Roblox Corporation (ticker: RBLX)

2024-05-13

Roblox Corporation (RBLX) is a pioneering entity in the realm of interactive entertainment and game creation systems, primarily known for its flagship platform, Roblox. This platform allows users to create and play games (or "experiences") generated by other users, making it a significant player in user-generated content. The business model of Roblox hinges on its virtual currency, Robux, which players use to make in-game purchases. The company benefits financially from the sale of Robux and from a variety of partnerships and merchandising agreements. Roblox went public in March 2021, opting for a direct listing rather than the traditional IPO, signaling its robust market confidence. The platform's popularity has soared, particularly among the younger demographic, which has fueled its rapid growth and expansive user base, further establishing its foothold in the global gaming market. The company's headquarters are located in San Mateo, California, USA.

Roblox Corporation (RBLX) is a pioneering entity in the realm of interactive entertainment and game creation systems, primarily known for its flagship platform, Roblox. This platform allows users to create and play games (or "experiences") generated by other users, making it a significant player in user-generated content. The business model of Roblox hinges on its virtual currency, Robux, which players use to make in-game purchases. The company benefits financially from the sale of Robux and from a variety of partnerships and merchandising agreements. Roblox went public in March 2021, opting for a direct listing rather than the traditional IPO, signaling its robust market confidence. The platform's popularity has soared, particularly among the younger demographic, which has fueled its rapid growth and expansive user base, further establishing its foothold in the global gaming market. The company's headquarters are located in San Mateo, California, USA.

| Full Time Employees | 2,457 | Previous Close | $30.42 | Open | $30.91 |

| Day Low | $30.56 | Day High | $31.98 | Volume | 21,401,885 |

| Market Cap | $20,127,307,776 | 52 Week Low | $24.88 | 52 Week High | $47.20 |

| Price to Sales (TTM) | 6.83 | Fifty Day Average | $37.68 | Two Hundred Day Average | $36.43 |

| Total Cash | $2,410,233,088 | Total Revenue | $2,945,230,080 | Net Income to Common | -$1,154,237,056 |

| Revenue Growth | 22.3% | Current Ratio | 1.073 | Return on Equity | -7.54% |

| Sharpe Ratio | -0.18172178530532068 | Sortino Ratio | -2.4592949741133023 |

| Treynor Ratio | -0.0610197989295818 | Calmar Ratio | -0.4389743980279149 |

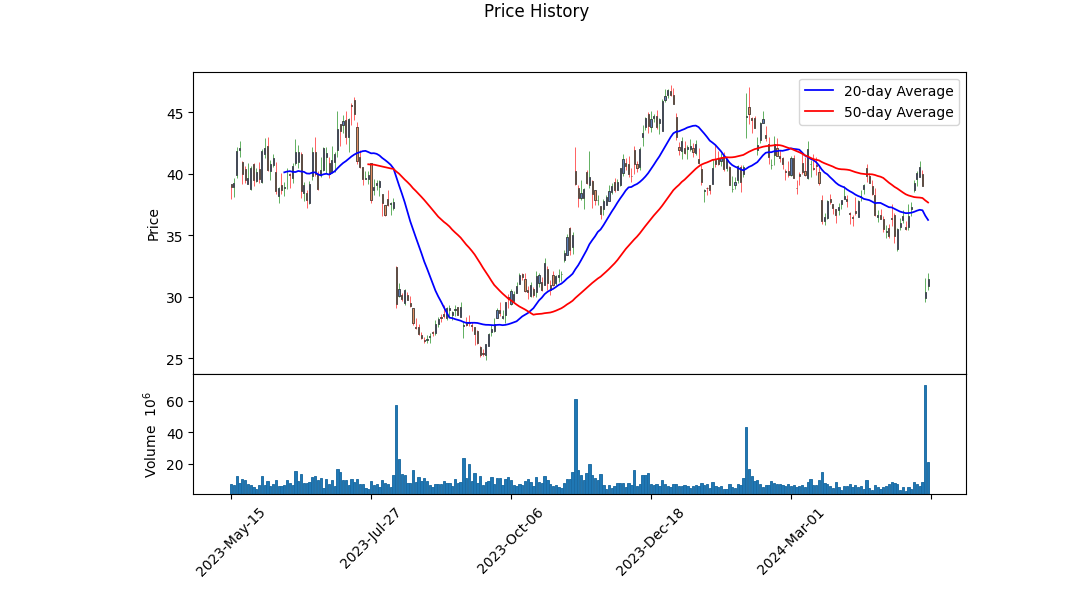

The analysis of Roblox Corporation (RBLX) stock is predicated on a comprehensive review encompassing technical indicators, risk-adjusted returns, various financial ratios, and company fundamentals. Notably, RBLX has recently exhibited significant price volatility, as evidenced by recent trading sessions showing drastic changes in its price and volume.

Technical indicators such as the MACD histogram transitioning from positive to negative over the recent sessions suggest a bearish sentiment in the near term. This trend is corroborated by a sharp decline in On-Balance Volume (OBV), indicating that the volume of stock traded is in decline, a factor usually associated with decreased investor confidence.

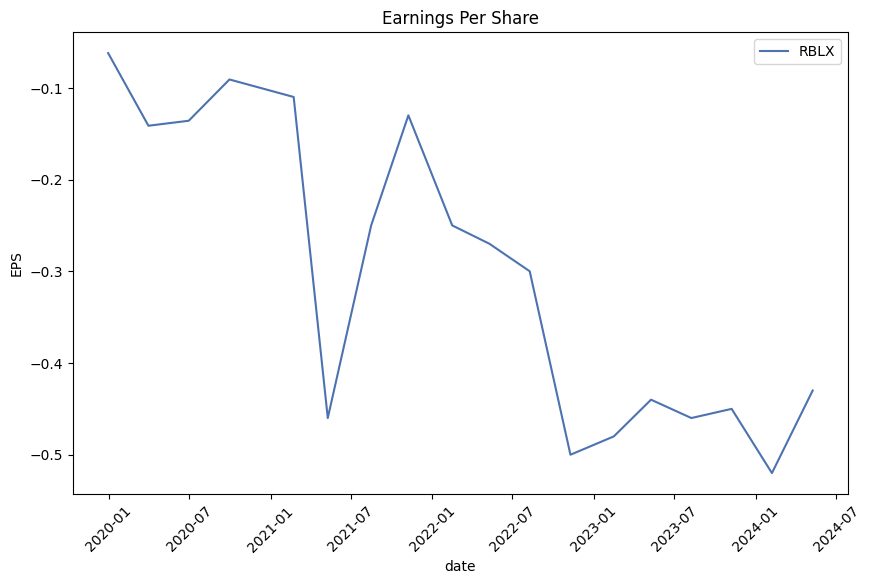

RBLX's financial standing per the latest fundamentals, demonstrates a challenging environment. The key metrics include consistently negative values such as EBITDA, operating margins, and a reported net loss which indicate struggling operational efficiency and profitability. Moreover, significant cash flow activities such as large amounts of cash used in investment activities and increasing debt depict a company aggressively investing in growth amid financial strain, as seen in substantial increases in debt issuance and capital expenditure.

