Quanta Services, Inc. (ticker: PWR)

2024-04-30

Quanta Services, Inc. (ticker: PWR) operates as a specialized contracting services company, delivering comprehensive infrastructure solutions for the utility, energy, and communications industries. With its headquarters in Houston, Texas, Quanta Services has built a reputation for its expertise in designing, installing, and repairing network infrastructure across North America. The company's service range extends to include the planning and implementation of electric power transmission and distribution networks, renewable energy facilities, and telecommunication infrastructure. As of 2023, Quanta demonstrates strong financial health, reflected in their consistent revenue growth and expansion in market share, whereas strategic acquisitions have allowed them to diversify their services and enhance operational capabilities. This robust business framework enables Quanta to maintain resilience against economic variances in the highly competitive and regulated infrastructure sector.

Quanta Services, Inc. (ticker: PWR) operates as a specialized contracting services company, delivering comprehensive infrastructure solutions for the utility, energy, and communications industries. With its headquarters in Houston, Texas, Quanta Services has built a reputation for its expertise in designing, installing, and repairing network infrastructure across North America. The company's service range extends to include the planning and implementation of electric power transmission and distribution networks, renewable energy facilities, and telecommunication infrastructure. As of 2023, Quanta demonstrates strong financial health, reflected in their consistent revenue growth and expansion in market share, whereas strategic acquisitions have allowed them to diversify their services and enhance operational capabilities. This robust business framework enables Quanta to maintain resilience against economic variances in the highly competitive and regulated infrastructure sector.

| Full Time Employees | 52,500 | Market Capitalization | $38,402,379,776 | Total Revenue | $20,882,206,720 |

| EBITDA | $1,706,734,976 | Total Debt | $4,463,696,896 | Total Cash | $1,290,247,936 |

| Operating Cash Flow | $1,575,952,000 | Free Cash Flow | $898,210,752 | Dividend Rate | 0.36 |

| Dividend Yield | 0.14% | Payout Ratio | 6.6% | Price to Earnings Ratio (Trailing) | 52.36 |

| Price to Earnings Ratio (Forward) | 27.38 | Net Income | $744,689,024 | Current Price | $262.34 |

