PayPal Holdings, Inc. (ticker: PYPL)

2024-02-09

PayPal Holdings, Inc. (ticker: PYPL) stands as an iconic entity in the digital payment landscape, leveraging technology to facilitate payments and financial transactions across the globe. Founded in 1998 and headquartered in San Jose, California, PayPal has grown significantly, becoming a go-to platform for both individual consumers and businesses. The company offers a wide range of payment solutions, including its mainstream PayPal platform, the peer-to-peer payment service Venmo, and international money transfer service Xoom, among others. PayPal's business model emphasizes convenience, security, and the seamless integration of financial services into digital platforms. Over the years, it has expanded its offerings by acquiring various companies and technologies to bolster its capabilities in fraud prevention, payment processing, and digital wallets. As of the latest fiscal year, PayPal reported handling billions of transactions amounting to hundreds of billions of dollars in payment volume, highlighting its substantial role in the digital economy. The corporation continues to innovate in financial technology, aiming to expand its global reach while enhancing user experience and security.

PayPal Holdings, Inc. (ticker: PYPL) stands as an iconic entity in the digital payment landscape, leveraging technology to facilitate payments and financial transactions across the globe. Founded in 1998 and headquartered in San Jose, California, PayPal has grown significantly, becoming a go-to platform for both individual consumers and businesses. The company offers a wide range of payment solutions, including its mainstream PayPal platform, the peer-to-peer payment service Venmo, and international money transfer service Xoom, among others. PayPal's business model emphasizes convenience, security, and the seamless integration of financial services into digital platforms. Over the years, it has expanded its offerings by acquiring various companies and technologies to bolster its capabilities in fraud prevention, payment processing, and digital wallets. As of the latest fiscal year, PayPal reported handling billions of transactions amounting to hundreds of billions of dollars in payment volume, highlighting its substantial role in the digital economy. The corporation continues to innovate in financial technology, aiming to expand its global reach while enhancing user experience and security.

| Address | 2211 North First Street | City | San Jose | State | CA |

| Zip | 95131 | Country | United States | Phone | 408 967 1000 |

| Website | https://www.paypal.com | Industry | Credit Services | Sector | Financial Services |

| Previous Close | 56.13 | Open | 56.205 | Day Low | 56.1601 |

| Day High | 59.22 | Volume | 28,020,126 | Average Volume (10 days) | 22,601,570 |

| Market Cap | 63,114,874,880 | Fifty-Two Week Low | 50.25 | Fifty-Two Week High | 82.85 |

| Enterprise Value | 57,581,871,104 | Profit Margins | 0.14262 | Book Value | 19.637 |

| Price to Book | 2.9989357 | Net Income to Common | 4,246,000,128 | Trailing EPS | 3.84 |

| Forward EPS | 5.68 | Total Cash | 14,060,000,256 | Total Revenue | 29,770,999,808 |

| Operating Cashflow | 4,842,999,808 | Free Cashflow | 5,477,499,904 | Debt to Equity | 54.558 |

| Current Price | 58.8901 | Target High Price | 120.0 | Target Low Price | 56.0 |

| Target Mean Price | 72.02 | Target Median Price | 70.0 | Recommendation Mean | 2.4 |