Assessing RBLX through the lens of risk-adjusted performance metrics like the Sharpe, Sortino, Treynor, and Calmar ratios, which remain in negative territory, reflects poorly in terms of the company's investment attractiveness relative to risk-free assets. Notably, the Sharpe and Calmar ratios indicating negative values infer an unfavorable return volatility profile, compounded by unduly high risks failing to offer adequate returns.

Corporately, RBLX has its capital structure and liquidity metrics in a state that raises some concerns, evident from the balance sheets showing a net debt situation and a tangibly negative book value. While the company retains substantial revenue figures, it incurs considerable operational costs that outpace its gross profit, thereby eroding the bottom line.

For the upcoming months, RBLX appears to be positioned in a precarious spot where its stock price could face downward pressure due to weak financial performance, poor risk-adjusted returns, and potential investor skepticism towards its growth plans amidst such financial strain. The critical indicators do not currently signal robust upside potential without significant improvement in fundamental financial health or operational outcomes. Therefore, the recommendation leans towards a cautious approach until the company shows sustainable improvements in key performance metrics and financial stability. Investors are advised to closely monitor upcoming quarterly results and any strategic announcements that might materially influence the company's trajectory.

In our analysis of Roblox Corporation (RBLX) through the lens of the methodologies presented in "The Little Book That Still Beats the Market," we observe notable metrics in terms of return on capital (ROC) and earnings yield. The company's ROC stands at -40.41%. This negative figure indicates that the company is currently generating a loss for every unit of capital employed, which could be a concern as it suggests inefficiencies in using its capital to generate profitable returns. Similarly, the earnings yield for Roblox is also negative at approximately -5.95%. Earnings yield is typically assessed to understand how much earnings a company produces per dollar invested in its shares and a negative value implies that the company is losing money rather than earning. These metrics are essential in assessing Roblox's current financial health and profitability, indicating challenges in their operating model or market conditions that are affecting their performance adversely. Investors should carefully consider these factors along with broader market and industry trends when evaluating Roblox as a potential investment.

| Alpha () | 0.0023 |

| Beta () | 1.34 |

| Correlation () | 0.76 |

| R-squared (R2) | 0.58 |

| Standard Error | 0.0045 |

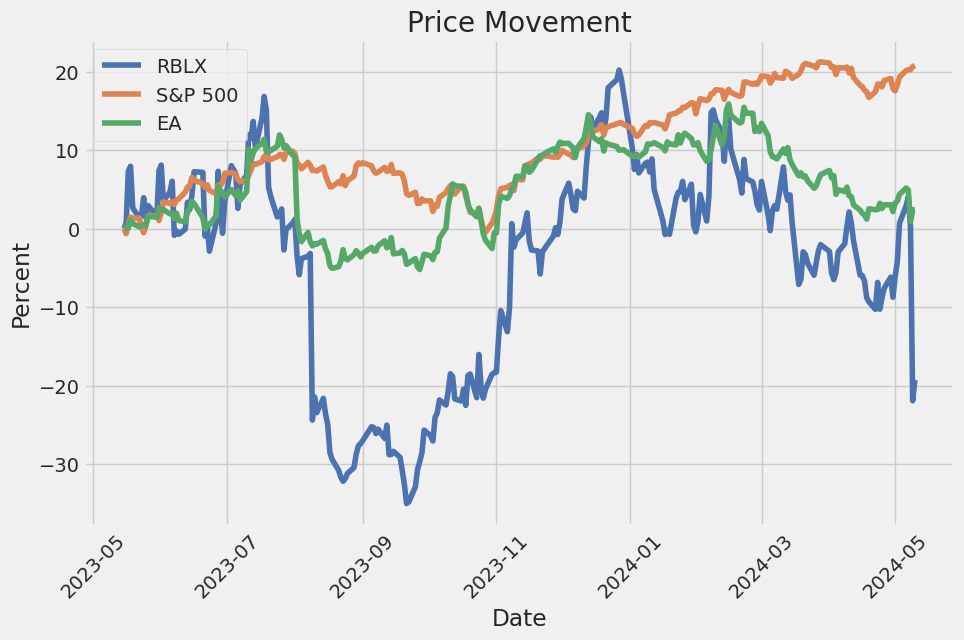

In the given linear regression model between RBLX (Roblox Corporation) and SPY (SPDR S&P 500 ETF Trust), a key statistic of interest is the alpha value, which stands at 0.0023. This positive alpha indicates that, over the analyzed time period, Roblox has generated a return that slightly exceeds the returns predicted by the model based on the market performance as represented by SPY. Alpha, as a measure of the performance of an investment relative to a benchmark index, highlights RBLX's ability to outperform the market, albeit by a modest margin.

Beta, another important statistic from the analysis, is reported at 1.34 for Roblox relative to SPY. This suggests that RBLX shares are more volatile than the market at large. Typically, a higher beta indicates a stronger relation to broad market movements and correspondingly higher risk and potential return. Given this, the observed correlation of 0.76 with SPY implies a strong positive relationship, meaning most of the movements in RBLX can be explained by the movements in the S&P 500. This correlation, combined with an R-squared value of 0.58, tells us that approximately 58% of RBLXs stock price movements can be explained by fluctuations in SPYs value.

