Peloton Interactive, Inc. Class A Common Stock (ticker: PTON)

2023-12-27

Peloton Interactive, Inc. (ticker: PTON) operates as an interactive fitness platform, revolutionizing the fitness industry by integrating cutting-edge technology and immersive fitness experiences. Founded in 2012 and headquartered in New York, Peloton has become synonymous with at-home exercise, offering a range of products, including stationary bikes and treadmills, that are equipped with large screens for streaming live and on-demand fitness classes. The company's business model includes recurring revenue streams from its subscription-based services, providing users with access to its extensive library of fitness content, led by professional instructors. Peloton's Class A Common Stock trades on the NASDAQ stock exchange, and its financial performance is reflective of its ability to attract and retain subscribers, as well as to innovate in product development and content creation. The company's stock performance is also impacted by broader market trends, competition, and investors' confidence in its growth strategy and long-term profitability.

Peloton Interactive, Inc. (ticker: PTON) operates as an interactive fitness platform, revolutionizing the fitness industry by integrating cutting-edge technology and immersive fitness experiences. Founded in 2012 and headquartered in New York, Peloton has become synonymous with at-home exercise, offering a range of products, including stationary bikes and treadmills, that are equipped with large screens for streaming live and on-demand fitness classes. The company's business model includes recurring revenue streams from its subscription-based services, providing users with access to its extensive library of fitness content, led by professional instructors. Peloton's Class A Common Stock trades on the NASDAQ stock exchange, and its financial performance is reflective of its ability to attract and retain subscribers, as well as to innovate in product development and content creation. The company's stock performance is also impacted by broader market trends, competition, and investors' confidence in its growth strategy and long-term profitability.

| As of Date: 12/27/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 2.23B | 1.80B | 2.74B | 4.02B | 2.70B | 2.36B |

| Enterprise Value | 3.84B | 3.35B | 4.26B | 5.56B | 4.23B | 3.47B |

| Trailing P/E | - | - | - | - | - | - |

| Forward P/E | - | - | - | - | - | - |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 0.78 | 0.63 | 0.93 | 1.26 | 0.78 | 0.62 |

| Price/Book (mrq) | - | - | - | 131.71 | 10.58 | 3.97 |

| Enterprise Value/Revenue | 1.38 | 5.63 | 6.64 | 7.43 | 5.33 | 5.64 |

| Enterprise Value/EBITDA | -4.92 | -33.36 | -23.29 | -25.71 | -13.57 | -9.71 |

| Address | 441 Ninth Avenue, Sixth Floor | City | New York | State | NY |

| Zip Code | 10001 | Country | United States | Phone | 917 671 9198 |

| Website | https://www.onepeloton.com | ||||

| Industry | Leisure | Sector | Consumer Cyclical | Full-time Employees | 3,497 |

| Previous Close | 6.19 | Open | 6.27 | Day Low | 6.22 |

| Day High | 6.5 | Volume | 6,915,537 | Market Cap | 2,290,659,584 |

| 52 Week Low | 4.28 | 52 Week High | 17.83 | Beta | 2.04 |

| Shares Outstanding | 342,433,984 | Shares Short | 45,804,153 | Shares Percent Shares Out | 0.1271 |

| Held Percent Insiders | 0.01854 | Held Percent Institutions | 0.89492995 | Short Ratio | 4.0 |

| Book Value | -1.029 | Net Income to Common | -1,012,499,968 | Trailing EPS | -2.88 |

| Total Cash | 748,499,968 | Total Debt | 2,353,499,904 | Total Revenue | 2,779,399,936 |

| Revenue Per Share | 7.906 | Return On Assets | -0.12525 | Gross Profits | 923,600,000 |

| Free Cash Flow | 285,400,000 | Operating Cash Flow | -264,000,000 | Gross Margins | 0.35706002 |

Based on the technical analysis data provided, we can deduce several indicators of potential future stock price movements for Peloton Interactive Inc. (PTON).

- Price Action: The closing price has been volatile from August to December, indicating active trading and potential investor uncertainty.

- Parabolic SAR (Stop and Reverse): With the absence of PSARs_0.02_0.2, the underlying trend can be presumed bullish given PSARl_0.02_0.2 values are present, suggesting the price has not fallen below the SAR values.

- On-Balance Volume (OBV): An increasing OBV trend through the majority of the period signals accumulation and can be bullish for the stock price.

- Moving Average Convergence Divergence (MACD): The MACD histogram shows a slightly negative value towards the end of December, implying a loss of bullish momentum or potential bearish reversal in trends.

In combination with the technical indicators, a review of the company's fundamentals provides a comprehensive outlook:

- Valuation Metrics: Fluctuations in market cap suggest variable investor sentiment. Enterprise value and valuation multiples, such as EV/Revenue, which are quite high, suggest the market expects future growth or potential takeover value.