| Sharpe Ratio | -0.7268974507644029 | Sortino Ratio | -9.913111405010524 |

| Treynor Ratio | -0.1737349378196971 | Calmar Ratio | -0.7440323763702534 |

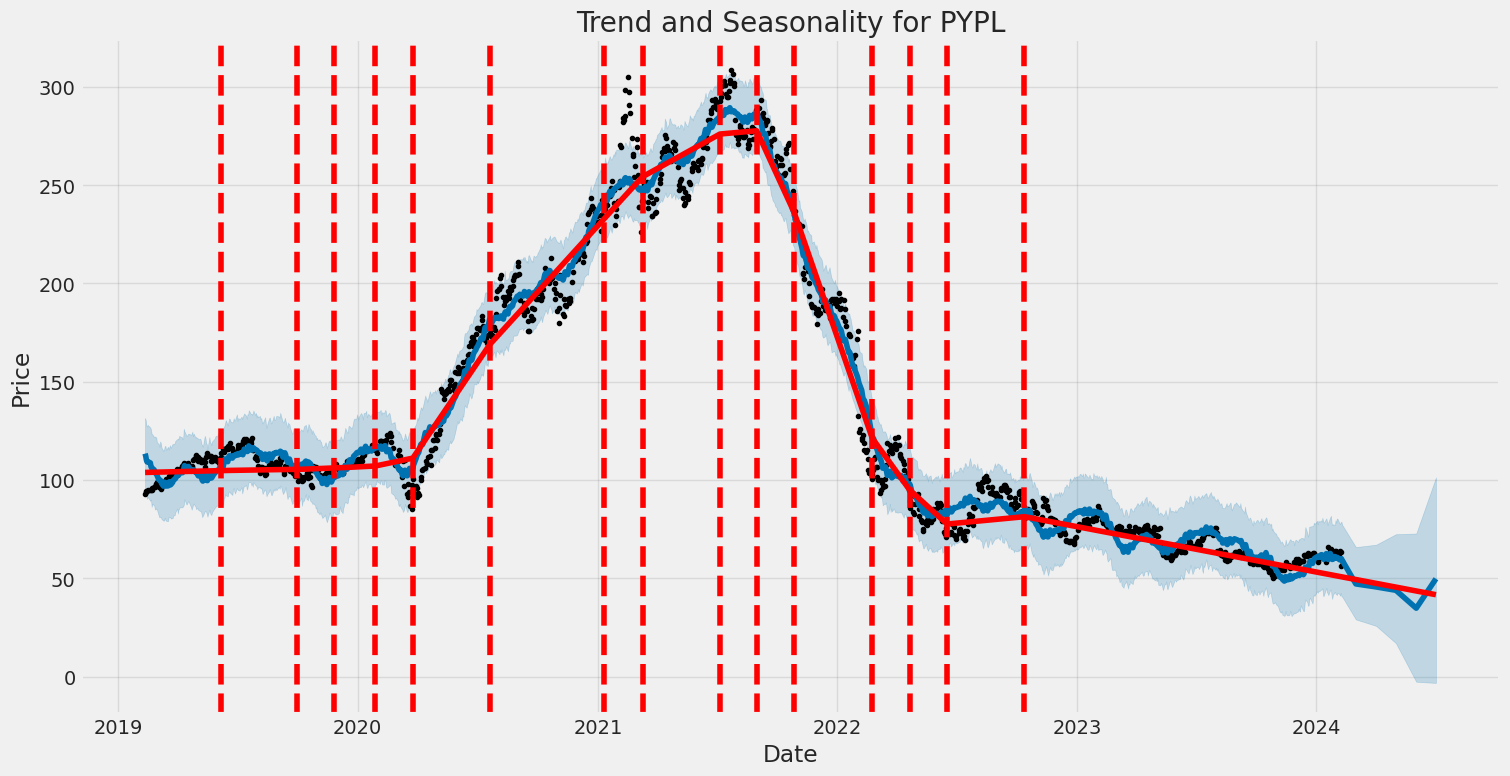

Analyzing the provided data for PayPal Holdings, Inc. (PYPL), it is apparent that a multi-faceted approach, incorporating technical analysis, fundamental analysis, balance sheet strength, and various financial ratios and analytics, is necessary to forecast the possible stock price movement in the upcoming months.