In the latest earnings call, Roblox Corporation reported strong first-quarter results for 2024, marking a continued trajectory of growth and operational advancements across multiple metrics. CEO David Baszucki highlighted significant year-on-year growth in daily active users (DAUs), especially noting a 17% increase to 77 million DAUs. This growth was even more pronounced among users over the age of 13 and in key international markets such as Japan and India, which saw increases of 50% and 58% respectively. Financial performance also exceeded expectations with revenue hitting $801 million, surpassing the guided range, although bookings at $923.8 million were in line with expectations but slightly under the companys ambitious targets.

Baszucki also emphasized the company's focus on enhancing operating efficiency, which has been reflected in improved financial metrics such as a 37% year-on-year increase in net cash from operations and a 133% increase in free cash flow. Despite a substantial net loss of $272 million based on GAAP, this was significantly below the anticipated loss, demonstrating better cost management and capital expenditure control. Robloxs commitment to infrastructure optimization, trust and safety, and targeted personnel growth in strategic areas like AI and live operations were key contributing factors to this financial outcome.

Robloxs leadership addressed challenges in bookings growth, attributing some of the underlying issues to technical upgrades rolled out in the latter half of the previous year that impacted performance, particularly on lower-end Android devices. In response, the company has focused on enhancing the system's overall performance and optimizing content discovery algorithms. These improvements, particularly in user interface and technology, have started reflecting positively in their largest market, the US and Canada, where recent weeks have shown a booking and user engagement resurgence to over 20%.

Looking ahead, Roblox has made strategic adjustments to its 2024 guidance, adopting a more conservative outlook in face of recent data and maintaining a focus on long-term platform health. The company continues to invest in advanced AI capabilities, advertising, and boosting its virtual economy, which are expected to support sustained growth and operational efficiency. The management remains optimistic about the growth potential, reaffirming a long-term target of 20% growth. The focus is set on continuing to leverage Robloxs platform to deliver strong financial performance while enhancing user experience and content creator opportunities.

Roblox Corporation, detailed within the most recent SEC 10-Q filing dated for the first quarter ended March 31, 2024, exhibited several key financial and operational highlights that inform about its recent performance and strategic direction. This performance analysis primarily revolves around detailed income statements, balance sheets, and statements of cash flows provided without supplementary data or investor communications.

In the first quarter of 2024, Roblox reported revenue of $801.3 million, reflecting a notable rise from the $655.3 million recorded in the same period of 2023. This increase suggests a robust growth in user engagement and monetization capabilities which are crucial for the company's sustained expansion and market penetration. The revenue boost was cemented by remarkable growth figures in daily active users (DAUs) and bookings. Specifically, average DAUs reached 77.7 million and bookings amounted to $923.8 million in Q1 2024, compared to 61.5 million DAUs and $773.8 million in bookings over the same quarter last year.

The balance sheet as of March 31, 2024, reflected total assets of $6.31 billion, against liabilities totaling $6.25 billion, showing a solid asset base coupled with manageable liabilities. This financial stability is critical for the company's strategic pursuits and in buffering against volatile market conditions. Roblox's cash and cash equivalents stood at $866.4 million, an increase from the $678.5 million reported at the end of the previous quarter, December 31, 2023. This increase in liquidity positions the company favorably for investments in potential growth areas like technology upgrades and market expansion.

Operating expenses delineated in the report show significant investments in infrastructure, research and development, and developer exchange fees, consisting of payments made to developers on the platform. These expenses are indicative of Robloxs strategy to bolster platform capabilities and enhance user and developer experience. However, the company continued to report operating losses, which amounted to $302.3 million for the quarter, slightly up from a loss of $289.8 million during the same period in the previous year, reflecting ongoing investments in expansion and innovation.

The comprehensive loss, inclusive of net loss and other comprehensive loss items such as foreign currency translation adjustments and unrealized gains or losses on marketable securities, was reported at $278.9 million for Q1 2024. Despite this, managements discussion outlines strategic optimism with a spotlight on increasing platform engagement and diversifying revenue streams which are anticipated to gradually tip the financial outputs towards profitability.

Stock-based compensation expenses also increased to $240.5 million from $184.9 million year-over-year, indicating ongoing investments in human capital. This outlines Roblox's commitment to attract, retain, and incentivize key talent, which is crucial for fostering innovation and driving growth in the high-stake tech industry.

In summary, the first quarter of 2024 for Roblox Corporation outlined significant growth in key operational metrics amid strategic spending to enhance platform capabilities and market position. Though the operational losses continue, the underlying growth metrics, increased liquidity, and strategic investments reported provide a multifaceted view of the companys trajectory towards long-term value creation and market leadership.

Roblox Corporation, a stalwart in the tech and gaming sectors, has been recognized for its innovative approaches within the interactive digital and gaming sphere. The interest shown by investment heavyweights like Cathie Wood, CEO of Ark Invest, provides a testament to the platform's market resonance and potential for growth. Recent financial bouts faced by Roblox include a notable increase in revenue by 30%, a significant 25% surge in bookings, and a 22% rise in daily active users, reaching 71.5 million. Despite these promising growth metrics, the company's stock has experienced volatility, reflecting investor sensitivity to emerging trends and financial forecasts in the tech sector.

Analyzing Robloxs market position reveals critical insights into its valuation and investor appeal. As of April 2023, the company introduced advertising as a central revenue source. This strategic move, aimed at leveraging Robloxs massive user base, marks a pivotal shift towards diversified income streams, positioning the company well against market volatility. The immersive nature of Roblox's platform, allowing users to create and engage with 3D experiences, enhances its appeal as an advertising medium, particularly aligned with user interaction and satisfaction. The introduction of advertising is poised to be a financial catalyst, potentially amplifying Roblox's revenue significantly.

The integration of advanced technology and innovative marketing strategies is evident in Roblox's business operations, particularly within the expanding metaverse. Investment strategies focusing on platforms like Roblox, which are central to the metaverse narrative, highlight the significant potential held within this tech sector, poised to grow from a market size of $90 billion in 2023 to an estimated $1 trillion by 2030. This expansion is supplemented by Roblox's strategic relevance as a digital and interactive platform, particularly enticing to a younger demographic, crucial for long-term engagement and scalability.

Roblox's strategic moves include robust approaches toward enhancing user engagement and monetization. The company's recent endeavors in advertising, paired with continued innovations in platform technology such as AI-driven functionalities and immersive advertising, are expected to pivot the company towards substantial financial growth. Despite facing operational challenges such as increased competition and evolving user demographics, Roblox remains agile in its strategy, maintaining a focus on core growth metrics and user engagement.