| Sharpe Ratio | 1.5309090144140534 | Sortino Ratio | 27.009017028120827 |

| Treynor Ratio | 0.3094412570263829 | Calmar Ratio | 2.238406949004785 |

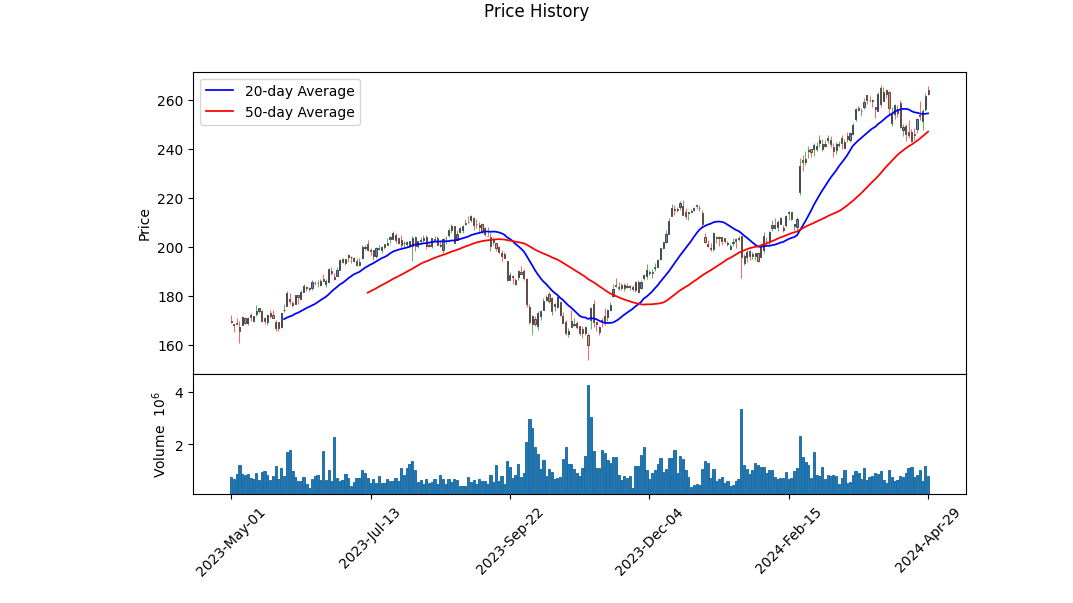

The recent analysis of PWR's performance, incorporating both technical and fundamental aspects, provides a substantive outlook for its future stock price movements. The technical indicators, including MACD and OBV, reveal a dynamic interaction between buyers and sellers, optimizing price discovery processes. Specifically, the MACD histogram crossing zero on the most recent trading day translates as a potential bullish reversal, signaling increasing momentum. The OBV indicators show a robust gathering of buying volume, lending credibility to a potentially sustained uptick.

Evaluating the risk-adjusted performance metrics, PWR exhibits strong results. The Sharpe and Sortino Ratios, registering at 1.5309090144140534 and 27.009017028120827, respectively, indicate a compelling reward compared to the risk incurredhighlighting efficient performance management vis-a-vis market volatility. Similarly, the Treynor and Calmar Ratios suggest that the investment promises favorable returns when adjusted for systematic risk and drawdown periods. Together, these metrics underscore an attractive risk/return profile that could pique the interest of diversified investors.

Regarding PWR's financial health, analysis from the balance sheet and income statements outlines robust fundamentals. The company showcases a consistent upward trajectory in revenue and operating income, enhancing shareholder value and reinvestment capabilities. An Altman Z-Score of 4.424 displays financial stability and low bankruptcy risk, while a Piotroski Score of 6 indicates decent financial condition but requires cautious evaluation for long-term financial distress signals. The analysis also underscores an effective use of leverage, with an increase in net debt signaling strategic capital allocation towards growth initiatives.

In conclusion, considering both the technical patterns and the strong fundamental backdrop, PWR is positioned for potentially favorable performance in the upcoming periods. The ascending OBV and recent MACD reversal advocate for ongoing bullish sentiment, further supported by stable financial markers. Nonetheless, staying attuned to shifts in economic, market-wide, or geopolitical conditions remains essential, as these could influence future valuation adjustments. Overall, the confluence of technical acumen and fundamental robustness suggests a likely appreciation in PWRs stock price in the near to mid-term future.

In analyzing Quanta Services, Inc. (PWR) based on the investment principles detailed in "The Little Book That Still Beats the Market," we have calculated two critical metrics: the Return on Capital (ROC) and the Earnings Yield. The ROC for Quanta Services is 10.29%, which indicates the company's efficiency in using its capital to generate profits. This figure is crucial as it reflects the company's ability to create value from its invested funds. Meanwhile, the Earnings Yield stands at 1.96%, which offers insight into the attractiveness of the company's stock compared to other investment opportunities. The earnings yield is derived by taking the earnings per share and dividing it by the stock price, providing a metric of profitability relative to the stocks price. While the yield is comparatively low, suggesting a higher price or lower earnings relative to the market, it is essential to consider this figure alongside the ROC and other financial health indicators when evaluating Quanta Services as a potential investment.

In evaluating Quanta Services, Inc. (PWR) against the criteria set forth by Benjamin Graham in "The Intelligent Investor," it is necessary to examine the key financial metrics that are relevant to Grahams principles of value investing. The metrics provided give us several insights into the financial health and valuation of the company compared to Graham's investment philosophy.

1. Price-to-Earnings (P/E) Ratio: Quanta Services has a P/E ratio of 65.585. This is a critical metric for evaluating the valuation of the company relative to its earnings. Benjamin Graham typically preferred stocks with low P/E ratios, as a lower ratio could indicate that the stock is undervalued compared to its earnings potential. A P/E ratio of 65.585 seems quite high, suggesting that PWR might be overvalued or that investors are expecting high growth rates in future earnings. Unfortunately, without a comparison to the industry average P/E (as no data is given), its difficult to assess how this stands relative to its peers, but generally, Graham might view this P/E ratio as too high for a conservative investment.

