Nike, Inc. (ticker: NKE)

2023-12-25

Nike, Inc. (ticker: NKE) is a global leader in athletic footwear, apparel, equipment, and accessories. Founded in 1964 as Blue Ribbon Sports by Phil Knight and Bill Bowerman, the company officially became Nike, Inc. in 1971, named after the Greek goddess of victory. Headquartered in Beaverton, Oregon, Nike has grown to become one of the most recognized and valuable brands in the world, driven by its iconic "Swoosh" logo and "Just Do It" slogan. The company operates on a global scale, with a vast portfolio that includes several subsidiary brands such as Converse and Jordan Brand. Nike's broad product line covers a wide range of sports and fitness activities, demonstrating a strong commitment to innovation through research and development. The brand has an extensive distribution network that includes Nike-owned retail stores, online sales, and independent distributors, retailers, and licensing partnerships. Nike's marketing strategies often feature high-profile athletes and aim to inspire consumers by tapping into the cultural zeitgeist. Financially, Nike has a solid track record of revenue growth and profitability, making it a staple in many investment portfolios. As of the knowledge cutoff in 2023, the company continues to invest in digital transformation and sustainability initiatives as a part of its business strategy.

Nike, Inc. (ticker: NKE) is a global leader in athletic footwear, apparel, equipment, and accessories. Founded in 1964 as Blue Ribbon Sports by Phil Knight and Bill Bowerman, the company officially became Nike, Inc. in 1971, named after the Greek goddess of victory. Headquartered in Beaverton, Oregon, Nike has grown to become one of the most recognized and valuable brands in the world, driven by its iconic "Swoosh" logo and "Just Do It" slogan. The company operates on a global scale, with a vast portfolio that includes several subsidiary brands such as Converse and Jordan Brand. Nike's broad product line covers a wide range of sports and fitness activities, demonstrating a strong commitment to innovation through research and development. The brand has an extensive distribution network that includes Nike-owned retail stores, online sales, and independent distributors, retailers, and licensing partnerships. Nike's marketing strategies often feature high-profile athletes and aim to inspire consumers by tapping into the cultural zeitgeist. Financially, Nike has a solid track record of revenue growth and profitability, making it a staple in many investment portfolios. As of the knowledge cutoff in 2023, the company continues to invest in digital transformation and sustainability initiatives as a part of its business strategy.

| As of Date: 12/25/2023Current | 11/30/2023 | 8/31/2023 | 5/31/2023 | 2/28/2023 | 11/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 164.43B | 167.82B | 155.01B | 161.26B | 182.94B | 170.02B |

| Enterprise Value | 166.68B | 171.21B | 156.48B | 163.02B | 184.84B | 170.73B |

| Trailing P/E | 31.50 | 34.03 | 31.49 | 30.33 | 33.56 | 31.16 |

| Forward P/E | 29.15 | 29.76 | 27.10 | 26.32 | 28.33 | 35.97 |

| PEG Ratio (5 yr expected) | 1.96 | 2.01 | 1.86 | 1.75 | 2.02 | 3.59 |

| Price/Sales (ttm) | 3.25 | 3.34 | 3.12 | 3.28 | 3.85 | 3.73 |

| Price/Book (mrq) | 11.62 | 12.01 | 11.07 | 11.10 | 11.98 | 10.75 |

| Enterprise Value/Revenue | 3.23 | 12.79 | 12.09 | 12.71 | 14.92 | 12.82 |

| Enterprise Value/EBITDA | 27.50 | 93.81 | 97.55 | 133.52 | 130.91 | 107.58 |

| Address | One Bowerman Drive, Beaverton, OR, 97005-6453, United States | Phone | 503 671 6453 | Website | https://www.nike.com |

| Industry | Footwear & Accessories | Sector | Consumer Cyclical | Full-time Employees | 83,700 |

| Previous Close | $122.53 | Open | $108.26 | Day's Low | $107.45 |

| Day's High | $110.80 | Dividend Rate | $1.48 | Dividend Yield | 1.37% |

| Market Cap | $186,479,198,208 | Beta | 1.079 | Trailing PE | 31.59 |

| Volume | 46,666,188 | Average Volume | 9,397,434 | Bid Size | 1,800 |

| Ask Size | 1,100 | Enterprise Value | $166,557,237,248 | Shares Outstanding | 1,224,009,984 |

| Profit Margins | 10.28% | Held Percent Insiders | 1.413% | Held Percent Institutions | 83.282% |

| Book Value | $9.30 | Price to Book | 11.61 | Revenue | $51,541,999,616 |

| Total Cash | $9,927,000,064 | Ebitda | $6,814,000,128 | Total Debt | $12,177,000,448 |

| Current Ratio | 2.737 | Debt to Equity | 86.081 | Return on Assets | 9.86% |

| Return on Equity | 36.026% | Gross Margins | 43.958% | EBITDA Margins | 13.22% |

The analysis of Nike, Inc. (NKE) incorporates a comprehensive view of both technical analysis and an understanding of underlying financial metrics. Nike's stock performance, when monitored through the lens of technical indicators, reveals several key insights.