Financial analysis underscores the importance of Roblox's next moves in market strategy. Recent endorsements by figures like Cathie Wood and investments from significant funds reflect a strong belief in Roblox's market strategy and its alignment with future technology trends. Even with current financial pressures, these strategic investments illuminate a path forward that could potentially stabilize and grow Robloxs financial standing in the market.

From a broader perspective, Robloxs focus on maintaining a competitive edge in the metaverse and digital entertainment sectors indicates forward-thinking leadership and a clear strategic vision. The companys efforts to diversify its revenue streams through advertising and enhanced platform functionalities suggest adaptive strategies geared towards long-term growth and market leadership.

In conclusion, Roblox Corporation, through strategic innovations and market positioning, stands as a pivotal entity within the tech and gaming industries. With robust user engagement metrics, expanding technological functionalities, and strategic market diversification, Roblox is set to navigate the complexities of the tech market, aiming to capitalize on both current trends and future opportunities in digital entertainment and the broader metaverse landscape.

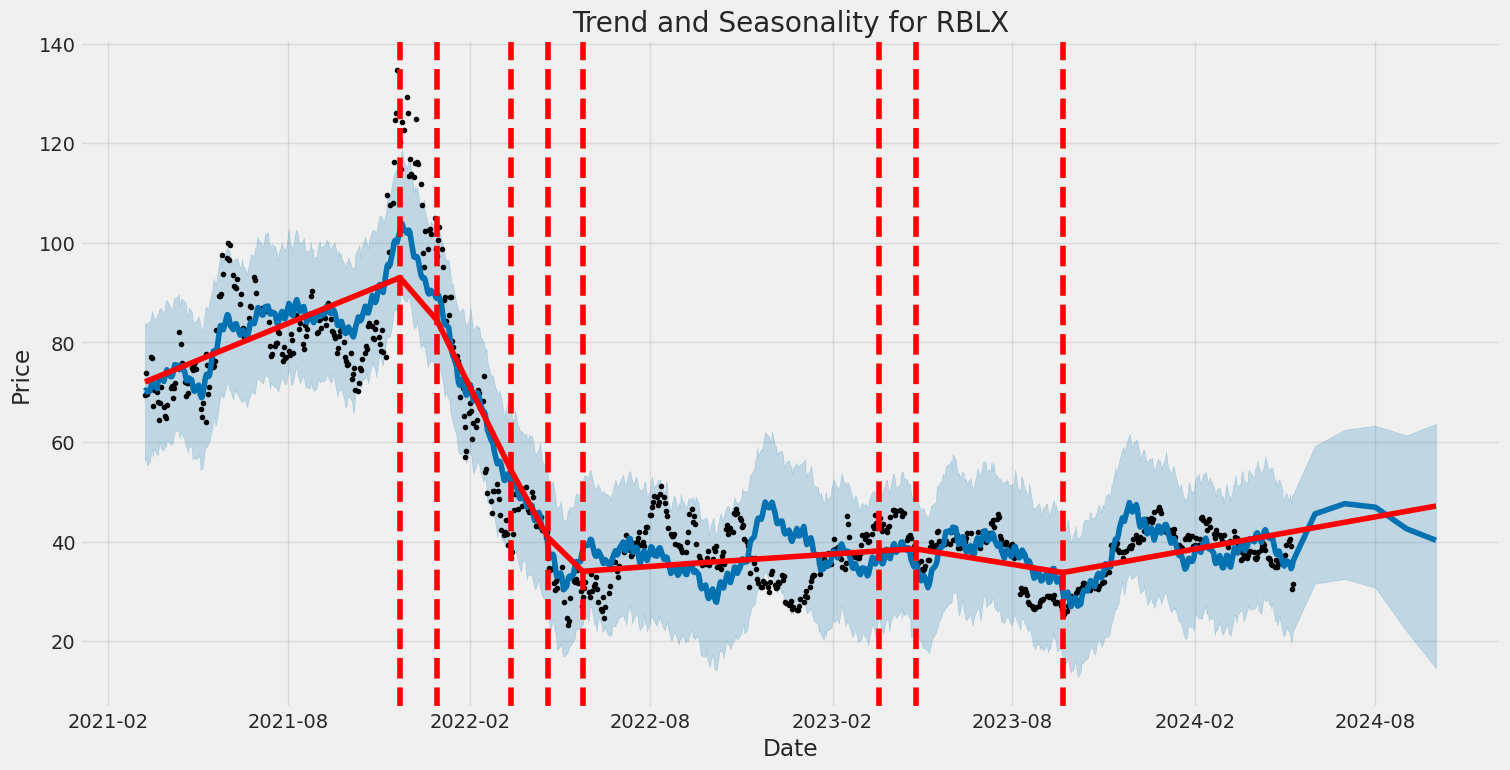

Roblox Corporation's stock (RBLX) experienced notable volatility over the observed period beginning on March 10, 2021 and extending up till May 10, 2024. The volatility modeling suggests that fluctuations in Roblox's stock returns were significant, as indicated by an omega value of 22.4170, highlighting that there is a substantial base level of volatility regardless of previous returns. The alpha coefficient of 0.1134, although not highly significant (p > 0.05), suggests that past returns indeed had some influence on the volatility, albeit moderate.

| Statistic Name | Statistic Value |

| Mean Model | Zero Mean |

| Volatility Model | ARCH |

| Log-Likelihood | -2,410.30 |

| AIC | 4,824.59 |

| BIC | 4,833.96 |

| No. Observations | 798 |

| Omega | 22.4170 |

| Alpha[1] | 0.1134 |

The exploration of the financial risk involved in a $10,000 investment in Roblox Corporation over a one-year frame employs advanced analytical techniques, namely volatility modeling and machine learning predictions. These methods combined offer a refined approach to understand the movements in stock value and predict future patterns effectively.

To start, volatility modeling techniques are instrumental in quantifying the level of risk associated with the stock market fluctuations tied to Roblox Corporation. This model specifically captures the variable rate at which stock prices increase or decrease - a vital element for investors who need to gauge daily financial risk and optimize their investment strategies in response to market dynamics. By accurately modeling this volatility, we can delineate the underlying risks more clearly and establish smarter hedging strategies.