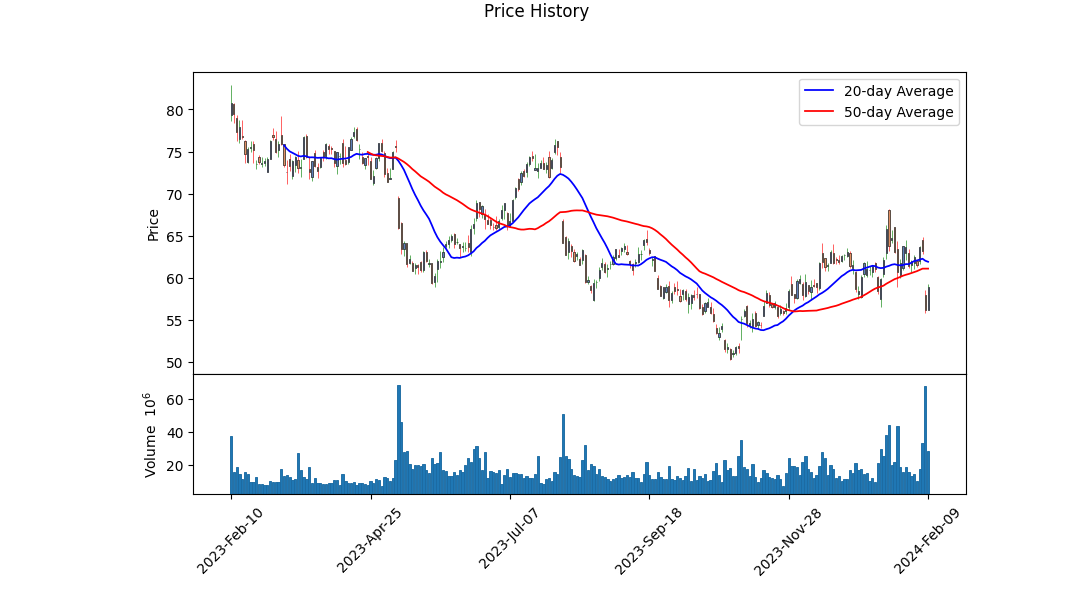

Technical Indicators Insight:

The provided summary of technical indicators shows an ascending trend in PYPL stock price over the observed period towards February 2024. Notably, the Open price increases from $56.50 to $62.00, indicating positive momentum. The presence of an OBV (On Balance Volume) rise from 1.20 to 12.84 million signals accumulating volume, which is a bullish indicator, albeit the MACD (Moving Average Convergence Divergence) histogram signals a decrease towards the end of the period, indicating declining momentum. Such mixed signals require cautious interpretation alongside fundamental analysis.

Fundamental Analysis:

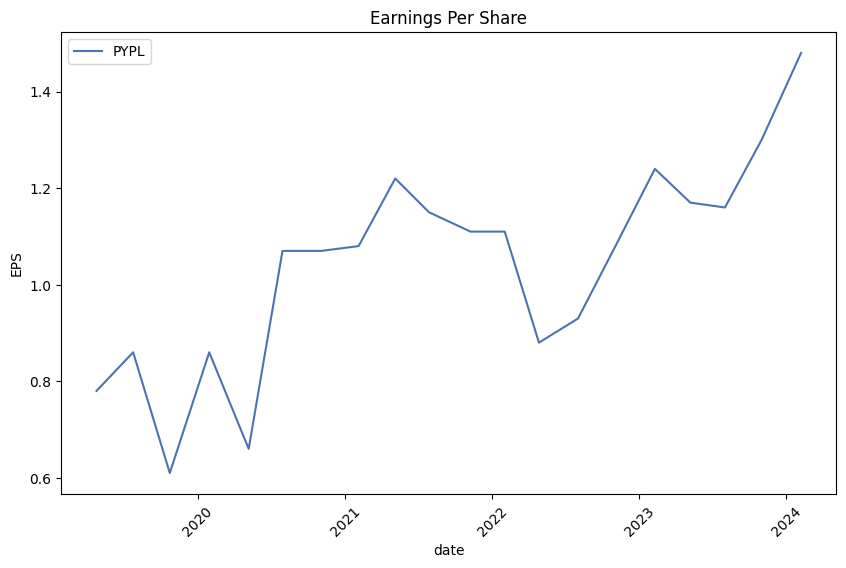

Upon reviewing PayPal's fundamentals, several key aspects stand out:

- Gross Margins and Operating Margins remain robust at 0.39586 and 0.17219, respectively, indicating the company's steady profitability.

- EBITDA has shown impressive figures, further reinforcing the company's operational strength.

- Trailing Peg Ratio at 0.4298 suggests potential undervaluation based on expected growth rates, making it an attractive investment proposition.

Moreover, the improvement in analysts' expectations with respect to EPS (Earnings Per Share) and Revenue for the next year marks another positive indicator. The consensus estimates forecast growth, indicating confidence in the company's ability to expand its earnings base.

