Nucor Corporation (ticker: NUE)

2023-12-16

Nucor Corporation (ticker: NUE) stands as a prominent player in the American steel production industry, renowned for its innovation and efficiency in manufacturing steel products. With its headquarters located in Charlotte, North Carolina, the company operates through three primary segments: Steel Mills, Steel Products, and Raw Materials. Nucor is known for employing electric arc furnaces in its mini-mill production processes, which sets it apart as a leader in energy efficiency and recycling, given its capacity to utilize scrap metal effectively. Structured as a decentralized organization, Nucor holds the distinction of being the largest recycler in North America. It has been committed to expanding its product range and market reach through strategic investments and acquisitions, fostering a robust supply chain network that serves various sectors including construction, automotive, and energy. The company values its employees through an incentive-based compensation system, which contributes to high productivity levels and a dynamic corporate culture. Nucor's financial performance and sustainable business practices reflect in its stock performance and market valuation, making it a significant entity to consider in the steel industry's landscape.

Nucor Corporation (ticker: NUE) stands as a prominent player in the American steel production industry, renowned for its innovation and efficiency in manufacturing steel products. With its headquarters located in Charlotte, North Carolina, the company operates through three primary segments: Steel Mills, Steel Products, and Raw Materials. Nucor is known for employing electric arc furnaces in its mini-mill production processes, which sets it apart as a leader in energy efficiency and recycling, given its capacity to utilize scrap metal effectively. Structured as a decentralized organization, Nucor holds the distinction of being the largest recycler in North America. It has been committed to expanding its product range and market reach through strategic investments and acquisitions, fostering a robust supply chain network that serves various sectors including construction, automotive, and energy. The company values its employees through an incentive-based compensation system, which contributes to high productivity levels and a dynamic corporate culture. Nucor's financial performance and sustainable business practices reflect in its stock performance and market valuation, making it a significant entity to consider in the steel industry's landscape.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 42.49B | 38.89B | 41.20B | 38.92B | 33.82B | 28.01B |

| Enterprise Value | 42.45B | 40.19B | 43.25B | 40.75B | 37.10B | 32.99B |

| Trailing P/E | 8.74 | 7.19 | 6.41 | 5.37 | 4.16 | 3.31 |

| Forward P/E | 14.58 | 13.55 | 9.61 | 9.65 | 9.06 | 7.30 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 1.22 | 1.07 | 1.07 | 0.98 | 0.82 | 0.69 |