Examining the On-Balance Volume (OBV) metric shows a sustained upward trend over the past several months, illustrating a positive accumulation of volume, which can be an indication of a healthy bullish trend for the stock. This is reinforced by the movement in the MACD (Moving Average Convergence Divergence) histogram, which, on the last trading day, did turn negative but considering its previous positive trajectory, it could imply a potential pullback in a broader upward trend.

In the recent trading session, there's been a marked decrease, with the price gapping down significantly. This sharp drop may be attributed to a market overreaction or an event-driven sell-off and does necessitate careful consideration of subsequent market action to determine if this presents a potential reversal of the trend or merely a temporary correction within an ongoing uptrend.

Looking at the company's fundamentals, the modest P/E (price-to-earnings) ratio has slightly decreased from its peak in February, denoting that the stock may have been priced more attractively compared to future earnings expectations. This Forward P/E indicates some market expectations of robust earnings growth. Nike's Growth PEG (price/earnings to growth) ratio, while lower than in November, still suggests the stock might not be undervalued relative to the company's anticipated growth.

The price/sales ratio shows a consistent value for the stock over the last several data points, possibly suggesting stability in the company's sales volume relative to the stock price. The Enterprise Value/Revenue and Enterprise Value/EBITDA both are within a reasonable range, insinuating that from an investment and debt standpoint, the company might not be overly leveraged, and earnings before interest, taxes, depreciation, and amortization are being sufficiently monetized.

Nike's financial performance, based on recent data, shows resilient net income figures and a strong gross profit margin. The increase in net income and operating revenues compared to previous years manifest the company's capacity to grow and maintain profitability, even in the face of rising costs of revenue.

Considering the technical and fundamental perspectives, the following months may present a cautiously optimistic outlook for Nike's stock price movement. Assuming continuation of the corporate performance and barring any adverse macroeconomic events or company-specific headwinds:

- There may be a potential recovery from the recent price gap, based on the preceding positive trend in the OBV and overall market sentiment.

- Short-term volatility is possible; however, continued accumulation and a sustained upward MACD histogram trend suggest an underlying bullish sentiment.

- Strength in fundamental financial metrics supports the case for a stable to positive outlook on the price movement.

In conclusion, the technical analysis, coupled with a solid fundamental backdrop, suggests that Nike is positioned to possibly experience a resumption of its long-term upward trend, subject to market conditions. The recent sell-off may offer a buying opportunity if the broader market trend remains favorable, with an expectation for potential price stabilization and appreciation in the subsequent months. Investors should monitor upcoming earnings reports, market trends, and any significant news that may impact consumer goods sectors as they could influence the future direction of Nike's stock price.

Amid a backdrop of buoyant stock market trends with its eighth consecutive week of gains, economic indicators have become paramount to investors gauging future market directions. Within this broader market narrative, Nike, Inc. (NKE), with its formidable global presence in the consumer cyclical sector, has stood as a beacon of interest. The stock market's rally, underpinned by a cooling Federal Reserve inflation measure, signals that a shift towards a stable inflation rate is underway, potentially leading to a reassessment of the Fed's monetary policies.

The slowdown in inflation raises the prospect of a more accommodating interest rate environment, which bodes well for consumer spending and economic cycles. This is critical for consumer brands like Nike, where discretionary income heavily dictates sales of sports apparel and footwear. Thus, the easing inflationary pressures could be a harbinger of positive development for Nike, potentially translating into an uptick in consumer expenditure on non-essential items.

Nike's performance has mirrored overall market sentiments, with investor confidence underpinned by its ability to steer through economic turbulence, as evidenced by its globally recognized brand and innovative product lines. Investors are acutely aware that a company's ability to adapt to macroeconomic factors, such as the likely easing of aggressive interest rate hikes, can significantly propel its growth prospects.

The brand's initiatives to enhance direct-to-consumer sales channels and digital transformation have only added luster to its investment appeal. These strategic thrusts have rendered the business more resilient, facilitating more profound engagement with customers and driving operational efficiencies which could lead to margin expansion and increased profitability over time.

As we draw closer to year-end trading, the attention remains fixed on the Federal Reserve's actions and broader economic factors. Stock market trends and company-specific strategies and financial reports are pivotal in shaping investment perspectives for stocks like Nike, especially in an economy where indicators hint at moderation in inflationary pressures.

Closely monitoring macroeconomic indicators is indispensable for companies like Nike, given their profound impact on consumer-driven businesses. The present stock market run, along with indications of retreating inflation, positions Nike as a prominent entity to watch in an economic landscape on the cusp of change.

However, the athletic industry's landscape has become more competitive, with firms like On Holding AG capturing investor attention with their rapid growth and innovative strategies. Despite market capitalization disparities, On Holding's dynamic approach and technological advancements have led to attractive margins and exponential growth, catching the eye of investors on December 22, 2023, despite its stock price decline of 3.71% to $28.03.