Balance Sheet and Cash Flows Analysis:

Analyzing the balance sheet and cash flows statements, the following observations are crucial:

- A healthy balance in Treasury Shares Number, reflecting stock buyback efforts and consequentially shareholder value enhancement.

- A noteworthy increase in Loans Receivable and Accounts Receivable, signaling increasing operational activities.

- Free Cash Flow remains robust even with aggressive repurchase of capital stock, indicating strong cash generation capabilities.

Market Sentiments and Ratios Analysis:

Market sentiment indicators, such as the Sharpe, Sortino, Treynor, and Calmar ratios, suggest the stock has undergone periods of higher risk-adjusted returns. However, the negative values indicated by these ratios over the past year suggest that the risk-adjusted returns have been lower than ideal, possibly reflecting market volatility and investor skepticism.

Predictive Outlook:

Considering the balance between technical indicators suggesting near-term momentum and the fundamental soundness of PayPal, coupled with bullish analyst expectations and strong cash flow operations, it is reasonable to anticipate an upward trend in PYPL's stock price over the next few months. However, the current market sentiment, as reflected by risk-adjusted performance metrics, suggests a cautious approach, with an emphasis on monitoring future earnings announcements, market trends, and broader economic indicators. The robust fundamental health of the company, combined with improving analyst sentiment, positions PYPL well for gradual appreciation, especially if market conditions stabilize and investor sentiment improves.

In our analysis of PayPal Holdings, Inc. (PYPL), two critical metrics stand out: the Return on Capital (ROC) and the Earnings Yield. PayPals ROC is calculated to be approximately 11.41%. This figure is indicative of how effectively the company utilizes its capital to generate profits; in PayPal's case, for every dollar of capital, the firm generates around 11.41 cents in profit. Such a number can be considered robust in the financial technology sector and demonstrates PayPals efficiency in deploying its capital. On the other hand, PayPal's Earnings Yield is estimated at 3.57%. The earnings yield, calculated as the inverse of the price-to-earnings ratio, offers insight into the company's profitability from the shareholder's perspective. A 3.57% earnings yield suggests that for every dollar invested in the stock, investors can expect to earn around 3.57 cents in profit. This can be particularly relevant in comparing PayPal's attractiveness to other investments. Both metrics, when analyzed together, can give a comprehensive view of PayPals financial health and its potential as an investment.

| Statistic Name | Statistic Value |

| R-squared | 0.422 |

| Adj. R-squared | 0.422 |

| F-statistic | 917.4 |

| Prob (F-statistic) | 9.48e-152 |

| Log-Likelihood | -2728.4 |

| No. Observations | 1258 |

| AIC | 5461 |

| BIC | 5471 |

| Const Coef | -0.0839 |

| Beta | 1.3741 |

| Omnibus | 645.117 |

| Prob(Omnibus) | 0.000 |

| Skew | -1.701 |

| Kurtosis | 24.501 |

| Cond. No. | 1.32 |

The linear regression analysis explores the relationship between the performance of PayPal (PYPL) and the broader market index SPY over a specified time period, ending today. The alpha () value of -0.0839, though statistically not significantly different from zero at the 5% level (p-value > 0.161), suggests a slight negative offset of PYPL returns relative to the predicted return by the model when SPY returns are zero. This could imply that PYPL, despite its strong linkage with the market, possesses unique factors that might underperform or outperform independent of the market's direct influence under certain conditions.

Furthermore, the significant beta () coefficient of 1.3741 indicates a positive and relatively elastic relationship between PYPL and SPY returns. This means that for every 1% increase in SPY returns, PYPL is expected to increase by approximately 1.374%, adjusting for all other factors. This highlights PYPL's sensitivity to market movements and implies that its performance is, to a large extent, influenced by the general market trends. The R-squared value of 0.422 suggests that about 42.2% of the variability in PYPLs returns can be explained by the SPY returns, underlining the significant but not exclusive influence of market movements on PYPLs performance.