| Price/Book (mrq) | 2.08 | 1.95 | 2.17 | 2.11 | 1.89 | 1.67 |

| Enterprise Value/Revenue | 1.19 | 4.58 | 4.54 | 4.68 | 4.25 | 3.14 |

| Enterprise Value/EBITDA | 5.33 | 22.01 | 18.48 | 21.60 | 20.08 | 12.43 |

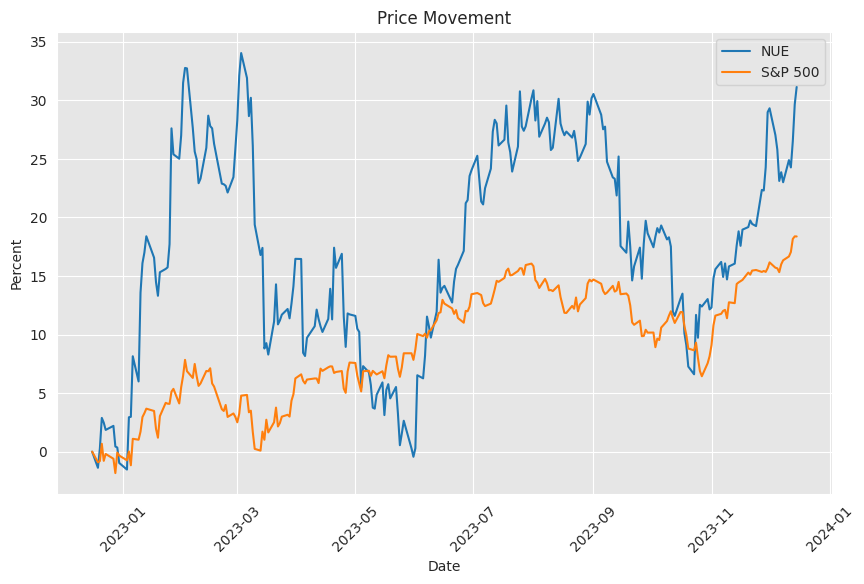

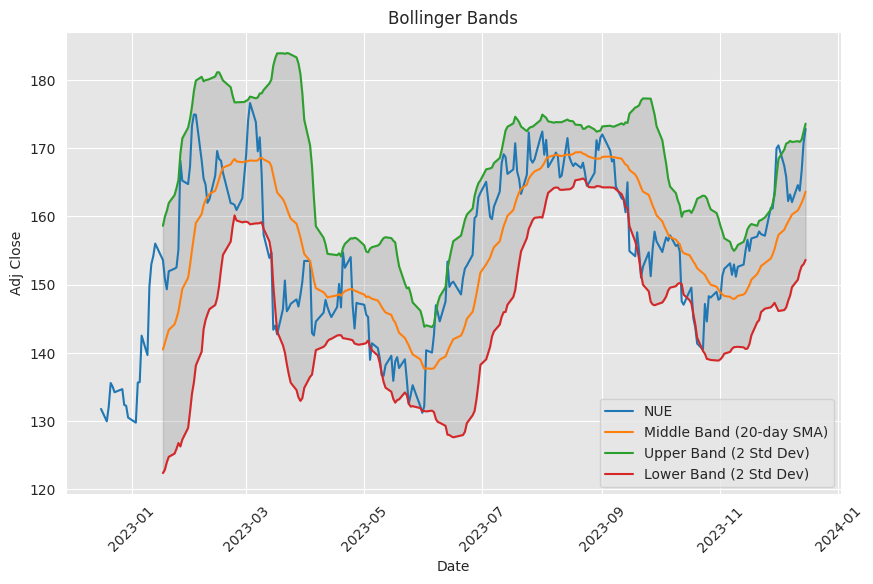

Upon assessing the technical analysis data provided coupled with the fundamental metrics, we can form a perspective on the potential trajectory of the stock price for Nucor Corporation (NUE) over the coming months.

Upon assessing the technical analysis data provided coupled with the fundamental metrics, we can form a perspective on the potential trajectory of the stock price for Nucor Corporation (NUE) over the coming months.

Technical Analysis Perspective: - The Adjusted Close of 172.82 indicates that the price is currently in an uptrend and near its recent highs. - A MACD value of 3.688 with a positive histogram value suggests that the bullish momentum is strong; however, caution is advised as the MACD is relatively high, which can sometimes precede a pullback. - The RSI at 70 could indicate that the stock is becoming overbought, warranting watchfulness for a potential reversal or sideways movement. - Bollinger Bands show that the price is hovering near the upper band, again indicating an overextended market that might pull back towards the mean in the near term. - SMA_20 is below the current price, demonstrating a bullish short-term trend. The EMA_50 below current price further supports the bullish trend over a medium-term horizon. - The On-Balance Volume (OBV) suggests that volume is following priceconsidered a positive sign. - Stochastic indicators (STOCHk and STOCHd) near 80 indicate that the stock might be overbought. - An ADX value of 23 suggests a moderate trend strength which, coupled with the bullish indicators, may signal that the uptrend could persist, though the possibility of a pullback should not be ruled out due to the high RSI and proximity to the Bollinger Band's upper limit. - Williams %R implies overbought conditions. - Chaikin Money Flow (CMF) is positive, implying buying pressure. - The Parabolic SAR also favors uptrend continuity.

Fundamental Analysis Perspective: - Increasing Market Cap and Enterprise Value over the recent quarters signify market confidence. - The Trailing P/E at 8.74 remains quite reasonable, with a modest raise in the Forward P/E, suggesting optimism about future earnings but also reflecting that future growth expectations may be priced in. - Improvements in Price/Sales and Price/Book ratios reflect a turn towards profitability and asset valuation improvement. - Enterprise Value/Revenue and Enterprise Value/EBITDA ratios have normalized after a spike, indicating stabilization. - Examination of the financials points toward strong and growing EBITDA and Net Income, indicating financial health and operational efficiency.

Overall Market Dynamics: In conclusion, a comprehensive evaluation reflects a robust bullish trend that has driven NUE's stock price higher. With enduring fundamental stability, supported by healthy earnings performance and sustained operational productivity, the stock exhibits a clear uptrend with a strong market presence. However, technical indicators signal caution in the near term due to potential overbought conditions, highlighting the possibility of a pullback or consolidation phase before a continuation of the uptrend.

In accordance with the technical and fundamental data, the potential for NUEs stock price in the next few months could include initial consolidation or a mild corrective phase due to the overbought conditions. Nevertheless, given the solid fundamentals, any pullback may be seen as an opportunity to buy for those investors with confidence in the company's long-term prospects. Ultimately, barring unforeseen market volatility or company-specific disruptions, NUEs stock price could continue its upward trajectory once corrective actions or consolidation has occurred, though vigilance is advisable given the currently elevated technical indicator levels.

