Micron Technology, Inc. (ticker: MU)

2023-12-20

Micron Technology, Inc. (NASDAQ: MU) is a global leader in semiconductor systems. Founded in 1978 and headquartered in Boise, Idaho, the company has grown to become one of the largest memory manufacturers in the world. Micron's core products include a wide range of dynamic random-access memory (DRAM), flash memory (NAND), and solid-state drives (SSDs) which are essential components in advanced computing devices. Their products serve a broad array of sectors, from computer and networking to mobile and automotive markets. Micron's commitment to innovation is illustrated by its robust R&D department that works continually on next-generation memory technologies. Despite the cyclical nature of the semiconductor industry and the intense competition, Micron has maintained its position through strategic partnerships, acquisitions, and a focus on operational efficiency. As of the knowledge cutoff in 2023, Micron remains a key player in a technologically driven market, looking forward to capitalizing on the increasing demand for data storage and memory solutions in the era of big data, AI, and IoT.

Micron Technology, Inc. (NASDAQ: MU) is a global leader in semiconductor systems. Founded in 1978 and headquartered in Boise, Idaho, the company has grown to become one of the largest memory manufacturers in the world. Micron's core products include a wide range of dynamic random-access memory (DRAM), flash memory (NAND), and solid-state drives (SSDs) which are essential components in advanced computing devices. Their products serve a broad array of sectors, from computer and networking to mobile and automotive markets. Micron's commitment to innovation is illustrated by its robust R&D department that works continually on next-generation memory technologies. Despite the cyclical nature of the semiconductor industry and the intense competition, Micron has maintained its position through strategic partnerships, acquisitions, and a focus on operational efficiency. As of the knowledge cutoff in 2023, Micron remains a key player in a technologically driven market, looking forward to capitalizing on the increasing demand for data storage and memory solutions in the era of big data, AI, and IoT.

| As of Date: 12/20/2023Current | 8/31/2023 | 5/31/2023 | 2/28/2023 | 11/30/2022 | |

|---|---|---|---|---|---|

| Market Cap (intraday) | 90.70B | 76.79B | 74.64B | 63.09B | 62.89B |

| Enterprise Value | 95.04B | 80.29B | 76.70B | 63.40B | 61.07B |

| Trailing P/E | 10.05 | - | 48.37 | 10.46 | 7.44 |

| Forward P/E | - | 588.24 | 50.51 | - | 161.29 |

| PEG Ratio (5 yr expected) | - | - | - | - | - |

| Price/Sales (ttm) | 5.78 | 4.22 | 3.26 | 2.37 | 2.10 |

| Price/Book (mrq) | 2.06 | 1.69 | 1.58 | 1.28 | 1.26 |

| Enterprise Value/Revenue | 6.12 | 20.02 | 20.44 | 17.17 | 14.95 |

| Enterprise Value/EBITDA | 38.23 | 132.06 | 238.21 | -264.17 | 34.01 |

| Full Time Employees | 43,000 | Current Price | 80.83 | Market Cap | 89,214,500,864 |

| Previous Close | 82.17 | Open | 81.46 | Day Low | 79.91 |

| Day High | 81.62 | Dividend Rate | 0.46 | Dividend Yield | 0.56% |

| Payout Ratio | 31.56% | Average Dividend Yield (5 Year) | 0.33% | Beta | 1.313 |

| Forward P/E | 13.79 | Volume | 5,874,603 | Average Volume (10 days) | 13,556,720 |

| Bid | 81.02 | Ask | 80.99 | Bid Size | 1,400 |

| Ask Size | 1,000 | Fifty Two Week Low | 48.43 | Fifty Two Week High | 82.99 |

| Price to Sales (12 Months) | 5.74 | Fifty Day Average | 73.4382 | Two Hundred Day Average | 66.95565 |

| Enterprise Value | 94,630,494,208 | Profit Margins | -37.54% | Float Shares | 1,094,443,898 |

| Shares Outstanding | 1,103,730,048 | Shares Short | 19,379,586 | Shares Short Prior Month | 19,642,294 |

| Shares Percent Shares Out | 1.76% | Held Percent Insiders | 0.277% | Held Percent Institutions | 83.965% |