PayPal Holdings, Inc. provided an expansive overview during their Fourth Quarter 2023 Earnings Conference Call, reflecting on both achievements and strategic shifts meant to propel the company forward. Alex Chriss, the President and CEO, spotlighted both the solid financial performance the company has seen over the quarter and reflected on the restructuring efforts, including notable leadership additions that are considered pivotal for the company's future trajectory. The financial results for Q4 showcased a 9% revenue growth with total payment volume reaching $410 billion. Further contributing to their optimistic outlook were the $600 million in share repurchases, enabling a 19% year-over-year increase in non-GAAP earnings per share.

Under Chriss's leadership, PayPal is entering 2024 with a decidedly strategic approach aimed at fostering growth and expanding profitability. Particular attention was given to enhancing the company's branded checkout business and PSP services, with an emphasis placed on unlocking the potential of data to drive customer value and operational efficiency. Chriss articulated a vision focused on customer-centricity, ensuring the products and services align closely with customer needs and thereby solidifying PayPal's position in the commerce ecosystem.

In addition to internal restructuring and strategic reprioritization, PayPal announced a workforce reduction of around 9%, aimed at increasing operational speed and focus. This decision reflects a broader intent to streamline operations, which is expected to enable more substantial investments in innovation and product development. These organizational shifts are part of a broader strategy to concentrate resources on key growth areas, including the acceleration of PayPal's branded checkout services and improving the overall profitability of high-growth PSP services.

The future positioning of PayPal, as discussed, seems earmarked by a transition year focused on executing these strategies to set the stage for long-term success. The leadership is clear-eyed about the near-term benefits of their initiatives and cautiously optimistic, embedding minimal contribution from recent innovations into the financial outlook for 2024. The commitment to transparency, customer-focused innovation, and disciplined growth was a recurring theme, indicating a strategic pivot meant to leverage PayPal's strengths more effectively while navigating the complexities of the global commerce landscape.

tal assets measured and recorded at fair value $ 24,894 $ 541 $ 24,353 Liabilities: Derivatives $ 2 $ $ 2 Total liabilities measured and recorded at fair value $ 2 $ $ 2

(1) Represents money market funds and time deposits with an original maturity of 90 days or less. (2) Represents securities classified as available-for-sale, with the exception of certain foreign currency denominated debt securities for which we have elected the fair value option. (3) Represents cash equivalents, U.S. government and agency securities, foreign government and agency securities, corporate debt securities, asset-backed securities, municipal securities, and commercial paper underlying customer balances. (4) In addition to marketable equity securities, includes time deposits with an original maturity of greater than 90 days.

December 31, 2022 Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Other Observable Inputs (Level 2) (In millions) Assets: Cash and cash equivalents (1) $ 923 $ $ 923 Short-term investments (2) : U.S. government and agency securities 812 812 Foreign government and agency securities 424 424 Corporate debt securities 627 627 Asset-backed securities 406 406 Commercial paper 324 324 Total short-term investments 2,593 2,593 Funds receivable and customer accounts (3) : Cash and cash equivalents 578 578 U.S. government and agency securities 8,484 8,484 Foreign government and agency securities 1,572 1,572 Corporate debt securities 1,662 1,662 Asset-backed securities 1,391 1,391 Municipal securities 407 407 Commercial paper 3,689 3,689 Total funds receivable and customer accounts 17,783 17,783 Derivatives 293 293 Crypto asset safeguarding asset 604 604 Long-term investments (2),(4) : U.S. government and agency securities 457 457 Foreign government and agency securities 364 364 Corporate debt securities 929 929 Asset-backed securities 1,067 1,067 Marketable equity securities 323 323 Total long-term investments 3,140 323 2,817 Total assets measured and recorded at fair value $ 25,343 $ 323 $ 25,020 Liabilities: Derivatives $ 4 $ $ 4 Total liabilities measured and recorded at fair value $ 4 $ $ 4

(1) Represents money market funds and time deposits with an original maturity of 90 days or less. (2) Represents securities classified as available-for-sale, with the exception of certain foreign currency denominated debt securities for which we have elected the fair value option. (3) Represents cash equivalents, U.S. government and agency securities, foreign government and agency securities, corporate debt securities, asset-backed securities, municipal securities, and commercial paper underlying customer balances. (4) In addition to marketable equity securities, includes time deposits with an original maturity of greater than 90 days.

