ArcelorMittal (ticker: MT)

2023-12-16

ArcelorMittal (NYSE: MT) is a leading integrated steel and mining company, with a presence in 60 countries and an industrial footprint spanning 18 countries. Guided by a philosophy to produce safe, sustainable steel, it is the leading supplier of quality steel products in all major markets including automotive, construction, household appliances, and packaging. The company has a crude steel production capacity of approximately 96 million metric tonnes, making it one of the world's largest steel manufacturers. ArcelorMittal is also the world's largest producer of iron ore and metallurgical coal, key raw materials for steelmaking, which aligns with its vertical integration strategy. The company's financial performance reflects the cyclical nature of the industry, with profitability closely tied to global economic conditions, demand for steel, and commodity price fluctuations. ArcelorMittal remains focused on operational efficiency, cost optimization, and innovation to maintain its competitive position in the market. As of the knowledge cutoff in 2023, ArcelorMittal continues to navigate the complex landscape of global trade tensions, environmental regulations, and evolving market dynamics.

ArcelorMittal (NYSE: MT) is a leading integrated steel and mining company, with a presence in 60 countries and an industrial footprint spanning 18 countries. Guided by a philosophy to produce safe, sustainable steel, it is the leading supplier of quality steel products in all major markets including automotive, construction, household appliances, and packaging. The company has a crude steel production capacity of approximately 96 million metric tonnes, making it one of the world's largest steel manufacturers. ArcelorMittal is also the world's largest producer of iron ore and metallurgical coal, key raw materials for steelmaking, which aligns with its vertical integration strategy. The company's financial performance reflects the cyclical nature of the industry, with profitability closely tied to global economic conditions, demand for steel, and commodity price fluctuations. ArcelorMittal remains focused on operational efficiency, cost optimization, and innovation to maintain its competitive position in the market. As of the knowledge cutoff in 2023, ArcelorMittal continues to navigate the complex landscape of global trade tensions, environmental regulations, and evolving market dynamics.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 22.51B | 21.04B | 22.74B | 23.91B | 21.37B | 16.57B |

| Enterprise Value | 26.77B | 25.67B | 27.92B | 26.26B | 25.30B | 20.91B |

| Trailing P/E | 5.40 | 4.88 | 3.81 | 2.96 | 1.91 | 1.20 |

| Forward P/E | 6.90 | 4.89 | 6.97 | 7.69 | 4.46 | 4.38 |

| PEG Ratio (5 yr expected) | 0.65 | - | - | - | - | - |

| Price/Sales (ttm) | 0.33 | 0.30 | 0.32 | 0.34 | 0.29 | 0.23 |

| Price/Book (mrq) | 0.40 | 0.38 | 0.43 | 0.45 | 0.41 | 0.30 |

| Enterprise Value/Revenue | 0.38 | 1.55 | 1.50 | 1.42 | 1.50 | 1.10 |

| Enterprise Value/EBITDA | 3.37 | 13.33 | 8.96 | 12.98 | 13.14 | 10.00 |

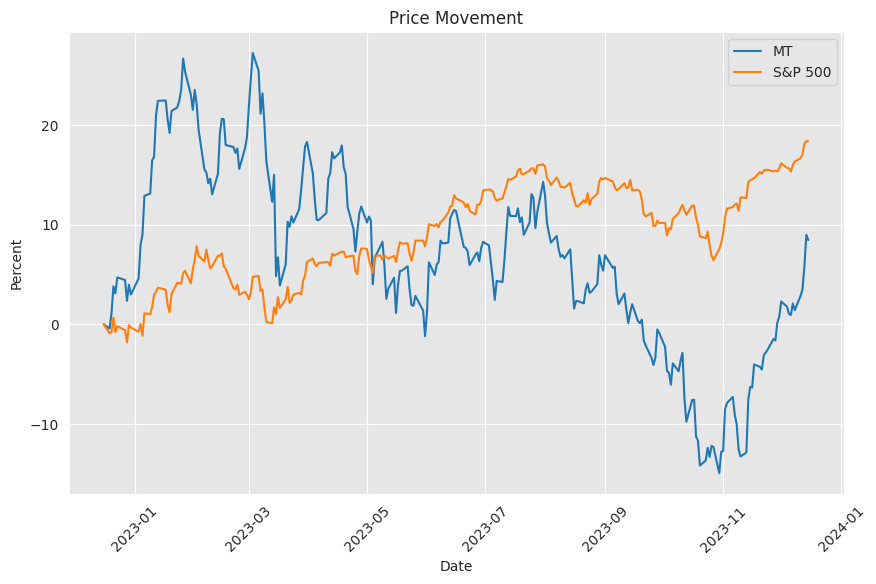

Technical Analysis Perspective:

- The current Adjusted Closing Price for the stock stands at $27.11.

- The Moving Average Convergence Divergence (MACD) is positive at 0.851453, and the MACD histogram value is 0.181582, suggesting continued bullish momentum.

- A high Relative Strength Index (RSI) of 76.23 indicates that the stock might be overbought, which typically precedes a potential pullback or consolidation in the price.