| Short Ratio | 1.58 | Book Value | 40.182 | Price to Book | 2.0116 |

| Net Income to Common | -5,832,999,936 | Trailing EPS | -5.34 | Forward EPS | 5.86 |

| Last Split Factor | 2:1 | Last Split Date | 957225600 | Enterprise to Revenue | 6.089 |

| Enterprise to EBITDA | 42.8 | S&P 52 Week Change | 22.95% | Last Dividend Value | 0.115 |

| Total Cash | 9,594,000,384 | Total Cash Per Share | 8.737 | EBITDA | 2,211,000,064 |

| Total Debt | 13,998,999,552 | Quick Ratio | 2.526 | Current Ratio | 4.458 |

| Total Revenue | 15,539,999,744 | Debt to Equity | 31.729 | Revenue Per Share | 14.218 |

| Return on Assets | -5.23% | Return on Equity | -12.41% | Gross Profits | -1,416,000,000 |

| Free Cash Flow | -5,133,374,976 | Operating Cash Flow | 1,559,000,064 | Revenue Growth | -39.6% |

| Gross Margins | -9.11% | EBITDA Margins | 14.23% | Operating Margins | -34.29% |

Based on the provided technical indicators and fundamental analysis data for MU (Micron Technology, Inc.), the following is an assessment of the likely movement in the stock price over the next few months:

- The adjusted closing price on the last trading day was $80.83, with the Moving Average Convergence Divergence (MACD) showing a value of 2.097582 and the histogram at 0.398672. This positive MACD indicates a current bullish trend in the stock.

- The Relative Strength Index (RSI) stood at 64.168352, which is relatively high and approaching overbought levels, suggesting a possible slowdown or reversal in momentum if it crosses above the overbought threshold of 70.

- The Bollinger Bands with a 5-day period indicate that the closing price is below the upper band ($82.651207) but above the middle band ($81.632001), hinting at a continuation of the prevailing trend.

- The Short-Term Moving Average (SMA_20) sits at $77.498001, while the longer-term Exponential Moving Average (EMA_50) is at $74.956151, both of which are below the last closing price, aligning with an uptrend.

- The On-Balance Volume (OBV) at 9.795660 million suggests that there is substantial volume behind the current price movement, often a bullish sign.

- Stochastic Oscillator values (STOCHk_14_3_3 at 85.387684 and STOCHd_14_3_3 at 87.328176) are in overbought territory, which could imply that the stock is due for a consolidation or pull-back in the near term.

- The Average Directional Index (ADX_14) at 36.414375 points to a strong current trend, and the negative Williams %R (WILLR_14 at -21.471139) corroborates overbought conditions.

- The Chaikin Money Flow (CMF_20) of 0.173109 is indicative of buying pressure and a bullish sign.

- The Parabolic SAR (PSAR) shows an uptrend, as indicated by PSARl_0.02_0.2 at $75.969026.

In correlation with the technical indicators, the fundamental analysis data reveals:

- MU's Market Cap is $90.70B, which shows a significant increase from earlier evaluations, indicating market confidence.

- The trailing Price to Earnings (P/E) ratio is relatively low at 10.05, which could be appealing to value investors.

- The Price/Sales (ttm) and Price/Book (mrq) ratios have risen, reflecting the stock's increasing valuation.

- The significant increase in Enterprise Value to Revenue ratio (from 14.95 to 17.17 to 6.12) suggests a growing premium on the company's sales.

- The financials demonstrate a significant loss in net income, substantial unusual items, and a decrease in gross profit, which raise concerns about the company's operational performance and profitability. The large negative normalized EBITDA and unusual items impacts could be warning signs for long-term investors.

Considering the blend of technical and fundamental perspectives, the stock appears to be in a strong technical uptrend supported by volume and buying pressure. However, there are overbought technical indicators and underlying concerns in the fundamentals which suggest that the current bullish sentiment could face challenges. It is reasonable to expect the following potential scenarios in the stock price movement:

- The bullish trend may continue in the short term due to favorable technical indicators such as positive MACD and high OBV, but investors should watch for signs of reversal, especially considering the overbought conditions indicated by the RSI and stochastic oscillators.

- If the stock price does encounter a reversal due to the overbought situation, it does not necessarily imply a long-term downtrend as long as the SMA_20 and EMA_50 continue to trend upward.