- Profitability: The absence of P/E ratios due to negative income indicates that the company has not been profitable recently.

- Revenue and Expenses: Total revenues have decreased over the last two fiscal years, signaling potential challenges in the business; however, if costs are managed, this could lead to improved margins in the future.

- EBITDA/Net Income: Negative EBITDA and Net Income figures suggest significant challenges in the profitability and operational efficiency of the company. This can act as a headwind against the stock price appreciation in the absence of a turnaround strategy.

Taking this composite view suggests that while short-term bullish trends are identified in technical analysis, underlying fundamentals raise concerns about the company's profitability and operational efficiency, which could affect the stock price negatively in the medium to long term unless the company addresses these issues effectively. Moreover, the recurring net losses and negative EPS dilute investor confidence, which could depress the stock price.

In the coming months, if there is no significant turnaround in fundamentals or positive news about the company's operations, expect the stock to potentially face downward pressure. However, should the market sentiment remain optimistic, or if the company initiates effective strategies for growth and cost control, this could counterbalance the negative pressures and lead to stability or moderate gains in the stock price. It is also important to monitor market trends, sector performance, and broader economic indicators, as these could significantly influence stock performance.

Investors should watch for signs of consolidation or breakout patterns in the price charts, as well as any shifts in volume that could indicate a change in investor sentiment. Additionally, staying up-to-date with the latest company news, earnings reports, and strategic decisions is essential to understand how these factors may impact stock price movements in the months ahead.

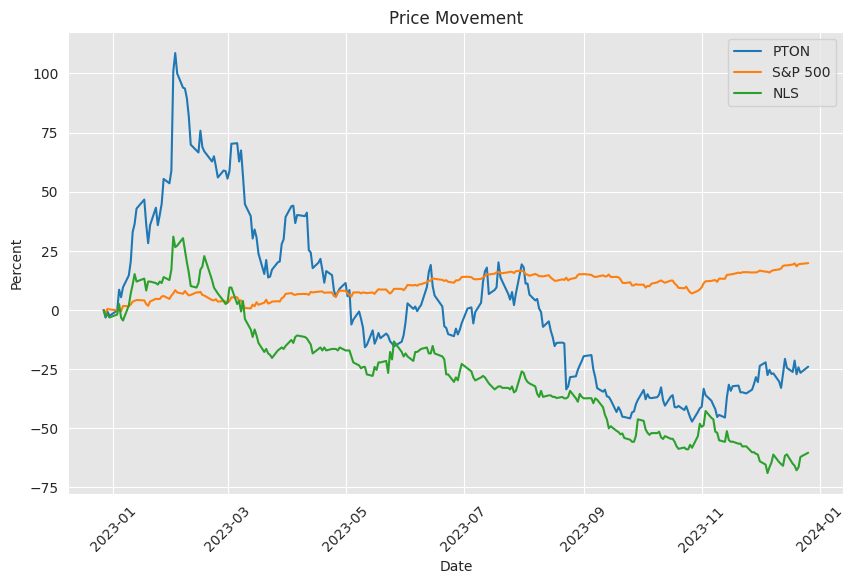

Peloton Interactive, Inc., a household name for at-home fitness enthusiasts and known for its high-tech stationary bikes and online workout content, has experienced a rollercoaster ride since its inception. With the world gripped by the COVID-19 pandemic, Peloton found itself at the forefront of a consumer shift toward home-based fitness regimens. Gyms were closed, and social distancing measures forced millions to reconsider their workout routines. This unique set of circumstances played right into Peloton's strengths, resulting in a soaring demand for its products that had a pronounced effect on the company's stock valuation.

The company's stock price rose a remarkable 560% from March to October 2020, marking it as one of the most sensational stories in the market during that time. Investors, both novice and experienced, were drawn to Peloton's rapid gains, funneling capital into what seemed like a company destined for long-term success. However, as the initial stages of the pandemic subsided and life began to return to some semblance of normalcy, Peloton's extraordinary growth started to wane. It became evident that Peloton's meteoric rise was not indefinitely sustainable, particularly as gyms reopened and consumers ventured back into the world.

This scenario highlights the importance of due diligence for investors. By rigorously evaluating company fundamentals, assessing risks, and studying market trends, investors stand a better chance of making informed decisions. Peloton's story underscores the need for a disciplined approach to investing, one that is not swayed by the frenzy of rapid stock market movements but is instead based on a comprehensive understanding of the business, its prospects, and the external environment it operates in.

One particular aspect of diligent investing involves scrutinizing the valuation of a company. When Peloton's stock price shot up, so did its price-to-sales ratio, reaching levels that were unsustainable when measured against its fundamental financial health. A more thorough assessment might have foreseen the inflated nature of this valuation, providing a note of caution to investors banking on continued growth.