Assets and liabilities measured at fair value are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. PayPal's policy is to recognize transfers in and out of levels within the fair value hierarchy at the end of the reporting period in which the transfers occurred. There were no significant transfers between levels during the periods presented. The company uses valuation techniques to measure the fair value of some of its financial instruments, which involves some level of management estimation and judgment, particularly for those financial instruments that are not actively traded or have little price transparency.

PayPal Holdings, Inc. remains a giant in the digital payments space, navigating through an era marked by both challenges and opportunities. Despite experiencing a challenging phase characterized by a downturn in investor sentiment and stock performance, the resilience of its foundational business model and strategic adjustments point toward promising growth potential.

The fintech landscape has been rapidly evolving, with increased competition from both established players and emerging fintech startups. PayPal's dominant position, built on a robust platform, extensive user base, and pioneering payment solutions, has been subjected to pressures necessitating continuous innovation and strategic agility. The company's enduring focus on expanding its service offerings and technological advancements underlines its commitment to retaining a competitive edge.

Amidst this backdrop, the company's financial resilience becomes evident through its growth metrics. PayPal has maintained a solid trajectory, evidencing robust revenue growth and profitability margins. However, the strategic challenge lies in balancing operational expenses to optimize profitability, a focus area under the leadership of CEO Alex Chriss. His tenure signifies a potential shift towards streamlining operations and enhancing platform efficiency, aimed at fostering long-term growth.

The digital economy's growth, coupled with shifting consumer behaviors towards online transactions, presents both challenges and opportunities for PayPal. The company's strategic forays into blockchain technology and cryptocurrencies reflect an understanding of these shifts, positioning PayPal to leverage emerging financial technologies for growth.

Investor sentiment has been mixed, influenced by PayPal's operational challenges and competitive landscape dynamics. However, the company's strategic initiativesranging from enhancing product offerings and customer experience to strategic acquisitionsunderscore a holistic approach to navigating uncertainties. PayPal's emphasis on operational efficiency, market expansion, and leveraging technological advancements offers a roadmap for overcoming current challenges.

The financial technology sector's competitive intensity underscores the necessity for PayPal to remain at the forefront of innovation. The company's engagements with technologies like blockchain and strategic partnerships aim to expand its market presence and service offerings, reflecting an adaptable approach to growth in the digital payments ecosystem.

With financial markets recognizing the value and risks associated with fintech investments, PayPal stands at a critical juncture. Its ability to innovate, adapt, and effectively execute strategic initiatives will be pivotal in determining its future trajectory. The company's current valuation, juxtaposed with its growth potential, presents an attractive investment opportunity for those looking at long-term value creation within the dynamic fintech segment.

As PayPal forges ahead, its focus on strategic growth areas, operational resilience, and leveraging global digital payment trends will be crucial. The company's trajectory offers insightful lessons on navigating the fintech landscape's complexities, emphasizing innovation, strategic agility, and market responsiveness as key to sustaining growth and investor confidence in a rapidly evolving digital economy.

Over the selected period, PayPal Holdings, Inc. (PYPL) demonstrated significant volatility, as indicated by the ARCH model results, highlighting the fluctuating nature of the company's stock. The omega value at 6.2660 points to a considerable baseline volatility in the returns of PayPal's stock, indicating that even without recent changes in stock prices, the stock is inherently volatile. Furthermore, the alpha[1] value of 0.2090 suggests that past returns have a substantial impact on current volatility, meaning that if PayPal's stock price experienced a large change yesterday, it's likely to see significant volatility today as well.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -3045.42 |

| AIC | 6094.85 |

| BIC | 6105.12 |

| No. Observations | 1258 |

| omega | 6.2660 |

| alpha[1] | 0.2090 |

To analyze the financial risk associated with a $10,000 investment in PayPal Holdings, Inc. (PYPL) over one year, we employ a two-pronged approach combining volatility modeling and machine learning predictions. This integrated methodology allows for a robust assessment of the potential risks and returns from investing in PYPL's stock.