- Previous financial irregularities and operational performance issues could weigh on the sentiment. Investors will likely be attentive to the next earnings release to reassess the fundamentals.

- Given the recent increase in valuation metrics, new entrants to the stock may be more cautious, potentially slowing down the momentum seen in recent months.

- A balance between technical and fundamental analysis is crucial. Investors might consider taking profits or protecting their positions with stop-loss orders to guard against potential shifts in sentiment due to fundamental factors while participating in the current technical uptrend.

As with all stock analysis, these predictions should be used as part of a broader investment strategy, taking into account the overall market conditions, sector-specific news, and individual investment goals.

Micron Technology, Inc., known as Micron, a leading American global corporation headquartered in Boise, Idaho, specializes in the production of several forms of semiconductor devices. These range from dynamic random-access memory (DRAM), flash memory, to USB flash drives. Micron's prominence is not just in manufacturing these critical components but also in its potential for growth as identified by various market analysts. The semiconductor industry, where Micron has made its mark, has been through a cycle of volatility with periods of oversupply and pricing pressures that have affected companies across the board.

A significant shift seems to be on the horizon for the industry, with financial analysis pointing towards a considerable turnaround for Micron. The memory market has undergone substantial changes with DRAM prices experiencing quarter-over-quarter increases, attributed to a resurgence in demand. TrendForce estimates indicate an upward trajectory for DRAM prices, and Gartner's prediction of a significant revenue surge in the memory market's revenue for 2024 reinforces the optimism about the industry's future.

The recovery in key segments such as the personal computer and smartphone markets is expected to contribute to this growth. Additionally, emergent areas of demand like artificial intelligence (AI) present new opportunities for companies like Micron. Its strategic investments position it well to reap the benefits of this growth. Projected financial growth for Micron is impressive, with revenue expected to climb significantly, reflecting a stark improvement from previous performance and a sign that earnings are poised to follow suit. This projection of revenue growth, along with a maintained sales multiple, implies a considerable increase in Micron's market capitalization, a sign that should interest investors.

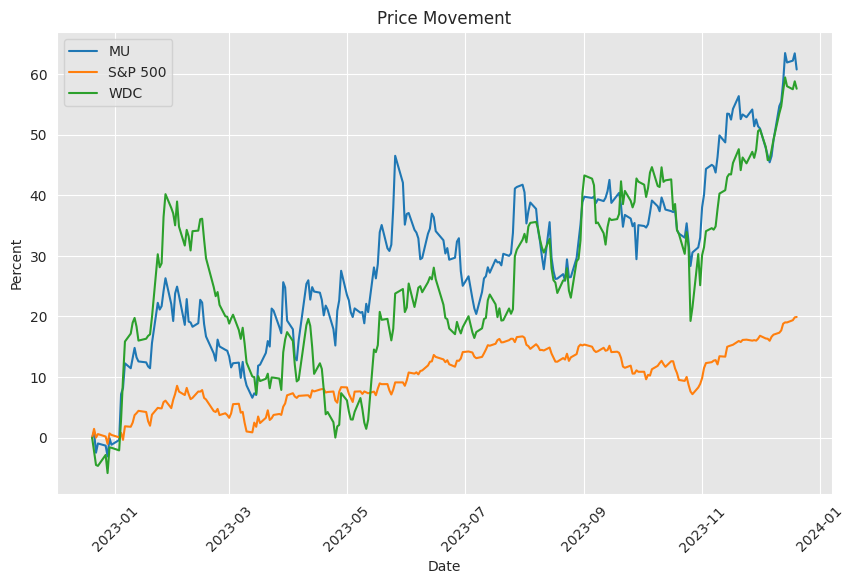

The stock market's response to these expectations has so far been positive, with substantial returns delivered to Micron's shareholders. A notable increase in the stock's value within just the first few months of the year demonstrates investor confidence in the company's ability both to navigate the memory market and capitalize on industry trends.

This bullish sentiment is further reinforced by the analysis of Micron as an attractive AI-related stock investment. The company's role in producing high-bandwidth memory (HBM) chips, which are crucial for AI technology, is a key factor driving demand. AI necessitates enhanced memory solutions, and with its HBM products, Micron is seen as a frontrunner to meet this growing need. Its supply relationship with Nvidia for the H100 chip using HBM and management's comments about meaningful revenue contributions from HBM starting fiscal 2024, underscore its critical positioning.