Additionally, the risk of declining demand post-pandemic should have been a critical consideration. Many wondered if Peloton's surge in sales represented a permanent change in consumer behavior or a temporary spike due to extraordinary circumstances. As it turned out, the latter seemed to be the case, suggesting that a comprehensive risk analysis could have provided investors with a more nuanced view of the company's trajectory in a post-pandemic world.

Amidst these considerations, Peloton has made moves to expand its offerings and maintain its market position. A notable partnership has been formed with the NBA, allowing Peloton to offer NBA League Pass to its subscribers. This strategic initiative pushes Peloton's equipment beyond the scope of traditional at-home fitness by integrating live sports entertainment with the workout experience, potentially opening up new consumer segments and enhancing the value proposition of its products.

The company's financial standing, as of the end of December 2023, reflects a $2 billion market cap with a stock price of $6.38 per share after experiencing a 3.15% downturn on the cited day. These figures suggest that while the health of the company may be subject to stock market volatility, it remains competitive within its industry. Investors and market analysts alike must consider these numbers in conjunction with Peloton's business strategies and external collaborations, like the NBA deal, to gauge the company's potential for rebound and growth.

This corporate strategy has not gone unnoticed by The Motley Fool, known for its investment advice. The financial services firm maintains positions in and recommends Peloton Interactive among other high-growth equities. Such endorsements provide a level of validation for Peloton's strategy and place within a diversified investment portfolio.

The company's broader context within the technology sector has also evolved, especially as the world has begun to move past the COVID-19 pandemic. A shift in consumer behavior and a return to in-person activities pose a critical test for Peloton. The company's revenue performance shows a decline from its peak in the fiscal year 2021 to the present day, which is not necessarily a signal of failure but does indicate the company's need to adapt to the changing market conditions.

Peloton has been scrutinized for its ability to sustain the growth experienced during the pandemic, with some industry experts suggesting potential acquisitions by larger tech companies. These speculations highlight the company's need to redefine its strategy and the importance of diversification in securing its future.

Furthermore, Peloton's leadership has seen changes, with Chris Bruzzo joining the Board of Directors in December 2023. Bruzzo brings to the table a wealth of experience from companies such as Electronic Arts, Starbucks, and Amazon, which is expected to be influential in guiding Peloton's strategy moving forward. These changes come at a time when the retail sector is witnessing significant strategic shifts, emphasizing the necessity for adaptation and resilience in a competitive marketplace.

However, as we approach 2024, the headwinds Peloton faces are becoming more apparent. Its strategy under CEO Barry McCarthy, emphasizing subscription services, has shown mixed results, with a decline in hardware sales and a modest uptick in subscription revenue. The company's fiscal health is challenged by continued financial losses and a shrinking subscriber base, necessitating a successful turn in business operations to avoid liquidity issues and necessitate further capital raising.

The broader market performance over the last week shows that despite fluctuations, there can be rapid recoveries, as exemplified by the S&P 500 ETF's recent rise. Peloton's stock, included among those displaying resilience, benefited from this broader market trend. Bespoke Investment Group lends credence to this view by drawing attention to the rebounding capacity of stocks post-downturns. According to the group's analysis, stocks like Peloton's have the potential to rebound strongly following market corrections.

Overall, the future of Peloton is both interesting and uncertain. The company has a track record of innovation and market leadership, but it must continue to adapt to an ever-changing business environment. The company's recent stock price surge offers a glimmer of hope for investors, yet a critical analysis of the multiple factors impacting the fitness tech industry remains essential. As it stands, Peloton's story is a testament to the trials and tribulations of a modern tech company navigating the choppy waters of an evolving consumer landscape.

Similar Companies in Leisure Products:

Nautilus, Inc. (NLS), Johnson Health Tech Co., Ltd. (1736), Garmin Ltd. (GRMN), ICON Health & Fitness, Inc. (IFIT), Planet Fitness, Inc. (PLNT)

News Links:

https://www.fool.com/investing/2023/11/17/i-made-mistake-last-bull-market-wont-make-it-again/

https://www.fool.com/investing/2023/10/22/peloton-is-making-all-the-right-moves/

https://finance.yahoo.com/news/3-overvalued-tech-stocks-sell-135548066.html

https://finance.yahoo.com/news/chris-bruzzo-joins-peloton-board-211500794.html

https://www.fool.com/investing/2023/12/21/3-stocks-im-avoiding-in-2024/

https://finance.yahoo.com/m/429cbd66-21e4-352f-a2ad-7a2118853e77/the-weekly-closeout%3A-ecco.html

https://www.fool.com/investing/2023/12/18/up-43-since-october-is-peloton-stock-still-a-buy/

https://seekingalpha.com/article/4647438-a-boomerang-bounce-for-us-stocks

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 8vR805

https://reports.tinycomputers.io/PTON/PTON-2023-12-27.html Home