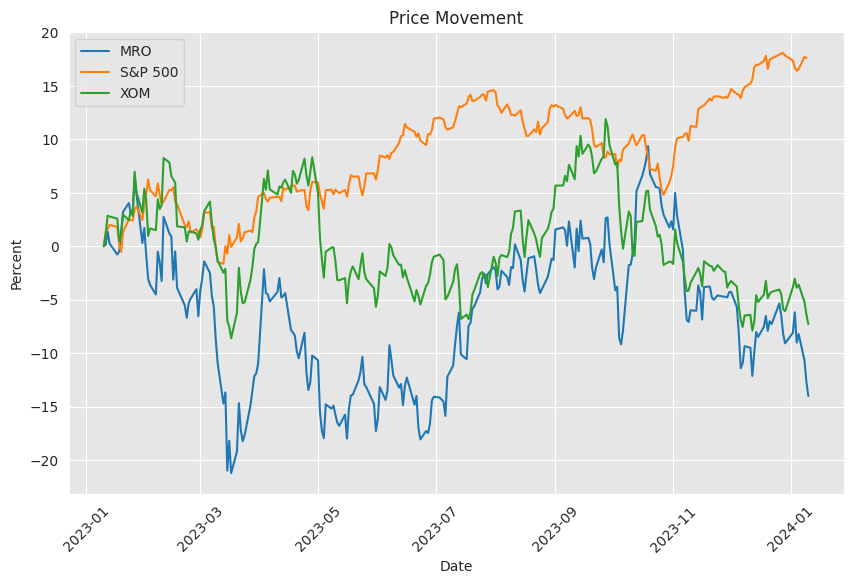

- Over the analyzed period, MRO's stock has demonstrated a declining trend, with a high of $27.63 and gradually decreasing to $22.85.

- The Moving Average Convergence Divergence (MACD) indicates a bearish crossover, with a shift toward negative values implying downward momentum.

- Parabolic SAR (PSAR) recently shifted above the price, endorsing the presence of a bearish trend.

- Volume trends show that the selling pressure outpaces buying momentum, as observed through the On-Balance Volume (OBV) which is on a decline.

Fundamental Analysis:

- MRO presents a healthy gross margin at 77.797%, suggesting the company's effective cost control relative to its peers.

- The operating margin of 35.815% reflects efficient management and profitable operations, yet there is room for improvement compared to industry leaders.

- The company exhibits strong EBITDA margins at 67.679%, indicative of robust core earnings generation capability.

Balance Sheet:

- A gradual year-over-year reduction in treasury shares implies a consistent stock buyback policy, which is typically a positive signal for investors regarding company confidence in its performance and prospects.

- Examining the financial statement from 2022-12-31 to 2020-12-31 shows an increase in net debt by over $900 million, which may raise concerns over leverage levels in a volatile environment.

- There is a consistent increase in accounts receivable year-over-year, suggesting a possible elevation in sales or lengthened credit terms to clients.

Analyst Expectations:

- Earnings estimates project a slight decline in the current quarter but anticipate improvement in subsequent quarters. However, the current year's forecasted earnings illustrate a significant decline compared to the previous year.

- Analysts predict increased revenue growth in the next quarter and the following year, signifying positive future expectations.

- EPS revisions over the past 30 days reveal downward adjustments which could affect short-term investor sentiment.

Considering the technical analysis results and fundamental health, MRO's stock is currently in a bearish phase but with underlying strengths indicated by strong margins and improved revenue forecasts. The bearish technical signals may lead to the stock experiencing further pressure in the short term. However, if MRO can capitalize on its fundamentals, it might offset the negative technical trends, and investors could witness stabilization or gradual improvement in price over the next few months. Market participants should monitor earnings releases, analyst revisions, and any significant changes in the energy sector, as these factors could influence Marathon Oil's stock trajectory in both short and long-term horizons.

| Statistic Name | Statistic Value |

| Prior Score (R^2) | 0.139900 |

| R^2 Standard Deviation for Prior | 0.010282 |

| Training Score (R^2) | 0.348267 |

| R^2 Standard Deviation for Training | 0.011848 |

| Test Score (R^2) | 0.430840 |

| R^2 Standard Deviation for Test | 0.023645 |

| Expected Loss on a $20,000 Position | $47.813 |

| Maximum Possible Loss | -$7,637.371 |

| Maximum Possible Profit | $7,233.088 |

The linear regression model examines the relationship between Marathon Oil Corporation (MRO) and the SPDR S&P 500 ETF (SPY), with the goal of understanding how MRO, an individual stock, behaves in relation to the performance of the broader market index. Over the specified period, the quality of the regression model is quantified by the R-squared (R^2) metric across different subsamples: prior sample, training sample, and test sample. The R2 values indicate the proportion of the variability in the dependent variable (MRO) that can be explained by the independent variable (SPY); these range from approximately 14% in the prior data sample to nearly 43% in the test data sample. The growth in R^2 from prior to test samples suggests an improving model fit as additional data was introduced.