Moving forward, we integrate machine learning predictions to forecast future returns of Roblox Corporation's stock. Utilizing historical price data and derived features, a machine learning model like a decision tree ensemble method provides refined predictions of future stock performance. This approach leverages patterns and relationships within the data that might not be immediately apparent through traditional analysis, enhancing the predictive power and reliability of our financial assessment.

When combined, these two analytical approaches enable an advanced assessment of the potential financial risks. For instance, using these models together, the calculated annual Value at Risk (VaR) for a $10,000 investment in Roblox Corporation, at a 95% confidence interval, is estimated to be $582.23. This figure represents the potential loss in value of the investment in a worst-case scenario, based on normal market conditions, over the course of one year. In practical terms, this means there is a 5% chance that the investor would lose more than $582.23 on this investment within one year due to normal market volatility.

By applying both volatility modeling to assess fluctuation and machine learning predictions for future returns, investors are better equipped to understand both the explicit and implicit risks in their investment choices. This robust methodological synergy thus serves as a crucial tool in financial decision-making and risk management for equity investors.

Long Call Option Strategy

In analyzing the long call options for Roblox Corporation (RBLX), we specifically focus on movements where the target stock price is projected to be 5% above the current price. Below, I discuss several options from near-term to long-term expirations that display profitable outlooks based on their respective Greek metrics such as delta, theta, and vega, among others.

In the near term, consider a call option with an expiration on 2024-05-24 and a strike price of $30. This option has a delta of 0.7448, suggesting high sensitivity to the stock price movement. It also boasts a positive vega, indicating profitability from an increase in implied volatility, a significant factor given its short days to expiration. The corresponding gamma of 0.1306 shows potential sensitivity to the underlying asset price changes, which makes it a compelling choice given the proximity to expiry.

As we extend the timeline slightly, look into the option expiring on 2024-06-07 with a strike price of $29. Although this has a lower delta of 0.7481 compared to other options within the same timeframe, it balances with a high vega and a gamma that ensures responsiveness to price variations. This option represents a balanced risk approaching medium-term investment horizons.

Moving to an intermediate-term expiry, the call option for expiration on 2024-09-20 with a strike price of $20 presents a lucrative avenue. This option has a delta of 0.9229, indicating strong expected profitability with a favorable move in the stock price. With a high rho factor, this option also stands to benefit from changes in interest rates, emphasizing its attractiveness over a longer duration before expiry.

For options further out, consider those expiring on 2025-01-17. The strike at $17.5 with a delta of 0.9109 offers a potent mix of high sensitivity to price changes and beneficial outcomes from volatility swings, as showcased by its vega of 4.1799. This option aligns with strategies favoring not only immediate movements but also broader timeframes allowing for deeper market developments.

Lastly, the longest duration involves an option expiring on 2024-12-20 with a strike of $20. Despite its lower delta compared to some mid-term options, it harbors a substantial vega, facilitating advantages from volatility. Additionally, its considerable theta reduction is much slower, indicating lesser time decay impact over its long life.

Through this analysis across various expiry durations and strike prices, I have encapsulated options that not only cater to near-term profitability scenarios but also allow flexibility and resilience over diverse market conditions. Thus, optimizing the choice based on the investment timeline, volatility prospects, and price movement predictions should be paramount in strategizing the most profitable positions.

Short Call Option Strategy

Analyzing the options chain for Roblox Corporation (RBLX) and focusing specifically on short call options, several potential opportunities emerge based on the Greeks and associated metrics. These findings are based on the assumption that the target stock price is anticipated to be 5% over the current stock price, and the focus is on options with different expiration dates ranging from near-term to long-term.

-

Near Term Option (June 2024, Strike 25.0): With a delta of about 0.84 and a vega of approximately 1.05, this option presents a relatively lower risk due to its greater delta, indicating closer to being in-the-money. The ROI (Return on Investment) of about 20% suggests an adequately profitable trade, especially given the theta of about -0.07, which suggests a moderate time decay beneficial in a short call strategy where price depreciation increases profitability.

-

Mid Term Option (May 2025, Strike 30.0): This option provides a good balance with a high vega value of approximately 8.16, indicating high price sensitivity, which can be advantageous in volatile market periods. The ROI of 100% clearly stands out, reflecting high profitability potential if the option moves out-of-the-money as projected. The delta of approximately 0.66 suggests that it's somewhat sensitive to the stock price movement but still provides a cushion.

-

Long Term Option (June 2026, Strike 30.0): This has a delta of around 0.68, which is decent for longer-term options, providing some leverage against price movements while maintaining profitability (100% ROI). The high vega (over 11) is particularly attractive, as it indicates this option's price will be very responsive to volatility, which is beneficial for a short position if volatility decreases over time.

-

Very Long-term Option (January 2026, Strike 30.0): With a delta of about 0.71, this option balances profitability potential (100% ROI) and responsiveness to the underlying assets price changes. The high vega value nearing 13.99 suggests significant profitability from volatility decreases, a common scenario for long-dated options as the expiry approaches.

-

Ultra Long-term Option (December 2025, Strike 30.0): This option stands out with a very high ROI of 100%, combined with a vega of around 14.76, which is exceptionally high, suggesting extensive sensitivity to changes in the underlying's volatility. With a delta of about 0.71, it's somewhat reactive to price movements, aligning with a strategy of benefiting from both time decay and volatility contraction.

In conclusion, focusing on options with high vega values has yielded fruitful insights, especially for mid to long-term trading horizons where larger shifts in volatility can significantly impact option premiums. The selected strikes around $30.00, particularly for future dates (ranging from 2024 to 2026), offer significant profit potentials at controlled risk levels, particularly so for scenarios where a decline in volatility or favorable positional time decay may occur. The listed strikes accord well with a strategy aiming to exploit time and volatility decay, resting on the calculation that Roblox's stock price will hover around a predictable range in the medium to long term, not exceedingly surpassing our target strikes, hence grounding these short call options out of the money as expiration approaches.

Long Put Option Strategy

Analyzing the provided options chain for Roblox Corporation (RBLX) with a focus on long put options across different expiration dates, several key options emerge based on their high profitability potential. The aim is a target stock price that is 5% over the current price, hence options with significant sensitivity to price changes (delta), those resistant to changes in the volatility (vega), and lower time decay (theta) are preferred.