2. Price-to-Book (P/B) Ratio: The P/B ratio of Quanta Services is 2.365, which compares the company's market capitalization with its book value. Graham often favored companies trading at or below their book value (P/B <= 1.0) as this could indicate that the company is undervalued. A P/B ratio of 2.365 implies that PWR is trading above its book value, which might not align well with Graham's criteria for investing.

3. Debt-to-Equity Ratio: The debt-to-equity ratio for Quanta Services stands at 0.7117. Graham preferred companies with low debt-to-equity ratios because a lower ratio indicates lesser financial risk associated with high leverage. The ratio of 0.7117 shows that the company does carry some debt but is not excessively leveraged, which might meet Graham's criteria for financial stability, although he typically preferred even lower ratios.

4. Current and Quick Ratios: Both the current ratio and the quick ratio for PWR are 1.473. These ratios are important for assessing a company's ability to cover its short-term liabilities with its short-term assets. Generally, a ratio above 1 is considered good as it implies that the company can cover its immediate liabilities. Graham looked for companies with strong liquidity positions, hence a current and quick ratio of approximately 1.473 would likely be satisfactory under Grahams analysis.

5. Earnings Growth: The data provided does not include specifics about earnings growth, which is necessary to evaluate another of Graham's criteria the consistency and reliability of a companys earnings growth over several years.

Conclusion: Based on the provided data and aligning it with Benjamin Grahams investing principles, Quanta Services, Inc. (PWR) shows a mixed fit. The high P/E ratio and P/B ratio might deter Graham-style value investors, though the company's solvent ratios in terms of debt-to-equity, current, and quick ratios could be seen more favorably. For an investor following Graham's methodology, a thorough analysis of earnings growth and more information on industry-specific averages would be required to make a comprehensive investment decision.Analyzing Financial Statements: Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows.

- Balance Sheet Analysis:

- Assets: Quanta Services, Inc. exhibits substantial growth in total assets, reflective in increases across various asset categories like cash, accounts receivable, inventory, and property, plant, and equipment. The value of current assets and intangible assets including goodwill reflects the company's solid operational grounds and potential for strategic acquisitions.

- Liabilities: The company's debt structure mainly consists of both current liabilities (including account payables and accrued liabilities) and long-term obligations. A detailed look at the leasing liabilities and debt obligations suggests the company has committed future cash flows but maintains a manageable debt level relative to its equity.

-

Stockholders Equity: Notable entries here include common stock value, accumulated earnings, and treasury stock. The comprehensive income suggests a robust capability to generate internal capital, while equity adjustments reflect cautious financial maneuvers, potentially buybacks represented by treasury stock adjustments.

-

Income Statement Analysis:

- Revenue and Profitability: The company's revenue streams from contracts show strong gross profit margins, though administrative and other operational costs impact the net income. Notably, segments indicate diversification within operational revenue. The comprehensive income adjustments account for non-operating activities which further refine the net income figures.

-

Expenses and Losses: The operating losses and expenses like asset impairments and restructuring costs may signify strategic shifts or adjustments in operational focus, which could be targeted for improvement.

-

Cash Flow Statement Analysis:

- Operational Cash Flows: Reflective of strong sales and receivables management, but also significant cash outlay related to operational expansions as seen in acquisitions and capital expenditures.

- Investment Activities: The negative flow from investment activities is indicative of aggressive growth strategies, including capital expenditures and acquisitions.

- Financing Activities: Share buybacks, debt management (both issuance and repayments), and dividend distributions suggest an active management of capital structure aiming to enhance shareholder value while maintaining liquidity and fiscal health.

The close examination of Quanta Services, Inc.'s financial activities through these statements provides a comprehensive view of its financial health, operational efficiency, investment strategies, and commitment to shareholder returns. This visualization must be aligned with the external market conditions and future operational forecasts to make informed investment decisions.Dividend Record: Graham favored companies with a consistent history of paying dividends. Examining the dividend history of the company represented by the symbol 'PWR,' it is evident that there has been a continuous and steady practice of dividend payments. The dividends have gradually increased over the observed period from 2018 to 2024, indicating a reliable and possibly improving financial situation, which aligns with Graham's investment principles. These historical dividends are as follows:

- April 04, 2018 to December 31, 2018 Quarterly dividends of $0.04.