Alpha, a key parameter in the model, represents the intercept term, which theoretically captures MRO's average excess return that is not explained by the market index's returns. However, the numeric value for alpha is not directly provided in the data summary. Instead, the expected financial loss on a position of $20,000 is given, suggesting it might be a practical application derived from the alpha term in a risk management scenario. The table indicates an expected loss of $47.813 for such a position. The extreme potential outcomes of the model's predictions also present a stark contrast, with a loss that could extend up to $7,637.371 and a potential profit which could reach $7,233.088.

Summary of Marathon Oil Corporation's Third Quarter 2023 Earnings Call

Introduction

Guy Baber introduced the Marathon Oil Third Quarter 2023 Earnings Conference Call. Lee Tillman, Dane Whitehead, Pat Wagner, and Mike Henderson were present for the call. The discussion included an overview of operational execution, financial results, capital returns, debt reduction, and future strategies.

Operational Execution and Financial Results

Tillman began by acknowledging the hard work of employees in continuing the company's operational excellence. In the third quarter, Marathon Oil reported an impressive $718 million in adjusted free cash flow with a low reinvestment rate of 38%. Production increased while capital spending decreased, and unit cash costs declined by over 15% from the previous year. The company is leveraging market-based deflation opportunities and driving efficiencies across their operations.

Capital Returns and Balance Sheet Enhancements

Marathon Oil has successfully prioritized returning capital to shareholders, providing a double-digit annualized distribution yield and leading the peer group in per share growth. There was $476 million returned to shareholders in the third quarter, totaling over $1.3 billion through the first three quarters or 41% of cash flow from operations. Additionally, the company has reduced gross debt by $450 million in the current year, aiming for a medium-term goal of around $4 billion, which would lower leverage metrics below one times EBITDA at conservative oil price assumptions.

EG Integrated Gas Business and 2024 Outlook

The company's integrated gas operations in Equatorial Guinea (EG) are set to provide a financial uplift starting in 2024 due to a new sales agreement transitioning from Henry Hub to a linkage with the Title Transfer Facility (TTF), potentially boosting annual EBITDA by $300 million to $500 million. Regarding the 2024 business plan, Marathon Oil is targeting maintaining a maintenance oil program with an expectation of strong well productivity across its portfolio, benefiting from the LNG market momentum.

Financial Update and Portfolio Overview

Dane Whitehead expanded on the company's financials, highlighting a substantial reduction in debt and strong shareholder returns. On operation specifics, Mike Henderson discussed the sustainable shareholder return initiatives, well productivity, and efficiency improvements across the U.S. portfolio, highlighting the Eagle Ford, Bakken, and Permian regions.

Q&A Session

During the Q&A, several topics were addressed. Tillman discussed M&A prospects, noting that current market offerings don't meet the company's criteria as well as the Ensign acquisition did. He also touched upon the potential for future capital allocation adjustments given strong results in certain regions. Discussion on EG included progress on capturing more volumes and the potential duration of the plant's capacity. Questions regarding the potential for hedging TTF-linked EG contracts were also raised, with a general preference to keep the upside unhedged. Lastly, there was clarification on the trajectory of quarterly oil production leading into 2024, as well as a look into how infill drilling in EG could impact production and declines.

Conclusion

Tillman concluded the call by reiterating the company's commitment to strong financial performance and evaluating strategic opportunities, whether organic or inorganic, to enhance shareholder value. He underscored the importance of maintaining an investment-grade balance sheet and generating sustainable free cash flow. The call was then concluded, thanking all employees and contractors for their dedication.

Marathon Oil Corporation (MRO) filed its Form 10-Q with the United States Securities and Exchange Commission for the fiscal quarter ending September 30, 2023. This comprehensive quarterly report provides detailed insights into Marathon's financial health, operational performance, and corporate activities during this period.