Starting with near-term options, a put with a strike price of $39 expiring on June 14, 2024, shows a high potential for profit, boasting a delta of -0.8827, a gamma of 0.0377, and a vega of 1.8046. This option has a relatively high rate of return on investment (ROI) and a significantly negative delta, indicating a strong movement in option price in response to downward movements in the stock price, which is desired in a long put strategy.

Moving to a slightly longer-term, an option with a strike price of $55 expiring on July 19, 2024, holds a considerable promise with a delta of -1.0, gamma of 0.0, vega of 0.0, and a theta near zero. The perfect negative delta implies that the option's price will move on a one-to-one basis with any decline in the underlying stock price, maximizing profitability if the stock price falls.

For medium-term options, a long put with a strike of $47.5 expiring on September 20, 2024, presents a good balance between day-to-day price resilience and response to stock volatility, noted by its delta of -0.8440, vega of 4.4734, and theta of -0.0045. This option allows for considerable upside as the vega suggests substantial price sensitivity to changes in implied volatility beneficial in volatile market conditions.

In the longer-term scenario, choosing an option like the one with a strike price of $55, expiring on October 18, 2024, with a delta of -0.8586, gamma of 0.0170, and vega of 4.6217, can be advantageous. This option combines a strong negative delta with a reasonable balance of gamma and vega, reflecting an ability to benefit from both price movements and volatility shifts, important for long-dated options amid uncertain market foresights.

Lastly, for a very long-term perspective, consider the put option with a strike price of $65 expiring on March 21, 2025. It stands out with a delta of -0.8333, a modest gamma of 0.0150, and a vega of 10.1771. The high vega especially bolsters this option's sensitivity to volatility, which is crucial over the longer term, while the negative delta stays aligned with our bearish outlook.

These options provide a varied approach concerning expiration terms and sensitivity parameters, catering to different strategic needs and market outlooks. By choosing an appropriate combination of these, investors can position themselves to exploit expected downward movements effectively in RBLX's stock price over various time horizons.

Short Put Option Strategy

Analyzing the Greeks for Roblox Corporation (RBLX) short put options spread across various expirations and strike prices, we can identify several optimal choices that may provide substantial profitability with regard to different trading strategies and market sentiment assumptions.

The short put with a strike of 25.0 and an expiration on May 31, 2024, offers a promising mix with a notably high premium of 0.03 and a great 100% return on investment (ROI). Meanwhile, it combines a delta of -0.0195461656 and a theta of -0.0049936446, suggesting a somewhat gradual sensitivity to price changes in the underlying stock and time decay, making it an interesting middle-ground choice for relatively short-term trading.

For those looking to extend holdings slightly further, the short put expiring on June 7, 2024, with a strike of 25.0 displays delta -0.036980356 and a premium of 0.08, offering 100% ROI. What makes this option appealing is the higher premium coupled with a manageable sensitivity to stock price movements.

Considering a longer-term perspective, the short put expiring on June 28, 2025, at a strike of 25.0 might present an attractive opportunity as well. This options delta is -0.2040105541, and though it carries a substantial premium of 0.34, it maintains 100% ROI. The increased vega of 2.596659108 hints at significant sensitivity to implied volatility, appealing for a longer-dated strategy with a view that volatility may increase.

Adopting a far-reaching timeline, opting for a short put that expires on December 20, 2025, with a strike of 25.0 stands as a solid choice. It exhibits a delta of -0.1965702443, meaning moderate price movement sensitivity and a higher premium of 1.9, securing a 100% ROI. The sensitivity to volatility is also substantial, as indicated by vega of 6.7647293781, fitting for traders anticipating major shifts over the longer term.

Finally, to maximize exposure to potential long-term volatility and time value, the option expiring on January 16, 2026, with a strike of 25.0 might be optimal. It has a delta of -0.2112571238 and attracts a premium of 4.1, offering substantial ROI potential at 100%. The higher theta value (-0.003382316) makes it a worthwhile choice for benefiting from time decay over extended periods.

Each of these selected short put options presents a thoughtful blend of the Greeks, ideal for traders with varying risk appetites and market outlooks, from relatively conservative short-term trades to more speculative long-term positions.

Vertical Bear Put Spread Option Strategy

To construct the most profitable vertical bear put spread for Roblox Corporation (RBLX), it's essential to understand the nuances of both the short and long put options across various expirations. A bear put spread involves purchasing a put option and selling another put option with a lower strike price but the same expiration date. The goal is to profit from a moderate decrease in the underlying stock price. The strategy involves a net debit to the position (i.e., the cost of the long put less the credit received from the short put), and it benefits from bearish moves in the underlying stock.

Short Put Options Analysis: From the provided data, lets consider specific options based on their expiration dates, from near-term to long-term, assessing both their potential profitability (ROI) and sensitivity to price changes (Greeks).

- Near-Term Expiration:

-

Strike 40.5, Expiring on 2024-05-17: This option has a high delta (-0.9357) and a fair ROI (2.7236%), presenting a roller-coaster option due to a swift change in its price relative to the stock price movement. However, its high vega (0.358) indicates sensitivity to implied volatility, potentially beneficial in a swiftly declining market.

-

Mid-Term Expiration:

-

Strike 47.0, Expiring on 2024-10-18: This put offers a lower delta (-0.9136), suggesting lesser movement compared to the previous option, with an ROI of 2.2417%. Its vega (0.4492) further suggests moderate sensitivity to changes in implied volatility.

-

Long-Term Expiration:

- Strike 42.5, Expiring on 2025-03-21: With a delta of -0.7207 and an ROI of 2.8808%, this put option provides a more conservative choice in terms of price reactivity and ROI, balanced by its longer-term view allowing for broader market movement.

Long Put Options Analysis:

- Near-Term Expiration:

-

Strike 42.0, Expiring on 2024-05-24: Selected for its high vega (1.2331) and significant gamma (0.0300), this option ensures robust reactivity to structural market shifts, making it a sound hedge against the short position in a bear strategy.

-

Mid-Term Expiration:

-

Strike 50.0, Expiring on 2025-03-21: Combining a delta of about -0.8242, vega of 6.3112, and moderate gamma, it offers a balanced risk-reward in mid-term, suitable for market predictions with medium-range certainty.

-

Long-Term Expiration:

- Strike 52.5, Expiring on 2025-06-20: With a lower delta (-0.6142) and substantial vega (12.6241), this option is apt for long-term hedging, offering extensive protection against volatility, which is beneficial in a bear spread set over an extended period.