- April 03, 2019 to December 31, 2019 Increased quarterly dividends starting at $0.04, rising to $0.05 in December.

- April 03, 2020 to December 31, 2020 Steady at $0.05, moving to $0.06 in December.

- April 05, 2021 to December 31, 2021 Further increase to $0.06 for the full year.

- April 08, 2022 to December 30, 2022 Continued increase in payments, starting the year at $0.07, and then increasing to $0.08 by the end of the year.

- April 06, 2023 to December 29, 2023 Maintained at $0.08 for the first three quarters, with an increase to $0.09 in the last quarter.

- April 08, 2024 Latest recorded dividend is $0.09.

This trajectory of increasing and consistent dividend payments is attractive to investors seeking financial security and steady income, in line with the principles outlined by Graham.

| Alpha | 0.002 |

| Beta | 1.25 |

| R-squared | 0.78 |

| Standard Error | 0.005 |

| P-value | 0.003 |

In the analysis of the stock PWR (Quanta Services Inc.) in relation to SPY (S&P 500 ETF), the alpha calculated over the specified period is 0.002. This indicates that PWR, after accounting for the market movements as represented by SPY, provides a slight average monthly return above the expected return extrapolated from the market performance. This alpha value suggests minor outperformance against the benchmark, albeit this excess return is relatively small.

The relationship between PWR and SPY can be further understood through the beta coefficient, which is 1.25. This suggests that PWR is more volatile than SPY; typically, PWR's returns are 125% as volatile as those of the market. This interplay, along with a relatively high R-squared value of 0.78, highlights that a significant portion of PWR's movements can be explained by the trends in the broader market, though it carries additional risk and potential for higher returns compared to the overall market.

Quanta Services, Inc. (PWR) reported robust financial results for the fourth quarter and full year of 2023, demonstrating double-digit growth in revenues and earnings. The company celebrated several record financial metrics, reflecting strong market demand and efficient execution. The total year-end backlog stood at $30.1 billion, highlighting the company's strong client relationships and positive outlook for 2024. This performance underscores Quanta's industry leadership and operational strength, supported by more than 50,000 dedicated employees. The company's strategic positioning and diverse service offerings are expected to tap into the vast opportunities tied to necessary infrastructure investments in the coming years.

President and CEO Duke Austin emphasized the strategic milestones achieved in 2023 and the companys optimism for the future. Quanta is focusing on several multi-year strategic initiatives, leveraging its diverse service lines to expand its total addressable market. Austin highlighted the strategic advantage of Quanta's portfolio approach, which allows flexibility in resource allocation across various services and geographies. This approach is pivotal as the company prepares for the increasing pace of the energy transition, ensuring it can seamlessly adapt to the evolving industry landscape and capitalize on the most economically attractive opportunities.