Marathons financial statements included in the filing show their revenue sources, detailed expenses, and net income or loss for the quarter. It helps the shareholders to understand how the company performed financially during that time frame. The balance sheet included in the 10-Q filing typically reflects the corporations assets, such as cash and cash equivalents, accounts receivable, inventory, and property, plant, and equipment and liabilities, including debts, accounts payable, and accrued expenses. These figures give an accurate snapshot of the company's financial posture.

The report provides an analysis of the company's cash flows, divided into operating, investing, and financing activities. This segment reveals where the company's cash is coming from and how it is being used. This segment can serve as an indicator of the company's operational efficiency and its capacity to generate cash to sustain and grow its operations.

Additionally, the 10-Q includes a management discussion and analysis section where the companys executives provide their narrative explanation of the financial statements and convey an overview of the company's current business conditions, including any risks it faces, changes in the marketplace, and financial condition. This discussion and analysis often include management's perspective on the factors that affect the companys earnings and their outlook on future performance.

The filing also includes notes that supplement the financial statements. These notes detail the accounting methodologies used to prepare the statements, adjustments and restatements, legal proceedings, mergers and acquisitions, related party transactions, market risk exposures, and breakdowns of certain balance sheet and income statement items. They are crucial as they provide context and additional details to the financial statement line items, ensuring transparency and a deeper understanding of the company's accounting practices and the nuances of its financial results.

Finally, the filing informs investors about important events that have occurred after the end of the quarter that could have a material impact on the company's financial position or results of operations. These subsequent events can include significant business deals, legal disputes, or other material occurrences that could affect investor decisions.

Overall, the 10-Q filing is an essential tool for investors, analysts, and other stakeholders to gauge Marathon Oil Corporation's quarterly financial health and operating performance, offering an in-depth look into the company's financials, operations, and outlook.

Marathon Oil Corporation, along with its contemporaries, represents a significant player in the US natural gas production sector. The energy landscape in the United States has been reshaping rapidly due to advancements in drilling techniques, particularly hydraulic fracturing and horizontal drilling, leading to an increased capacity for capturing natural gas from challenging geologic formations such as shale. In 2022, the US Energy Information Administration reported record highs in natural gas productionapproximately 36.35 trillion cubic feet, which averages about 96.60 billion cubic feet per day. The major producing states, contributing to around 70.4% of the national production, include Texas, Pennsylvania, Louisiana, West Virginia, and Oklahoma.

Marathon Oil specifically operates in several of the most lucrative resource plays, cementing its presence in areas such as the Eagle Ford Shale in Texas and the Bakken Shale in North Dakota, alongside other vital locations like the SCOOP and STACK areas in Oklahoma and parts of the Permian Basin. The company's strategy has been to unlock the potential of these rich natural gas reserves to scale up its production capacity, a focus that was firmly highlighted by the strategic acquisition of assets from Ensign Natural Resources in 2022 for $3 billion. This move significantly expanded its stake in the Eagle Ford region, adding over 130,000 acres of land to its portfolio, complete with numerous undrilled locations and actively producing wells.

The company's presence in an industry characterized by continual change is apparent with mergers and acquisitions reshaping the market structure. While in the broader context Chevron's acquisition of Hess Corporation demonstrates the competitiveness within the sector, Marathon Oil itself aims to expand reach, secure additional resources, enhance technological capabilities, and bolster market positioning through its own strategic deals.

Top natural gas producers, including Marathon Oil, diversify and strengthen their market shares through various strategic initiatives. Exploiting opportunities from the Marcellus Shale to the Permian Basin, companies have adapted to shifting market demands and an evolving geopolitical landscape. As a globally emphasized issue, energy security and sustainability are at the forefront; US natural gas producers are well-positioned to satisfy domestic energy requirements and contribute to the global supply, particularly through LNG exports.

Marathon Oil Corporation's steady involvement in increasing natural gas production aligns with the industry-wide emphasis on strategic asset acquisitions and the leveraging of technology-driven exploration and resource exploitation. In synchrony with peers, Marathon Oil adapts its approach to uphold its position as one of the top producers in the US, catering to both domestic energy demands and expanding its reach globally.

However, the industry, including the likes of Marathon Oil, faces notable challenges. Persistent high inflation has led to increased market volatility and downstream effects on energy demand, posing notable impediments for integrated energy companies. Moreover, the high input costs associated with refining operations have inflicted stress on profit margins for firms whose work spans the gamut of extraction to finished product creation.

Despite these pressures, the resilience of the integrated oil industry in the U.S., as reflected by the industry's spot in the Zacks Industry Rank, is evident. While the rank points to a bearish sentiment largely due to the hurdles such as inflation and refining costs, it is subject to change as market dynamics evolve. The stock market performance of the industry has lagged behind the broader oil and energy sector, and the valuation metrics like the EV/EBITDA ratio reflect a complex picture with mixed implications.