The first step involves using a volatility modeling technique to quantify the fluctuating nature of PayPal Holdings, Inc.'s stock returns. This approach is adept at capturing the time-varying volatility, making it an essential tool in the risk management process. By fitting the model to historical stock price data, we can derive key parameters that describe how the volatility of PYPL's stock changes over time. This information is vital in understanding the underlying risk dynamics of this investment. Specifically, volatility modeling provides the statistical framework needed to forecast the future volatility of the stock, which is a critical component in the calculation of Value at Risk (VaR).

Simultaneously, machine learning predictions, based on a decision-tree ensemble method, are utilized to forecast future stock returns of PayPal Holdings, Inc. By analyzing historical data, this machine learning algorithm is capable of recognizing complex patterns that could influence future returns. It takes into account various features, including past prices, volume, market conditions, and potentially other external factors, to generate predictions about the likelihood of various return scenarios over the next year.

Integrating these two approaches, we calculate the Value at Risk (VaR) at a 95% confidence interval for the $10,000 investment in PYPL. VaR is a widely used risk measure that estimates the maximum potential loss over a specified time period with a given level of confidence. In this case, the combined insights from volatility modeling and machine learning predictions enable a comprehensive evaluation of the investment's risk profile.

The calculated annual VaR at a 95% confidence level is $417.82. This means that, under normal market conditions, there is a 95% probability that the investment in PYPL will not lose more than $417.82 over the next year. It's a quantifiable measure that encapsulates the potential downside risk based on both the anticipated volatility and the future return predictions of PayPal Holdings, Inc.'s stock.

This analysis, leveraging both volatility modeling and machine learning predictions, provides a nuanced view of the equity investment risk, focusing not just on potential losses but also on the probability of those losses occurring. The calculated VaR is critical for investors in making informed decisions, as it offers a numerical estimate of the maximum expected loss under typical market conditions, furnishing investors with a clearer understanding of the potential financial risk entailed in a $10,000 investment in PayPal Holdings, Inc. over the coming year.

Analyzing the options chain for PayPal Holdings, Inc. (PYPL) call options with a target stock price 5% over the current price, we focus on specific metrics, notably the Greeks such as Delta, Gamma, Vega, Theta, and Rho, alongside the strike price, days to expiration, premium, return on investment (ROI), and profit. These metrics are crucial for assessing the profitability and risk profile of each option.

Options with a strike price nearer to the current price often exhibit higher Delta values, indicating a close correlation to the stock's price movement. For instance, options expiring on 2024-02-16 with a Delta nearing 1.0, such as those with strike prices of $35.00, display significant sensitivity to stock price movement, offering high returns for minimal changes in stock price. However, their premium costs are quite high, which might deter investors seeking lower upfront costs.

On the other side of the spectrum, options with longer expiration dates and lower strike prices present intriguing possibilities. Options expiring on 2024-05-17, with a strike price of $45.00 and a Delta of 0.8829763887, show a balanced mix of responsiveness to stock price movements (Delta), decay over time (Theta), and sensitivity to implied volatility (Vega). With an ROI indicating potential for considerable gain relative to the premium paid, such options might attract investors willing to take on moderate risk for substantial upside potential.

For a high-risk, high-reward strategy, options such as those expiring on 2024-04-19, with a strike price of $42.5 and a Delta of 0.94376372, stand out. Despite their shorter time until expiration, they offer a high Delta, promising significant returns for bullish movements in the underlying stock. Coupled with their Vega and Theta, these options are suited for investors confident in near-term bullish forecasts.

Investors seeking a longer-term investment might consider options with expiration dates far into the future, like those expiring in 2025 or 2026. These options, despite lower Delta values indicating less sensitivity to immediate stock price movements, afford investors more time for their predictions to unfold. An example is options expiring on 2025-12-19, with a Delta of 0.8974932998 and a strike price of $32.5. These options offer a balance between time decay and leverage, suitable for those with a longer-term bullish outlook on PayPal Holdings, Inc.

In conclusion, for immediate, high-return potential, options with high Delta values and nearing expiration dates offer attractive prospects, particularly for speculative investors confident in short-term price movements. Conversely, options with longer expiration dates provide a strategic investment for those with a bullish long-term view, granting the benefit of time and reduced impact of time decay. The choice of option largely depends on the investor's risk tolerance, market outlook, and investment horizon.