Nucor Corporation (NUE), a titan in the steel manufacturing industry, has recently caught the eye of energy giant ExxonMobil, which itself has made significant moves to enhance its oil and gas production while prioritizing carbon emission reduction. ExxonMobil's bold acquisitions of Pioneer Natural Resources and Denbury Resources for a combined amount nearing $70 billion demonstrate a strategic pivot to deepen its footprint in sustainable practices. These transactions spotlight Nucor's critical involvement in carbon capture initiatives, which aligns with ExxonMobil's environmental and operational objectives.

The acquisition of Denbury Resources delivers to ExxonMobil an extensive carbon dioxide pipeline network and carbon sequestration sites crucial for scaling up carbon capture and sequestration (CCS) efforts. These new assets are expected to amplify ExxonMobil's commitment to reducing emissions in industries that have historically been challenged by decarbonization. Moreover, prior agreements with Nucor and other industrial partners hinted at the power of collaborations that could rival the carbon offset of 2 million electric vehicles. Now, incorporating Denbury's capacity, ExxonMobil looks to enhance these efforts by achieving up to 100 million tons of annual carbon emission reductions.

ExxonMobil's merger with Pioneer Natural Resources is yet another strategic play that doubles its production capabilities. This acquisition is designed not only to escalate efficiency but also to expedite environmental initiatives, integrating Pioneer's water recycling and net-zero strategies to meet the growing demand for responsible energy solutions. Signifying more than increased production, this merger is a testament to ExxonMobil's dedication to environmental stewardship.

Financial profitability is not overlooked in these deals as ExxonMobil foresees potential annual savings of $1 billion post-integration. These savings are predicated on envisioned eco-friendly development plans and leaner resource extraction processes that envision a cumulative $2 billion in annual savings over the subsequent decade. This demonstrates a commitment to achieving a fine balance between financial performance and environmental accountability.

Nucor's involvement in these developments is a noteworthy example of established corporations adapting to the modern call for sustainability. The reliance on innovation and sustainability has been central to Nucor's reputation within the North American steel manufacturing landscape. As a company that regularly leverages the technological advantages of electric arc mini-mills, Nucor has shown commitment to adjusting operational outputs to align closely with market demands. This nimbleness underscores Nucor's ability to marry economic efficiency with environmental stewardship, two increasingly important considerations in today's industrial world.

A defining feature of Nucor's corporate culture is the unique relationship it shares with its employees. The company's profit-sharing structure has created a work environment conducive to cohesiveness and productivity, which pays dividends in periods of economic strain. Such corporate ethos adds layers of resilience and competitiveness to Nucor's business model.

The investment decisions and operating philosophy of Nucor emphasize long-term vitality over ephemeral gains. Through consistent reinvestment in its operations, even amidst downturns, Nucor exemplifies sustained business growth and resilience. This foresight has positioned the firm to capitalize on market recoveries with greater momentum.

Recognized for its reliability in rewarding shareholders, Nucor is decorated as a Dividend King for increasing its dividend payments for several decades. This consistency is a boon for investors seeking stable income streams and solidifies Nucor's status as a financially disciplined enterprise.

Nucor offers a hedge against market fluctuations with its business model that can readily adapt to changing market conditions. The companys ability to navigate cyclical markets and maintain strong investor returns speaks to its sound underpinning business structure. Nucor's financial resilience and sustained commitment to strategic investment make it a notable participant in the investment landscape, particularly during market corrections.

Significant investment commitments between 2020 and 2022 saw Nucor allocate approximately $10 billion towards expansion, mirroring the company's dedication to growth through strategic acquisitions and internal advancements. Not only does this bolster operational capacity, but it also equips Nucor with a diverse portfolio and the tools needed to enhance its position in higher-margin steel products.

Nucor's effective management of its financial resources and operations offers investors compelling reasons to contemplate its stock for long-term investments. The company embodies stability and resilient performance, traits that are of interest to investors seeking refuge amid market volatility. Its strategic growth initiatives combined with investor-friendly policies portray Nucor as an judicious choice for investing at opportune moments.

Investors familiar with the streamlined investment approach inspired by Warren Buffett may appreciate how Nucor exemplifies such principles. By focusing on the company's solid financial performance, dividend reputation, and strong market positioning, investors can navigate investment decisions with confidence. Buffett's counsel, emphasizing simplicity, avoiding mistakes, and keeping focus on fundamental business performance, mirrors the disciplined approach that has favored Nucor's success.