Marathon Oil, navigating through an era of considerable challenges, has responded by strengthening its asset portfolio and refining its business operations to ensure cash flow and shareholder value. Through its strategic focus on resources like the Eagle Ford and Bakken formations, the company aims to capitalize on favorable commodity prices. Its upward earnings estimate revisions for the coming year indicate a potential overcoming of the near-term industry challenges.

However, the company's stock has not been immune to the broader market moves. Since its last earnings report, the stock price saw a decline of 9.2%. Despite this, strong domestic oil and gas production coupled with lower unit costs helped Marathon Oil outperform analysts' earnings expectations, reflecting the company's operational strengths.

The company's declared quarterly cash dividend increase is a testament to its commitment to returning value to shareholders amidst fluctuating oil and gas prices. It is this kind of financial maneuvering that enables Marathon Oil to navigate the constantly evolving landscape of the energy sector.

While the stock's rank and estimates spotlight its potential value, it is critical to note that Marathon Oil's recent adjustments to production expectations and its tactful approach to capital expenditure illustrate the company's strategic preference for financial stability over aggressive expansion. This circumspect outlook underscores the company's focus on sustainable growth, cautious investment, and shareholder returns, key elements for long-term success in a volatile industry.

Exploring Marathon Oil's operations further, its International E&P unit, particularly in Equatorial Guinea, reported lower earnings and decreased production compared to the previous year. These international endeavors, while facing some hurdles, remain a crucial part of Marathon Oil's diversified portfolio. Domestically, the U.S. E&P division showcased an increase in production, though tempered by lower commodity prices.

In financial terms, the stability in Marathon Oil's total costs stands in contrast to the decline in its adjusted operating cash flow, which underscores the industry's broader challenges. Nonetheless, the company maintains a strong cash position and a prudent level of long-term debt, showcasing the effectiveness of its financial management.

As the company looks to the future, its reaffirmed capital expenditure forecast suggests a commitment to a strategy that prizes shareholder returns. The consistency of this approach, coupled with anticipated production volumes, positions Marathon Oil to potentially weather the market uncertainties ahead.

Analyst sentiment, though cautious, retains a Zacks Rank #3 (Hold) for Marathon Oil, balancing a mixed forecast with a positive tilt towards the company's value potential. The company's resilience is further highlighted when considering the performance trajectories of peer companies within the industry. Not all have faced the same setbacks, indicating pockets of growth and potential for Marathon Oil within the industry.

In the broader scheme, Marathon Oil's stock performance and strategic maneuvers reveal a company that is adjusting its sails to meet the challenging winds of the energy market. A low P/S ratio added to its appeal for investors searching for undervalued options. The company's strategic repositioning and financial stability point toward an organization that seeks to stay agile and forward-looking amidst market fluctuations.

In the overall context of the oil and gas industry, the company's attributes recommend it as a potentially undervalued investment, especially when considering a wide array of financial metrics and the company's qualitative strengths. The monitoring of this and similar stocks could shine a light on potential investment opportunities within various sectors, particularly those labeled with low P/S ratios.

As Marathon Oil operates alongside industry giants like ConocoPhillips and Occidental Petroleum Corporation, its integrated approach to oil and gas exploration and production seems to buffer against some industry strains. The company's stake in prolific shale plays and its active involvement in midstream operations underscore its strategic positioning. Despite a challenging backdrop for the Oil & Gas US Integrated industry, the company's Zacks Rank reflects an anticipated positive earnings performance for 2023, offering a counterpoint to the overall bearish industry outlook.

Hedging against the overarching challenges of inflation and high refining costs, Marathon Oil's diversification and strategic location in key US shale regions could afford it a certain resilience. Though low dividend yields may not entice everyone, the company's overall strategy appears capable of navigating the volatile industry landscape.

Financial results from the third quarter of 2023 revealed that Marathon Oil exceeded analyst expectations regarding both revenue and earnings per share. The company managed to post higher-than-forecasted net sales volumes, enabling them to somewhat mitigate the impact of declining oil realizations. This adept handling of financials, coupled with the company's positive stock momentum and a Zacks Rank #2 (Buy), suggests an ability to potentially outperform the market.