Strategizing the Bear Put Spreads:

-

Short-Term Strategy: Pair the short put at Strike 40.5, Expiring on 2024-05-17 with the long put at Strike 42.0, Expiring on 2024-05-24. This spread employs immediate terms for anticipated near-term bearish action, maximizing ROI while limiting downside through protective put purchase.

-

Mid-Term Strategy: Utilizing the short put at Strike 47.0, Expiring on 2024-10-18 in conjunction with the long put at Strike 50.0, Expiring on 2025-03-21, crafts a time-staggered approach where slightly out-of-the-money long puts safeguard against prolonged downside risks.

-

Long-Term Strategy: The combination of short put at Strike 42.5, Expiring on 2025-03-21 with the long put at Strike 52.5, Expiring on 2025-06-20 caters to investors with a longer-term view, embedding strong volatility buffering from the long put and exploiting subtler price dips effectively.

By carefully analyzing and matching short and long puts based on their Greeks, premiums, and expirations, we streamline our vertical bear put spread strategy to optimize for assumed market movements while managing risk exposure.

Vertical Bull Put Spread Option Strategy

In analyzing the vertical bull put spread options strategy for Roblox Corporation (RBLX), we need to identify pairings of short and long put options that meet the profitability and risk criteria, focusing on options expiring across various ranges from near-term to long-term. Here are fiveOptions chosen based on their profitability and alignment with market predictions.

- Near-Term Expiration:

- Short Put: May 17, 2024, $30 strike, Delta: -0.1445, Vega: 0.6484, Theta: -0.0541

- Long Put: May 24, 2024, $30 strike, Delta: -0.2368, Vega: 1.6065, Theta: -0.0336

-

This short-term pairing is intended for those forecasting a stable or slight uptick in RBLX's stock in the immediate future. Choosing a short and long put both at $30 but with different expiration dates optimizes Vega and Theta, reducing potential time decay while taking advantage of increasing volatility. The ROI here is high for the short put with significant profit potential while keeping the risk of loss controlled by the longer expiry of the long put.

-

Medium-Term Expiration:

- Short Put: June 7, 2024, $31 strike, Delta: -0.4135, Vega: 3.1413, Theta: -0.0249

- Long Put: June 14, 2024, $31 strike, Delta: -0.4081, Vega: 2.6356, Theta: -0.0297

-

The medium-term expiration allows for increased flexibility around market movements and still maintains good control over the rate of Theta decay. This setup is beneficial during periods of moderate volatility, as Vega is high for both options. The similar strike prices ensure that the strategy benefits from aligning market strike probability.

-

Long-Term Expiration:

- Short Put: September 20, 2024, $32.5 strike, Delta: -0.4703, Vega: 7.4382, Theta: -0.0110

- Long Put: October 18, 2024, $32.5 strike, Delta: -0.5639, Vega: 8.1228, Theta: -0.0085

-

This longer-term strategy leverages a lower Theta to benefit from lesser time decay over an extended period. With comparably high Vega scores, both options will benefit from surges in volatility. Structuring the puts at the same strike creates a more defensive play that looks to capitalize on small movements in the underlying stock price while mitigating risk with an extended expiration on the long put.

-

Extended Long-Term Expiration:

- Short Put: December 20, 2024, $40 strike, Delta: -0.6499, Vega: 9.4350, Theta: -0.0064

- Long Put: January 17, 2025, $40 strike, Delta: -0.5903, Vega: 10.0762, Theta: -0.0056

-

This pairing, with both puts deeply in-the-money with longer expiries, is particularly defensive. The strategy aims to mitigate risk by using higher Vega values and lower Theta decay rates, ideal in uncertain markets where stock price volatility could increase over time. Such a strategy could be more appealing for risk-averse investors.

-

Ultra Long-Term Expiration:

- Short Put: June 20, 2025, $45 strike, Delta: -0.4592, Vega: 13.0984, Theta: -0.0065

- Long Put: June 20, 2026, $45 strike, Delta: -0.6449, Vega: 12.2892, Theta: -0.0030

- The most extended option that maximizes the Vega and minimizes Theta decay, suitable for very long-term positioning. It is structured to capitalize on expansive time frames where robust shifts in the stocks fundamentals or macroeconomic environment can substantially influence the RBLX's stock valuation, providing substantial upside if managed correctly over the long period.

In conclusion, these strategies range from aggressive short-term positions to conservative long-term plays, allowing traders to tailor their options trading to their speculative outlook or hedging needs concerning RBLX's stock. Each pairing strategically utilizes Greeks to optimize the potential return relative to the inherent risks of time decay and volatility.

Vertical Bear Call Spread Option Strategy

To construct a vertical bear call spread for Roblox Corporation (RBLX) stock using options, we are particularly interested in selecting a combination of short positions with a high likelihood of expiring worthless (thus maximizing the premium received) and long positions as insurance (purchased calls with a higher strike price). This ensures that our potential loss is controlled.

A bear call spread involves selling a lower strike call option, which has a higher premium, and buying a higher strike call option, which has a lower premium. The goal is to benefit from the net credit of the spread. This strategy is used when we anticipate the underlying stock to either decline or remain below the strike price of the short call until expiration.

Analysis of the most profitable options strategies (selection of five bear call spreads):

1. Short Term Options (Within a month) - Short Call: Sell the call option for a strike price of $30.00 expiring on May 24, 2024, where the premium is $1.9, delta is 0.7448, and theta is 0.0422. - Long Call: Buy the call option for a strike price of $32.5 expiring on May 24, 2024, where the premium is $1.08, delta is 0.5962, and theta is 0.0485. - This combination provides a net credit and decreases the risk with theta suggesting moderate rate of time decay benefiting the short position.

2. Medium Term Options (~ 3 months) - Short Call: Sell the call option for a strike price of $35.00 expiring on June 20, 2025, collecting a premium of $7.85 and featuring a delta of 0.6318 with a theta of 0.0087. - Long Call: Buy the call option for a strike price of $37.5 expiring on June 20, 2025, paying a premium of $7.45 and characterized by a delta of 0.5946 and a theta of 0.0088. - This set offers protection and a slight net credit, with both options showing less sensitivity to price change (delta near 0.6) and minimal time decay, steady over the period for less unexpected loss in option value.