On the other hand, Nike continues to be revered by investors for its extensive market outreach and entrenched reputation. Endorsements from top athletes and impactful marketing campaigns have fortified its marketplace stance, reflected consistently in the stock's long-standing performanceeven though susceptible to the usual market oscillations.

The investment question posed between Nike and its up-and-coming competitor On Holding distills to varying investor preferences. On Holding, with its swift rise, may attract investors hungry for quick growth and the buzz of a burgeoning brand. Nike, in contrast, may appeal more to those seeking a steadfast investment in a tried-and-true industry stalwart.

Investment services like The Motley Fools Stock Advisor and Rule Breakers bring to light the potential of informed investment decision-making. These services have registered returns of 543% and 266% respectively, significantly outstripping the S&P 500's returns, reaffirming the significance of astute investment choices in a marketplace where both Nike and On Holding command consequential but distinctly different investment theses.

Nike has managed to sustain market leadership with its sheer size, brand power, and global reach, whereas On Holding's agility and pronounced growth trajectory pose opportunities for potentially heightier short-term gains. Investment decisions should be weighed against each companys market position, growth potential, and long-term prospects.

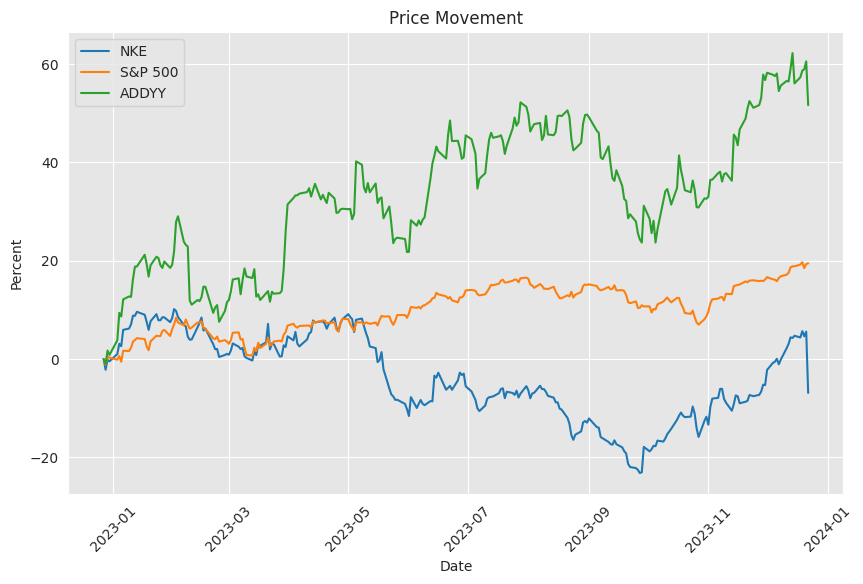

Similar Companies in Footwear & Accessories:

Adidas AG (ADDYY), Under Armour, Inc. (UAA), PUMA SE (PUMSY), Skechers U.S.A., Inc. (SKX), ASICS Corporation (ASCCY), Lululemon Athletica Inc. (LULU), Columbia Sportswear Company (COLM), Deckers Outdoor Corporation (DECK), VF Corporation (VFC), New Balance Athletics, Inc. (Privately Held)

News Links:

https://finance.yahoo.com/m/133350d4-9eb7-39cd-9d30-9c4d6096cfa7/stock-market-today%3A-stocks.html

https://www.fool.com/investing/2023/12/15/better-stock-nike-or-on-holding/

https://seekingalpha.com/article/4659385-wall-street-breakfast-what-moved-markets

https://www.fool.com/investing/2023/12/22/why-nike-stock-got-hammered-today/

https://www.fool.com/investing/2023/12/20/3-beaten-down-dow-stocks-to-buy-before-they-pop/

https://finance.yahoo.com/news/nike-inc-nyse-nke-q2-202748222.html

https://finance.yahoo.com/news/results-nike-inc-exceeded-expectations-120715662.html

https://finance.yahoo.com/m/9365e5da-dc0b-3149-b032-944aee2db6c2/s%26p-500-gains-and-losses.html

https://finance.yahoo.com/m/a9d2b457-5278-3821-96fe-f24aa1f5d6a4/these-stock-market-sectors.html

https://www.fool.com/earnings/call-transcripts/2023/12/21/nike-nke-q2-2024-earnings-call-transcript/

https://finance.yahoo.com/m/f392b57d-12e0-36be-8733-d19b36a14ba7/stock-market-closes-mixed-but.html

https://finance.yahoo.com/m/c714eecb-b025-31dc-8d69-d6f77c88ad7b/3-reasons-to-buy-on-holding.html

https://finance.yahoo.com/news/15-countries-produce-best-nba-221136885.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 1R7bLZ

https://reports.tinycomputers.io/NKE/NKE-2023-12-25.html Home