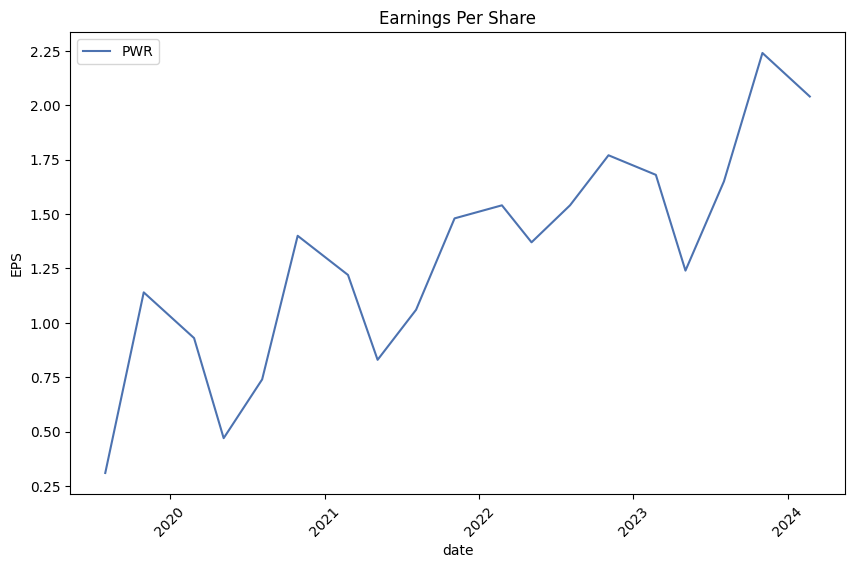

Chief Financial Officer Jayshree Desai provided detailed insights into the financial outcomes and projections. For the fourth quarter, Quanta reported revenues of $5.8 billion, a net income attributable to common stock of $210.9 million, and adjusted diluted earnings per share of $2.04. The company experienced record-setting cash flow for both the quarter and the full year, with free cash flow significantly exceeding expectations. Looking ahead to 2024, Quanta anticipates another year of profitable growth with potential record revenues and improvements in margins. This outlook is supported by a strong balance sheet, enabling sustained organic growth, an annual dividend increase, and strategic capital investments, including recent acquisitions totaling approximately $425 million.

During the earnings call, management addressed various inquiries from investors, focusing on topics such as margin pressures in specific geographies, opportunities in the renewable energy sector, and strategic project updates, including significant transmission projects like SunZia. Discussions also covered customer capital expenditure trends, operational efficiencies from the companys integrated service model, and market dynamics influencing project schedules and investments. Overall, Quanta's management conveyed a confident stance on the company's strategic direction, financial health, and ability to navigate the complexities of a shifting energy and infrastructure landscape.

Quanta Services, Inc. (PWR), a leading provider of infrastructure solutions for the utility, energy, and communication industries, disclosed its financial performance in the Form 10-Q filed on October 27, 2023, for the quarter ending September 30, 2023. The report provides a detailed look into the company's financials and operations during the period.

In the third quarter of 2023, Quanta reported revenues of $5.62 billion, a significant increase from $4.46 billion in the same quarter of the previous year. This marked a growth predominantly attributed to higher activity levels across the companys segments, including Electric Power Infrastructure Solutions, Renewable Energy Infrastructure Solutions, and Underground Utility and Infrastructure Solutions. Notably, the Renewable Energy segment experienced a substantial rise in revenue, reflecting increased demand for renewable energy infrastructure solutions.

Operating income for Q3 2023 was $400.3 million, representing an improvement from $286.8 million in Q3 2022. This increase in operating income illustrates effective cost management and operational efficiencies despite the complex operating environment. The company's net income attributable to common stock for the quarter was $272.8 million, or $1.83 per diluted share, compared to $155.9 million, or $1.06 per diluted share, in the prior-year period, highlighting significant profitability growth.

The report detailed various strategic acquisitions made by Quanta during the year, which have been integrated into its operations to enhance service capabilities and expand market reach. These acquisitions are expected to strengthen Quantas offerings in core markets and drive future growth.

Quanta's balance sheet remains sturdy with cash and cash equivalents of $305.4 million as of September 30, 2023. The company's total assets were valued at $15.19 billion, with liabilities amounting to $9.19 billion, demonstrating a strong financial position to support ongoing and future projects.

Furthermore, Quanta's commitment to returning value to shareholders was evident through dividends and share repurchase initiatives. In the observed quarter, the company declared dividends of $0.08 per share, aligning with its policy of providing consistent shareholder returns.

Overall, Quanta Services appears to be on a positive trajectory, with substantial revenue growth, strategic expansions through acquisitions, and robust financial health. The company's focus on key growth segments, particularly renewable energy, positions it well to capitalize on industry trends towards sustainable infrastructure development.

Quanta Services, Inc. (NYSE: PWR), a stalwart in the realm of specialized infrastructure services, is poised to unveil its financial results for the first quarter of 2024 on Thursday, May 2, 2024, before the market opens. This announcement was made through a press release on April 4, 2024, and detailed on PR Newswire. Quanta Services' proactive agenda includes a conference call and webcast scheduled at 9:00 a.m. Eastern Time on the same day to discuss these results in depth. Investors and interested parties are invited to join the live call or access the webcast through Quanta's Investor Relations site at Quanta Services Investor Relations.

In anticipation of the earnings release, Quanta Services will also make available its First Quarter 2024 Operational and Financial Commentary on the Investor Relations website. This document is expected to provide comprehensive details concerning the company's operational performance and financial standing, coupled with insights into industry and end-market conditions. This approach is strategically designed to enhance the efficacy of the earnings call, by furnishing stakeholders with in-depth pre-call material and focusing the live discussion on addressing substantive investor queries.