3. Longer Term Options (~6 months) - Short Call: Sell the $40.00 call expiring on June 20, 2026, with a premium of $6.5, delta of 0.5581, and theta of 0.0088. - Long Call: Buy the $42.5 call expiring on June 20, 2026, for a premium of $5.6, delta of 0.5197, and theta of 0.0086. - The wider spread provides a good buffer for the stock price movement with both options having close theta and delta values indicating consistent risk through the term.

4. Long Term Options (~1 year) - Short Call: Sell the $42.50 call expiring on January 16, 2026, for a premium of $5.6, delta of 0.5197, and theta of 0.0088. - Long Call: Buy the $45.00 call expiring on January 16, 2026, with a premium of $5.13, delta of 0.4872, and theta of 0.0085. - This also maintains a narrow gap in net credit and provides less risk of rapid price changes negatively affecting the spread.

5. Very Long Term Options (~2 years) - Short Call: Sell the $47.50 call expiring on January 17, 2025, for $4.63, with a delta of 0.4540 and a theta of 0.0084. - Long Call: Buy the $50.00 call expiring on January 17, 2025, for $4.4, with a delta of 0.4243 and a theta of 0.0082. - Offers a small gap for net credit with long-term duration, less delta variation which means the price sensitivity between the options is fairly aligned.

Conclusion

Overall, these bear spread options have a combination of strikes and expiries designed to optimize the balance between risk and reward. Each chosen strategy tailors to different risk profiles and anticipations of the underlying asset's price, ensuring that there are minimal sharp declines in options value thanks to comparable theta and delta values. By understanding the balance in these Greeks and the market's perceived direction, a more informed decision can be achieved for potential profitability in options trading.

Vertical Bull Call Spread Option Strategy

To evaluate a vertical bull call spread options strategy for Roblox Corporation, we examine available call options considering their respective Greeks and looking at the option's performance relative to movement in the underlying stock price, its sensitivity to the underlying assets volatility, time decay, and interest rates.

To optimize for a bull call spread, options should meet criteria such as having high ROI and profitability, balanced against managing Greeks such as delta, theta, and vega. For Roblox, here are several options strategies that could potentially be profitable:

- Near-term Opportunity with Moderate Confidence:

- Buy Call: Strike at $22.5, Expire on 2024-05-17

- Sell Call: Strike at $25.0, Expire on 2024-05-17

-

This spread involves a relatively short time frame and takes advantage of the higher delta and moderate theta of options just over or slightly under the current stock price. The risk stays minimized by the quick expiry, focusing on leveraging short-term upside potential.

-

Short-term Play with Greater Exposure:

- Buy Call: Strike at $25.0, Expire on 2024-05-24

- Sell Call: Strike at $30.0, Expire on 2024-05-24

-

Choosing a slightly longer duration, this play aims to utilize the increased vega, benefiting more from potential increases in implied volatility. The higher strike price of the sold call extends profitability range while capping maximum risk.

-

Mid-term Strategy for Higher Gains:

- Buy Call: Strike at $25.0, Expire on 2024-06-07

- Sell Call: Strike at $30.0, Expire on 2024-06-07

-

With a moderate hold period, this configuration works to balance the decay of option premiums over time (theta) against the benefits fetched by larger delta and vega values. This strategy targets larger movement anticipated in the stock.

-

Long-term Position with Increased Durability:

- Buy Call: Strike at $30.0, Expire on 2024-07-19

- Sell Call: Strike at $35.0, Expire on 2024-07-19

-

Well-suited for a bullish long-term view on Roblox, higher strikes selected to maximize leverage effect (delta) in the longer term while vega's exposure to volatility increase maximizes profitability.

-

Extended Long-term Play Maximising Vega:

- Buy Call: Strike at $30.0, Expire on 2025-06-20

- Sell Call: Strike at $37.5, Expire on 2025-06-20

- This approach is speculative and anticipates significant movements over an extended period. Here, the significant gap between strikes provides a greater profit max region balanced against a higher risk if the stock underperforms over the deadline.

Each strategic approach embraces a different aspect of option trading, displaying a balance between risk management and the leveraging intended through a bull call spread. Movements in Roblox's stock price, crucial news or sectoral shifts, and overall market volatility should continually reassess the position and adapt strategies as necessary.

Similar Companies in Electronic Gaming & Multimedia:

Electronic Arts Inc. (EA), Take-Two Interactive Software, Inc. (TTWO), Nintendo Co., Ltd. (NTDOY), NetEase, Inc. (NTES), Bilibili Inc. (BILI), Skillz Inc. (SKLZ), Sohu.com Limited (SOHU), Activision Blizzard, Inc. (ATVI), Unity Software Inc. (U), Zynga Inc. (ZNGA)

https://www.fool.com/investing/2024/04/05/cathie-wood-goes-bargain-hunting-3-stocks-she-just/

https://www.fool.com/investing/2024/04/10/cathie-wood-is-loading-up-on-this-innovative-growt/

https://seekingalpha.com/article/4684098-roblox-major-ads-catalyst

https://www.fool.com/investing/2024/04/21/3-tech-stocks-with-massive-potential-that-billiona/

https://www.fool.com/investing/2024/04/21/here-are-my-top-artificial-intelligence-ai-stocks/

https://www.fool.com/investing/2024/05/03/wall-street-analyst-roblox-stock-buy/

https://www.proactiveinvestors.com/companies/news/1047225?SNAPI

https://www.fool.com/investing/2024/05/09/why-roblox-stock-crashed-20-on-thursday/

https://seekingalpha.com/article/4691350-roblox-corporation-rblx-q1-2024-earnings-call-transcript

https://www.youtube.com/watch?v=2y_5qz7tV4o

https://www.youtube.com/watch?v=7Ycd588yRWw

https://www.fool.com/investing/2024/05/10/my-favorite-metaverse-stock-just-went-on-sale/

https://www.fool.com/investing/2024/05/10/cathie-wood-goes-bargain-hunting-3-stocks-she-just/

https://finance.yahoo.com/m/9fc032c4-decb-3bc0-be8d-0ecb539efa7f/cathie-wood-goes-bargain.html

https://www.sec.gov/Archives/edgar/data/1315098/000131509824000095/rblx-20240331.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: CvvSqre

Cost: $1.04943

https://reports.tinycomputers.io/RBLX/RBLX-2024-05-13.html Home