Nucor's reputation as a Dividend King is a testament to its strategic long-term focus and smart financial management. The company's technological advantage, through electric arc mini-mills, provides it with a competitive edge, allowing it to modulate operations efficiently in response to the cyclical nature of steel demand. This operational flexibility is further exemplified in Nucor's investment profile, demonstrating a commitment to growth and asserting industry leadership.

Financial prudence has been a hallmark of Nucor's strategy. With a conservative debt-to-equity ratio and a strong balance sheet, Nucor boasts significant financial health. The company's approach to capital allocation, characterized by cyclical investments and a disciplined cash reserve policy, ensures that Nucor remains a robust competitor capable of navigating industry cycles and capitalizing on growth opportunities.

While the steel industry encompasses a variety of business models and approaches, companies like Nucor have separated themselves through their pursuit of continuous improvement and technological innovation. This differentiation is starkly apparent when considering the total shareholder return that Nucor has provided, outperforming some high-profile tech stocks.

Nucor's strategic investments signify not just business expansion but also a commitment to environmental efficiency and operational innovation. Since the adoption of electric arc furnace technology, the company has paved the way for quality and efficient steel production, challenging the traditional notions within the industry. The consistency in pursuing growth-oriented investments reflects Nucor's dedication to enhancing future profit streams and supporting its canny yet disciplined approach to shareholder returns.

Capitalizing on favorable market conditions, Nucor invests accordingly. The deployment of nearly $14 billion towards growth projects and acquisitions since 2017 has robustly positioned Nucor for future profitability. Despite the occasional cyclicality in market valuations, Nucor's continuous expansion, such as in the form of the new steel mill project launching in 2025, showcases its persistent drive for progress and sector dominance.

The ability to return profits to shareholders, specifically through a disciplined dividend strategy, underscores Nucor's prudent financial management. A long record of dividend increases and a consistent buyback program are clear indicators of Nucor's commitment to shareholder value. Moreover, a healthy cash position grants Nucor the freedom to explore further expansion without jeopardizing its financial stability or its loyalty to shareholders.

When evaluating the contrasting fortunes of industry titans U.S. Steel and Nucor, it becomes evident that Nucor's innovative and efficient operations have solidified its leadership in the steel sector. Investors looking at long-term trends have seen Nucor's stock outperform U.S. Steel, reflecting the strategic foresight and operational nimbleness that Nucor possesses. The shift in industry dynamics affirms the investment viability of companies like Nucor that embrace modern technologies and effective management strategies.

With mergers and purchases reshaping the steel landscape, Cleveland-Cliffs Inc. has emerged as a significant player following its recent acquisitions. The market, however, remains cautious, partly due to financial concerns raised by Cleveland-Cliffs's aggressive expansion. Analysts have voiced the necessity of stable, profitable operations, and while the company's performance post-acquisitions has had high points, financial challenges persist.

Amid the unfolding acquisition narratives within the steel industry, Nucor stands out as an attractive investment destination. Its operational efficiencies and financial strengths contrast sharply with the speculative excitement surrounding U.S. Steel's potential sale. Nucor's consistency, innovative spirit, and focus on long-term shareholder value offer a stable option for those looking at the steel sector as part of their investment portfolios.

Conclusion:

As United States Steel Corporation becomes the focus of acquisition speculation, industry behemoths like Nucor scrutinize the strategic implications of such a market move. While curiosity about whether Nucor will throw its hat in the ring continues, it stands strong with its robust balance sheet and impressive profitability margins. Yet, any potential acquisition by Nucor or its competitors would come with its own set of regulatory and strategic challenges. As the steel market braces for potential consolidation, industry watchers are glued to the unfolding drama, with key players such as Nucor possibly poised to reshape the industry landscape.

News Links:

https://www.fool.com/investing/2023/11/06/why-exxonmobil-is-so-excited-about-its-nearly-70-b/

https://www.fool.com/investing/2023/09/21/3-no-brainer-stocks-to-buy-in-a-correction/

https://www.fool.com/investing/2023/10/26/3-stocks-to-buy-if-they-take-a-dip/

https://www.fool.com/investing/2023/11/15/how-warren-buffett-quotes-inspire-my-investing/

https://www.fool.com/investing/2023/11/10/this-dividend-king-has-a-balance-sheet-built-for-a/

https://www.fool.com/investing/2023/12/10/the-boring-business-beating-amazon-by-3x/

https://www.fool.com/investing/2023/09/30/if-you-invested-10000-in-us-steel-10-years-ago-thi/

https://seekingalpha.com/article/4636682-cleveland-cliffs-us-steel-step-too-far

https://www.fool.com/investing/2023/10/24/us-steel-stock-up-40-on-possible-acquisition-is-th/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: lfiXGv