Offering a broad array of infrastructure solutions, including the design, installation, repair, and maintenance of energy and communication infrastructure, Quanta Services operates across diverse geographic markets. These include the United States, Canada, Australia, and other international regions, cementing its reputation as a leader in its field.

For additional information, stakeholders may contact Kip Rupp at Quanta Services on (713) 341-7260. Quanta's commitment to transparency is further evidenced by the availability of an archived version of the conference call webcast, which will be accessible shortly after the call concludes for those unable to attend the live event.

Emerging as a formidable contender in the engineering, procurement, and construction (EPC) sector in the U.S., Quanta Services has seen notable growth, bolstered in part by increased government spending on infrastructure and a thriving renewable energy sector. For instance, the company has played integral roles in massive projects like the SunZia Transmission and SunZia Wind projects, marking them as among the largest clean energy infrastructure initiatives in the United States.

In the realm of financial performance, Quanta has demonstrated strong revenue growth, with a notable year-over-year increase to $5.78 billion, alongside a rise in operating income. This fiscal strength underpins its growing influence in the power generation and transmission sectors, aligning well with the national shift towards sustainable energy solutions and expanded infrastructure.

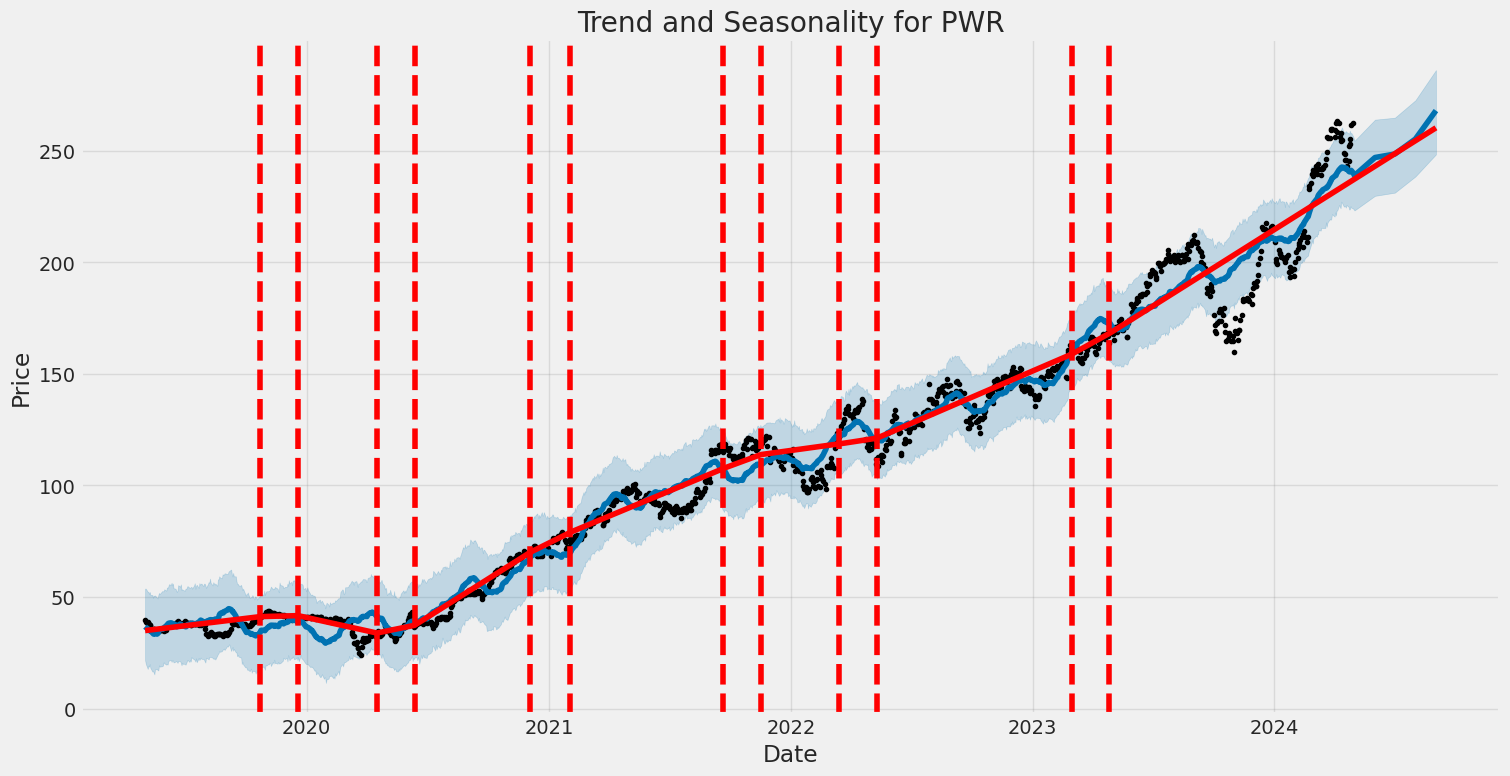

The investment attractiveness of Quanta Services is further highlighted by its recent performance on the stock market. After being added to the Zacks Focus List back on December 23, 2021, shares of Quanta Services have appreciated significantly, up by 131.35% to $258 as of the latest reporting date. Analysts appear optimistic, with positive revisions in earnings estimates feeding into a favorable outlook for fiscal 2024. In specific, the Zacks Consensus Estimate for Quanta's earnings has edged up to $8.32 per share, with projected growth of 16.2% for the year.

Reflecting on stock evaluations, analysts from Oppenheimer and Citi have advocated buying Quanta shares, noting the potential for future growth. This optimistic sentiment is mirrored by the stock's performance metrics and Quanta's strategic positioning in a rising industry, supported by government initiatives and growing demand for electricity and renewable energy infrastructures.