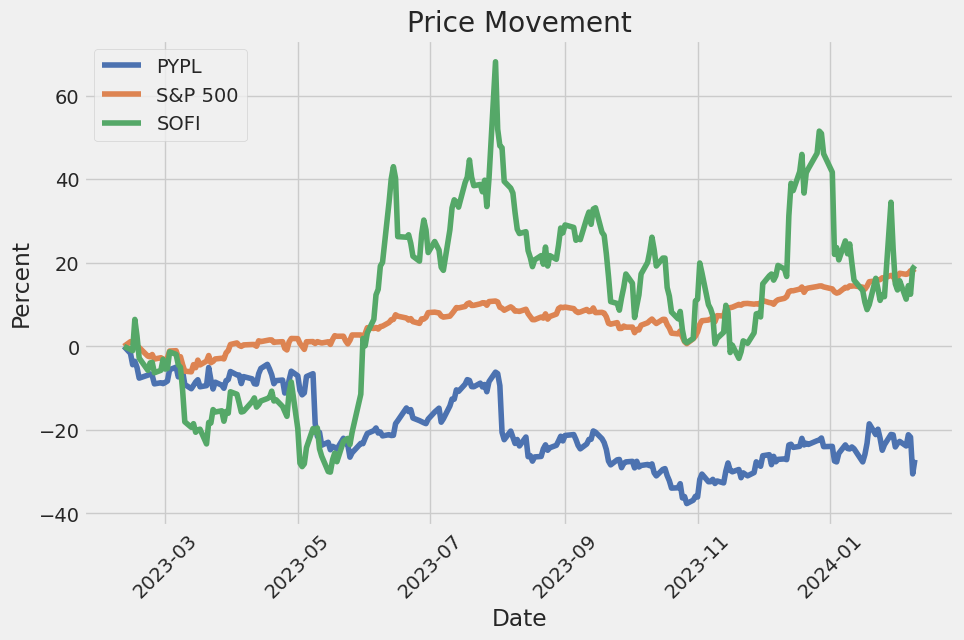

Similar Companies in Credit Services:

SoFi Technologies, Inc. (SOFI), Visa Inc. (V), Mastercard Incorporated (MA), Capital One Financial Corporation (COF), American Express Company (AXP), Upstart Holdings, Inc. (UPST), Ally Financial Inc. (ALLY), Square, Inc. (SQ), Adyen NV (ADYEY), Discover Financial Services (DFS), Western Union Co (WU)

https://www.fool.com/investing/2023/12/27/where-will-paypal-be-in-5-years/

https://www.fool.com/investing/2023/12/27/where-will-paypal-stock-be-in-2-years/

https://seekingalpha.com/article/4660144-3-undervalued-stocks-i-am-buying

https://seekingalpha.com/article/4660233-paypal-working-off-the-bottom

https://seekingalpha.com/article/4660238-paypal-compelling-bull-case-crumbling-bear-case

https://seekingalpha.com/article/4660423-wise-the-best-alternative-to-paypal-upgrading-to-buy

https://www.fool.com/investing/2023/12/31/3-undebatable-reasons-2024-be-paypal-best-year/

https://seekingalpha.com/article/4660510-paypal-dont-keep-hanging-on-to-a-poor-call

https://www.fool.com/investing/2024/01/01/3-no-brainer-growth-stocks-to-buy-for-less-than-10/

https://www.youtube.com/watch?v=a5OQjfQ_NsA

https://www.fool.com/investing/2024/01/04/the-nasdaq-100-just-had-its-best-year-since-1999-h/

https://seekingalpha.com/article/4660837-showcasing-seeking-alphas-december-2023-new-analysts-draft

https://www.youtube.com/watch?v=i5eOuuti69E

https://www.fool.com/investing/2024/01/05/is-paypal-a-millionaire-maker/

https://www.sec.gov/Archives/edgar/data/1633917/000163391723000156/pypl-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: vGmOzl

Cost: $0.85355

https://reports.tinycomputers.io/PYPL/PYPL-2024-02-09.html Home