The demand for HBM, seen as integral for general AI and generative AI models, is projected to increase substantially over the next few years. By securing a significant portion of the HBM market, Micron could witness robust growth, as market analysts anticipate. The company's current stock valuation makes it an attractive investment proposition, and investors are becoming keenly aware of the potential before an expected price increase tied to AI-driven demand, considering its impressive year-to-date price increase.

As for Micron's core business in DRAM and NAND flash memory, the role these products play in AI cannot be overstated. Memory is indispensable in AI for data processing tasks and algorithm functions. Despite market challenges, including decreased PC and smartphone demand coupled with geopolitical tensions, Micron's unique position as the only U.S.-based manufacturer of DRAM adds a favorable edge. High expectations of revenueindicative of a market recoverystrengthen the outlook for Micron.

The supply discipline model adopted by major producers, including production cutbacks, may well play into Micron's hands as controlled supply could boost profitability. Moreover, the transition towards advanced chip packaging in the industry could call for higher memory integration levels. This bodes well for firms like Micron as next-generation technologies take center stage.

Micron's development path is particularly noteworthy as it pivots towards HBM3E products tailored for AI applications, beginning shipments in early 2024. This product will cater to the data and speed requirements of sophisticated AI solutions, giving Micron a competitive advantage. With industry-wide anticipation of memory cycles tied to the AI boom, Micron is setting itself up for potential growth beyond the current fiscal year.

Ongoing efforts in R&D are paving the way for Micron to capitalize on the expanding AI-driven market. The demand for memory, particularly specialized memory to power AI technology, is expected to bolster Micron's profitability and industry standing. This focus on AI and the launch of specialized memory products presents Micron with a robust foundation for growth, aligning with the overall industry's trajectory towards a profitable cycle.

Micron's recent challenges have seen a decrease in demand for DRAM and NAND chips, causing revenue setbacks and net losses for the company. Despite this, revised fiscal guidance suggests that conditions are improving. An updated revenue forecast above previous midpoints reflects early signs of a market upturn. Although margins are still negative, they are less severe than expected. Optimism within the company predicts that 2025 could potentially be a record year if market recovery persists.

In an industry marked by cyclical trends, specialized HBM chips utilization in AI accelerators is a key area of growth for Micron. As AI servers continue to employ significant amounts of DRAM and NAND chips, the demand for Micron's offerings is anticipated to rise. This could further improve chip pricing, aiding the companys financial recovery.

Micron's strategic partnership with Nvidia stands to boost its role in the burgeoning AI market. With Nvidia's latest AI processors expected to feature Micron-supplied HBM3e memory chips, Micron's growth prospects are tightly linked to its ability to deliver for high-demand AI solutions. According to revenue forecasts, this partnership, along with a strong AI-oriented product lineup, could result in remarkable revenue increases and elevate Micron's market cap.

Therefore, Micron's potential for significant growth lies ahead, driven by the AI sector's ever-increasing demand for advanced memory solutions. Despite the inevitable susceptibility to market fluctuations, strategic positioning in AI technology, emerging partnerships, and favorable market forecasts point towards a flourishing era for Micron in the semiconductor landscape. Investors are closely watching Micron's trajectory, with anticipation that its involvement in AI and memory chip technology will yield substantial rewards in the near future.

Similar Companies in Data Storage:

Western Digital Corporation (WDC), Seagate Technology Holdings PLC (STX), Intel Corporation (INTC), Samsung Electronics Co., Ltd. (SSNLF), SK Hynix Inc (000660.KS), Kioxia Holdings Corporation (TOSBF), NAND Flash Manufacturers (Various) (Varies)

News Links:

https://www.fool.com/investing/2023/12/20/the-ultimate-growth-stocks-to-buy-with-1000-right/

https://www.fool.com/investing/2023/12/05/want-add-artificial-intelligence-ai-stocks-buy/

https://www.fool.com/investing/2023/12/05/3-top-ai-stocks-beyond-the-magnificent-seven/

https://www.fool.com/investing/2023/12/03/things-are-finally-looking-up-for-micron/

https://www.fool.com/investing/2023/11/24/this-artificial-intelligence-ai-stock-is-all-set-f/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: QCAX4F