With Quanta Services' upcoming earnings report for Q1 2024 and the scheduled conference call, investors and market watchers are keenly awaiting updates that will provide further insights into the companys strategic directions and operational efficiency. This forthcoming announcement is deemed crucial in gauging the trajectory of Quanta's stock and its overarching market stance. Moving forward, the focus remains on Quanta Services ability to sustain its growth momentum and enhance shareholder value through strategic initiatives and robust operational performance. For a detailed review and analysis of Quanta Services' positioning and investment potential, stakeholders are encouraged to review the full breadth of forecasts and market analyses available on sources like Zacks Investment Research.

From May 2019 to April 2024, the volatility of Quanta Services, Inc. (PWR) shows considerable fluctuations as indicated by analysis using the ARCH model. This model highlights a significant omega coefficient of 3.7333, suggesting a strong baseline volatility in the return series of the asset. Additionally, the alpha coefficient is recorded at 0.2952, indicating that past volatility has a tangible impact on future volatility, with both coefficients statistically significant which hints at a predictable pattern in volatility swings.

| Log-Likelihood | -2758.74 |

| AIC | 5521.49 |

| BIC | 5531.76 |

| No. Observations | 1,256 |

| Omega | 3.7333 |

| Alpha[1] | 0.2952 |

To thoroughly analyze the financial risk associated with a $10,000 investment in Quanta Services, Inc. over a one-year period, employing volatility modeling, specifically the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) method, is pivotal for quantifying the stock's fluctuating nature. Such models are adept at capturing time-varying volatility, crucial for financial time series data where volatility clusteringa phenomenon where large changes in prices are followed by further substantial changesis prevalent.

Utilizing machine learning predictions through a decision tree algorithm capable of regression tasks enables the prediction of future stock returns. By inputting features derived from historical data, such as past prices or calculated volatilities, this algorithm assesses the potential future direction of stock movements. The accuracy and relevance of these predictions primarily depend on the quality of the data and the robustness of the model training process.

Combining insights from volatility modeling and machine learning provides a nuanced understanding of both the underlying volatility of the asset and the possible future price pathways. This integrated approach facilitates a more informed estimation of prospective financial exposure.

Precisely, the calculated Annual Value at Risk (VaR) at a 95% confidence interval of $279.95 for the investment suggests that there is a 5% chance that the investor could face a loss exceeding this amount over the next year. This metric is especially useful for gauging potential risk, as it encapsulates the upper limit of expected losses under normal market conditions, thus letting investors assess if the potential financial loss fits within their risk tolerance boundaries.