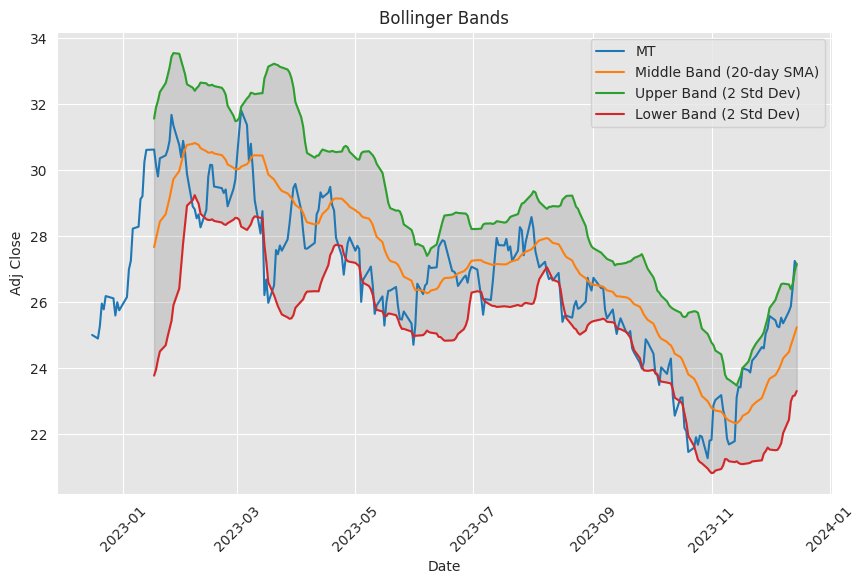

- Bollinger Bands reveal that the price is touching the upper Bollinger Band, signifying high buying pressure but also cautioning about possible mean reversion.

- The stock price is above both the Simple Moving Average (SMA_20) and the Exponential Moving Average (EMA_50), indicating an overall bullish trend.

- On Balance Volume (OBV) is at -0.386 million, showing some level of distribution or selling pressure, despite the uptrend.

- The Stochastic oscillator values (STOCHk_14_3_3 at 94.44 and STOCHd_14_3_3 at 95.18) are above 80, which typically indicates overbought conditions.

- A strong Average Directional Index (ADX_14) reading of 36.32 implies a strong trending market.

- Williams %R (WILLR_14) stands at -9.859, further highlighting the current overbought status.

- The Chaikin Money Flow (CMF_20) is slightly negative at -0.07, pointing towards a slight bearish divergence from the price action.

- Parabolic SAR shows the current stop-loss levels for a bullish trend.

Technical Analysis Perspective:

- The current Adjusted Closing Price for the stock stands at $27.11.

- The Moving Average Convergence Divergence (MACD) is positive at 0.851453, and the MACD histogram value is 0.181582, suggesting continued bullish momentum.

- A high Relative Strength Index (RSI) of 76.23 indicates that the stock might be overbought, which typically precedes a potential pullback or consolidation in the price.

- Bollinger Bands reveal that the price is touching the upper Bollinger Band, signifying high buying pressure but also cautioning about possible mean reversion.

- The stock price is above both the Simple Moving Average (SMA_20) and the Exponential Moving Average (EMA_50), indicating an overall bullish trend.

- On Balance Volume (OBV) is at -0.386 million, showing some level of distribution or selling pressure, despite the uptrend.

- The Stochastic oscillator values (STOCHk_14_3_3 at 94.44 and STOCHd_14_3_3 at 95.18) are above 80, which typically indicates overbought conditions.

- A strong Average Directional Index (ADX_14) reading of 36.32 implies a strong trending market.

- Williams %R (WILLR_14) stands at -9.859, further highlighting the current overbought status.

- The Chaikin Money Flow (CMF_20) is slightly negative at -0.07, pointing towards a slight bearish divergence from the price action.

- Parabolic SAR shows the current stop-loss levels for a bullish trend.

Fundamentals Overview: - The company has shown a significant increase in Market Cap from $16.57B to $22.51B over the recent quarters. - In terms of valuation metrics, a trailing P/E of 5.40 and a forward P/E of 6.90 denote an attractive pricing of earnings. - The company demonstrates a low Price/Sales ratio (ttm) at 0.33 and a low Price/Book (mrq) at 0.40, suggesting undervaluation compared to the broader market. - Enterprise Value multiples like EV/Revenue and EV/EBITDA are very low at 0.38 and 3.37, respectively, which may appeal to value investors. - The financials reflect a strong normalized EBITDA, and despite the presence of unusual items, the net income has been robust for the period ending 12/31/2022.

The technical indicators combined with supportive fundamentals set a positive outlook for the stock in the following months. However, given the high RSI values, the stock might experience some near-term corrective movements or consolidation before resuming its uptrend. The solid EBITDA suggests that the company has healthy operational effectiveness, while the low valuation multiples compared to earnings and sales indicate that the stock is likely undervalued.