Marathon Oil's strategic focus on dividend growth iterates its dedication to shareholder value within an industry affected by oil price instability. With hedge fund investment indicating confidence in the company and operational metrics backing up its financial health, the firm demonstrates why it's considered a stalwart in a sector prone to cyclical challenges. Although marketplace realities have led to sector underperformance, Marathon Oil's solid fiscal foundation and dividend policy make it an intriguing choice for those seeking income-generating investments in the energy sector.

The oils-energy sector, encompassing a wide array of companies, serves as a barometer for Marathon Oil Corporation's performance. Given its Zacks Rank #1 (Strong Buy), the company is expected to exhibit strengths that outmatch its peers in the short term. This optimism is mirrored by the positive revisions in earnings estimates, which have escalated significantly.

Year-to-date, Marathon Oil's gains slightly surpass the sector's average, delineating its promising position. However, PBF Energy's performance highlights the diversity within the sector, showcasing an even greater return and a shared top-tier Zacks Rank, further emphasizing the unique trajectories within the industry.

By categorizing Marathon Oil's industry sector separately, it becomes evident that the company's accomplishments are modest relative to its industry peers. Yet, the strength and potential progression of the oils-energy sector is an essential factor for investors to weigh, as they continue to survey Marathon Oil and similar companies embarking on future financial journeys within a fluid and competitive energy market landscape.

Marathon Oil Corporation's third-quarter results for 2023 showcased a company excelling in earnings while facing a slight slump in profits compared to the previous year. The increase in production, especially in the United States, contrasts with the reduced earnings in both U.S. and International E&P units due to fluctuating commodity prices. This dichotomy exemplifies the challenges inherent in the oil and gas industry, including the pressure from weaker oil realizations.

Nonetheless, the company's board demonstrated confidence by increasing quarterly cash dividends, further emphasizing their intent to prioritize shareholder value amidst market turbulence. Tight control over costs has allowed Marathon Oil to maintain financial stability and accrue significant free cash flow, enabling rewarding investment avenues such as share repurchases.

The company's capital and exploratory expenditures for the quarter are indicative of its pragmatic and focused investment strategy, which seeks to optimize returns amidst a variable production outlook. This strategic balancing act reflects the broader approach Marathon Oil is taking to navigate an industry rife with uncertainties and shifting economic dynamics.

From the given ARCH model results for Marathon Oil Corporation (MRO) between January 2019 and January 2024, we can deduce the following about the volatility of the company's asset returns:

- The 'Zero Mean' model used here indicates that the ARCH model does not predict a long-term average return for the asset; instead, it focuses solely on modeling the volatility of returns over time.

- The 'omega' coefficient is relatively large at 9.1705, which suggests that there is a significant baseline volatility in MRO's asset returns, even before considering any additional effects from past returns.

- The 'alpha[1]' coefficient, which measures the impact of the previous day's return shocks on today's volatility, is 0.3137. This value is statistically significant, as shown by the p-value (P>|t|) being less than 0.05, indicating that past return shocks have a substantial effect on the current volatility of MRO's assets.

In simpler terms, the volatility of Marathon Oil Corporation is significant, with large swings in asset returns that are notably influenced by the returns from the previous day. There's a consistent baseline level of volatility, and when the asset experiences a change in returns, this volatility tends to increase, creating a pattern where big changes tend to follow past big changes.

Similar Companies in Oil & Gas:

Exxon Mobil Corporation (XOM), Chevron Corporation (CVX), ConocoPhillips (COP), EOG Resources, Inc. (EOG), Occidental Petroleum Corporation (OXY), Pioneer Natural Resources Company (PXD), Devon Energy Corporation (DVN), Hess Corporation (HES), Apache Corporation (APA), Noble Energy, Inc. (NBL)

https://www.zacks.com/stock/news/2181474/5-low-price-to-sales-stocks-to-get-the-best-of-the-market

https://finance.yahoo.com/news/marathon-oil-mro-down-9-163201050.html

https://finance.yahoo.com/news/zacks-industry-outlook-highlights-conocophillips-092300953.html

https://finance.yahoo.com/news/top-25-natural-gas-producers-204113643.html

https://finance.yahoo.com/news/carrier-global-marathon-oil-rise-175748737.html

https://www.zacks.com/stock/news/2182169/marathon-mro-q3-earnings-top-as-u-s-output-grows-cost-falls

https://finance.yahoo.com/news/12-best-energy-dividend-stocks-162248616.html

https://www.sec.gov/Archives/edgar/data/0001002910/000100291023000112/aee-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: kbKgTa

https://reports.tinycomputers.io/MRO/MRO-2024-01-10.html Home