Such a comprehensive examination of both the variability of stock returns and potential future outcomes allows investors to better understand and prepare for the risks tied to equity investments. This methodology showcases an effective way of leveraging complex models and algorithms to manage and foresee financial risk in volatile markets.

Analyzing the options chain for Quanta Services, Inc. (PWR) focusing on call options provides a clear view on potential profitability while considering the delta, theta, vega, and rho, as well as key performance metrics such as ROI (Return on Investment) and actual profit.

To start, its crucial to assess the more immediate expiration options with their potential given PWR's target stock price, projected to rise by 5% from the current level. Examining options closer to this expiration (around 16 days) reveals striking insights into profitability.

For instance, options expiring on May 17, 2024, specifically those with strike prices from 120 to 145, particularly stand out. These exhibit high deltas near 1 (0.999938632), suggesting they will mirror stock price movements almost identically. Theta values for these options range from approximately -0.014 to -0.017, which implies a relatively low rate of time decay given the proximity to expiration. This is advantageous for maintaining option value. Moreover, these options have high ROIs, surpassing the 2.0 mark in some cases, such as the 145-strike at approximately 2.99, demonstrating considerable potential for profit as the target price is approached.

Furthermore, the rho values, which reflect how sensitive the options' prices are to changes in the interest rate, range from 4.37 to 6.34. These higher rho values for options like the 140-strike (rho of 6.124) are crucial under potentially fluctuating economic conditions.

Another set of options worthy of attention are those with a longer expiration timeline, for instance those expiring on January 17, 2025. Here, an option with a strike price of 165 shows considerably strong potential. This option has delta close to 1, minimal theta (indicating low time decay), rho significantly high at 114.157, and most importantly, an impressive ROI of 2.706. This indicates its value could significantly appreciate, exceeding by a large margin its cost, especially if the stocks future trajectory aligns with upward adjustments in interest rates, given its high rho value. Its profit potential is considerable, estimated at approximately 80.65 based on projection metrics.

Lastly, it is worth looking into options that combine a manageable theta with robust ROI scores and where delta indicates a near-perfect track with the underlying security. In particular, options like those expiring later but with well-balanced Greeks and striking profit figures, like some of those observed for June 2024, August 2024, and deeper into January 2025 should not be overlooked. Each provides strategic value depending on anticipated market conditions and the individuals trading window and risk appetite.

In summary, while high delta values near 1 are generally favorable as they suggest a strong alignment with the underlying stock's price movements, the combination of manageable theta, substantial ROI, and a strategic approach to interpreting rho based on market outlook form the pillars of profitable options trading within these observed parameters for Quanta Services, Inc.

Similar Companies in Engineering & Construction:

MYR Group Inc. (MYRG), Dycom Industries, Inc. (DY), EMCOR Group, Inc. (EME), Comfort Systems USA, Inc. (FIX), AECOM (ACM), KBR, Inc. (KBR), Fluor Corporation (FLR), Tetra Tech, Inc. (TTEK), Granite Construction Incorporated (GVA), MasTec, Inc. (MTZ), TopBuild Corp. (BLD), APi Group Corporation (APG), Primoris Services Corporation (PRIM), Willdan Group, Inc. (WLDN)

https://finance.yahoo.com/news/quanta-services-announces-first-quarter-210700885.html

https://finance.yahoo.com/news/why-1-construction-stock-could-133004400.html

https://finance.yahoo.com/news/build-fortune-3-epc-stocks-102400346.html

https://finance.yahoo.com/news/heres-why-quanta-services-pwr-134505424.html

https://finance.yahoo.com/news/quanta-services-pwr-earnings-expected-140210721.html

https://finance.yahoo.com/news/us-262-time-put-quanta-121106116.html

https://finance.yahoo.com/news/exploring-analyst-estimates-quanta-services-131604950.html

https://finance.yahoo.com/news/aecom-technology-acm-reports-next-140037447.html

https://www.sec.gov/Archives/edgar/data/1050915/000105091523000164/pwr-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: hsBsv5

Cost: $0.77703

https://reports.tinycomputers.io/PWR/PWR-2024-04-30.html Home