This juxtaposition of strong fundamental valuations against the backdrop of several overbought technical signals can often lead to conflicting investor sentiment. Such scenarios may result in heightened volatility or slight retracements as traders take profits. However, given the company's robust financial health as evidenced by the sustained growth in market cap and operating income, any pullbacks may be viewed as buying opportunities by long-term investors.

The continuous uptrend shown by the moving averages, such as the SMA and EMA, along with the strong ADX, support the potential continuation of the current trend. However, traders and investors should monitor the OBV and CMF closely, as inconsistencies here could imply a weakening momentum, which may need to be validated by either an increase in volume or fundamental shifts.

In conclusion, the overall stock price trajectory seems poised for an ongoing bullish trend, albeit with caution advised in the near term due to possible overbought retracements. Long-term investors might gain from the stock's fundamental strength, while short-term traders could seek strategic entries post any temporary corrections. As market conditions evolve, maintaining an adaptive strategy with risk management practices, such as adjusting stop-loss orders to the levels indicated by tools like the Parabolic SAR, would be prudent.

ArcelorMittal, the world's leading integrated steel and mining company, has a presence that spans across more than 60 countries. The company, founded in 2006 through the merger of Arcelor and Mittal Steel, represents a formidable force in the steel industry, driven by its mission to deliver safe, sustainable steel. The company's main premise is to be at the forefront of innovation and to maintain a balance between creating economic value, being environmentally responsible, and being socially progressive.

Headquartered in Luxembourg, ArcelorMittal operates under the stewardship of Chairman and CEO Lakshmi Mittal, who has been instrumental in sculpting the multinational steel manufacturing corporation into what it is today. The company garnered significant attention when it became the world's largest steel producer, a position it has been maintaining through a combination of vast product portfolio, extensive research and development, and strategic acquisitions and partnerships.

Its global footprint is supported by a sizable workforce, recruiting over 170,000 employees. This vast pool of human resources is responsible for a diverse range of operations that include the production of crude steel to sophisticated product development. ArcelorMittal is segmented into various business divisions, including flat carbon steel, long carbon steel, and mining operations that maintain a synergy to support a vertically integrated business model.

The business model that ArcelorMittal employs allows for a high degree of control over its supply chain through its mining operations. With iron ore and coal mining assets, the company is not only self-sufficient but also benefits from the cost advantages associated with being a low-cost producer. The mining segment holds strategic importance for the company, ensuring a reliable supply of raw materials, which contributes to the consistency and quality of the steel produced.

ArcelorMittal's R&D efforts are central to its growth and sustainability ethos. The company significantly invests in this area to continuously develop new steel grades and solutions that are more energy-efficient and exhibit higher performance characteristics a necessity in today's fast-paced and environmentally conscious market. One of the recent innovations to come out of ArcelorMittals R&D is the range of advanced high-strength steels used by the automotive industry to reduce vehicle weight and enhance safety, which directly supports the industry's transition towards more fuel-efficient and electric vehicles.

Moreover, ArcelorMittal has shown a keen sense of corporate responsibility. The company is actively engaged in numerous sustainability initiatives, aiming to align its operations with the Paris Agreement. Its 10-point plan to reduce emissions and its commitment to being carbon-neutral by 2050 are testaments to its dedication to sustainable operations. ArcelorMittal's XCarb initiative is designed to bring together all of its reduced, low, and zero-carbon products and steelmaking activities, as well as to support technologies that are aimed at decarbonizing the steelmaking process.

The company's financial health is another cornerstone of its leadership position. Despite the cyclical nature of the steel industry and the volatility in global markets, ArcelorMittal has historically demonstrated robust financial performance. This is due to its diversified portfolio, economies of scale, and efficiency improvements. The company's revenue streams are diversified not only in terms of the variety of products offered but also geographically; this ensures a spread of risk and exposure to different market dynamics.

ArcelorMittal's commitment to innovation has also led to the development of digital technologies that improve efficiency. The company is embracing industry 4.0, implementing smart manufacturing systems and leveraging artificial intelligence and machine learning. These technologies enhance operational efficiency, product quality, and enable predictive maintenance, further solidifying its competitive edge.

In the realm of social investment, ArcelorMittal has established various community development programs, focusing on key areas such as education, health, and local economic development. These programs are not mere exercises in philanthropy; they are strategic in nature, helping to foster a positive relationship with the communities where the company operates and ensuring a stable and favorable operating environment.

On the corporate governance front, the company maintains a transparent and robust governance structure that upholds the highest standards of business ethics and compliance. This structure outlines the principles that govern the company's operations and engagements with stakeholders, reinforcing trust and integrity, which is particularly important in an industry that operates on a global scale and subject to intense regulatory scrutiny.

In conclusion, ArcelorMittal's position in the steel industry can be attributed to a multifaceted strategy which encapsulates innovation, sustainability, operational diversification, and financial resilience. The company's substantial investments in technology and its commitment to a sustainable future are core components that will likely continue to drive ArcelorMittals success. While this report does not include an overall conclusion or a detailed discussion on the risks of investing in stocks, it is evident that ArcelorMittal's ongoing evolution and adaptation to global challenges position it well to navigate the steel industry's dynamic landscape.

News Links:

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: b3Zdnm